- Home

- »

- Healthcare IT

- »

-

AI Platform For Clinical Conversations Market Report, 2033GVR Report cover

![AI Platform For Clinical Conversations Market Size, Share & Trends Report]()

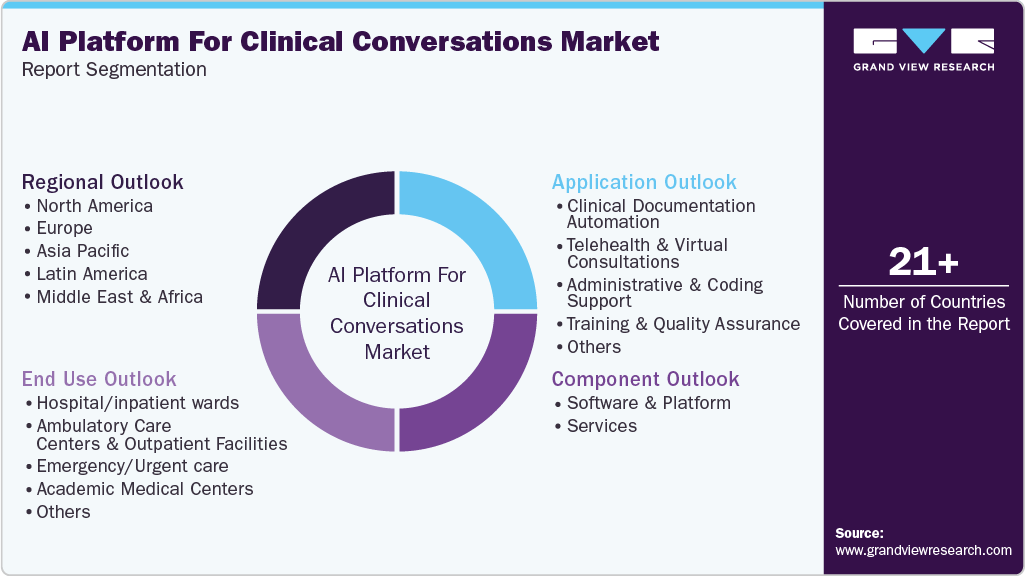

AI Platform For Clinical Conversations Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software & Platform, Services), By Application (Clinical Documentation Automation, Telehealth & Virtual Consultations), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-818-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Platform For Clinical Conversations Market Summary

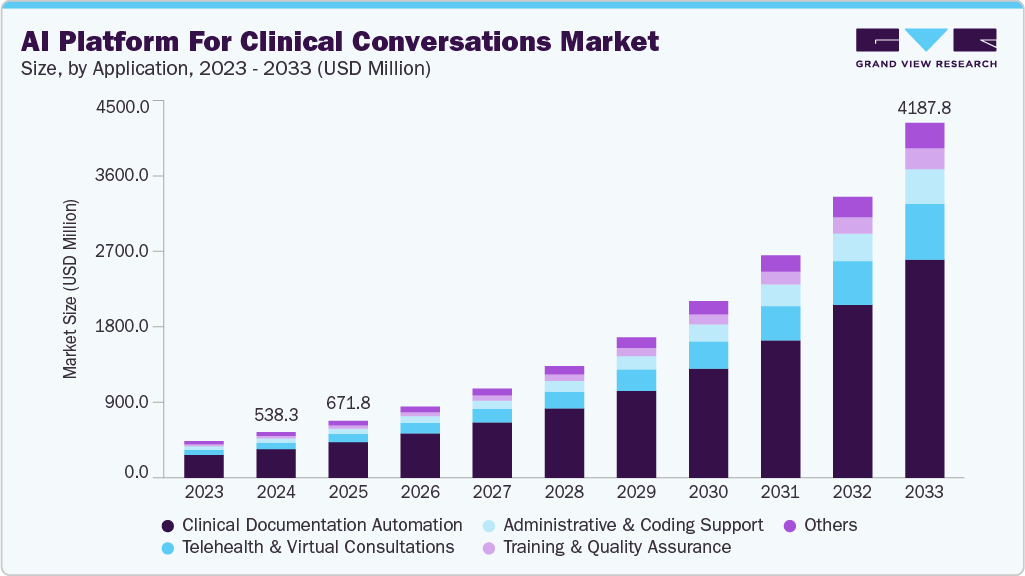

The global AI platform for clinical conversations market size was estimated at USD 538.31 million in 2024, and is projected to reach USD 4,187.77 million by 2033, growing at a CAGR of 25.70% from 2025 to 2033. Rising clinician burnout, the need to reduce administrative burden, and a growing emphasis on personalized patient engagement and remote patient monitoring are significant factors contributing to market growth.

