- Home

- »

- Next Generation Technologies

- »

-

AI Video Generator Market Size, Share, Industry Report 2033GVR Report cover

![AI Video Generator Market Size, Share & Trends Report]()

AI Video Generator Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Organization Size (Large Enterprises, SMEs), By Source, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-055-8

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Video Generator Market Summary

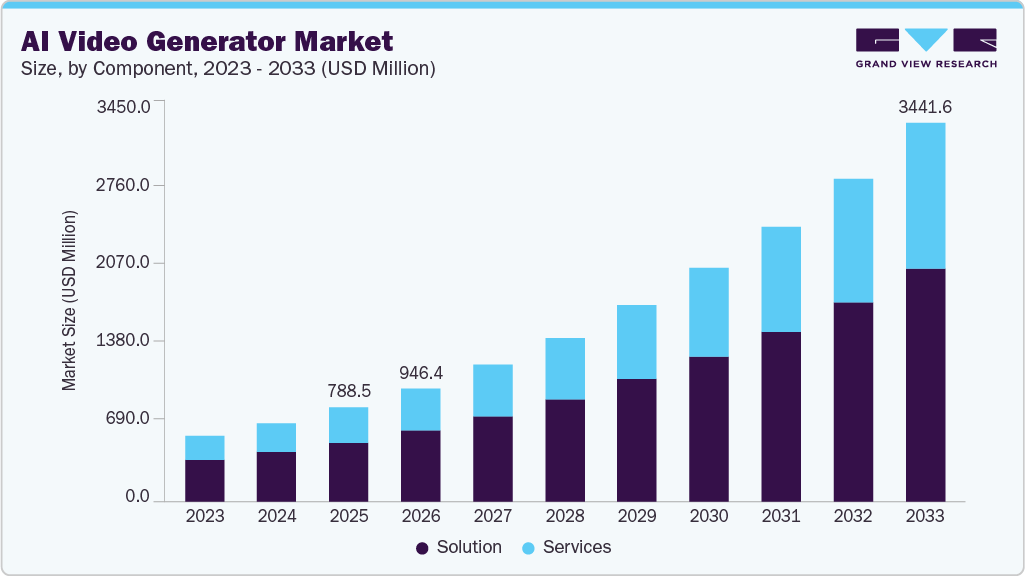

The global AI video generator market size was estimated at USD 788.5 million in 2025 and is projected to reach USD 3,441.6 million by 2033, growing at a CAGR of 20.3% from 2026 to 2033. The market growth is primarily driven by companies that have developed AI-enabled tools, enabling users to create videos from various sources, including text, PowerPoint presentations, or spreadsheets, through software. These easy-to-use tools are gaining widespread popularity as they save time and significantly reduce manual effort.

