- Home

- »

- Medical Devices

- »

-

Aesthetic Lasers Market Size, Share, Industry Report, 2033GVR Report cover

![Aesthetic Lasers Market Size, Share & Trends Report]()

Aesthetic Lasers Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Laser Hair Removal, IPL Laser Treatment, Laser Skin Resurfacing, Noninvasive Tightening, Laser-assisted Lipoplasty), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-078-1

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aesthetic Lasers Market Summary

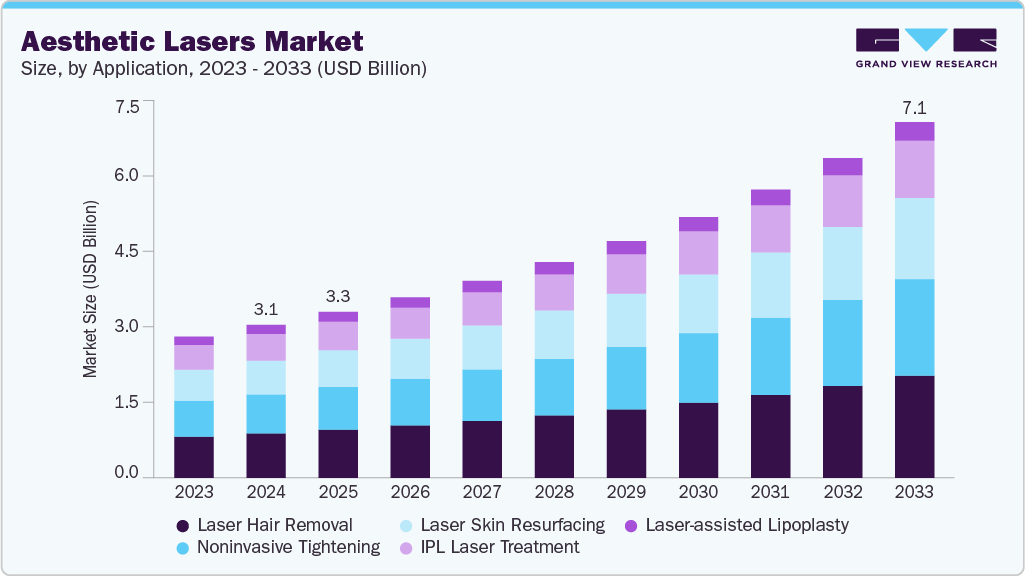

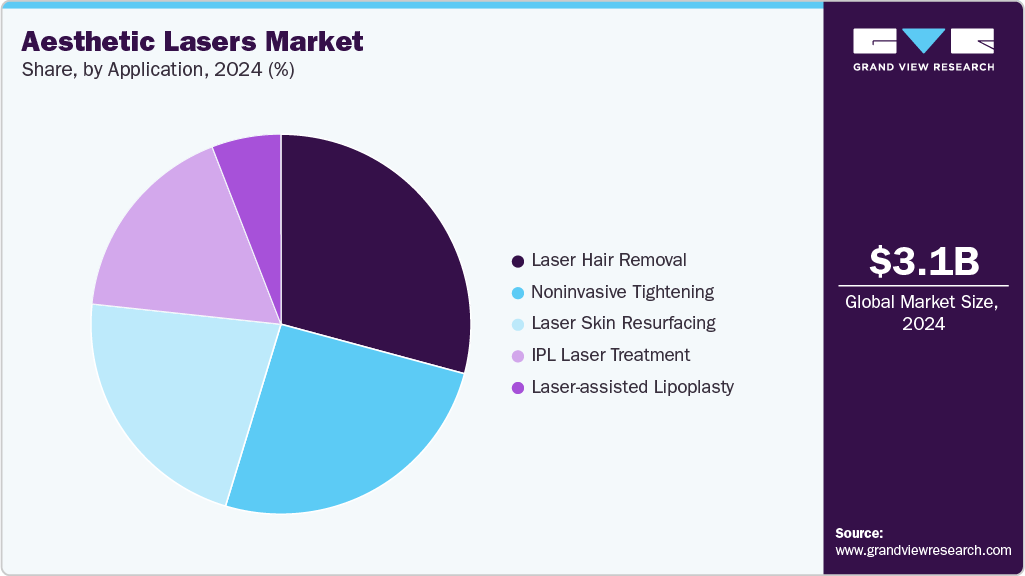

The global aesthetic lasers market size was estimated at USD 3.1 billion in 2024 and is projected to reach USD 7.1 billion by 2033, growing at a CAGR of 10.0% from 2025 to 2033. This growth is driven by increasing consumer preference for non-invasive and minimally invasive aesthetic procedures, rising awareness of cosmetic treatments, and a growing focus on personal appearance.

