- Home

- »

- Advanced Interior Materials

- »

-

Anchoring Fasteners Market Size, Industry Report, 2033GVR Report cover

![Anchoring Fasteners Market Size, Share & Trends Report]()

Anchoring Fasteners Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Mechanical Anchors, Chemical Anchors), By Substrate (Concrete, Solid Masonry), By End Use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-618-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anchoring Fasteners Market Summary

The global anchoring fasteners market size was estimated at USD 3.12 billion in 2024, and is projected to reach USD 4.51 billion by 2033, growing at a CAGR of 4.3% from 2025 to 2033. The industry is driven by the acceleration of construction and infrastructure activities across the globe.

Key Market Trends & Insights

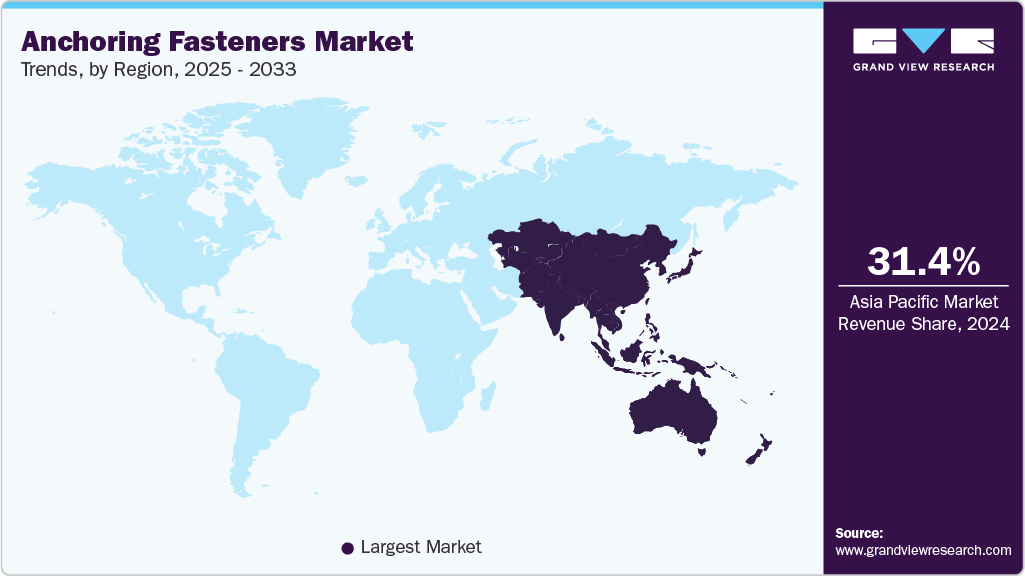

- Asia Pacific dominated the global industry and accounted for the largest revenue share of about 31.37% in 2024.

- By substrate, the concrete segment dominated the market and accounted for the largest revenue share of 42.28% in 2024.

- By end use, the construction & real estate segment dominated the market and accounted for the largest revenue share of 43.89% in 2024.

- By distribution dhannel, the indirect segment dominated the market and accounted for the largest revenue share of 70.93% in 2024.

- By product, the mechanical anchors segment led the market and accounted for the largest revenue share of 58.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.12 Billion

- 2033 Projected Market Size: USD 4.51 Billion

- CAGR (2025-2033): 4.3%

- Asia Pacific: Largest market in 2024

As governments invest in the modernization of roads, bridges, commercial buildings, and urban housing, the demand for reliable anchoring solutions has soared. These fasteners are crucial for ensuring structural stability and load distribution, especially in high-rise buildings, modular infrastructure systems, and prefabricated construction. Emerging economies, in particular, are fueling demand through massive smart city initiatives and transit corridor projects, requiring specialized anchors that can meet both safety and regulatory benchmarks. Developed regions, meanwhile, are focused on retrofitting aging infrastructure, further augmenting the use of high-performance anchors in restoration and reinforcement works.

