- Home

- »

- Next Generation Technologies

- »

-

Agricultural Tractors Market Size And Share Report, 2030GVR Report cover

![Agricultural Tractors Market Size, Share & Trends Report]()

Agricultural Tractors Market (2024 - 2030) Size, Share & Trends Analysis Report By Engine Power (Less Than 40 HP, 41 to 100 HP, & More Than 100 HP), By Driveline (2WD, 4WD), By Propulsion, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-429-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Agricultural Tractors Market Summary

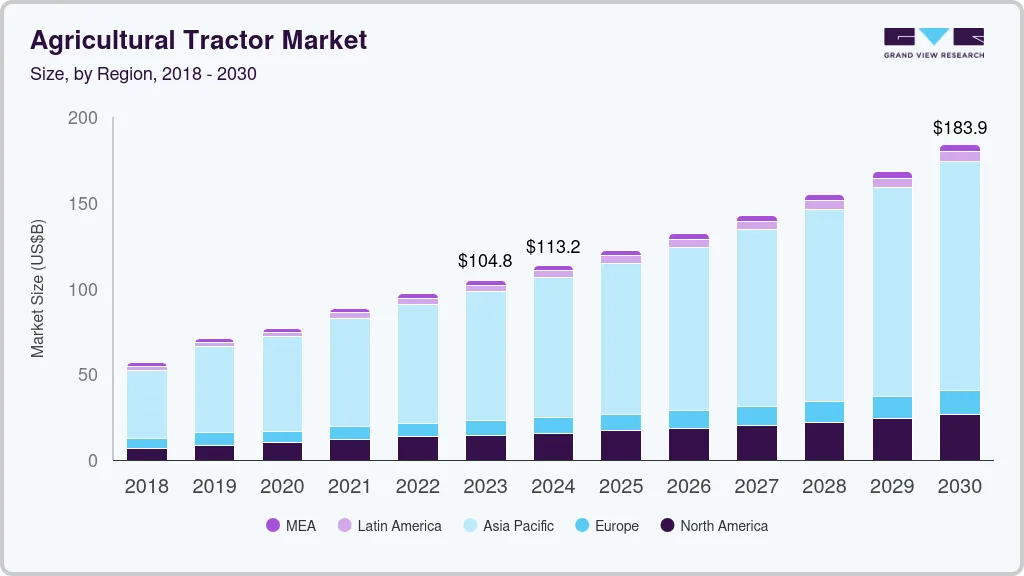

The global agricultural tractor market size was estimated at 3,098.2 thousand units in 2023 and is projected to reach 4,965.5 thousand units by 2030, growing at a CAGR of 7.2% from 2024 to 2030. The increase in demand for compact tractors on small farms and technical developments such as the integration of telematics with agricultural tractors are expected to drive growth.

Key Market Trends & Insights

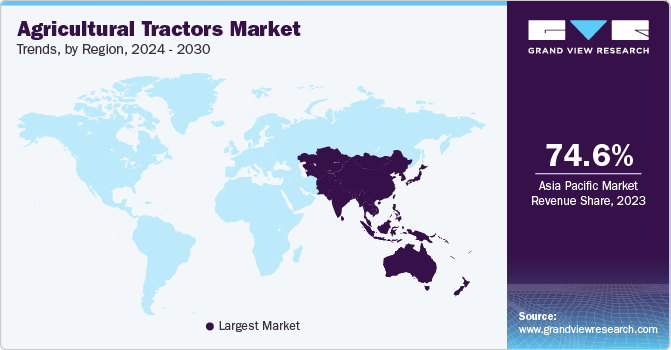

- The Asia Pacific led the global market with a volume share of more than 74.57% in 2023 and is estimated to grow at the fastest CAGR over the forecast period retaining the dominant position.

- The U.S. is expected to account for a significant revenue share in North America agricultural tractor market.

