- Home

- »

- Next Generation Technologies

- »

-

AI Infrastructure Market Size, Share & Growth Report, 2030GVR Report cover

![AI Infrastructure Market Size, Share & Trends Report]()

AI Infrastructure Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology (Machine Learning, Deep Learning), By Application, By Deployment, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-269-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Infrastructure Market Summary

The global AI infrastructure market size was estimated at USD 35.42 billion in 2023 and is projected to reach USD 223.45 billion by 2030, growing at a CAGR of 30.4% from 2024 to 2030. AI infrastructure refers to the hardware, software, and networking components that enable organizations to develop, deploy, and manage artificial intelligence (AI) projects.

Key Market Trends & Insights

- North America dominated the AI infrastructure market with the revenue share of 38.4% in 2023.

- The AI infrastructure market in U.S. accounted for the largest revenue share of 88.9% in 2023.

- Based on deployment, the on-premise segment held the market with the largest revenue share of 50.0% in 2023.

- Based on technology, the machine learning segment led the market with the largest revenue share of 58.4% in 2023.

- Based on application, the training segment led the market with the largest revenue share of 71.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 35.42 Billion

- 2030 Projected Market Size: USD 223.45 Billion

- CAGR (2024-2030): 30.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The growing need for high-performance computing power to process large datasets for AI training and inference, increasing adoption of cloud-based AI platforms, and rising demand for AI-powered solutions in various sectors such as healthcare, manufacturing, and finance are driving the market growth.

Advancements in processing technologies, including specialized AI chips, enable faster and more efficient AI computations, facilitating more complex and sophisticated AI applications. It also involves integrating and developing more powerful and efficient processors like GPUs (Graphics Processing Units) and TPUs (Tensor processing units) and custom AI chips to increase the computational capabilities of AI. For instance, in March 2024, U.S. tech giant NVIDIA launched a new Artificial Intelligence Chip that is capable of advanced cloud computing and can be used by leading tech companies across the globe. In addition, the company launched a new line of AI chips that automobile companies can use to integrate AI into their vehicles.

AI infrastructure has seen growing demand from healthcare and finance sectors, where the integration of AI into operations is rising. In the healthcare sector, AI is used for new drug discovery to forecast the outcome of the treatment, and with the help of AI and ML, dentists can picture the result of Invisalign treatment for patients. AI has growing demand in the finance sector as it can be used for fraud detection and risk management. Both sectors have a growing demand for AI infrastructure and are expected to drive the market growth over the forecast period.

Market Concentration & Characteristics

The degree of innovation is higher in AI infrastructure, with new possibilities unlocked with the adoption of AI in day-to-day business activities. Companies are constantly innovating and upgrading their platforms to integrate AI. AI infrastructure has seen rapid growth since the introduction of 5G technology; as cloud computing requires high-speed data transfers, faster and more stable connectivity is necessary to process and transfer the data. The level of mergers and acquisitions is higher as companies across the globe are coming together to develop new cutting-edge AI infrastructure and expand the industry reach. In January 2024, Google Cloud LLC announced a partnership with Hugging Face Ink for new AI infrastructure, allowing Google to integrate Vertex AI into their search engine.

The impact of regulations is higher in AI infrastructure. Government bodies like the EU recently announced new rules on AI to enhance the transparency of data collection and lower the risks of failures surrounding AI infrastructures. End-use concentration refers to the distribution of AI across various industries or sectors. Industries such as e-commerce, healthcare, and finance allocate a significant portion of their budgets to cloud computing and data processing to improve efficiency and integrate AI into their businesses seamlessly.

Component Insights

Based on components, the hardware segment held the market with the largest revenue share of 63.3% in 2023. Increasing demand for specialized chips and processors to handle complex computations required by AI and machine learning algorithms drives the segment's growth. As AI systems become more complicated, the energy consumption needed to power them increases, hence the growing demand for hardware that can provide the necessary computational power for AI applications while being energy efficient. Innovations in chip design and architecture aimed at reducing power consumption while maintaining performance are rising and driving the market growth.