Industrial expansion is another significant factor fueling the anchoring fasteners market. Heavy machinery installations in manufacturing plants, energy facilities, and processing units require anchoring systems capable of withstanding vibration, high loads, and environmental stress. Industries such as oil & gas, mining, and renewable energy are adopting anchoring fasteners in both onshore and offshore settings, often using corrosion-resistant materials like stainless steel or zinc-plated carbon steel.

Technology and innovation are also reshaping the landscape of the anchoring fasteners industry. Manufacturers are introducing products with improved designs that offer faster installation, higher tensile strength, and better seismic performance. Innovations such as undercut anchors, self-drilling anchors, and expansion bolts with torque-controlled mechanisms are helping contractors reduce project timelines while maintaining structural integrity. Furthermore, advancements in building codes and simulation software are allowing engineers to optimize anchor placement and performance, enhancing the safety profile of construction projects in seismically active regions. The emphasis on green construction is also pushing the adoption of recyclable and low-carbon anchoring materials.

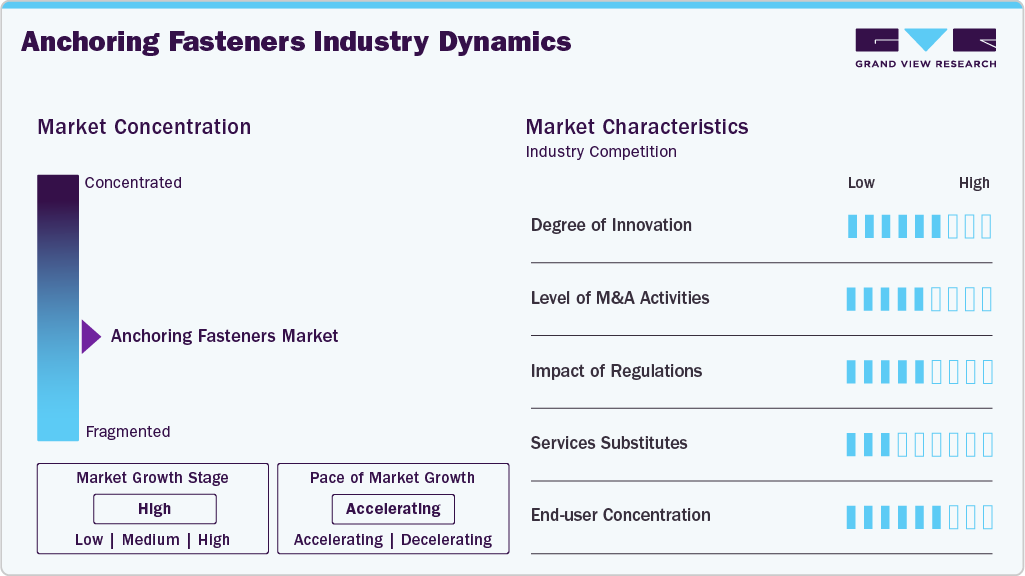

Market Concentration & Characteristics

The industry is characterized by moderate to high market concentration, with a few global players such as Hilti, Fischer Group, Würth, and ITW commanding significant shares, especially in developed regions. These companies maintain their competitive edge through strong distribution networks, proprietary fastening technologies, and compliance with international construction standards. The degree of innovation within the market is notably high, particularly in product design, corrosion resistance, seismic performance, and installation efficiency.

Innovations such as chemical anchors for high-load applications and pre-engineered fastening systems for modular construction have become increasingly prevalent. Furthermore, technological integration in terms of BIM (Building Information Modeling) compatibility and load simulation software is reshaping procurement decisions among contractors and structural engineers. This continuous push for technical superiority has created barriers to entry for smaller players lacking in R&D capabilities or certification credentials.

The market also witnesses a moderate level of mergers and acquisitions, primarily driven by the need for portfolio expansion, geographic reach, and regulatory alignment. Companies operating in regions with stringent construction norms-such as North America, Europe, and parts of Asia-must navigate evolving building codes, seismic anchoring standards, and fire resistance guidelines, all of which influence product design and certification timelines.