Key Market Trends & Insights

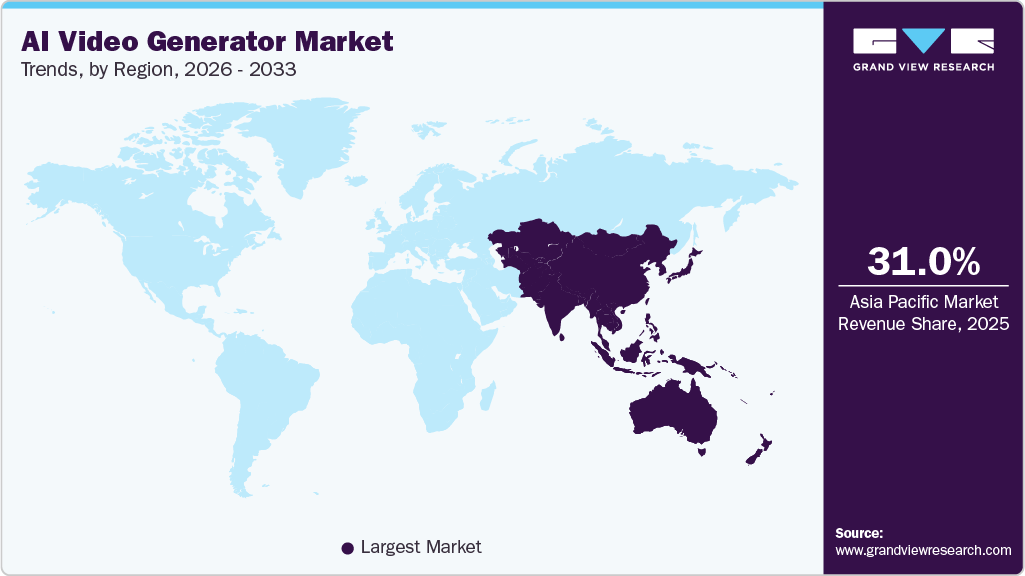

- Asia Pacific dominated the global AI video generator market with the largest revenue share of 31.0% in 2025.

- The China AI video generator industry led Asia Pacific, with the largest revenue share in 2025.

- By component, the solution segment led the market, with the largest revenue share of 63.0% in 2025.

- By organization size, the large enterprises segment held the largest revenue share of 62.2% in 2025.

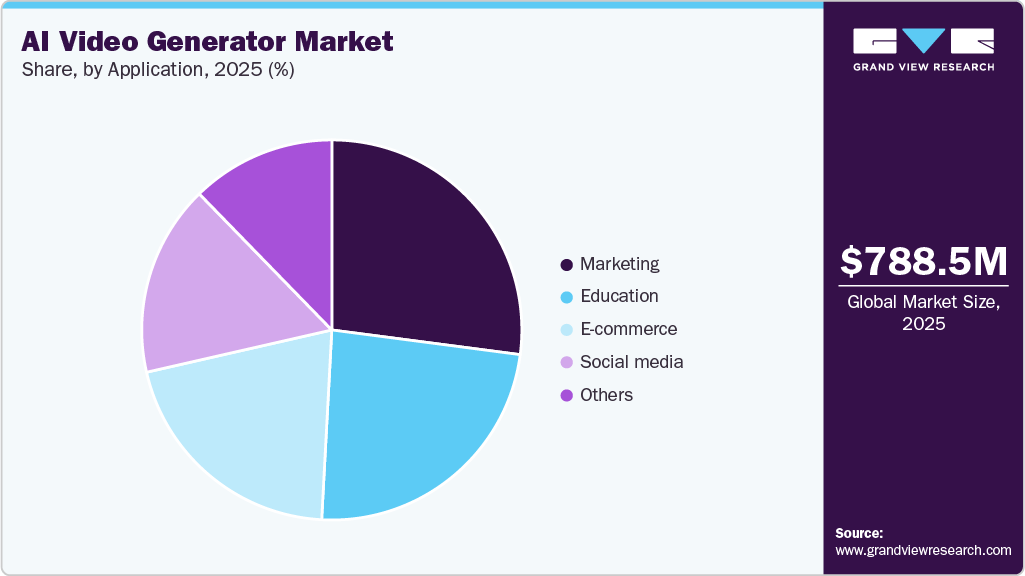

- By application, the social media segment is expected to grow at the fastest CAGR of 20.8% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 788.5 Million

- 2033 Projected Market Size: USD 3,441.6 Million

- CAGR (2026-2033): 20.3%

- Asia Pacific: Largest Market in 2025

The demand for video content is on the rise, considering the growing acceptance of the visual environment across businesses. Approximately 80% of the online traffic is due to video content, as individuals prefer visual media over text and images. Availability of high-speed internet, a large audience having access to social media platforms, and rising consumer preference for the video content have propelled the demand for tools and services associated with the video generators.

Artificial Intelligence (AI) is disrupting the process chain across each industry. The AI video generator market is in its early stages and is expected to experience significant growth in the coming years. The changing perspective of organizations to engage customers via video media or social media platforms is one of the major growth enablers for the AI video generator software.

Companies are increasingly becoming data-driven, which enables AI companies to diversify their offerings. To promote their brands and reach the expected audience, businesses are adopting the recent tools and services that help to make the process easier and efficient. Although some organizations still prefer the conventional way of creating content, the assistance of AI video generators is garnering significant attention. In the coming years, such tools are expected to dominate the global content creation category.

