- Home

- »

- Alcohol & Tobacco

- »

-

Hard Seltzer Market Size, Share And Growth Report, 2030GVR Report cover

![Hard Seltzer Market Size, Share & Trends Report]()

Hard Seltzer Market (2024 - 2030) Size, Share & Trends Analysis Report By ABV Content, By Packaging Type, By Distribution Chanel (Off-trade, On-trade), By Flavor, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-805-3

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hard Seltzer Market Summary

The global hard seltzer market size was estimated at USD 18.97 billion in 2023 and is projected to reach USD 60.16 billion by 2030, growing at a CAGR of 8.5% from 2024 to 2030. The surge in market demand for low-alcohol content beverages among millennials and the younger generation is propelled by their growing popularity.

Key Market Trends & Insights

- The North America hard seltzer market held a share of around 56% of the global revenues in 2023.

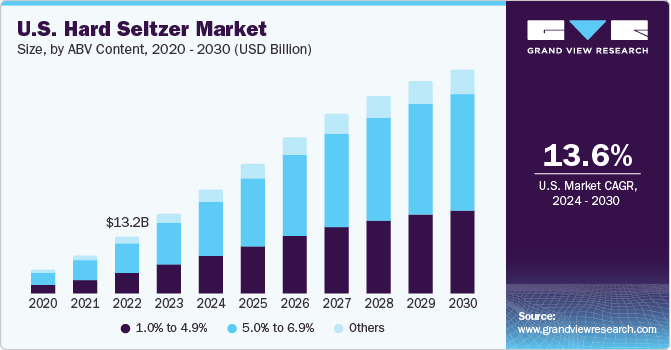

- The hard seltzer market in the U.S.is projected to grow at a CAGR of 13.6% from 2024 to 2030.

- Based on flavor, the flavored hard seltzer market accounted for a share of over 80% of the global revenues in 2023.

- On the basis of packaging type, the metal cans segment dominated the market, having accounted for a revenue share of over 75% in 2023.

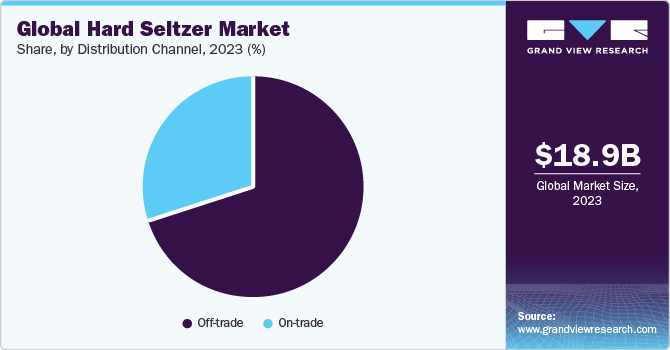

- According to distribution channel, the off-trade sales segment accounted for a share of over 70% of the global revenues in 2023.

Market Size & Forecast

- 2023 Market Size: USD 18.97 Billion

- 2030 Projected Market Size: USD 60.16 Billion

- CAGR (2024-2030): 8.5%

- North America: Largest market in 2023

In addition, consumers' inclination towards reducing alcohol consumption and exploring the concept of being "sober-curious" has contributed to the heightened demand for low-alcoholic beverages. The COVID-19 pandemic has had a profound effect on the consumption habits of alcoholic beverages, with consumers shifting their preferences from high alcohol content to low alcohol content due to an increased focus on health and well-being. During the pandemic, the sales of hard seltzer experienced a substantial increase through e-commerce platforms owing to global stay-at-home orders.

Alcohol delivery applications like Drizly and Minibar witnessed a significant surge in orders during February and March 2023, with the total order costs surpassing the usual amount by over 20%. Hard seltzers, with their low-calorie and low-sugar profiles, appeal to consumers who are conscious of their dietary choices and are seeking refreshing alternatives to traditional alcoholic beverages. This target market includes individuals who prioritize wellness and are looking for alcoholic options that align with their healthier lifestyle choices. The rise in health consciousness and the desire for beverages that offer a balance between taste and wellness are significant drivers for the target market of hard seltzers. According to a survey by IWSR, as of 2019, 52% of consumers surveyed were trying to reduce their alcohol consumption.

