- Home

- »

- Advanced Interior Materials

- »

-

Aluminum Extrusion Market Size, Industry Report, 2030GVR Report cover

![Aluminum Extrusion Market Size, Share & Trends Report]()

Aluminum Extrusion Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Shapes, Rods & Bar, Pipes & Tubes), By Application (Building & Construction, Automotive & Transportation, Consumer Goods, Electrical & Energy), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-700-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aluminum Extrusion Market Summary

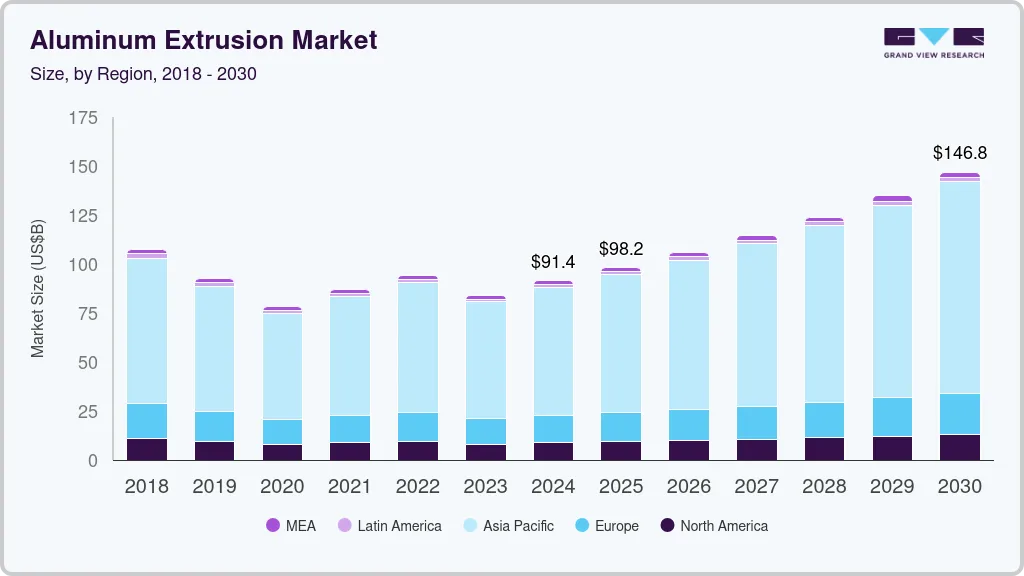

The global aluminum extrusion market size was estimated at USD 91.38 billion in 2024 and is projected to reach USD 146.82 billion by 2030, growing at a CAGR of 8.4% from 2025 to 2030. The automotive and transportation industry is experiencing a rise in the utilization of aluminum in both traditional internal combustion vehicles and Electric Vehicles (EVs), contributing to potential market expansion.

