- Home

- »

- Next Generation Technologies

- »

-

Aircraft Fuel Systems Market Size, Industry Report, 2033GVR Report cover

![Aircraft Fuel Systems Market Size, Share & Trends Report]()

Aircraft Fuel Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Piping, Inerting Systems), By Engine Type (Jet Engine), By Technology, By Application (Commercial, Military, UAV), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-666-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aircraft Fuel Systems Market Summary

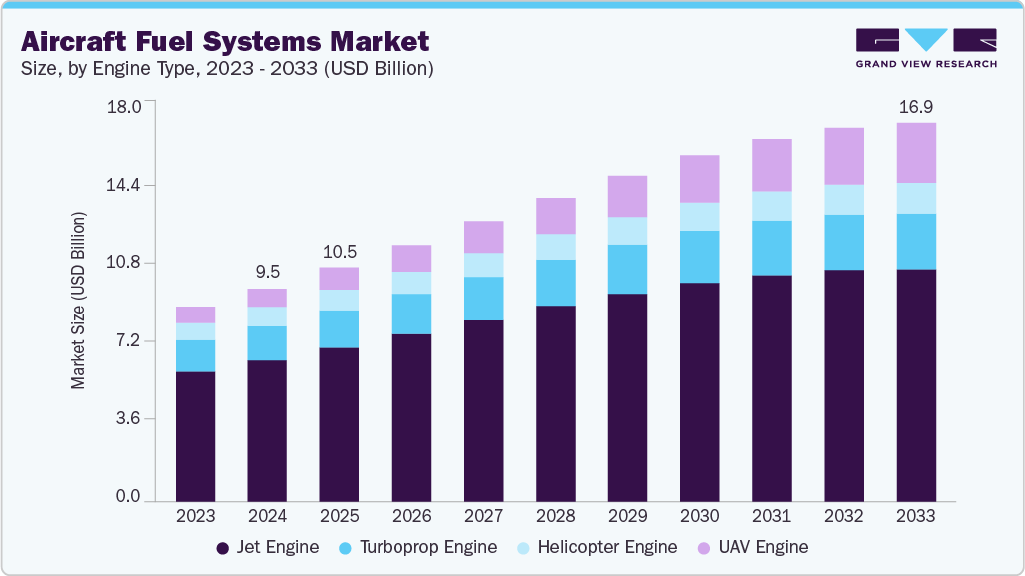

The global aircraft fuel systems market size was estimated at USD 9.53 billion in 2024 and is projected to reach USD 16.98 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The growing integration of advanced fuel management technologies that enhance efficiency and real-time monitoring, the growing adoption of sustainable aviation fuels (SAFs) requiring system compatibility upgrades, and the growing development of lightweight, fuel-efficient components to reduce overall aircraft weight and emissions are the key factors driving the aircraft fuel systems industry growth.

