- Home

- »

- Plastics, Polymers & Resins

- »

-

Americas Strapping Materials Market, Industry Report, 2030GVR Report cover

![Americas Strapping Materials Market Size, Share & Trends Report]()

Americas Strapping Materials Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Steel, Polypropylene, Polyester), By Application (Food & Beverage, Industrial Logistics & Warehouse, F&B), And Segment Forecasts

- Report ID: GVR-2-68038-737-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Americas Strapping Materials Market Trends

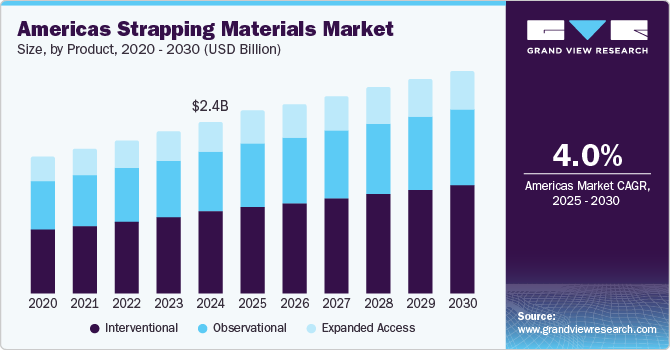

The Americas strapping materials market size was estimated at USD 2.41 billion in 2024 and is anticipated to register a CAGR of 4.0% from 2025 to 2030. This growth is attributed to a resurgence in manufacturing output, particularly in the food and beverage sector. In addition, the rapid expansion of e-commerce necessitates robust logistics and packaging practices. The shift towards sustainable packaging materials, such as recycled polyester, also supports market growth. Furthermore, rising awareness of environmentally friendly practices enhances the demand for innovative strapping solutions across various industries.

The strapping materials market is witnessing robust growth driven by many interconnected factors across various industries. One of the primary catalysts is the increasing demand for medical devices, consumer electronics, household appliances, textiles, and pharmaceutical products. As these sectors expand, they require reliable and secure packaging solutions to ensure product integrity during transportation and storage. Moreover, the flourishing e-commerce industry plays a crucial role in this growth, as it necessitates efficient logistics operations and packaging practices to meet consumer expectations for timely deliveries.

Furthermore, the rise in mail orders has also contributed significantly to the demand for strapping materials as businesses seek to ensure that products arrive safely at their destinations. The rising awareness for sustainable and environmentally friendly packaging options is growing. This shift in consumer preferences encourages manufacturers to adopt more eco-conscious practices, further fueling market growth.

Product Insights

Polypropylene (PP) dominated the market and accounted for the largest revenue share of 47.5% in 2024 attributed to its lightweight properties and cost-effectiveness. As industries increasingly seek efficient packaging solutions, PP offers a flexible and durable alternative that meets the demands of various applications, including food and beverage, consumer goods, and logistics. Moreover, the rising emphasis on sustainable packaging practices enhances the appeal of PP, as it can be produced from recycled materials. This trend aligns with consumer preferences for environmentally friendly options, further propelling the demand for polypropylene strapping.

Steel strapping is expected to grow at a CAGR of 3.7% over the forecast period, owing to its high tensile strength and durability, making it ideal for heavy-duty applications in construction, shipping, and manufacturing sectors. In addition, the increasing production of steel globally supports this trend, as more industries require robust packaging solutions to secure heavy loads during transport. Furthermore, stringent safety regulations necessitate steel strapping in certain applications to ensure product integrity. Moreover, the rising demand for steel in infrastructure projects also contributes to the market expansion, positioning steel strapping as a reliable choice for securing goods in challenging environments.

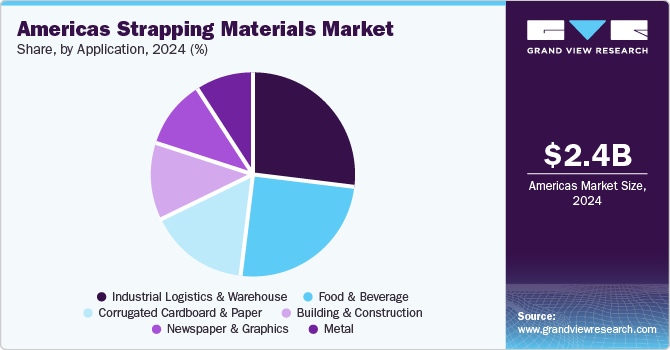

Application Insights

The industrial logistics & warehouse application led the market and accounted for the largest revenue share of 26.6% in 2024 attributed to the expansion of e-commerce and the increasing demand for efficient supply chain solutions. In addition, as companies seek to optimize their logistics operations, there is a heightened need for reliable packaging materials to secure products during storage and transportation. Furthermore, the resurgence of manufacturing and the trend toward near-shoring also contribute to this growth, as businesses require robust logistics infrastructure to support their operations effectively.