Key Market Trends & Insights

- North America's aesthetic lasers market held the largest share of 41.0% of the global market in 2024.

- The U.S. aesthetic lasers industry is expected to grow significantly over the forecast period.

- By application, the laser hair removal segment held a leading market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.1 Billion

- 2033 Projected Market Size: USD 7.1 Billion

- CAGR (2025-2033): 10.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

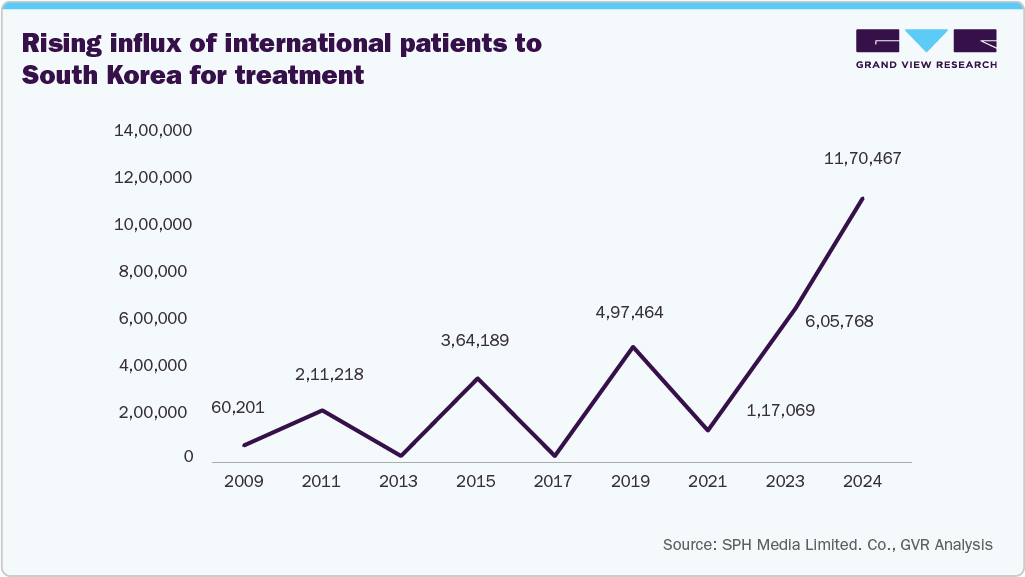

Continuous technological advancements, such as multi-wavelength and energy-efficient laser systems, are enhancing treatment safety and effectiveness. In addition, the expanding number of aesthetic clinics, favorable reimbursement trends in select regions, and strong demand from emerging markets further support market expansion.Medical aesthetic tourism has become a major demand-side catalyst for the global aesthetic lasers market, with South Korea standing out as a prime example. High concentrations of dermatology and cosmetic clinics particularly in areas such as Gangnam have positioned aesthetic procedures as a tourism-driven service rather than purely medical care. As international demand rises, a new segment has emerged: medical concierge services, which guide foreign patients to clinics and support them throughout their treatment journey, adding a new layer to the value chain.

In 2024 alone, 1.17 million foreign patients visited South Korea for medical treatment nearly double the number recorded in 2023 marking the highest level since records began in 2009. Importantly, dermatology accounted for 56.6% of these visits, overtaking plastic surgery for the first time.

Aesthetic laser procedures are uniquely suited to medical tourism because they are quick, minimally invasive, and require little to no downtime. As highlighted by Korean dermatologists, many laser-based skin treatments can be completed in under an hour, allowing patients to resume sightseeing the same day. This compatibility with short travel itineraries significantly increases the appeal of laser treatments over surgical procedures, which require longer recovery periods. As a result, clinics catering to international patients invest heavily in advanced laser systems to meet high patient volumes and diverse skin concerns. Han Hye-young, a physician at Highly Clinic Dermatology, further reinforces our statements by noting that,

“The reason dermatology is so popular is actually very simple it’s safe and effective. An injection or a laser procedure takes less than an hour and requires almost no downtime. Many tourists come for treatment in the morning and go sightseeing in the afternoon. Even without advertising on social media, we always have foreign clients walking in.”

