- Home

- »

- IT Services & Applications

- »

-

AI Platform Market Size And Trends, Industry Report, 2033GVR Report cover

![AI Platform Market Size, Share & Trends Report]()

AI Platform Market (2025 - 2033) Size, Share & Trends Analysis Report By Platform Type (Development, Lifecycle Management, Infrastructure & Enablement), By Functionality, By Deployment Mode, By End-user, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-732-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Platform Market Summary

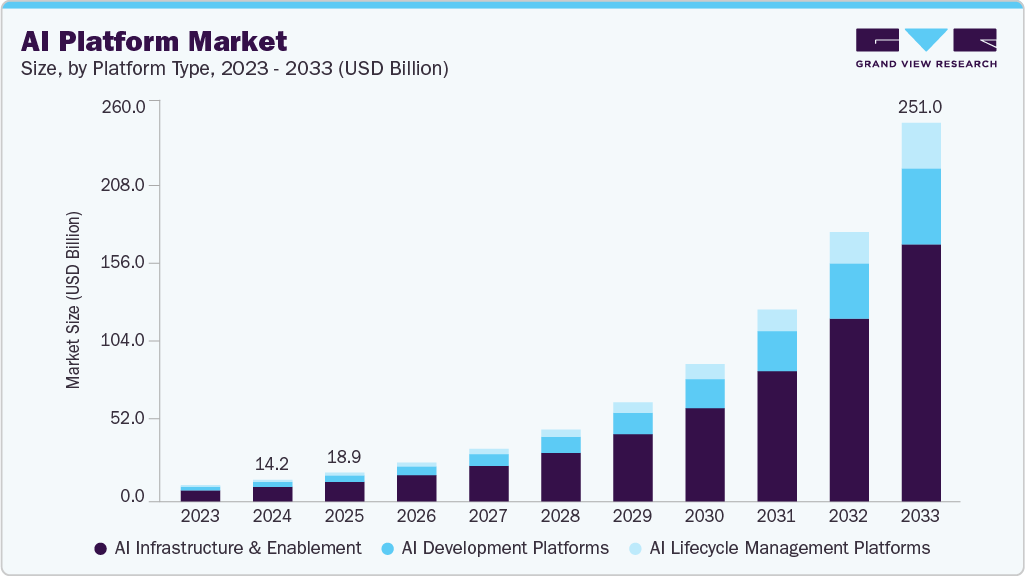

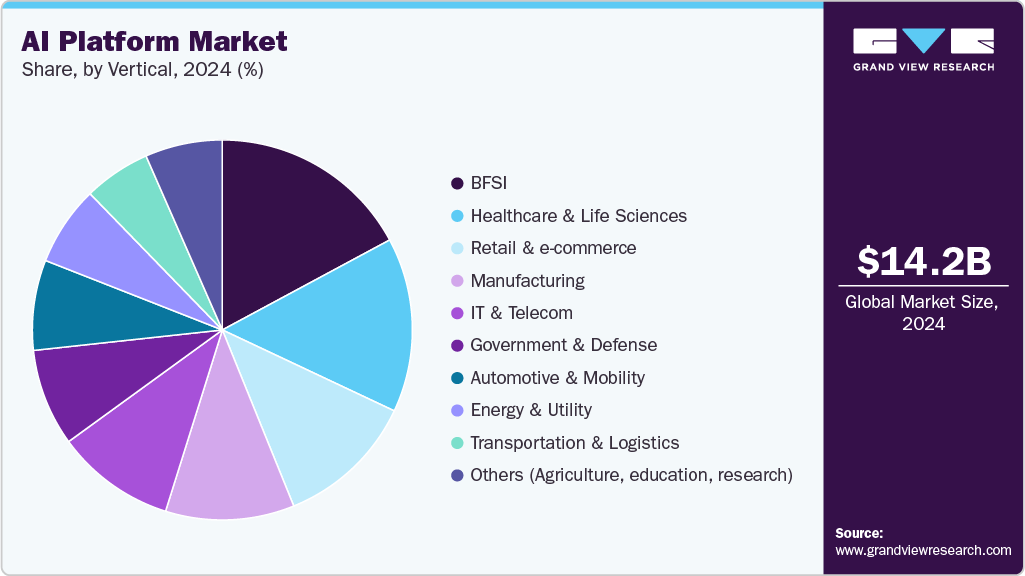

The global AI platform market size was estimated at USD 14.21 billion in 2024 and is projected to reach USD 251.01 billion by 2033, growing at a CAGR of 38.1% from 2025 to 2033. The market is growing rapidly, due to the growing adoption of artificial intelligence (AI) technologies across sectors such as healthcare, finance, manufacturing, and retail.

Key Market Trends & Insights

- North America dominated the global AI platform market with the largest revenue share of 26.4% in 2024.

- The AI platform industry in the U.S. led North America with the largest revenue share in 2024.

- By platform type, the AI infrastructure & enablement segment led the market with the largest revenue share of 67.5% in 2024.

- By functionality, the data management & preparation segment held a dominant market position with the largest revenue share of 19.0% in 2024.

- By vertical, the healthcare & life sciences segment is expected to grow at the fastest CAGR of 40.8% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 14.21 Billion

- 2033 Projected Market Size: USD 251.01 Billion

- CAGR (2025-2033): 38.1%

- North America: Largest Market in 2024

- Asia Pacific: Fastest growing market

Also, the demand is rising for automated data processing, predictive analytics, and real-time decision-making supports this growth. The AI platform industry expands continuously as enterprises seek scalable and customizable AI solutions to enhance operational efficiency and customer experience. Advancements in cloud computing infrastructures enable easier integration and deployment of AI platforms. Additionally, rising investments in AI research and development contribute to ongoing innovation within the market as business demand for AI models that comply with legal and social norms drives continued platform enhancement.

