- Home

- »

- Medical Devices

- »

-

Aesthetic Injectable Market Size, Share, Growth Report, 2030GVR Report cover

![Aesthetic Injectable Market Size, Share & Trends Report]()

Aesthetic Injectable Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Hyaluronic Acid, Aquatic Light Injections), By Application (Facial Line Correction, Lip Augmentation), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-275-9

- Number of Report Pages: 143

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aesthetic Injectable Market Summary

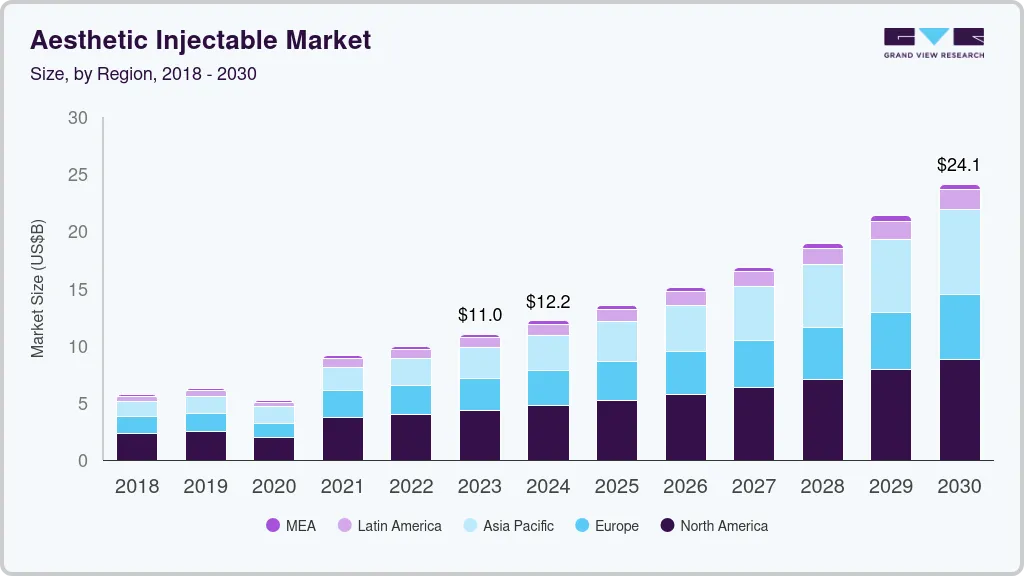

The global aesthetic injectable market size was estimated at USD 10.99 billion in 2023 and is projected to reach USD 24.13 billion by 2030, growing at a CAGR of 12.1% from 2024 to 2030. The increasing awareness and acceptance of aesthetic treatments, the launch of novel injectable products for different applications, and technological advancements drive the market.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 39.3% in 2023.

- The aesthetic injectable market in the U.S. held the largest share with 87.22% in 2023.

- By product, the botulinum toxin (Botox) segment held the largest market share of 45.75% in 2023.

- By application, the facial line correction segment accounted for the largest revenue share of 33.4% in 2023.

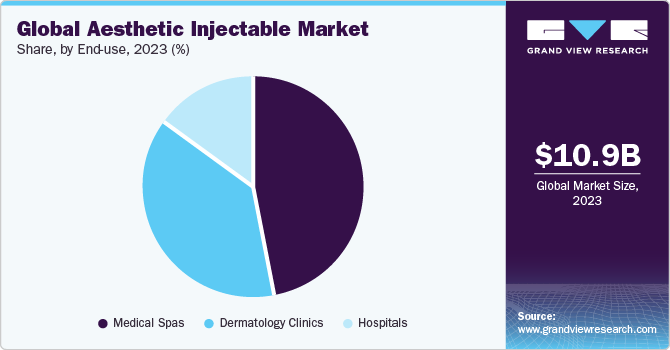

- By end-use, the medical spas segment accounted for the largest revenue share of 46.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.99 Billion

- 2030 Projected Market Size: USD 24.13 Billion

- CAGR (2024-2030): 12.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

According to the American Society of Plastic Surgeons, in 2022, Botulinum Toxin (Botox) treatment was the most commonly performed noninvasive procedure in the U.S., with more than 7.4 million people receiving Botox injections. People are becoming more active, informed, and knowledgeable about utilizing aesthetic injectables to enhance their appearance and address cosmetic concerns. Moreover, the increasing global geriatric population is also driving the market. According to Australia's 2023 Intergenerational Report, by 2050, the country's population aged 65 to 84 is projected to more than double, and the population of those aged 85 & over is expected to quadruple. This demographic shift is increasing the number of specialized clinics that cater to the needs of older people.

