Aminophylline Market Size & Trends

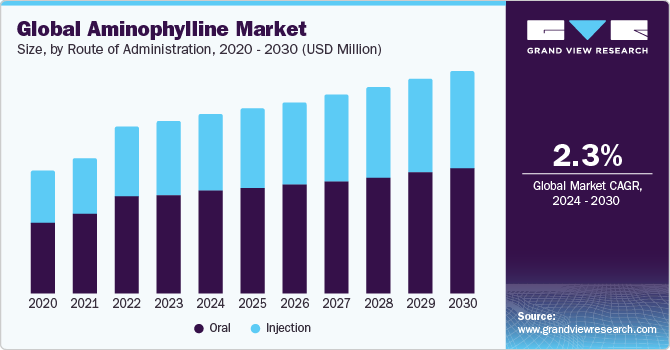

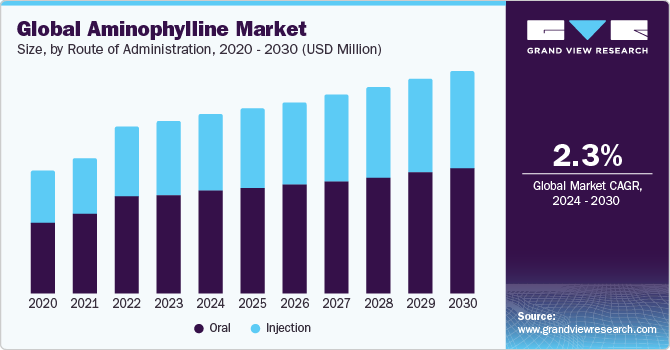

The global aminophylline market size is expected to grow at a compound annual growth rate (CAGR) of 2.3% from 2024 to 2030. This growth can be attributed to the rising prevalence of respiratory disorders, a surging demand for cost-effective treatment options, and an increasing number of cases of Chronic Obstructive Pulmonary Disease (COPD). Moreover, patient’s rising preference for oral medications is further expected to fuel the market growth.

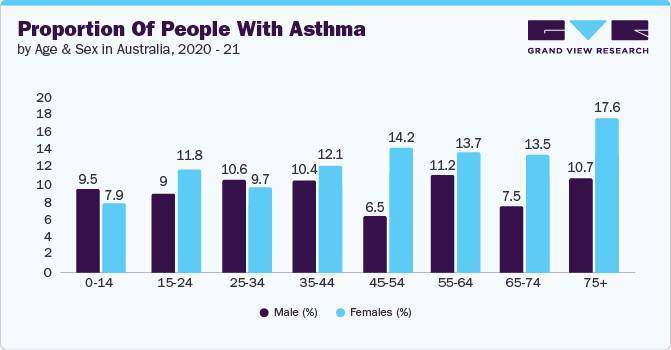

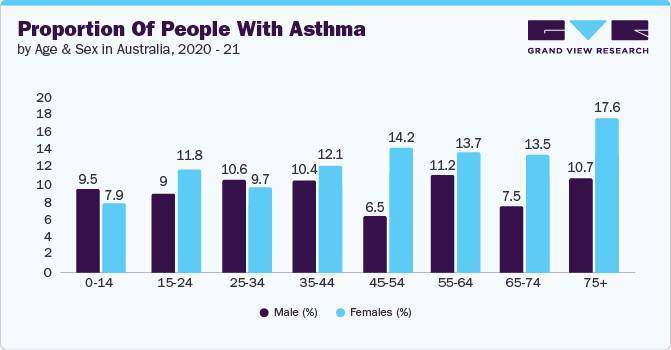

Aminophylline, a bronchodilator with caffeine-like properties, serves as a crucial medication for managing respiratory conditions like asthma and COPD. Considering the WHO’s statistics indicating respiratory diseases as leading causes of mortality, aminophylline assumes a pivotal role in not only treating but also diagnosing individuals dealing with these ailments. For instance, a 2023 article in The Economic Times highlighted the global surge in asthma prevalence, affecting approximately 339 million people. Even though asthma can impact individuals of all ages, it is particularly more prevalent in children than in adults. These insights underscore the role of aminophylline in reducing the growing burden of respiratory illnesses.

Moreover, advancements in personalized medicine and technological progress are also major factors driving this market. The personalized medicine approach helps create treatments based on individual genetic profiles and medical needs, which has revolutionized healthcare by improving treatment efficacy while reducing adverse effects. Pharmaceutical companies are increasingly focusing on targeted therapies for respiratory conditions, such as asthma and COPD, utilizing genetic insights and advanced diagnostics. For instance, in November 2022, AstraZeneca's PT027, a pioneering pressurized Metered-dose Inhaler (pMDI) with aminophylline, was recommended by FDA Advisory Committee, positioning it as a potential treatment for asthma. AstraZeneca's recent announcement, rebranding PT027 as Airsupra (albuterol/budesonide), signifies a significant milestone in healthcare. It marks the approval of the first and only rescue medication in the U.S., which can be used to lower the risk of asthma exacerbations, offering new hope and improved options for asthma patients.

