- Home

- »

- Healthcare IT

- »

-

AI In Genomics Market Size & Share, Industry Report, 2033GVR Report cover

![AI In Genomics Market Size, Share & Trends Report]()

AI In Genomics Market (And Segment Forecasts 2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology (Machine Learning), By Functionality (Genome Sequencing, Gene Editing), By Application, By End Use, By Region

- Report ID: GVR-4-68040-037-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Genomics Market Summary

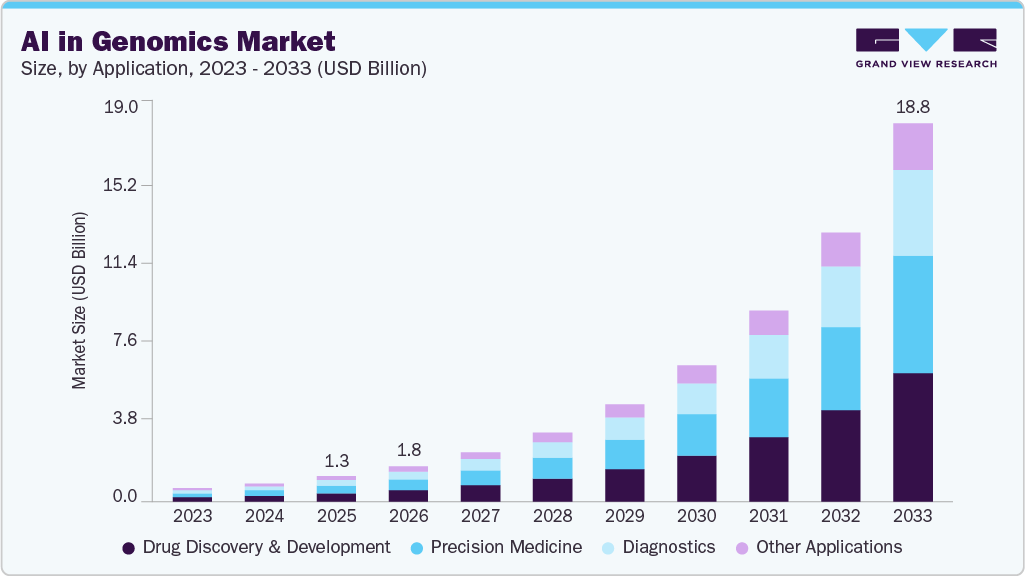

The global AI in genomics market size was valued at USD 1.26 billion in 2025 and is projected to reach USD 18.82 billion by 2033, growing at a CAGR of 40.30% from 2026 to 2033. The growing volume of genomic data, the rising demand for precision medicine, and the acceleration of drug discovery & development are significant factors contributing to market growth.

