- Home

- »

- Next Generation Technologies

- »

-

Alternative Data Market Size & Share, Industry Report, 2030GVR Report cover

![Alternative Data Market Size, Share & Trends Report]()

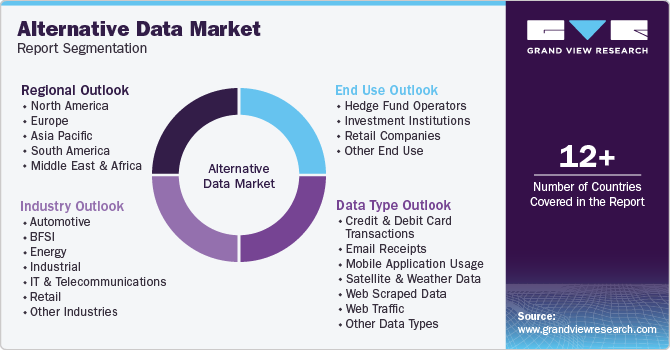

Alternative Data Market (2025 - 2030) Size, Share & Trends Analysis Report By Data Type (Credit & Debit Card Transactions, Email Receipts), By Industry (Automotive, BFSI), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-025-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alternative Data Market Summary

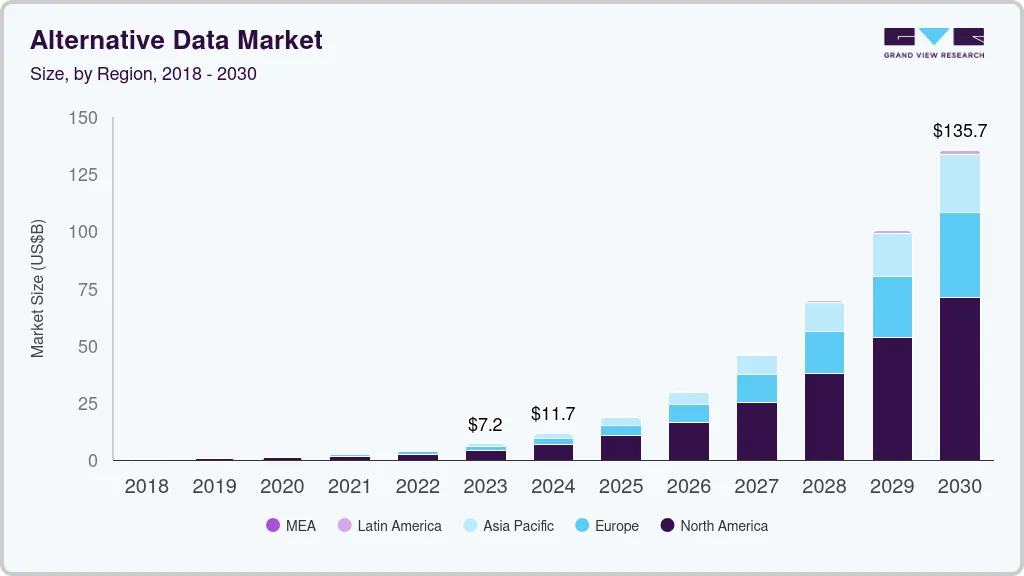

The global alternative data market size was estimated at USD 11.65 billion in 2024 and is anticipated to reach USD 135.72 billion by 2030, growing at a CAGR of 63.4% from 2025 to 2030. The growing use of alternative data in investment and financial services drives market growth.

Key Market Trends & Insights

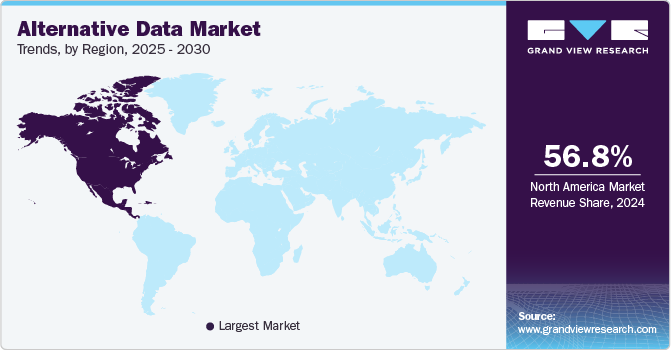

- North America alternative data market held a significant share of around 56.8% in 2024.

- The demand for alternative data in the U.S. is experiencing significant growth due to rise of fintech.

- Based on data type, the credit & debit card transactions segment dominated the market with a revenue share of 17.2% in 2024.

