- Home

- »

- HVAC & Construction

- »

-

Agricultural Ventilation Fans Market Size, Share Report, 2030GVR Report cover

![Agricultural Ventilation Fans Market Size, Share & Trends Report]()

Agricultural Ventilation Fans Market (2023 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Dairy/Livestock, Equine, Greenhouse), By Region (North America, Europe, APAC, South America, MEA) And Segment Forecasts

- Report ID: GVR-4-68039-311-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agricultural Ventilation Fans Market Trends

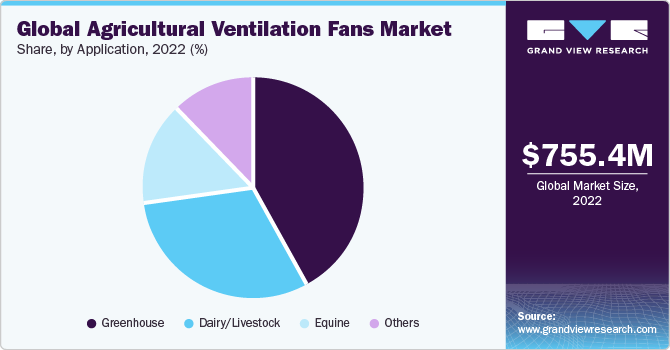

The global agricultural ventilation fans market size was valued at USD 755.4 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.7% from 2023 to 2030. The demand for agricultural ventilation fans has surged over the last few years due to the continual rise in indoor farming practices. The ever-increasing global population and changing climatic conditions have increased the demand for urban agriculture globally. Benefits such as relatively more harvest per unit area and reduced water requirement have encouraged farmers to adopt indoor farming practices, thereby boosting demand for indoor agriculture ventilation systems. Agricultural ventilation fans help maintain an optimum humidity level, carbon dioxide proportion, and temperature required for growing vegetables and plants on indoor farms. It also reduces humidity content on plant surfaces, avoiding mold or fungi development.

The growing demand for exotic vegetables, fruits, and flowers, coupled with the uncertain climatic conditions, has compelled farmers to cultivate them in a controlled environment using ventilation equipment. Furthermore, due to the scarcity of open space for cattle grazing, farmers are transforming their farms into greenhouses and installing agricultural ventilation systems to provide the desired environment inside the greenhouse. Moreover, agricultural ventilation fans are in huge demand in countries with dry climates or low water levels. In such countries, farmers or harvesters prefer to produce crops vertically as it conserves water used for crop cultivation and regulates the room's temperature to optimize the yield's nutrient quality and growth. This, in turn, bodes well for market growth.

Small-scale farmers, especially in underdeveloped and emerging countries, find it challenging to adapt to advanced agricultural ventilation technologies such as ECplus and Vplus, which help save around 80-85% of energy in dairy/livestock farming. This is primarily due to the lack of awareness, reluctance to shift from conventional agriculture practices to advanced ones, and lack of technical know-how. Further, as indoor farms are primarily located within populated city areas, the initial cost of setting up the indoor structure and agricultural ventilation system becomes difficult for small-scale farmers.

In addition, the reluctance of small-scale farmers to shift to indoor farming techniques is also aided by the fact that the climatic conditions and agricultural land in several regions/countries, including France, Italy, Ukraine, and India, are favorable for conventional agricultural practices. The major portion of the land in these countries is already fertile to the extent that the farmers do not feel the need to shift to such advanced farming techniques by investing additional funds. Hence, indoor-grown crops could be cultivated at a much higher scale in such regions. The increased capital investment required, coupled with the reluctance of farmers to move towards advanced farming practices, poses a challenge to the adoption of indoor farming.

The outbreak of COVID-19 caused disruptions in food supply chains across the globe. In the initial stages of the pandemic, movement restrictions and illness resulted in labor shortages and a reduced supply of raw materials required to produce agricultural ventilation fans. This disruption of the supply chain further delayed the feed supply. However, the COVID-19 outbreak also contributed to an upsurge in demand for indoor-grown produce. The ability of indoor farming to address the shortage of food in the COVID-19 pandemic situation and the increasing demand for indoor-grown crops supported the demand for agricultural ventilation fans.