Regulatory compliance is thus both a challenge and a catalyst for differentiation. Service substitutes are limited due to the critical nature of anchor fasteners in ensuring structural stability, though mechanical anchors may be interchanged with chemical ones depending on application-specific requirements. End-user concentration is relatively high in infrastructure, industrial, and commercial construction sectors, with large EPC firms, government contractors, and facility operators constituting key customer segments.

Substrate Insights

The concrete segment dominated the market and accounted for the largest revenue share of 42.28% in 2024, driven by the extensive use of concrete as a foundational material in both structural and non-structural applications. Anchoring fasteners play a critical role in ensuring the secure attachment of structural elements, equipment, and support systems to concrete substrates. The continued growth in high-rise construction, industrial facilities, transportation infrastructure, and urban development projects globally is fueling the demand for mechanical and chemical anchors specifically designed for concrete.

Hollow or perforated masonry segment is expected to grow at the fastest CAGR of 4.9% over the forecast period, driven by the rising adoption of lightweight construction materials in both residential and commercial building sectors. Hollow blocks, perforated bricks, and lightweight masonry units are increasingly preferred for their cost efficiency, insulation properties, and ease of handling. However, these materials pose unique challenges in load-bearing and fastening, thereby necessitating the use of specialized anchoring systems.

End Use Insights

The construction & real estate segment dominated the market and accounted for the largest revenue share of 43.89% in 2024, driven by its expansive demand for structural stability, safety, and long-term durability in buildings and infrastructure. As urbanization continues to accelerate, particularly in emerging economies, there has been a sharp rise in the development of commercial complexes, residential towers, and public infrastructure such as airports, hospitals, and schools. These structures rely extensively on anchoring systems to secure structural elements like steel beams, façade panels, piping, HVAC units, and foundation reinforcements.

Energy & utilities (solar and green roofs) segment is expected to grow at fastest CAGR of 4.8% over the forecast period. The global push toward renewable energy adoption has led to a rise in solar panel installations across residential, commercial, and utility-scale projects. These installations require precise and durable anchoring solutions to secure solar racking systems to concrete, metal, or membrane surfaces. Fasteners must provide long-term structural stability while resisting corrosion, UV exposure, and thermal expansion stresses.

Distribution Channel Insights

The indirect segment dominated the market and accounted for the largest revenue share of 70.93% in 2024. The increasing specialization and technical expertise of third-party distributors are enhancing the value proposition of the indirect channel. Many distributors now provide technical advisory, anchor selection guidance, and even on-site training, enabling customers to make informed decisions based on substrate type, load requirement, and environmental conditions. In markets such as Europe and North America, where adherence to building codes and certifications is critical, distributors often carry pre-approved and regionally certified anchoring products, thus streamlining procurement processes for contractors.

The direct segment is expected to grow significantly at CAGR of 3.6% over the forecast period, driven by the increasing preference of large-scale contractors, industrial buyers, and government agencies for customized, high-performance anchoring solutions. Direct sales enable manufacturers to establish long-term relationships with end users, allowing for a deeper understanding of technical requirements, project timelines, and compliance standards. This channel also facilitates tailored offerings, such as project-specific anchor bolt assemblies or special coatings for corrosive environments, which are often not feasible through third-party distributors.

Product Insights

The mechanical anchors segment led the market and accounted for the largest revenue share of 58.3% in 2024, driven by the increasing adoption of concrete-based construction across residential, commercial, and industrial sectors. Mechanical anchors, including wedge anchors, sleeve anchors, and expansion bolts, are preferred in applications requiring immediate load-bearing capacity and fast installation. These anchors are widely used in reinforced concrete structures due to their ability to provide a reliable mechanical interlock without the need for curing time, unlike chemical anchors.