Key Market Trends & Insights

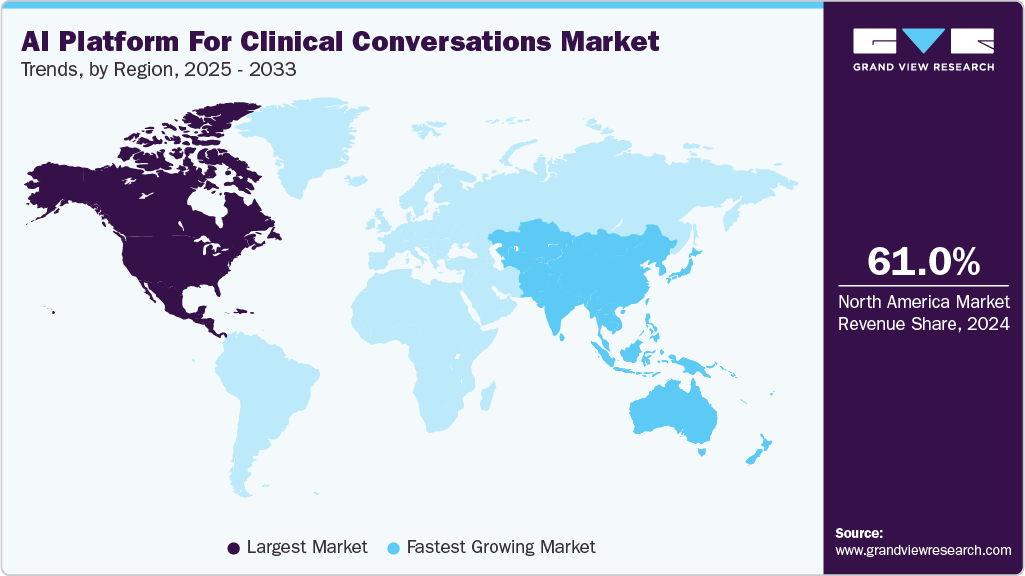

- The North America AI platform for clinical conversations market accounted for the largest revenue share of 61.00% in 2024.

- The AI platform for clinical conversations market in the U.S. is expected to grow significantly over the forecast period.

- By components, the software & platforms segment led the market, with the largest revenue share of 77.04% in 2024.

- By application, the clinical documentation automation segment accounting for the largest revenue share of 62.66% in 2024.

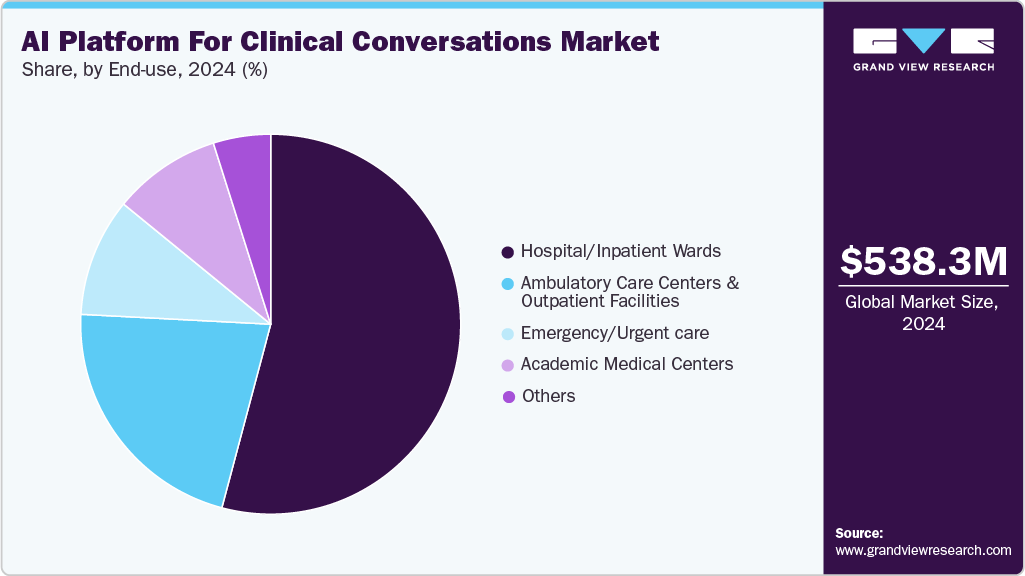

- By end-use, the hospital/inpatient wards segment held the largest market share of 54.14% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 538.31 Million