Major economies are undergoing a demographic shift owing to a rapidly aging population, and the demand for cosmetic solutions is growing to combat the visible signs of aging and maintain a youthful appearance. This has led to a significant surge in demand for botulinum toxin and aesthetic injectables that effectively reduce wrinkles, fine lines, & other age-related concerns.

Technological advancements have revolutionized aesthetic medicine, leading to safer, more effective, and minimally invasive treatments. For instance, in May 2023, the approval of SKINVIVE by JUVÉDERM by the U.S. FDA showcases a significant advancement in the industry; it was the first hyaluronic acid intradermal microdroplet injection approved for enhancing cheek smoothness. Such approvals can help introduce a range of targeted solutions for individuals seeking to improve their appearance.

In addition, introducing various insurance schemes for aesthetic and cosmetic procedures has contributed to an increase in the awareness and acceptance of aesthetic injectables, driving market growth. For instance, Hamilton Fraser, a UK-based insurance company, covers a broad range of aesthetic procedures, including laser treatments, dermal fillers, chemical peels, and botulinum toxin. Furthermore, social media plays a vital role in influencing the purchasing decisions of millennials.

The development of combination therapies has emerged as a significant technological advancement in the market. Combining botulinum toxin with other treatments, such as dermal fillers or laser therapies, achieves a more comprehensive approach to facial rejuvenation, resulting in enhanced patient outcomes. Clinics and practitioners across the globe are increasingly offering customized treatment plans utilizing combination therapies to address individual needs. This trend is fueled by advancements in product formulations and a deeper understanding of how different treatments can synergistically work together to achieve optimal results. For instance, in March 2022, Sinclair Pharma launched a training program for practitioners to enhance the effectiveness of its hyaluronic acid dermal filler procedures. Such focused training programs improve the product outlook and practitioner acceptability, driving demand in the longer term.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The aesthetic injectable industry is characterized by a high degree of innovation. In recent years, the global market has witnessed a significant degree of innovation. This innovation is driven by advancements in technology, research, and development of new products. Companies are constantly striving to introduce novel formulations and delivery methods to meet the evolving needs and preferences of consumers. Moreover, technological innovations have led to the development of more precise injection techniques, reducing discomfort and downtime for patients. The use of microcannulas and advanced imaging technologies has enhanced the safety and efficacy of aesthetic injectable procedures.

The aesthetic injectable industry is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. Companies within the industry are engaging in strategic partnerships, acquisitions, and collaborations to strengthen their product portfolios, expand their market presence, and leverage complementary capabilities. For instance, in June 2022, Prollenium Medical Technologies acquired SoftFil, a France-based aesthetic medicine company for an undisclosed amount for expansion.

Regulations play a crucial role in shaping the global market. In Germany, aesthetic injectables fall under the purview of the Federal Institute for Drugs and Medical Devices (BfArM). To gain marketing approval, companies must adhere to strict regulations and undergo a rigorous evaluation process. Similarly, in the U.S, the Food and Drug Administration (FDA) regulates aesthetic injectables. The FDA also conducts post market surveillance to monitor any adverse events or safety concerns. This stringent regulatory process is in place to ensure that aesthetic injectables meet the highest safety and quality standards before they reach consumers.

Product expansion is a key strategy employed by companies operating in the global market to cater to diverse consumer needs and preferences. Manufacturers are continuously introducing new formulations, variations, and combinations of aesthetic injectables to address specific concerns such as facial rejuvenation, wrinkle reduction, lip augmentation, and contouring. The expansion of product lines allows companies to differentiate themselves from competitors, target niche markets effectively, and capitalize on emerging trends in aesthetics.

The market is witnessing significant regional expansion as companies seek to capitalize on growing demand for minimally invasive cosmetic procedures worldwide. Emerging economies in Asia-Pacific, Latin America, and Middle East & Africa present lucrative opportunities for market expansion due to rising disposable incomes. For instance, in June 2021, Galderma reported that Alluzience (BoNT-A liquid) completed its decentralized procedure in Europe, which resulted in a favorable decision for its first ready-to-use neuromodulator-an injectable that relaxes wrinkles.