Key Market Trends & Insights

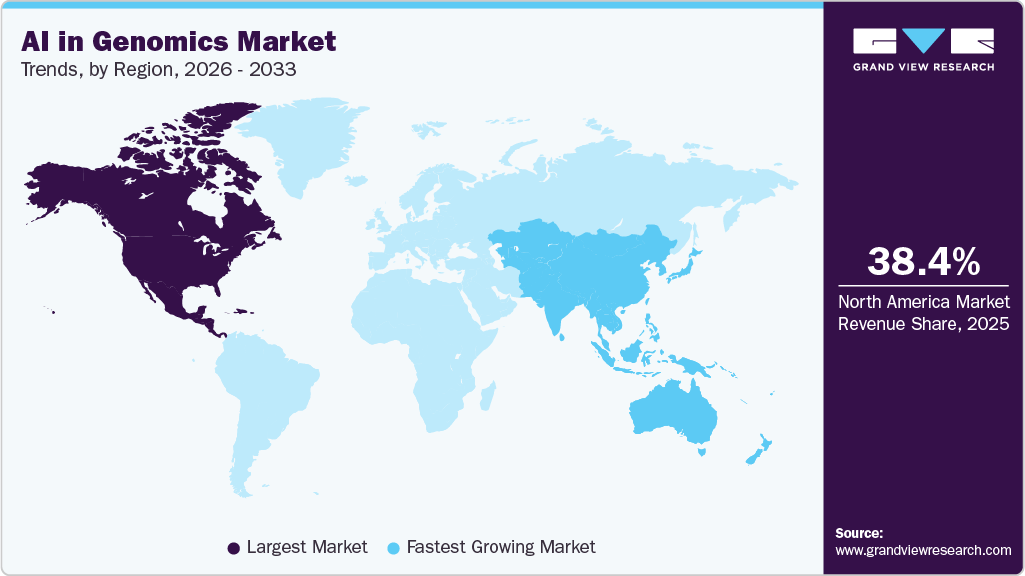

- North America AI in genomics market held the largest share of over 38.36% of the global market in 2025.

- The AI in genomics industry in the U.S. is expected to grow significantly over the forecast period.

- Based on component, the software segment held the largest market share of 41% in 2025.

- Based on technology, the machine learning segment held the largest market share in 2025.

- Based on functionality, the genome sequencing segment held the highest market share in 2025.

- Based on application, the drug discovery & development segment held the highest market share of 33.57% in 2025.

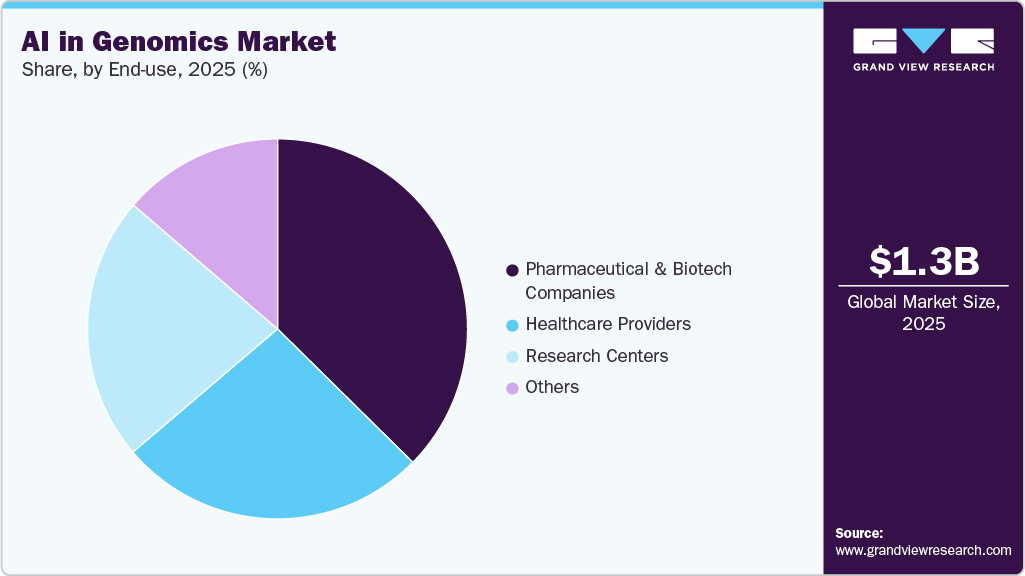

- Based on end use, the pharmaceutical and biotechnology companies segment held the largest market share of 37.39% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.26 Billion

- 2033 Projected Market Size: USD 18.82 Billion

- CAGR (2026-2033): 40.30%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Moreover, technological advancements and industry partnerships are strengthening the market environment. Rapid advances in next-generation sequencing have significantly increased the volume and complexity of genomic datasets. Whole-genome and multi-omics studies generate data that exceed the capacity of traditional bioinformatics tools. For instance, the National Human Genome Research Institute predicts that genomics research is expected to generate between 2 and 40 exabytes of data within the next decade. However, AI enables scalable processing, interpretation, and integration of these large datasets. The growing intensity of data makes AI essential for genomic research and clinical applications. This structural shift strongly drives AI adoption in genomics.