- 2033 Projected Market Size: USD 4,187.77 Million

- CAGR (2025-2033): 25.70%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, the expansion of telehealth and virtual care services is another factor that is further fueling market growth. The rising demand for workflow efficiency and the reduction of administrative burden are primary drivers accelerating the global adoption of AI platforms for clinical conversations. Health systems are increasingly facing physician burnout due to manual documentation, coding complexity, and regulatory compliance requirements.AI-powered ambient scribe solutions streamline note-taking during patient-provider interactions, automatically capturing key details and structuring clinical documentation to enhance efficiency. This automation enables clinicians to focus on patient care, resulting in enhanced satisfaction, improved clinical accuracy, and increased workflow productivity. For instance, in October 2025, Northwell Health announced the deployment of Abridge’s ambient AI platform system-wide, automating clinical documentation to support 20,000 physicians and 22,000 nurses across 28 hospitals. The solution improves efficiency, reduces burnout, and integrates deeply with EMRs, helping clinicians manage over 50 million annual medical conversations with enterprise-grade security and multi-specialty support.

“Physician wellness and resiliency is one of the most essential issues facing healthcare today and promoting it requires redesigning how we work. The patient and clinician interaction is precious and time is an invaluable resource. By reducing documentation burden, Abridge will help our clinicians return to what they do best: caring for our patients.”

-Jill Kalman, MD, executive vice president, chief medical officer and deputy physician-in-chief at Northwell Health

Recent advancements in natural language processing (NLP) and large language models (LLMs) are accelerating the development of AI-driven clinical conversation platforms, enabling healthcare organizations to deliver more efficient, informed, and patient-centric care. These technologies facilitate contextual understanding across a wide range of medical scenarios and specialties. For instance, in October 2025, VideaHealth launched Voice Notes, the first AI-powered ambient scribe specifically designed for dentistry. Built on the VideaAI platform trained on over one billion dental images, it converts chairside conversations into complete, compliant clinical notes without disrupting workflows. AI systems now summarize, transcribe, and interpret medical discourse across various accents, dialects, and languages. Enhanced multimodal capabilities enable integration of audio, textual, and image data for a unified patient view.

Significant investment, strategic partnerships, and rapid product launches mark the competitive landscape of the AI platform for clinical conversations industry. For instance, in September 2025, Philips SpeechLive partnered with Corti to integrate ambient AI into its dictation platform, delivering real-time, structured clinical documentation and instant medical insights. Leading technology firms, health IT vendors, and emerging startups are developing AI conversation platforms tailored for inpatient, outpatient, and specialty settings. In February 2025, Akron Children’s Hospital announced the expansion of its use of the Abridge generative AI platform across pediatric specialties, including primary care, gastroenterology, cardiology, and pediatric psychiatry.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, characteristics, and participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The AI platform for clinical conversations market is slightly fragmented. Moreover, several emerging players are entering the market, thereby contributing to increased fragmentation within the market. The degree of innovation, the level of partnerships & collaboration activities is high. In addition, the impact of regulations and the regional expansion of industry is also high.

The market is characterized by constant innovation, with a strong focus on launching new platforms or upgrading the existing platforms to save time, reduce cognitive burden, and minimize duplicate work. Prominent players are launching advanced solutions to sustain a competitive advantage. For instance, in June 2025, Abridge expanded its capabilities to support inpatient care settings and streamline outpatient orders through seamless integration with Epic Systems. “Abridge Inside for Inpatient” integrates seamlessly with Epic workflows (Haiku and Hyperspace), enabling automated bedside note generation, rapid charting, and management of multiple patients.

“Abridge Inside automatically transforms bedside conversations into structured Epic notes, empowering inpatient clinicians who deliver the intricately balanced coordinated care for admitted patients to devote more time to patient care. Seamless Epic integration into a variety of note types makes it easy to use, and our admitting hospitalists, in particular, are thrilled.”

- Dr. Veena Jones, Vice President and Chief Medical Information Officer at Sutter Health, one of the early pilot partners

The AI platform for clinical conversations industry is experiencing a high level of partnerships and collaborations undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in September 2025, Abridge partnered with Hartford HealthCare to deploy its AI-powered clinical documentation platform across the system.

