- Home

- »

- IT Services & Applications

- »

-

Africa Business Process Outsourcing Market Report, 2030GVR Report cover

![Africa Business Process Outsourcing Market Size, Share & Trends Report]()

Africa Business Process Outsourcing Market Size, Share & Trends Analysis Report By Service (Human Resource, KPO), By Application (BFSI, Healthcare), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-145-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Africa BPO Market Size & Trends

The Africa business process outsourcing market size was estimated at USD 2.85 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 4.0% from 2023 to 2030. Policy to promote outsourcing by enhancement in telecom and IT services, intellectual property protection, and providing financial aid are also expected to bode well for the market growth. The adoption of AI, robotic process automation, and cloud-based services in the business process outsourcing (BPO) sector is poised to drive market growth during the projection period. By deploying technologies such as cloud, AI, and automation, vendors can utilize large datasets to gather actionable insights for offering enhanced customer service. Moreover, cross-channel campaigns, omnichannel communications, and online interactions are poised to play a significant role in improving customer engagement processes, which bodes well for market growth.

In recent years, businesses worldwide have recognized Africa as a suitable location for outsourcing operations due to factors such as a sizable talent pool, adequate knowledge, and neutral English dialects that are easy to comprehend, favoring market growth. Compared to India, Africa offers more actuarial resources with an emphasis on analytics and AI-driven services, and it can offer support in several languages, including French and Spanish. This is anticipated to accelerate market growth over the forecast period. In addition, efforts to enhance the employability of the African youth by organizations such as Business Process Enabling South Africa have contributed significantly to the growth of the sector by encouraging skill development, disseminating best practices, and enabling its members to access business associations that support the industry transition. The government of different African countries has also implemented several tax incentives and initiatives for the development of infrastructure and support for skills, which is further expected to drive market growth.

The Africa business process outsourcing (BPO) industry is expanding and growing owing to innovation and new technologies. BPO has given companies the tools they need to grow earnings and reduce costs successfully. The benefits gained from innovative technologies like cloud computing, process automation, social networking, and others are also driving the market growth. BPOs can further raise the efficiency of their services. It is also projected that Africa business process outsourcing (BPO) service providers would make effective use of new technological advancements to manage shortages of employees, improve products and services, and solve market issues while maintaining low operating costs which is further expected to drive market growth.

Moreover, the growing traction towards multichannel communication in the BPO landscape is further bolstering the growth of the market for Africa business process outsourcing. Multichannel communication is a method of communication for companies with customers via different platforms, including SMS, email, fax, web page forms, social media, and more. It can also be called multichannel marketing, as it is usually used in the marketing strategy of a company. There are various benefits of multichannel communication, including understanding audience preferences, serving customers at their location, improving customer experience, and boosting customer loyalty. It also provides an opportunity for customers to reach out to companies from the convenience of their home, office, or other places using a laptop or smartphone. Many companies outsource this multichannel communication as it helps maintain sales by understanding the exact needs of the customers, as well as their satisfaction and complaints by saving a bulk of staffing costs, thus driving market growth.

Business process outsourcing (BPO) entails the exchange of information, such as processes, procedures, designs, and other crucial business data, to guarantee the highest possible quality of the product or service that the outsourcing partner delivers. Such information frequently includes patented and copyrighted processes and techniques that the business relies on to keep its competitive edge and protect client privacy. To ensure the proper execution of business processes, outsourcing related to verticals such as healthcare and banking necessitates the sharing of vital information with the outsourcer, including customer name, contact information, account number, social security number, and disease history, among others. As a result, outsourcing firms are frequently concerned about the use of the information supplied, which acts as a major restraint for market growth.

Service Insights

Based on service, the customer services segment held the largest market share of 32.92% in 2022 and it is anticipated to register the fastest CAGR over the forecast period. The growth is ascribed to the expansion of service centers, which call for both online and offline technical help. Customer service BPO specializes in handling inquiries from customers who contact them via phone, email, chat, social media, and other methods. The customer service BPO sector is booming, has grown significantly in recent years, and is predicted to experience significant expansion in the years to come.

The customer services segment is anticipated to grow at the fastest CAGR of 5.5% over the forecast period. Technological advancements such as Chatbots, voice assistants, virtual assistants, and customer service automation are expected to further create new growth avenues for the market. The deployment of chatbots and automation tools aids in reducing the load on call centre employees by handling basic customer queries. Likewise, voice assistants are used extensively for order booking, confirmation, and reservations. The use of such tools aids in refining customer experience, thus driving segment growth.

Application Insights

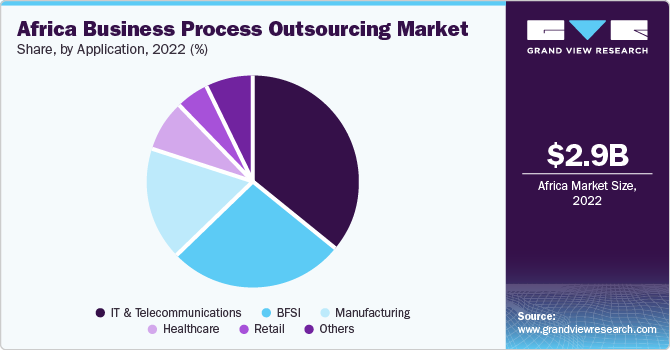

Based on application, the IT & Telecommunications segment held the largest market share of 36.16% in 2022. Telecommunications outsourcing is being used by telecom firms globally to cut down on overall capital expenditure. The telecom industry outsources a range of corporate tasks, including call center, billing, and finance and accounting outsourcing. Accessing expert personnel, maximizing current investments, and managing cost pressures are all made possible by outsourcing services for telecom organizations. In addition, it is projected that infrastructure and service delivery costs would rise, making the outsourcing of non-core and crucial corporate tasks even more crucial. This enables telecom businesses to concentrate on innovation, increase operational effectiveness, and provide improved client experiences.

