- Home

- »

- Agrochemicals & Fertilizers

- »

-

Agrigenomics Market Size & Share Analysis Report, 2030GVR Report cover

![Agrigenomics Market Size, Share & Trends Report]()

Agrigenomics Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Crop, Livestock), By Sequencer (Sanger Sequencing, Illumina Hi Seq Family, PacBio Sequencing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-140-4

- Number of Report Pages: 116

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agrigenomics Market Summary

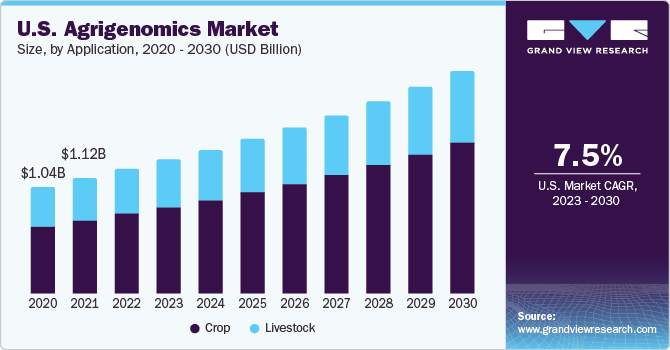

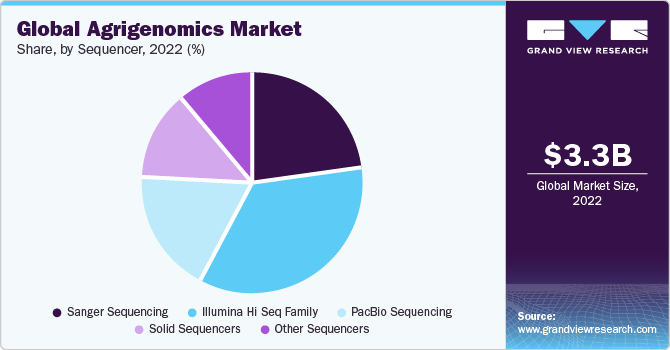

The global agrigenomics market size was estimated at USD 3.3 billion in 2022 and is projected to reach USD 7.47 billion by 2030, growing at a CAGR of 9.5% from 2023 to 2030. This growth is attributed to the rising importance of genomics in agriculture, as farmers and researchers seek to optimize crop yields, improve livestock health, and enhance overall sustainability.

Key Market Trends & Insights

- The North America segment dominated the market with a revenue share of 42% in 2022.

- Agrigenomics plays a crucial role in addressing various challenges in the Asia Pacific region, where agriculture is a significant economic sector.

- Based on application, the crops segment dominated the market with a revenue share of 64% in 2022.

- In terms of sequencer, the Illumina Hi seq segment dominated the market with a revenue share of 35% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 3.3 billion

- 2030 Projected Market Size: USD 7.47 billion

- CAGR (2023-2030): 9.5%

- North America: Largest market in 2022

Agrigenomics involves the application of modern genomic tools and techniques to understand the genetic makeup of crops, livestock, and other agricultural organisms. Its primary goal is to enhance the efficiency, productivity, and sustainability of agricultural practices.

Understanding genetic diversity is crucial for developing crops and livestock with desirable traits, such as resistance to diseases, tolerance to environmental stress, and improved yield. Researchers use genomic information to identify genes associated with desirable traits in crops, such as increased yield, better nutritional content, and resistance to pests or diseases. This knowledge helps in the development of genetically improved varieties through breeding programs.

Agrigenomics is applied to enhance the breeding of livestock for traits such as disease resistance, meat quality, milk production, and reproductive efficiency. Genomic information can also be used to reduce the prevalence of genetic disorders within livestock populations. Genomic data, along with other technologies such as sensors and remote sensing, is employed in precision agriculture. This involves optimizing the use of resources such as water, fertilizers, and pesticides based on the specific genetic characteristics of crops and the environmental conditions of the fields.

Agrigenomics plays a crucial role in identifying genes associated with resistance to diseases in plants and animals. This information is essential for developing crops and livestock that can withstand various pathogens, reducing the reliance on chemical interventions. It is closely linked with biotechnology, including genetic engineering and gene editing techniques. These tools allow scientists to introduce specific genes or modify existing ones to confer desired traits in crops or livestock.

Agrigenomics plays a crucial role in developing crops and livestock that are more resistant to diseases, pests, and environmental stress, leading to improved yields and enhanced food security.It allows scientists to study and preserve the genetic diversity of plant and animal species. This is essential for maintaining resilient agricultural ecosystems, as diverse genetic resources can provide a pool of traits that can be utilized in breeding programs to adapt to changing environmental conditions.

Application Insights

Based on application, the crops segment dominated the market with a revenue share of 64% in 2022. This is attributed to its ability to accelerate the process of crop improvement by identifying genes associated with desirable traits. This includes traits such as increased yield, resistance to diseases, improved nutritional content, and tolerance to adverse climatic conditions. Faster and more precise breeding methods can be employed to develop crops with these desired characteristics.

In the livestock sector, agrigenomics is used to enhance traits related to meat quality, milk production, disease resistance, and reproductive efficiency. This contributes to increased productivity and improved economic returns for farmers. Genomic tools allow for the rapid and accurate screening of large populations of plants, facilitating the identification of individuals with desired traits. This accelerates the traditional breeding process, enabling the development of improved crop varieties in a more time-efficient manner.

