- Home

- »

- Sensors & Controls

- »

-

Agriculture Sensor Market Size, Share, Industry Report, 2030GVR Report cover

![Agriculture Sensor Market Size, Share & Trends Report]()

Agriculture Sensor Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Application (Dairy Management, Soil Management, Climate Management, Water Management, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-600-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Agriculture Sensor Market Summary

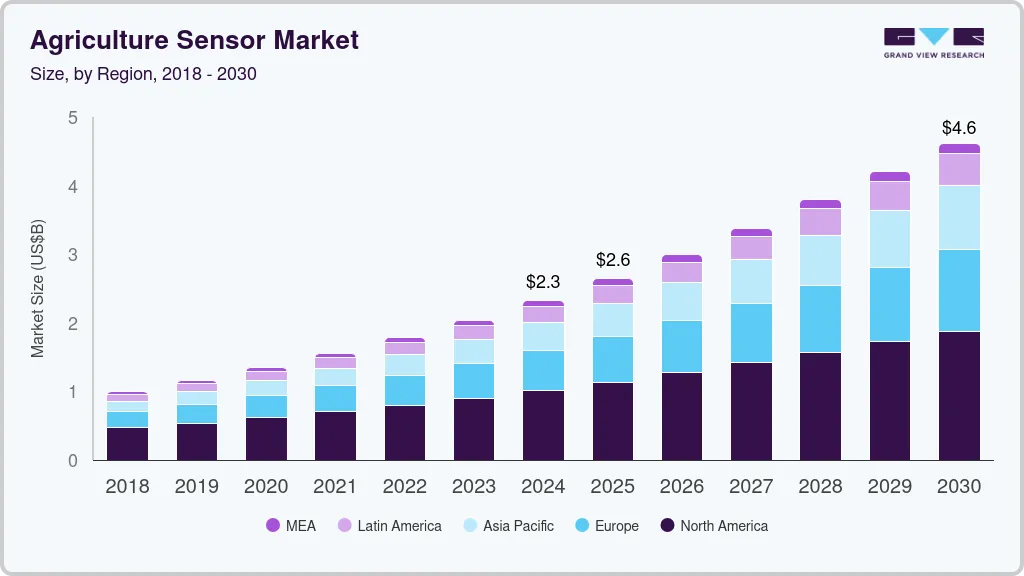

The global agriculture sensor market size was estimated at USD 2,324.3 million in 2024 and is projected to reach USD 4,618.7 million by 2030, growing at a CAGR of 11.8% from 2025 to 2030. The growth of this market is primarily influenced by aspects such as the increasing adoption of technology assistance by farmers, the growing participation of technology companies and consumer goods manufacturers in contract farming activities, and the emergence of concepts such as precision farming, irrigation automation, and more.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, location sensor accounted for a revenue of USD 361.6 million in 2024.

- Soil Moisture Sensors is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2,324.3 Million

- 2030 Projected Market Size: USD 4,618.7 Million

- CAGR (2025-2030): 11.8%

- North America: Largest market in 2024

In recent years, the agriculture industry has been experiencing significant growth in demand driven by the increasing need for fresh produce, grains, pulses, and vegetables worldwide. The growing prevalence of lifestyle-driven diseases and chronic health issues such as hypertension, cardiac diseases, diabetes, and others have resulted in increasing consumption of fresh produce and organic agriculture products. Increasing inclination towards consuming food products made with naturally sourced and organically grown materials also adds to the growth of the agriculture industry. These aspects have stimulated the increasing adoption of technology-driven processes, machinery, automation tools, and software support.

Agriculture sensors are technology equipped with electronic devices that collect complex data associated with various influential factors such as weather changes, soil moisture, water levels, humidity, changes in plant conditions, and more. It assists systems and software technology that process the collected data to provide actionable intelligence and insights to users. These insights include water level indications, weather condition insights, forecasts, post-weather change influence measures, and more. Different types of such sensors include location sensors, electrochemical sensors, airflow sensors, optical sensors, pressure sensors, mechanical sensors, water sensors, and others.

The emergence of modern technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), machine learning, and others have resulted in the availability of advanced agriculture technology solutions. Product launches and collaborations among key market participants in the agriculture technology industry also drive the demand for agriculture sensors. For instance, in February 2024, Syngenta, one seed and crop protection products company, collaborated with digital farm management technology provider CropX Inc. to offer sustainability solutions to its seed suppliers in the American Midwest. The agronomic farm management system provided by CropX is equipped to gather real-time data through satellites, sensors, rain gauges, and other machinery deployed in the field. Such collaborations and partnerships among companies operating in various dynamics of agriculture technology are expected to add lucrative growth opportunities for this market during the forecast period.

Increasing support from multiple governments, the entry of numerous technology and innovation industry participants in this market, and the ease of availability of technology tools are expected to generate growth in the next few years. The launch of technology-based products developed in collaboration related to water management, precision irrigation, and advanced farm monitoring is expected to contribute to growth. For instance, in February 2024, REINKE MANUFACTURING CO., INC. and CropX Technologies jointly introduced Reinke Direct ET by CropX. The innovation-based solution offers cost-effective Actual Evapotranspiration (ETa) measurements with the help of the Reinke Center pivot irrigation system.