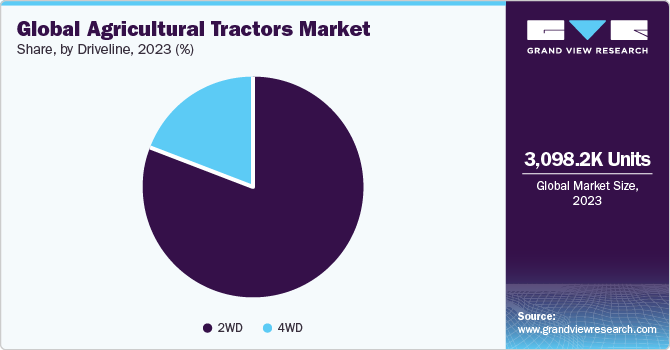

- Based on driveline, the 2WD segment accounted for more than 80.78% market share in terms of volume in 2023.

- Based on engine power, the less than 40 HP segment accounted for more than 62.25% market share in terms of volume in 2023.

Market Size & Forecast

- 2023 Market Size: 3,098.2 Thousand Units

- 2030 Projected Market Size: 4,965.5 Thousand Units

- CAGR (2024-2030): 7.2%

- Asia Pacific: Largest market in 2023

Furthermore, the quick adoption of mechanization is expected to be favorable for the market's expansion during the following eight years. Additionally, it is anticipated that the market will witness growth due to the migration of farm workers to cities, which would result in a labor shortage. Due to the brief production halt and supply chain disruption caused by the COVID-19 outbreak, product demand was impeded.

However, in H1 2022, the demand for tractors bounced back significantly with double-digit growth in major economies, such as the U.S., Canada, the U.K., Germany, China, and India. Also, strong crop production in these markets, along with the need to replace aging equipment, increased product sales in H1 2022. However, a sudden increase in demand led to lower inventory levels of tractors in H2 2022, a trend expected to continue over the next few quarters of 2022. In 2022, OEMs are presumed to increase agricultural tractor prices from 4% to 22%, which is anticipated to slow down the market growth. It is attributed to low inventory levels of tractors experienced by dealers.

Also, OEMs are currently experiencing a shortage of semiconductors coupled with supply chain disruptions and market uncertainty due to the growing COVID-19 cases, which may delay production. Furthermore, a hike in steel and aluminum prices is expected to increase tractor prices, which is further anticipated to hinder market growth over the next few quarters. Favorable government policies are likely to boost market growth over the forecast period. For instance, on September 15, 2022, the U.S. Department of Agriculture (USDA) introduced a Precision Agriculture Loan (PAL) Act to allow farmers and ranchers to avail of loans to purchase precision agriculture equipment.

Similarly, the implementation of the Canadian Agricultural Loans Act (CALA) and the U.K. Agriculture Act 2020 is expected to increase product demand over the forecast period. Over the course of the projected period, such initiatives are anticipated to fuel market expansion. Agricultural tractors' technological developments are also anticipated to be favorable for the market's expansion throughout the forecast period. For instance, the growing use of electric and driverless tractors will boost farming production.

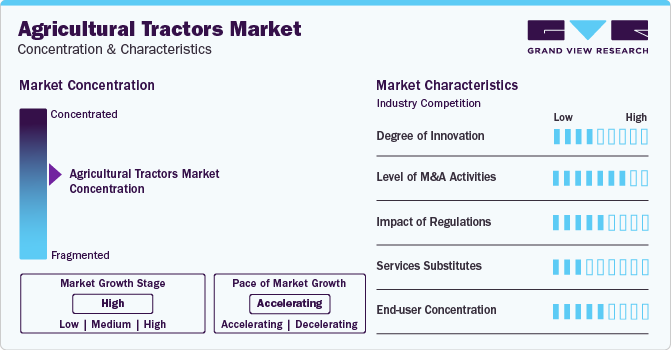

Market Concentration & Characteristics

The market growth stage in the agricultural tractors market is high, and the pace of the market growth is accelerating. The agriculture tractor market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in machine learning algorithms, availability of big data, and increasing computing power. Subsequently, innovative AI applications are constantly emerging, disrupting existing industries and creating new ones.

The agriculture tractor market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to increase customer base, increase product offerings, and the need to consolidate in a rapidly growing market.

The agriculture tractor market is also subject to increasing regulatory scrutiny due to concerns about the environmental damage due to ICE tractor engines. As a result, governments across the globe are investing in the development of electric infrastructure and developing economies provide considerable subsidies for purchasing agricultural tractors to encourage modernized farming.