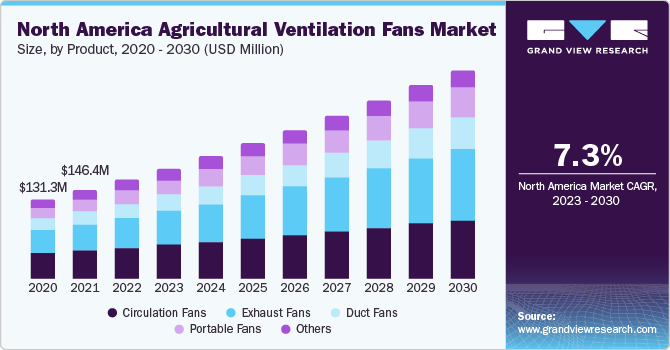

Product Insights

The circulation fan segment dominated the market and accounted for the largest revenue share of 31.9% in 2022. The high share of the segment can be attributed to the increased adoption of the back two-fold feature offered in terms of providing both cooling and ventilation to the open livestock barns. Also, these fans move a high air volume with low pressure to balance the temperature in greenhouses. Moreover, these fans help distribute warm air from the overhead heat systems during cold seasons.

The exhaust fan segment is expected to emerge as the fastest-growing segment, registering a CAGR of 11.5% during the forecast period. The exhaust fans are one of the most essential components in the mechanical ventilation system as they remove odor and exhalations in the livestock. Also, they help not only improve the quality of animal life but also contribute to preventing the risk of epidemics and disease in livestock. Therefore, in housing poultry and livestock facilities, these fans work as a driving force that provide necessary air exchange. Furthermore, agricultural ventilation fans such as circulation fans and exhaust fans combined with other equipment such as humidifiers are increasingly used for creating micro-climates ideal for various cultivations.

Application Insights

The greenhouse segment led the market and accounted for more than 42.0% of the global revenue in 2022. The high share is attributable to the rising demand for vertical and indoor farming for cultivating fruits and vegetables. In greenhouses, climatic conditions are controlled by the agricultural ventilation fans to improve product quality as well as quantity. Further, to maintain optimal temperatures inside the greenhouses during the summer, hot air inside the greenhouse needs to be replaced with cooler outside air. Harvesters use ventilation fans to achieve this, resulting in higher crop production than when natural ventilation techniques are employed.

The dairy/livestock segment accounted for a significant market share of 30.5% in 2020. The segment is expected to be the fastest-growing segment with a CAGR of 10.6% for the forecast period. The growth is attributed to the increasing population of livestock in advanced economies such as the U.S., the U.K., China, and Germany. A ventilation fan in dairy/livestock housing helps in maintaining a comfortable and uniform climate for animals. These fans remove the odors, heat, and moisture generated by livestock and refill the oxygen supply by bringing in cooler outside air.

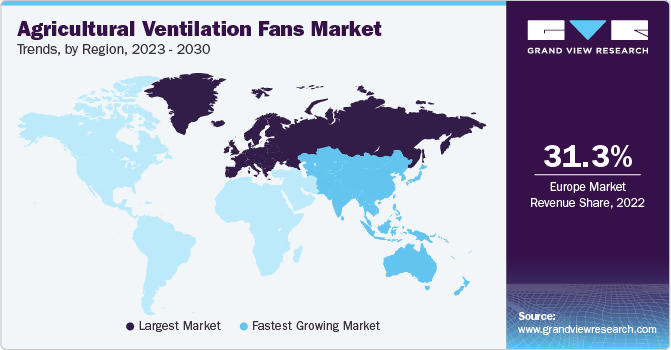

Regional Insights

Europe dominated the agricultural ventilation fans market and accounted for 31.3% of the global revenue share in 2022. The high share is attributable to the rising adoption of technologies like Controlled Environment-Agriculture (CEA) in the region. The U.K. held a significant share of the European market owing to the ongoing trend of adopting U.S.-style greenhouse cultivation. Besides, several initiatives have been taken by the governments and agencies of several countries to build indoor farms to overcome challenges, including increasing population, food production, and climate change.

In Asia Pacific, the market is estimated to register the highest CAGR of 11.2% during the forecast period. The growth is characterized primarily by the combination of factors including rising population, increasing awareness among farmers regarding the need to adopt alternative farming practices, changing consumption patterns of consumers in the region, and growing disfavor for using excessive pesticides in fruit and vegetable cultivation. The need to adopt alternative farming practices in the wake of uncertain climatic conditions and rising food demand has resulted in the increasing construction of greenhouses and vertical farms to produce crops, thereby driving the installation of agricultural ventilation fans in the region.