Growing awareness regarding benefits associated with the use of technology that collects data, interprets datasets, and provides actionable insights is expected to develop significant growth in demand. Increasing availability of information, strategies deployed by key technology companies and agriculture industry participants to convey the significance of agriculture sensors, and ease of availability are also contributing to the growth experienced by this industry.

Type Insights

Based on type, location sensors dominated the global agriculture sensor industry with a revenue share of 13.7% in 2024. This is attributed to the growing utilization of numerous activities such as field mapping, enhanced resource allocation, real-time crop monitoring, improved decision-making, sustainable farming practices, etc. Location sensors accurately map field boundaries and provide digitally developed maps. Additionally, these sensors held machinery and other technology tools to identify precise paths and areas for determined performances. Location sensors also assist farmers and users in identifying crops experiencing disruptions in water availability, diseases of any sort, etc., and equipment tracking.

The soil moisture sensors segment is expected to experience the highest growth over the forecast period. The development of this segment is primarily influenced by the increasing adoption of farmers for improved irrigation performances and scheduling. Different soil moisture sensors include capacitance sensors, probes, Time Domain Transmissometry (TDT) Sensors, gypsum blocks, tensiometers, granular matrix sensors, and others. Farmers and organizations engaged in contract farming prefer using soil moisture sensors for improved crop productivity, data-driven decision-making, process enhancements, enhanced irrigation monitoring, and more.

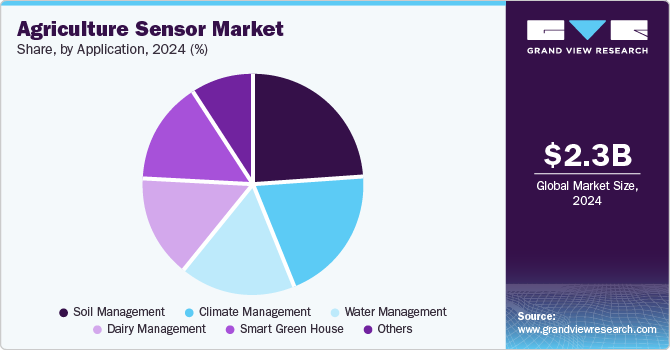

Application Insights

The soil management segment held the largest revenue share of the global agriculture sensor industry in 2024. This is attributed to factors such as increasing demand from large land farmers, contract agriculture projects, and other industries. The data provided by the sensors regarding factors such as water retention level, moisture level, soil health, and others enables users to plan further actions associated with a variety of processes such as irrigation, fertilizing soil, crop rotation, tillage, composting, sediment control, regulating water supply to crops, and more.

The smart green house segment is anticipated to experience the fastest growth from 2025 to 2030. Growth of this segment is mainly driven by the increasing adoption of precision farming practices. The significance of temperature monitoring and soil moisture management in smart green houses, efficient use of water and other resources associated with green house farming, and dependency on data-driven insights are expected to generate growth of this segment.

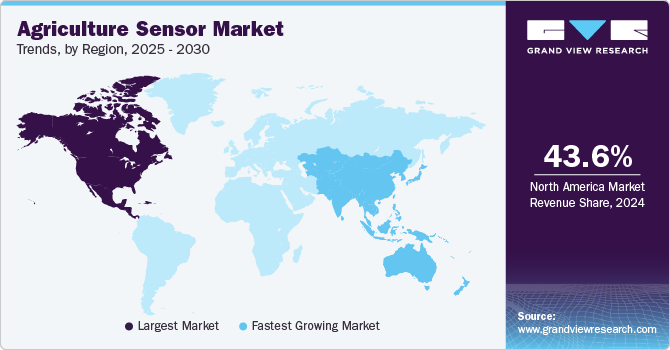

Regional Insights

North America dominated the global agriculture sensor industry with a revenue share of 43.6% in 2024. The growth of this market is mainly driven by the increasing adoption of technology assistance by farmers in the region, the presence of large landowners operating in the agriculture industry, and the presence of multiple agriculture technology product manufacturers in the region. A significant increase in modern farming practices such as precision farming, irrigation automation, and others is likely to add lucrative growth opportunities for this market in the next few years.

U.S. Agriculture Sensor Market Trends

The U.S. agriculture sensor market held the largest revenue share of the regional industry in 2024. This market is influenced by factors such as the robust technology industry operating in the country and the increasing availability of agriculture technology systems and solutions that operate with the help of data inputs provided by agriculture sensors. The increasing adoption of software solutions and intelligence systems that offer significant insights derived from the vast amounts of data collected by sensors is expected to generate growth in demand for this market over the forecast period.

Europe Agriculture Sensor Market Trends

Europe was identified as one of the key regions of the global agriculture sensors industry in 2024. An increase in demand for fresh produce, organically grown crops, grains, pulses, and produce used in the development of multiple food products has developed the need for advanced farming technology and practices assisted by modern technology capabilities. This includes agriculture sensors, numerous pieces of equipment, software solutions, and more. Increasing awareness regarding benefits associated with data-driven decision-making and enhanced performances facilitated by improved management and process implementation are anticipated to add growth.