Key Market Trends & Insights

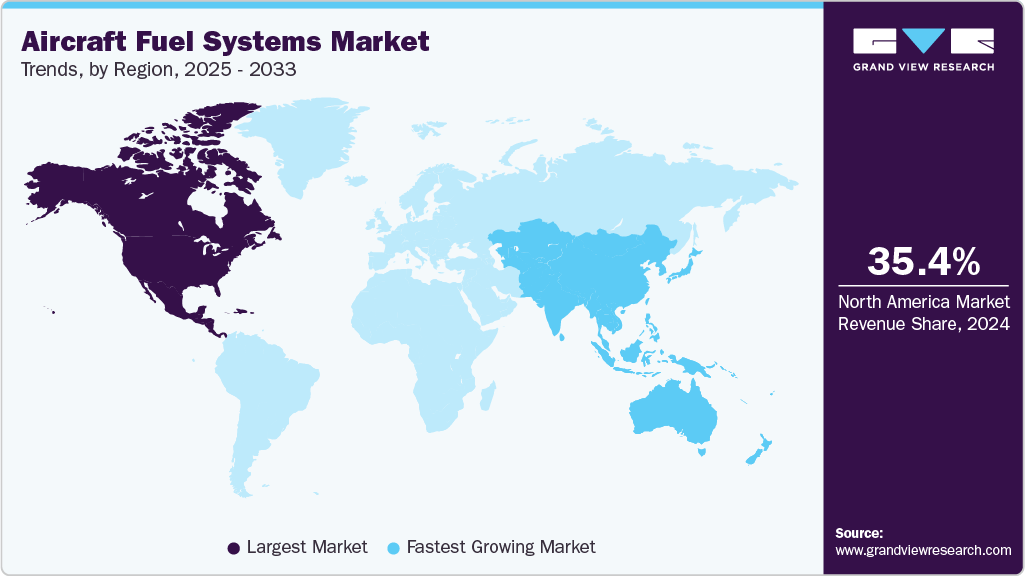

- North America dominated the market with the largest revenue share of 35.45% in 2024.

- The U.S. aircraft fuel systems market dominated the market with a share of 80.3% in 2024.

- Based on component, the piping segment accounted for the largest revenue share of 22.8% in 2024.

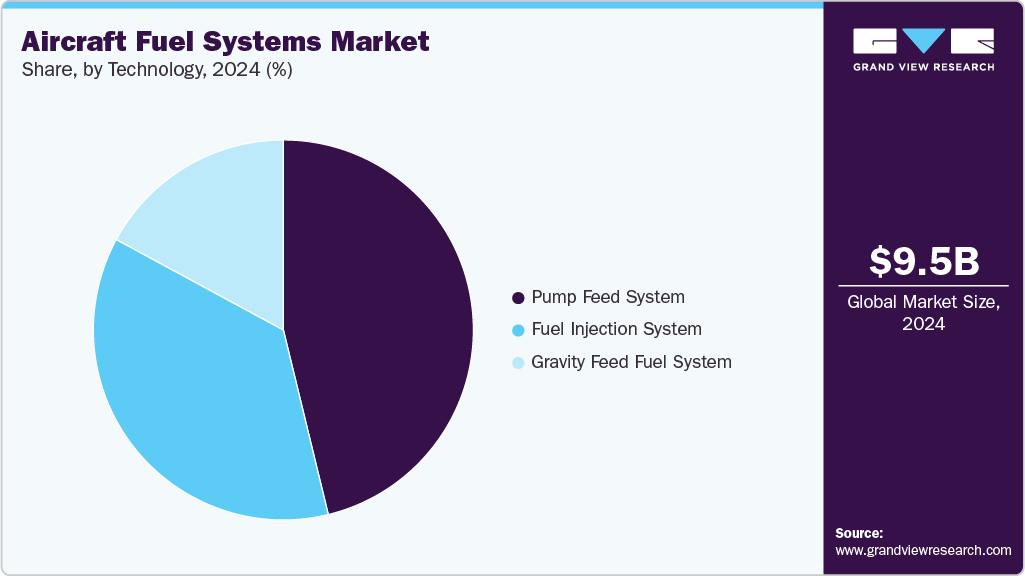

- Based on technology, the pump feed system segment accounted for the largest market revenue share in 2024.

- Based on application, the commercial application dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.53 Billion

- 2033 Projected Market Size: USD 16.98 Billion

- CAGR (2025-2033): 6.2%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

The growing innovations in fuel control, monitoring, and delivery systems are critical factors accelerating the aircraft fuel system industry growth. Advanced fuel systems improve fuel efficiency, operational transparency, and real-time data management, which are essential as aircraft propulsion systems become more complex and regulatory requirements tighten. These systems help reduce operating costs by minimizing fuel waste, enhancing performance, and enabling predictive maintenance.

In addition, the continuous growth in global air passenger traffic and the expansion of commercial, cargo, and military aircraft fleets are fueling demand for advanced and reliable fuel systems. Airlines are upgrading older jets and expanding fleets to meet increasing travel demand, especially in emerging markets such as Asia Pacific and the Middle East. This growth necessitates fuel systems that can efficiently manage fuel distribution and storage, further expandingthe aircraft fuel system industry growth.

