- Home

- »

- Next Generation Technologies

- »

-

Artificial Intelligence For IT Operations Platform Market Report, 2030GVR Report cover

![Artificial Intelligence For IT Operations Platform Market Size, Share & Trends Report]()

Artificial Intelligence For IT Operations Platform Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering, By Application (Network & Security Management), By Deployment, By Organization Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-169-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Artificial Intelligence For IT Operations Platform Market Summary

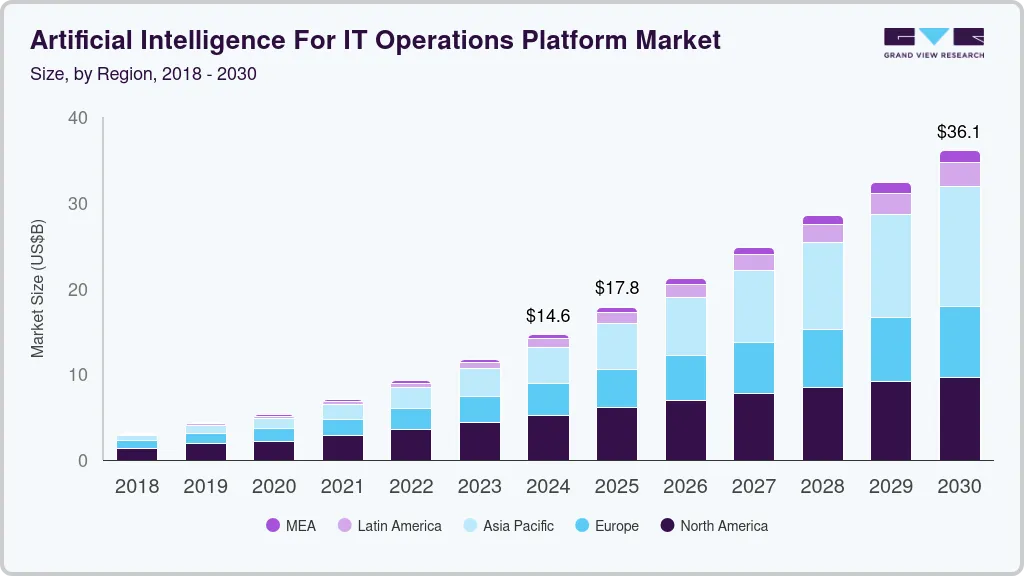

The global artificial intelligence for IT operations platform market size was estimated at USD 14.60 billion in 2024 and is projected to reach USD 36.07 billion by 2030, growing at a CAGR of 15.2% from 2025 to 2030. AIOps platforms utilize machine learning (ML), big data analytics, and automation to streamline IT operations, enabling real-time monitoring, anomaly detection, and proactive issue resolution.

Key Market Trends & Insights

- North America artificial intelligence for IT operations platform market dominated the global industry with a revenue share of over 35% in 2024.

- The artificial intelligence for IT operations (AIOps) platform market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030.

- By offering, the platform segment led the market in 2024, accounting for over 86% share of the global revenue.

- By application, the real-time analytics segment accounted for the largest market revenue share in 2024.

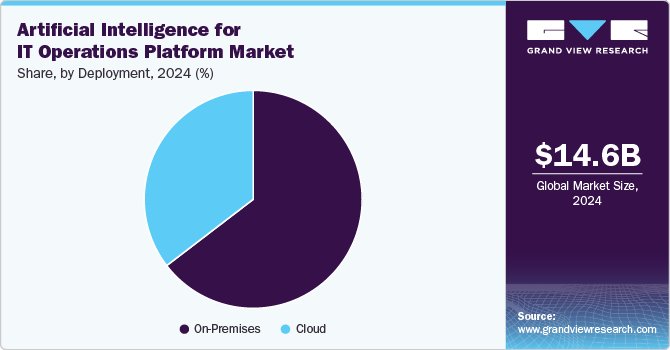

- By deployment, the on-premises segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.60 Billion

- 2030 Projected Market Size: USD 36.07 Billion

- CAGR (2025-2030): 15.2%

- North America: Largest market in 2024

The growing complexity of IT environments, combined with the need for faster and more accurate problem-solving, has accelerated the adoption of AIOps solutions across various industries, including banking, healthcare, retail, and manufacturing. Additionally, the integration of AIOps with other technologies, such as DevOps and cloud computing, has further expanded its application areas.Recent technological advancements have paved the way for AI in IT operations. Several companies are adopting the connection of knowledge, NLP, and domain-enriched ML techniques to offer improved AIOps platforms and services. Over recent years, several advanced elements have been identified, analyzed, and acknowledged for self-driving cars. Deep learning algorithms are applied to assist self-driving cars in contextualizing information picked up by their sensors, such as speed of movement, distance from other objects, and a prediction of where they will be in 5-10 seconds. AIOps platform uses intelligence and ML-based self-learning algorithms to automate regular IT tasks. It also detects and anticipates possible events via historical and behavioral data analysis. Moreover, it provides cognitive data analysis by leveraging big data analytics and derives meaningful information from data for comprehensive processing.

