- Home

- »

- HVAC & Construction

- »

-

Agriculture Equipment Market Size And Share Report, 2030GVR Report cover

![Agriculture Equipment Market Size, Share, & Trends Report]()

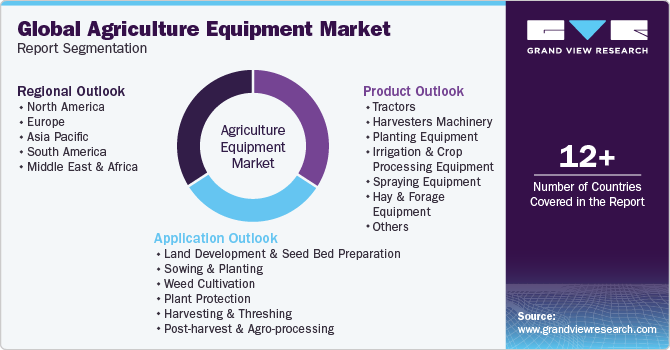

Agriculture Equipment Market Size, Share, & Trends Analysis Report By Product (Tractors, Combine Harvesters, Forage Harvesters, Planting Equipment, Irrigation & Crop Processing Equipment, Spraying Equipment), By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-455-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

Agriculture Equipment Market Size & Trends

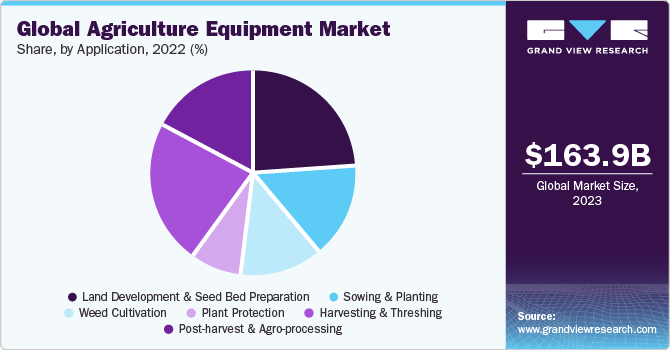

The global agriculture equipment market size was valued at USD 163.97 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. Increasing mechanization in agriculture sector coupled with surge in farmers’ income is expected to be a primary factor driving the growth. Favorable climatic conditions for food production and government support with loan waiver schemes for farmers of all income categories are also presumed to favor market growth. Technologically advanced agricultural robotics, such as autonomous tractors and flying drones to help farmers produce food at low costs to fulfill the growing demand for food, are anticipated to be better prospects for market growth over the forecast period.

The COVID-19 outbreak caused a slight slump in the agricultural equipment market in 2020. Restrictions imposed by governments to curb the novel coronavirus led to temporary shutdown of manufacturing facilities, leading to production delays. As a result, the industry was negatively impacted in the first half of 2020. Several players such as AGCO Industries, Deere & Company, and Kubota Corporation witnessed a decline in agriculture equipment sales in H1/2020. However, as governments opened up economies in H2/2020, the demand for agriculture equipment bounced back and witnessed double-digit growth, a trend that continued till H1/2021.

The sudden increase in demand for tractors, harvesters, and planters in H1 /2021 led to lower inventory levels for OEMs and their dealers in H2/2021. In addition, OEMs worldwide are currently experiencing a shortage of semiconductors and high commodity prices of steel, aluminum, and other raw materials. As a result, OEMs are unable to balance supply and demand, which may allow OEMs to increase their product prices ranging from 4% to 22% in the next few quarters of 2022, a trend that is expected to continue till 2023. However, strong crop production in Asian economies, notably in China and India, along with need to replace aging equipment are expected to drive the growth of the market.

High initial cost of agricultural equipment is anticipated to be one of the bottlenecks for adopting agriculture equipment, notably for small income farmers. The rental business is expected to be one of the new revenue streams for market growth to overcome such challenges. Companies such as KwippedInc.; JFarm Services (TAFE Corporate Communications); Mahindra & Mahindra Ltd. (TRRINGO.com); and MACALLISTER RENTALS are established players in the agriculture equipment rental business. Moreover, several start-ups are now engaged in developing applications that will help farmers connect among themselves. These applications will also help the farmers connect with rental companies in their vicinity.

Favorable government initiatives are anticipated to drive the growth of the market during the forecast period. For instance, the Russian government is attempting to trigger investment in capital purchases by proposing several subsidies for strategically significant sub-sectors including meat and milk production. The Ministry of Agriculture sanctioned 464 projects worth USD 4 billion, expected to receive government support food security and reduce livestock imports. Moreover, factors such as lack of human resources and availability of easy credit and funds are projected to spur the demand for tractors and other farm equipment in other emerging countries over the forecast period.