The UK held the largest revenue share of the regional industry in 2024. Increasing precision farming practices in the country, growing sustainability awareness, technology advancements adopted by industry participants, and increasing government support for modern technology-driven agriculture solutions are some of the key growth factors for this market.

Asia Pacific Agriculture Sensor Market Trends

Asia Pacific agriculture sensor market is anticipated to experience the highest growth over the forecast period. Agriculture is one of the most significant industries in countries such as China, India, Australia, and others. Government agencies and organizations have been encouraging farmers to embrace cutting-edge technology-based solutions. Increasing demand for grains and pulses, overall growth in food demand, ease of use and convenience offered by the user-friendly technology tools, and evidence of improved results associated with the use of technology are some of the key factors that are anticipated to influence the growth of this market.

Australia agriculture sensor market dominated the regional industry in 2024. This is attributed to factors such as the increasingly large share of the agriculture industry in domestic production, the increasing focus of farmers on adopting advanced technologies to reduce costs and improve performances, and the enhanced availability of software solutions supported by the data collected through sensors.

Key Agriculture Sensor Company Insights

Some key companies in the global agriculture sensor industry include CropX inc., Deere & Company, METER, Sentera, Climate LLC and others. To address growing competition and increasing demand for technologically advanced sensors, the market participants have been embracing strategies such as acquisitions, portfolio expansions, geographical expansions, collaborations and others.

-

CropX Inc. is an agriculture technology innovation company that offers a digital agronomy platform equipped with advanced technology capabilities. The platform provided by the company is characterized by a user-friendly interface, data collection and processing capabilities, easy-to-install hardware, and more.

-

Sentera, a precision agriculture innovation-driven organization, offers a wide range of solutions and technology-based products, including sensors. Its sensor portfolio features the 6X sensor series, 65R sensor, Sentera DGR system, Double 4K, custom sensors, PHX fixed wing, single sensor, and others.

Key Agriculture Sensor Companies:

The following are the leading companies in the agriculture sensor market. These companies collectively hold the largest market share and dictate industry trends.

- Acclima Inc.

- auroras S.r.l.

- Climate LLC

- CropX inc.

- Deere & Company

- Libelium Comunicaciones Distribuidas S.L.

- METER

- Pycno

- Sentera

- Soil Scout Oy

- SOLCHIP

- Texas Instruments Incorporated

- Trimble Inc.

- Yara

- Zenvus

Recent Developments

-

In September 2024, CropX inc., one of the market players in agriculture technology, acquired technology application startup, EnGeniousAg. The startup delivered innovation-based nitrogen sensing technique to assist farmers in optimizing nitrogen fertilizer application while reducing the environmental impact.

-

In January 2024, Ethos Connected, a company with a portfolio of environmental and agriculture technology solutions, unveiled its sensor production facility in Lincoln, Nebraska. The strategically located facility is anticipated to assist local farmers and the agriculture ecosystem in the state of Nebraska in continuing to play their crucial role through water conservation, technology advancements, and more.

Agriculture Sensor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.64 billion

Revenue forecast in 2030

USD 4.62 billion

Growth Rate

CAGR of 11.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, South Korea, Australia, Brazil, KSA, UAE, South Africa

Key companies profiled

Acclima Inc.; auroras S.r.l.; Climate LLC; CropX inc.; Deere & Company; Libelium Comunicaciones Distribuidas S.L.; METER; Pycno; Sentera; Soil Scout Oy; SOLCHIP; Texas Instruments Incorporated; Trimble Inc.; Yara; Zenvus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

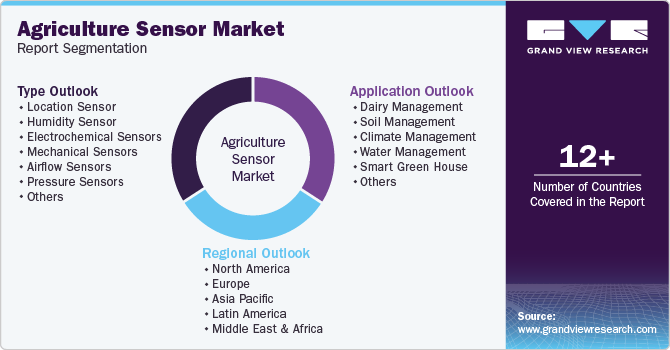

Global Agriculture Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global agriculture sensor market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Location Sensor

-

Humidity Sensor

-

Electrochemical Sensors

-

Mechanical Sensors

-

Airflow Sensors

-

Pressure Sensors

-

Optical Sensors

-

Water Sensors

-

Soil Moisture Sensors

-

Capacitance Sensors

-

Probes

-

Time Domain Transmissometry (TDT) Sensors

-

Gypsum Blocks

-

Tensiometers

-

Granular Matrix Sensors

-

-

Livestock Sensors

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy Management

-

Soil Management

-

Climate Management

-

Water Management

-

Smart Green House

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.