Moreover, the increasing demand for precision medicine further drives market growth. Genomic insights are crucial for identifying patient-specific disease risks and predicting therapy responses. AI supports the interpretation of complex genotype-phenotype relationships at scale. Precision oncology, rare disease diagnostics, and pharmacogenomics increasingly rely on AI-enabled genomics. In addition, integration with clinical data improves actionable decision-making. For instance, in November 2025, Complete Genomics and SOPHiA GENETICS collaborated at the AMP Annual Meeting to integrate IMSK-IMPACT and MSK-ACCESS, powered by SOPHiA DDM, onto the DNBSEQ-T1+ sequencer, delivering end-to-end, AI-driven cancer genomic profiling.

"Pairing MSK-IMPACT and MSK-ACCESS powered with SOPHiA DDM with our DNBSEQ-T1+ platform creates a powerful and accessible solution for laboratories looking to scale high-quality cancer genomic profiling. By combining MSK's rigorously validated assays, SOPHiA GENETICS' robust analytics, and our sequencing technology, we are enabling decentralized labs to deliver faster, more accurate, and more affordable insights to clinicians and researchers."

-Rob Tarbox, vice president of product and marketing at Complete Genomics

Furthermore, accelerated drug discovery and development contribute to market growth. Pharmaceutical companies face rising research and development (R&D) costs and high attrition rates. AI-driven genomics enhances target identification and validation by leveraging genetic evidence. Moreover, genomics-informed AI models reduce the risk of early-stage failure. In addition, drug repurposing opportunities emerge from large genomic datasets, thereby increasing the value proposition and driving strong industry adoption. For instance, in January 2026, Variant Bio launched Inference, an agentic AI genomic drug discovery platform built on the largest unified public-proprietary multi-omic dataset.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The AI in genomics market is fragmented, with several emerging players entering the market. The degree of innovation is high. The level of merger & acquisition activities is moderate. Moreover, the impact of regulations and the regional expansion of industry is high.

AI in genomics market is characterized by constant innovation, with a strong focus on launching new platforms and devices to enhance drug discovery and disease diagnostics. For instance, in September 2025, Cytiva and Paris-based WhiteLab Genomics partnered to utilize WhiteLab’s AI platform to optimize stable cell line development for AAV-based genomic medicines through in silico clone selection.

The industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. In September 2025, SeqOne acquired UK-based Congenica to create the largest global software-only player in clinical genomics, serving over 160 labs in more than 30 countries. The combined AI-powered NGS analysis and clinical decision-support platform addresses the genomic interpretation bottleneck, accelerating the diagnosis of rare diseases and the development of personalized oncology treatments.

Regulations, such as the HIPAA in the U.S. and the GDPR in Europe, establish standards for safeguarding patient data privacy and security. Compliance with these regulations is crucial for AI applications in healthcare to ensure the safe and secure handling of patient information, reducing the risk of data breaches and unauthorized access.

The industry is witnessing high geographical expansion. Companies within the AI in genomics industry seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions.

Component Insights

Based on components, the software segment held the largest market share of 41.00% in 2025. In addition, this segment is expected to witness the fastest CAGR during the forecast period. The rapid adoption of AI-based software solutions for genomics by healthcare institutions, research and development centers, and pharmaceutical and biotechnology companies are expected to drive the segments. Moreover, increasing use of genomics in precision medicine drives segment growth further. For instance, in June 2023, Illumina launched PrimateAI-3D, an AI algorithm predicting disease-causing genetic mutations with enhanced accuracy.

The hardware segment is anticipated to grow significantly over the forecast period. This segment comprises high-throughput sequencing systems, automated sample preparation platforms, data storage infrastructure, and specialized computing hardware optimized for genomic analytics. Advances in next-generation sequencing and long-read technologies generate large-scale genomic datasets that necessitate robust AI-ready hardware. Integration of GPUs, TPUs, and high-performance servers enables accelerated sequence alignment, variant calling, and genome assembly.

Technology Insights

Based on technology, the machine learning segment accounted for the largest revenue share of 63.67% in 2025. In addition, this segment is anticipated to grow at the fastest CAGR during the forecast period. Supervised and unsupervised learning models support variant detection, gene expression analysis, and genotype-phenotype correlation. These techniques enhance the accuracy of identifying pathogenic mutations and disease-associated biomarkers. Moreover, machine learning enables pattern recognition across multi-omics datasets, including genomics, transcriptomics, and epigenomics.

