- Home

- »

- Next Generation Technologies

- »

-

AI Assistant Software Market Size, Industry Report, 2033GVR Report cover

![AI Assistant Software Market Size, Share & Trends Report]()

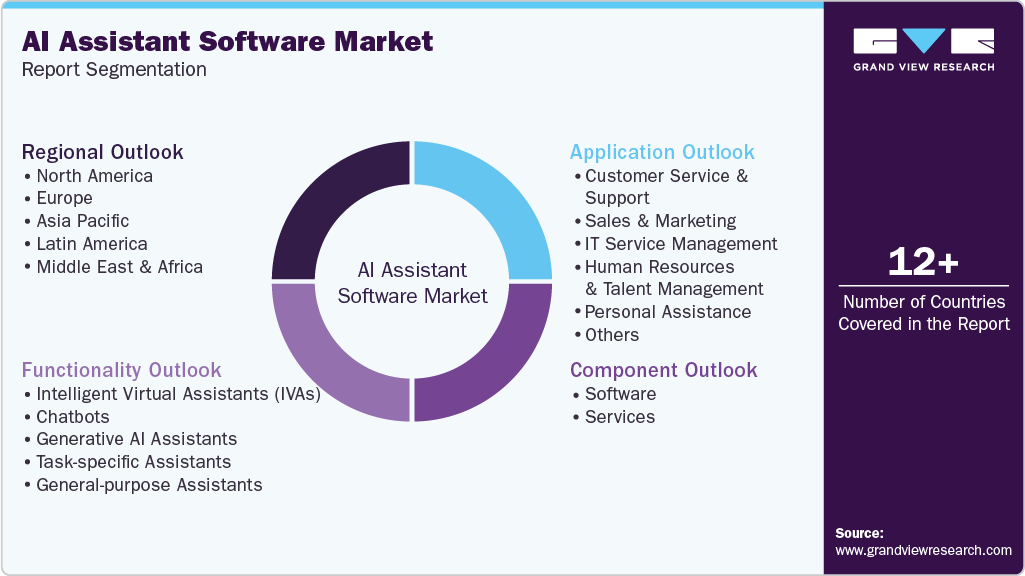

AI Assistant Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Functionality (Chatbots, Generative AI Assistants, Task-specific Assistants, General-purpose Assistants), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-677-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Assistant Software Market Summary

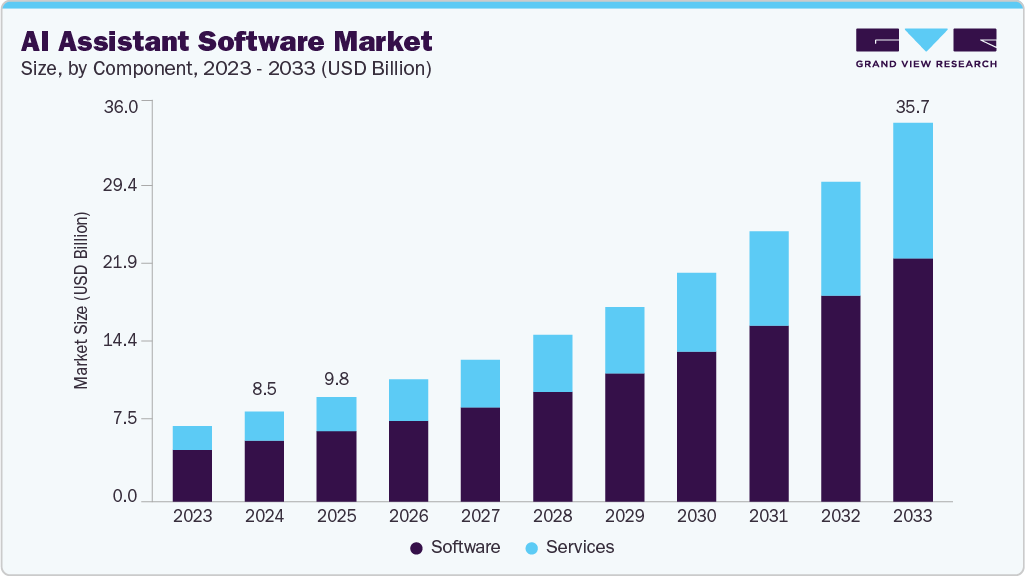

The global AI assistant software market size was estimated at USD 8,464.9 million in 2024 and is projected to reach USD 35,720.6 million by 2033, growing at a CAGR of 17.5% from 2025 to 2033. The artificial intelligence assistant software industry is experiencing strong growth as enterprises adopt these tools to improve operational efficiency and decision support.