Regulatory frameworks and industry standards evolve to address data privacy, ethical AI use, and transparency, influencing platform design and adoption as organizations emphasize compliance and risk management while adopting AI, which guides market trends toward more secure and explainable platforms. The need for data governance and ethical AI practices shapes preferences for platforms offering enhanced control and audit capabilities. Regional differences in regulations affect adoption speed and platform features in varied markets.

Furthermore, technology advancements in natural language processing, machine learning algorithms, and edge AI promote further diversification of platform capabilities as companies integrate AI platforms with complementary technologies, such as IoT and robotics, to expand functional applications. The increasing availability of AI training data and improvements in computational power support the development of more efficient and specialized AI models. Also, the market competition encourages providers to innovate by adding user-friendly interfaces and automated model management tools. Growing interest from small and medium enterprises also expands the market reach for AI platform solutions.

Platform Type Insights

The AI infrastructure & enablement segment led the AI platform market with the largest revenue share of 67.5% in 2024. AI infrastructure and enablement platforms drive the market by providing scalable and flexible cloud-based and on-premises hardware and software personalized for high-performance AI workloads. They harness specialized computer resources such as GPUs and TPUs for efficient parallel processing, accelerating model training and deployment, as well as strong data storage, management, and networking solutions, enabling fast, secure data flow critical to AI applications. Integration capabilities with existing enterprise systems support seamless adoption and operational continuity, also there continuous monitoring and maintenance ensure AI infrastructure performs optimally while adhering to evolving data privacy and security regulations. For instance, in June 2025, Lenovo expands its Hybrid AI Advantage with new advisory services, industry solutions, and hybrid AI platforms designed to help enterprises build, scale, and operate AI-powered factories. The offering combines high-performance servers, accelerated computing, and integrated networking with proven AI use cases to drive faster deployment and measurable business value. Lenovo’s ecosystem partnerships with Cisco, IBM, and NVIDIA support comprehensive AI adoption across industries, enhancing productivity, agility, and trust in enterprise AI platform transformation.