Market Dynamics

Mechanization of farm plays a vital role in sustainable agriculture. Agriculture equipment, such as a, tractors, harvesters, and other cultivation equipment, assist numerous farming activities. Mechanization involves a cautious application of inputs by expending agricultural equipment, such as bullock-drawn equipment, hand tools, and power-driven machines (comprising prime movers), for executing several operations of crop production. It ensures reduction of drudgery, linked with several farm operations, and retrenches utilization of inputs to harness the potentials of accessible resources.

With the increasing population, the global demand for food is expected to rise significantly; thereby, increasing pressure on agrarians to produce more crops. This is expected to instigate farmers to be efficient, in terms of land usage and choice of machinery. Businesses & governments must increase productivity, improve skills, and encourage innovations to accomplish a sustainable food balance. The rise in demand for agricultural products is projected to escalate the demand for agricultural equipment in the near future. A radical change in product offerings, instigated due to several farming practices and amplification of farms, is projected to augment the agriculture equipment market growth.

Technologically advanced agricultural robotics, such as ground-based sensors, autonomous tractors, and flying drones, aid farmers in producing food at low costs to fulfill the growing demand for food. Farmers are gradually becoming tech-savvy and the adoption of GPS software products & tractors, equipped with telematics, are anticipated to spur the agriculture equipment sales. The government subsidies provided for the procurement of agriculture machinery are projected to offer great opportunities for market growth. According to the government of China, the farming sector is vital to national, economic, and social progress.

Market Concentration & Characteristics

The agriculture equipment market growth stage is high. The agriculture equipment market is witnessing a significant degree of innovation, marked by the integration of technologies such as Google Earth navigation systems, GPS, and robotic systems in the existing machinery to improve productivity. Also, advancements in sensor technologies are optimizing returns while reducing environmental impacts on agriculture.

The agriculture equipment market is subject to growing regulatory scrutiny as governments globally prioritize the efficiency of agricultural products. To comply with international standards, agricultural equipment must undergo rigorous product testing, particularly for use in the European Union and countries adhering to the EMC compliance standard. Companies in the agriculture equipment sector also need to meet the CSA/ANSI standard for tractors, self-propelled equipment, and implements, ensuring their products adhere to industry benchmarks.

Furthermore, governments around the world are actively initiating various programs to provide financial assistance to farmers in developing regions, facilitating their procurement of essential raw materials and equipment. These initiatives aim to enhance the overall efficiency and productivity of the agriculture sector.

The limited availability of direct substitutes for agriculture equipment makes it a unique and innovative approach to agriculture. However, new innovations being carried out in semi-automated mechanization in place of capital intensive equipment may act as a market substitute over the coming years.

Product Insights

The tractor segment accounted for the largest revenue share of over 34.41% in 2022, attributed to labor shortage and growing population to meet the global food requirements, which has made tractors a prerequisite for increasing productivity in the agriculture industry. Promotion of farm mechanization and increasing adoption of precision farming in regions such as the Asia Pacific and Latin America have also accelerated the growth. Emergence of electric tractors is anticipated to be a significant growth prospect for market participants. The growth is ascribed to the cost-effectiveness coupled with electric tractors' eco-friendly and high-efficiency attributes. However, a lack of energy density to cater to large field operations is expected to hamper their adoption over the forecast period.

The harvester segment is anticipated to record a CAGR of over 7.2% over the forecast period. Innovations in harvesting equipment are anticipated to favor the growth of the segment over the next few years. Rising popularity of smart combine harvesters and integration of smart actuators into existing combine harvesters also contribute to market growth. Smart combine harvesters enable farmers to monitor grain flow rate and better control harvesting applications. In light of these factors, farmers and contractors are inclined toward smart combine harvesters over conventional harvesters.

Application Insights

The land development and seedbed preparation segment accounted for over 24% of the revenue share in 2022 and is expected to expand at a significant CAGR of over 6.0% during the forecast period. The segment is inclusive of tractors, levelers, and agriculture implements. Demand for agricultural tractors is gaining traction owing to numerous factors such as increasing need for food propelling the need to mechanize farm work, availability of technologically advanced tractors, and increased urbanization causing a shortage in labor, forcing farmers to adopt machinery. This is anticipated to contribute to the growth of the overall market.

Adoption of tech-driven agriculture machineries such as robotics is also expected to fuel the demand for the farm machinery market in the forthcoming years. Furthermore, preference for smart agriculture equipment is gradually picking up pace in countries such as India, Australia, and Southeast Asia, which is currently an emerging market. Moreover, the region is witnessing substantial investments from agricultural OEMs and governments to promote smart agriculture initiatives. Varying climatic conditions across these countries and demand for cost-efficient equipment, particularly balers, are driving the demand for advanced agricultural equipment.