AI platforms for clinical conversationsare increasingly being classified as Software as a Medical Device (SaMD) under regulatory standards. In the U.S., the Food and Drug Administration (FDA) regulates AI-powered clinical conversation tools under its SaMD framework, emphasizing risk classification, clinical validation, and real-world performance monitoring. In Europe, AI-based clinical conversation platforms fall under the EU Medical Device Regulation (MDR) and the emerging AI Act.

The industry is witnessing high geographical expansion. Companies within the AI platform for clinical conversations industry seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from both developed and developing countries. For instance, in October 2025, UPMC expanded its partnership with Abridge, scaling the AI-powered ambient clinical intelligence platform enterprise-wide to over 12,000 clinicians by 2026. The platform integrates deeply with existing workflows across more than 40 hospitals and 800 outpatient sites.

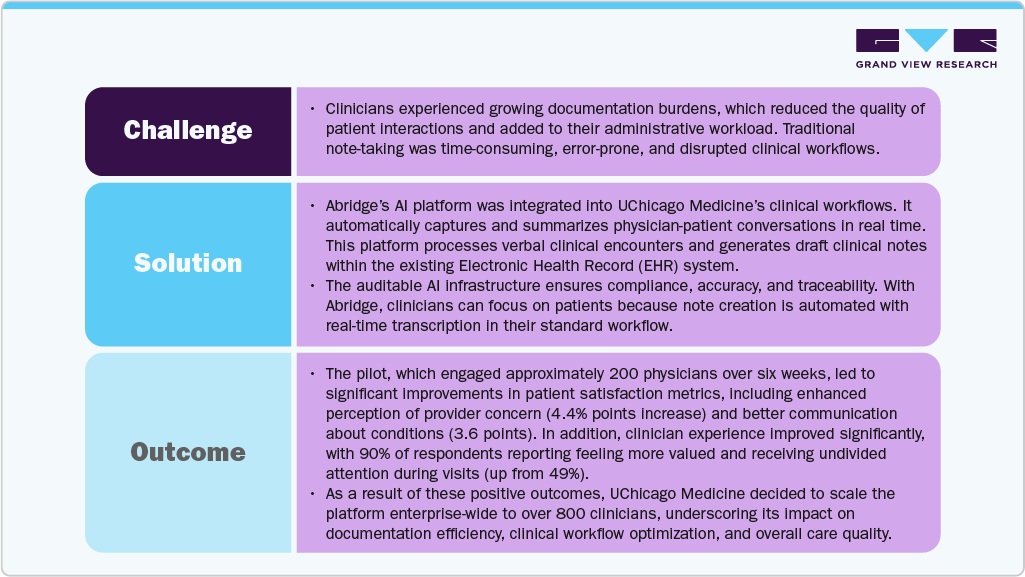

Case Study Insights: Enhancing Clinical Documentation and Patient Experience with Abridge AI at UChicago Medicine

UChicago Medicine piloted the Abridge AI platform, an advanced generative AI solution designed to transform patient-clinician conversations into structured, real-time clinical documentation. The initiative sought to address clinician burnout, improve note accuracy, and enhance patient engagement.

Component Insights

The software & platforms segment led the AI platform for clinical conversations market, with the largest revenue share of 77.04% in 2024. This can be attributed to the widespread adoption of AI-driven documentation systems integrated within electronic health records (EHRs). Hospitals, clinics, and telehealth providers increasingly rely on these platforms to automate transcription, summarization, and clinical note generation in real time. Leading solutions, such as Nuance DAX Copilot and Abridge, leverage large language models (LLMs) and ambient intelligence to reduce administrative workload and improve documentation accuracy. Their seamless interoperability with major EHR vendors, such as Epic, further strengthens enterprise-scale deployment and market penetration.

The services segment is expected to grow at the fastest CAGR during the forecast period, due to the increasing demand for implementation, integration, and workflow customization support. Services also include AI model tuning, data management, and continuous performance monitoring, which improve accuracy and outcomes. Providers increasingly seek outsourcing to manage AI platform operations, updates, and compliance with dynamic regulatory frameworks. As AI technology evolves rapidly, ongoing professional assistance is crucial to maintaining system effectiveness and addressing emerging clinical documentation and regulatory needs. This necessity fuels accelerated growth in this segment.

Application Insights

The clinical documentation automation segment led the AI platform for clinical conversations industry, accounting for the largest revenue share of 62.66% in 2024. Automating documentation with advanced AI technologies, such as natural language processing and speech recognition, enables real-time transcription and organization of physician-patient interactions. This reduces clinician burnout, improves clinical record accuracy, and streamlines coding and billing. Healthcare providers are adopting these solutions to enhance compliance and patient care quality.