The AI lifecycle management platforms segment is predicted to foresee significant growth in the forecast period due to its end-to-end automation from data collection and model training to deployment and monitoring, ensuring faster time to value and also supporting comprehensive data governance, including quality, fairness, and explainability, crucial for enterprise trust and compliance. The platforms optimize resource allocation and reduce operational costs via automated scaling, retraining, and efficient infrastructure use. Scalability and real-time monitoring capabilities allow continuous model performance adaptation to dynamic business needs for security frameworks and compliance monitoring embedded within these platforms protect against evolving threats and regulatory challenges which further enhancing productivity, reliability, and responsible AI platform adoption across industries. For instance, in May 2024, Siemens Digital Industries Data management & preparation partners with Microsoft to offer the Siemens Xcelerator as a Service portfolio on Microsoft Azure, integrating generative AI and Copilot features to enhance flexibility and access to AI solutions for customers. The collaboration includes delivering Teamcenter X software on Azure, enabling scalable, secure PLM solutions that reduce cycle times and IT costs while accelerating innovation. Siemens and Microsoft are also developing AI-powered applications within Microsoft Teams to improve collaboration across product lifecycle teams, harnessing generative AI and Natural Language Processing for better productivity and frontline worker support.

Functionality Insights

The data management & preparation segment accounted for the largest revenue share of the AI platform industry in 2024. The growth is driven by the ongoing need to handle vast and diverse datasets from multiple sources and formats, ensuring their accuracy, reliability, and accessibility for effective AI use as automation accelerates the integration, cleaning, transformation, and validation of data, improving efficiency and reducing errors. For instance, in November 2024, Diliko launched a cloud-delivered Agentic AI platform designed to transform data management for mid-sized enterprises, automating complex workflows while ensuring security and AI governance. It addresses industry needs by enabling seamless data integration, orchestration, and real-time analytics without requiring costly infrastructure, supporting industries such as healthcare, finance, and logistics. This solution incorporates patent-pending data privacy techniques, zero-trust security, and automated ETL processes to reduce operational complexity and enhance compliance, empowering organizations to focus on innovation and growth.

The model governance & compliance segment is predicted to foresee significant growth during the forecast period. The services segment is driven by the increasing integration of AI in organizational and governmental operations, raising visibility of potential negative impacts such as bias and ethical risks. The growing regulatory landscape, including frameworks such as GDPR and the EU AI Act, pushes organizations to adhere to transparency, fairness, and accountability in AI usage. Moreover, the continuous monitoring and updating of AI models address challenges of model drift, ensuring sustained ethical standards and performance. For instance, in June 2025, Fairly AI acquired anch.AI to create Asenion, a comprehensive AI governance platform built to help organizations quickly meet the requirements of the EU AI Act and other regulations, as it gives enterprises tools to identify and reduce risks across the entire AI lifecycle by covering both models and data, while improving oversight, trust, and compliance. By integrating anch.AI’s research-based frameworks with advanced testing tools, Asenion delivers governance, risk, and compliance support for predictive, generative, and agent-based AI.

Deployment Mode Insights

The cloud segment accounted for the largest revenue share of the AI platform market in 2024, driven by the need for scalable computational resources to support AI model training and inference, the rapid growth of data volumes, and the demand for cost-effective, flexible infrastructure. Cloud-based solutions offer enterprises on-demand access to high-performance computing, enabling faster innovation cycles and reduced time-to-market for AI applications. Enhanced collaboration, automatic system updates, and easier integration with existing enterprise workflows further accelerate adoption and facilitate widespread AI implementation. For instance, in February 2025, Fujitsu launched its Cloud Service Generative AI Platform, offering enterprises a secure, cloud-based environment for managing and leveraging generative AI with strong data confidentiality and compliance features.

The hybrid segment is predicted to foresee significant growth over the forecast period. Enterprise needs operational efficiency, business continuity, and real-time integration across private, public, and edge environments; increasing complexity from fragmented cloud architectures and security requirements; demand for automation, predictive analytics, and centralized governance for AI agents; and the imperative to activate both structured and unstructured data to enable scalable, production-ready AI, with cost optimization and regulatory compliance as ongoing priorities. For instance, in February 2025,Fabric introduced a Hybrid AI platform designed specifically for healthcare, combining conversational AI with physician-built clinical logic to streamline workflows and enhance patient experiences safely and effectively. The platform supports a wide range of healthcare functions, including symptom checking, virtual care, care pathways, provider search, scheduling, and advances operational efficiency, clinical decision support, and personalized patient journeys, enabling seamless integration across health systems and improving care delivery quality.