Regional Insights

North America was valued at USD 37.37 billion in 2023 and is expected to register a CAGR of over 5.9% during the forecast period. The growth is primarily driven by abundance of large farmland, which has led to high demand for farm mechanization. Moreover, the region is witnessing increased adoption of intelligent combine harvesters equipped with monitoring tools to increase farm yield. Factors such as rising labor costs, amalgamation of robotic systems and Global Positioning Systems (GPS) in tractors and harvesters, increasing demand for high-capacity machinery due to large farms, and rising popularity of self-propelled machines are all expected to drive the regional market growth over the forecast period.

South Africa, Saudi Arabia, and UAE are notable markets in the region. The arid and semiarid countries in the Middle East with low and variable rainfall are likely to witness increased demand for irrigated and crop processing equipment over the forecast period. Increasing Chinese investments in African countries are expected to boost the regional agriculture sector. Recent business expansion of New Hope Group, an investment firm, in Egypt is one such instance that suggests the increasing Chinese influence in the region.

Key Companies & Market Share Insights

Some of the key players operating in the market include AGCO Corporation; Fliegl Agro-Center GmbH; Agromaster; APV GmbH; Bellota Agrisolutions; CLAAS KGaA mbH; CNH Industrial N.V.; Deere & Company; Escorts Limited; HORSCH Maschinen GmbH; ISEKI & Co., Ltd.; J C Bamford Excavators Ltd; Quivogne CEE GmbH (Kiwon RUS LLC); Rostselmash; KRUKOWIAK; KUBOTA Corporation; KUHN SAS; LEMKEN GmbH & Co. KG; Mahindra & Mahindra Ltd; Mascar SpA; Maschio Gaspardo S.p.A, MaterMacc S.p.A; Morris Equipment Ltd; SDF S.p.A.; Tractors and Farm Equipment Limited (TAFE); Väderstad AB; Valmont Industries, Inc.

-

AGCO Corporation is engaged in the designing, manufacturing, and distribution of agricultural tractors and replacement parts, worldwide. In 1990, the company offered products under the Gleaner and AGCO Allis brands in North America. Currently, it offers its agricultural tractors under the following brand names: Challenger, Fendt, Massey Ferguson, and Valtra. AGCO Corporation offers tractors with higher horsepower for use in large farms for cultivating row crops; utility tractors primarily for livestock, dairy, vineyards, and orchards; and compact tractors for small farms, landscaping, and specialty agricultural industries as well as for residential use. The company focuses on product innovation and invests in the research & development of High Horsepower (HHP) tractors and advanced harvesting technology platforms.

-

CNH Industrial N.V. is engaged in the designing, production, marketing, sales, and financing of agricultural & construction equipment and commercial vehicles. Additionally, the company offers transmissions, engines, and axles for these vehicles. The company’s subsidiaries include CNH Industrial America LLC, CNH Industrial Asian Holding Limited N.V., CNH Industrial Belgium, CNH Industrial Capital LLC, CNH Industrial Finance S.p.A., CNH Industrial Russia LLC, CNH U.K. Limited, and CNH Industrial Services S.r.l.

Key Agriculture Equipment Companies:

- AGCO Corporation

- FlieglAgro-Center GmbH

- APV GmbH

- Bellota Agrisolutions

- CLAAS KGaAmbH

- CNH Industrial N.V.

- Deere & Company

- Escorts Limited

- HORSCH Maschinen GmbH

- ISEKI & Co., Ltd.

- J C Bamford Excavators Ltd

- Quivogne CEE GmbH (Kiwon RUS LLC)

- Rostselmash

- KRUKOWIAK

- KUBOTA Corporation

- KUHN SAS

- LEMKEN GmbH & Co. KG

- Mahindra & Mahindra Ltd.

- MascarSpA

- MaschioGaspardo S.p.A

- MaterMacc S.p.A

- Morris Equipment Ltd

- SDF S.p.A.

- Tractors and Farm Equipment Limited (TAFE)

- Väderstad AB

- Valmont Industries, Inc.

Recent Developments

-

In July 2023, Deere & Company announced the acquisition of Smart Apply, Inc. The company planned to leverage Smart Apply’s precision spraying to assist growers address the challenges associated with input costs, labor, regulatory requirements, and environmental goals.

-

In July 2023, CLAAS KGaA mbH unveiled the company’s high-performance XERION 12 Series tractors. The two new tractor models are integrated with the highly efficient low-engine speed drive concept 2.0.

-

In June 2023, JCB announced plans to introduce the company’s first electric wheeled loader with zero-emission and low-noise capabilities. The loader comes with options for wide or narrow wheels and tire options for agriculture or industrial deployment.