Component Insights

In terms of market size, the solution segment dominated the AI video generator market, accounting for a 63.0% share in 2025. The solutions segment thrives on the rising demand for scalable software platforms that automate video creation from text prompts, enabling rapid production of personalized content. Advancements in neural networks and deep learning models enhance the realism and consistency of generated videos, driving their adoption across various creative workflows. User-friendly interfaces and cloud-based deployment further accelerate accessibility, reducing dependency on specialized hardware and manual editing.

The services segment is predicted to experience significant growth during the forecast period. The growth of the segment is driven by the increasing demand for installation, maintenance, and upgrade support to optimize platform performance in the face of evolving AI technologies. Demand surges for management services that ensure seamless integration and customization, enhancing content quality in dynamic use cases. Educational and training support alongside these services boosts user engagement by simplifying adoption for diverse applications.

Organization Size Insights

The large enterprises segment led the AI video generator industry, accounting for the largest revenue share in 2025. The segment’s growth is driven by the need for scalable video production to create personalized training materials, product demos, and internal communications at scale. Integration with marketing automation platforms enables automated content generation based on user data, resulting in consistent messaging and enhanced customer personalization. These organizations prioritize cost-effectiveness and faster content creation through AI, supporting large-scale operations without extensive manual resources.

The SMEs segment is predicted to foresee significant growth over the forecast period. SMEs in the AI video generator market benefit from accessible, affordable tools that produce professional videos for social media, product explanations, and customer testimonials. The ease of use allows quick content creation, helping resource-limited businesses compete in fast-paced digital marketing. Adoption is accelerating due to budget-friendly scalability, enabling innovative marketing and communication without heavy investments in traditional production.

Source Insights

The text to video segment accounted for the largest market revenue share in 2025. Rising demand for quick content creation drives the use of text-to-video tools, enabling users to transform scripts or prompts into engaging visuals without requiring extensive editing skills. Advancements in generative AI models enhance realism and customization, allowing seamless integration of styles, voices, and animations from simple descriptions. Businesses are increasingly adopting these for scalable marketing videos and social media clips, prioritizing efficiency over traditional production methods. Integration with natural language processing enhances output quality, making it accessible to creators across various creative industries.

The PowerPoint to video segment is predicted to foresee significant growth over the forecast period. The shift toward dynamic presentations drives the conversion of PowerPoint presentations into polished, narrated videos, making it effortless to transform static slides into engaging, narrated videos. Enhanced AI capabilities add transitions, voiceovers, and effects, elevating basic decks into professional multimedia content. This trend supports remote collaboration and e-learning by automating video generation from existing slide libraries. Growing emphasis on viewer retention boosts adoption, as automated enhancements make content more interactive and shareable.

Application Insights

In terms of market size, the marketing segment dominated the AI video generator industry in 2025. AI video generators drive marketing efforts through the rapid creation of personalized video content tailored to specific audience preferences, enhancing engagement and conversion rates. These tools significantly reduce production costs and timelines, enabling the creation of scalable, dynamic advertisements, product demonstrations, and interactive campaigns. Integration with analytics enables data-driven optimization of content, enhancing the effectiveness of brand promotions. Demand surges as businesses seek high-engagement visuals for digital advertising and influencer collaborations.

The social media segment is predicted to experience significant growth over the forecast period. AI video generators fuel social media by enabling the quick production of short-form content, such as reels and trends, capitalizing on rapidly evolving platform algorithms. Automatic captioning, text-to-video conversion, and repurposing of existing materials streamline workflows, enabling higher posting frequencies. These tools enhance personalization and user-generated content, driving interaction and visibility across feeds. Platforms increasingly prioritize AI-enhanced videos, redefining brand-audience connections through creative stimulation.

Regional Insights

The North America AI video generator market is experiencing significant growth, driven by booming consumer demand for video content, which is pushing businesses to create more. Advancements in AI enable high-quality video generation with user-friendly interfaces. The rise of short-form video platforms and the affordability of AI tools are making this technology accessible to businesses of all sizes.

U.S. AI Video Generator Market Trends

The AI video generator industry in the U.S. is characterized by rapid innovation, widespread adoption across industries, regulatory challenges, a focus on user experience, strategic partnerships, and significant investment activity. These trends are shaping the future of video content creation and consumption in the country. Further, the prevalence of leading technology companies in the country is also fostering the market growth in the U.S.

