- Home

- »

- Next Generation Technologies

- »

-

Alternative Lending Platform Market Size Report, 2030GVR Report cover

![Alternative Lending Platform Market Size, Share & Trends Report]()

Alternative Lending Platform Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution, By Service, By Deployment, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-960-5

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Alternative Lending Platform Market Summary

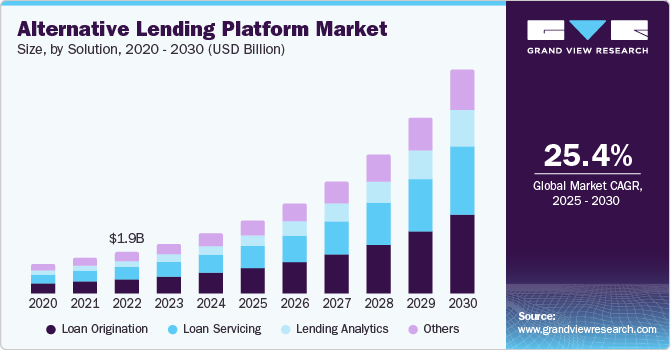

The global alternative lending platform market size was estimated at USD 3,817.9 million in 2024 and is projected to reach USD 14,466.9 million by 2030, growing at a CAGR of 25.4% from 2025 to 2030. The alternative lenders can penetrate the market due to their ability to provide effective and efficient loan services to underserved firms and individuals.

Key Market Trends & Insights

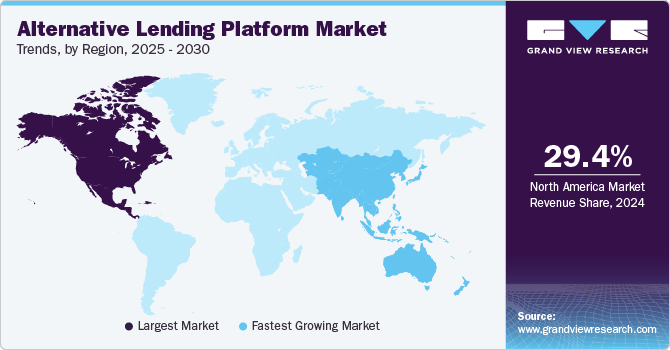

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, U.S. is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, solution accounted for a revenue of USD 2,765.0 million in 2024.

- Service is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,817.9 Million

- 2030 Projected Market Size: USD 14,466.9 Million

- CAGR (2025-2030): 25.4%

- North America: Largest market in 2024

The faster credit approval processes and ease of accessing the online platforms are also anticipated to boost the growth. Adopting technologies such as blockchain and Artificial Intelligence (AI) is likely to enhance the experience for lenders and borrowers, thus fueling the industry’s growth.

The digital transformation in financial processes is expected to make it transparent and relatively more reliable for end users as compared to the traditional approach. Moreover, in alternative lending platforms, lending decisions are made by computer algorithms in real-time. Consequently, the growing popularity of such platforms in developed countries is expected to propel market growth. In addition, the ascending markets of developing countries with relatively lower exposure to formal financing services create a positive outlook for the industry.

The rising student population will likely create further opportunities as most students look for loans at a considerably lower interest rate. Various types of alternative lending platforms can offer lower interest rates as the cost of operations is less than that of traditional lenders. Moreover, the emergence of startups and fintech lending companies also bodes well for the industry as these companies are considered high-risk ventures. Alternative lending platforms provide financing to such ventures even without a mortgage and to borrowers with no credit history. The strict lending regulations among legacy financing institutions increase the need for these platforms.

Moreover, both individual and institutional investors consider alternative lending an efficient asset class as it is the least volatile investment substitute. Investment in this newly emerged asset class is simple and provides reasonable returns over a short span. Financial regulators are attempting to discover ways to govern this ever-changing alternative financing market so that it can grow safely. The regulators have established sandboxes in many industrialized nations, including the U.S, Australia, the UK, and Singapore, to promote and accelerate the sector's advancements.

However, the potential risk of investors losing their money as a result of repayment defaults is expected to be a significant impediment to the development of the market. Such risks arise as most borrowers on the alternative lending platform don't have a good credit score. Although, lenders on the alternative lending platform let the borrowers qualify based on sales figures. Despite this, such risks can be mitigated with the integration of blockchain to increase the authenticity and security of lenders and borrowers.

Solution Insights

The loan origination segment dominated the market in 2024 and accounted for a 6share of more than 34.0% of the global revenue. The dominance is attributable to the growing popularity of alternative lending platforms as many individuals, especially students, are applying for personal and education loans. Several non-bank institutions such as insurance companies and fund managers previously invested in securitized products are exploring the growth potential. They offer credit to startups and SMEs in their developing phase.