End-user Insights

The data scientists & engineers segment accounted for the largest revenue share of the AI platform industry in 2024. They drive the adoption of AI platforms as they demand integrated environments for model development, training, and deployment due to their need for scalable data management and streamlined workflows to support platform usage across multiple industries. Continuous innovation in automation, MLOps, and reusable components enhances efficiency for advanced experimentation. Growing focus on governance, interoperability, and performance optimization strengthens reliance on these platforms for enterprise applications. For instance, in May 2023, Cognizant launched the Neuro AI platform to allow enterprises to accelerate and responsibly deploy generative AI technology with flexibility, security, and scalability, as it combines consulting, advisory, ecosystem partnerships, and industry expertise to help clients seamlessly transition into generative AI adoption and build reusable, safe AI-powered applications across multi-cloud environments.

The MLOPS/AI engineers’ segment is predicted to foresee significant growth during the forecast period. The market is anticipated due to optimizing infrastructure deployment across cloud and hybrid environments to better support ML workloads, ensuring efficient model management through enterprise-wide accessible registries, and maintaining strict data governance and privacy with edge-based storage solutions. They also benefit from integrated model observability tools that provide oversight throughout MLOps phases and automation of code builds, testing, deployments, and infrastructure provisioning, enabling streamlined, self-service operations. For instance, in June 2025, Nebius and Saturn Cloud teamed up to offer a ready-to-use AI/ML infrastructure that provides immediate access to NVIDIA Hopper GPUs along with full compatibility with the NVIDIA AI Enterprise software.

Vertical Insights

The BFSI segment accounted for the largest revenue share of the AI platform market in 2024, and is gaining power due to the demand through ongoing adoption of automated risk assessment and fraud detection as institutions are enhancing customer engagement with AI-driven personalization in digital banking and wealth management. Regulatory compliance management is advancing with AI-enabled monitoring and reporting capabilities. Process efficiency gains are expanding through intelligent automation in credit scoring, claims processing, and back-office operations. For instance, in June 2024, Mastek announced the advancement of its icxPro platform with NVIDIA accelerated computing to deliver next-generation AI-powered customer experience (CX) solutions for manufacturing, healthcare, and BFSI sectors. The cloud-native icxPro platform integrates NVIDIA AI Enterprise software, enabling faster time-to-market, deeper customer insights, personalized interactions, and task automation across channels.

The healthcare & life sciences segment is projected to grow significantly over the forecast period, driven by the increasing need for personalized therapies and precision medicine, which demands enhanced data performance and analytics. AI accelerates drug discovery, improves clinical trial efficiency with automation and synthetic data, and enhances patient safety through predictive analytics and digital twins. The market also advances through AI-powered optimization of clinical trial protocols, supply chain inventory, and patient engagement using conversational AI and intelligent decisioning. These capabilities facilitate faster innovation, improved operational efficiency, and compliance within the complex, regulated health ecosystem. For instance, in July 2024, GE HealthCare and Amazon Web Mode deployment & Services (AWS) announced a strategic collaboration to develop generative AI models and applications aimed at transforming healthcare operations. This collaboration focuses on leveraging AWS technologies such as Amazon Bedrock and Amazon SageMaker to analyze complex medical data, improve diagnostic accuracy, streamline workflows, and enhance patient care.

Regional Insights

North America dominated the AI platform market and accounted for a 26.4% revenue share in 2024. The market is expanding as enterprises are increasing adoption of cloud-native infrastructure, growing investment in generative AI capabilities, and deepening integration of AI into data-driven business operations. Large-scale deployment across healthcare, finance, and retail is advancing platform maturity, while a strong ecosystem of technology providers is accelerating enterprise use cases.