Recent developments across dermatology, aesthetics, hair restoration, and ophthalmology highlight how next-generation laser technologies are expanding the scope, safety, and commercial adoption of aesthetic laser systems, acting as a strong demand-side driver for the global aesthetic lasers market. According to expert dermatologists at the Laser & Skin Surgery Center of New York (March 2024), laser and energy-based therapies remain the gold standard for non-surgical skin tightening due to their proven ability to stimulate collagen, improve firmness, and reduce wrinkles.

Below is a consolidated table of the top lasers and energy-based devices for skin tightening, along with their clinical positioning and benefits.

Laser / Device

Technology Type

Description & Key Benefits

Clear + Brilliant

Fractional non-ablative laser

Gentle resurfacing option for early aging; creates microscopic treatment zones to boost collagen, improve tone, reduce pigmentation, and maintain a radiant complexion with minimal downtime.

LaseMD Ultra

Non-ablative fractional laser (1927 nm)

Targets pigmentation, fine lines, and photoaging; penetrates dermal layers while preserving the epidermis, enabling quick recovery and customizable treatments.

Active FX

Fractional CO₂ laser

High-energy resurfacing for sun damage and fine wrinkles; treats a fraction of skin at a time to accelerate healing and reveal smoother skin.

Deep FX

Fractional CO₂ laser

Designed for deeper wrinkles and acne scars; delivers deeper thermal heating to tighten collagen, especially around eyes and mouth.

Fraxel Repair

Ablative fractional CO₂ laser

Intense resurfacing for advanced aging signs; vaporizes micro-columns of skin to stimulate strong collagen and elastin regeneration with long-lasting results.

Erbium YAG

Fractional ablative laser

Precisely removes micro-layers of skin by targeting water in cells; promotes collagen remodeling, smoother texture, and visible tightening with shorter downtime than CO₂.

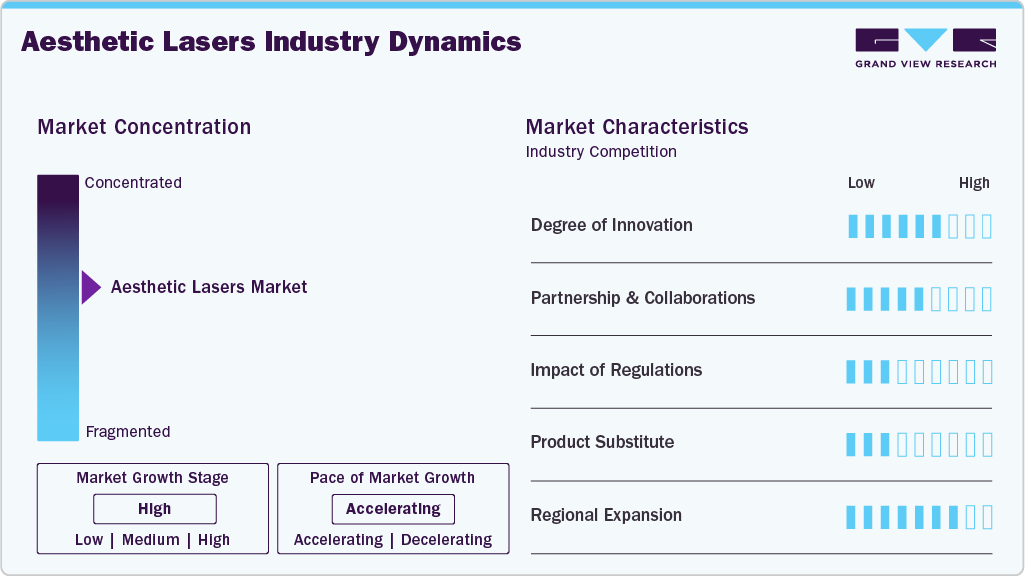

Market Concentration & Characteristics

The aesthetic lasers market is moderately concentrated, with a few established players accounting for a significant share due to strong brand presence, proprietary technologies, and extensive distribution networks. Key companies focus on continuous innovation in multi-wavelength platforms, energy-based devices, and AI-enabled systems to differentiate offerings. High capital investment, regulatory approvals, and clinical validation create entry barriers. However, emerging players are gaining traction through niche applications and cost-effective systems. The market is characterized by rapid technological upgrades, strong demand from dermatology and aesthetic clinics, and increasing preference for minimally invasive, customizable treatments.