Key Market Trends & Insights

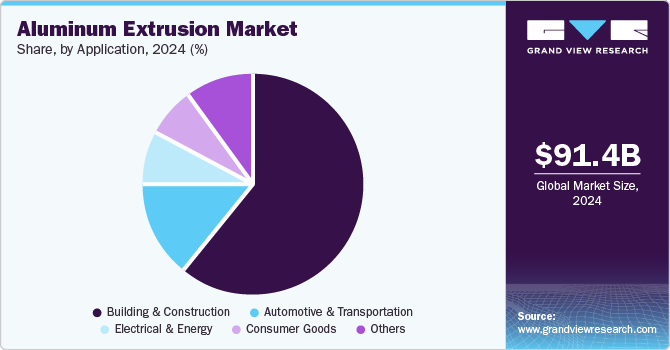

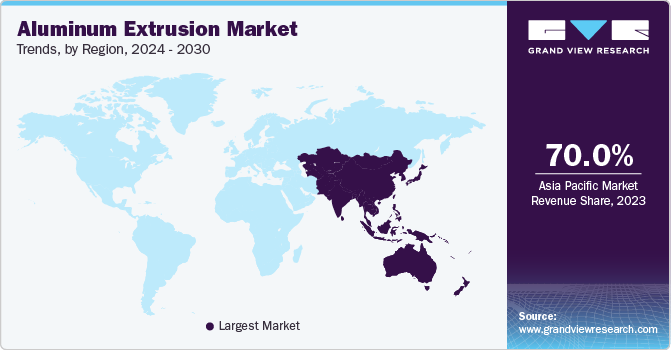

- Asia Pacific aluminum extrusion market dominated the global industry in 2024 and accounted for the largest revenue share of more than 71.0%.

- By product, the shapes segment accounted for the largest revenue share of 79.0% in 2024.

- By application, the building & construction sector accounted for the largest revenue share of over 60.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 91.38 Billion

- 2030 Projected Market Size: USD 146.82 Billion

- CAGR (2025-2030): 8.4%

- Asia Pacific: Largest market in 2024

Auto manufacturers face challenges in complying with regulatory mandates concerning the environmental footprint of their vehicles. Agencies, such as the National Highway Traffic Safety Administration (NHTSA), the California Air Resources Board (CARB), and the U.S. Environmental Protection Agency (EPA), have enacted rules and regulations regarding Greenhouse Gas (GHG) emissions.

For instance, according to emission regulations issued by the NHTSA, stringency pertaining to fuel economy and carbon dioxide emissions increased by 1.5% from 2021 to 2026. This is anticipated to augment demand for automotives and different aluminum components over the projected period.

The U.S. is a significant aluminum extrusion producer and consumer. The aerospace and defense, automotive, and construction sectors in the U.S. have faced significant repercussions from economic fluctuations, leading to a decreased demand for extruded products. Negative sentiments surrounding new construction projects directly contributed to a decline in the volume of aluminum extrusion in the U.S. throughout fiscal year 2022. However, demand for construction activities has recovered gradually over a period of one year in 2023.

Construction activities were propelled owing to the announcements of mega projects such as the Gordie Howe International Bridge, the Hudson Tunnel Project, and JFK Airport Expansion, among others. These projects have led to the opening of material inflow for construction purposes. The low costs and weight of extrusion products contribute to their rising demand in various industrial applications, mainly in automotive and aerospace & defense sectors.

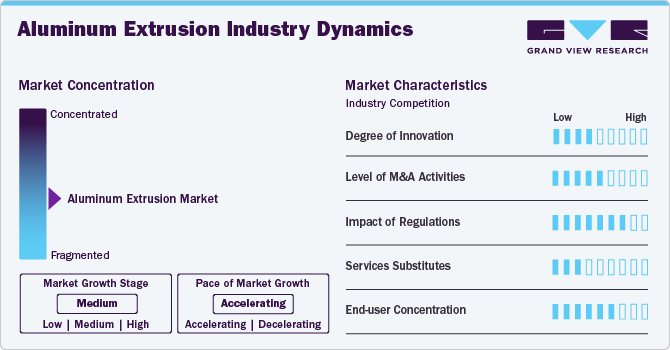

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The industry is characterized by rising demand for extruded products and growing adoption of aluminum extrusion, owing to the adoption of lightweight aluminum parts from various industries such as aerospace, automotive, and the construction industry. The industry is severely impacted by amendments in regulations and the degree of innovation.

The industry is also characterized by a high level of merger and acquisition (M&A) activity by leading aluminum extrusion manufacturers. Emerging players in the market resort to long-term agreements and collaboration in a competitive market. This is due to several factors, including the desire to gain market share and the need to consolidate in a growing market.

The market is also subject to increasing end-user concentration. Governments around the world are developing regulations on end-use industries that are impacting the industry. Regulations pertaining to the mining of bauxite and the production of aluminum could have a significant impact on the market, affecting the development and adoption of extrusion products.