The market is also being driven by the rising use of hybrid and multi-cloud environments, where AIOps tools can efficiently manage disparate IT resources. Emerging technologies, including 5G, the IoT, and edge computing, are further contributing to the demand for AIOps as they generate large volumes of data requiring real-time processing and analysis. Enterprises are leveraging AIOps to handle challenges such as data silos, infrastructure scaling, and the need for rapid incident resolution. By automating tasks like root cause analysis and performance optimization, AIOps platforms help reduce operational costs and improve service reliability.

Offering Insights

The platform segment led the market in 2024, accounting for over 86% share of the global revenue. AIOps platforms integrate multiple functionalities, including event correlation, anomaly detection, and automated incident response, providing a holistic approach to IT operations. This integration enables IT teams to gain better visibility and proactively manage complex, hybrid, and multi-cloud environments. Platforms also facilitate the use of machine learning, big data analytics, and automation, streamlining workflows and reducing costs. The scalability of these platforms to adapt to dynamic IT needs has driven their demand as businesses seek solutions that support digital transformation and improve operational efficiency.

The services segment is predicted to foresee significant growth in the coming years.As organizations adopt AIOps solutions, they often require expert guidance for successful deployment and integration with existing IT systems. Consulting services play a crucial role in helping businesses tailor AIOps strategies to meet specific operational needs and industry requirements. Additionally, managed services enable companies to offload routine monitoring and maintenance tasks, allowing internal teams to focus on strategic initiatives. The demand for training and support services is also rising as organizations seek to empower their workforce to leverage AIOps tools effectively, ensuring a smoother transition to automated IT operations.

Application Insights

The real-time analytics segment accounted for the largest market revenue share in 2024. Organizations are generating vast amounts of data from various sources, and the ability to analyze this data in real-time is crucial for proactive decision-making. Real-time analytics enables IT teams to quickly identify and resolve issues, reducing downtime and improving service quality. Additionally, as businesses undergo digital transformation, the demand for continuous monitoring and instant feedback has intensified. Real-time analytics not only enhances operational efficiency but also supports strategic initiatives by providing actionable insights that help organizations optimize resource allocation, enhance customer experiences, and maintain a competitive edge in rapidly changing environments.

The infrastructure management segment is predicted to foresee significant growth in the coming years. AIOps platforms enhance infrastructure management by providing real-time monitoring, predictive analytics, and automated incident response, allowing IT teams to identify and resolve performance issues before they escalate quickly. Additionally, the need for efficient resource utilization and cost management drives organizations to adopt AIOps solutions that can optimize infrastructure performance and reduce operational overhead. This segment’s growth is further fueled by the demand for enhanced visibility and control over dynamic IT environments to support business continuity and scalability.

Deployment Insights

The on-premises segment accounted for the largest market share in 2024. Many organizations, particularly those in highly regulated industries such as finance and healthcare, prefer on-premises solutions to ensure sensitive data remains within their own infrastructure, minimizing the risk of data breaches. Additionally, on-premises deployments allow for greater customization and integration with existing legacy systems, which is crucial for organizations that have invested heavily in their IT infrastructure. As businesses seek to leverage AIOps capabilities while maintaining control over their data and operations, the demand for on-premises solutions is expected to rise, driving growth in this segment of the market.

The cloud segment is anticipated to witness significant growth in the coming years.Cloud-based AIOps platforms offer several advantages, including reduced upfront costs, easy scalability, and the ability to access advanced analytics without the need for extensive on-premises hardware. Additionally, the cloud facilitates collaboration and data sharing across distributed teams, enhancing operational efficiency. As businesses continue to embrace digital transformation and seek agility in their IT operations, the demand for cloud-based AIOps solutions is poised to rise substantially.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share in 2024.Large organizations typically manage vast amounts of data across multiple systems and locations, necessitating sophisticated solutions to monitor and optimize their IT infrastructure. AIOps platforms provide these enterprises with the ability to automate incident response, enhance visibility, and leverage predictive analytics to mitigate risks proactively. Furthermore, large enterprises often face greater regulatory and compliance pressures, making it crucial to implement robust AIOps strategies that ensure service reliability and data security.

