- Home

- »

- Next Generation Technologies

- »

-

AI in Oil & Gas Market Size & Share, Industry Report, 2033GVR Report cover

![AI In Oil And Gas Market Size, Share & Trends Report]()

AI In Oil And Gas Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Product (Material Movement, Production Planning), By Technology, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-171-7

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Oil And Gas Market Summary

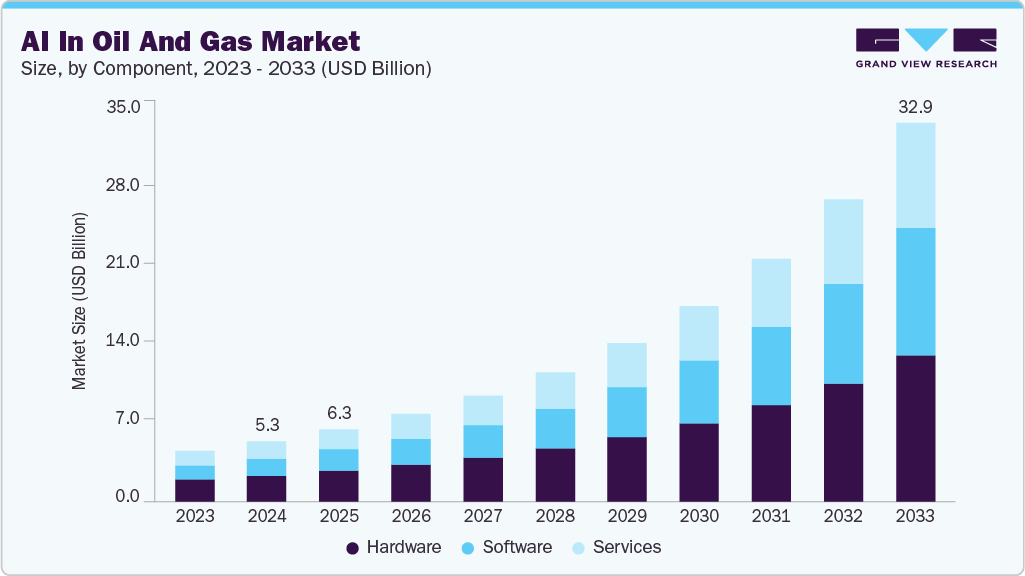

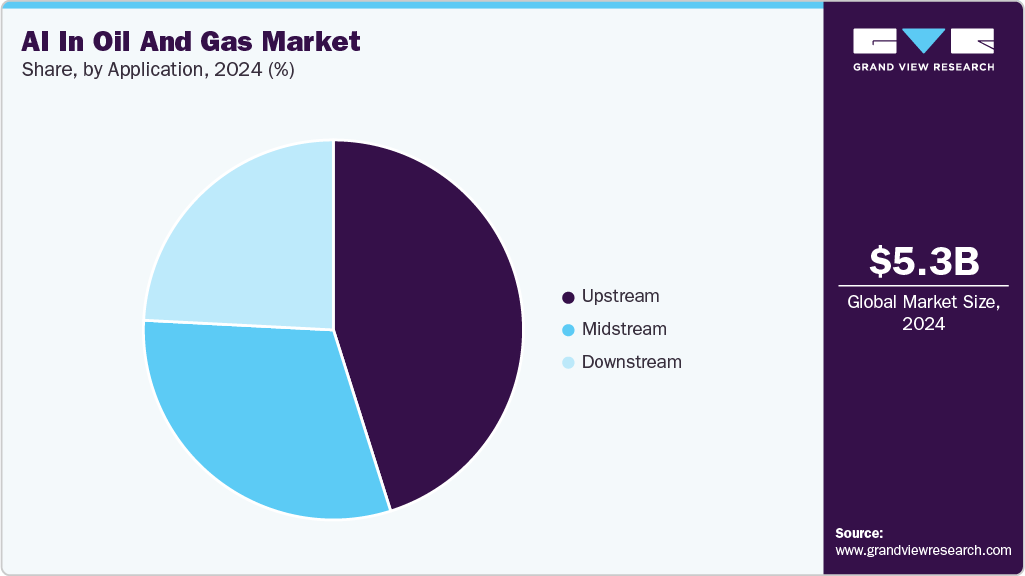

The global AI in oil and gas market size was estimated at USD 5.29 billion in 2024 and is projected to reach USD 32.98 billion by 2033, growing at a CAGR of 22.9% from 2025 to 2033. The market growth is primarily driven by increasing adoption of predictive maintenance and asset optimization solutions, growing demand for AI-enabled reservoir management and exploration analytics, rising integration of computer vision and robotics for safety and inspection, and expanding use of generative AI and digital twins to enhance operational efficiency and decision-making.