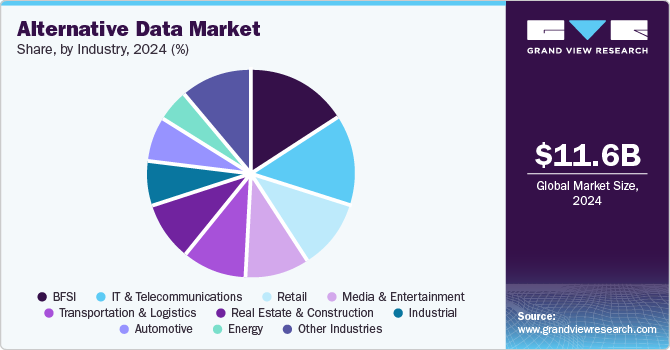

- Based on industry, the BFSI segment dominated the market with a revenue share of 16.5% in 2024.

- Based on end users, the hedge fund operators segment dominated the market with a revenue share of 68.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.65 Billion

- 2030 Projected Market Size: USD 135.72 Billion

- CAGR (2025-2030): 63.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Hedge funds, asset managers, and institutional investors are using alternative data to gain unique insights that give them an edge in the market. With access to datasets such as foot traffic in retail stores, sentiment analysis from social media, or geolocation data, investors make more accurate predictions about market trends and company performance. This real-time data allows for more agile decision-making in investment strategies, which is critical in the financial sector. According to the 2023 State of Alternative Credit Data Report, 62% of financial institutions utilize alternative data to enhance risk profiling and improve their credit decision-making processes.

The expansion of artificial intelligence (AI) and machine learning technologies is further fueling the growth of the alternative data market. These technologies enable businesses to analyze large, complex datasets more efficiently and derive actionable insights. Alternative data sources, which are often unstructured and come from various formats, are processed and analyzed with the help of AI to uncover patterns and trends that were previously difficult to detect. As AI and machine learning become more sophisticated, they enhance the value of alternative data by providing deeper insights faster, encouraging more companies to adopt alternative data solutions to stay ahead of their competition.

In addition, the growing volume of data generated from digital transformation and the Internet of Things (IoT) is significantly contributing to the expansion of the alternative data market. With the rapid increase in connected devices, sensors, and online activities, vast amounts of data are generated daily. When analyzed properly, this data provides companies with a deeper understanding of consumer behaviors, market trends, and operational efficiencies. In particular, the proliferation of IoT devices develops new streams of alternative data that businesses use to gain real-time insights. As digital transformation continues to accelerate across industries, the availability of alternative data will grow, further driving demand for tools and platforms to process and analyze these new data sources effectively.

Furthermore, the rise of sustainable and ESG (Environmental, Social, and Governance) investing is also fueling demand for alternative data. Investors and companies are under increasing pressure to demonstrate their commitment to sustainability, and alternative data provides the metrics needed to evaluate ESG factors effectively. For instance, satellite data track deforestation rates, water usage, or pollution levels near manufacturing plants, while social media can provide insight into public sentiment on sustainability practices. As more investors adopt ESG-focused strategies, they rely on alternative data to measure companies' true environmental and social impact, driving further growth in the alternative data market.

Data Type Insights

Based on data type, the market is segmented into credit & debit card transactions, email receipts, geo-location (foot traffic) records, mobile data type usage, satellite & weather data, social & sentiment data, web scraped data, web traffic, and other data types. The credit & debit card transactions segment dominated the market with a revenue share of 17.2% in 2024. The increased use of card transaction data for credit risk assessment drives market growth. Financial institutions and lenders are using credit and debit card data as an additional information layer to assess potential borrowers' creditworthiness.

Traditional credit scoring methods often overlook valuable consumer behavior insights that card transactions can provide, such as spending habits, cash flow patterns, and financial stability. By incorporating card transaction data, lenders develop more accurate credit models, reduce default risks, and extend credit to underbanked or thin-file customers. This shift towards more data-driven credit assessments fuels the demand for transaction-based alternative data in the financial services sector. According to an article published by The Federal Reserve, the rise in credit and debit card usage between 2022 and 2023 led to over 60% of monthly payments being made with credit cards (32%) and debit cards (30%).

The social & sentiment data segment is anticipated to grow significantly with a CAGR of 67.0% over the forecast period. The growth is attributed to the rising demand for smartphone usage from the retail industry. Retail companies utilize it to analyze the user’s e-commerce data type usage patterns. Further, retailers increasingly use sentiment data from social media websites to understand user interests from various groups and regions. Geolocation (foot traffic) from satellite images is also gaining popularity in analyzing customer store visits at a particular time and day, framing the operational strategies for operating the stores. Although these sources have low accuracy compared to transaction data, the companies are finding ways to connect the dots to derive insights.