The BSFI segment is anticipated to register the fastest CAGR of 5.7% over the forecast period. The growth can be attributed to the increasing number of banking services, online payment facilities, and regulatory standards in the banking industry, which have led to a need for service outsourcing as it allows for a sizable reduction in operating expenses.

The increased need for resources across many sub-segments, such as payment processing, recruiting and relocation, administration, and other employee benefit services, is also expected to cause the human resource segment to expand significantly over the forecast period.

Country Insights

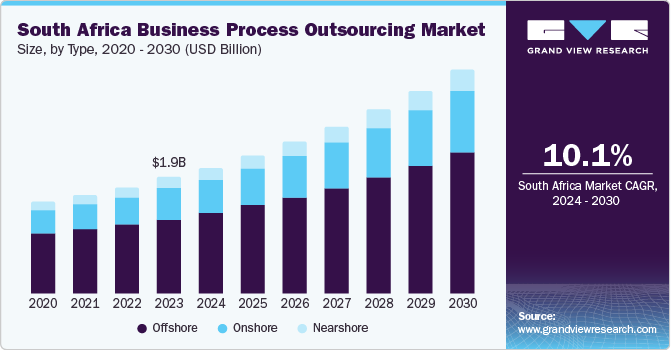

The South Africa region held the largest market share of 30.0% in 2022. Over the years, South Africa has been recognized as a preferred destination for business process outsourcing (BPO) services. South Africa has recognized the business process outsourcing (BPO) industry as a major enabler of development. In South Africa, Cape Town is one of the prominent cities for BPO and is the preferred location for many international and domestic operation expansions. South Africa ranks as a leading destination for global business services - or offshoring business processes.

Nigeria is anticipated to grow at a CAGR of 2.9% during the forecast period. Nigeria is emerging as Africa’s home to a large young workforce. Nigeria is a natural destination for BPO or outsourcing IT development needs, with numerous English-speaking university graduates joining the labor pool each year.With government support, BPO has become a vital source of new job openings for young Nigerians. With the right policy and essential infrastructure in place, outsourcing has the potential to create indirect and direct jobs in the country.

Key Companies & Market Share Insights

The major players operating in the African market include AMDOCS, HCL Technologies Limited, Capgemini, IBM Corporation, and Wipro, among others. To enhance their product offering, companies leverage a variety of inorganic growth tactics, such as partnerships, mergers, acquisitions, and expansions. For example, in June 2023, Wipro increased its presence in South Africa by establishing a new office in Cape Town. The office would serve as a center for BPO operations, helping the company to cater to rising client requirements efficiently. The company would also focus on providing skill development and employment opportunities to the local talent through this development.

Key Africa Business Process Outsourcing Companies:

- Accenture

- AGR GROUP INC

- AMDOCS

- Capgemini

- HCL Technologies Limited

- IBM Corporation

- Infosys Limited (Infosys BPM)

- MCI, LC.

- NCR Corporation

- OutProsys

- Rewardsco

- SA Commercial.

- Sodexo

- TTEC Holdings, Inc.

- Wipro Limited

Africa Business Process Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.00 billion

Revenue forecast in 2030

USD 3.95 billion

Growth rate

CAGR of 4.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service, application, country

Regional Scope

Africa

Country scope

South Africa; Nigeria; Ghana; Kenya

Key companies profiled

Accenture; AGR GROUP INC; AMDOCS; Capgemini; HCL Technologies Limited; IBM Corporation; Infosys Limited (Infosys BPM); MCI, LC.; NCR Corporation; OutProsys; Rewardsco; SA Commercial; Sodexo; TTEC Holdings, Inc; Wipro Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Africa Business Process Outsourcing Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Grand View Research has segmented the Africa business process outsourcing market report based on service, application, and country:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Finance & Accounting

-

Human Resource

-

KPO

-

Procurement & Supply Chain

-

Customer Services

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Manufacturing

-

IT & Telecommunications

-

Retail

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

South Africa

-

Nigeria

-

Ghana

-

Kenya

-

Frequently Asked Questions About This Report

b. The Africa business process outsourcing market size was estimated at USD 2.85 billion in 2022 and is expected to reach USD 3.00 billion in 2023.

b. The Africa business process outsourcing market is expected to grow at a compound annual growth rate of 4.0% from 2023 to 2030 to reach USD 3.95 billion by 2030.

b. South Africa held the largest share of 30% in 2022. Over the years, South Africa has been recognized as a preferred destination for business process outsourcing (BPO) services. South Africa has recognized the business process outsourcing (BPO) industry as a major enabler of development.

b. Some key players operating in the Africa business process outsourcing market include Accenture, AGR GROUP INC, AMDOCS, Capgemini, HCL Technologies Limited, IBM Corporation, Infosys Limited (Infosys BPM), MCI, LC., NCR Corporation, OutProsys, Rewardsco, SA Commercial, Sodexo, TTEC Holdings, Inc, Wipro Limited.

b. Policy to promote outsourcing by enhancement in telecom and IT services, intellectual property protection, and providing financial aid are also expected to bode well for the Africa business process outsourcing (BPO) market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."