- Home

- »

- Advanced Interior Materials

- »

-

Bauxite Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Bauxite Market Size, Share & Trends Report]()

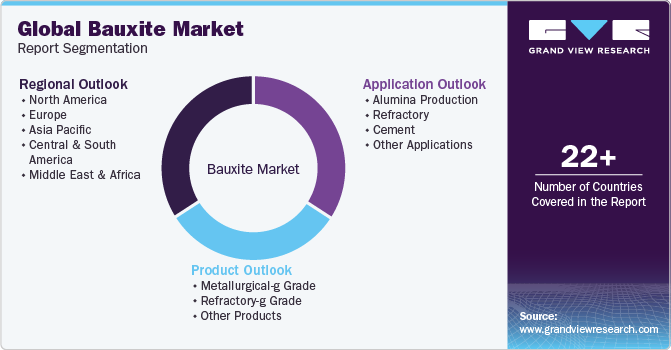

Bauxite Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Metallurgical-grade, Refractory-grade), By Application (Alumina Production, Refractory, Cement), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-637-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bauxite Market Summary

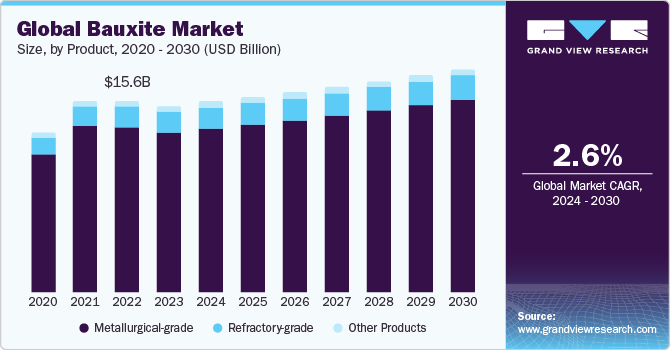

The global bauxite market size was estimated at USD 15.17 billion in 2023 and is projected to reach USD 18.15 billion by 2030, growing at a CAGR of 2.6% from 2025 to 2030. Favorable government policies for electric vehicles (EVs) and rising investment in the production of lightweight vehicles are anticipated to propel demand for aluminum. This trend is likely to prove fruitful for the industry growth.

Key Market Trends & Insights

- The Bauxite Market in Asia Pacific held the largest revenue share of over 81.0% in 2023.

- The U.S. bauxite market is anticipated to register a growth rate of 4.4% during the forecast period.

- Based on product, the metallurgical-grade segment held the largest revenue share of over 85.0% in 2023.

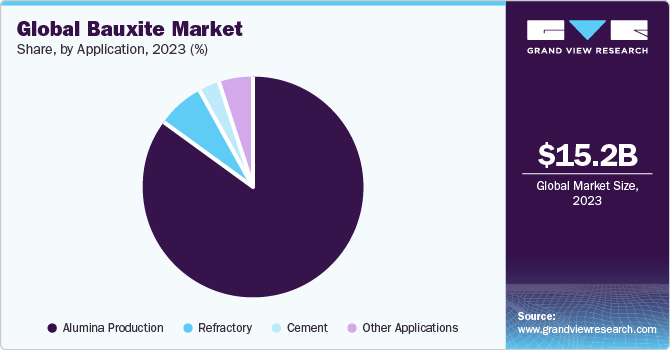

- Based on application, the alumina production segment accounted for the largest revenue share of over 85.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 15.17 Billion

- 2030 Projected Market Size: USD 18.15 Billion

- CAGR (2024-2030): 2.6%

- Asia Pacific: Largest market in 2024

For instance, in February 2022, Volvo Cars decided to invest in aluminum mega-casting in its Torslanda manufacturing plant in Sweden. The investment is worth USD 1.1 billion, and the mega-casting makes the production process less complex and reduces the overall environmental footprint.

The U.S. holds the largest share of the North American bauxite market. The rise in aluminum and cement production is expected to benefit market growth. According to the Aluminum Association, in the U.S., the amount of aluminum is expected to grow to 514 pounds (lbs) per vehicle by 2026 as it is the most used material by automakers. Rising demand for aluminum flat-rolled products in automotive industries is making its manufacturers increase their production capacity, thereby fueling the demand for bauxite. For instance, in April 2023, RMK Industries LLC started utilizing new technology-based equipment for manufacturing aluminum sheets used for developing heat- and weather-resistant facades used in construction.