Key Market Trends & Insights

- North America AI in oil & gas industry dominated the global market with the largest revenue share of over 36% in 2024.

- The AI in oil & gas industry in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, hardware led the market and held the largest revenue share of over 43% in 2024.

- By technology, machine learning led the market and held the largest revenue share of over 44% in 2024.

- By end use, the midstream segment is expected to grow at the fastest CAGR of over 26% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 5.29 Billion

- 2033 Projected Market Size: USD 32.98 Billion

- CAGR (2025-2033): 22.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest market in 2024

The growing demand for AI in the oil & gas industry is driven by the need for predictive maintenance and real-time operational analytics across exploration, production, and refinery operations. The rising adoption of machine learning and computer vision is helping companies optimize drilling efficiency, monitor equipment health, and reduce operational downtime. There is an increasing focus on AI-enabled automation and digital twin technologies to enhance safety, improve accuracy, and minimize costs. The growing integration of cloud-based AI platforms is enabling faster, data-driven decision-making and seamless collaboration across complex operations. In addition, companies are leveraging AI to support sustainability initiatives, monitor emissions, and achieve greater operational efficiency across the value chain.

The demand for AI in safety and risk management is enhancing operational reliability and compliance. The rising deployment of AI-powered monitoring systems allows for early detection of anomalies and potential hazards. Companies are integrating AI with predictive modeling to prevent accidents and reduce workplace risks. AI-driven analytics is improving decision-making for emergency response and environmental impact management. In addition, the application of AI is helping operators maintain regulatory compliance while optimizing operational efficiency.

AI in the oil & gas industry is increasingly being adopted for advanced reservoir simulation and resource estimation, allowing more accurate exploration planning. The growing use of AI-powered supply chain optimization is helping companies reduce logistics costs and improve delivery efficiency. AI-driven market analytics is enabling operators to forecast commodity prices and optimize production strategies. The application of natural language processing (NLP) is facilitating automated report generation, knowledge extraction, and regulatory compliance. Furthermore, AI is enhancing workforce productivity through intelligent scheduling, remote monitoring, and operator decision support systems.

Component Insights

The hardware segment dominated the market in 2024, accounting for an over 43% share, owing to the increasing deployment of AI-enabled sensors, servers, and edge devices across exploration, drilling, and production operations. The growing demand for robust computing infrastructure is driving investment in high-performance GPUs and specialized hardware for real-time analytics. Companies are adopting AI hardware to enhance predictive maintenance, monitor equipment health, and improve operational efficiency. The integration of AI hardware with IoT devices is enabling seamless data collection and faster decision-making. In addition, advancements in ruggedized and energy-efficient hardware are supporting operations in remote and challenging oil and gas environments.

The software segment is anticipated to witness significant growth over the forecast period, driven by the rising adoption of AI platforms and analytics solutions for exploration, production, and refinery operations. Companies are increasingly leveraging machine learning, predictive analytics, and digital twin software to optimize drilling, monitor assets, and improve operational efficiency. The growing integration of cloud-based AI software is enabling real-time data processing and seamless collaboration across geographically dispersed operations. AI-powered software solutions are also supporting sustainability initiatives by monitoring emissions, energy consumption, and regulatory compliance. Furthermore, the increasing demand for customized, scalable software applications is driving continuous innovation in AI-enabled oil and gas solutions.

Product Insights

The production planning segment is growing owing to the increasing adoption of AI-driven tools for optimizing production schedules and resource allocation. Companies are leveraging predictive analytics and machine learning algorithms to forecast production performance and minimize operational bottlenecks. The integration of AI with real-time monitoring systems enabling dynamic adjustments to drilling, extraction, and processing activities. AI-based production planning solutions are helping operators reduce costs, enhance efficiency, and improve overall asset utilization. Furthermore, the emphasis on data-driven decision-making is driving continuous investment in advanced production planning software and platforms.