The SME segment is anticipated to exhibit the highest CAGR over the forecast period. As SMEs increasingly rely on technology to compete in a digital-first landscape, they require scalable AIOps solutions that can streamline their IT operations without heavy investment in infrastructure. AIOps platforms help SMEs by automating routine tasks, providing real-time insights into system performance, and enabling faster incident resolution, all of which are crucial for maintaining service quality. Additionally, the rise of cloud-based AIOps solutions offers SMEs an accessible way to leverage advanced analytics and automation, empowering them to optimize resources and enhance decision-making while minimizing operational costs.

Vertical Insights

The BFSI segment accounted for the largest market revenue share in 2024.Financial institutions are facing mounting regulatory pressures and cyber threats, necessitating robust AIOps solutions that can provide real-time monitoring, anomaly detection, and automated incident response. AIOps platforms enable BFSI organizations to gain actionable insights from vast amounts of transactional data, improving risk management and customer service. Additionally, as these institutions adopt digital transformation initiatives to meet evolving customer expectations, AIOps tools play a crucial role in optimizing IT performance and ensuring the reliability of critical financial applications, driving their adoption in the BFSI sector.

The government segment is anticipated to exhibit the highest CAGR over the forecast period. Within the government and public sector, there is a growing recognition of the need to enhance operational efficiency, optimize resource utilization, and ensure the delivery of reliable and secure IT services. AIOps offers significant potential to address these challenges by providing advanced analytics, automation, and predictive capabilities. Government agencies manage vast amounts of data across various departments, necessitating sophisticated IT solutions to streamline operations and ensure effective resource allocation. AIOps platforms provide real-time monitoring and analytics, enabling government entities to proactively identify and resolve issues, thus minimizing downtime and enhancing service delivery.

Regional Insights

North America artificial intelligence for IT operations platform market dominated the global industry with a revenue share of over 35% in 2024. The region is home to many leading technology companies and advanced IT infrastructures, which facilitates the early adoption of innovative AIOps solutions. The presence of a large number of enterprises across various sectors, such as finance, healthcare, and retail, drives the demand for efficient IT operations and proactive incident management. Additionally, the increasing complexity of IT environments and the need for real-time data analytics further fuel the growth of AIOps platforms in North America.

U.S. Artificial Intelligence for IT Operations Platform Market Trends

The artificial intelligence for IT operations (AIOps) platform market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. Strong investments in research and development by key players, along with a skilled workforce, also contribute to the U.S.'s high share in the AIOps market. Furthermore, the focus on digital transformation initiatives and cloud adoption among U.S. businesses enhances the demand for scalable AIOps solutions.

Europe Artificial Intelligence for IT Operations Platform Market Trends

The artificial intelligence for IT operations (AIOps) platform market in the Europe region is expected to witness significant growth over the forecast period. European enterprises are increasingly adopting cloud technologies and automation to enhance operational efficiency, driving demand for AIOps solutions that provide real-time insights and automated incident management. Additionally, stringent regulations, such as GDPR, necessitate robust IT management practices to ensure data privacy and compliance, further propelling the adoption of AIOps platforms.

Asia Pacific Artificial Intelligence for IT Operations Platform Market Trends

The artificial intelligence for IT operations (AIOps) platform market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. Many countries in the region, such as China, India, and Japan, are investing heavily in IT infrastructure to enhance operational efficiency and improve customer experiences. As businesses face growing data volumes and complexity, AIOps platforms provide the necessary tools for real-time monitoring, predictive analytics, and automated incident management. Additionally, the rising demand for cost-effective IT solutions among SMEs further fuels the adoption of AIOps technologies.

Key Artificial Intelligence For IT Operations Platform Company Insights

Some key players in the artificial intelligence for IT operations (AIOps) platform market, such as AppDynamics, BMC Software, Inc., Broadcom Inc., HCL Technologies Limited, and IBM Corporation, are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the development of new products and technologies. This proactive approach allows them to enhance their market presence and innovate in response to evolving security needs.

-

Broadcom Inc. is a global technology company specializing in semiconductor and infrastructure software solutions. With a strong focus on innovation, the company provides a wide range of products and services, including those related to networking, broadband, enterprise software, and data center operations. By integrating AIOps capabilities into its existing software portfolio, including solutions for network management and security, Broadcom Inc. empowers businesses to proactively manage complex IT infrastructures, reduce operational costs, and enhance overall efficiency.