The lending analytics segment is anticipated to witness significant growth over the forecast period. The growth is driven by the growing adoption of tools such as data analytics and predictive analytics in financing activities to reduce operational costs and maximize profitability. Improved customer acquisition and enhanced consumer experience contribute to the growth. Moreover, the efficient lifecycle management of the loans is one of the principal elements responsible for the growth of the segment.

Service Insights

The integration & deployment segment dominated the market in 2024.The growing prevalence of alternative lending and the rising awareness of digital means of financing are propelling the segment’s growth. Continuous improvement in customer acquisition and the growing demand for matching the right lender with the borrowers are responsible for increasing the need for these services. Moreover, the flexibility to pick the deployment model as per various attributes such as security, budget, organizational needs, and infrastructure capability is also an important factor in boosting the growth of the segment.

The managed services segment is expected to register the fastest CAGR over the forecast period.Managed services can help the institutions to cope with the rapidly changing industry trends and technological advancements. Businesses cannot maintain their line of operations while keeping up with the most recent IT trends. With the help of managed services, businesses are empowered to focus on what they do best. Additionally, the technology partners support these efforts with strong IT support; hence the segment is growing significantly.

Deployment Insights

The on-premise segment dominated the market in 2024.Although the lending industry is steadily adopting the cloud, many lenders still view this as a barrier since they are apprehensive about data security. They choose on-premise deployment over the cloud because they are unfamiliar with the technology and concerned about losing control over their data. The data kept with lending institutions are sensitive and can be stolen or misused. As a result, businesses are still preferring on-premise deployment.

The cloud segment is anticipated to grow at the fastest CAGR over the forecast period.In addition to offering a comprehensive view of client relationships to provide a better customer experience, cloud technology also reduces overall costs and improves operational efficiency. Furthermore, adopting cloud-based deployment enables remote access, which increases business flexibility. Several players are deploying cloud-based models to gain a competitive edge over their peers.

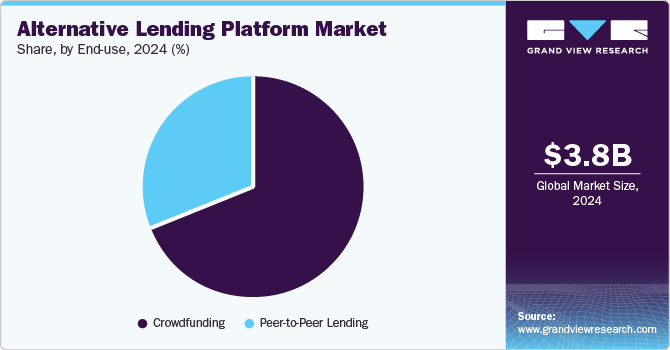

End-use Insights

The crowdfunding segment dominated the market in 2024.The growing prevalence of social media platforms contributes to the segment's dominance as it acts as a low-cost promotional tool for crowdfunding platforms. The global reach of social media provides the necessary push to the crowdfunding campaigns to onboard a pool of investors from around the globe. Several crowdfunding platforms are also utilized to raise funds for various initiatives or fight a cause, thus creating a positive outlook for the segment.

The peer-to-peer lending segment is anticipated to grow at a promising CAGR during the forecast period. The proliferation of smartphones and internet penetration is driving the segments’ growth as P2P lending platforms are run primarily via the internet using laptops or smartphones. In addition, the advantages associated with it, such as relatively low operational cost compared to legacy platforms, fuel the segments' growth. Moreover, the convenience of getting a loan and easy accessibility also bodes well for growth.

Regional Insights

North America dominated the alternative lending platform market in 2024. In addition, technological advancements and adoptions are also contributing to regional market growth. For instance, in June 2022, StellarFi, the U.S.-based public benefit corporation, launched its fintech platform, which is expected to help its users build their credit scores by paying their liabilities timely.

U.S. Alternative Lending Platform Market Trends

The alternative lending platform market in the U.S. is anticipated to register a significant growth from 2024 to 2030. The U.S. alternative lending market is rapidly growing as digital platforms leverage AI and big data to offer faster, more flexible loan approvals. Increasing demand for personalized financial solutions is driving the shift away from traditional banking models.

Asia Pacific Alternative Lending Platform Market Trends

Asia Pacific is expected to grow at the highest CAGR over the forecast period. The growth of the regional market can be attributed to the growing awareness in countries such as China, India, and Japan, about the benefits offered by alternative lending platforms. The aggressive efforts being pursued by various organizations across the Asia Pacific to promote the utilization of alternative lending platforms are also expected to contribute to the growth of the regional market. For instance, in June 2022, a Singapore-based startup named Helicap raised USD 6.94 million in funding, and it has developed a technology for crunching data points of loans which can help in evaluating the creditworthiness of over 500 lenders across South East Asia and Oceania.

The China alternative lending platform market is anticipated to register a significant growth from 2024 to 2030. The market growth is driven by the country’s rapid digital transformation and the increasing demand for consumer and SME financing. With a significant portion of the population still underserved by traditional banks, alternative lending platforms, particularly peer-to-peer (P2P) lending, have grown rapidly to meet these financing gaps.