-

In June 2023, Mahindra Group’s Swaraj Tractors unveiled the launch of a lightweight compact tractor named ‘Swaraj Target’. The tractor features first-in-class functionalities, matchless performance capability, and state-of-the-art technology to cater to the special needs of Indian farmers.

-

In May 2023, AMAZONE announced new products as a part of its precision seeders business range. The new advanced trailed models, Precea 12000-TCC and 9000-TCC have been designed exclusively for large-scale farms & contractors.

-

In April 2023, AGCO Corporation announced a strategic collaboration with Hexagon, for the expansion of AGCO’s factory-fit and aftermarket guidance offerings. The new guidance system was planned to be commercialized as Fuse Guide on Valtra and Massey Ferguson tractors.

-

In April 2023, HORSCH announced the commencement of its new plant in Curitiba, Brazil. The plant includes the single grain seed drill assembly line and tillage machines line along with the development facility of crop care technology.

-

In February 2023, Kubota Corporation announced the acquisition of a stake in Chouette. Chouette deploys AI technology to analyze captured images by cameras to identify tree vigor and diseases and develops optimal volume of sprays through exceptional algorithms

Agriculture Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 163.97 billion

Revenue forecast in 2030

USD 236.04 billion

Growth rate

CAGR of 5.3% from 2023 to 2030

Actual Data

2017 - 2030

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Netherlands; Spain; Denmark; Russia; China; India; Japan; Singapore; South Korea; Taiwan; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa.

Key companies profiled

AGCO Corporation; Fliegl Agro-Center GmbH; Agromaster; APV GmbH; Bellota Agrisolutions; CLAAS KGaA mbH; CNH Industrial N.V.; Deere & Company; Escorts Limited; HORSCH Maschinen GmbH; ISEKI & Co., Ltd.; J C Bamford Excavators Ltd; Quivogne CEE GmbH (Kiwon RUS LLC); Rostselmash; KRUKOWIAK; KUBOTA Corporation; KUHN SAS; LEMKEN GmbH & Co. KG; Mahindra & Mahindra Ltd; Mascar SpA; Maschio Gaspardo S.p.A, MaterMacc S.p.A; Morris Equipment Ltd; SDF S.p.A.; Tractors and Farm Equipment Limited (TAFE); Väderstad AB; Valmont Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agriculture Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global agriculture equipment market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tractors

-

Less than 40 HP

-

41 to 100 HP

-

More than 100 HP

-

-

Harvesters Machinery

-

Planting Equipment

-

Row Crop Planters

-

Air Seeders

-

Grain Drills

-

Others

-

-

Irrigation & Crop Processing Equipment

-

Spraying Equipment

-

Hay & Forage Equipment

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Land Development & Seed Bed Preparation

-

Sowing & Planting

-

Weed Cultivation

-

Plant Protection

-

Harvesting & Threshing

-

Post-harvest &Agro-processing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Netherlands

-

Spain

-

Denmark

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Singapore

-

South Korea

-

Taiwan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global agriculture equipment market size was estimated at USD 155.68 billion in 2021 and is expected to reach USD 159.42 billion in 2022.

b. The global agriculture equipment market is expected to grow at a compound annual growth rate of 5.0% from 2022 to 2030 to reach USD 236.04 billion by 2030.

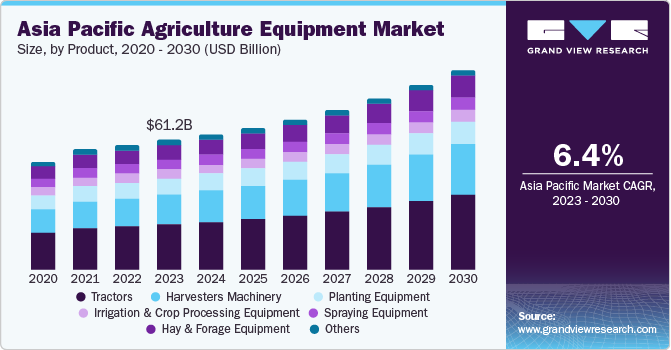

b. The Asia Pacific dominated the agriculture equipment market with a share of 36.0% in 2021. This is attributable to the presence of largely agricultural land and growing awareness among farmers regarding the need to enhance overall crop output and quality.

b. Some key players operating in the agriculture equipment market include AGCO Corporation, Agrocenter Ltd., Agromaster, AMAZONE Ltd., AMAZONE Ltd., APV – Technische Produkte GmbH, CLAAS KGaA mbH, CNH Industrial N.V, Escorts Group, Horsch Maschinen GmbH, and ISEKI & Co., Ltd.

b. Key factors that are driving the agriculture equipment market growth include rising mechanization in farm practices and government support in form of subsidies, especially in developing economies.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Agriculture Equipment Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Industry Opportunities