The level of innovation in the aesthetic lasers industry is exceptionally high, with laser technologies expanding beyond traditional dermatology applications. Advances are transforming hair restoration, historically reliant on surgical transplants and long-term medications. The introduction of FoLix, the first FDA-cleared fractional laser for hair loss, highlights this shift by using controlled micro-injury to stimulate natural healing, circulation, and dormant hair follicles. Compared with passive red-light devices, this approach delivers more noticeable clinical results with short, anesthesia-free sessions and minimal downtime. Simultaneously, laser innovation is extending into vision-preserving therapies. Research from Aalto University demonstrates the potential of precisely dosed laser heat to activate cellular repair pathways for dry age-related macular degeneration. Together, these innovations emphasize growing multi-indication use, enhanced safety, faster treatments, and stronger clinical validation, positioning technological advancement as a central growth driver for the aesthetic lasers market.

Strategic partnerships and collaborations play a pivotal role in driving growth within the aesthetic lasers industry. These alliances help companies accelerate innovation, broaden geographic reach, and strengthen engagement with clinicians and patients. By combining technological expertise, clinical know-how, and distribution capabilities, partnerships enable faster commercialization of advanced solutions. For instance, in March 2025, ID Hospital signed an MOU with Sinclair to establish Asia’s largest regenerative aesthetics center. The collaboration focuses on advancing next-generation treatments, clinical education, and regional leadership, showcasing Sinclair’s portfolio, including Elansé, Silhouette Soft, and Prime Raze. Such initiatives highlight how partnerships are strengthening innovation pipelines and accelerating market expansion.

Regulatory frameworks play a critical role in shaping growth in the aesthetic lasers industry by ensuring product safety, clinical effectiveness, and patient protection. Stringent approval processes, such as clearance requirements from the U.S. Food and Drug Administration and conformity with CE marking standards in Europe, raise entry barriers but strengthen market credibility. Clear regulatory pathways encourage manufacturer investment in clinical trials, advanced safety features, and post-market surveillance. At the same time, evolving guidelines for energy-based devices support innovation while limiting unsafe or unproven technologies. Overall, well-defined regulations enhance physician confidence, promote patient trust, and enable sustainable adoption of aesthetic laser systems globally.

Product substitutes for aesthetic lasers include a range of non-laser and minimally invasive technologies used for similar cosmetic indications. These include radiofrequency and ultrasound-based devices for skin tightening, intense pulsed light (IPL) systems for pigmentation and hair reduction, and injectable treatments such as botulinum toxin and dermal fillers. Topical cosmeceuticals and medical-grade skincare also serve as lower-cost alternatives for mild conditions. In hair restoration, platelet-rich plasma (PRP) therapy and oral or topical medications act as substitutes. While these options may offer shorter recovery times or lower upfront costs, aesthetic lasers remain preferred for precision, durability of results, and broader treatment versatility.

The global aesthetic lasers industry is witnessing notable regional expansion, with companies adopting targeted strategies to strengthen their international footprint. For instance, in June 2024, Sinclair North America introduced the Primelase Diode Laser System, delivering advanced, multi-wavelength hair removal suitable for all skin types. As the manufacturer, Sinclair offers ongoing upgrades, comprehensive training, and technical support, enabling clinics to utilize a high-performance, reliable system that improves treatment efficiency, patient comfort, and outcomes. Such initiatives highlight how region-specific product launches and localized support are driving adoption and reinforcing market growth worldwide.

Application Insights

The laser hair removal segment accounted for the largest market share in 2024. Laser hair removal remains one of the most widely recognized and adopted applications of aesthetic lasers among consumers. Many seek this treatment for its long-lasting results, reduced maintenance compared with shaving or waxing, and the convenience of a low-effort grooming routine, appealing especially to time-conscious individuals. Growth in this segment is fueled by technological advancements, including faster applicators, enhanced cooling, and safer energy delivery, which reduce pain and session times, improving the overall experience and encouraging first-time users. Manufacturers actively promote these features to highlight efficiency and comfort.

The rise of at-home laser devices further expands accessibility, appealing to consumers who prioritize privacy or lower per-use costs. For instance, in March 2025, Ulike showcased its latest IPL devices, including the Ulike Air 10, Air 3, and X, at the American Academy of Dermatology Annual Meeting, emphasizing salon-quality results at home and innovations for diverse skin tones and hair types.