Furthermore, airlines and manufacturers are prioritizing fuel efficiency to reduce operational costs and meet sustainability goals. This drives the development of lightweight fuel system components, optimized fuel injection, and delivery technologies. Moreover, the adoption of sustainable aviation fuels (SAFs) requires modifications to existing fuel systems to ensure compatibility, further propelling innovation in the aircraft fuel system industry.

Moreover, companies are adopting various strategies to enhance their competitive edge. Key companies are focusing on investing in research and development to innovate lightweight, fuel-efficient, and environmentally friendly fuel system technologies that comply with stringent global emission regulations and support sustainable aviation fuels (SAFs). They are also pursuing strategic partnerships and collaborations with OEMs and defense organizations to co-develop advanced fuel management solutions tailored for next-generation aircraft, including hybrid-electric and hydrogen-powered models. Such strategies by key players are expected to drive the aircraft fuel systems industry in the coming years.

Component Insights

The piping segment led the market with the largest revenue share of 22.8% in 2024, driven by the need for lightweight, durable, and corrosion-resistant materials to efficiently transport fuel within aircraft while minimizing weight and ensuring safety. Advances in composite materials and alloys help reduce overall aircraft weight, improving fuel efficiency and performance. Increasing air traffic and fleet expansions require robust piping systems capable of handling higher fuel flow rates and pressures, especially in modern and next-generation aircraft designs.

The inerting systems segment is expected to register at the fastest CAGR of 8.4% from 2025-2033, propelled by stringent safety regulations aimed at reducing the risk of fuel tank explosions by displacing oxygen with inert gases. The adoption of advanced inerting technologies, such as nitrogen generation systems, is increasing across commercial and military aircraft to enhance fuel system safety. Rising awareness of fuel tank safety and regulatory mandates globally are key drivers, along with modernization programs upgrading older aircraft with improved inerting solutions.

Engine Type Insights

The jet engine segment accounted for the largest market revenue share in 2024, driven by the need for advanced fuel systems that ensure efficient fuel delivery across diverse engine conditions to enhance performance and reduce emissions. Rising production of both commercial and military jet aircraft, along with growing emphasis on fuel efficiency and environmental compliance, is spurring innovation in fuel injection and control technologies. In addition, the integration of fuel systems with emerging propulsion solutions such as sustainable aviation fuels and hybrid-electric engines is further propelling growth in this segment.

The UAV engine segment is expected to register at the fastest CAGR from 2025 to 2033, owing to the expanding use of unmanned aerial vehicles in military, surveillance, and commercial applications. UAVs require compact, lightweight, and highly reliable fuel systems tailored to diverse mission profiles. Increasing demand for long-endurance and high-performance UAVs drives the development of specialized fuel delivery and management systems optimized for smaller engines and hybrid propulsion.

Technology Insights

The pump feed system segment accounted for the largest market revenue share in 2024. The segment benefits from their simplicity and reliability, especially in high-wing and light aircraft, where fuel flow can be maintained without pumps. Growth in general aviation and training aircraft supports demand for gravity feed systems due to lower cost and ease of maintenance. However, modernization trends are encouraging integration with pump-fed systems for improved fuel management in newer aircraft models.

The fuel injection systems segment is expected to register at the fastest CAGR from 2025 to 2033, driven by the need for precise fuel metering to improve engine performance, reduce fuel consumption, and lower emissions. Advances in electronic fuel injection and digital control systems enable better optimization of fuel-air mixtures across flight regimes. Increasing regulatory pressure on emissions and fuel efficiency, along with the adoption of sustainable aviation fuels, are key factors pushing innovation in this segment.

Application Insights

The commercial segment accounted for the largest market revenue share in 2024, fueled by rising global air traffic, fleet expansions, and the replacement of older aircraft with more fuel-efficient models. Airlines are adopting advanced fuel systems that support sustainable aviation fuels, hybrid propulsion, and improved operational efficiency to meet environmental regulations and reduce costs. Growth in regional and low-cost carriers also contributes to demand for reliable, scalable fuel system technologies.