Key Market Trends & Insights

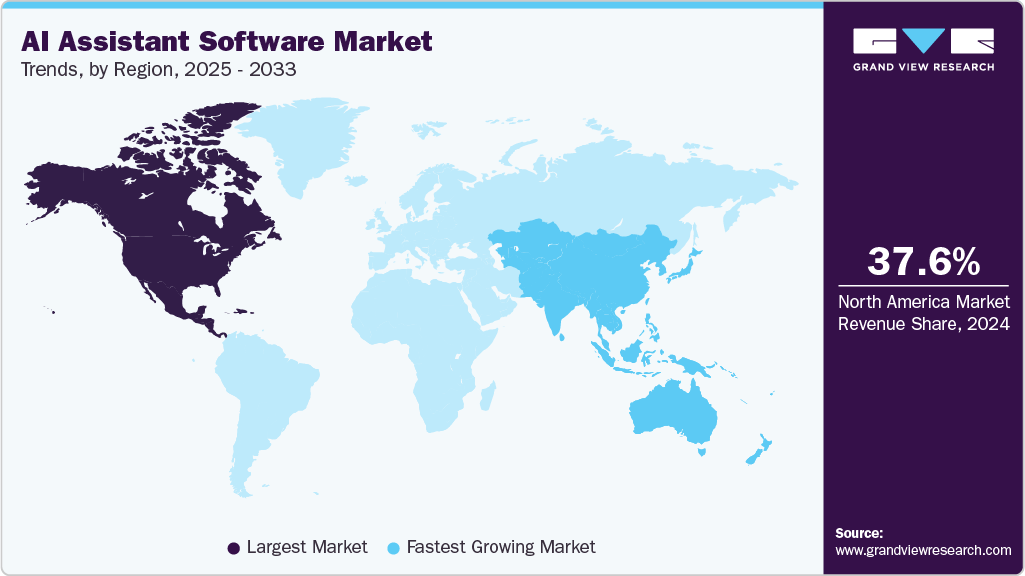

- North America dominated the global AI assistant software market with a revenue share of 37.6% in 2024.

- The AI Assistant Software market in U.S. led the North America region and held the largest share in 2024.

- By component, software segment held the largest revenue share of 67.2% in 2024.