Market developments underscore growing consumer preference for laser hair removal. In October 2025, Milan Laser Hair Removal opened a new clinic in Laredo, Texas, offering intense-pulsed-light services, while in November 2024, DermRays launched the V8S Pro at-home device, delivering professional-grade performance. These trends highlight increasing demand for accessible, effective, and convenient hair-removal solutions both in clinics and at home.

The noninvasive skin tightening segment is experiencing rapid growth, driven by patient demand for firmer, lifted skin without surgery or long recovery. Clinics favor these treatments for their minimal risk, repeatability, and ability to offer tiered or maintenance packages. Technological advancements have improved efficacy and safety, boosting clinician and consumer confidence. Busy, mid-life patients prefer minimally invasive options that fit their lifestyles. In 2024, over 1.23 million non-surgical skin tightening procedures were performed globally, up 38.9% year-over-year. Devices such as Bausch Health’s Thermage FLX, Clear + Brilliant, and Fraxel FTX illustrate the rising adoption of advanced aesthetic lasers for collagen stimulation and skin contouring.

Regional Insights

The North American aesthetic lasers marketis experiencing robust growth, driven by the U.S., Canada, and Mexico, which collectively represent a mature and high-demand region. A well-informed consumer base, advanced healthcare infrastructure, and a large network of aesthetic service providers fueling the market’s growth. Consumers increasingly prefer laser-based treatments for their visible results, minimal downtime, and lower risk compared to surgical alternatives. Notably, younger demographics are adopting preventive and maintenance-focused procedures, expanding the market across age groups. The rising popularity of non-invasive solutions further strengthens demand for advanced aesthetic lasers.

Key factors supporting this growth include the influence of digital beauty trends, social media, and celebrity culture, which have normalized cosmetic enhancements. Technological advancements have introduced versatile, safer, and more efficient laser platforms capable of addressing multiple skin concerns across various skin types. North America also benefits from a high number of certified practitioners, ensuring safe, reliable outcomes. In addition, rising disposable incomes and greater willingness to invest in self-care sustain market demand.

U.S. Aesthetic Lasers Market Trends

Aesthetic lasers market in the U.S. is witnessing consistent growth, characterized by intense competition and strong domestic and international players. Leading U.S.-based companies such as Candela and Cutera coexist with global firms such as Lumenis, Sisram/Alma, Cynosure, and Lutronic, which maintain significant operations in the country. Specialist companies such as Sciton and STRATA are recognized for clinical expertise in resurfacing and niche procedures, while consumer-focused brands dominate the at-home segment. Many vendors operate direct sales networks, service centers, and training academies, making multi-platform systems, bundled practice solutions, and professional support key competitive differentiators.

Market growth is driven by rising consumer preference for minimally invasive aesthetic procedures. Clinics and med-spas increasingly offer treatments such as intense pulsed light (IPL) for vascular and pigmentation concerns, highlighting growing demand for advanced aesthetic lasers. Broader awareness and acceptance of cosmetic procedures have fueled the expansion of medical spas. According to the American Medical Spa Association (AmSpa), the U.S. medical spa sector grew from 8,899 facilities in 2022 to around 10,488 in 2023, reflecting steady growth over 15 years. This expansion indicates a dynamic industry with new entrants, increasing service offerings, and rising adoption of laser-based technologies across clinical and consumer-focused segments, further supporting market development.

Europe Aesthetic Lasers Market Trends

Aesthetic lasers market in Europe is growing rapidly, driven by rising demand for non-surgical cosmetic procedures in key economies such as the UK, Germany, France, Italy, and Spain. Consumers prefer laser treatments for their visible results and shorter recovery times compared to surgery. Popular procedures include laser hair removal, skin resurfacing, and lipoplasty. In 2024, Europe recorded approximately 892,000 aesthetic procedures, highlighting strong adoption of non-invasive treatments. In the UK, laser hair removal was the most searched aesthetic service in 2023, particularly in urban centers like Greater London, reflecting high consumer awareness and growing demand for minimally invasive laser solutions.

The UK aesthetic lasers market is steadily expanding, supported by key players such as Cutera, Candela, Lumenis, and local company Lynton, along with Sisram/Alma and Cynosure Lutronic through established distributors. Competition focuses on clinical education, regulatory compliance (MHRA/UKCA), and post-sale support, while niche suppliers such as Sciton and STRATA serve high-end dermatology centers. Growth is driven by rising demand for non-invasive treatments offering visible results and shorter recovery times. An aging population, desire for youthful appearance, and increasing obesity contribute to higher demand for skin resurfacing, wrinkle reduction, pigmentation correction, and fat-reduction procedures, as evidenced by the BAAPS 2023–2024 audit showing a 10% increase in liposuction.