3.3.4. Industry Challenges

3.4. Agriculture Equipment Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

3.5. Agriculture Equipment Price Analysis

3.6. Farm Equipment Technology Adoption

Chapter 4. Agriculture Equipment Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Agriculture Equipment Market: Product Movement Analysis, USD Billion, 2023 & 2030

4.3. Shipping Container

4.3.1. Shipping Container Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.4. Tractors

4.4.1. Tractor Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.4.2. Less than 40 HP

4.4.2.1. Less than 40 Hp Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.4.3. 41 to 100 HP

4.4.3.1. 41 to 100 Hp Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.4.4. More than 100 HP

4.4.4.1. More than 100 Hp Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.5. Harvesters

4.5.1. Harvester Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.6. Planting Equipment

4.6.1. Planting Equipment Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.6.2. Row Crop Planters

4.6.2.1. Row Crop Planter Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.6.3. Air Seeders

4.6.3.1. Air Seeder Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.6.4. Grain Drills

4.6.4.1. Grain Drills Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.6.5. Others

4.6.5.1. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.7. Irrigation & Crop Processing Equipment

4.7.1. Irrigation & Crop Processing Equipment Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.8. Spraying Equipment

4.8.1. Spraying Equipment Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.9. Hay & Forage Equipment

4.9.1. Hay & Forage Equipment Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.10. Others

4.10.1. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

Chapter 5. Agriculture Equipment Market: Application Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Agriculture Equipment Market: Application Movement Analysis, USD Billion, 2023 & 2030

5.3. Land Development & Seed Bed Preparation

5.3.1. Land Development & Seed Bed Preparation Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.4. Sowing & Planting

5.4.1. Sowing & Planting Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.5. Weed Cultivation

5.5.1. Weed Cultivation Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.6. Plant Protection

5.6.1. Plant Protection Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.7. Harvesting & Threshing

5.7.1. Harvesting & Threshing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.8. Post-harvest & Agro-processing

5.8.1. Harvesting & Threshing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

Chapter 6. Agriculture Equipment Market: Regional Estimates & Trend Analysis

6.1. Agriculture Equipment Market Share, By Region, 2023 & 2030, USD Billion

6.2. North America

6.2.1. North America Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.2.2. North America Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.2.3. North America Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.2.4. U.S.

6.2.4.1. U.S. Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.2.4.2. U.S. Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.2.4.3. U.S. Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.2.5. Canada

6.2.5.1. Canada Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.2.5.2. Canada Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.2.5.3. Canada Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.3. Europe

6.3.1. Europe Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.2. Europe Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.3.3. Europe Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.3.4. U.K.

6.3.4.1. U.K. Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.4.2. U.K. Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.3.4.3. U.K. Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.3.5. Germany

6.3.5.1. Germany Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.5.2. Germany Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.3.5.3. Germany Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.3.6. France

6.3.6.1. France Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.6.2. France Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.3.6.3. France Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.3.7. Spain

6.3.7.1. Spain Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.7.2. Spain Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.3.7.3. Spain Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.3.8. Italy

6.3.8.1. Italy Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.8.2. Italy Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.3.8.3. Italy Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.3.9. Netherland

6.3.9.1. Netherland Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.9.2. Netherland Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.3.9.3. Netherland Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.3.10. Russia

6.3.10.1. Russia Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.10.2. Russia Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.3.10.3. Russia Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.3.11. Denmark

6.3.11.1. Denmark Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.11.2. Denmark Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.3.11.3. Denmark Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.4. Asia Pacific

6.4.1. Asia Pacific Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.2. Asia Pacific Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.4.3. Asia Pacific Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.4.4. China

6.4.4.1. China Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.4.2. China Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.4.4.3. China Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.4.5. Japan

6.4.5.1. Japan Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.5.2. Japan Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.4.5.3. Japan Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.4.6. India

6.4.6.1. India Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.6.2. India Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.4.6.3. India Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.4.7. South Korea

6.4.7.1. South Korea Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.7.2. South Korea Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.4.7.3. South Korea Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.4.8. Singapore

6.4.8.1. Singapore Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.8.2. Singapore Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.4.8.3. Singapore Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.4.9. Taiwan

6.4.9.1. Taiwan Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.9.2. Taiwan Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.4.9.3. Taiwan Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.4.10. Australia

6.4.10.1. Australia Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.10.2. Australia Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.4.10.3. Australia Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.5. Latin America

6.5.1. Latin America Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.5.2. Latin America Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.5.3. Latin America Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.5.4. Brazil

6.5.4.1. Brazil Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.5.4.2. Brazil Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.5.4.3. Brazil Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.5.5. Mexico

6.5.5.1. Mexico Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.5.5.2. Mexico Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.5.5.3. Mexico Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.5.6. Argentina

6.5.6.1. Argentina Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.5.6.2. Argentina Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.5.6.3. Argentina Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.6. Middle East and Africa

6.6.1. Middle East and Africa Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.6.2. Middle East and Africa Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.6.3. Middle East & Africa Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.6.4. UAE