The UAV application segment is expected to register at the fastest CAGR from 2025 to 2033, owing to growing military and commercial use of drones for reconnaissance, delivery, and agricultural purposes. Fuel systems for UAVs must be lightweight, compact, and adaptable to various engine types, including hybrid and electric propulsion. Increasing investments in UAV technology and the need for longer flight endurance are driving the development of specialized fuel management solutions tailored to unmanned platforms.

Regional Insights

North America dominated the aircraft fuel systems market with the largest revenue share of 35.45% in 2024. The region benefits from strong aerospace industry capabilities, rising global air traffic, fleet expansions, and military modernization programs. Technological advancements and strategic contracts further boost the market, with a focus on predictive analytics and nitrogen-inerting safety retrofits.

U.S. Aircraft Fuel Systems Market Trends

The aircraft fuel systems market in the U.S. accounted for the largest market revenue share in North America in 2024, propelled by expanding commercial and military fleets, stringent environmental regulations, and innovation in fuel management systems. The FAA's oversight of extensive air traffic and investments in hybrid-electric and sustainable aviation fuels stimulate demand for next-generation fuel systems. The US market emphasizes fuel efficiency, operational reliability, and integration of real-time health monitoring technologies.

Europe Aircraft Fuel Systems Market Trends

The aircraft fuel systems market in Europe accounted for the second-largest market revenue share of 26.63% in 2024, driven by fleet modernization toward fuel-efficient platforms and rising defense spending amid geopolitical tensions. The EU enforces strict environmental regulations, prompting the adoption of low-emission and sustainable fuel system technologies. Key countries like Germany, France, and Italy invest in advanced fuel management systems, supported by collaborations among aerospace manufacturers and technology providers.

The Germany aircraft fuel systems market is expected to grow at a significant CAGR during the forecast period, owing to the country's investment in military aircraft modernization and commercial fleet expansions. German manufacturers and suppliers are active in developing advanced fuel pumps, valves, and inerting systems tailored to evolving aviation requirements.

The aircraft fuel systems market in the UK is rapidly expanding. The market aligns with broader European trends, focusing on upgrading existing fleets with innovative fuel systems to meet environmental mandates and improve fuel economy. Defense modernization and UAV procurement add to the demand. The UK aerospace sector leverages partnerships and R&D to develop lightweight, efficient fuel system components catering to both commercial and military aircraft.

Asia Pacific Aircraft Fuel Systems Market Trends

The aircraft fuel systems market in Asia Pacific is expected to grow at the fastest CAGR of 9% from 2025 to 2033, owing to rapid expansion in air travel, rising disposable incomes, and urbanization in countries such as China, India, Japan, and Southeast Asia. The region benefits from government initiatives supporting local aircraft manufacturing and aviation infrastructure development. Military modernization and large-scale procurement of new aircraft models drive demand for sophisticated fuel systems. Sustainability and emission reduction efforts also shape market trends.

The China aircraft fuel systems market is driven by rapid economic development, increasing digitalization, and the adoption of advanced technologies by domestic enterprises. The government’s focus on digital infrastructure and smart city initiatives further propels market expansion.

The aircraft fuel systems market in Japan is rapidly expanding, driven by the increasing trend toward remote and hybrid work models. The need for dependable and high-quality aircraft fuel systems platforms is rising as organizations prioritize flexible work arrangements. Technological advancements in mobile broadband and network infrastructure also enhance the user experience. Japan’s corporate sector adoption and government support for digital transformation initiatives underpin this growth.

Key Aircraft Fuel Systems Company Insights

Some of the key players operating in the market include Eaton Corporation and Honeywell International, Inc., among others.

-

Eaton Corporation is a global manufacturer of advanced aerospace fuel systems, offering a comprehensive portfolio that includes fuel pumps, valves, sensors, and accessories. The company provides integrated fuel conveyance and delivery sub-systems from the tank to the engine, supporting both commercial and military aircraft programs. The company emphasizes system integration, reliability, and efficiency, with extensive capabilities in fuel system design, testing, and simulation, serving major OEMs like Airbus, Boeing, and Lockheed Martin.

