- Home

- »

- Advanced Interior Materials

- »

-

Aerosol Caps Market Size & Share, Industry Report, 2030GVR Report cover

![Aerosol Caps Market Size, Share & Trends Report]()

Aerosol Caps Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Personal Care, Household, Automotive & Industrial, Foods, Paints, Medical), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-885-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerosol Caps Market Size & Trends

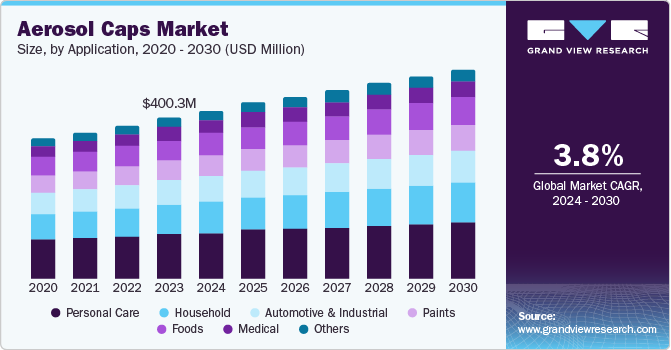

The globalaerosol capsmarket size was valued at USD 400.3 million in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. Aerosol packaging is widely used for deodorants, hairsprays, shaving creams, and other grooming products. The demand for aesthetically pleasing and functional aerosol packaging has increased in recent years with an increasing focus on personal grooming and hygiene, particularly in emerging economies. The versatility of aerosol caps, which ensures product safety and controlled dispensing, makes them an ideal choice for manufacturers, thus increasing their demand in the market.

Constant improvements in the design of closure devices and the use of recyclable products to advance sustainability initiatives are further anticipated to aid market growth. For instance, in June 2023, Berry Global introduced a spray through overcap that uses 50% recycled content for automotive, homecare, and industrial markets, as part of the company’s ‘Bmore Circular Solutions.

Aerosol packaging is extensively used to deliver or apply various medications, such as inhalers for respiratory conditions and topical sprays. Aerosols are easy to use, as they only need to be aimed at the applicable area and sprayed according to requirements. This reduces wastage of the contents and ensures more efficient and long-term use. The rising prevalence of respiratory diseases, coupled with the growing aging population, has driven the demand for inhalers and other aerosol-based drug delivery systems. This trend has led to increased production of high-quality aerosol caps that ensure precise dosage and product protection. Additionally, the growing popularity of DIY projects in households has led to increased sales of decorative products such as spray paints. They provide a transformed look to any object while also acting as a protective coating, increasing its lifespan. Additionally, they are also very popular as an interior decoration tool. As all these applications require controlled amounts of spray, the use of quality aerosol caps has maintained significance.

The food and beverage industry is increasingly adopting aerosol packaging for products such as whipped creams, cooking sprays, and edible oils. This form of packaging ensures convenience and extended shelf life for the product, making it a preferred option in this sector. As the global food and beverage industry continues to expand, driven by changing consumer lifestyles and the emergence of ready-to-eat products, the demand for aerosol caps is anticipated to grow accordingly. For households, products such as air fresheners, cleaning agents, disinfectants, and insecticides are commonly packaged in aerosols due to their ease of use and effectiveness in delivering the contents. The demand for products such as disinfectants and hand sanitizers has increased with the growing focus on hygiene and cleanliness, particularly after the COVID-19 pandemic. This trend is expected to continue in the coming years, driving the demand for durable and reliable aerosol caps that ensure product safety and longevity.

Application Insights

The personal care segment accounted for a leading revenue share of 27.6% in the global market in 2023. The global trend of increased grooming routines among men has increased the demand for male-specific personal care products, such as shaving foams, aftershave sprays, and deodorants, many of which are packaged in aerosols. This growing segment presents a lucrative opportunity for manufacturers of aerosol caps as brands look to create innovative, durable, and functional packaging designs suited to male consumers. Meanwhile, there is a significant demand for perfumes and deodorants among both men and women, particularly in the working professionals demographic. These consumers use such products multiple times daily to maintain a pleasant appearance, driving significant sales and leading to increased production of aerosol caps in this application area.