The chemical anchors segment is expected to grow at the fastest CAGR of 4.2% over the forecast period, driven by its superior load-bearing capabilities and adaptability across diverse construction environments. Unlike mechanical anchors, chemical anchors offer a non-expansive bonding method that reduces stress on base materials, making them ideal for cracked concrete, seismic zones, and applications requiring post-installed rebar connections. This advantage is particularly relevant in retrofitting projects, structural upgrades, and heavy-duty industrial installations where traditional fastening solutions may fall short.

Regional Insights

North America anchoring fasteners market is supported by renovation and retrofitting of aging infrastructure, particularly in the U.S. and Canada. Increasing federal funding for infrastructure upgrades such as roads, bridges, and public utilities is driving demand for seismic anchors and high-performance fastening systems. The region’s strict adherence to building and seismic codes, such as the International Building Code (IBC) and ACI standards, necessitates the use of approved anchoring systems, which in turn support market development. Additionally, the surge in warehousing, data centers, and industrial expansion, driven by the e-commerce boom, is fueling demand for fasteners used in structural steel and concrete fixtures.

U.S. Anchoring Fasteners Market Trends

The anchoring fasteners market in the U.S. is driven by a combination of commercial construction activity, robust industrial investment, and stringent safety regulations. Major infrastructure programs like the Bipartisan Infrastructure Law are catalyzing nationwide upgrades of transportation and utility infrastructure. These developments require certified and performance-tested anchors for use in critical applications such as bridge joints, energy installations, and seismic zones. Moreover, the growth of the renewable energy sector and warehouse automation in logistics hubs is generating increased demand for custom-engineered anchoring products designed for durability and ease of installation.

Asia Pacific Anchoring Fasteners Market Trends

The anchoring fasteners market in Asia Pacific dominated the global industry and accounted for the largest revenue share of about 31.37% in 2024, driven by large-scale infrastructure development and rising urbanization across countries such as China, India, Indonesia, and Vietnam. The region is witnessing increased government spending on smart cities, public transportation networks, commercial real estate, and residential housing, all of which require high-strength and reliable anchoring systems. Additionally, the proliferation of modular and prefabricated construction in countries like Japan and Australia is accelerating the demand for mechanical and chemical anchors that offer speed and precision. The rising adoption of international building codes and earthquake-resistant structures is also contributing to the increased use of certified and advanced anchoring solutions.

China anchoring fasteners market is primarily driven by its massive construction sector, backed by government stimulus and ongoing industrial expansion. The country continues to invest heavily in new infrastructure projects-including high-speed rail, airports, power plants, and logistics parks generating consistent demand for anchoring systems. Furthermore, China's shift toward high-rise construction and sustainable green buildings is fostering demand for advanced, corrosion-resistant, and load-bearing fasteners. Domestic manufacturers are also investing in innovation to comply with new national codes and to reduce reliance on imports, boosting local production and technological capabilities.

Europe Anchoring Fasteners Market Trends

The anchoring fasteners market in Europe is shaped by sustainability-driven construction, refurbishment of old buildings, and compliance with unified Eurocodes. The European Union’s emphasis on green construction and energy-efficient buildings has led to a surge in retrofitting projects where anchoring fasteners are used to support insulation panels, façade systems, and structural reinforcements. Additionally, growing investment in wind energy and public transportation projects across Germany, France, and Scandinavia is boosting demand for fasteners that can withstand mechanical stress and environmental corrosion. European firms also prioritize anchoring systems with EOTA and CE certifications, reinforcing the market for high-quality and technically compliant solutions.

Germany anchoring fasteners market is driven by the high demand in sectors such as automotive manufacturing facilities, logistics centers, and renewable energy plants. The country’s strict seismic and fire-resistance norms in construction drive the use of certified anchor bolts and heavy-duty fastening systems. Moreover, Germany’s leadership in green building initiatives is stimulating innovation in recyclable and energy-efficient fastening solutions, offering new avenues for growth in the anchoring systems market.