6.6.4.1. UAE Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.6.4.2. UAE Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.6.4.3. UAE Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.6.5. KSA

6.6.5.1. KSA Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.6.5.2. KSA Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.6.5.3. KSA Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

6.6.6. South Africa

6.6.6.1. South Africa Agriculture Equipment Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.6.6.2. South Africa Agriculture Equipment Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Billion)

6.6.6.3. South Africa Agriculture Equipment Market Estimates and Forecasts, by Product, 2017 - 2030 (USD Billion)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis by Key Market Participants

7.2. Company Categorization

7.3. Company Market Positioning

7.4. Company Market Share Analysis

7.5. Strategy Mapping

7.5.1. Expansion

7.5.2. Mergers & Acquisition

7.5.3. Partnerships & Collaborations

7.5.4. New Application Launches

7.5.5. Research And Development

7.6. Company Profiles

7.6.1. AGCO Corporation

7.6.1.1. Participant’s Overview

7.6.1.2. Financial Performance

7.6.1.3. Product Benchmarking

7.6.1.4. Recent Developments

7.6.2. FlieglAgro-Center GmbH

7.6.2.1. Participant’s Overview

7.6.2.2. Financial Performance

7.6.2.3. Product Benchmarking

7.6.2.4. Recent Developments

7.6.3. Agromaster

7.6.3.1. Participant’s Overview

7.6.3.2. Financial Performance

7.6.3.3. Product Benchmarking

7.6.3.4. Recent Developments

7.6.4. APV GmbH

7.6.4.1. Participant’s Overview

7.6.4.2. Financial Performance

7.6.4.3. Product Benchmarking

7.6.4.4. Recent Developments

7.6.5. Bellota Agrisolutions

7.6.5.1. Participant’s Overview

7.6.5.2. Financial Performance

7.6.5.3. Product Benchmarking

7.6.5.4. Recent Developments

7.6.6. CLAAS KGaAmbH

7.6.6.1. Participant’s Overview

7.6.6.2. Financial Performance

7.6.6.3. Product Benchmarking

7.6.6.4. Recent Developments

7.6.7. CNH Industrial N.V.

7.6.7.1. Participant’s Overview

7.6.7.2. Financial Performance

7.6.7.3. Product Benchmarking

7.6.7.4. Recent Developments

7.6.8. Deere & Company

7.6.8.1. Participant’s Overview

7.6.8.2. Financial Performance

7.6.8.3. Product Benchmarking

7.6.8.4. Recent Developments

7.6.9. Escorts Limited

7.6.9.1. Participant’s Overview

7.6.9.2. Financial Performance

7.6.9.3. Product Benchmarking

7.6.9.4. Recent Developments

7.6.10. HORSCH Maschinen GmbH

7.6.10.1. Participant’s Overview

7.6.10.2. Financial Performance

7.6.10.3. Product Benchmarking

7.6.10.4. Recent Developments

7.6.11. ISEKI & Co., Ltd.

7.6.11.1. Participant’s Overview

7.6.11.2. Financial Performance

7.6.11.3. Product Benchmarking

7.6.11.4. Recent Developments

7.6.12. J C Bamford Excavators Ltd

7.6.12.1. Participant’s Overview

7.6.12.2. Financial Performance

7.6.12.3. Product Benchmarking

7.6.12.4. Recent Developments

7.6.13. Quivogne CEE GmbH (Kiwon RUS LLC)

7.6.13.1. Participant’s Overview

7.6.13.2. Financial Performance

7.6.13.3. Product Benchmarking

7.6.13.4. Recent Developments

7.6.14. Rostselmash

7.6.14.1. Participant’s Overview

7.6.14.2. Financial Performance

7.6.14.3. Product Benchmarking

7.6.14.4. Recent Developments

7.6.15. KRUKOWIAK

7.6.15.1. Participant’s Overview

7.6.15.2. Financial Performance

7.6.15.3. Product Benchmarking

7.6.15.4. Recent Developments

7.6.16. KUBOTA Corporation

7.6.16.1. Participant’s Overview

7.6.16.2. Financial Performance

7.6.16.3. Product Benchmarking

7.6.16.4. Recent Developments

7.6.17. KUHN SAS

7.6.17.1. Participant’s Overview

7.6.17.2. Financial Performance

7.6.17.3. Product Benchmarking

7.6.17.4. Recent Developments

7.6.18. LEMKEN GmbH & Co. KG

7.6.18.1. Participant’s Overview

7.6.18.2. Financial Performance

7.6.18.3. Product Benchmarking

7.6.18.4. Recent Developments

7.6.19. Mahindra & Mahindra Ltd.

7.6.19.1. Participant’s Overview

7.6.19.2. Financial Performance

7.6.19.3. Product Benchmarking

7.6.19.4. Recent Developments

7.6.20. MascarSpA

7.6.20.1. Participant’s Overview

7.6.20.2. Financial Performance

7.6.20.3. Product Benchmarking

7.6.20.4. Recent Developments

7.6.21. MaschioGaspardo S.p.A

7.6.21.1. Participant’s Overview

7.6.21.2. Financial Performance

7.6.21.3. Product Benchmarking

7.6.21.4. Recent Developments

7.6.22. MaterMacc S.p.A

7.6.22.1. Participant’s Overview

7.6.22.2. Financial Performance

7.6.22.3. Product Benchmarking

7.6.22.4. Recent Developments

7.6.23. Morris Equipment Ltd

7.6.23.1. Participant’s Overview

7.6.23.2. Financial Performance

7.6.23.3. Product Benchmarking

7.6.23.4. Recent Developments

7.6.24. SDF S.p.A.

7.6.24.1. Participant’s Overview

7.6.24.2. Financial Performance

7.6.24.3. Product Benchmarking

7.6.24.4. Recent Developments

7.6.25. Tractors and Farm Equipment Limited (TAFE)

7.6.25.1. Participant’s Overview

7.6.25.2. Financial Performance

7.6.25.3. Product Benchmarking

7.6.25.4. Recent Developments

7.6.26. Väderstad AB

7.6.26.1. Participant’s Overview

7.6.26.2. Financial Performance

7.6.26.3. Product Benchmarking

7.6.26.4. Recent Developments

7.6.27. Valmont Industries, Inc

7.6.27.1. Participant’s Overview

7.6.27.2. Financial Performance

7.6.27.3. Product Benchmarking

7.6.27.4. Recent Developments

List of Tables

Table 1 List of Abrevation

Table 2 Global Agriculture Equipment Market revenue estimates and forecast, by Application, 2017 - 2030 (USD Billion)

Table 3 Global Agriculture Equipment Market revenue estimates and forecast, By Product, 2017 - 2030 (USD Billion)

Table 4 Global Agriculture Equipment Market revenue, by Region, 2023 & 2030 (USD Billion)