With the challenges posed by climate change, agrigenomics is used to develop crops that are more resilient to changing climatic conditions. This includes identifying genes associated with heat tolerance, resistance to pests, and adaptability to varying precipitation patterns. Agrigenomics contributes to improving the quality of animal products, such as meat and milk. By understanding the genetic factors influencing traits such as meat tenderness or milk composition, farmers can selectively breed animals that produce higher-quality products.

Sequencer Insights

Based on sequencer, the Illumina Hi seq segment dominated the market with a revenue share of 35% in 2022. This is attributed to their use for whole-genome sequencing of crops and livestock. This involves determining the complete DNA sequence of an organism and providing insights into its genetic makeup, variation, and potential traits of interest. This is employed to study the transcriptome of agricultural organisms. This involves sequencing and quantifying the RNA molecules in a sample, providing insights into gene expression levels. This is used to understand how genes are expressed under different conditions, such as stress or developmental stages.

In agricultural biotechnology, researchers often use genetic engineering techniques to introduce specific genes into crops for traits such as pest resistance, drought tolerance, or enhanced nutritional content. Sanger sequencing is used to verify the accuracy of the inserted DNA sequences in genetically modified organisms (GMOs). For studying specific genes or gene regions in depth, Sanger sequencing can be a cost-effective and accurate method. This might be relevant in agricultural research when a detailed analysis of specific genes associated with traits like stress tolerance or nutritional content is required.

PacBio sequencing is advantageous for accurately identifying and quantifying alternatively spliced isoforms and understanding the complexity of gene expression in crops. It is used to sequence the genomes of plant pathogens, including viruses, bacteria, and fungi. Understanding the genomic makeup of these pathogens is crucial for developing strategies to control diseases that can affect crops. Understanding the epigenetic regulation of genes in crops can provide insights into processes such as stress response, development, and adaptation to environmental conditions. It can be used to identify and distinguish different varieties or cultivars of crops. This is crucial in agriculture for ensuring the authenticity and purity of seeds and plants in breeding programs.

Regional Insights

The North America segment dominated the market with a revenue share of 42% in 2022. This is attributable to increasing consumer awareness of genetically modified products and interest in sustainable agriculture practices. Consumers prefer products derived from crops or livestock developed using genomic technologies. Consumers and regulatory agencies are increasingly concerned about food safety and traceability. Agrigenomics can be used to trace the origin of agricultural products, ensuring the safety and quality of the food supply chain.

The impact of climate change on agriculture has led to a need for crops and livestock that are more resilient to changing environmental conditions. Agrigenomics plays a role in developing varieties that can thrive in altered climates and withstand stressors like drought or increased temperatures. Advances in biotechnology and genetic engineering are driving the demand for genomics in agriculture. Agrigenomics supports the development and validation of genetically modified organisms (GMOs) with specific traits, contributing to advancements in crop and livestock biotechnology.

Agrigenomics plays a crucial role in addressing various challenges in the Asia Pacific region where agriculture is a significant economic sector and food security is a pressing concern. The use of the product in the region spans several applications, contributing to crop improvement, sustainable farming practices, and the overall advancement of agriculture. In many Asia Pacific countries, staple crops such as rice, wheat, maize, and others are crucial for food security. Agrigenomics is used to study the genomes of these crops to enhance their productivity, nutritional content, and adaptability to local conditions. It also aids in the conservation of genetic diversity within crop and livestock populations. Preserving diverse genetic resources is crucial for maintaining resilient agricultural ecosystems, thus, the market is expected to witness significant growth in the coming years.

Key Companies & Market Share Insights

The market is characterized by intense competition where companies are engaged in expanding their regional presence via different strategic initiatives. Numerous biotechnology companies are actively involved in developing and offering genomic technologies and solutions for crop and livestock improvement. For instance, in February 2023, Tecan collaborated with Singular Genomics to use the turnkey MagicPrep NGS system to create sequencing-ready libraries for the G4 sequencing platform. The agreement will combine Tecan’s expertise in laboratory automation, genomics, and bioinformatics with Singular Genomics’ fast, flexible, and highly accurate sequencing technology to simplify life in the lab.

Companies providing genomic services, including sequencing, genotyping, and bioinformatics analysis, cater to the needs of agricultural researchers and companies. Furthermore, service providers such as BGI; Eurofins; and others contribute to the accessibility of genomic data in agriculture. Some prominent players in the global agrigenomics market include:

-

Thermo Fisher Scientific, Inc.

-

Agilent Technologies, Inc.

-

Tecan Genomics Inc.

-

BGI

-

Illumina, Inc.

-

Eurofins Scientific SE

-

LGC Limited

-

Arbor Biosciences

-

Biogenetic Services Inc.

-

Galseq Srl Via Italia

Agrigenomics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.96 billion

Revenue forecast in 2030

USD 7.47 billion

Growth rate

CAGR of 9.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, sequencer, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Brazil; Argentina, Saudi Arabia; South Africa

Key companies profiled

Thermo Fisher Scientific, Inc.; Agilent Technologies Inc.; Tecan Genomics Inc.; BGI, Illumina, Inc.; Eurofins Scientific SE; LGC Limited; Arbor Biosciences; Biogenetic Services Inc. ; Galseq Srl Via Italia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agrigenomics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agrigenomics market report based on application, sequencer, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Crop

-

Livestock

-

-

Sequencer Outlook (Revenue, USD Million, 2018 - 2030)

-

Sanger Sequencing

-

Illumina Hi Seq Family

-

PacBio Sequencing

-

Solid Sequencers

-

Other Sequencers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.