The services segment is expected to register at a significant CAGR over the forecast period. The increasing need for tailored AI solutions that seamlessly integrate with organizations' existing systems and processes drives the market growth. Service providers offering customization and integration of services enable businesses to leverage AI technologies effectively. With the rapid pace of AI advancements, maintaining an in-house team of AI experts becomes costly for the organization. Hence, the demand for the services segment in the global market is expected to grow in the future.

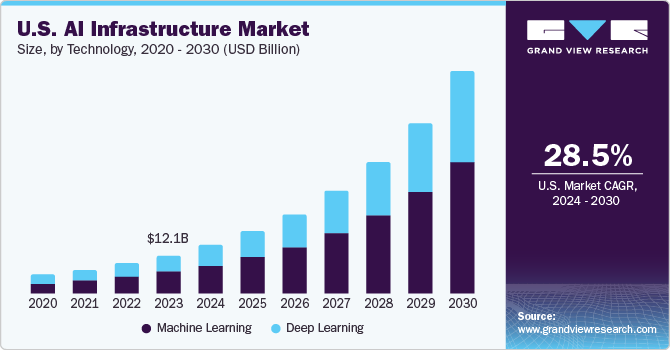

Technology Insights

Based on technology, the machine learning segment led the market with the largest revenue share of 58.4% in 2023. Large volumes of data drive the market growth of machine learning in AI infrastructure, and advances in computational hardware, such as GPUs and specialized AI processors, and continuous innovation in machine learning algorithms are key factors for segment growth. In addition, demand for machine learning solutions is driven by their potential to address industry-specific challenges and opportunities.

The deep learning is the fastest-growing segment and is expected to grow at a significant CAGR over the forecast period. Developing more powerful and energy-efficient GPUs, TPUs, and specialized hardware will accelerate the progress of deep learning. These advancements in hardware enable training increasingly complex models, reducing the time and energy required to achieve breakthroughs.

Application Insights

Based on application, the training segment led the market with the largest revenue share of 71.4% in 2023. The segment is driven by an increase in data generation across various sectors. This data provides the raw material necessary for training sophisticated AI models. Large and diverse datasets enable models to learn more nuanced patterns and make more accurate predictions. In addition, innovations in deep learning architectures and training algorithms, such as transformer models and reinforcement learning techniques, continue to push the boundaries of what is possible in AI.

The inference segment is expected to grow at a significant CAGR over the forecast period. The shift towards edge computing, where data processing occurs closer to the data source, is a major driver for AI inference.

Deployment Insights

Based on deployment, the on-premise segment held the market with the largest revenue share of 50.0% in 2023. The growing demand for data security and compliance, low latency requirements, customization and control, and reduced ownership cost are key factors driving segment growth. Organizations in industries like finance and healthcare require strict control over data privacy and often use on-premise AI infrastructure to maintain control over sensitive data.

The hybrid segment is anticipated to grow at a significant CAGR over the forecast period. The hybrid infrastructure allows organizations to reduce costs by keeping their core operations on-premise and uploading the rest to the cloud, avoiding the maintenance cost of the last on-premise setup. In addition, organizations can use on-premise setups to manage regular workloads and cloud resources for AI model training or higher computing tasks, offering a balance between performance and cost.

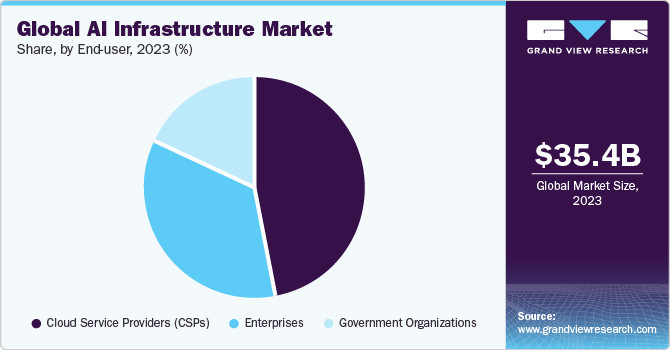

End-use Insights

Based on End-user, the cloud service providers (CSPs) segment held the market with the largest revenue share of 47.4% in 2023. The rapid growth in data from social media, IoT devices, online transactions, and others provides a rich foundation for AI and machine learning models. Enterprises heavily invest in AI infrastructure to harness this data for actionable insights. AI technologies such as process automation and predictive maintenance significantly reduce costs, streamline operations, and improve efficiency, promoting the adoption of AI solutions for enterprises.