Asia Pacific Aesthetic Lasers Market Trends

Aesthetic lasers market in APAC is experiencing strong growth, driven by rising demand for non-invasive cosmetic procedures and increasing awareness of aesthetic treatments. In countries like China, South Korea, Japan, and India, procedures such as skin rejuvenation, hair removal, pigmentation correction, lipoplasty, and acne scar treatment are becoming popular due to their effectiveness and short recovery times. In India and China, treatments for skin brightening and pigmentation removal are widely adopted, reflecting cultural preferences. Technological advances, including fractional and diode lasers, have improved safety, speed, and accessibility, encouraging more clinics to offer these services and boosting consumer adoption across urban and middle-class populations.

Aesthetic laser market in Japan is highly competitive and technology-focused, dominated by global players including Lumenis Be Ltd., Candela, Cutera, Cynosure Lutronic, Solta Medical, Sisram, Sciton, STRATA, and Sinclair, operating via local subsidiaries or distributors. Clinics prioritize clinical evidence, safety, and reliable post-sale support, favoring suppliers with local training and maintenance. Consumer brands such as Tria Beauty target the home-use segment. Market demand is rising due to demographic shifts, cultural factors, and healthcare awareness. Middle-aged and elderly consumers increasingly prefer non-surgical treatments for skin tightening, wrinkle reduction, and pigmentation correction, driving growth in laser-based aesthetic procedures.

Latin America Aesthetic Lasers Market Trends

The Latin America aesthetic lasers market is experiencing strong growth, mainly driven by strong cultural acceptance of cosmetic treatments and high patient interest in appearance-focused procedures. Several countries such as Brazil and Argentina have an aesthetic culture of decades where treatments such as laser hair removal, skin resurfacing, pigmentation correction, and acne scar reduction are easily embraced by different age groups. Particularly, Brazil has the highest number of aesthetic procedures globally, which makes it very attractive for clinics and dermatology centers to keep investing in advanced laser systems. The rising preference towards non-surgical and minimally invasive treatments is also a significant reason, as laser treatments deliver visible results in a short period of recovery as compared to surgery. This aligns well with the lifestyle needs of working professionals and younger consumers, especially in urban areas. Moreover, strong influence from social media, beauty trends, and local celebrities is increasing awareness of laser-based treatments, pushing more patients to seek professional aesthetic services.

The aesthetic lasers market in Brazilis growing, with major international players driving growth through strong brand presence and local partnerships. Lumenis Be Ltd., Candela Corporation, Cutera, Inc., Cynosure/Lutronic, and Sisram Medical are among the top suppliers, offering a wide range of hair removal, skin resurfacing, and body-contouring laser systems. These companies leverage distributor networks, training programs, and after-sales service to support dermatology and aesthetic clinics across the country.

Middle East & Africa Aesthetic Lasers Market Trends

The Middle East and Africa region is experiencing steady growth in demand for aesthetic lasers as more patients are choosing fast, low-downtime treatments such as laser hair removal, skin resurfacing, and pigment correction. Strong Gulf economies such as the UAE and Saudi Arabia are investing heavily in healthcare infrastructure and promoting medical tourism, which brings both international patients and higher clinic revenues that support purchases of advanced aesthetic laser systems. For instance, in 2023, Dubai welcomed more than 691,000 international medical tourists, reflecting strong growth in the country’s medical tourism ecosystem, supported by advanced healthcare facilities and premium cosmetic services.

Aesthetic lasers market in Saudi Arabiaisdriven by rising disposable incomes, increasing consumer interest in cosmetic and non-invasive procedures, and a growing focus on personal grooming and beauty. The market is supported by the rapid expansion of dermatology and medical-aesthetic clinics in major cities like Riyadh, Jeddah, and Dammam, often located in shopping malls and high-traffic urban areas, making aesthetic treatments more accessible to a broad consumer base. International and local laser device manufacturers are introducing innovative, high-safety platforms suitable for diverse skin types, meeting the demand for effective and low-downtime procedures. In addition, government initiatives promoting medical tourism, professional training for practitioners, and regulatory oversight ensuring safe practices are boosting consumer confidence and encouraging further investment, collectively driving the sustained growth of Saudi Arabia’s aesthetic-laser market.