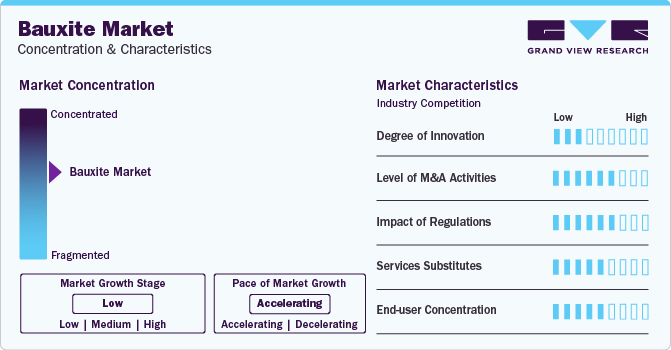

Market Concentration & Characteristics

The global bauxite market is highly competitive owing to the presence of several manufacturers. To gain an advantage over their competitors, companies pursue mergers, acquisitions, and capacity expansion strategies.

Some of the key manufacturers include Alcoa Corp., Rusal, South32, Norsk Hydro ASA, Rio Tinto, and Aluminum Corp. of China Ltd. (CHALCO), among others. Moreover, several key players are vertically integrated across the value chain. They engage in the mining of bauxite, and further producing and distributing alumina, and aluminum products to a range of end-use industries. These strategies enable companies to control production costs, leading to competitive pricing for their products.

Magnesium alloy and carbon fiber are primary substitutes for aluminum in the automotive sector. Magnesium alloys offer better machinability along with dent resistance, which favors their demand. Furthermore, they also shield from damped vibrations and electromagnetic radiations. These advantages are anticipated to negatively impact market growth over the forecast period.

Product Insights

The metallurgical-grade segment held the largest revenue share of over 85.0% in 2023 and this trend is anticipated to continue over the forecast period. Bauxite contains alumina in the range of 50-55%. Increasing demand for alumina from various industries, such as automotive & transportation, packaging, and building & construction, is expected to propel the product demand. Refractory-grade bauxite contains high alumina content (59%- 61%). The product can resist cracking, physical & chemical reactions, and spalling.

It is suitable for manufacturing combustion lining for boilers, furnace parts, and regenerator walls and checkers. Rising investments in refractory manufacturing facilities are anticipated to augment the demand for refractory-grade products over the forecast period. For instance, in January 2022, Harbison Walker International (HWI), a leading supplier of refractory products, decided to invest USD 25 million in setting up a facility for the manufacturing and distribution of refractory products.

Application Insights

The alumina production segment accounted for the largest revenue share of over 85.0% in 2023 and this trend is expected to continue over the forecast period. Alumina is derived from bauxite and is widely used in various industries owing to its properties, such as high chemical stability in different environments, high melting point, hardness strength, and electrical resistance. Refractory is one of the important application segments of the market. It is a material installed inside a furnace to protect structures from corrosive environments and high temperatures. Refractories are used in various industries including steel, glass, ceramics, cement, and petrochemicals.

Cement is another key application segment of the market and is expected to register rapid growth over the forecast period. Bauxite residue has been used as an additive for the production of Portland cement clinkers. Major countries that currently utilize bauxite residue in their respective cement sectors include Greece, India, Ukraine, China, Moldova, Georgia, and Russia. Manufacturers are collaborating with the cement industry for the production of cement from bauxite residues. For instance, in February 2022, Vedanta Aluminium, India, collaborated with the cement industry to utilize their bauxite residue for cement manufacturing.

Regional Insights

The bauxite market in North America is expected to register the fastest CAGR from 2024 to 2030. The region has a presence of several end-use industries. Moreover, various automobile plants and a robust construction industry in the region will support market growth.

U.S. Bauxite Market Trends

The U.S. bauxite market is anticipated to register a growth rate of 4.4% during the forecast period. The strong presence of numerous end-users in the region along with large-scale automobile plants, a robust construction industry, and infrastructural developments are boosting the demand for alumina, which is further anticipated to benefit the demand for bauxite.

Europe Bauxite Market Trends

The bauxite market in Europe accounted for the second-largest revenue share in 2023. The region is investing in decarbonizing by increasing the usage of aluminum in lightweight mobility, construction of energy-efficient buildings, and making packaging more efficient. This trend has increased the consumption of bauxite in Europe

The Germany bauxite market will have significant growth over the forecast period. Germany is one of the leaders in the global automotive manufacturing market, as it has various advanced automobile manufacturing facilities and innovative R&D centers. Consistent production from automotive companies is projected to play a key role in the demand for downstream aluminum, which, in turn, is expected to influence upstream primary aluminum production and, thereby, drive domestic bauxite demand.

Asia Pacific Bauxite Market Trends

The Bauxite Market in Asia Pacific held the largest revenue share of over 81.0% in 2023 and is projected to maintain its lead over the coming years. Increasing requirements for aluminum in the EV, packaging, and construction industries are anticipated to propel the demand for bauxite. For instance, in November 2023, Hyundai Motor started building a KRW 2 trillion (USD 1.5 billion) EV plant in South Korea. Moreover, fast developments in aluminum production due to the presence of primary aluminum-producing countries, such as China, Australia, and India, will support market growth.