The computer vision-based image analysis segment is anticipated to register significant growth from 2026 to 2033. Computer vision algorithms automate cell segmentation, chromosomal abnormality detection, and spatial pattern recognition. These capabilities enhance the accuracy of analyzing fluorescence in situ hybridization and histopathology-linked genomic data. Clinical genomics laboratories use computer vision to support cancer diagnostics and hereditary disorder screening. Research institutions apply these tools to study tumor heterogeneity and gene-environment interactions.

Functionality Insights

Based on functionality, the genome sequencing segment held the largest revenue share of 44.52% in 2025. In addition, this segment is expected to grow at the fastest CAGR during the forecast period. AI algorithms accelerate read alignment, variant calling, and the detection of structural variations across large datasets. Moreover, automation shortens turnaround times and supports high-throughput clinical and research workflows. For instance, in October 2025, researchers at the University of Queensland and the University of Cambridge developed DNAscent, an AI-powered nanopore sequencing platform that precisely measures DNA replication stress in cancer cells. It identifies biomarkers that predict tumor chemotherapy response and can be generalized to other genomes, supporting the development of targeted therapeutics and personalized cancer treatment.

The gene editing segment is projected to grow significantly from 2026 to 2033. This segment focuses on applying artificial intelligence to optimize genome modification technologies such as CRISPR-Cas systems. Moreover, AI platforms help prioritize disease-relevant targets and predict the phenotypic outcomes of edits. In drug development, these tools accelerate validation of novel therapeutic targets. Research institutions use AI to automate high-throughput editing experiments and data analysis.

Application Insights

Based on application, the drug discovery & development segment accounted for the largest revenue share of 33.57% in 2025. AI algorithms analyze genetic variants, gene expression profiles, and pathway interactions to discover disease-driving mechanisms. As a result, these insights improve target selection and reduce attrition in early-stage drug development. Moreover, integration of genomics with AI enables patient stratification and biomarker discovery, further enhancing the drug development process. Furthermore, this segment supports precision therapeutics by aligning drugs with genetic profiles. This approach enhances efficiency across preclinical pipelines.

The precision medicine segment is anticipated to witness the fastest growth of over 46% during the forecast period. Growth in this segment is driven by the expansion of genomic testing and an increasing demand for individualized therapies. The integration of AI enhances the interpretation of complex genomic data in clinical settings. Precision medicine applications are prominent in oncology, rare diseases, and pharmacogenomics.

End Use Insights

Based on end use, the pharmaceutical and biotechnology companies’ segment held the largest market share of 37.39%. These organizations leverage AI-driven genomic analytics to improve target identification, biomarker discovery, and patient stratification. Integration of genomics with AI reduces drug development timelines and attrition rates. Moreover, AI tools also enable drug repurposing and lifecycle management. For instance, in October 2025, Genomics, a techbio company, launched Mystra, an AI-enabled human genetics platform built on the world’s largest, harmonized genotype-phenotype database and 20,000+ GWAS, to supercharge target discovery.

The healthcare providers segment is likely to witness the fastest CAGR over the forecast period from 2026 to 2033. Hospitals dedicate a significant budget to research in the field of personalized medicine. In addition, the increasing adoption of patient health-related digital information datasets is expected to contribute to segment growth in the coming years.

Regional Insights

North America AI in genomics market accounted for the largest revenue share of 38.36% in 2025. The market is driven by the integration of AI-based diagnostics, strong digital infrastructure, and high investment in clinical research. For instance, major U.S. cancer centers are deploying deep learning models for tumor classification and biomarker quantification, improving diagnostic accuracy and enabling personalized treatment strategies. In addition, strong presence of pharmaceutical and biotechnology companies drives market growth further.

U.S. AI In Genomics Market Trends

The U.S. AI in genomics market held the largest market share in 2025. The market is expanding due to the robust presence of pharmaceutical and biotechnology companies and substantial investments in artificial intelligence in healthcare and life sciences. In addition, growing focus on precision medicine drives market growth further. For instance, in October 2025, Verily integrated NVIDIA’s AI stack, including NeMo, Parabricks, CUDA-X, and Blackwell/Hopper GPUs, into its Pre platform and Workbench research environment to accelerate genomic and multimodal analyses from hours to minutes. The NVIDIA‑enhanced Pre platform powers NIH All of Us and supports multimodal foundation models for improved disease prediction and precision health.

