- Home

- »

- Next Generation Technologies

- »

-

AI Laptop Market Size, Share, Growth, Industry Report, 2033GVR Report cover

![AI Laptop Market Size, Share & Trends Report]()

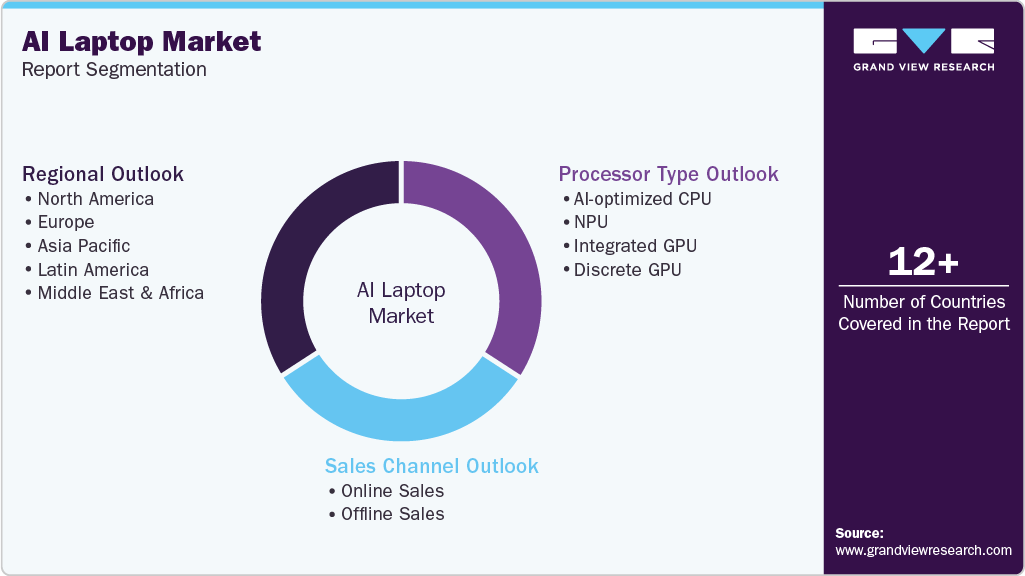

AI Laptop Market (2025 - 2033) Size, Share & Trends Analysis Report By Processor Type (AI-optimized CPU, NPU, Integrated GPU, Discrete GPU), By Sales Channel (Online Sales, Offline Sales), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-684-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Laptop Market Summary

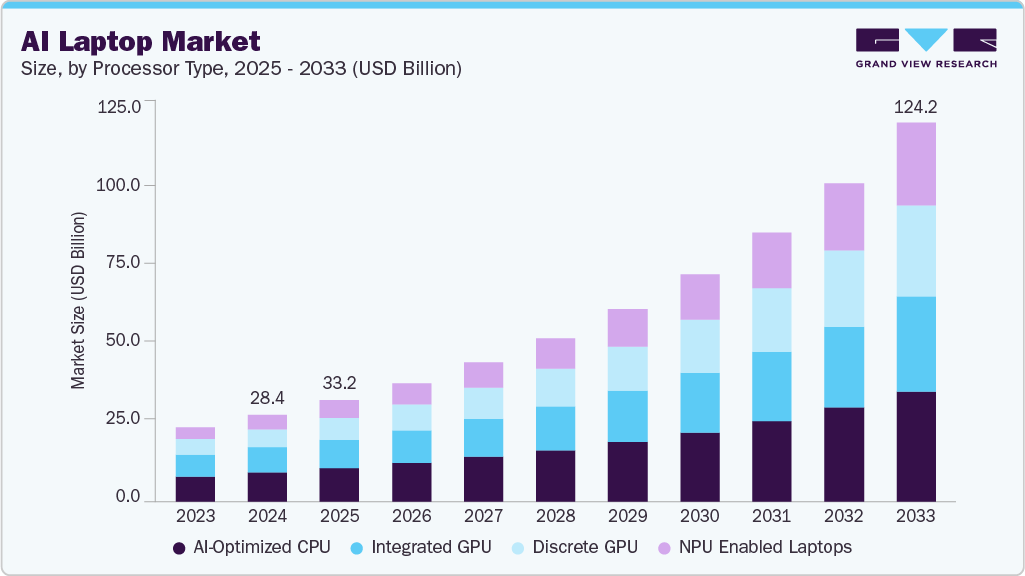

The global AI laptop market size was estimated at USD 28,401.9 million in 2024 and is projected to reach USD 124,214.7 million by 2033, growing at a CAGR of 17.9% from 2025 to 2033. The market is driven by growing expectations for smarter, more efficient, and deeply personalized computing.