The enterprise segment is expected to grow at the fastest CAGR over the forecast period. The rapid growth in data from social media, IoT devices, online transactions, and others provides a rich foundation for AI and machine learning models. Enterprises heavily invest in AI infrastructure to harness this data for actionable insights. AI technologies such as process automation and predictive maintenance significantly reduce costs, streamline operations, and improve efficiency, promoting the adoption of AI solutions for enterprises.

Regional Insights

North America dominated the AI infrastructure market with the revenue share of 38.4% in 2023. North America is a leader in cloud computing services, with major providers like Amazon Web Services, Microsoft Azure, and Google Cloud Platform headquartered in the region. The availability and adoption of cloud services facilitate scalable AI infrastructure solutions.

U.S. AI Infrastructure Market Trends

The AI infrastructure market in U.S. accounted for the largest revenue share of 88.9% in 2023. Major U.S. corporations across industries, including healthcare, finance, automotive, retail, and manufacturing, are adopting AI to improve efficiency, product innovation, and customer service, driving demand for AI infrastructure. The U.S. is home to leading technology companies and startups at the forefront of AI, machine learning, and computing hardware innovations, creating a strong ecosystem for AI research and development and necessitating robust AI infrastructure.

Asia Pacific AI Infrastructure Market Trends

The AI infrastructure market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period. Growing startup ecosystems and expanding internet and smartphone penetration are a few drivers responsible for the increasing need for AI infrastructure in the region. APAC's digital consumer base is growing, creating opportunities for AI-driven services and applications supported by underlying AI infrastructure.

The China AI infrastructure market accounted for the revenue share of 35.6% in Asia Pacific in 2023. The growing adoption of AI and machine learning in software and application building is fostering market growth in the country. In March 2024, NVIDIA and BYD, a Chinese automobile manufacturer, collaborated to develop new AI infrastructure for a future line of electric vehicles.

The AI infrastructure market in India is expected to grow at the fastest CAGR over the forecast period. The growing number of startups in the country is raising the demand for AI infrastructure; the Indian government is promoting the building and development of new AI infrastructure, and the government is planning to invest USD 1.2 billion in the AI market. The government will invest in AI projects to build computing infrastructure and support the country's startups.

Europe AI Infrastructure Market Trends

The AI infrastructure market in Europe is anticipated to grow at a significant CAGR over the forecast period. Policy-driven initiatives, technological innovation, and market demand drive the expansion of Artificial Intelligence (AI) infrastructure in Europe. In February 2024, the EU announced new AI measures; the new AI innovation strategies would help grow startups and SMEs in the region. Some of the new strategies include creating AI factories and making data accessible through common European data spaces.

Key AI Infrastructure Company Insights

Some of the key companies operating in the global market are Google Cloud LLC, OpenAi, and Alibaba Cloud:

-

Google LLC offers a comprehensive suite of AI infrastructure solutions, providing products and services designed to empower businesses, developers, and researchers. Google’s offerings in AI infrastructure are broadly categorized under its cloud platform, Google Cloud, which includes various tools and services for machine learning, data analytics, and more. The company offers Google Cloud AI and machine learning, Data Analytics and processing, AI Infrastructure & computing, APIs & AI services, and collaboration & productivity tools

-

Amazon Web Services (AWS) is a comprehensive cloud platform offering many cloud computing services and resources. In AI and machine learning, AWS provides various products and services to support AI application development, deployment, and scaling. Amazon SageMaker is one such service. AWS also provides a robust infrastructure tailored to handle high-performance tasks, including GPU and CPU instances for AWS DeepLens, AWS DeepRacer, Amazon Rekognition, Amazon Lex, Amazon Polly, Amazon Transcribe, Amazon Translate, Amazon Comprehend, and Amazon Textrack

Key AI Infrastructure Companies:

The following are the leading companies in the ai infrastructure market. These companies collectively hold the largest market share and dictate industry trends.