“With NVIDIA's cutting-edge AI capabilities now available in our Pre platform, we are providing researchers with unparalleled tools to enhance the speed and efficiency of AI model development and omics analysis, ultimately accelerating the understanding of disease and advancing precision health for everyone."

-Stephen Gillett, Verily CEO

Europe AI In Genomics Market Trends

Europe AI in genomics market is expected to witness significant growth during the forecast period. This is attributed to the widespread adoption of AI technologies in healthcare and growing need for rapid disease diagnosis. The region also benefits from significant presence of biotechnology companies, strong investment in healthcare digitization, and supportive regulatory frameworks that encourage innovation and integration of digital diagnostics.

The UK AI in genomics market is expected to grow over the forecast period, owing to the robust healthcare infrastructure and increasing investments in AI technologies to enhance medical diagnosis and patient care. In addition, strong government funding for forensic science, along with enhancements to laboratory capabilities, coupled with increased public awareness of genetic testing, drives demand for AI-enabled software and devices.

The Germany AI in genomics market is expected to grow significantly over the forecast period. This growth is attributed to increasing investments in healthcare technology and robust healthcare infrastructure. In addition, advanced research in digital diagnostics and strong technological innovation further contribute to market growth. For instance, in May 2025, QIAGEN expanded its genomics product portfolio by acquiring Genoox, incorporating its AI-powered Franklin cloud platform for NGS interpretation into QIAGEN Digital Insights.

Asia Pacific AI In Genomics Market Trends

Asia Pacific AI in genomics market is expected to grow at the fastest CAGR in the coming years. This growth is attributed to the rising healthcare expenditure, increasing adoption of AI in healthcare and life sciences, and growing prevalence of chronic diseases. In addition, growing focus on rapid diagnostics and precision medicine propel market growth further. For instance, in December 2024, HealthCare Global Enterprises Limited (HCG) partnered with Accenture to accelerate cancer research using generative AI, deep learning, and quantum computing on multi-omic data. Focuses on early detection, molecular signatures for lung adenocarcinoma and head/neck cancer.

The India AI in genomics marketis expanding rapidly, driven by substantial investments in healthcare and life sciences and technological innovation. Moreover,rapidly growing pharmaceutical & biotechnology industries and increasing government initiatives to boost R&D activities in the country are expected to create lucrative opportunities in India AI in genomics market.

The AI in genomics market in Japan is expected to grow rapidly over the forecast period. Strong government support and significant investments in healthcare innovation drive extensive research and development in this field. For instance, in January 2026, One Genomics, an AI-focused de-aging genomics company, and the CiRA Foundation at Kyoto University formed a strategic research collaboration to advance precision genome engineering.

Latin America AI In Genomics Market Trends

Latin America AI in genomics market is anticipated to grow at a significant CAGR over the forecast period. Rising prevalence of cancer and chronic diseases fuels demand for faster, precise diagnostics, while government initiatives and funding support digital healthcare infrastructure. Investments in R&D and growing clinician awareness of AI-assisted diagnostics are expanding market adoption.

Middle East and Africa AI In Genomics Market Trends

Middle East and Africa AI in genomics market is expected to grow at a significant CAGR over the forecast period. The market is characterized by a dynamic landscape driven by the increasing adoption of AI in healthcare, rising healthcare expenditures and supportive government policies. Countries such as Saudi Arabia and the UAE are integrating AI into healthcare infrastructure under strategic visions such as Saudi Vision 2033 and the UAE National Strategy for Artificial Intelligence 2031.

Key AI In Genomics Company Insights

Key players operating in the AI in genomics market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key AI In Genomics Companies:

The following are the leading companies in the AI in genomics market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft Corporation

- NVIDIA Corporation

- DEEP GENOMICS

- Data4Cure, Inc.