Moreover, hard seltzer contains low amounts of alcohol, ranging from 1%-8% ABV, and is low-calorie in comparison to beer, with most versions having around 100 calories. Thus, moderate drinkers prefer to consume hard seltzer as a substitute for beer. These properties are anticipated to boost the sales of the product across the globe over the forecast period. Many consumers are looking for reduced sugar, low-calorie, organic, and healthy halo beverages that not only fulfill their demands but also align with their keto and vegan diets. Many manufacturers have been offering products in this category. For instance, Mass Bay Brewing Co.’s hard seltzers contain 100 calories and 3 grams of carbohydrates. These are sugar- and gluten-free as well as considered vegan and keto-friendly.

Similarly, in December 2023, White Claw, a brand known for its hard seltzers, launched a 0% alcohol version in the U.S. The brand identifies a shift in drinking culture, with a majority of people, especially Gen Z and Millennials, showing interest in exploring a sober or damp lifestyle. White Claw promises that their 0% Alcohol seltzers will have the taste and complexity of alcoholic beverages, achieved through years of research and proprietary plant-based sweetener technology. The brand aims to provide better non-alcoholic options that have flavors consumers like, are from familiar brands, contain electrolytes, and are low in sugar.

Brands have actively capitalized on this social media buzz by designing visually appealing hard seltzer packaging to enhance user engagement and by collaborating with influencers and consumers. Research conducted by Bank of America reveals a six-fold increase in Instagram conversations about hard seltzer in January 2020 compared to January 2019.

Market Concentration & Characteristics

The hard seltzer market has seen significant innovation, characterized by diverse and creative advancements. Key areas include the expansion of flavor varieties, ranging from traditional to exotic, catering to a wide range of consumer tastes. There's also a focus on ingredient innovation, with natural, organic, and functional additions appealing to health-conscious buyers. Variations in alcohol content cater to preferences for lighter or stronger beverages. Packaging and branding have become more sophisticated, with eye-catching designs and eco-friendly options. Targeting niche markets, hard seltzer brands are offering products like gluten-free or low-calorie options.

Companies focus on strategic acquisitions to expand their presence overseas and reinforce their position in the market. Over the next few years, internationally reputed companies are likely to acquire small-and medium-sized companies operating in the industry in a bid to facilitate regional expansion.

ABV Content Insights

Hard seltzers with ABV content of 5.0% to 6.9% accounted for a share of 51.8% of the global revenues in 2023. The idea of moderation is a booming trend, not just a fad, especially in the U.S., which is driving the growth of this segment. Many players operating in the alcohol industry have been expanding their low-alcohol options.

The 1.0% to 4.9% ABV content category is anticipated to grow at a CAGR of 15.9% from 2024 to 2030. Due to the growing emphasis on health and well-being, consumers of all age groups are actively reducing their alcohol intake. In the past couple of years, there has been a remarkable surge in online discussions regarding low- and no-alcohol drinking, accompanied by a notable decline in conversations about casual and heavy drinking occasions. Some of the brands offering these drinks with 1.0% to 4.9% of ABV content include Corona, San Juan Spiked, BON V!V Spiked, Night Shift Hoot, Smirnoff, Willie’s Superbrew, Coors, Crook & Marker Spiked Seltzer, and Funky Buddha Premium Hard Seltzer.

Packaging Type Insights

The metal cans segment dominated the market, having accounted for a revenue share of over 75% in 2023. This can be attributed to the convenience and portability they offer making them an ideal packaging option for ready-to-drink beverages like hard seltzers. Cans are lightweight, easy to carry, and can be easily consumed on-the-go, which aligns well with the active and mobile lifestyles of consumers. Metal cans provide excellent product integrity and protection against light, oxygen, and other external elements that can degrade the quality and taste of the beverage. Hard seltzers often contain delicate flavors and carbonation, and metal cans help maintain their freshness and prevent spoilage. Also, metal cans offer ample space for branding and attractive designs providing beverage companies the opportunity to create visually appealing packaging that catches consumers' attention on store shelves or in online marketplaces.

The glass bottles segment is expected to grow at a CAGR of 18.4% from 2024 to 2030. Glass bottles are often associated with a premium and high-quality image. Hard seltzers positioned as premium or craft beverages may choose glass bottles to enhance their brand perception. The use of glass can create a sense of sophistication and elevate the overall drinking experience, appealing to certain consumer segments. Glass bottles offer a transparent and visually appealing packaging option. The ability to see the product inside can be enticing to consumers, allowing them to assess the beverage's clarity, color, and carbonation. Glass bottles can also showcase the brand's design and label, helping it stand out on store shelves and capture consumer attention.