There are a limited number of direct product substitutes for aluminum extruded products owing to its unique characteristics, such as lightweight, high strength, and corrosion resistance, among others. However, there are a number of technologies that can be used to achieve similar production outcomes in aluminum extrusion, such as automation, hot extrusion, and direct extrusion. These production technologies can be used as methods for extruding to achieve certain characteristics and improve the performance of aluminum extruded products.

Product Insights

The shapes segment accounted for the largest revenue share of 79.0% in 2024. Aluminum's remarkable malleability facilitates seamless production of various shapes through the extrusion process. In this method, aluminum billets undergo heating and are subjected to high pressure using a ram or hydraulic press against steel dies. Subsequently, aluminum shapes are created, precisely mirroring the contours of the dies.

Within the automotive and transportation industry, aluminum shapes find applications in various components such as transmission housings, chassis, panels, engine blocks, and roof rails for a wide range of vehicles, including cars, trucks, railways, and boats. Rising demand for structural elements in vehicles is driven by the objective of achieving lighter weight. A notable instance is the construction of the Ford F-150 model, which incorporates substantial aluminum components and the vehicle's weight is significantly influenced by the utilization of aluminum in body panels and extruded shapes.

In the extrusion process, aluminum billets undergo heating and are subsequently passed through a sequence of rolls. The material is then coiled and drawn into rods, bars, and tubes through finely crafted dies. Rods and bars find extensive application in construction, particularly in the creation of scaffolding systems. These lightweight scaffolding systems present several advantages over conventional alternatives, including enhanced stability, reduced weight, and increased flexibility.

Application Insights

The building & construction sector accounted for the largest revenue share of over 60.0% in 2024. Use of extruded products in construction activities has been greatly influenced by investment in the housing sector. China currently holds a leading position in the construction sector, boasting the highest nominal value. Ongoing efforts of various countries to invest in new housing development are poised to contribute to the growth of this segment over the coming years.

The automotive and transportation sector, ranking as the second-largest in terms of volume share in 2023, is anticipated to experience a lucrative CAGR throughout the forecast period. Aluminum extrusions play a crucial role in vehicles, with wide-ranging applications including engine mounts, anti-intrusion beams, radiator beams, fuel distribution pipes, longitudinal beams, seat tracks, cross rails, roof rails, and tailgate frames, underbody space frame rockers, among other components.

Consumer goods accounted for the lowest market share in 2024 as the aluminum applications in consumer goods are lower compared to other sub-segments. Nevertheless, the anticipated surge in consumer goods manufacturing is poised to drive the need for aluminum extrusions, particularly in the production of furniture, sporting equipment, toys, refrigerators, freezers, and other significant appliances throughout the projected period. Extruded components, including sheets, tailored shapes, and bars, are extensively employed in the consumer goods industry. Customized extruded shapes find broad application in computer devices, audio-video systems, and various appliances. The escalating production of these devices and appliances is expected to contribute to a heightened demand for the product in the upcoming years.

Regional Insights

North America aluminum extrusion market is witnessing robust growth due to expanding applications across various industries, including construction, transportation, consumer goods, and renewable energy. The region's strong manufacturing base, coupled with technological innovation, supports the production of high-performance aluminum extrusions tailored to meet evolving industry standards. The shift toward sustainable materials and circular economy practices is also fueling demand, as aluminum is 100% recyclable without losing its properties. Additionally, rising investments in renewable energy infrastructure, such as solar panel framing and mounting systems, are creating new avenues for aluminum extrusions across the continent.

U.S. Aluminum Extrusion Market Trends

The automotive industry is a significant growth driver for the aluminum extrusion market in the U.S., driven by the push toward vehicle lightweighting to improve fuel efficiency and meet stringent emission regulations. Electric vehicles (EVs) particularly benefit from aluminum's properties, as manufacturers seek to extend battery range without compromising structural integrity. Furthermore, advancements in extrusion technology have enabled more complex and high-performance aluminum components, opening up new applications in aerospace, industrial machinery, and consumer goods. This technological evolution, combined with reshoring trends and domestic manufacturing incentives, is propelling the U.S. aluminum extrusion market forward.