- Freenome Holdings, Inc.

- Thermo Fisher Scientific

- Illumina, Inc.

- SOPHiA GENETICS

- BenevolentAI

- Fabric Genomics

Recent Developments

-

In January 2026, Gleneagles Hong Kong announced it would launch an AI-powered genomic health service using Quantum Life’s Longevity.Omics platform to integrate whole genome sequencing, epigenetic assessment, and clinical data for personalized health management.

-

In November 2025, NVIDIA, Sheba Medical Center (Israel), and Mount Sinai (NY) launched a three-year AI initiative targeting the noncoding 98% of the human genome. Uses large language models and high-performance computing to decode regulatory elements driving complex diseases and identify precision medicine targets.

-

In July 2025, 10x Genomics and A*STAR GIS launched the TISHUMAP study to analyze up to 2,500 FFPE cancer tissues on the Xenium spatial platform combined with advanced AI. The project aims to identify novel biomarkers and drug targets, enabling the development of new diagnostics and personalized treatments for cancer and inflammatory diseases.

-

In January 2025, Illumina and NVIDIA formed a genomics-AI partnership to run DRAGEN on NVIDIA GPUs, bringing BioNeMo, RAPIDS, and MONAI into Illumina Connected Analytics. The collaboration targets multi-omic analysis, foundational biology models, and sovereign AI genomics, expanding global access to high-performance, AI-enabled sequencing insights across research, drug discovery, and clinical settings.

AI In Genomics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.76 billion

Revenue forecast in 2033

USD 18.82 billion

Growth rate

CAGR of 40.30% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, functionality, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Microsoft Corporation; NVIDIA Corporation; DEEP GENOMICS; Data4Cure, Inc.; Freenome Holdings, Inc.; Thermo Fisher Scientific; Illumina, Inc.; SOPHiA GENETICS; BenevolentAI; Fabric Genomics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI in Genomics Market Report Segmentation

This report forecasts, revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented global AI in genomics market report based on component, technology, functionality, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Hardware

-

Service

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Machine Learning (ML)

-

Deep Learning

-

Supervised Learning

-

Unsupervised Learning

-

Others

-

-

Computer Vision

-

-

Functionality Outlook (Revenue, USD Million, 2021 - 2033)

-

Genome Sequencing

-

Gene Editing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Discovery & Development

-

Precision Medicine

-

Diagnostics

-

Other Applications

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical and Biotech Companies

-

Healthcare Providers

-

Research Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The rising R&D spending and growing demand for tailored medications are driving AI in the genomics market. Collaborations among key companies are further fostering the market's expansion. Other factors driving the demand for AI in the genomics industry are the rapid advancements in AI technology and its cost-effectiveness. With the rapid advancements in AI technology, new AI-powered software solutions are being developed that are specifically designed for the genomics industry. These solutions are more sophisticated and efficient, enabling researchers to analyze and manage genomic data more effectively than ever before. AI algorithms and software solutions can help to automate many of the manual tasks involved in genomic research, reducing the need for human labor and making the process more cost-effective.

b. The global AI in genomics market size was estimated at USD 1.26 billion in 2025 and is expected to reach USD 1.76 billion in 2026.

b. The global AI in genomics market is expected to grow at a compound annual growth rate of 40.30% from 2026 to 2033 to reach USD 18.82 billion by 2033.

b. In 2025, North America AI in genomics market accounted for the largest revenue share of 38.36%. The market is driven by the integration of AI-based diagnostics, strong digital infrastructure, and high investment in clinical research. For instance, major U.S. cancer centers are deploying deep learning models for tumor classification and biomarker quantification, improving diagnostic accuracy and enabling personalized treatment strategies. In addition, strong presence of pharmaceutical and biotechnology companies drives market growth further.

b. Some of the key market players operating in the AI in genomics market are Microsoft Corporation; NVIDIA Corporation; DEEP GENOMICS; Data4Cure, Inc.; Freenome Holdings, Inc.; Thermo Fisher Scientific; Illumina, Inc.; SOPHiA GENETICS; BenevolentAI; Fabric Genomics; among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.