U.S. AI Platform Market Trends

The U.S. dominates AI platform adoption in North America, due to high demand for AI platforms in enterprise productivity and customer engagement, as technology leaders are deploying dedicated AI-optimized infrastructure across data centers to enable faster training and inference of large models. The presence of venture capital investments is encouraging startups to build platforms for industry-specific deployment, and public sector initiatives are promoting AI adoption in defense, healthcare modernization, and public service optimization, reinforcing government technology usage. Growing demand for automation in logistics, retail, and business services is creating ongoing momentum for MLOps adoption.

Europe AI Platform Market Trends

In Europe, the AI platform industry is progressing through investment in ethical AI frameworks and compliance-driven deployment, aligning with regional data protection mandates as companies operating in automotive, energy, and healthcare are expanding use cases by blending edge AI with centralized platforms to manage distributed data. Funding programs from the European Union are enhancing innovation ecosystems that connect startups with established enterprises. Cloud adoption is evolving with hybrid strategies, enabling flexible deployment across regulated and cross-border environments. Strong focus on sustainability is driving AI adoption in energy efficiency, predictive analytics, and circular economy initiatives.

Asia Pacific AI Platform Market Trends

The Asia Pacific AI platform industry is anticipated to register the fastest CAGR over the forecast period. The market is expanding rapidly, fueled by rapid digitization initiatives in sectors such as retail, telecom, and banking. Enterprises are integrating AI into customer experience management, supply chain optimization, and smart city development, as well as governments across the region are investing in national AI strategies that emphasize data-sharing frameworks and large-scale innovation hubs. Strong presence of cloud providers in countries such as China and India is enhancing accessibility of scalable AI infrastructure. Local enterprises are integrating open-source and commercial AI tools to optimize regional deployment needs. The diversity of markets in the region is encouraging cross-industry experimentation and faster commercial adoption of AI platforms.

Key AI Platform Company Insights

Some key companies in the AI platform industry are Microsoft, H2O.ai, IBM, and Google.

-

Microsoft is known for its software offerings such as Windows and Microsoft Office, along with a rapidly growing presence in cloud computing and artificial intelligence via Microsoft Azure. The company has made major strides in AI innovation and enterprise cloud solutions, fostering transformation across industries. Microsoft prioritizes trust, sustainability, inclusion, and empowering customers and employees to achieve more through its technologies.

-

IBM is a technology company that provides hybrid cloud and AI solutions to modernize applications, infrastructure, and security while enabling automation and predictive capabilities. IBM’s driving advancements in AI, hybrid cloud, and responsible technology. Their mission focuses on making the world work better through ethical business practices and sustainable technological efforts. IBM collaborates with businesses and governments to address challenges such as climate change and digital transformation, supporting progress toward a more equitable and secure future.

Key AI Platform Companies:

The following are the leading companies in the artificial intelligence (AI) platform market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services Inc.

- DataRobot, Inc.

- Google LLC

- H2O.ai

- IBM

- Microsoft

- NVIDIA Corporation

- Oracle

- Salesforce, Inc.

- SAP SE

Recent Developments

-

In July 2025, H2O.ai made its H2O AI Cloud available in the AWS Marketplace, allowing customers to easily find, purchase, and deploy AI agent solutions through their AWS accounts. This fully managed, secure, and scalable AutoML platform supports organizations in speeding up AI adoption, minimizing risks, and efficiently managing resources while protecting sensitive data. It includes features such as automated machine learning, a no-code AI app builder, smooth model deployment, and monitoring to quickly develop and scale AI models. H2O.ai’s intelligent AI solutions work seamlessly with AWS services, providing flexible deployment options and enhancing AI-driven processes in sectors such as finance, healthcare, and technology.

-

In May 2025, IBM partners with Oracle to integrate its watsonx AI portfolio into Oracle Cloud Infrastructure (OCI), enabling a new era of multi-agentic, AI-driven enterprise productivity. Starting in July, IBM's watsonx Orchestrate AI agents will be available on OCI, supporting workflows across both Oracle and non-Oracle applications. The partnership also includes making IBM’s Granite AI models accessible via OCI Data Science and launching IBM Envizi ESG Suite on OCI to support sustainability efforts. Additionally, IBM Consulting expands services to help customers migrate and optimize workloads on OCI, enhancing hybrid cloud and AI capabilities.