Distribution Channel Insights

The off-trade sales segment accounted for a share of over 70% of the global revenues in 2023. The segment includes all retail outlets, such as hypermarkets, supermarkets, convenience stores, mini markets, and wine & spirit shops. People prefer these stores as they offer huge discounts and offers. Furthermore, the majority of the brands launch their product through big chains of supermarkets, such as Walmart and Target, to reach maximum customers.

The on-trade sales category is projected to grow at a CAGR of 15.4% from 2024 to 2030. The category includes outlets, such as clubs, bars, hotels, and lounges. The COVID-19 pandemic has led to lockdowns and shutdowns across the world. This has led to a reduction in sales from these channels. However, the reopening of the world, with people focusing on outside get-togethers, socializing, and parties, is likely to increase sales through on-trade channels.

Flavor Insights

The flavored hard seltzer market accounted for a share of over 80% of the global revenues in 2023. Consumer preferences have shifted towards lighter and low-calorie alcoholic beverages. Flavored hard seltzers align with these preferences as they offer a refreshing, low-calorie, and low-sugar alternative to traditional alcoholic beverages like beer or cocktails. Consumers seeking healthier options or those looking for variety have embraced flavored hard seltzers. Flavored hard seltzers provide a wide range of flavors including Black Cherry, lime, and mango among others, which offers consumers a diverse and enjoyable drinking experience.

The availability of various fruit flavors, Black Cherry blends, and even unique combinations appeals to consumers who appreciate variety and experimentation. The ability to cater to different taste preferences has contributed to the growth of this segment. Classic or unflavored hard seltzers are projected to grow at a CAGR of 19.4% during the forecast period. Unflavored or classic hard seltzers appeal to consumers who prefer simplicity and versatility in their beverage choices. These beverages provide a clean and straightforward flavor profile without added fruit or flavorings.

They can be enjoyed on their own or used as a base for creating personalized cocktails by adding mixers or garnishes according to individual preferences. Unflavored hard seltzers are often marketed as low-calorie and low-sugar alternatives to traditional alcoholic beverages. With increasing health consciousness among consumers, these beverages align with the trend toward healthier choices. Unflavored hard seltzers cater to individuals seeking a lighter alcoholic option while minimizing calorie and sugar intake.

Regional Insights

The North America hard seltzer market held a share of around 56% of the global revenues in 2023. The region has been witnessing high demand, especially from young consumers. Key manufacturers are promoting their products in innovative ways. For instance, White Claw, a popular brand manufactured by Vancouver-based Mark Anthony Brands, received a significant sales boost courtesy of its strong social media presence including internet memes and YouTube videos in June 2019. The success of brands like White Claw serves as a prominent example, while other players, both established and emerging, compete for market share.

U.S. hard seltzer market

The hard seltzer market in the U.S.is projected to grow at a CAGR of 13.6% from 2024 to 2030. Consumers are becoming increasingly health-conscious and are looking for lower-calorie, lower-sugar alternatives to traditional alcoholic beverages. Hard seltzers typically have fewer calories and less sugar compared to beers, wines, or mixed drinks. Beverage companies are continually innovating in this space, introducing new flavors and even branching into hybrid products (like hard seltzer lemonades or iced teas). This innovation keeps the category dynamic and appealing to consumers.

Furthermore, the mass appeal of these drinks has made them acceptable to both male and female drinkers, which, in turn, is likely to further increase the consumption of hard seltzer in the upcoming years. The European market is expected to witness a significant growth rate of 43.7% during the forecast period. This growth can be attributed to the emergence of numerous new brands in the markets of the U.K. and Germany, which has intensified competition among industry players. In response to the rising demand for hard seltzers, established alcoholic beverage companies and craft breweries are entering the market by launching their own hard seltzer products. This strategic move allows them to tap into the expanding consumer base and capitalize on the growing popularity of hard seltzers in Europe.

The health consciousness of the UK consumers has reached new heights, with the challenge of the Covid-19 pandemic further amplifying this trend. Currently, 68% of UK consumers actively strive to lead a healthy lifestyle, with two out of three individuals taking precautions to safeguard their long-term health. These precautions include making dietary changes and adjusting exercise routines. Against this backdrop, consumers are increasingly inclined to choose alcoholic beverages that are lighter in nature and lower in calories. Due to this shift in preferences, the UK market is expected to grow at a CAGR of around 37% from 2024 to 2030. The Rest of the World is the fastest-growing regional sub-segment and is expected to witness a CAGR of over 40% from 2024 to 2030.