Table 5 North America Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 6 North America Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 7 North America Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 8 U.S. Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 9 U.S. Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 10 U.S. Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 11 Canada Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 12 Canada Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 13 Canada Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 14 Mexico Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 15 Mexico Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 16 Mexico Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 17 Europe Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 18 Europe Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 19 Europe Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 20 U.K. Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 21 U.K. Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 22 U.K. Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 23 Germany Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 24 Germany Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 25 Germany Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 26 France Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 27 France Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 28 France Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 29 Spain Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 30 Spain Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 31 Spain Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 32 Italy Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 33 Italy Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 34 Italy Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 35 Denmark Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 36 Denmark Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 37 Denmark Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 38 Russia Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 39 Russia Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 40 Russia Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 41 Netherand Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 42 Netherland Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 43 Netherland Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 44 Asia Pacific Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 45 Asia Pacific Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 46 Asia Pacific Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 47 China Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 48 China Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 49 China Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 50 India Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 51 India Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 52 India Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 53 Japan Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 54 Japan Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 55 Japan Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 56 South Korea Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 57 South Korea Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 58 South Korea Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 59 Singapore Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 60 Singapore Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 61 Singapore Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 62 Australia Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 63 Australia Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 64 Australia Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 65 Taiwan Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 66 Taiwan Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 67 Taiwan Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 68 Latin America Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 69 Latin America Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 70 Latin America Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 71 Brazil Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 72 Brazil Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 73 Brazil Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 74 Mexico Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 75 Mexico Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 76 Mexico Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 77 Argentina Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 78 Argentina Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 79 Argentina Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 80 Middle East & Africa Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 81 Middle East & Africa Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 82 Middle East & Africa Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 83 KSA Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 84 KSA Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 85 KSA Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 86 UAE Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 87 UAE Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 88 UAE Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 89 South Africa Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 90 South Africa Agriculture Equipment Market estimates & forecasts, by product, 2017 - 2030 (USD Billion)

Table 91 South Africa Agriculture Equipment Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 92 Participant’s Overview

Table 93 Financial Performance

Table 94 Product Benchmarking

Table 95 Key companies undergoing expansion

Table 96 Key companies involved in mergers & acquisitions

Table 97 Key companies undertaking partnerships and collaboration

Table 98 Key companies launching new product/type launches

List of Figures

Fig. 1 Agriculture Equipment Market segmentation

Fig. 2 Information procurement

Fig. 3 Data analysis models

Fig. 4 Market formulation and validation

Fig. 5 Data validating & publishing

Fig. 6 Market snapshot

Fig. 7 Segment snapshot, by Type and Application

Fig. 8 Segment snapshot By Crop Category

Fig. 9 Competitive landscape snapshot

Fig. 10 Agriculture Equipment Market value, 2017 - 2030 (USD Billion)