The predictive maintenance & machinery inspection segment is anticipated to grow at a faster rate over the forecast period owing to the increasing adoption of intelligent monitoring systems to anticipate equipment failures and reduce unplanned downtime. Companies are leveraging machine learning and advanced analytics to analyze sensor data and optimize maintenance schedules. The integration of predictive maintenance tools with IoT-enabled machinery is enhancing operational efficiency and extending the lifespan of critical assets. Remote monitoring and automated diagnostics are helping operators reduce maintenance costs and improve safety standards. Furthermore, the focus on minimizing operational disruptions and maximizing asset performance is driving continued investment in predictive maintenance technologies.

Technology Insights

The machine learning segment is growing owing to the increasing use of advanced algorithms to analyze complex datasets and extract actionable insights. Companies are leveraging machine learning models to optimize exploration, production, and asset management processes. The integration of machine learning with real-time monitoring systems is enabling predictive decision-making and operational efficiency. It is also helping operators improve safety, reduce costs, and enhance overall process reliability. Furthermore, the rising demand for intelligent automation and data-driven strategies is driving continuous investment in machine learning solutions across the industry.

The computer vision segment is projected to grow at the fastest CAGR over the forecast period owing to the increasing use of visual data analytics for monitoring equipment, pipelines, and operational processes. Companies are leveraging image and video recognition technologies to detect anomalies, enhance safety, and prevent operational failures. The integration of computer vision with drones and remote inspection tools is enabling faster and more accurate asset monitoring in challenging environments. It is also supporting quality control by identifying defects and ensuring compliance with operational standards. Furthermore, the rising demand for automated inspection and real-time visual intelligence is driving continued investment in computer vision technologies.

Application Insights

The upstream segment is growing owing to the increasing adoption of advanced technologies for exploration, drilling, and production optimization. Companies are leveraging predictive analytics and machine learning to identify new reserves and enhance well performance. Real-time monitoring and data-driven decision-making are improving operational efficiency and reducing risks in complex field operations. The use of automated and remote inspection tools is helping to minimize downtime and enhance safety in upstream activities. Furthermore, the rising focus on maximizing resource recovery and cost-effective production is driving continued investment in upstream technologies and solutions.

The midstream segment is anticipated to witness the fastest CAGR over the forecast period owing to the increasing adoption of advanced monitoring and optimization technologies for transportation, storage, and distribution of oil and gas. Companies are leveraging predictive analytics and real-time data to enhance pipeline integrity and prevent leaks or operational disruptions. The integration of automation and remote monitoring systems is improving operational efficiency and reducing maintenance costs. AI-driven solutions are being used to optimize logistics, storage management, and throughput across midstream operations. Furthermore, the focus on safety, regulatory compliance, and cost-effective asset management is driving continued investment in midstream technologies and solutions.

Regional Insights

North America AI in oil & gas industry dominated the global market with a share of over 36% in 2024, owing to the accelerated adoption of AI for predictive maintenance, reservoir modeling, and real-time operational analytics. Companies are leveraging machine learning and computer vision to optimize drilling efficiency and reduce equipment downtime. There is increasing use of digital twins and AI-enabled automation to enhance safety and operational efficiency. Cloud-based AI platforms are further enabling agile decision-making across upstream and downstream operations.

U.S. AI In Oil And Gas Market Trends

The U.S. AI in oil & gas industry dominated the market with a share of over 59% in 2024, driven by the rapid deployment of AI-powered analytics for exploration, production optimization, and predictive maintenance. Companies are integrating AI with IoT sensors to monitor pipelines and equipment health in real time. There is growing investment in smart drilling technologies and automation to reduce operational costs and improve efficiency. In addition, AI is being used to monitor refinery emissions and support sustainability initiatives across energy operations.

Europe AI In Oil & Gas Market Trends

The Europe AI in oil & gas industry is expected to grow at a CAGR of around 22% from 2025 to 2033, owing to the increasing focus on energy transition and sustainable operations. AI is being applied for predictive maintenance, smart refinery operations, and process optimization. The use of AI-driven analytics for upstream exploration and midstream pipeline management is rising steadily. Regulatory compliance and environmental sustainability goals are further accelerating AI integration across European oil and gas operations.