Key Market Trends & Insights

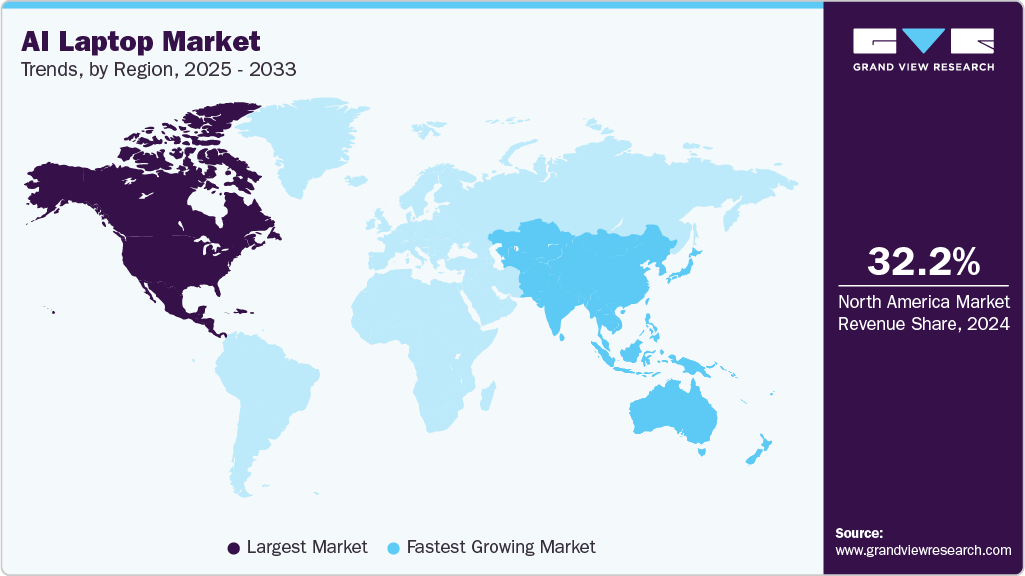

- North America dominated the global AI laptop market with the largest revenue share of 32.2% in 2024.

- The AI laptop market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By processor type, the AI-optimized CPU segment led the market with the largest revenue share of 33.5% in 2024.

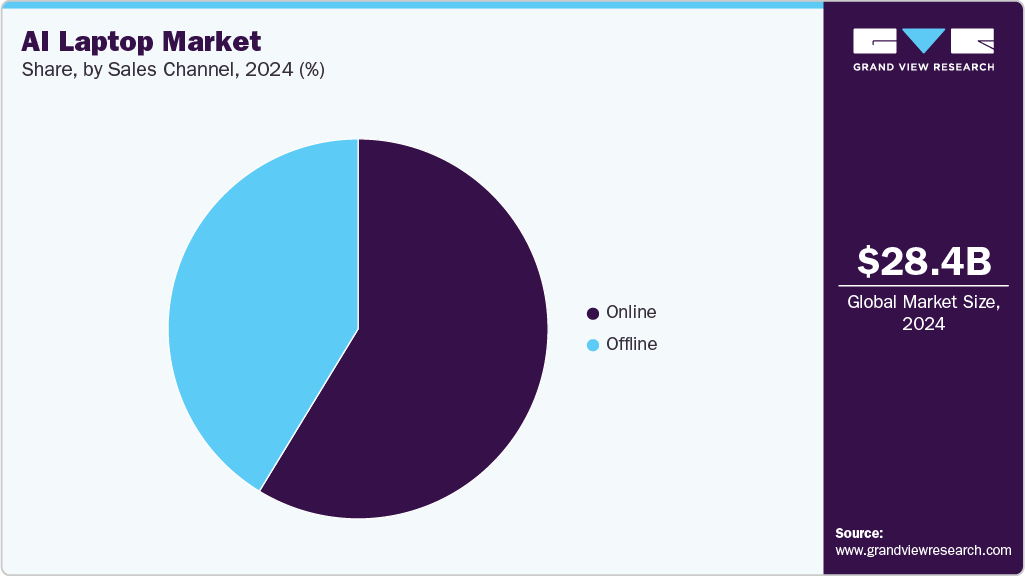

- By sales channel, the online sales segment led the market with the largest revenue share of 58.7% in 2024.