-

IBM Corporation is a multinational technology and consulting company renowned for its extensive range of products and services, including cloud computing, AI, and enterprise software solutions. As a pioneer in the field of AI, the company has been at the forefront of developing innovative technologies that enhance IT operations through automation and intelligent analytics. By integrating data from various sources and applying AI-driven analytics, IBM Corporation helps businesses streamline their IT workflows, reduce downtime, and improve operational efficiency. With a strong emphasis on hybrid cloud solutions and a commitment to helping organizations navigate their digital transformation journeys, IBM Corporation is a key player in the AIOps market, empowering enterprises to harness the power of AI for smarter IT management.

Key Artificial Intelligence For IT Operations Platform Companies:

The following are the leading companies in the artificial intelligence for IT operations platform market. These companies collectively hold the largest market share and dictate industry trends.

- APPDYNAMICS

- BMC Software, Inc.

- Broadcom Inc.

- HCL Technologies Limited

- IBM Corporation

- Micro Focus International plc

- Dell Inc.

- ProphetStor Data Services, Inc.

- Splunk LLC

- Thales

Recent Developments

-

In September 2024, Vitria Technology, Inc., the designer of the VIA AIOps platform, an agile AI solution designed for large-scale operational intelligence, reported a surge in demand and customer adoption. Over the past year, Vitria Technology's AIOps platform enabled its clients to achieve a 60% improvement in overall service availability and an 80% reduction in the time required to resolve service issues, and 92% of incidents were detected before impacting customers.

-

In March 2024, Visionet Systems Inc. partnered with Algomox Private Limited to enhance cloud management through AI-driven AIOps solutions. This collaboration aims to improve Visionet Systems Inc.'s Managed IT services by automating complex tasks, providing operational insights, and enhancing cloud security while reducing costs. Algomox Private Limited's advanced AIOps platform will be integrated into Visionet Systems Inc.'s services, fostering innovation and operational efficiency. The partnership highlights the potential of startups to contribute significantly to the industry by aligning established firms with emerging technologies.

-

In January 2024, Juniper Networks, a prominent player in secure AI-Native Networking, announced the launch of the industry's first AI-Native Networking Platform, specifically designed to utilize AI for optimizing end-to-end experiences for operators and end-users. The new platform consolidates all campus, branch, and data center networking solutions under a unified AI engine and the Marvis Virtual Network Assistant (VNA). This integration allows for comprehensive AIOps capabilities, automated troubleshooting, in-depth insights, and seamless end-to-end networking assurance.

Artificial Intelligence for IT Operations Platform Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.79 billion

Revenue forecast in 2030

USD 36.07 billion

Growth Rate

CAGR of 15.2% from 2025 to 2030

Actual data

2017 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, application, deployment, organization size, vertical, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

AppDynamics; BMC Software, Inc.; Broadcom Inc.; HCL Technologies Limited; IBM Corporation; Micro Focus International plc; Dell Inc.; ProphetStor Data Services, Inc.; Splunk LLC; VMware, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Intelligence for IT Operations Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global artificial intelligence for IT operations (AIOps) platform market report based on offering, application, deployment, organization size, vertical, and region.

-

Offering Outlook (Revenue, USD Billion, 2017 - 2030)

-

Platform

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Infrastructure Management

-

Application Performance Analysis

-

Real-Time Analytics

-

Network & Security Management

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

IT & Telecom

-

Retail & E-Commerce

-

Energy & Utilities

-

Media & Entertainment

-

BFSI

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence for IT operations platform market size was estimated at USD 14.60 billion in 2024 and is expected to reach USD 17.79 billion by 2025.

b. The global artificial intelligence for IT operations platform market is anticipated to grow at a CAGR of 15.2% from 2025 to 2030 to reach USD 36.07 billion by 2030.

b. North America dominated the artificial intelligence for IT operations platform market with a share of 35.7% in 2024. This is attributable to the massive investments in R&D activities and continued digital transformation in developed economies in the region.

b. Some key players operating in the AIOps platform market include International Business Machines Corporation; AppDynamics; BMC Software, Inc.; Broadcom; HCL Technologies Limited; Micro Focus; Moogsoft; ProphetStor Data Services, Inc.; Resolve Systems; Splunk Inc.; and VMware, Inc.

b. Key factors that are driving the AIOps platform market growth include the rapid adoption of cloud-based infrastructure in the IT sector; a surge in demand for AI-based applications; and an increasing need for risk mitigation in IT organizations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.