Fig. 11 Agriculture Equipment Market - Industry value chain analysis

Fig. 12 Agriculture Equipment Market - Market trends

Fig. 13 Agriculture Equipment Market: Porter’s analysis

Fig. 14 Agriculture Equipment Market: PESTEL analysis

Fig. 15 Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 16 Agriculture Equipment Market, by Product: Key takeaways

Fig. 17 Agriculture Equipment Market, by Product: Market share, 2023 & 2030

Fig. 18 Tractors Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 19 Less than 40 HP Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 20 41 to 100 HP Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 21 More than 100 HP Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 22 Harvesters Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 23 Combine Harvesters Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 24 Forage Harvesters Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 25 Planting Equipment Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 26 Row Crop Planters Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 27 Air Seeders Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 28 Grain Drills Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 29 Others Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 30 Irrigation & Crop Processing Equipment Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 31 Spraying Equipment Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 32 Hay & Forage Equipment Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 33 Others Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 34 Agriculture Equipment Market, by Application: Key takeaways

Fig. 35 Agriculture Equipment Market, by Application: Market share, 2023 & 2030

Fig. 36 Hardware Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 37 Land Development & Seed Bed Preparation Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 38 Sowing & Planting Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 39 Weed Cultivation Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 40 Plant Protection Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 41 Harvesting & Threshing Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 42 Post-harvest & Agro-processing Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 43 Global Agriculture Equipment Market revenue, by Region, 2023 & 2030 (USD Billion)

Fig. 44 North America Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 45 U.S. Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 46 Canada Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 47 Europe Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 48 U.K. Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 49 Germany Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 50 France Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 51 Spain Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 52 Italy Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 53 Denmark Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 54 Russia Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 55 Netherland Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 56 Asia Pacific Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 57 China Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 58 India Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 59 Japan Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 60 South Korea Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 61 Singapore Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 62 Austraia Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 63 Taiwan Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 64 Latin America Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 65 Brazil Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 66 Mexico Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 67 Argentina Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 68 Middle East & Africa Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 69 UAE Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 70 KSA Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 71 South Africa Agriculture Equipment Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 72 Key company categorization

Fig. 73 Agriculture Equipment Market - Key company market share analysis, 2023

Fig. 74 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Agriculture Equipment Product Outlook (Revenue, USD Billion; 2017 - 2030)

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Agriculture Equipment Application Outlook (Revenue, USD Billion; 2017 - 2030)

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest & Agro-processing

- Agriculture Equipment Regional Outlook (Revenue, USD Billion; 2017 - 2030)

- North America

- North America Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- North America Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- U.S.

- U.S. Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- U.S. Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- U.S. Agriculture Equipment Market by Product

- Canada

- Canada Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Canada Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest & Agro-processing

- Canada Agriculture Equipment Market by Product

- North America Agriculture Equipment Market by Product

- Europe

- Europe Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Europe Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- U.K.

- U.K. Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- U.K. Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- U.K. Agriculture Equipment Market by Product

- Germany

- Germany Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Germany Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Germany Agriculture Equipment Market by Product

- France

- France Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- France Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- France Agriculture Equipment Market by Product

- Spain

- Spain Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Spain Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Spain Agriculture Equipment Market by Product

- Italy

- Italy Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Italy Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Italy Agriculture Equipment Market by Product

- Netherland

- Netherland Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Netherland Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Netherland Agriculture Equipment Market by Product

- Denmark

- Denmark Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Denmark Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Denmark Agriculture Equipment Market by Product

- Russia

- Russia Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Russia Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Russia Agriculture Equipment Market by Product

- Europe Agriculture Equipment Market by Product

- Asia Pacific

- Asia Pacific Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Asia Pacific Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- China

- China Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- China Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- China Agriculture Equipment Market by Product

- India

- India Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- India Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- India Agriculture Equipment Market by Product

- Japan

- Japan Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Japan Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Japan Agriculture Equipment Market by Product

- South Korea

- South Korea Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- South Korea Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- South Korea Agriculture Equipment Market by Product

- Singapore

- Singapore Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Singapore Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Singapore Agriculture Equipment Market by Product

- Taiwan

- Taiwan Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Taiwan Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Taiwan Agriculture Equipment Market by Product

- Australia

- Australia Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Australia Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Australia Agriculture Equipment Market by Product

- Asia Pacific Agriculture Equipment Market by Product

- Latin America

- Latin America Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Latin America Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Brazil

- Brazil Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Brazil Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Brazil Agriculture Equipment Market by Product

- Mexico

- Mexico Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Mexico Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Mexico Agriculture Equipment Market by Product

- Argentina

- Argentina Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Argentina Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- Argentina Agriculture Equipment Market by Product

- Latin America Agriculture Equipment Market by Product

- Middle East & Africa

- Middle East & Africa Agriculture Equipment Market by Product

- Tractors

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

- Harvesters

- Combine Harvesters

- Forage Harvesters

- Planting Equipment

- Row Crop Planters

- Air Seeders

- Grain Drills

- Others

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

- Tractors

- Middle East & Africa Agriculture Equipment Market by Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

- KSA