- By sales channel, the offline segment is expected to grow at the fastest CAGR of 16.76% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 28,401.9 Million

- 2033 Projected Market Size: USD 124,214.7 Million

- CAGR (2025-2033): 17.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

AI-enabled battery management systems adapt to individual usage patterns, effectively optimizing power consumption to extend battery life. This boosts portability and convenience for professionals and students but also helps devices run longer between charges and preserves overall battery health over time.The expansion of AI laptops is primarily driven by intelligent performance optimization. AI automatically manages CPU and GPU workloads according to the tasks at hand, ensuring maximum power during demanding activities such as gaming or video editing, while saving energy during lighter use. This smart balancing act enhances both user experience and energy efficiency, making laptops more adaptable and capable across a wide range of applications.

Moreover, the growth in AI’s ability to deliver personalized and adaptive gameplay is fueling market growth over the forecast period. AI-driven security improvements are also a key factor behind their growing use in laptops. Features such as adaptive facial recognition and biometric authentication leverage AI to boost accuracy, speed, and reliability. These intelligent algorithms continually learn and adjust to a user’s unique biometric traits, making it harder for unauthorized access and protecting sensitive information. As a result, AI-enabled laptops offer enhanced trust and peace of mind, whether used for personal or professional purposes.

Furthermore, the drive for personalized experiences and contextual AI support is advancing user interface intelligence in laptops. AI customizes settings such as screen brightness, audio levels, and app recommendations by learning user preferences and adapting to the environment. Features such as voice-activated assistants and instant language translation further boost productivity and enable seamless global communication. This smart adaptability transforms laptops into intuitive partners that grow with the user’s needs, setting new standards for convenience and efficiency in computing.

Processor Type Insights

The AI-optimized CPU segment led the market with the largest revenue share of 33.5% in 2024, driven by as it is designed with enhanced core architectures and instruction sets to efficiently handle AI workloads, improving system responsiveness and overall productivity. These processors feature advanced AI acceleration capabilities, enabling them to execute complex pattern recognition, predictive analytics, and adaptive power management directly within everyday computing processes. By seamlessly balancing AI and non-AI tasks, AI-optimized CPUs support dynamic task scheduling, intelligent resource allocation, and faster inference for standard applications. This integration of AI acceleration within the CPU not only extends battery life but also sharpens real-time responsiveness for features such as virtual assistants, automated workflows, and background optimizations.

The NPU enabled laptops segment is expected to grow at the fastest CAGR during the forecast period, as NPUs in laptops are specialized chips built to accelerate AI operations by mimicking neural networks in the human brain, achieving trillions of computations per second with far greater energy efficiency than traditional CPUs or GPUs. NPUs manage AI-intensive tasks such as voice recognition and image creation in real time, offloading work from the CPU and GPU to boost overall system speed and support enhanced creative workflows. By enabling powerful, low-latency, on-device AI processing, NPUs help extend battery life while delivering AI features such as instant translation and intelligent creative tools. Ongoing driver updates maintain compatibility and peak performance across devices, making NPUs a pivotal force in advancing AI laptop processors.

Sales Channel Insights

The online sales segment accounted for the largest market revenue share in 2024, due to the major OEMs such as Lenovo, HP, Dell, and ASUS are leveraging online-exclusive launches and partnerships with top e-commerce platforms to maximize reach. The market is driven by increasing consumer preference for convenient digital shopping and the rapid integration of AI features in laptops. This shift is especially pronounced in regions such as India and North America, where online channels have lowered traditional retail in sales growth, with some markets recording over 20% year-over-year increases. Enhanced product visibility, user reviews, and flash sales further fuel online demand. In addition, corporate upgrades and hybrid work trends are accelerating procurement through digital channels, making online platforms the primary engine for market expansion.

The offline sales segment is expected to grow at the fastest CAGR over the forecast period, particularly in emerging markets and enterprise procurement segments. Brick-and-mortar retail outlets, electronics chains, and authorized resellers remain critical for consumers who prefer hands-on product evaluation and personalized guidance, especially when investing in premium AI-enabled models. Furthermore, businesses and institutions often rely on offline distribution for bulk purchasing, support contracts, and configuration services. Though the online segment is expanding faster, offline sales benefit from brand experience centers and bundled service offerings. With increasing awareness and in-store AI demos, offline adoption is expected to maintain a moderate but stable growth trajectory.

