- Home

- »

- Alcohol & Tobacco

- »

-

Airport Duty-free Liquor Market Size & Share Report, 2030GVR Report cover

![Airport Duty-free Liquor Market Size, Share & Trends Report]()

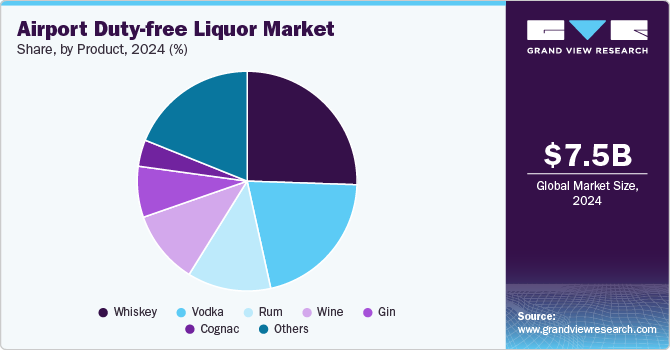

Airport Duty-free Liquor Market Size, Share & Trends Analysis Report By Product (Whiskey, Vodka, Rum, Gin, Wine, Cognac, Others), By Region (North America, Europe, APAC, MEA), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-925-6

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Airport Duty-free Liquor Market Size & Trends

The global airport duty-free liquor market size was estimated at USD 7.49 billion in 2024 and is expected to grow at a CAGR of 10.2% from 2025 to 2030. The market's growth can be attributed to the increasing number of airport travelers. Liquor purchases at these locations are exempt from government taxes and duties, making them more affordable for passengers. Furthermore, travelers often opt to spend any leftover foreign currency on liquor from duty-free shops before returning to their home countries. These factors are anticipated to contribute significantly to market growth in the coming years.

Government regulations play a crucial role in shaping the market's growth. Different countries have specific rules regarding duty-free shops. For instance, the Indian government permits international travelers to purchase up to two liters or two bottles of alcohol. Furthermore, airport duty-free shops are popular among travelers looking to buy items before heading abroad, as these purchases are exempt from local import duties or taxes imposed by local authorities.

The increasing consumption of premium alcoholic beverages, particularly from developed economies like the U.S. and the UK, is expected to drive market growth in the coming years. Rising demand for beer, wine, and dark spirits is boosting sales of alcoholic drinks at airports. In addition, the growing popularity of lounges, bars, and restaurants in the tourism sector will likely enhance market growth further during the forecast period.

The demand for flavorful beers that aid digestion is a key factor propelling the industry's expansion. Moreover, the increasing interest in artisanal spirits in emerging markets such as China and India is projected to contribute to market growth. The growing desire for affordable, value-added hard seltzer products also presents significant growth opportunities for the market. However, the rising trend of consuming non-alcoholic beverages challenges market growth.

Increased investments from leading UK-based companies in high-quality Scotch whisky production fuel market expansion. Major players also focus on acquiring premium quality cider, perry, and rice wine. The rapidly growing demand for lower-calorie beer options among U.S. consumers drives the alcoholic beverage industry, further contributing to market growth.

Product Insights

Airport duty-free whisky accounted for a global revenue market share of 25.5% in 2024. This can be credited to the rising demand for premium whiskey in developed European economies. Premium whiskey is gaining popularity in the U.S. to fulfill the demand for flavored alcoholic beverages. Furthermore, the demand for whiskey is expected to boom over the forecast period as whiskey is premium and known for its superior quality.

The airport duty-free gin market is projected to grow at a CAGR of 11.1% from 2025 to 2030. The rise of the premium and craft gin trend is a major driver. Consumers, especially international travelers, are increasingly drawn to high-end, artisanal gins that offer unique botanical blends and flavors. Duty-free shops capitalize on this by offering exclusive or limited-edition gins that cater to this demand for premiumization. Moreover, the growing popularity of gin-based cocktails, such as gin and tonics, has increased gin’s appeal among travelers, who often purchase it as a high-quality ingredient for home use or gifting.

Regional Insights

The airport duty-free liquor market in North America accounted for a global revenue share of 11.9% in 2024. One of the primary drivers is the high volume of international travelers, particularly from the U.S. and Canada. North American airports are major hubs for long-haul flights, especially to Europe, Asia, and Latin America, leading to a significant captive audience in duty-free stores. Travelers often seek out duty-free liquor, including gin, for gifting or personal consumption, benefiting from tax exemptions that make high-end liquors more affordable.

U.S. Airport Duty-free Liquor Market Trends

The airport duty-free liquor market in the U.S. is projected to grow at a CAGR of 10.1% from 2025 to 2030. American consumers, particularly millennials and affluent travelers, have increasingly gravitated towards high-end, small-batch, and artisanal gins. This trend is reflected in U.S. duty-free stores, which stock a wide range of premium and exclusive gin brands to cater to this growing preference. Duty-free shopping provides an opportunity for travelers to access luxury and limited-edition gins that may not be widely available in regular stores, thus enhancing the appeal.

Europe Airport Duty-free Liquor Market Trends

The airport duty-free liquor market in Europe is projected to grow at a CAGR of 10.2% from 2025 to 2030. This can be attributed to the growing demand for premium liquors in developed countries. Furthermore, the UK is the largest seller of duty-free liquors from airport shops, thus boosting the regional market growth. The rising trend in the region to adopt the classic brands of alcoholic beverages such as Arnold Palmer Spiked Half & Half, Bergenbier, and Burgasko will boost the market growth. Moreover, the funding provided by the private firms of the region to procure premium alcoholic beverages at the airport is anticipated to boost the market growth.