-

In March 2025, DataRobot, in partnership with SAP, launches new AI application suites for finance and supply chain operations, enabling seamless integration of AI into customer environments and business processes. These AI suites leverage SAP business data from solutions such as SAP S/4HANA and SAP IBP to deliver focused, real-time insights that enhance forecasting, risk management, demand planning, and inventory control. The Finance AI App Suite supports cash flow management, revenue forecasting, and fraud detection, while the Supply Chain AI App Suite optimizes demand planning, lead times, and workforce management.

-

In November 2024, Temenos and NVIDIA launched a high-performance on-premises generative AI platform designed for banks, enabling them to generate real-time insights while maintaining full control over sensitive data. The AI solution leverages NVIDIA's accelerated computing platform, including GPUs and AI Enterprise software, to process unstructured data efficiently and securely within bank infrastructures. This collaboration integrates explainable AI to meet regulatory transparency requirements in areas such as credit scoring and anti-money laundering. Also, it supports scalable, personalized, and compliant banking operations, marking a significant step toward responsible AI adoption in financial services.

-

In May 2024, Siemens Digital Industries Data management & preparation partners with Microsoft to offer the Siemens Xcelerator as a Service portfolio through Microsoft’s Azure cloud and AI platform, integrating generative AI and Copilot features. The collaboration begins with delivering Teamcenter X, a scalable and secure Product Lifecycle Management (PLM) solution, on Azure, enabling customers to manage product data more efficiently, reduce cycle times, and lower IT costs. Siemens enhances collaboration by integrating the Teamcenter app with Microsoft Teams, using AI-powered tools to facilitate real-time access and task management for frontline and engineering teams.

AI Platform Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.99 billion

Revenue forecast in 2033

USD 251.01 billion

Growth rate

CAGR of 38.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform type, functionality, deployment mode, end-user, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Europe; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Amazon Web Services Inc.; DataRobot, Inc.; Google LLC; H2O.ai; IBM; Microsoft; NVIDIA Corporation; Oracle; Salesforce, Inc.; SAP SE

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Platform Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI platform market report based on platform type, functionality, deployment mode, end-user, vertical, and region:

-

Platform Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

AI Development Platforms

-

AI Lifecycle Management Platforms

-

AI Infrastructure & Enablement

-

-

Functionality Outlook (Revenue, USD Billion, 2021 - 2033)

-

Data management & preparation

-

Model development & training

-

Mode deployment & serving

-

Monitoring & maintenance

-

Model governance & compliance

-

Model fine-tuning & personalization

-

Explainability & bias tools

-

Security & privacy

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premises

-

Hybrid

-

-

End-user Outlook (Revenue, USD Billion, 2021 - 2033)

-

Data scientists & engineers

-

MLOPS/ AI engineers

-

Business analysts & citizen developers

-

AI product managers

-

IT & cloud architects

-

-

Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Healthcare & Life sciences

-

Retail and e-commerce

-

Transportation & Logistics

-

Automotive & mobility

-

IT & Telecom

-

Government & defense

-

Energy & utility

-

Manufacturing

-

Others (Agriculture, education, research)

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI platform market size was estimated at USD 14.21 billion in 2024 and is expected to reach USD 18.99 billion in 2025.

b. The global AI platform market is expected to grow at a compound annual growth rate of 38.5% from 2025 to 2033 to reach USD 251.01 billion by 2033.

b. North America dominated the AI platform market with a share of 26.4% in 2024. The AI platform market in North America is expanding as enterprises are increasing adoption of cloud-native infrastructure, growing investment in generative AI capabilities, and deepening integration of AI into data-driven business operations.

b. Some key players operating in the AI platform market include Amazon Web Services Inc.; DataRobot, Inc; Google LLC; H2O.ai; IBM; Microsoft; NVIDIA Corporation; Oracle; Salesforce, Inc.; SAP SE.

b. Key factors that are driving the market growth include continuously as enterprises seek scalable and customizable AI solutions to enhance operational efficiency and customer experience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.