- Home

- »

- Next Generation Technologies

- »

-

AI Agents Market Size And Share, Industry Report, 2033GVR Report cover

![AI Agents Market Size, Share & Trends Report]()

AI Agents Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Machine Learning, Natural Language Processing (NLP), Deep Learning, Computer Vision, Others), By Agent System, By Type, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-471-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Agents Market Summary

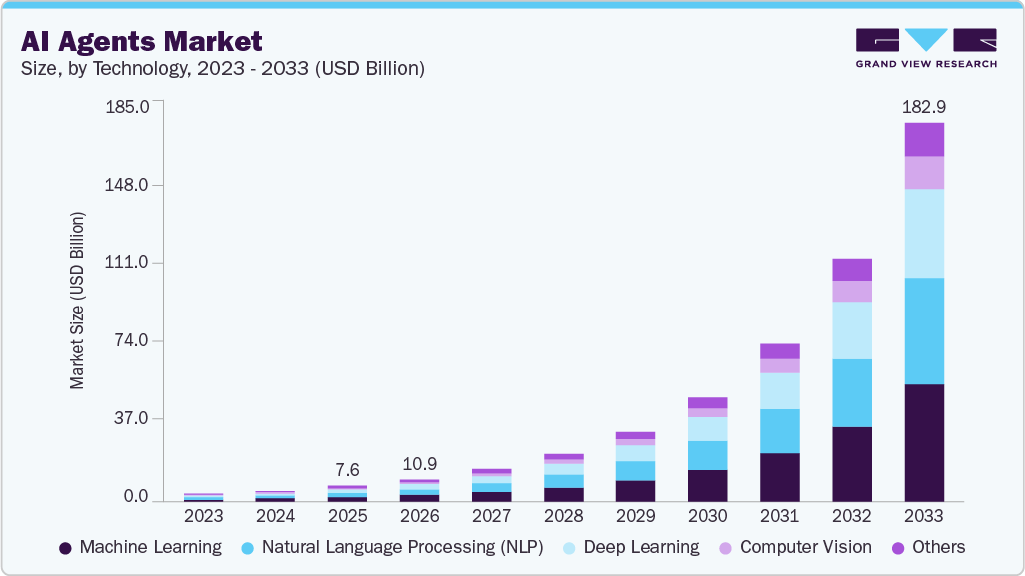

The global AI agents market size was estimated at USD 7.63 billion in 2025 and is projected to reach USD 182.97 billion by 2033, growing at a CAGR of 49.6% from 2026 to 2033. The increased demand for automation, advancements in natural language processing (NLP), and the trend for personalized customer experiences are primarily driving the growth of the AI agents industry.

Key Market Trends & Insights

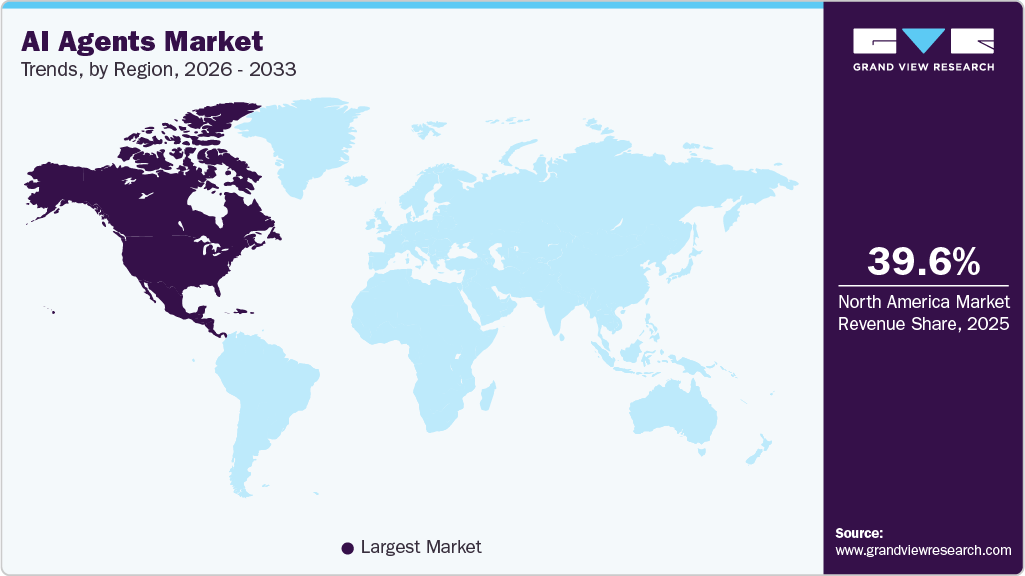

- North America dominated the global AI agents market with the largest revenue share of 39.63% in 2025.