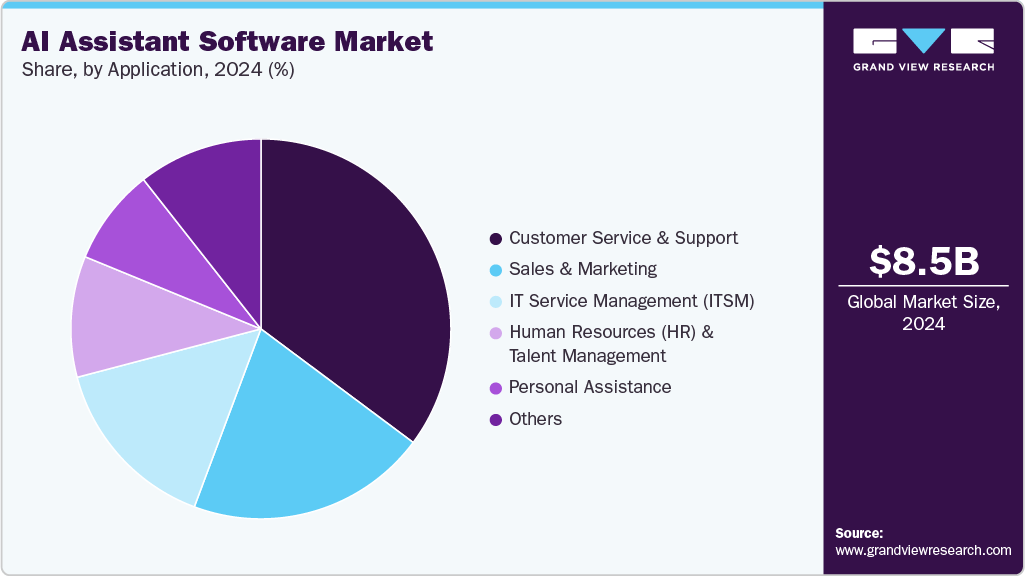

- By functionality, the chatbots segment accounted for the largest revenue share of 34.1% in 2024.

- By application, the IT Service Management (ITSM) segment is expected to grow at the fastest CAGR of 19.6% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 8,464.9 Million

- 2033 Projected Market Size: USD 35,720.6 Million

- CAGR (2025-2033): 17.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

AI assistant software is evolving from rule-based solutions to systems powered by large language models. These advanced assistants manage complex, open-ended business interactions with greater accuracy and flexibility. They support tasks such as drafting emails, summarizing content, and executing multi-step queries. Generative AI is being embedded into enterprise software to enable large-scale automation of complex business tasks. It allows AI assistants to process natural language inputs, generate contextual responses, and support real-time decision-making. These assistants are powered by large language models trained on diverse datasets and fine-tuned for specific organizational needs.Organizations are actively deploying AI assistants across functions such as operations, customer support, and IT to improve efficiency, accelerate workflows, and reduce manual effort. For instance, in February 2025, Honeywell International Inc., a U.S.-based technology and manufacturing company, announced the release of its Forge Production Intelligence platform, with a generative AI assistant that helps engineers and plant managers access insights, automate tasks, and resolve issues through natural language prompts. These assistants enhance performance monitoring and support faster, data-driven decisions in industrial operations.

In the AI assistant software market, solutions are shifting toward multifunctional capabilities. Assistants now combine natural language interaction, reasoning, and task automation in a single platform. This integration allows users to perform end-to-end activities such as querying, planning, and execution without switching tools. It enhances efficiency across personal, enterprise, and industrial use cases. Market participants are focusing on unified systems to address the growing demand for intelligent, action-oriented assistants. Organizations are actively developing such integrated AI assistant platforms. For instance, in March 2025, Alibaba Group Holding Limited, an e-commerce company in China, launched a version of its AI assistant app powered by its advanced Qwen AI reasoning model, integrating chatbot, deep thinking, and task execution into a single platform. This move demonstrates its effort to compete globally by investing heavily in AI infrastructure and forming strategic partnerships to expand its capabilities.

AI assistant vendors are increasingly adopting hybrid architectures that combine cloud-based large language models (LLMs) with on-device models. This approach enables a balance between computational efficiency and user privacy. Cloud-based models provide the power to handle complex tasks and real-time updates. On-device models support faster responses and function without an active internet connection. This reduces latency and enhances user experience, particularly in mobile and consumer electronics. By processing sensitive data locally, vendors address rising privacy and regulatory concerns. Hybrid deployment also lowers infrastructure costs for frequently used functions. It enables context-aware interactions by storing user preferences on the device. This trend is especially relevant for smartphones, wearables, and embedded systems. Leading companies are integrating this approach into next-generation AI assistant platforms to improve reliability and accessibility.

Component Insights

The software segment dominated the AI assistant software market in 2024, accounting for a 67.2% share, due to its foundational role in enabling intelligent system behavior. The core value is derived from advanced algorithms, natural language processing, and reasoning capabilities embedded within the software. Vendors focus on software innovation to improve accuracy, contextual understanding, and response quality. Most performance enhancements and new features are delivered through regular software updates. Subscription-based and license-driven models ensure predictable revenue for vendors. Software platforms are also essential for integrating with third-party applications and APIs.