There are no direct product substitutes for agriculture tractors. Also, advances in robotic technology are anticipated to lead to the development of advanced autonomous tractors. Precision farming technologies, including autonomous tractors, drones, and robotic systems, are emerging as alternatives that offer more efficient and precise farming operations. These technologies aim to optimize resource use, enhance productivity, and reduce environmental impact.

Driveline Insights

2WD segment accounted for more than 80.78% market share in terms of volume in 2023. The segment is also estimated to register the fastest CAGR over the forecast period. Low upfront costs and better maneuverability are long-term factors that are expected to drive the demand in the 2WD segment, notably in the Asia Pacific market. The 2WDs are the most preferred tractors among middle-income farmers in India. However, a rise in diesel prices has already pushed up farmers' operating costs, which is anticipated to be one of the major worries over the projection period.

India now outsources semiconductor devices and chips for the automotive industry and other industries. To address the country's scarcity of semiconductors, the government proposed a USD 10 billion package of incentives for businesses to establish manufacturing facilities in India. The policy's goal is to encourage the development and refinement of semiconductor chips, which will probably improve domestic local component production for the foreseeable future.

Engine Power Insights

The less than 40 HP segment accounted for more than 62.25% market share in terms of volume in 2023. The high growth can be attributed to the low cost, compact size, and greater convenience offered by less than 40HP tractors to perform all basic farming operations. These equipment are adopted mainly in the Asia Pacific region, where approximately 85% of farmlands are below 10 hectares and are preferred by most farmers in the region. In addition, the electrification of tractors in the less than 40 HP segment is expected to gain momentum over the next few years.

The 40 HP to 100 HP segment is expected to register a significant CAGR during the forecast period. It is credited to a surge in demand for these tractors from developed markets, such as the U.S., Japan, and Germany. Increased income levels, tech-savvy farmers, and well-established after-sales services are expected to favor the growth of this segment over the forecast period. The rising demand for high-power tractors for more than 10-hectare farm sizes is expected to be a long-term factor, which is expected to drive the segment over the forecast period.

However, farmers' operating costs have already grown due to a rise in diesel prices, which is anticipated to be one of the major worries for the forecast period. Currently, India outsources semiconductor devices and chips for the automotive industry and other industries. Therefore, to overcome the semiconductor shortage in the country, and to encourage businesses to establish production facilities in India, the government unveiled a USD 10 thousand-unit package. The policy aims to promote semiconductor chip manufacturing and refining, which is likely to further boost the indigenous local production of components for the next few years.

Propulsion Driveline

Stringent environmental regulations aimed at reducing the impact of Internal Combustion Engine (ICE) tractor engines have prompted a shift in the approach of tractor manufacturers. Governments are implementing stringent standards to address environmental concerns associated with traditional tractor engines. In response, tractor manufacturers are increasingly focusing on the development of electric-powered tractors as a more environmentally friendly alternative. Electric tractors offer high compatibility with evolving regulatory standards and present a cost-effective solution with lower maintenance requirements. This shift reflects the industry's commitment to sustainability and aligns with global efforts to reduce carbon emissions and promote greener technologies in the agricultural sector.

Regional Insights

Asia Pacific led the global market with a volume share of more than 74.57% in 2023 and is estimated to grow at the fastest CAGR over the forecast period retaining the dominant position. The growth is driven by India, followed by China and the rest of Asia Pacific. India led the APAC regional market accounting for a significant share in 2023. In India, product sales are expected to reach over 900 thousand units by 2022. Easy loan availability, favorable Minimum Support Price (MSP), and better monsoon are expected to bode well for the regional market growth in 2022.

Europe is expected to grow at a moderate CAGR in terms of volume over the next few quarters in 2023. The growth is attributed to the increased demand for large farm tractors, particularly from Italy, Greece, and Lithuania. In addition, the high demand for autonomous tractors is expected to drive regional market growth over the forecast period. On the other hand, a long waiting period for new tractor purchases due to production delays is expected to hamper market growth over the forecast period.

U.S. Agricultural Tractor Market

The agriculture tractor market in the U.S. is expected to account for a significant revenue share in North America agricultural tractor market. The US tractor market is a key segment within the broader agricultural machinery industry and is characterized by the production, sale, and use of tractors for various agricultural activities.