Latin America Anchoring Fasteners Market Trends

The anchoring fasteners market in Latin America is gaining momentum due to urban development, housing shortages, and increasing public investment in infrastructure. Countries like Brazil, Mexico, and Colombia are modernizing their transport networks and energy systems, including hydroelectric and wind energy projects that require stable anchoring in varying terrains. The region’s construction sector is gradually adopting international safety and quality standards, thereby encouraging the use of durable and compliant anchoring solutions. While economic volatility and regulatory inconsistencies pose challenges, ongoing industrialization and urban sprawl continue to drive market demand.

Middle East & Africa Anchoring Fasteners Market Trends

The anchoring fasteners market in the Middle East & Africa is fueled by mega infrastructure and urban development projects, especially in GCC countries such as Saudi Arabia, UAE, and Qatar. Projects like NEOM, Expo City Dubai, and extensive oil & gas infrastructure expansion require large volumes of heavy-duty anchors for steel structures, pipelines, and prefabricated units. The increasing focus on seismic compliance and fire safety standards in construction has led to greater adoption of advanced anchoring systems. In Africa, improving construction practices and growing FDI in real estate and industrial zones are contributing to a gradual rise in demand for anchoring fasteners, although the market remains price-sensitive and fragmented.

Key Anchoring Fasteners Company Insights

Key players operating in the anchoring fasteners market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Anchoring Fasteners Companies:

The following are the leading companies in the anchoring fasteners market. These companies collectively hold the largest market share and dictate industry trends.

- Hilti

- Structural Bolt and Manufacturing

- UNIQUE FASTNERS

- ARGIP

- Powers Fasteners

- Pacific Bolt Manufacturing Ltd.

- Classic Metallic Sheets Factory LLC.

- BTM Manufacturing

- EDSCO Fasteners

Recent Developments

-

In March 2024, Hilti introduced the HST4 series as their highest-performing wedge expansion anchors, designed for high static and seismic loads in cracked concrete. The HST4-R variant is made of A4 stainless steel, suitable for both indoor and outdoor applications.

Anchoring Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.23 billion

Revenue forecast in 2033

USD 4.51 billion

Growth rate

CAGR of 4.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, substrate, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; Brazil; Saudi Arabia; UAE; Turkey

Key companies profiled

Hilti; Structural Bolt and Manufacturing; UNIQUE FASTNERS; ARGIP; Powers Fasteners; Pacific Bolt Manufacturing Ltd.; Classic Metallic Sheets Factory LLC.; BTM Manufacturing; EDSCO Fasteners

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anchoring Fasteners Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global anchoring fasteners market report based on product, substrate, end use, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Mechanical Anchors

-

Chemical Anchors

-

Plastic Anchors

-

-

Substrate Outlook (Revenue, USD Million, 2021 - 2033)

-

Concrete

-

Solid Masonry

-

Hollow or Perforated Masonry

-

Autoclaved Aerated Concrete

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction & Real Estate

-

Energy & Utilities (Solar and Green Roofs)

-

Industrial & Manufacturing

-

Government & Public Sector

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct

-

Indirect

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The mechanical anchors segment led the market and accounted for the largest revenue share of 58.3% in 2024, driven by the increasing adoption of concrete-based construction across residential, commercial, and industrial sectors

b. Some of the prominent companies in the anchoring fasteners market include Hilti, Structural Bolt and Manufacturing, UNIQUE FASTNERS, ARGIP, Powers Fasteners, Pacific Bolt Manufacturing Ltd., Classic Metallic Sheets Factory LLC., BTM Manufacturing, EDSCO Fasteners

b. Key factors driving the anchoring fasteners market include rising infrastructure development, stringent building codes, and growing demand for high-performance construction solutions.

b. The global anchoring fasteners market size was estimated at USD 3.12 billion in 2024 and is expected to reach USD 3.24 billion in 2025.

b. The anchoring fasteners market is expected to grow at a compound annual growth rate of 4.3% from 2025 to 2033 to reach USD 4.51 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.