Industry Insights

Based on industry, the market is segmented into automotive, BFSI, energy, industrial, IT & telecommunications, media & entertainment, real estate & construction, retail, transportation & logistics, and other industries. The BFSI segment dominated the market with a revenue share of 16.5% in 2024. The increasing use of alternative data for fraud detection and prevention drives the segment growth in the alternative data market.

In the BFSI sector, fraudulent activities such as identity theft, money laundering, and unauthorized transactions pose significant threats. To combat these, financial institutions leverage alternative data from various sources, including geolocation data, mobile device usage patterns, and behavioral analytics, to detect real-time anomalies. This ability to track non-traditional data points helps banks and insurance companies identify unusual activities that might go unnoticed by traditional monitoring systems. The need for robust fraud prevention strategies, especially in the age of digital payments, is pushing demand for alternative data solutions within the BFSI sector.

The retail segment is expected to grow significantly from 2025 to 2030. The expansion of e-commerce and omnichannel strategies is also fueling the adoption of alternative data in the retail sector. As more consumers shop online and through multiple channels, retailers seek alternative data to track and analyze customer behavior across various touchpoints. This includes data from mobile apps, online searches, and in-store foot traffic, which helps retailers create a seamless shopping experience across platforms. Integrating alternative data into e-commerce strategies also supports personalized product recommendations, dynamic pricing, and targeted advertising, which are critical for increasing conversion rates in the highly competitive retail landscape. According to a survey conducted by Harvard Business Review in 2023, around 62% of retailers globally had adopted omnichannel strategies, including services such as click-and-collect, online-to-offline (O2O) marketing, and integrated customer service systems.

End Use Insights

Based on end users, the industry is divided into hedge fund operators, investment institutions, retail companies, and other end users. The hedge fund operators segment dominated the market in terms of revenue with a revenue share of 68.0% in 2024. The increased integration of natural language processing (NLP) and sentiment analysis in investment decision-making drives market growth. Hedge funds leverage alternative data from news articles, earnings call transcripts, and social media posts to gauge sentiment around companies, sectors, or economic conditions. NLP tools enable funds to analyze these large, unstructured datasets and extract valuable insights into market sentiment, investor confidence, or public perception. By using these insights, hedge funds can adjust their portfolios in response to shifts in sentiment, allowing them to react more swiftly to market-moving events.

The retail segment is expected to emerge as the fastest-growing segment over the forecast period. The growing need for enhanced customer insights and personalized marketing drives market growth. Retailers increasingly recognize that traditional data sources, such as sales figures and demographic information, often fail to provide a comprehensive understanding of customer preferences and behaviors. Retailers gain deeper insights into consumer sentiment and purchasing behavior by leveraging alternative data, such as social media interactions, online reviews, and web traffic analytics. This data enables retailers to tailor their marketing strategies, optimize product end users, and create personalized shopping experiences that resonate with their target audience, ultimately driving sales and customer loyalty.

Regional Insights

North America alternative data market held a significant share of around 56.8% in 2024. The rise of the gig economy and freelance work is influencing the alternative data market in North America. As more individuals engage in gig work or freelance opportunities, businesses are increasingly interested in understanding the dynamics of this labor market. Alternative data can provide insights into gig worker availability, preferences, and income patterns, allowing companies to align their strategies with this evolving workforce better. The need to adapt to these changes fosters a demand for alternative data solutions that can help organizations tap into new opportunities the gig economy presents.

U.S. Alternative Data Market Trends

The Demand for alternative data in the U.S. is experiencing significant growth due to rise of fintech. As financial technology companies innovate and disrupt traditional banking and financial services, they increasingly rely on alternative data to assess creditworthiness and mitigate risk. For instance, fintech firms often use non-traditional data sources such as payment histories, utility bills, and even social media behavior to evaluate borrowers who may lack comprehensive credit histories. This approach expands access to credit for underserved populations and enhances the overall efficiency of lending processes.

Asia Pacific Alternative Data Market Trends

Asia Pacific region alternative data market is expected to achieve the fastest CAGR of 68.2% during the forecast period in the market. The growing trend of collaborative consumption is also impacting the alternative data market. As consumers increasingly adopt sharing economies and collaborative consumption models, businesses leverage alternative data to understand these markets' dynamics better. Companies identify emerging trends and consumer preferences by analyzing data related to shared services, peer-to-peer platforms, and subscription models. This understanding allows businesses to tailor their end users and marketing strategies to align with the evolving landscape of consumer behavior, thus capturing new market opportunities.