Europe AI Video Generator Market Trends

Collaboration between European AI startups, research institutions, and established companies is fostering innovation and driving market growth. Partnerships between AI technology providers and industry-specific players are leading to the development of tailored solutions that address specific market needs and challenges.

Asia Pacific AI Video Generator Market Trends

The Asia Pacific AI video generator industry held the largest global revenue share of 31.0% in 2025. Asia Pacific is the largest region in terms of population and has high internet penetration. With a growing number of SMEs in the region and a growing user base for social media in the region, the demand for quality video content is evident. Additionally, the number of AI startups, as well as the adoption of AI tools, has increased significantly in the region over the past few years.

Key AI Video Generator Company Insights

Key AI video generator market companies include Lumen5, Synthesia, and FlexClip.

-

Lumen5 operates as an AI-powered video creation platform that transforms text, blogs, and existing content into engaging videos using automated script generation and media selection. The platform offers drag-and-drop tools, branded templates, and a comprehensive library of royalty-free assets to streamline production for marketers and businesses. It supports multi-language voiceovers and video reformatting for diverse platforms, enabling efficient content repurposing.

-

Synthesia develops AI technology for video content creation without requiring cameras, microphones, or studios, focusing on generative techniques for synthetic actors. The company emphasizes intuitive interfaces and photo-realistic video generation to empower users across various applications. A dedicated team addresses AI safety and ethics to guide responsible development.

Key AI Video Generator Companies:

The following are the leading companies in the AI video generator market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- FlexClip

- Lumen5

- Muse.ai

- OpenAI

- Pictory

- Runway

- Rephrase.ai

- Synthesia

Recent Developments

-

In December 2025, OpenAI and The Walt Disney Company announced a licensing agreement designating Disney as the first major content partner for Sora, OpenAI's short-form generative AI video platform, enabling users to create videos featuring over 200 characters from Disney, Marvel, Pixar, and Star Wars.

-

In May 2025, Google introduced Flow, an AI filmmaking tool powered by Veo 3, Imagen, and Gemini models that enables the creation of cinematic clips and scenes from text prompts with consistent characters and objects. The platform offers camera controls for motion and angles, Scenebuilder for editing and extending shots, and asset management for organizing ingredients and prompts.

-

In October 2024, Adobe launched the Firefly Video Model in limited public beta, expanding its generative AI family to include commercially safe video generation alongside image, vector, and design models. The model introduces text-to-video and image-to-video capabilities with controls for camera angle, motion, and zoom, integrated into tools like Premiere Pro's Generative Extend for seamless clip extensions and transitions.

AI Video Generator Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 946.4 million

Revenue forecast in 2033

USD 3,441.6 million

Growth rate

CAGR of 20.3% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, organization size, application, source, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Adobe; FlexClip; Google; Lumen5; Muse.ai; OpenAI; Pictory; Runway; Rephrase.ai; Synthesia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Video Generator Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI video generator market report based on component, organization size, source, application, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Services

-

-

Organization Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Text to Video

-

PowerPoint to Video

-

Spreadsheet to Video

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Marketing

-

Education

-

E-commerce

-

Social Media

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI video generator market size was estimated at USD 788.5 million in 2025 and is expected to reach USD 946.4 million in 2026.

b. The global AI video generator market is expected to grow at a compound annual growth rate of 20.3% from 2026 to 2033 to reach USD 3,441.6 million by 2033.

b. Asia Pacific dominated the AI video generator market with a share of 31.0% in 2025. Asia Pacific is the largest region in terms of population and has high internet penetration. With a growing number of SMEs in the region and a growing user base for social media in the region, the demand for quality video content is evident. .

b. Some key players operating in the AI video generator market include Adobe; FlexClip; Google; Lumen5; Muse.ai; OpenAI; Pictory; Runway; Rephrase.ai; Synthesia

b. Key factors that are driving the market growth include increasing demand for quality video content across various applications, rising awareness about the cost-effective benefits of AI video generators, and increasing application in social media.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.