The automotive & industrial segment is anticipated to register the fastest CAGR over the forecast period. In the automotive industry, aerosols are commonly used for products such as lubricants, degreasers, brake cleaners, and tire shine sprays. As vehicle ownership continues to rise globally, especially in emerging economies, the need for regular maintenance and care products has also increased. This trend drives the demand for durable, high-performance aerosol caps that can withstand exposure to extreme chemicals and ensure precise application in automotive components. Across industries, aerosols are widely used for the application of coatings, adhesives, and sealants, all of which require precise amounts of release that necessitate the use of reliable and easy-to-use aerosol caps. Additionally, products such as adjustable nozzles enable switching between various spray patterns, such as stream and mist, providing versatility in usage and improving user experience.

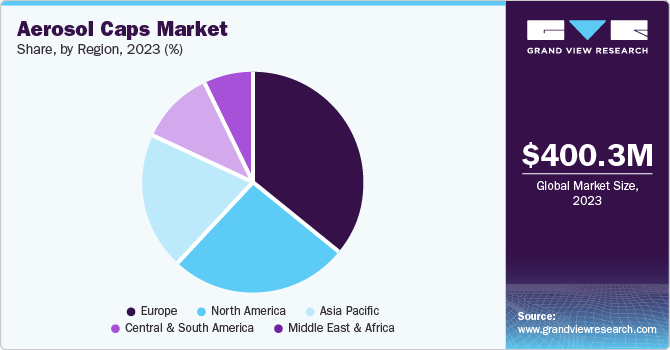

Regional Insights

Europe accounted for the largest revenue share of 35.4% in the global aerosol caps market in 2023. The well-established personal care and automotive industries in regional economies such as France, Germany, and the UK, coupled with constant improvements in nozzle design, have ensured a steady expansion of the regional market. Increasing use of hair sprays and skincare products of major brands by regional consumers is expected to maintain the production of advanced aerosol caps. The growth of e-commerce platforms, coupled with the convenience of online shopping, is expected to drive the demand for robust and secure nozzles that protect products through manufacturing and transportation in Europe. As more consumers purchase aerosol-packaged products online, there is a need for packaging that withstand the challenges of shipping and handling.

Germany Aerosol Caps Market Trends

Germany’s aerosol caps market accounted for the largest revenue share in the region in 2023. The country is the headquarters of major automotive manufacturers and an expanding automotive aftermarket, where aerosol products are widely used for vehicle maintenance, cleaning, and detailing. As the automotive sector continues to evolve, focusing on efficiency and sustainability, the demand for high-quality aerosol packaging solutions, including caps, remains strong. The economy is also known for implementing stringent policies and regulations regarding environmental standards and product safety, compelling manufacturers to invest in innovative and high-quality aerosol caps.

North America Aerosol Caps Market Trends

The North American aerosol caps market is expected to witness significant growth over the forecast period. The region's well-established beauty and personal care industry, driven by high consumer spending, has led to a significant demand for aerosol packaging. Products such as deodorants, hair sprays, and body mists are popular among consumers, and the convenience of aerosol delivery systems enhances their use. This strong consumer demand drives the need for high-quality aerosol caps that ensure product safety, user convenience, and an attractive design, driving market expansion. The presence of companies such as Ball Corporation, Crown, RPC Group, and Silgan has made the market highly competitive, enabling the introduction of advanced nozzles in the industry.

U.S. Aerosol CapsMarket Trends

The U.S. aerosol caps market is expected to advance at a steady CAGR from 2024 to 2030. The region's large vehicle fleet and high vehicle ownership rates lead to a strong demand for automotive maintenance and care products, many of which are packaged in aerosols. Both professional mechanics and DIY enthusiasts commonly use products such as lubricants, cleaners, and protective sprays. The growing popularity of these products requires durable and reliable aerosol caps that can withstand harsh automotive environments, contributing to the growth of the aerosol caps market in the region. Furthermore, American households are known to extensively participate in DIY activities such as painting furniture and walls and installing cabinetry, which require the use of aerosol cans to apply color, protect painted surfaces, and bond materials, leading to increasing demand for these items.