Europe Alternative Lending Platform Market Trends

The alternative lending platform market in Europe is poised for significant growth from 2024 to 2030. As traditional banks maintain stringent lending criteria, many small and medium-sized enterprises (SMEs) and individual borrowers are turning to alternative platforms for faster, more flexible financing options. The rise of fintech and peer-to-peer (P2P) lending platforms has significantly contributed to this shift, offering innovative solutions powered by artificial intelligence and data-driven credit assessments. Furthermore, the COVID-19 pandemic accelerated the demand for digital lending services, as businesses sought quick, remote access to capital.

The UK alternative lending platform market is anticipated to register a significant growth from 2024 to 2030. In the UK, the market is driven by increasing demand for flexible financing solutions among small and medium-sized enterprises (SMEs) and individuals. The UK’s highly developed fintech ecosystem and favorable regulatory environment have allowed alternative lending platforms to flourish, offering faster access to credit through digital means.

The alternative lending platform market in Germany is anticipated to register a significant growth from 2024 to 2030.In Germany, the alternative lending market is experiencing rapid growth, largely due to the rise in digital transformation and the need for SMEs to secure capital more easily. With Germany’s traditionally conservative banking system making it harder for smaller businesses to access loans, alternative lending platforms have gained traction by offering more agile and personalized financing solutions.

Key Alternative Lending Platform Company Insights

Key players such as Funding Circle, On Deck Capital, and Kabbage have emerged as leading solution providers in this space, focusing on offering streamlined, digital lending solutions for small businesses and individual borrowers. These companies leverage sophisticated data analytics and artificial intelligence to improve credit assessments and decision-making processes, enabling faster and more accessible loans.

To maintain their market positions, companies in the alternative lending space are taking various strategic initiatives, such as launching new products, forming partnerships, and pursuing mergers and acquisitions.

-

Funding Circle continues to innovate by offering tailored lending solutions for small and medium-sized enterprises (SMEs) through its online platform, which connects businesses directly with investors.

- On Deck Capital focuses on enhancing its platform’s ability to provide fast, flexible financing options, particularly for businesses that may not meet traditional banking criteria.

Key Alternative Lending Platform Companies:

The following are the leading companies in the alternative lending platform market. These companies collectively hold the largest market share and dictate industry trends.

- Funding Circle

- On Deck Capital

- Kabbage

- Social Finance, Inc.

- Prosper Funding LLC

- Avant, LLC

- Zopa Bank Limited

- LendingClub Bank

- Upstart Network, Inc.

- CommonBond, Inc.

Recent Developments

-

In April 2024, Teylor announced acquisition of German SME financing platform Creditshelf, positioning itself as the digital market leader in the European SME lending space, valued at over USD 1.1 trillion. This strategic acquisition strengthens Teylor's origination capabilities and expands its product offering, with debt instruments ranging from USD 106,000 to USD 5.3 million. With approximately USD 1.06 billion in assets originated to date, the acquisition also allows Teylor to integrate Creditshelf’s expert team and differentiated underwriting technology. This move solidifies Teylor’s leadership in providing a wide array of financing solutions for SMEs across Europe.

Alternative Lending Platform Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.66 billion

Revenue forecast in 2030

USD 14.47 billion

Growth rate

CAGR of 25.4% from 2025 to 2030

Base year of estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Funding Circle; On Deck Capital, Inc.; Kabbage; Social Finance, Inc.; Prosper Funding LLC; Avant, LLC.; Zopa Bank Limited; LendingClub Bank., Upstart Network, Inc.; CommonBond, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alternative Lending Platform Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the alternative lending platformmarket report based on solution, service, deployment, end-use, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Loan Origination

-

Loan Servicing

-

Lending Analytics

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Integration & Deployment

-

Support & maintenance

-

Training & Consulting

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Cloud

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Crowdfunding

-

Peer-to-Peer Lending

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alternative lending platform market size was estimated at USD 3.82 billion in 2024 and is expected to reach USD 4.66 billion in 2025.

b. The global alternative lending platform market is expected to grow at a compound annual growth rate of 25.4% from 2025 to 2030 to reach USD 14.47 billion by 2030.

b. North America dominated the alternative lending platform market with a share of 29.41% in 2024. The dominance is attributable to the presence of several key players in the region. In addition, technological advancements and adoptions are also contributing to regional market growth.

b. Some key players operating in the alternative lending platform market include Funding Circle; On Deck Capital, Inc.; Kabbage; Social Finance, Inc.; Prosper Funding LLC; Avant, LLC.; Zopa Bank Limited; LendingClub Bank., Upstart Network, Inc.; CommonBond, Inc.

b. Key factors that are driving the alternative lending platform market growth include the rising adoption of digital channels to improve the customer experience and the rising adoption of machine learning, blockchain, and AI-based alternative lending platforms and solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.