The services segment is witnessing rapid growth as businesses demand more integration and support for AI deployment. Organizations seek professional services to customize AI assistants according to specific workflows and operational needs. Managed services are becoming crucial for continuous model training, system monitoring, and performance optimization. Consulting services assist clients navigate data privacy, ethical concerns, and industry-specific compliance. With increasing adoption across sectors, service providers are expanding capabilities to handle scale and complexity. The rise of AI-as-a-service models reflects a shift toward recurring support and flexible delivery.

Functionality Insights

Chatbots dominated the AI assistant software market in 2024. Chatbots have historically dominated the AI assistant market due to their early adoption across customer service, e-commerce, and enterprise communication. They are designed for rule-based or scripted interactions, providing structured responses to predefined queries. Their low deployment cost and easy integration into websites and apps have driven widespread use. Businesses have relied on them to handle high volumes of repetitive inquiries with minimal human intervention. Chatbots continue to serve as entry-level automation tools in many industries.

Generative AI assistants are witnessing rapid growth due to advancements in large language models and contextual understanding. These assistants can generate human-like responses, perform multi-step reasoning, and handle complex, unstructured tasks. Similarly, rule-based chatbots, they learn from context and adapt to user inputs dynamically. Their growing use in enterprise productivity, healthcare, education, and creative tasks marks a shift toward intelligent, proactive systems. Organizations are adopting generative assistants to enhance personalization and automate decision support. Investments in generative AI platforms and APIs are accelerating this growth.

Application Insights

The Customer service and support dominated the AI Assistant Software market in 2024. Organizations widely use AI to automate responses, resolve queries, and manage high volumes of customer interactions. AI assistants improve response times, reduce operational costs, and maintain service availability 24/7. Rule-based chatbots were the early tools in this space, now being replaced by more intelligent generative assistants. The segment continues to benefit from strong demand across retail, banking, telecom, and travel sectors. Customer satisfaction and operational efficiency remain the key drivers for AI adoption in this domain. The dominance of this use case shows its clear return on investment and scalability.

AI assistant adoption is growing steadily in IT Service Management (ITSM) as organizations seek to automate internal support and technical operations. AI assistants help resolve employee IT requests, reset credentials, manage tickets, and provide real-time system diagnostics. This reduces the workload on human support teams and improves resolution times. Integration with ITSM platforms is driving broader adoption across enterprises. Natural language interfaces enable employees to interact with IT systems conversationally, improving usability and efficiency. As enterprise IT environments become more complex, demand for intelligent, self-service support tools is increasing.

Regional Insights

North America AI assistant software market held the largest share of the global market, accounting for 37.6% in 2024. This dominance is driven by early technology adoption and high investment in AI infrastructure. Major companies in the region continue to develop advanced assistant platforms across industries. The strong presence of key vendors supports regional growth and innovation. Regulatory support and enterprise digitalization further strengthen the market position.

U.S. AI Assistant Software Market Trends

The U.S. represents the largest national market for AI assistant software in 2024. High enterprise adoption and strong R&D investments drive sustained growth. Major tech companies continue to release advanced generative AI assistants across sectors. Government initiatives and regulatory clarity support innovation and commercialization. The market benefits from robust cloud infrastructure and a mature digital ecosystem.

Europe AI Assistant Software Market Trends

Europe is witnessing steady growth in AI assistant adoption across the public and private sectors. Emphasis on ethical AI and data privacy is shaping product development. Enterprises are integrating AI assistants into customer support, IT operations, and compliance functions. Regional regulations such as GDPR influence design and deployment strategies. Collaboration between governments and AI vendors is expanding use cases in healthcare, finance, and manufacturing.

Asia Pacific AI Assistant Software Market Trends

Asia Pacific is emerging as the fastest-growing region in the AI assistant software market. Rapid digital transformation and mobile penetration support mass adoption. Local companies are developing region-specific assistants with multilingual capabilities. Government-backed AI initiatives in countries such as China, India, and South Korea are accelerating growth. The region is also attracting significant investments in AI infrastructure and platform development.