Countries like Australia, New Zealand, and China contribute most of the share in the rest of the world. Rising disposable income, health consciousness, and easy availability of international brands have led to increased consumption of such products in these countries. The 1% to 4.9% ABV segment content is much more popular in Asian countries, thus manufacturers are keen to capture this market by launching products. For instance, in May 2020, United Breweries and Carlton launched Actual Vodka Seltzer with 4.2% ABV in two flavors-Pure and Lime-made with 100% natural ingredients to attract the growing vegan population in Australia.

Key Companies & Market Share Insights

The market is still in its nascent stage, where new entrants are launching products and other key players in the alcoholic beverages market are planning to launch their products due to the increasing popularity of these low-alcohol content beverages across the globe. Nowadays, drinks with natural ingredients, low calories, and health claims appeal the most to consumers, thus, manufacturers are focused on launching products with these attributes

Key Hard Seltzer Companies:

The following are the leading companies in the hard seltzer market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these hard seltzer companies are analyzed to map the supply network.

- Mark Anthony Brands International

- Carlsberg Group

- Anheuser-Busch InBev

- The Coca-Cola Company

- Diageo plc

- Heineken N.V.

- The Boston Beer Company

- Molson Coors Beverage Company

- Constellation Brands, Inc.

- Kopparberg

- San Juan Seltzer, Inc.

Recent Developments

-

In January 2022, Topo Chico Hard Seltzer released its new flavor, Topo Chico Ranch Water Hard Seltzer, in select regional markets and its variety pack nationwide. It is available in several states and comes in a 12-pack of slim cans with 4.7% alcohol by volume and 100 calories per can. Additionally, the existing variety pack of Topo Chico Hard Seltzer is expanding nationwide with four unique flavors.

-

In April 2021 HEINEKEN launched a new hard seltzer brand in Europe-Pure Piraña, which would be available in Austria, Ireland, Netherlands, Portugal, and Spain. It is crafted with carbonated purified water and natural flavorings with 4.5% alcohol and is available in three flavors, such as Lemon Lime, Red Berries, and Grapefruit.

-

In April 2021, Mark Anthony Brands- White Claw brand launched its first global marketing campaign in collaboration with a diverse group of creators from across the U.S. and around the world to capture unscripted, momentary content inspired by the feeling White Claw evokes

Hard Seltzer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.86 billion

Revenue forecast in 2030

USD 57.34 billion

Growth Rate (Revenue)

CAGR of 14.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

ABV Content, Packaging Type, Distribution Channel, and Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, China, India, Japan, South Korea, Australia & New Zealand, Brazil, South Africa, UAE

Key companies profiled

Mark Anthony Brands International; Carlsberg Group, Anheuser-Busch InBev; The Coca-Cola Company; Diageo plc; Heineken N.V.; The Boston Beer Company; Molson Coors Beverage Company; Constellation Brands, Inc.; Kopparberg; San Juan Seltzer, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hard Seltzer Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hard seltzer market report on the basis of product, packaging type, flavor, distribution channel, and region:

-

ABV Content Outlook (Revenue, USD Million, 2018 - 2030)

-

1.0% to 4.9%

-

5.0% to 6.9%

-

Others

-

-

Packaging Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass Bottles

-

Metal Cans

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Off-trade

-

On-trade

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Classic or unflavored

-

Flavored

-

Black Cherry

-

Lime

-

Ruby Grapefruit

-

Mango

-

Raspberry

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global hard seltzer market size was estimated at USD 13.48 billion in 2022 and is expected to reach USD 18.97 billion in 2023.

b. The global hard seltzer market is expected to grow at a compounded growth rate of 19.8% from 2023 to 2030 to reach USD 57.34 billion by 2030.

b. Off-trade segment dominated the global hard seltzer market with a share of 70% in 2022. This is attributed to the huge offers and discounts these stores offer.

b. Some key players operating in hard seltzer market include Mark Anthony Brands International, Carlsberg Group, Anheuser-Busch InBev, The Coca Cola Company, Diageo plc, Heineken N.V., The Boston Beer Company, Molson Coors Beverage Company, Constellation Brands, Inc. among others.

b. Key factors that are driving the market growth include surge in market demand for low-alcohol content beverages among millennials and the younger generation is propelled by their growing popularity.

b. The U.K. hard seltzer market is expected to grow at a compound annual growth rate of 60.2% from 2023 to 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.