The food & beverage segment is expected to grow at a CAGR of 4.5% over the forecast period, owing to the rising consumption of packaged food products and the need for secure packaging solutions to ensure product safety and integrity. In addition, as consumer preferences shift towards convenience, manufacturers increasingly rely on effective packaging to maintain freshness and quality. Furthermore, stringent regulations regarding food safety and handling further drive the adoption of strapping materials in this industry. The growth of online grocery shopping and delivery services also enhances the demand for reliable packaging solutions, reinforcing the importance of strapping materials in food and beverage applications.

Regional Insights

North America strapping materials market dominated the Americas market and accounted for the largest revenue share of 69.8% in 2024 attributed to innovation, trade agreements, and a diverse economy. In addition, countries such as the U.S. and Canada enhance this dynamic with a stable economic environment and a highly educated workforce. Furthermore, trade agreements such as USMCA facilitate cross-border commerce, while investments in renewable energy and technology further bolster regional economic prospects despite some concerns over labor market weaknesses.

U.S. Strapping Material Market Trends

The strapping material market in the U.S. dominated the North American market and accounted for the largest revenue share in 2024, owing to its robust technology sector, significantly impacting various industries, including healthcare and manufacturing. In addition, this sector is projected to grow rapidly, driven by artificial intelligence and cloud computing advancements. Furthermore, construction and retail are expanding due to urbanization and consumer spending patterns. Moreover, legislation such as the Inflation Reduction Act supports investments in clean energy and infrastructure, positioning the U.S. for sustained economic resilience despite potential downturns.

Latin America Strapping Material Market Trends

Latin America strapping material market is expected to grow at a CAGR of 3.0% over the forecast period, owing to foreign investment, commodity exports, and improved trade relations. Countries such as Brazil and Chile benefit from rich natural resources, with Brazil being a major player in agriculture and mining. In addition, economic reforms aimed at enhancing business environments are crucial for attracting investment. Furthermore, continued focus on infrastructure development and education is vital for fostering long-term economic stability in the region.

The strapping material market in Brazil is expected to witness substantial growth over the forecast period. This growth is attributed to agriculture, particularly in soybeans and coffee exports, alongside a burgeoning technology sector. In addition, the country is making strides in diversifying its economy through investments in renewable energy and digital innovation. Furthermore, strengthening infrastructure and regulatory frameworks is expected to be essential for attracting foreign investment and achieving sustainable economic development in Brazil.

Key Americas Strapping Materials Company Insights

Some key companies in the market include Cyklop, UNIPACK, Mosca GmbH, and others. These companies adopt various strategies, including new product launches focusing on sustainable materials, strategic collaborations, and mergers and acquisitions, to consolidate their market presence and enhance their competitive edge. Furthermore, firms are investing in innovative technologies to improve product performance and meet rising demand in sectors such as e-commerce and logistics, ensuring they remain responsive to market trends and customer needs.

Cyklop International offers various products, including polypropylene, polyester strapping, and steel straps. The company serves various segments, such as industrial logistics, packaging, and manufacturing, focusing on providing reliable and efficient solutions to secure goods during transportation and storage. Their commitment to innovation and sustainability enhances their position in the competitive landscape of strapping materials.

UNIPACK specializes in producing various types of strapping materials, including plastic, polyester, and steel straps. The company caters to multiple segments, such as food packaging, logistics, and construction, ensuring that its products meet the diverse needs of industries requiring secure and durable packaging solutions. Its focus on quality and customer satisfaction positions it as a trusted partner in the strapping materials sector.

Key Americas Strapping Materials Companies:

The following are the leading companies in the americas strapping materials market. These companies collectively hold the largest market share and dictate industry trends.

- Cyklop

- UNIPACK

- Mosca GmbH

- Panorama Packaging Pvt. Ltd.

- Plastofine Industries.

- GREENBRIDGE

- Signode Industrial Group LLC

- Signor Polymers Pvt. Ltd.

- StraPack, Corp.

- Titan Umreifungstechnik GmbH & Co. KG

- 3M

Recent Developments

- In April 2023, EAM-Mosca Corp. announced an exclusive sales and marketing agreement with Spain's Reisopack S.L. This partnership allows EAM-Mosca to supply Reisopack strapping systems and OEM parts across the U.S., Canada, Mexico, and Brazil. The collaboration aims to enhance customer service by combining Reisopack’s expertise in strapping materials for fresh produce with EAM-Mosca’s established sales and engineering capabilities. Both companies anticipate significant growth opportunities in the Americas, improving customer satisfaction in the strapping materials market.

Americas Strapping Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.57 billion

Revenue forecast in 2030

USD 3.11 billion

Growth Rate

CAGR of 4.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Latin America

Country scope

U.S., Canada, Mexico, Brazil, Argentina, Chile

Key companies profiled

Cyklop; UNIPACK; Mosca GmbH; Panorama Packaging Pvt. Ltd.; Plastofine Industries.; GREENBRIDGE; Signode Industrial Group LLC; Signor Polymers Pvt. Ltd.; StraPack, Corp.; Titan Umreifungstechnik GmbH & Co. KG; 3M

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Americas Strapping Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Americas strapping materials market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Polypropylene (PP)

-

Polyester (PET)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Industrial Logistics & Warehouse

-

Corrugated Cardboard & Paper

-

Newspaper & Graphics

-

Building & Construction

-

Metal

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.