In addition, aminophylline has been found to suppress stress-induced visceral hypersensitivity and defecation in irritable bowel syndrome, according to a study published in Scientific Reports. Precision medicine, a new approach that considers differences in people's genes and behaviors, is changing the way diseases like cancer are treated. Advancements in precision medicine have already resulted in strong new discoveries and development of various new therapies that are tailored to specific traits, such as a person's genetic makeup or the genetic profile of a tumor. The FDA has been working to respond, anticipate, and help drive scientific developments in personalized therapeutics & diagnostics, which is paving the way for personalized medicine.

Route Of Administration Insights

The oral segment held the largest market share in 2023. This can be attributed to its convenience and patient-friendly characteristics. The oral route of administration offers a non-invasive, easily accessible, and patient-compliant option, making it a preferred choice for many individuals with respiratory conditions like asthma and COPD. In addition, a study published in the American Chemical Society states that the oral route of drug delivery is the largest, oldest, and fastest-growing segment of the overall drug delivery market. Patients often find it more comfortable to take oral medications, and healthcare providers appreciate the simplicity & precision of dosing, contributing to growth of the oral segment.

Application Insights

On the basis of application, the market is segmented into COPD, asthma, and infant apnea. COPD segment held the largest market share in 2023. The rising global incidence of respiratory disorders and infections, especially COPD, presents a pressing healthcare challenge. It is a type of lung disease that causes breathing difficulties by restricting airflow. COPD is most common among smokers and people over the age of 40 and is currently the third leading cause of illness & mortality worldwide. Aminophylline enhances diaphragm contraction, protects airways from irritants, and provides anti-inflammatory benefits by relaxing lung muscles, contributing significantly to diagnosis and management of respiratory diseases.

Distribution Channel Insights

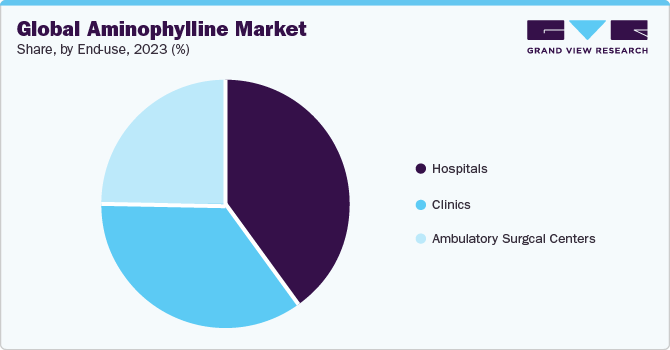

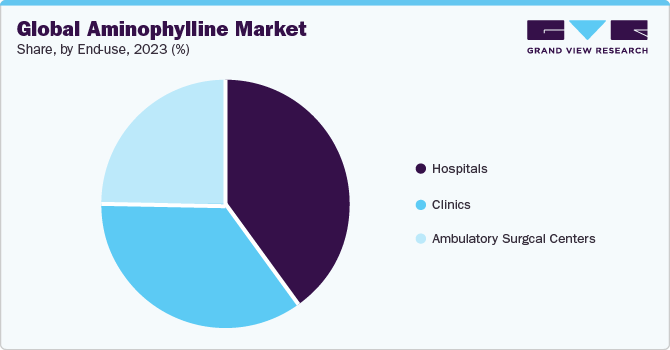

The hospital segment is expected to be the fastest-growing segment during the forecast period. This growth is driven by the increasing number of respiratory disease cases and a corresponding surge in hospital admissions, which highlights the crucial role of hospitals in managing these conditions. In addition, the rising number of patients with respiratory disorders and infections worldwide has led to an increase in the adoption of aminophylline & other drugs, which further drives the hospital segment growth. Moreover, the cost of medications continues to increase due to a rise in both price and patient volume. These factors have led to an increase in the adoption of aminophylline and other drugs in hospitals, which is expected to drive the hospital segment growth.

Regional Insights

North America held the largest market share in 2023. This growth can be attributed to several factors, including the region's well-established healthcare infrastructure and advanced medical research facilities that enable rapid adoption of innovative treatments. Moreover, a higher prevalence of respiratory disorders, particularly in the U.S. and Canada, has driven the demand for aminophylline. For instance, the 2023 clinical research in cardiology research paper revealed that globally, COPD affects approximately 12% of the general population and stands as the third leading cause of mortality, resulting in 3 million deaths, trailing only behind Cardiovascular Diseases (CVDs). Moreover, North America has seen considerable advancements in personalized medicine and the development of patient-centric therapies, which leads to the rising demand for aminophylline.

Competitive Insights

Some key players operating in the market are Pfizer Inc., Omega Laboratories, Actiza Pharmaceutical, Endo International, Merck KGaA, Torque Pharma, Octapharma AG, and Johnsons & Johnsons Private Limited. The market participants are constantly working toward new product development, M&A activities, and other strategic initiatives to gain market share. The following are some instances of such initiatives:

-

In January 2023, AstraZeneca's Airsupra, formerly known as PT027, was approved by the U.S. FDA as the first and only rescue medication for as-needed use to reduce the risk of asthma exacerbations.

-

Glenmark received U.S. FDA approval in June 2021 for Theophylline ER tablets, an oral bronchodilator with a limited therapeutic range, prescribed for managing conditions like asthma and COPD.