The India bauxite market accounted for a volume share of over 6% in 2023 of the global market. It is predicted to be a lucrative market for bauxite in the long term as India’s primary aluminum production is bound to increase on account of strong economic growth, a rapidly growing manufacturing sector, and increasing industrialization.

Central & South America Bauxite Market Trends

The bauxite market in Central & South America is experiencing steady growth, fueled by factors, such as rising investments in construction activities in different countries. Countries in the region are investing in infrastructural development, such as airports, ports, public buildings, roads, and highways. Such investments are expected to propel the product consumption.

The Brazil bauxite market accounted for a revenue share of over 5% in 2023. Demand for primary aluminum from downstream industries, such as construction and automotive, is expected to play a key role in driving the production of primary aluminum and, thereby, positively influencing industry growth. Moreover, the country’s ambitious infrastructure projects and R&D investments further bolster growth prospects for the product market.

Middle East & Africa Bauxite Market Trends

The bauxite market in Middle East & Africa is anticipated to develop at a fast pace owing to high investments for the development of large skyscrapers, which is propelling the demand for aluminum & cement, and thus bauxite. For instance, in August 2022, China State Construction Engineering Corporation (CSCEC) started the construction of five residential skyscrapers in New Alamein City, Egypt.

The UAE bauxite market is expected to witness steady growth in the future. UAE is the largest producer of primary aluminum in Middle East & Africa. It accounted for a volume share of more than 35.4% in 2023 of the global bauxite consumption. Emirates Global Aluminium is the largest primary aluminum producer in the UAE and is a key domestic consumer of bauxite.

Key Bauxite Company Insights

Some of the key players operating in the market include Alcoa Corporation and Norsk Hydro

-

Alcoa Corporation is a global multinational company headquartered in the U.S. The company has three reportable business segments, namely bauxite, alumina, and aluminum.Bauxite and alumina segments primarily include several affiliated operating companies held under a global, unincorporated joint venture between Alcoa known as Alcoa World Alumina and Chemicals (AWAC) and Alumina Limited

-

Norsk Hydro ASA is primarily engaged in the aluminum industry with fully integrated operations from mining to primary aluminum production. The company's business segments are primary metal, bauxite & alumina, metal markets, rolled products, extruded solutions, and energy. This business segment comprises bauxite mining and alumina refining operations in Brazil.

Key Bauxite Companies:

The following are the leading companies in the bauxite market. These companies collectively hold the largest market share and dictate industry trends.

- Alcoa Corporation

- Rio Tinto

- Aluminum Corporation of China Limited (CHALCO)

- Norsk Hydro ASA

- South32

- Rusal

- NALCO India

- Hindalco Industries Ltd.

- Emirates Global Aluminium PJSC

Recent Developments

-

In April 2023, Glencore announced the acquisition of 45% equity stakes in Mineracão Rio do Norte S.A. and 30% stakes in Alunorte S.A. from Norsk Hydro ASA. An agreement was reached between the two companies for a combined total equity value of USD 775 million.

-

In May 2022, South32 acquired an additional stake in Mineracao Rio do Norte (MRN), a firm that operates the largest bauxite mine in Brazil. The company already owned 14.8% of MRN and has now bought 18.2% from Grupo Alcoa

Bauxite Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.52 billion

Revenue forecast in 2030

USD 18.15 billion

Growth rate

CAGR of 2.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Norway; Russia; Turkey; China; India; Australia; Brazil; Saudi Arabia; UAE

Key companies profiled

Alcoa Corp.; Rio Tinto; Aluminum Corp. of China Ltd. (CHALCO); Norsk Hydro ASA; South32; Rusal; NALCO India; Hindalco Industries Ltd.; Emirates Global Aluminium PJSC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bauxite Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bauxite market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Metallurgical-grade

-

Refractory-grade

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Alumina Production

-

Refractory

-

Cement

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Norway

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global bauxite market was estimated at USD 15.17 billion in 2023 and is expected to reach USD 15.52 billion in 2024.

b. The global bauxite market is expected to grow at a compound annual growth rate of 2.6% from 2024 to 2030 to reach USD 18.15 billion by 2030.

b. Metallurgical Grade was the key product segment of the market with a revenue share of above 85.0% of the market in 2023.

b. Some of the key players operating in the bauxite market are Alcoa Corporation, Rio Tinto, Norsk Hydro ASA, and NALCO India among others.

b. Rising penetration of aluminum and its related products in EVs production is projected to drive the growth for the bauxite market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.