Regional Insights

North America dominated the AI laptop market with the largest revenue share of 32.2% in 2024, driven by the substantial investment in AI research, along with the region’s leadership in key technology innovation hubs. The strong presence of major tech companies accelerates the adoption of AI-enabled devices, particularly across professional, educational, and healthcare sectors that rely on advanced data analytics and productivity tools. Both consumers and organizations in this region are attracted to features such as AI-driven security, automated workflows, and machine learning that simplify complex tasks. In addition, cloud integration and edge AI capabilities support real-time, secure on-device processing, further driving demand in the region.

U.S. AI Laptop Market Trends

The AI laptop market in the U.S. accounted for the largest market revenue share in North America in 2024, driven by the widespread adoption of AI-powered enterprise solutions, rapid growth in cloud infrastructure, and a strong push for digital transformation across both public and private sectors. Companies are increasingly implementing AI laptops to enhance productivity, streamline routine tasks, and ensure compliance with strict data privacy laws. This enterprise momentum is further strengthened by strategic partnerships between hardware manufacturers and software developers, driving continuous innovation in AI features. For instance, in March 2024, HP introduced AI-powered PCs in the U.S. market, featuring the latest HP Elite laptops and Z by HP mobile workstations, for enhancing productivity and creativity in hybrid work settings. These AI PCs come equipped with cutting-edge processors that include dedicated NPUs, advanced collaboration features, and strong security measures such as firmware safeguards against potential quantum computing threats.

Europe AI Laptop Market Trends

The AI laptop market in Europe is anticipated to witness at a steady CAGR over the forecast period,due to the chip makers integrating AI accelerators such as neural processing units (NPUs) directly into laptops, making AI features more of a standard expectation than an optional extra for consumers. However, adoption of high-performance AI laptops with advanced NPUs has been slower due to their higher costs, uncertain real-world advantages, and compatibility challenges, particularly with ARM-based processors in corporate settings. As AI software continues to evolve, prices drop, and compatibility improves, demand will transition from passive acceptance to proactive adoption, driving greater productivity and collaboration. Meanwhile, global trends highlight growing sales of AI-enabled PCs used for productivity, personalization, energy efficiency, and security benefits of on-device AI, encouraging chipmakers and OEMs to keep pushing innovation in this area.

Asia Pacific AI Laptop Market Trends

The AI laptop market in the Asia Pacific region is anticipated to register at the fastest CAGR over the forecast period, driven by rapid digitalization, growing demand for smart consumer devices, and significant investment in data-focused AI technologies. Countries such as China, India, and Japan are at the forefront, propelled by their strong manufacturing bases and desire to use AI for greater economic competitiveness and productivity gains. For instance, in March 2025, Lenovo introduced AI-driven Yoga and IdeaPad laptops in the Asia Pacific market, for boosting creativity and productivity through advanced Copilot+ capabilities and powerful NVIDIA or AMD processors. These laptops offer high-performance AI experiences, stunning OLED Pure Sight Pro displays, and future-ready storage solutions to cater to a wide range of user needs across the region. Highlighting its dedication to sustainability, Lenovo also introduced the Yoga Solar PC Concept, featuring innovative solar-powered technology. Supportive regulations and policies promoting digital sovereignty and data localization are also pushing businesses to favor laptops with on-device AI capabilities.

Key AI Laptop Company Insights

Some key companies in the AI Laptop industry are Razer Inc., Microsoft, SAMSUNG, and HP INDIA SALES PRIVATE LIMITED.

-

Razer Inc. is a lifestyle brand for gamers, known for its high-performance gaming laptops such as the Blade series, which incorporate advanced AI to elevate gaming and productivity. The company offers a strong ecosystem that blends hardware, software, and services, serving users with tools such as Razer Chroma RGB and Razer Synapse that maximize device performance. Razer consistently pushes boundaries with AI innovations and features to deliver powerful, immersive laptops designed for both gamers and creators. Their laptops harness AI for personalized experiences, performance tuning, and deeper immersion, addressing the evolving needs of users.

-

Dell Inc. is dedicated to advancing human progress through innovative solutions, including its latest AI-powered laptops. The devices are equipped with Intel Core Ultra processors and the Microsoft Copilot Plus PC platform, offering AI features such as on-device neural processing with up to 48 TOPS performance. Their AI laptops provide superior productivity, portability, long-lasting battery life, and stunning displays. Integrated AI tools enhance multitasking, creative processes, and overall user experience, all while ensuring strong security and sustainable design. Dell remains at the forefront of delivering accessible, high-performance AI computing to meet the diverse demands of the digital world.

Key AI Laptop Companies:

The following are the leading companies in the AI laptop market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Microsoft

- Lenovo

- HP INDIA SALES PRIVATE LIMITED

- Dell Inc.