Key AI Assistant Software Company Insights

Some of the key companies in the AI Assistant Software industry include Amazon.com, Inc., Apple Inc., Google LLC, IBM Corporation, Meta Platforms, Inc., Microsoft, Oracle, SAP SE, Salesforce, Inc., ServiceNow, Inc. and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Google has developed its generative AI assistant under the Gemini brand, replacing its earlier Bard model. Gemini is integrated into Google Workspace tools such as Gmail, Docs, Sheets, and Meet, providing real-time writing, summarization, and task execution capabilities. It also powers voice interactions on Android devices and enhances search experiences with contextual awareness. Google has focused on making Gemini multimodal, allowing it to process and generate text, images, code, and more.

-

IBM Corporation has advanced its AI assistant offering through Watsonx Assistant, part of the broader Watsonx AI and data platform. The assistant is designed for enterprise environments and supports both voice and chat-based interactions across customer service, IT support, and HR functions. It emphasizes transparency, control, and data privacy, aligning with corporate governance standards. Watsonx Assistant integrates seamlessly with IBM’s automation, cloud, and analytics tools.

Key AI Assistant Software Companies

The following are the leading companies in the AI assistant software market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- Apple Inc.

- Google LLC

- IBM Corporation

- Meta Platforms, Inc.

- Microsoft

- Oracle

- SAP SE

- Salesforce, Inc.

- ServiceNow, Inc.

Recent Developments

-

In June 2024, Apple Inc. launched Apple Intelligence, integrating generative AI across iPhone, iPad, and Mac with features such as writing assistance, image creation, and an upgraded Siri. The company aims to improve user experience through personalized, context-aware AI while maintaining strong privacy standards.

-

In February 2024, Amazon.com, Inc. launched Alexa+, a next-generation AI-powered voice assistant, featuring generative AI, enhanced personalization, multimodal capabilities, and smart task management. The assistant supports document analysis, video understanding, contextual memory, and broader integration with devices and services.

-

In May 2023, SAP SE collaborated with IBM Corporation to integrate IBM Watson artificial intelligence into SAP solutions to enhance user experiences through AI-driven insights and automation. As part of the collaboration, IBM Watson powers SAP’s digital assistant in SAP Start, aiming to improve productivity with natural language capabilities and predictive analytics.

AI Assistant Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9,835.3 million

Revenue forecast in 2033

USD 35,720.6 million

Growth rate

CAGR of 17.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Component, functionality, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Amazon.com, Inc.; Apple Inc.; Google LLC; IBM Corporation; Meta Platforms, Inc.; Microsoft; Oracle; SAP SE; Salesforce, Inc.; ServiceNow, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Assistant Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI assistant software market in terms of component, functionality, application, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Functionality Outlook (Revenue, USD Million, 2021 - 2033)

-

Intelligent Virtual Assistants (IVAs)

-

Chatbots

-

Generative AI Assistants

-

Task-specific Assistants

-

General-purpose Assistants

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Customer Service & Support

-

Sales & Marketing

-

IT Service Management (ITSM)

-

Human Resources (HR) & Talent Management

-

Personal Assistance

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI assistant software market size was estimated at USD 8,464.9 million in 2024 and is expected to reach USD 9,835.3 million in 2025.

b. The global AI assistant software market is expected to grow at a compound annual growth rate of 17.5% from 2025 to 2033 to reach USD 35,720.6 million by 2033.

b. North America dominated the AI assistant software market with a share of 37.6% in 2024. This is attributable to widespread enterprise adoption, strong tech infrastructure, and significant investment in AI research across the region.

b. Some key players operating in the AI assistant software market include Amazon.com, Inc., Apple Inc., Google LLC, IBM Corporation, Meta Platforms, Inc., Microsoft, Oracle, SAP SE, Salesforce, Inc., and ServiceNow, Inc.

b. Key factors driving the market growth include rising demand for automation in business processes, increasing adoption of AI technologies across industries, growing use of virtual assistants for customer support, and advancements in natural language processing capabilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.