- The AI agents market in the U.S. led the North America market and held the largest revenue share in 2025.

- By technology, the machine learning segment led the market and held the largest revenue share of 30.56% in 2025.

- By agent system, the single agent systems segment held the dominant position in the market and accounted for the leading revenue share of 59.24% in 2025.

- By end use, the industrial segment is expected to grow at the fastest CAGR of 49.2% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 7.63 Billion

- 2033 Projected Market Size: USD 182.97 Billion

- CAGR (2026-2033): 49.6%

- North America: Largest Market in 2025

Moreover, the widespread adoption of cloud computing has made it easier and cost-effective for businesses to deploy AI agents. Consumers expect more personalized interactions, and AI agents enable businesses to deliver customized solutions by using data to provide targeted recommendations, customer support, and marketing outreach, increasing customer satisfaction and loyalty. AI agents enhance customer engagement in e-commerce by offering real-time product recommendations, assisting with transactions, and improving the online shopping experience.

Moreover, the rise of online retail has been a significant growth driver as AI agents are used in telemedicine, patient management, and diagnostics, which are crucial in streamlining healthcare operations. Their ability to handle patient queries, assist in appointment scheduling, and offer health guidance contributes significantly to the growth of the AI agents industry in healthcare.

AI agents are integrated with security systems to monitor, analyze, and respond to security threats in real time. Their capabilities in detecting anomalies, predictive analysis, and automating security procedures drive market demand in both public and private sectors. Moreover, ongoing research and development in AI technologies, particularly in machine learning, deep learning, and NLP, are improving AI agents' functionality and performance. As AI agents become more advanced, industries are adopting them for increasingly complex tasks.

Technology Insights

The machine learning technology segment led the market and accounted for 30.56% of the global revenue share in 2025. Machine learning algorithms enable AI agents to analyze vast amounts of data and make informed decisions quickly. This capability enhances automation and improves overall operational efficiency across various industries. For instance, in May 2025, NTT DATA announced the Smart AI Agent Ecosystem, which incorporates machine learning through large language models (LLMs) and small language models (SLMs) in its platform for agentic AI solutions across industries, including healthcare, automotive manufacturing, finance, supply chain, and marketing.

The deep learning technology segment is predicted to experience significant growth in the forecast period. Enhanced performance and accuracy, big data availability, and advancements in computational power & real-time processing are factors primarily driving the segment's growth. For instance, in December 2025, Snowflake partnered with Anthropic to integrate Claude models, which employ deep learning transformer architectures, into the Snowflake platform, enabling AI agents to perform multi-step analysis on structured and unstructured data with over 90% accuracy on text-to-SQL tasks via Snowflake Cortex AI and Intelligence.

Agent System Insights

The single agent systems segment accounted for the largest market revenue share in 2025. These systems are easier and faster to implement compared to multi-agent systems. Businesses can deploy these solutions quickly without extensive customization, making them suitable for companies seeking to rapidly enhance efficiency. Moreover, the development and deployment costs associated with single agent systems are generally lower. Organizations can achieve automation and AI capabilities without the significant investment required for multi-agent systems.

The multi-agent systems segment is predicted to witness significant growth over the forecast period. The market is driven due to the multi-agent systems enable better communication and collaboration among agents, leading to improved coordination and teamwork. For instance, in December 2025, Fujitsu Limited announced a new technology that enables AI agents from different companies and vendors to work together securely in supply chains. This technology provides global best control, even when information is incomplete, and utilizes a secure gateway to safeguard data during operations.

Type Insights

The ready-to-deploy agents segment accounted for the largest market revenue share in 2025. Businesses can implement ready-to-deploy agents with minimal setup time, allowing them to start benefiting from AI technologies immediately. For instance, in June 2025, Salesforce announced Agentforce 3, which provides observability through the command center, interoperability via Model context protocol support. The platform includes an updated Atlas architecture with reduced latency and expanded language support across multiple regions.