Key Alternative Data Company Insights

Some of the key players operating in the market include Dataminr and Preqin, among others.

-

Dataminr is a real-time information discovery and alerts company that analyzes publicly available data to provide actionable insights for various industries. Dataminr’s flagship products include Dataminr for News, Dataminr for Risk, Dataminr for Sports, customizable alerts, and alternative data. Moreover, Dataminr has developed partnerships with major platforms such as Twitter, which allows the company to access and analyze vast amounts of real-time data generated on social media. This collaboration enhances Dataminr’s ability to provide accurate and relevant insights, further solidifying its position in the alternative data market.

UBS Evidence Lab and YipitDataare some of the emerging market participants in the target market.

-

YipitData is an alternative data provider primarily delivering insights and analytics from many non-traditional data sources. YipitData's core end users include data derived from various sources, such as consumer transaction data, web scraping, app usage data, and more. By aggregating this information, the company provides detailed market insights to inform investment strategies across multiple sectors, including e-commerce, technology, and consumer goods. YipitData competes with several other firms, such as Quandl, RavenPack, and Second Measure, all end users varying data analytics and insights.

Key Alternative Data Companies:

The following are the leading companies in the alternative data market. These companies collectively hold the largest market share and dictate industry trends.

- 1010Data

- Advan

- Dataminr

- Earnest Analytics

- M Science

- Preqin

- RavenPack

- Thinknum Alternative Data

- UBS Evidence Lab

- YipitData

Recent Developments

-

In October 2024, Earnest Analytics, a data analytics company serving investors, businesses, and consulting firms, launched the Earnest Analytics Spend Index (EASI). This EASI is an alternative data-driven assessment of consumer activity by monitoring spending across 89 merchant category codes (MCC) and including thousands of U.S. merchants. The near real-time data is sourced from millions of de-identified U.S. consumers' credit and debit card transactions.

-

In August 2024, Bipsync, a research and workflow automation software provider, announced a data integration partnership with Preqin, a company specializing in alternative assets data, tools, and insights. This collaboration will enable Bipsync users to access the latest Preqin data on investors, private equity, venture capital, hedge funds, and more. The partnership aims to enhance the experience for clients across all asset classes and strategies, including investors, asset allocators, and fund managers, by providing them with top-tier alternative data to improve decision-making.

Alternative Data Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.74 billion

Revenue forecast in 2030

USD 135.72 billion

Growth rate

CAGR of 63.4% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Data type, industry, end use, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key Companies Profiled

1010Data; Advan; Dataminr; Earnest Research; M Science; Preqin; RavenPack; Thinknum Alternative Data; UBS Evidence Lab; YipitData

Customization Scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alternative Data Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global alternative data market based on data type, industry, end use, and region.

-

Data Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Credit & Debit Card Transactions

-

Email Receipts

-

Geo-location (Foot Traffic) Records

-

Mobile Application Usage

-

Satellite & Weather Data

-

Social & Sentiment Data

-

Web Scraped Data

-

Web Traffic

-

Other Data Types

-

-

Industry Outlook (Revenue, USD Billion, 2017 - 2030)

-

Automotive

-

BFSI

-

Energy

-

Industrial

-

IT & Telecommunications

-

Media & Entertainment

-

Real Estate & Construction

-

Retail

-

Transportation & Logistics

-

Other Industries

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hedge Fund Operators

-

Investment Institutions

-

Retail Companies

-

Other End Use

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alternative data market size was estimated at USD 11.65 billion in 2024 and is expected to reach USD 18.74 billion in 2025.

b. The global alternative data market is expected to grow at a compound annual growth rate of 63.4% from 2025 to 2030 to reach USD 135.72 billion by 2030.

b. North America dominated the alternative data market with a share of over 56% in 2024. This is attributable to the presence of numerous players such as Advan, Dataminr, Eagle Alpha, M Science, and UBS Evidence Lab in the region.

b. Some key players operating in the alternative data market include 1010Data, Advan, Dataminr, Earnest Research, M Science, Preqin, RavenPack, Thinknum Alternative Data, UBS Evidence Lab, and YipitData.

b. Key factors that are driving the alternative data market growth include a significant increase in the types of alternative data sources over the last decade and rising demand for alternative data among hedge fund managers to gain alpha.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.