U.K. Agricultural Tractor Market

The agriculture tractor market in the U.K. is expected to account for a significant revenue share in Europe agricultural tractor market. Several factors influence the U.K. tractor market, including agricultural trends, technological advancements, regulatory policies, economic conditions, and consumer preferences.

Germany Agricultural Tractor Market

The agriculture tractor market in Germany is expected to account for a significant revenue share in Europe agricultural tractor market. Government regulations and policies also impact Germany agricultural tractor market, particularly in areas related to emissions standards, safety regulations, labor laws, and trade policies.

France Agricultural Tractor Market

The agriculture tractor market in France is expected to account for a significant revenue share in Europe agricultural tractor market. In France, agricultural tractors are essential equipment used by farmers for various tasks, including plowing, planting, tilling, fertilizing, spraying, and harvesting. Tractors come in various sizes, power ratings, and configurations to cater to different farming operations and field conditions.

China Agricultural Tractor Market

The agriculture tractor market in China is expected to account for a significant revenue share in Asia Pacific agricultural tractor market. The tractor market in China is a vital component of the country's agricultural machinery industry, supporting the cultivation, management, and harvesting of crops across its vast agricultural landscape. As one of the world's largest agricultural producers, China relies heavily on tractors for various farming activities, including plowing, planting, tilling, fertilizing, spraying, and harvesting.

India Agricultural Tractor Market

The agriculture tractor market in India is expected to account for a significant revenue share in Asia Pacific agricultural tractor market. India’s tractor market is influenced by several factors, including government policies, economic conditions, technological advancements, and demographic trends. Government initiatives aimed at modernizing agriculture, increasing mechanization, and boosting rural development have played a significant role in driving demand for tractors in India.

Japan Agricultural Tractor Market

The agriculture tractor market in Japan is expected to account for a significant revenue share in Asia Pacific agricultural tractor market. Technological advancements, particularly in precision agriculture, automation, and electrification, are driving innovation in the Japan tractor market. Manufacturers are increasingly incorporating features such as GPS guidance systems, telematics, remote monitoring, and electric drivetrains to improve tractor performance, efficiency, and productivity while reducing environmental impact.

Brazil Agricultural Tractor Market

The agriculture tractor market in Brazil is expected to account for a significant revenue share in Latin America agricultural tractor market. Government regulations and standards, including emissions control, safety requirements, and quality certifications, also shape the Brazil tractor market. Compliance with these regulations is essential for manufacturers to ensure market access and maintain consumer confidence.

Saudi Arabia (KSA) Agricultural Tractor Market

The agriculture tractor market in Saudi Arabia (KSA) is expected to account for a significant revenue share in Middle East & Africa agricultural tractor market. The Middle East & Africa tractor market consists of a mix of smallholder farmers, commercial farms, and agribusinesses, each with different requirements and preferences for tractor types, sizes, and power ratings.

Key Agricultural Tractors Market Company Insights

Key vendors in this space, such as Deere & Company, CLAAS KGaAmbH Escorts Ltd., SOLECTRAC, and Monarch, have commercially launched concepts for their autonomous and electric tractors. For example, in November 2022, VST Tillers Tractors Ltd. and ZETOR TRACTORS presented two best-in-class tractors at their operations in India and the Czech Republic, VST and ZETOR jointly produced these tractors in the 45 HP and 50 HP categories.

-

Deere & Company is engaged in the manufacturing & construction of agricultural and forestry machinery; drivetrains and diesel engines for heavy equipment; and lawn care machinery. Additionally, the company also manufactures and provides other heavy manufacturing equipment. The company serves diverse industries such as agriculture, forestry, construction, landscaping & grounds care, engines & drivetrain, government and military, and sports turf.

-

AGCO Corporation is a U.S.-based agriculture equipment manufacturer. The company develops and sells products and solutions such as tractors, combines, foragers, hay tools, self-propelled sprayers, smart farming technologies, seeding equipment, and tillage equipment.

Iron Ox and Rowbot Systems are some of the emerging market participants in the target market.

-

Iron Ox is a global service provider of agriculture technology. The company provides automated robotic arms for tasks such as planting, harvesting, and packaging.

-

Rowbot Systems is a agriculture solution provider. The company develops and provides a robotic machine that allows farmers to practice in-season nitrogen management.