The build-your-own agents segment is expected to observe notable growth over the forecast period. Build-your-own agents can be designed to integrate with various enterprise systems, facilitating seamless workflows. For instance, in October 2025, KPMG Velocity launched Global Business Services, enabled by the ServiceNow AI Platform, to streamline workflows across finance, procurement, human resources, and IT functions. The solution provides a digital platform for orchestrating AI agents, for building and managing autonomous agents and workflows.

Application Insights

The customer service and virtual assistants segment accounted for the largest market revenue share in 2025. The market is driven due to the advanced AI algorithms that allow virtual assistants to analyze customer data and interactions, providing personalized responses and recommendations that enhance the customer experience. For instance, in August 2024, Interactions launched Task Orchestration, an AI-powered agent assist solution that extends its intelligent virtual assistants framework for contact centers. It integrates with existing robotic process automation solutions and supports multichannel self-service without escalations to live agents.

The healthcare segment is poised for significant growth over the forecast period. The market is driven by various factors such as improved patient engagement, efficiency in operations, enhanced diagnosis and decision support, and integration with wearable devices are primarily driving the growth of the healthcare segment. For instance, in April 2025, Tulu Health launched its AI-agent platform, integrated with WhatsApp and hospital websites, offering modular AI agents for both providers and patients throughout the full healthcare journey, from consultation to post-hospitalization.

End Use Insights

The enterprise segment accounted for the largest market revenue share in 2025. AI agents offer 24/7 customer support, personalized interactions, and prompt responses, enhancing overall customer satisfaction and loyalty, which is essential for businesses in competitive markets. For instance, in October 2025, PALO ALTO launched the Rubrik Agent Cloud, a new enterprise platform designed to enable organizations to deploy AI agents at scale, while maintaining oversight and control as it delivers security, accuracy, and operational efficiency during AI-driven transformation.

The industrial segment is projected to grow significantly over the forecast period. The demand is driven by the increasing automation aimed at enhancing operational efficiency and reducing labor costs. AI agents can automate repetitive tasks, monitor processes, and make real-time decisions. For instance, in May 2025, Siemens announced the rollout of advanced AI agents designed to integrate with its existing Industrial Copilot ecosystem. These agents mark a shift from traditional query-based AI assistants to autonomous systems capable of managing entire industrial workflows without human oversight.

Regional Insights

The North America AI agents industry dominated the market with a 39.63% revenue share in 2025, due to the region’s advanced technological infrastructure, high concentration of leading technological companies, and substantial investments in research and development in the region. Furthermore, the early adoption of AI technologies across various sectors, including defense, healthcare, finance, and retail, contributes significantly to the growth of the AI agents industry.

U.S. AI Agents Market Trends

The U.S. AI agents industry is driven due to the presence of tech giants that are establishing advancements in AI agent technology. A thriving startup ecosystem, focused on AI innovation and automation, further accelerates development across diverse sectors, including finance, education, and customer service. Government initiatives, such as the U.S. National AI Initiative, are also important in raising AI research, development, and deployment, setting the U.S. market position.

Europe AI Agents Market Trends

The AI agents industry in Europe is driven by government support through regulations and initiatives such as the European Union's AI strategy. This strategic framework promotes research, innovation, and the responsible deployment of AI agents across various industries, including manufacturing, healthcare, and energy. Furthermore, increasing investments in AI research and development, with a growing awareness of the benefits of AI agents in enhancing efficiency and productivity, are fueling market expansion in Europe.

Asia Pacific AI Agents Market Trends

The AI agents industry in the Asia Pacific is anticipated to register the fastest CAGR over the forecast period, fueled by rapid digital transformation across industries, leading to increased adoption of AI technologies. Businesses are increasingly using AI to optimize operations, enhance customer engagement, and drive innovation. Factors such as expanding internet penetration, rising disposable income, and supportive government policies further contribute to the market's growth potential in this region.

Key AI Agents Company Insights

Some key companies in the AI agents industry are Baidu, Alibaba Group Holding Limited, Google, and Microsoft, among others.