Product Insights

The Botulinum Toxin (Botox) segment held the largest market share of 45.75% in 2023. Botulinum Toxin Type A (BoNTA) is a purified substance (neurotoxic protein) derived from bacteria that prevents muscle contraction, reduces facial wrinkles, and also helps treat crow’s feet, frown lines, forehead furrows, and skin bands on the neck. With the growing global demand for aesthetic procedures, Botox has become crucial in addressing age-related concerns. The market for Botox has expanded due to its efficacy in treating various medical conditions and the growing disposable income of the ever increasing population. According to the American Society of Plastic Surgeons, in 2022, Botox was the most commonly performed noninvasive procedure, with over 7.4 million people receiving Botox injections in the U.S., indicating a strong demand for Botox in the aesthetic injectables segment.

The Hyaluronic Acid (HA) segment is anticipated to witness the fastest CAGR of 12.7% during the forecast period. With an increasing preference for noninvasive cosmetic procedures, hyaluronic acid-based dermal fillers have gained popularity due to their effectiveness and minimal downtime. According to the American Society of Plastic Surgeons, around 4.8 million hyaluronic dermal injection procedures were performed in 2022, nearly 70% higher than pre pandemic levels. Some of the key HA-based fillers used in the U.S. were Juvederm, Restylane, and Belotero. HA fillers can be customized based on each patient's specific needs, allowing for tailored treatment plans that cater to individual aesthetic goals. Beyond its cosmetic applications, HA is also utilized in wound healing, addressing skin ulcers & burns, and as an effective moisturizer. Moreover, applying HA as a lip filler in plastic surgery boosts segment growth.

Application Insights

The facial line correction segment held the largest market share in 2023 and is expected to witness the fastest CAGR during the forecast period. The rising preference for noninvasive cosmetic procedures, such as dermal fillers and Botox injections, to address facial lines and wrinkles is a significant factor driving the growth of the facial line correction segment. With age, collagen & elastin production decreases, causing the skin to lose its elasticity and firmness. Hence, correcting facial lines with injectables can help restore a youthful appearance; the aging population is expected to drive the demand for procedures to smoothen lines & wrinkles.

Facial line correction is a significant application within the aesthetic injectables market, catering to the preferences of individuals seeking nonsurgical cosmetic enhancements. Furthermore, aesthetic injectables provide a nonsurgical and noninvasive alternative to address facial lines and wrinkles. Several individuals prefer this approach over invasive surgical procedures for reduced downtime and minimal discomfort. Continuous advancements in aesthetic injectables, including improved formulations and delivery techniques, enhance treatments' efficacy and safety, attracting more consumers toward facial line correction procedures.

End-use Insights

The medical spas segment held the largest market share in 2023 and is expected to witness the fastest CAGR during the forecast period owing to the increasing consumer demand for non-invasive cosmetic procedures, advancements in technology leading to more effective treatments, and a growing emphasis on self-care and wellness. In 2022, the American Med Spa Association reported that over 8,841 Med spas were operational in the U.S., an increase of 62% over 2018. The establishment of medical spas requires licenses in aesthetics and medical education, owned by a physician, which enhances the spa's credibility and boosts patient confidence in treatments.

Med spas are a grouping of aesthetic medical centers & day spas that provide medical skincare treatments & products such as aesthetic injections (dermal fillers & botulinum); noninvasive body contouring (sculpting, butt/breast shaping, etc.); skin rejuvenation (chemical peel, laser resurfacing, photorejuvenation, & hydra-dermabrasion); laser hair removal; Intense Pulsed Light (IPL) hair removal; laser tattoo removal; and laser scar removal. According to the American Med Spa Association’s 2022 Medical Spa State of the Industry Report, an average medical spa generates more than USD 1.9 million annually.

Regional Insights

North America dominated the market with a revenue share of 39.3% in 2023. This is attributed to the growing population aged between 25 and 65 years, a demographic showing high concern related to skin aging, including skin laxity, wrinkles, and dark spots. Consequently, there has been a surge in demand for cosmetic enhancement products. Moreover, rising disposable income in the region is expected to drive market growth over the forecast period. The market in the region is experiencing extensive growth, driven by leaders involved in advancements, R&D, and product launches. The availability and adoption of advanced treatment options for scars, such as laser treatment, have been widely accepted in North America. Furthermore, awareness about aesthetic appeal and outward appearance contributes to the growth of this market in North America.