-

Honeywell International, Inc. is a major aerospace supplier known for its comprehensive range of aircraft fuel system components and integrated solutions. The company develops fuel pumps, valves, sensors, and control systems that enhance fuel efficiency, safety, and operational performance. The company serves commercial, military, and business aviation sectors, leveraging advanced technologies to optimize fuel management and system reliability.

GKN PLC and Meggitt PLC are some of the emerging market participants in the aircraft fuel systems industry.

-

GKN PLC operates as an emerging participant in the aircraft fuel systems market, specializing in aerospace components such as aerostructures, engine products, and propulsion systems. GKN Aerospace focuses on developing and manufacturing fuel system components that support both commercial and military aircraft, emphasizing lightweight materials and integrated system solutions to improve fuel efficiency and performance. The company’s expertise in advanced manufacturing and engineering supports its growing role in supplying critical fuel system parts.

-

Meggitt PLC is an aerospace engineering company developing and producing high-performance fuel system components and sub-systems for aircraft engines and airframes. Meggitt specializes in precision-engineered parts such as valves, sensors, and thermal management systems that contribute to efficient fuel delivery and safety-critical operations. The company leverages advanced materials and engineering capabilities to meet evolving market demands in commercial and defense aviation fuel systems.

Key Aircraft Fuel Systems Companies:

The following are the leading companies in the global aircraft fuel systems market. These companies collectively hold the largest market share and dictate industry trends.

- Eaton Corporation Plc

- GKN PLC

- Honeywell International Inc.

- Meggitt PLC

- Parker Hannifin Corporation

- RTX Corporation (Collins Aerospace division)

- Triumph Group, Inc.

- United Technologies Corporation

- Woodward, Inc.

- Zodiac Aerospace

Recent Developments

-

In March 2025, RTX Corporation announced three agreements with JetZero to supply critical propulsion and structural components for JetZero’s full-scale blended wing body (BWB) aircraft demonstrator.

-

In January 2025, Eaton Corporation announced an agreement with Air Support to establish the first authorized service center for Eaton's aerospace business across Europe, the Middle East, and Africa (EMEA).

-

In September 2024, Honeywell International, Inc. partnered with USA BioEnergy to implement its Experion PKS Distributed Control System (DCS) and safety system at USA BioEnergy’s Texas Renewable Fuels Bon Wier advanced biorefinery.

Aircraft Fuel Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.46 billion

Revenue forecast in 2033

USD 16.98 billion

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year of estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, engine type, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East; and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Eaton Corporation Plc; GKN PLC; Honeywell International Inc.; Meggitt PLC; Parker Hannifin Corporation; RTX Corporation (Collins Aerospace division), Triumph Group, Inc., United Technologies Corporation, Woodward, Inc., and Zodiac Aerospace

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aircraft Fuel Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global aircraft fuel systems market report based on component, engine type, technology, application, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Piping

-

Inerting Systems

-

Pumps

-

Valves

-

Gauges

-

Filters

-

Others

-

-

Engine Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Jet Engine

-

Turboprop Engine

-

Helicopter Engine

-

UAV Engine

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Gravity feed fuel system

-

Fuel injection system

-

Pump feed system

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Military

-

UAV

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aircraft fuel systems market size was estimated at USD 9.53 billion in 2024 and is expected to reach USD 10.46 billion in 2025.

b. The global aircraft fuel systems market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 16.98 billion by 2033.

b. The piping segment dominated the market with a share of over 22% in 2024, driven by the need for lightweight, durable, and corrosion-resistant materials to efficiently transport fuel within aircraft while minimizing weight and ensuring safety.

b. Some of the key players operating in the aircraft fuel systems market include Eaton Corporation Plc, GKN PLC, Honeywell International Inc., Meggitt PLC, Parker Hannifin Corporation, and RTX Corporation (Collins Aerospace division).

b. The growing integration of advanced fuel management technologies that enhance efficiency and real-time monitoring, the growing adoption of sustainable aviation fuels (SAFs) requiring system compatibility upgrades, and the growing development of lightweight, fuel-efficient components to reduce overall aircraft weight and emissions are the key factors driving the aircraft fuel systems market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.