- ASUSTeK Computer Inc.

- Acer Inc.

- SAMSUNG

- Razer Inc.

- Google LLC

Recent Developments

-

In June 2025, Formula 1 and Lenovo partnered to test Lenovo’s AI-driven ThinkPad X9 Aura Edition laptop during the 2025 Chinese Grand Prix. It brings AI-enabled computing into motorsport, helping accelerate decision-making and advance sustainability objectives. The AI PC showcased advanced capabilities such as Smart Modes and superior energy efficiency, supporting F1’s target of achieving net zero carbon by 2030. This partnership allows both organizations to continue to drive innovation to create a smarter, greener future for racing and enhance fan experiences.

-

In June 2025, Apple launched an advanced Apple Intelligence features for the iPhone, iPad, Mac, Apple Watch, and Apple Vision Pro, to elevate communication, visual understanding, and creativity while keeping user privacy by providing features such as live translation for messages and calls, customized workout coaching on Apple Watch, and innovative creative tools such as Genmoji and Image Playground. Developers can use Apple’s on-device foundation model to build smart, private, and offline-capable apps.

-

In April 2025, Lenovo introduced updated ThinkPad lineup for the AI-driven workforce, showcasing high-performance Copilot+ mobile workstations such as the ThinkPad P14s Gen 6 AMD and P16s Gen 4 AMD, alongside the latest ThinkPad L Series business laptops and expanded ThinkPad X1 Aura Editions equipped with the AMD Ryzen AI PRO processors, increased memory capacities, and AI-enhanced productivity tools, the new ThinkPads are ideal for professionals ranging from content creators and engineers to hybrid teams. These devices are developed to deliver outstanding performance, advanced manageability, and smart features that enable AI workloads.

-

In April 2025, ASUS India introduced its AI-driven ExpertBook P Series laptops, equipped with Intel Core Ultra 7 and 13th Gen Intel Core i7 processors. It comprises the ExpertBook P1, P3, and P5 models which offers durability with military-grade certification and strong enterprise security features. These laptops come with advanced AI capabilities, fast PCIe Gen 4 SSD storage, support for up to 64GB DDR5/LPDDR5X RAM, and improved thermal management to ensure top-tier performance.

-

In January 2025, Samsung Electronics introduced the Galaxy Book5 Pro and Galaxy Book5 360, the AI-powered PCs designed to boost productivity and deliver personalized user experiences. Equipped with Intel Core Ultra processors featuring NPUs offering up to 47 TOPs, they integrate Galaxy AI tools such as AI Select and provide smooth cross-device connectivity. The Galaxy Book5 Pro offers impressive features such as up to 25 hours of battery life, a Dynamic AMOLED 2X display, and rich audio with Dolby Atmos for an immersive experience.

AI Laptop Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 33,165.5 million

Revenue forecast in 2033

USD 124,214.7 million

Growth rate

CAGR of 17.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Market revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Processor type, sales channel, regional.

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Apple Inc.; Microsoft; Lenovo; HP INDIA SALES PRIVATE LIMITED; Dell Inc.; ASUSTeK Computer Inc.; Acer Inc.; SAMSUNG; Razer Inc.; Google LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Laptop Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI laptop market report based on the processor type, sales channel, and region.

-

Processor Type Outlook (Revenue, USD Million, 2021 - 2033)

-

AI-optimized CPU

-

NPU

-

Integrated GPU

-

Discrete GPU

-

-

Sales Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online sales

-

Offline sales

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI in Laptop market size was estimated at USD 28.40 billion in 2024 and is expected to reach USD 33.17 billion in 2025.

b. The global AI in Laptop market is expected to grow at a compound annual growth rate of 17.9% from 2025 to 2033 to reach USD 124.21 billion by 2033.

b. North America dominated the AI in Laptop market with a share of 32.2% in 2024. Driven by the substantial investment in AI research, along with the region’s leadership in key technology innovation hubs.

b. Some key players operating in the AI in Laptop market include Apple Inc.; Microsoft; Lenovo; HP INDIA SALES PRIVATE LIMITED; Dell Inc.; ASUSTeK Computer Inc.; Acer Inc.; SAMSUNG; Razer Inc.; Google LLC

b. Key factors that are driving the market growth include the expansion of AI in laptops is primarily driven by the intelligent performance optimization. AI automatically manages CPU and GPU workloads according to the tasks at hand, ensuring maximum power during demanding activities such as gaming or video editing, while saving energy during lighter use.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.