U.S. Aesthetic Injectable Market Trends

The aesthetic injectable market in the U.S.held the largest share with 87.22% in 2023, in the North American region, owing to the high demand for advanced laser scar treatment instruments. According to a report by the International Society of Aesthetic Plastic Surgery (ISAPS), in 2022, nearly 4,556,970 nonsurgical injectable procedures were performed in the U.S., of which 3,945,282 procedures involved Botox fillers and 521,169 involved HA fillers. An increase in the number of cosmetic procedures is expected to boost the U.S. aesthetic injectable market over the forecast period.

Europe Aesthetic Injectable Market Trends

The aesthetic injectable market in Europe is expected to witness lucrative growth over the forecast period, owing to favorable reimbursement policies. The growing number of nonsurgical procedures in the region is expected to boost the market over the forecast period. According to the International Society of Aesthetic Plastic Surgery (ISAPS) 2022 report, nearly 77,924 nonsurgical procedures were performed in the UK, of which nearly 64,000 were injectable procedures. In addition, nearly 35,000 botulinum toxin and 27,000 HA-based procedures were performed in 2022. According to the same report, an estimated 600 surgeons were registered nationwide.

UK aesthetic injectable market held a significant share in Europe. In 2021, the UK government drafted the Botulinum Toxin and Cosmetic Fillers (Children) Act, which made any form of injectable procedure performed on patients aged 18 or below a criminal offense. In September 2023, the UK government proposed to ban unlicensed providers of cosmetic treatments, such as Botulinum toxin and injectable fillers. The regulation makes related illicit procedures a criminal offense when offered by a non-licensed practitioner.

The aesthetic injectable market in Germany is a major contributor to the European market. Various factors, such as an increase in the popularity of cosmetic procedures, technological advancements, and a rise in beauty consciousness, are driving the market. Furthermore, rising urban population, novel product approvals, advancements in noninvasive procedures, and availability of skilled professionals are other factors expected to boost the market. However, the high cost of aesthetic procedures is likely to impede the market growth. According to the ISAPS report, in 2022, over 496,785 injectable filler procedures were performed in Germany, of which 293,736 were botulinum toxin filler procedures, while nearly 7,000 procedures were related to CaHA. This highlights the high demand for filler procedures in this country.

France aesthetic injectable market is anticipated to witness significant growth attributing to the increased awareness among customers about the potential benefits of aesthetic procedures, coupled with the growing adoption of minimally invasive procedures, is boosting the aesthetic injectable market in France. Hyaluronic acid injectable products, such as Perfectha by Sinclair, are popular in the country and are designed for wrinkle correction and volume restoration. Sinclair manufactures nearly 30,000 syringes of the Perfectha line each week from its unit in Lyon, France. Furthermore, local players are rapidly advancing their geographic reach, which is expected to boost the market. For instance, in May 2023, Symatese, a French dermal filler manufacturer, entered into an agreement with a U.S.-based distributor to sell its HA-based product line. The press release states that the products may be launched from 2025 to 2027. As per the agreement, Symatese received EUR 16.2 million (USD 17.02 million).

Asia Pacific Aesthetic Injectable Market Trends

The aesthetic injectable market in Asia Pacific is expected to exhibit the highest CAGR of 15.8% over the forecast period due to the presence of growth opportunities in this region, especially in India, Japan, and China. The growing disposable income in various countries, increasing patient awareness, and rising geriatric population are among the major factors expected to drive the market. According to the Asian Development Bank (ADB), one in four people in the region is expected to be aged 60 years or above by 2050. Moreover, with the rapidly developing economies, the market is expected to witness growth. This can be attributed to the growing medical tourism industry, especially in Southeast Asia. According to the ISAPS 2022 report, 29% of the patients undergoing aesthetic treatment in Thailand were foreign nationals. The growing preference among foreign nationals to undergo treatments in Thailand can be attributed to the availability of advanced techniques and cost-effective treatment options.