Asia Pacific Aluminum Extrusion Market Trends

Asia Pacific aluminum extrusion market dominated the global industry in 2024 and accounted for the largest revenue share of more than 71.0%. The region will retain its dominant position throughout the forecast years due to the presence of major manufacturing sectors in countries, such as China, India, Vietnam, Japan, and South Korea. China is anticipated to be a pivotal driver of industry expansion among the mentioned countries, chiefly propelled by its expansive construction sector.

The Chinese government's strategic investments in transportation and energy infrastructure are expected to have a positive impact on market growth in the foreseeable future. In terms of revenue, North America is forecasted to experience substantial growth between 2024 and 2030. The resumption of commercial operations post-pandemic and recessionary pressures is anticipated to boost market growth.

Europe Aluminum Extrusion Market Trends

The aluminum extrusion market in Europe is driven by the diminishing production of the European automotive sector, which is impacting the need for aluminum and its products. In an effort to recover from this setback, manufacturers in the region have collaborated to foster the development of the automotive industry. They are endorsing specific initiatives, like the vehicle-renewal program, which concentrates on promoting sales of environmentally friendly vehicles, including clean ICEs and EVs.

Key Aluminum Extrusion Company Insights

Some of the key players operating in the market include Arconic Corp., Hindalco Industries Ltd., and Norsk Hydro ASA.

-

Hindalco Industries Ltd provides a wide range of extruded products and has increased the number of production plants across various regions through investments, collaboration, and strategic partnerships in order to expand its business. Further, it has gained economies with scale at such mass levels of production of aluminum extruded products.

-

Norsk Hydro ASA is amongst the market leaders in the aluminum extrusion industry. It has resorted to multiple acquisitions across various regions to expand its business footprint and sustain market share in such a competitive market.

Balexo Bahrain Aluminum Extrusion Company and QALEX are some of the emerging market participants in the aluminum extrusion market.

- QALEX is an aluminum extrusion company offering high-quality extruded products in the region. The company has started acquiring small-sized market players in the country to expand its reach across the country. For instance, the recent acquisition of Abdul Noor Ahmed Extrusion Factory in the country.

Key Aluminum Extrusion Companies:

The following are the leading companies in the aluminum extrusion market. These companies collectively hold the largest market share and dictate industry trends.

- Alupco

- Arconic Corp.

- Bahrain Aluminum Extrusion Company

- Constellium N.V.

- Gulf Extrusions Co. LLC

- Hindalco Industries Ltd.

- Kaiser Aluminum

- Norsk Hydro ASA

- QALEX

Recent Developments

-

In September 2023, Hindalco Industries Ltd and Metra SpA entered into a partnership agreement to build aluminum rail coaches. The Italian company will assist the Indian manufacturer with the latest aluminum extrusion technology for building railway coaches.

-

In December 2022, Norsk Hydro ASA acquired Hueck’s Aluminum in Germany. The Norway-based market leader has acquired German aluminum extrusion and window, façade, and door system manufacturers to expand its business portfolio across the European region. This acquisition will enhance Norsk’s stake in the German market and enable both businesses to grow simultaneously.

Aluminum Extrusion Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 98.20 billion

Revenue forecast in 2030

USD 146.82 billion

Growth rate

CAGR of 8.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Brazil; and Saudi Arabia

Key companies profiled

Alupco; Arconic Corp.; Bahrain Aluminum Extrusion Company; Constellium N.V.; Gulf Extrusions Co. LLC; Hindalco Industries Ltd.; Kaiser Aluminum; Norsk Hydro ASA; QALEX

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aluminum Extrusion Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aluminum extrusion market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Shapes

-

Rods & Bar

-

Pipes & Tubes

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Consumer Goods

-

Electrical & Energy

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.