Key Aesthetic Lasers Company Insights

The aesthetic lasers market is highly competitive, with key players such Sinclair, Lumenis Be Ltd., Solta Medical, Inc., Cynosure Lutronic, STRATA Skin Sciences, Candela Corporation, Cutera, Inc., Sisram Medical, Lynton Lasers Ltd, Sciton, Tria Beauty, SilkPro USA and among others. The major companies undertake various organic and inorganic strategies such as product introduction, collaborations, and regional expansion to serve the unmet needs of their customers.

Key Aesthetic Lasers Companies:

The following are the leading companies in the aesthetic lasers market. These companies collectively hold the largest market share and dictate industry trends.

- Lumenis Be Ltd.

- Solta Medical, Inc.

- Cynosure Lutronic

- STRATA Skin Sciences

- Candela Corporation

- Cutera, Inc.

- Sisram Medical

- Lynton Lasers Ltd

- Sciton

- Tria Beauty

- SilkPro USA

- Sinclair

Recent Developments

-

In April 2025, Lumenis Be Ltd. unveiled the enhanced SPLENDOR X at the American Society for Laser Medicine and Surgery Conference, presenting new clinical data that support its FDA-cleared dual-wavelength BLEND X technology. The system demonstrates improved hair removal outcomes across skin types and is now available in the U.S. and Canada.

-

In March 2023, Israel-based Sisram Medical, a global leader in medical aesthetic devices, announced that its wholly owned subsidiary Alma Lasers has acquired 60% of PhotonMed International for ¥270 million (approximately USD 38.7 million), forming a major joint venture. This acquisition strengthens Alma’s direct sales channels and brand presence in the People’s Republic of China (PRC), enhancing market penetration. PhotonMed, a strategic partner since 2003, has distributed Alma’s energy-based devices across the PRC. The move aligns with Sisram’s direct-to-consumer strategy and supports its global expansion. In 2022, Sisram posted record revenue of USD 354.5 million, up 20.5% year-over-year, with profits of USD 40.1 million.

-

In November 2023, Alma Lasers, a Sisram Medical company, launched a new subsidiary in Tokyo, Japan, marking its sixth Asia Pacific branch. This expansion strengthens Alma’s leadership in APAC, providing Japanese doctors direct access to its award-winning energy-based devices, enhancing brand presence, and supporting tailored, innovative aesthetic solutions in the rapidly growing Japanese market.

Aesthetic Lasers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.3 billion

Revenue forecast in 2033

USD 7.1 billion

Growth rate

CAGR of 10.0% from 2025 to 2033

Actual period

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Russia; Japan; China; India; Australia; Thailand; South Korea; Singapore; Malaysia; Taiwan; Vietnam; Philippines; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Sinclair; Lumenis Be Ltd.; Solta Medical, Inc.; Cynosure Lutronic; STRATA Skin Sciences; Candela Corporation; Cutera, Inc.; Sisram Medical; Lynton Lasers Ltd; Sciton; Tria Beauty; SilkPro USA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aesthetic Lasers Market Report Segmentation

This report forecasts revenue growth at global, region and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global aesthetic lasers market report on the basis of application, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Laser Hair Removal

-

IPL Laser Treatment

-

Laser Skin Resurfacing

-

Noninvasive Tightening

-

Laser-assisted Lipoplasty

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Thailand

-

Australia

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global aesthetic lasers market size was estimated at USD 3.1 billion in 2024 in 2024 and is expected to reach USD 3.3 billion in 2025.

b. The global aesthetic lasers market is expected to grow at a compound annual growth rate of 10.0% from 2025 to 2033 to reach USD 7.1 billion by 2033.

b. North America dominated the aesthetic lasers market with a share of over 41.0 % in 2024. This is attributable to the growing aesthetic consciousness amongst the elderly population and rapid technological advancements.

b. Some key players operating in the aesthetic lasers market include Solta Medical, Inc. (acquired by Valeant Pharmaceuticals); Lumenis; Cynosure, Inc.; STRATA Skin Sciences; Syneron Medical Ltd.; Lutronic; Cutera; Viora; Lynton Lasers; and Sciton, Inc.

b. Key factors that are driving the aesthetic lasers market growth include the increasing geriatric population, availability of surplus income middle class to spend on cosmetic surgeries, and increasing awareness and consciousness about appearance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.