China aesthetic injectable market held the largest revenue share and is expected to grow fastest, owing to the increasing demand for antiaging and antipollution procedures.in the region. Moreover, the presence of major players is driving the market. For instance, Bloomage Biotechnology, one of the world’s largest producers of HA-based dermal fillers, is headquartered in China, which drives innovations & product acceptability, contributing to market growth. Furthermore, in June 2023, Bloomage Biotech announced a project to construct an ecosystem focused on HA production. Consequently, Bloomage Biotech and Jinan High-tech Zone will jointly develop the project, and the former firm will contribute USD 37 billion.

The aesthetic injectable market in Australia is expected to show a lucrative growth owing to the millennials showing greater awareness and adopting a healthier lifestyle as the influence from social platforms. In September 2022, the Australian Health Practitioner Regulation Agency (Ahpra) & the Medical Board of Australia launched an external review to address patient safety concerns and strengthen the regulation of industry practitioners. The review aimed to implement checks and balances while emphasizing the need for improved communication and cooperation among state and territory authorities involved in the existing regulatory system. In line with the review process, in September 2023, Ahpra announced that new guidelines with stringent practice standards and new advertising rules will be launched by the end of 2023 or early 2024.

India aesthetic injectable market is expected to show lucrative growth owing to the increasing awareness and adoption of aesthetic treatments. According to the ISAPS 2022 report, nearly 176,899 injectable procedures were performed in the country, with 96,368 botulinum toxin procedures and around 71,734 HA injection procedures. Easy accessibility of cosmetic clinics, growing awareness about procedures through social media, rising disposable income, and growing awareness about various cosmetic procedures are likely to drive the market. Moreover, lower treatment costs in the country are expected to contribute to the growing medical tourism.

Latin America Aesthetic Injectable Market Trends

The presence of untapped opportunities in developing economies, such as Mexico and Brazil, is expected to propel the aesthetic injectable market in the region during the forecast period. Latin American countries are preferred for medical tourism due to the availability of treatments at lower costs (30% to 70% discount) compared to North American & European countries. In addition, a stronger emphasis on physical beauty, coupled with extensive acceptance of facial surgeries, has led to the high demand for aesthetic injectables in Brazil.

Brazil aesthetic injectable market is expected to grow significantly owing to factors such as rising adoption and awareness about aesthetic procedures, technological advancements and rsising product collaborations. Brazil has a strong culture of beauty and aesthetics, emphasizing youthful appearances and physical attractiveness. This cultural focus on beauty has contributed to the widespread acceptance and use of aesthetic injectable to enhance or maintain appearance. According to the ISAPS 2022 report, the estimated number of nonsurgical procedures performed in Brazil was 971,294, of which 793,934 were injectable filler procedures. The number of Botox procedures was estimated to be 433,263, followed by 327,563 HA-based filler procedures.

MEA Aesthetic Injectable Market Trends

Key countries in the Middle East & Africa include South Africa, Saudi Arabia, and the UAE. Middle Eastern countries such as Saudi Arabia, Qatar, UAE, Kuwait, and Oman are prospering economies. This region is technologically developed; however, there is very low awareness about botulinum toxin and other aesthetic treatments. Moreover, some countries in the African region lack healthcare infrastructure. Thus, the market is expected to exhibit moderate growth during the forecast period.

South Africa aesthetic injectable market witnessed a significant increase in demand for cosmetic procedures during the pandemic. A rapidly growing population and increasing investments in the aesthetic & cosmetic sectors are among the key factors expected to boost the market in the country. According to Africa Business Pages, there has been a three-fold increase in the middle-class population, which has created opportunities for various local and international companies.

The aesthetic injectable market in Saudi Arabia is growing at a rapid rate owing to increased acceptance of facial aesthetic procedures. Key drivers of the market include growing aesthetic & health consciousness, increasing adoption of technologically advanced products, and rising acceptance of ingredients used in fillers. Furthermore, the growing acceptance of cosmetic procedures among men is expected to drive market growth. Furthermore, as per a review published in the NCBI in 2021, nearly 47.6% of the survey respondents indicated that they were willing to undergo a minor cosmetic procedure, while nearly 60.9% of survey respondents stated that cosmetic procedures aided in improving self-esteem.

Key Aesthetic Injectable Company Insights

Some of the key players operating in the market include Ipsen Pharma, AbbVie, Inc., Merz GmbH and Co. KGaA, Galderma, Sinclair Pharma.

-

Ipsen Pharma is a France based biopharmaceutical company which focuses on transformative medicines. It develops & markets pharmaceuticals in oncology, neurology, and rare disorders. It was established as a consumer wellness company focusing on neurological and digestive diseases. Over time, the organization’s focus shifted toward specialized care, which now constitutes a significant portion of its revenue.