The UK airport duty-free liquor market accounted for a share of 26.6% in 2024. A major driver is the strong cultural association with gin. The UK is often considered the birthplace of modern gin, and the spirit has deep-rooted historical significance. This tradition has fueled a strong domestic and international demand for UK-produced gins, with many travelers seeking well-known British brands like Beefeater, Tanqueray, and Hendrick’s, as well as craft gins made from local botanicals.

The airport duty-free liquor market in Germany is projected to grow at a CAGR of 10.3% from 2025 to 2030. Germany’s major airports serve as critical hubs for international and transcontinental flights, particularly within Europe and between Europe and Asia. This high volume of travelers increases foot traffic in duty-free stores, where liquor products are popular, especially for gifting and personal consumption.

Asia Pacific Airport Duty-free Liquor Market Trends

The airport duty-free liquor market in Asia Pacific accounted for a share of 49.9% of the global revenue in 2024. The majority of passengers from developing countries spend money on liquor as it is available at economical rates at airports. Rising disposable income and improved economic conditions in developing countries are also important factors for market growth. Increasing travel and tourism in this region owing to a larger millennial population willing to spend on leisure tourism and exploration will further drive the market.

China airport duty-free liquor market accounted for a share of 35.5% of the in 2024. China has experienced significant growth in both international and domestic air travel over the last decade, with major airports like Beijing Capital, Shanghai Pudong, and Guangzhou Baiyun serving millions of travelers annually. This surge in passenger traffic, particularly among affluent middle-class travelers and business elites, has expanded the duty-free liquor market, where travelers take advantage of tax-free shopping to buy premium liquor brands.

The airport duty-free liquor market in Japan is projected to grow at a CAGR of 10.4% from 2025 to 2030. One of the strongest drivers in Japan’s market is the global demand for Japanese whisky. Japanese whisky brands such as Yamazaki, Hibiki, and Nikka have gained worldwide recognition for their quality and craftsmanship, leading to significant demand from both domestic and international travelers.

Central & South America Airport Duty-free Liquor Market Trends

The airport duty-free liquor market in Central & South America is projected to grow at a CAGR of 8.6% from 2025 to 2030.There is a growing middle class and a rising demand for premium products in Central & South American countries, including high-end liquor. Travelers are increasingly opting for luxury spirits, such as premium whiskey, aged rum, and fine cognac, which are available at competitive prices in duty-free stores.

Middle East & Africa Airport Duty-free Liquor Market Trends

The airport duty-free liquor market in Middle East & Africa is projected to grow at a CAGR of 9.6% from 2025 to 2030.The MEA region boasts a diverse demographic with varying cultural attitudes toward alcohol consumption. While some countries have strict regulations regarding alcohol sales, others, like the UAE and South Africa, have a more relaxed approach. This diversity creates a unique market dynamic where duty-free stores can cater to both local and international consumers.

Key Airport Duty-free Liquor Company Insights

Key players are increasingly investing in R&D to produce non-alcoholic beverages for consumers who prefer non-alcoholic beverages. Moreover, liquor manufacturers are focusing on the expansion and launches of recent developments.

Key Airport Duty-free Liquor Companies:

The following are the leading companies in the airport duty-free liquor market. These companies collectively hold the largest market share and dictate industry trends.

- Heineken N.V.

- Diageo plc

- Pernod Ricard

- Constellation Brands, Inc.

- The Brown-Forman Corporation

- Rémy Cointreau

- Edrington

- Glen Moray

- William Grant & Sons Ltd

- Bacardi Limited

Recent Developments

-

In August 2024, Delhi Duty-Free launched exclusive products such as the Royal Salute 25-Year Old Delhi Edition in collaboration with Pernod Ricard, which is now available exclusively at their airport locations. This move is part of a broader strategy to cater to the rising demand for premium spirits and to provide unique offerings that appeal to travelers seeking luxury items.

Airport Duty-free Liquor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.25 billion

Revenue forecast in 2030

USD 13.15 billion

Growth rate

CAGR of 10.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Heineken N.V.; Diageo plc; Pernod Ricard; Constellation Brands, Inc.; The Brown-Forman Corporation; Rémy Cointreau; Edrington; Glen Moray; William Grant & Sons Ltd.; Bacardi Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Airport Duty-free Liquor Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global airport duty-free liquor market report based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Whiskey

-

Vodka

-

Rum

-

Gin

-

Wine

-

Cognac

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global airport duty-free liquor market size was estimated at USD 7.49 billion in 2024 and is expected to reach USD 8.25 billion in 2025.

b. The global airport duty-free liquor market is expected to grow at a compound annual growth rate of 10.2% from 2025 to 2030to reach USD 13.15 billion by 2030.

b. The Asia Pacific dominated the airport duty-free liquor market with a share of 49.9% in 2024. This is attributable to majority of passengers from developing countries spending on liquor as they are available at economical rates at the airports.

b. Some key players operating in the airport duty-free liquor market include Heineken; Diageo; Pernod Ricard; Constellation Brands, Inc.; Brown-Forman; REMY COINTREAU; Erdington; Glen Moray; Accolade Wines; and Bacardi.

b. Key factors that are driving the airport duty-free liquor market growth include the rising number of travelers at airports, tax and airport duties exemption for liquor at airports, and rising consumption of liquor and low-alcohol beverages across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."