The telehealth & virtual consultations segment is anticipated to grow at the fastest CAGR from 2025 to 2033, due to rising demand for remote healthcare delivery. Additionally, the growth of remote specialty care and behavioral health consultations is further accelerating demand for AI transcription and summarization capabilities tailored for virtual environments.

End-use Insights

The hospital/inpatient wards segment held the largest market share of 54.14% in 2024. Hospitals require advanced AI tools to capture patient interactions seamlessly, reduce clinician administrative burden, and enable more face-to-face care. These platforms integrate deeply with electronic health records (EHRs), supporting diverse specialties and complex workflows typical in inpatient care. The high patient volume and acuity in hospitals drive sustained demand for scalable AI solutions.

In addition, inpatient settings present complex challenges, including multidisciplinary care coordination, extensive documentation requirements, and regulatory compliance, which contribute to the increased adoption of AI platforms. For instance, in April 2025, Sharp HealthCare announced the implementation of the Abridge generative AI platform enterprise-wide to enhance clinical documentation.

The ambulatory care centers & outpatient facilities segment is anticipated to grow at the fastest CAGR from 2025 to 2033. These centers offer cost-effective care options with shorter wait times, driving higher patient volumes. AI platforms improve workflow efficiency and documentation accuracy, facilitating streamlined patient management in outpatient settings. The capability to support diverse specialties and integrate seamlessly with EHR systems aligns with the rising demand for scalable solutions.

Regional Insights

The North America AI platform for clinical conversations market accounted for the largest revenue share of 61.00% in 2024. This is attributed to the advanced healthcare infrastructure and widespread adoption of AI/ML technologies. Increasing telehealth adoption and integration of conversational AI in patient monitoring and hospital management enhances efficiency. Large integrated delivery networks (IDNs) and favorable reimbursement policies further boost expenditure on AI platforms.

U.S. AI Platform For Clinical Conversations Market Trends

The U.S. AI platform for clinical conversations industry held the largest revenue share in 2024. This is attributed to the country’s technological leadership and deep integration of AI within healthcare systems. The high adoption of telehealth and patient engagement tools creates a demand for conversational AI platforms. In addition, increasing partnerships between technology companies, healthcare providers, and research institutes propel market growth further. For instance, in March 2025, Memorial Sloan Kettering Cancer Center expanded its use of Abridge’s AI clinical documentation platform after a successful pilot in multiple oncology specialties.

“We are looking forward to expanding its use at MSK, bringing advanced digital tools to the bedside that help our clinicians focus on the care of their patients, not clicks in the EHR.”

-Peter Stetson, MD, MSK’s Chief Health Informatics Officer.

Europe AI Platform For Clinical Conversations Market Trends

The Europe AI platform for clinical conversations industry is growing, driven by the increasing government and private investments in healthcare digitization and AI integration. Countries such as Germany and the UK lead in infrastructure development and funding for digital health initiatives. Moreover, collaborative efforts between tech companies and healthcare providers enhance interoperability.

The UK AI platform for clinical conversations market is expected to grow over the forecast period. The UK market benefits from a robust healthcare system that is committed to digital transformation and the adoption of AI. Government initiatives, including substantial AI funding and strategic plans to foster healthcare innovation, strengthen the ecosystem.

The AI platform for clinical conversations market in Germanyheld the largest revenue share in 2024, attributed to increasing investments in healthcare technology and robust healthcare infrastructure. Additionally, the expansion of telemedicine and digital health will further propel market growth. The regulatory environment fosters responsible AI use and adherence to data privacy principles.

Asia Pacific AI Platform For Clinical Conversations Market Trends

The Asia Pacific AI platform for clinical conversations industry is expected to grow at the fastest CAGR during the forecast years. This growth is attributed to rising healthcare expenditures, the adoption of AI in healthcare, and the prevalence of chronic diseases. Countries such as China, Japan, South Korea, and India are leading innovation through government-backed AI healthcare policies. Moreover, collaborations between key market players expedite market growth. Private sector investment and research collaborations further contribute to technological development.

The India AI platform for clinical conversations marketis expected to grow significantly over the forecast period. India is experiencing rapid expansion, fueled by the digitalization of healthcare and high smartphone penetration, which enables widespread access to AI. Government initiatives promoting telemedicine and digital health infrastructure support the growth of conversational AI.