-

AbbVie, Inc. is an U.S. based pharmaceutical company which offers advance aesthetic solutions. It also offers neurology, eye care, gastroenterology, antiinfective, and women’s health products. End users include physicians, healthcare providers, and patients. The company has a presence in more than 100 countries.

Key Aesthetic Injectable Companies:

The following are the leading companies in the aesthetic injectable market. These companies collectively hold the largest market share and dictate industry trends.

- Ipsen Pharma

- AbbVie, Inc.

- Merz GmbH and Co. KGaA

- Galderma

- Prollenium Medical Technologies, Inc.

- Suneva Medical, Inc.

- Sinclair Pharma

- Medytox, Inc.

- Revance Therapeutics, Inc.

Recent Developments

-

In June 2023, Galderma received approval from the U.S. FDA for Restylane Eyelight. This HA dermal filler addresses undereye hollows or dark shadows in adults aged over 21 years. Restylane Eyelight was the first product in the U.S. utilizing NASHA Technology, providing natural-looking results for volume loss under the eyes.

-

In September 2022, Revance Therapeutics, Inc. received FDA approval for DAXXIFY, a daxibotulinumtoxinA indicated to be used for the treatment of glabellar lines.

-

In April 2022, Sinclair introduced Perfectha Lidocaine, a hyaluronic acid-based dermal filler for wrinkle correction, facial contouring, and facial volume restoration.

- In March 2022, Suneva Medical entered a definitive partnership agreement with Viveon Health Acquisition Corp. to improve existing technology in aesthetic medicines.

Aesthetic Injectable Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.18 billion

Revenue forecast in 2030

USD 24.13 billion

Growth rate

CAGR of 12.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use and application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Ipsen Pharma; AbbVie, Inc.; Merz GmbH and Co. KGaA; Galderma; Prollenium Medical Technologies, Inc.; Suneva Medical, Inc.; Sinclair Pharma; Medytox, Inc.; Revance Therapeutics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aesthetic Injectable Market Report Segmentation

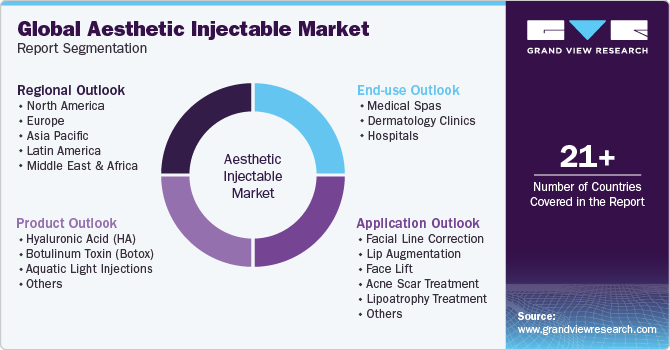

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aesthetic injectable market report based on product, end-use, application and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hyaluronic Acid (HA)

-

Botulinum Toxin (Botox)

-

Aquatic Light Injections

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Spas

-

Dermatology Clinics

-

Hospitals

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Facial Line Correction

-

Lip Augmentation

-

Face Lift

-

Acne Scar Treatment

-

Lipoatrophy Treatment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global aesthetic injectable market size was estimated at USD 10.99 billion in 2023 and is expected to reach USD 12.18 billion in 2024.

b. The global aesthetic injectable market is expected to grow at a compound annual growth rate of 12.1% from 2024 to 2030 to reach USD 24.13 billion by 2030.

b. North America dominated the aesthetic injectable market with a share of 39.32% in 2023. This is attributable to the growing population aged between 25 and 65 years, a demographic showing high concern related to skin aging, including skin laxity, wrinkles, and dark spots.

b. Some of the players operating in this market are Ipsen Pharma, AbbVie, Inc., Merz GmbH and Co. KGaA, Galderma, Prollenium Medical Technologies, Inc., Suneva Medical, Inc., Sinclair Pharma, Medytox, Inc., Revance Therapeutics, Inc.

b. Key factors that are driving the aesthetic injectable market growth include the shifting beauty standards and a growing aging population contribute to market expansion, availability of a wide range of injectable products, coupled with innovative marketing strategies by key players, stimulate market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.