Key Agricultural Tractors Companies:

The following are the leading companies in the agricultural tractors market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these agricultural tractor’s companies are analyzed to map the supply network.

- AGCO Corp.

- CNH Industrial N.V.

- Deere & Company

- CLAAS KGaAmbH

- Escorts Ltd.

- International Tractors Ltd.

- YanmarCo., Ltd.

- KubotaCorp.

- Mahindra & Mahindra Ltd.

- Tractors and Farm Equipment Ltd.

Recent Developments

-

In November 2022, CNH Industrial N.V. signed a long-term agreement with Monarch Tractor, an AgTech company, to develop fully electrified autonomous tractors. The initiative would enable the former company to increase its product portfolio.

-

In August 2022, AGCO Corporation launched the latest New 700 Vario Series tractors in North America which have a more efficient powertrain with FendtiD low engine speed, hydraulic capacity, VarioDrive transmission, and a larger frame. This launch is expected to strengthen the company’s position in the North America region.

-

In March 2021, CLAAS KGaAmbH launched CLASS ARION 400 tractors equipped with turbochargers and 4-valve technology. These tractors have low AdBlue and low diesel consumption. This launch was expected to strengthen the company’s position in the market.

-

In September 2022, Kubota Corporation launched an electric compact tractor in Europe in 2023. This initiative is aimed at carbon neutrality. LXe-261 is the model’s name, which will be available by April 2023 for long-term rental service.

-

In Jully 2022, Mahindra & Mahindra Ltd. launched the Yuvo Tech+ range supported by ELS 4-cylinder engines and mZIP3 cylinders for better mileage, torque, and power. The range has three options of speed(H-M-L) for optimal performance based on different agriculture and soil types of applications. This launch was expected to strengthen its position of it in the market.

-

In May 2022, Tractors and Farm Equipment Limited launched EICHER PRIMA G3 Series, which utilizes high-intensity 3D cooling technology and Digi NXT Dashboard for more extended and continuous operations. This launch was expected to strengthen its position in the market.

Agricultural Tractors Market Report Scope

Report Attribute

Details

Market size volume in 2023

3,098.2 Thousand units

Revenue forecast in 2030

4,965.5 Thousand units

Growth rate

CAGR of 7.2% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in thousand units, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Engine power, driveline, propulsion, and region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Ukraine; Romania; Poland; Benelux; Turkey; China; India; Japan; Australia; South Korea; Brazil; and Mexico

Key companies profiled

AGCO Corp.; CLAAS KGa AmbH; CNH Industrial N.V.; Deere & Company; Escorts Ltd.; International Tractors Ltd/; Kubota Corp.; Mahindra & Mahindra Ltd.; Tractors and Farm Equipment Ltd.; YanmarCo., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agricultural Tractors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global agricultural tractors market report based on engine power, driveline, propulsion, and region:

-

Engine Power Outlook (Volume, Thousand Units, Revenue, USD million 2017 - 2030)

-

Less than 40 HP

-

41 to 100 HP

-

More than 100 HP

-

-

Driveline Outlook (Volume, Thousand Units, Revenue, USD million 2017 - 2030)

-

2WD

-

4WD

-

-

Propulsion Outlook (Volume, Thousand Units, Revenue, USD million 2017 - 2030)

-

Electric

-

ICE

-

-

Regional Outlook (Volume, Thousand Units, Revenue, USD million 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Ukraine

-

Romania

-

Poland

-

Benelux

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global agricultural tractor market demand was estimated at 2,942.8 thousand units in 2022 and is expected to reach 3,105.0 thousand units in 2023.

b. The global agricultural tractors market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach 4,968.1 thousand units by 2030.

b. Less than 40 hp tractors dominated the agricultural tractor market with a share of 35.95% in 2022. This is attributable to the benefits associated with these agricultural tractors, such as compact size, low cost, and ability to perform all the basic agricultural activities.

b. Some key players operating in the agricultural tractors market include AGCO Corporation; CLAAS KGaA mbH; CNH Industrial N.V.; Deere & Company; Escorts Limited; and KUBOTA Corporation.

b. Key factors that are driving the agricultural tractors market growth include rising demand for food products and increasing mechanization in the agriculture industry along with the technological advancements that are revolutionizing the farming and agricultural processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.