China and India are among the countries with the largest livestock and predominant conventional farming practices. Thus, both these markets offer huge growth opportunities for technology adoption, including ventilation. In addition, several countries in Asia Pacific benefitted from favorable government policies and subsidies that promote the adoption of indoor farming. For instance, in Japan, more than half of growers have received either a subsidy or a loan to establish indoor agriculture operations. This, in turn, is expected to boost the demand for agricultural ventilation fans.

Key Companies & Market Share Insights

Market players are focusing on inorganic growth strategies, such as acquisitions & mergers, and collaborations, to augment their market share. For instance, in May 2023, EBM-Papst, a German fan and motor maker announced its plan to relocate its Shanghai operations to a new 33,000m site in the city. EBM-Papst China aims to bring all staff together in a pleasant working atmosphere.

Key Agricultural Ventilation Fans Companies:

- AirMax Fans

- American Coolair Corp.

- Bigass Fans (Delta T, LLC)

- Multi-Wing America, Inc.

- OSBORNE INDUSTRIES INC.

- QC Supply, a PS Operating Company LLC

- Schaefer

- Vostermans Ventilation

- New York Blower Company

- ebm-papst

Recent Developments

-

In April 2022, Multi-Wing Group, a manufacturer of adaptable and configurable axial fans based in the U.S., acquired long-term partner Fabrika Special Motors, a Danish company specializing in electric motors. The acquisition enabled Multi-Wing Group to provide global customers with better and more efficient fan solutions in the future.

-

In November 2022, ebm‑papst established a new plant in Tennessee, U.S., for highly energy-efficient fans and motors. The company aims to serve local clients more effectively and become independent of foreign pressures via three different supply chains.

-

In October 2020, American Coolair Corp developed a new fan with a high-density polyethylene (HDPE) cone. HDPE is a high-strength thermoplastic polymer, which is lighter than additional fiberglass.

Agricultural Ventilation Fans Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 840.2 million

Revenue forecast in 2030

USD 1.6 billion

Growth Rate

CAGR of 9.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

AirMax Fans; American Coolair Corp.; Bigass Fans (Delta T, LLC); Multi-Wing America, Inc.; OSBORNE INDUSTRIES INC.; QC Supply, a PS Operating Company LLC.; Schaefer; Vostermans Ventilation; New York Blower Company; ebm-papst

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

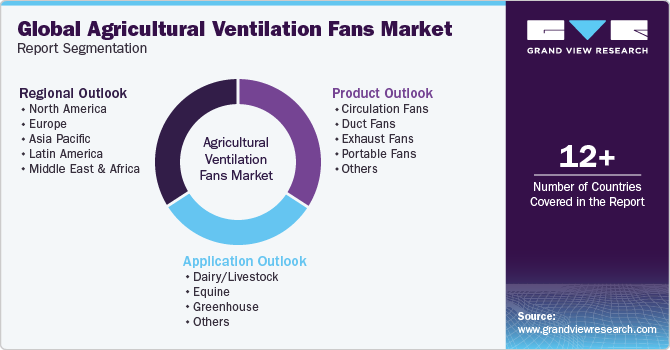

Global Agricultural Ventilation Fans Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global agricultural ventilation fans market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Circulation fans

-

Duct fans

-

Exhaust fans

-

Portable fans

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Dairy/Livestock

-

Equine

-

Greenhouse

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global agricultural ventilation fans market size was estimated at USD 755.4 million in 2022 and is expected to reach USD 840.2 million in 2023.

b. The global agricultural ventilation fans market is expected to grow at a compound annual growth rate of 9.7% from 2023 to 2030 to reach USD 1.6 billion by 2030.

b. Europe dominated the agricultural ventilation fans market with a share of 31.32% in 2022. This is attributable to the increasing trade of agricultural machinery in the regional market.

b. Some key players operating in the agricultural ventilation fans market include Bigass Fan, QC Supply, New York Blower Company, and OSBORNE INDUSTRIES INC., among others.

b. Key factors that are driving the agricultural ventilation fans market growth include rising growth in indoor farming and growing demand for indoor farming produce in emerging markets such as the Middle East and the Asia Pacific.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.