Middle East & Africa Aerosol CapsMarket Trends

The Middle East & Africa market for aerosol caps is expected to witness the fastest growth over the forecast period. The region's fast-developing industrial and manufacturing base, which includes the automotive, machinery, chemicals, and electronics sectors, relies heavily on aerosol products for maintenance, cleaning, lubrication, and protective applications. Additionally, growing demand for aerosol caps that meet stringent requirements of industrial environments, such as durability, chemical resistance, and precision, drives market expansion. The region's emphasis on high-quality manufacturing further increases the need for advanced and reliable aerosol caps.

The Saudi Arabian aerosol caps market is expected to witness substantial growth over the forecast period. The government has implemented various sustainability initiatives that emphasize the use of eco-friendly packaging. This drives the demand for aerosol caps made from recyclable materials or those that reduce overall plastic usage. Additionally, there is a growing interest in innovative designs that support eco-friendly aerosol packaging, such as caps that enable product refills or minimize waste. The country’s stringent environmental regulations and increasing consumer preference for green products are driving the adoption of sustainable aerosol caps.

Key Aerosol Caps Company Insights

Key players involved in the aerosol caps market include Crown, LINDAL Group, MITANI VALVE, and PLZ Corp, among others.

-

Crown is a global metal packaging solutions company, specializing in aluminum and steel vessels for beverage, food, and other consumer products. The company offers a wide range of packaging solutions, including beverage cans, food cans, and closures. Crown manufactures straight wall aerosol cans and necked-in aerosol cans, both of which are available in a range of sizes and volumes. The former has been indicated for use in hair sprays, dry shampoos, shaving creams, disinfectants, and deodorizers; necked-in cans find use in cooking sprays and laundry products, such as stain removers.

-

PLZ Corporation is a leading provider of specialized aerosol and liquid packaging solutions, catering to a variety of industries, including consumer goods, industrial, and automotive industries. The company’s Sprayway brand of cleaning solutions has been designed to enable efficient household cleaning, while Sprayway Automotive products deal with cleaning and detailing for vehicles. The Srayway Industrial line includes solutions such as industrial lubricants and automotive detailing waxes. The company also offers baking sprays under the Bak-klene brand and Vegalene food release sprays for food preparations.

Key Aerosol Caps Companies:

The following are the leading companies in the aerosol caps market. These companies collectively hold the largest market share and dictate industry trends.

- SILGAN PLASTICS

- Crown

- Clayton Corporation

- Berry Global Inc.

- LINDAL Group

- MITANI VALVE CO.,LTD

- Tri-Sure

- PLZ Corp

- Rackow Polymers Corp.

- Weener

Recent Developments

-

In July 2024, Silgan Holdings announced that it had signed an agreement for the acquisition of Weener Plastics, a Netherlands-based provider of advanced plastic packaging solutions for containing, dispensing, and closing functions. This acquisition aims to combining the product portfolios and expertise of both companies to meet changing consumer requirements on a global scale.

-

In February 2024, Lindal Group announced that it had joined the UK Aerosol Recycling Initiative as a funding partner. This project, launched in 2022, aimed at driving awareness regarding aerosol recycling across the region and increasing its uptake, with the objective of reaching a 50% recycling rate by 2030. The company, which develops and manufactures actuators, specialist valves, and spray caps for use in aerosol products, would enable the acceleration of feasibility studies as part of this development while conducting consumer engagement campaigns and data collection activities.

Aerosol CapsMarket Report Scope

Report Attribute

Details

Market size value in 2024

USD 419.8 million

Revenue forecast in 2030

USD 523.7 million

Growth rate

CAGR of 3.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in million units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, South Korea, Argentina, Brazil, Saudi Arabia, South Africa

Key companies profiled

SILGAN PLASTICS; Crown; Clayton Corporation; Berry Global Inc.; LINDAL Group; MITANI VALVE CO.,LTD; Tri-Sure; PLZ Corp; Rackow Polymers Corp.; Weener

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerosol Caps Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aerosol caps market report based on application and region.

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Personal Care

-

Household

-

Automotive & Industrial

-

Foods

-

Paints

-

Medical

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.