-

Baidu operates as an AI-focused company with an internet foundation, providing search services, AI cloud solutions, autonomous driving technology via its Apollo platform, and digital assistants like DuerOS. Its offerings include online marketing, video streaming through iQIYI, maps, and mobile ecosystem products serving a broad user base across search, advertising, and enterprise applications. The company maintains a full AI stack encompassing deep learning frameworks, models, and applications integrated into its diversified portfolio.

-

Microsoft Corporation develops, licenses, and supports software, services, devices, and solutions worldwide, with operations spanning productivity tools, intelligent cloud platforms, and personal computing. The company provides operating systems, such as Windows, productivity applications including Office and Teams, cloud services through Azure, and hardware, including Surface devices and Xbox consoles. It also delivers enterprise solutions such as SQL Server, Dynamics 365, and developer tools like Visual Studio.

Key AI Agents Companies:

The following are the leading companies in the AI agents market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Apple Inc.

- Baidu

- IBM Corporation

- Meta

- Microsoft

- NVIDIA Corporation

- Salesforce, Inc.

Recent Developments

-

In December 2025, Google released Google Workspace Studio, enabling business users to build and deploy AI-powered agents across Gmail, Drive, Chat, and other Google Workspace applications using the new Gemini 3 model. This launch transforms traditional rule-based automation toward flexible, context-aware workflows that enable non-technical employees to automate routine and complex tasks without writing code.

-

In November 2025, Baidu announced its new foundation model ERNIE 5.0, described as a natively omni-modal system capable of processing and generating across text, images, audio, and video. Alongside ERNIE 5.0, Baidu introduced a suite of AI offerings, including upgraded digital-human technology, a no-code application builder Miaoda, a general-AI agent GenFlow, a self-evolving agent Famou, and an integrated AI workspace Oreate for international deployment via its cloud and enterprise channels.

-

In March 2025, NVIDIA introduced the open “Llama Nemotron” family of reasoning-capable models for developers and enterprises, providing a production-ready foundation for building agentic AI platforms. The models are available in Nano, Super, and Ultra variants that support a range of deployment scenarios from edge devices to multi-GPU data-center servers.

AI Agents Market Report Scope

Report Attribute

Details

Market size in 2026

USD 10.91 billion

Revenue forecast in 2033

USD 182.97 billion

Growth rate

CAGR of 49.6% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, agent system, type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Europe; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Alibaba Group Holding Limited; Amazon Web Services, Inc.; Apple Inc.; Baidu; Google; IBM Corporation; Meta; Microsoft; NVIDIA Corporation; Salesforce, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI agents market report based on technology, agent system, type, application, end use, and region.

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Machine Learning

-

Natural Language Processing (NLP)

-

Deep Learning

-

Computer Vision

-

Others

-

-

Agent System Outlook (Revenue, USD Billion, 2021 - 2033)

-

Single Agent Systems

-

Multi Agent Systems

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Ready-to-Deploy Agents

-

Build-Your-Own Agents

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Customer Service and Virtual Assistants

-

Robotics and Automation

-

Healthcare

-

Financial Services

-

Security and Surveillance

-

Gaming and Entertainment

-

Marketing and sales

-

Human Resources

-

Legal and compliance

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Consumer

-

Enterprise

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI agents market size was estimated at USD 7.63 billion in 2025 and is expected to reach USD 10.91 billion in 2026.

b. The global AI agents market is expected to grow at a compound annual growth rate of 49.6% from 2026 to 2033 to reach USD 182.97 billion by 2033.

b. North America dominated the AI agents market with a share of 39.6% in 2025, due to the advanced technological infrastructure, a high concentration of leading technological companies, and substantial investments in research and development in the region.

b. Some key players operating in the AI agents market include Alibaba Group Holding Limited; Amazon Web Services, Inc.; Apple Inc.; Baidu; Google; IBM Corporation; Meta; Microsoft; NVIDIA Corporation; Salesforce, inc.

b. Increased demand for automation, advancements in Natural Language Processing (NLP), and rising demand for personalized customer experiences are primarily driving the growth of the AI agents market. Moreover, the widespread adoption of cloud computing has made it easier and cost-effective for businesses to deploy AI agents.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.