The AI platform for clinical conversations market in Japan is expected to grow rapidly in the coming years. This growth is driven by the rising demand for personalized medicine and the widespread adoption of AI in healthcare. Supportive government policies and digital transformation initiatives further promote the integration of AI. In addition, an aging population and increasing chronic diseases highlight the need for efficient clinical management. Growing investments in AI research and healthcare IT infrastructure also enable the development of advanced conversational AI applications.

Latin America AI Platform For Clinical Conversations Market Trends

The Latin America AI platform for clinical conversations industry is anticipated to grow at a significant CAGR over the forecast period. This is attributed to the growing awareness about AI technologies, increasing government spending, and growing advancements in healthcare infrastructure.

Middle East and Africa AI Platform for Clinical Conversations Market Trends

The MEA AI platform for clinical conversations industry is expected to grow at a significant CAGR over the forecast period. The market is characterized by a dynamic landscape driven by the growing adoption of technologically advanced medical devices, increasing healthcare expenditures, and supportive government policies. The significant integration of AI in healthcare technology across the region further contributes to market growth. Countries such as Saudi Arabia and the UAE are integrating AI into their healthcare infrastructure as part of their strategic visions, including Saudi Vision 2030 and the UAE National Strategy for Artificial Intelligence 2031.

Key AI Platform for Clinical Conversations Company Insights

Key players operating in the AI platform for clinical conversations market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key AI Platform For Clinical Conversations Companies:

The following are the leading companies in the AI platform for clinical conversations market. These companies collectively hold the largest Market share and dictate industry trends.

- Abridge Al, Inc.

- Infinitus Systems

- IBM

- Suki AI, Inc.

- Nuance Communications (acquired by Microsoft)

- Sunoh.ai (by healow)

- Speechmatics

- Heidi

- Augmedix

- 3M (M*Modal)

- Regard

Recent Developments

-

In September 2025, Seattle Children's Hospital implemented Abridge's AI platform enterprise-wide to automate clinical documentation. The solution captures, transcribes, and compiles provider-patient conversations, generating draft notes that are integrated with EHRs.

-

In July 2025, Regard upgraded its AI platform to combine EHR chart data with physician-patient conversations, enabling more accurate proactive diagnoses and documentation.

-

"This is the first product to market that can intelligently combine the key information from the conversation that a doctor has with the data that's in the medical record to make a complete note,"

-Eli Ben-Joseph, founder and CEO of Regard, said in an interview with Fierce Healthcare.

-

In July 2025, the Hospital for Special Surgery (HSS), a leading orthopedic health system, partnered with Abridge to enhance orthopedic clinical documentation through AI. Abridge’s platform captures clinical conversations in real time using ambient listening technology, enabling clinicians to focus on patient care rather than documentation.

-

In July 2025, Regard launched an AI-powered platform that proactively combines patient chart data and patient-physician conversations to surface diagnostic insights and generate draft clinical notes before encounters. Featuring Max, a real-time AI agent, the platform enhances care quality, improves documentation accuracy, and boosts revenue while reducing the physician EHR burden for hospitals.

-

In February 2025, Abridge partnered with Inova Health to deliver AI-powered clinical conversations. The solution records, transcribes, and summarizes provider-patient interactions, automatically generating draft notes for review.

-

"With Abridge, our providers will be able to spend less time on documentation and more time engaging directly with their patients. By streamlining workflows and reducing administrative burden, our goal is to improve the overall healthcare experience for both providers and patients."

-Matt Kull, chief information and digital strategy officer for Inova

-

In March 2023, Microsoft's Nuance Communications integrated OpenAI's GPT-4 into its Dragon Ambient eXperience (DAX) Express, a voice-enabled AI medical scribe.

AI Platform For Clinical Conversations Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 671.85 million

Revenue forecast in 2033

USD 4,187.77 million

Growth rate

CAGR of 25.70% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abridge Al, Inc.; Infinitus Systems; IBM; Suki AI, Inc.; Nuance Communications (acquired by Microsoft); Sunoh.ai (by healow); Speechmatics; Heidi; Augmedix; 3M (M*Modal); Regard

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Platform For Clinical Conversations Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI platform for clinical conversations market report based on component, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software & Platform

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical Documentation Automation

-

Telehealth & Virtual Consultations

-

Administrative & Coding Support

-

Training & Quality Assurance

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital/inpatient wards

-

Ambulatory Care Centers & Outpatient Facilities

-

Emergency/Urgent care

-

Academic Medical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.