Asia Pacific AI In Oil & Gas Market Trends

Asia Pacific AI in oil & gas industry is expected to grow at the fastest CAGR of over 26% from 2025 to 2033. The demand is fueled by rising exploration and production activities and strong government support for AI adoption in the energy sector. Companies are increasingly implementing AI for predictive maintenance, production optimization, and asset monitoring to enhance efficiency. Cloud-based AI solutions and data-driven decision-making are becoming key enablers for rapid growth in the region.

Key AI In Oil And Gas Company Insights

Some of the key companies in the AI in oil & gas industry include IBM, Accenture, Google, Microsoft, Oracle, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

IBM is a global leader in applying artificial intelligence and advanced analytics to optimize oil and gas operations across exploration, production, and distribution. Through its Watson AI platform, IBM helps energy firms leverage predictive maintenance, anomaly detection, and process automation to reduce downtime and enhance safety. The company’s AI solutions are widely used to analyze seismic data, predict equipment failure, and optimize drilling strategies. IBM’s strong expertise in integrating AI with IoT and cloud computing enables real-time decision-making in complex industrial environments. Its strategic collaborations with major oil companies have positioned IBM as a key enabler of digital transformation in the energy sector.

-

Accenture specializes in AI-driven digital transformation consulting for the oil and gas industry, focusing on improving operational efficiency and sustainability. The company integrates AI with automation, data analytics, and cloud technologies to streamline production and enhance asset performance. Through its Industry X and Accenture Applied Intelligence platforms, it delivers customized AI solutions for predictive maintenance, energy forecasting, and workforce optimization. Accenture also partners with major technology providers such as Microsoft and AWS to accelerate innovation in upstream and downstream operations. Its holistic approach helps oil and gas firms transition toward intelligent, data-centric operations aligned with energy transition goals.

Key AI In Oil And Gas Companies:

The following are the leading companies in the AI in oil & gas market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- Accenture

- Microsoft

- Oracle

- Intel

- Numenta

- Sentient Technologies

- Inbenta

- General Vision

- Cisco

- Fugenx Technologies

Recent Developments

-

In August 2025, Wood Mackenzie launched two advanced tools Prospect Valuation and AI-powered Analogues integrated into its Lens Subsurface platform. These innovations help upstream companies identify oil and gas resources with strong economics and low carbon footprints. The AI-powered Analogues tool leverages Synoptic AI to provide unbiased, efficient assessments of subsurface data, enabling quick and accurate identification of resource analogues. According to Andrew Latham, Senior Vice President of Energy Research at Wood Mackenzie, these tools support the development of profitable and sustainable upstream portfolios in a rapidly evolving energy landscape.

-

In July 2025, GeoComputing launched the GEN 6 RiVA platform, a geotechnical computing solution designed to support AI tools such as PaleoScan, Petrel, and Kingdom. The platform addresses challenges in exploration and production by providing a highly efficient and performant solution for complex work environments. It integrates AI-supported GPUs and configurable workstation profiles to enhance operational efficiency and enable containerized AI workflows. By allowing seamless incorporation of advanced technologies, the GEN 6 RiVA platform helps operators unlock new geoscience insights with improved speed and accuracy

-

In September 2024, Huawei unveiled significant advancements in AI applications for the oil and gas sector during HUAWEI CONNECT 2024 in Shanghai. These innovations focused on large model construction, refined exploration techniques, intelligent oilfield reconstruction, and upgrades to the natural gas industry. The goal of these initiatives is to enhance operational efficiency, increase reserves and production, and ensure safe and high-quality development. Li Peng, Senior Vice President of Huawei, emphasized the company’s commitment to driving intelligent transformation across exploration, production, and transportation processes in the industry.

AI In Oil And Gas Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.34 billion

Revenue forecast in 2033

USD 32.98 billion

Growth rate

CAGR of 22.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Component, product, technology, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

IBM; Accenture; Google; Microsoft; Oracle; Intel; Numenta; Sentient Technologies; Inbenta; General Vision; Cisco; Fugenx Technologies

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI in Oil & Gas Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI in oil & gas market report based on component, product, technology, application, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Material Movement

-

Predictive Maintenance & Machinery Inspection

-

Production Planning

-

Field Services

-

Quality Control & Reclamation

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Machine Learning (ML)

-

Computer Vision

-

Context Awareness

-

Natural Language Processing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Upstream

-

Midstream

-

Downstream

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.