- Google LLC

- Nvidia Corporation

- AIBrain

- IBM

- Microsoft

- ConcertAI

- Oracle

- Salesforce, Inc.

- Amazon.com Inc.

- Alibaba Cloud

Recent Developments

-

In March 2024, Microsoft announced an investment of USD 2.9 billion in AI and cloud infrastructure in Japan, aiming to enhance the nation's skills, research capabilities, and cybersecurity measures. This significant investment aligns with Microsoft's commitment to empowering Asia as a global innovation engine, focusing on upskilling workers, countering cybersecurity threats, and promoting responsible AI usage. The investment is expected to bolster Japan's digital infrastructure, stimulate economic growth, and create new job opportunities

-

In October 2023, Futureverse, a metaverse and AI technology and content company and Alibaba Cloud partnered to introduce cloud computing services in the Jen Music AI platform. The partnership focuses on advancing AI generative music technology, mainly through developing the JEN-1 text-to-music generation model

-

In September 2023, Tata Consultancy Services announced partnership with NVIDIA U.S. base AI chip manufacturer. With this partnership NVIDIA will offer AI computing infrastructure and platforms for developing artificial intelligence solutions. The company aims to provide state-of-the-art AI capabilities to startup in India

-

In March 2023, NVIDIA announced the launch of DGX cloud service which will give enterprises access to its AI Infrastructure and software for training models for generative AI.This cloud-based service provides enterprises with immediate access to robust AI infrastructure and software via a web browser. DGX Cloud eliminates the complexity of setting up and managing on-premise hardware, allowing businesses to focus on developing cutting-edge AI models for tasks like generative AI

-

In March 2023, AWS and NVIDIA announced a partnership to build the next generation of cloud-based infrastructure designed specifically for training powerful machine learning models and developing generative AI applications. This collaboration focuses on creating highly scalable and on-demand AI infrastructure that can handle the ever-growing complexity of large language models (LLMs)

-

In November 2023, Dell Technologies and Hugging Face announced a partnership to make it easier for businesses to use generative AI. With the collaboration, the company aims to simplify creating, customizing, and deploying customized large language models (LLM) on Dell's reliable infrastructure. It allows other enterprises to leverage the benefits of open-source GenAI models from Hugging Face while keeping their data secure on-premises

AI Infrastructure Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 45.49 billion

Revenue forecast in 2030

USD 223.45 billion

Growth rate

CAGR of 30.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, deployment, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Google LLC; Nvidia Corporation; AIBrain; IBM; Microsoft; ConcertAI; Oracle; Salesforce, Inc.; Amazon.com Inc; Alibaba Cloud

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Infrastructure Market Report Segmentation

This report forecasts revenue growth at global, region, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global AI infrastructure market report based on component, technology, application, deployment, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Machine Learning

-

Deep Learning

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Training

-

Inference

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premise

-

Cloud

-

Hybrid

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Enterprises

-

Government Organizations

-

Cloud Service Providers (CSPs)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI infrastructure market size was estimated at USD 35.42 billion in 2023 and is expected to reach USD 45.49 billion in 2024.

b. The AI infrastructure market is expected to grow at a compound annual growth rate of 30.4% from 2024 to 2030 to reach USD 223.45 billion by 2030.

b. The hardware segment held the highest market share of 63.3% in 2023. Increasing demand for specialized chips and processors to handle complex computations required by AI and machine learning algorithms drives the segment's growth.

b. Some key players operating in the AI infrastructure market include Google LLC, Nvidia Corporation, AIBrain, IBM, Microsoft, ConcertAI, Oracle, Salesforce, Inc., Amazon.com Inc, Alibaba Cloud.

b. The growing need for high-performance computing power to process large datasets for AI training and inference, increasing adoption of cloud-based AI platforms, and rising demand for AI-powered solutions in various sectors such as healthcare, manufacturing, and finance are driving the growth of the AI infrastructure market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.