- Home

- »

- Animal Health

- »

-

Animal Euthanasia Market Size, Share, Industry Report, 2033GVR Report cover

![Animal Euthanasia Market Size, Share & Trends Report]()

Animal Euthanasia Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Pharmaceuticals, Inhalants), By Animal, By Route of Administration, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-768-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Animal Euthanasia Market Summary

The global animal euthanasia market size was estimated at USD 1.58 billion in 2024 and is projected to reach USD 2.68 billion by 2033, growing at a CAGR of 6.47% from 2025 to 2033. The market is experiencing growth driven by increasing pet ownership, demand for humane end-of-life care, and the need for disease control in both companion and livestock animals.

Key Market Trends & Insights

- The North America animal euthanasia market held the largest revenue share of 42.79% in 2024.

- The U.S. animal euthanasia industry dominated with the largest revenue share in 2024.

- By product, the pharmaceuticals segment held the largest market share of 62.61% in 2024.

- By animal, the companion animal segment held the largest market share in 2024.

- By route of administration, the injectable segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.58 Billion

- 2033 Projected Market Size: USD 2.68 Billion

- CAGR (2025-2033): 6.47%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

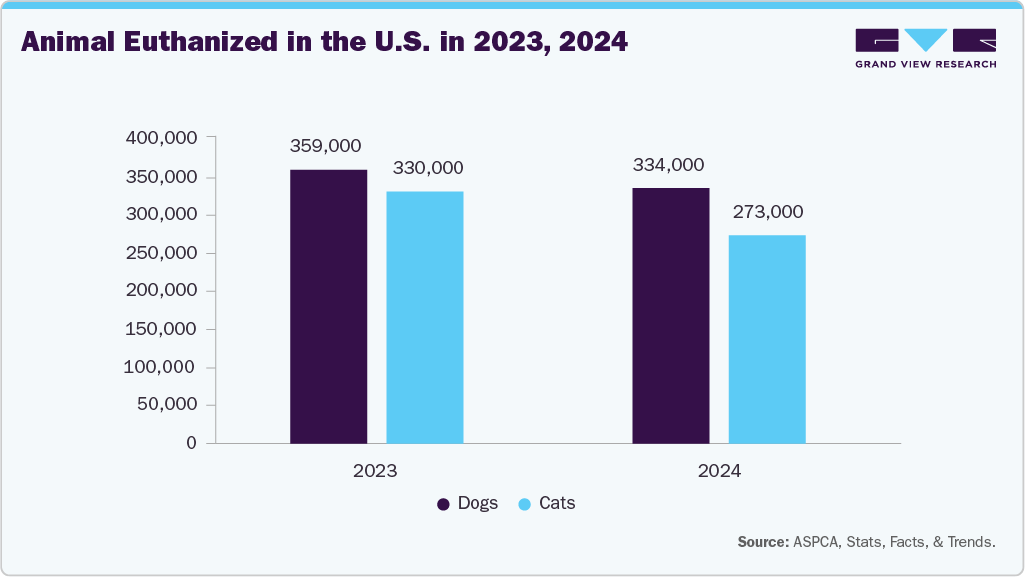

Growing awareness of ethical euthanasia practices and the expansion of mobile and in-clinic veterinary services further fuel the growth. One of the primary factors driving the demand for animal euthanasia services is overcrowding in shelters. Many shelters operate with limited space and financial resources, making it difficult to care for large numbers of stray or surrendered animals. As a result, euthanasia is often used as a last resort when adoption or rehoming is not feasible. According to the ASPCA, an estimated 920,000 dogs and cats are euthanized annually in U.S. shelters, including about 390,000 dogs and 530,000 cats, mainly due to overpopulation and limited capacity.

Additionally, the growth of the animal euthanasia industry is also driven by the rising pet ownership, increasing awareness of humane end-of-life care, and the need for disease control in both companion and livestock animals. For instance, in January 2025, Memphis Animal Services (MAS) euthanized nearly 100 dogs following a canine distemper outbreak traced to a litter of puppies, closing the shelter until further notice to contain the virus and protect both animals and the community. Such large-scale, disease-driven euthanasia events highlight the critical role of shelter medicine and emergency protocols, potentially increasing demand for veterinary euthanasia drugs, mobile euthanasia services, and disease-prevention measures.

Market Concentration & Characteristics

The animal euthanasia market exhibits a moderately concentrated structure, with a few key players, including veterinary pharmaceutical companies and large veterinary service networks, holding significant market share. Major firms dominate the supply of injectable euthanasia drugs and veterinary services, while smaller local providers and mobile euthanasia services serve niche markets. Strategic partnerships, mergers, and acquisitions among leading companies further consolidate market control, though regional variations maintain opportunities for new entrants and specialized services.

The market is witnessing moderate innovation, primarily focused on developing more humane, stress-free, and efficient euthanasia methods. Advances include pre-sedation protocols, inhalant agents like nitrogen or CO₂ alternatives, and improved injectable formulations for rapid and painless procedures. Additionally, technology-driven solutions such as mobile in-home euthanasia services and digital monitoring tools for dosing accuracy are enhancing convenience and safety. These innovations aim to improve animal welfare while addressing the growing demand for ethical end-of-life care.

The animal euthanasia industry has seen moderate mergers and acquisitions, driven by consolidation among veterinary service providers, pharmaceutical manufacturers, and animal care networks. Companies are acquiring smaller veterinary clinics, mobile euthanasia services, and pharmaceutical producers to expand geographic reach and service portfolios. For example, the merger of Southern Veterinary Partners and Mission Veterinary Partners in 2024 strengthened their presence in the U.S. companion animal sector, reflecting a broader trend of strategic consolidation to enhance market share and operational efficiency.

Regulations significantly impact the market by enforcing standards for humane practices, drug usage, and shelter operations. Stringent guidelines on the use of euthanasia drugs, such as pentobarbital, and restrictions on methods like gas chambers in many regions ensure ethical and controlled procedures. Compliance with veterinary and animal welfare laws drives the adoption of certified pharmaceuticals and trained personnel, while regional differences in legislation influence market accessibility and service delivery models across countries.

Product substitutes in the market include mechanical methods (e.g., captive bolt devices), inhalant agents like carbon dioxide or nitrogen, and sedative-based alternatives for less invasive procedures. These substitutes are increasingly adopted in shelters, laboratories, and livestock settings to provide humane, low-stress euthanasia where injectable drugs may be impractical or restricted. The choice of substitutes is often driven by animal size, regulatory guidelines, and ethical considerations, complementing or replacing traditional pharmaceutical methods.

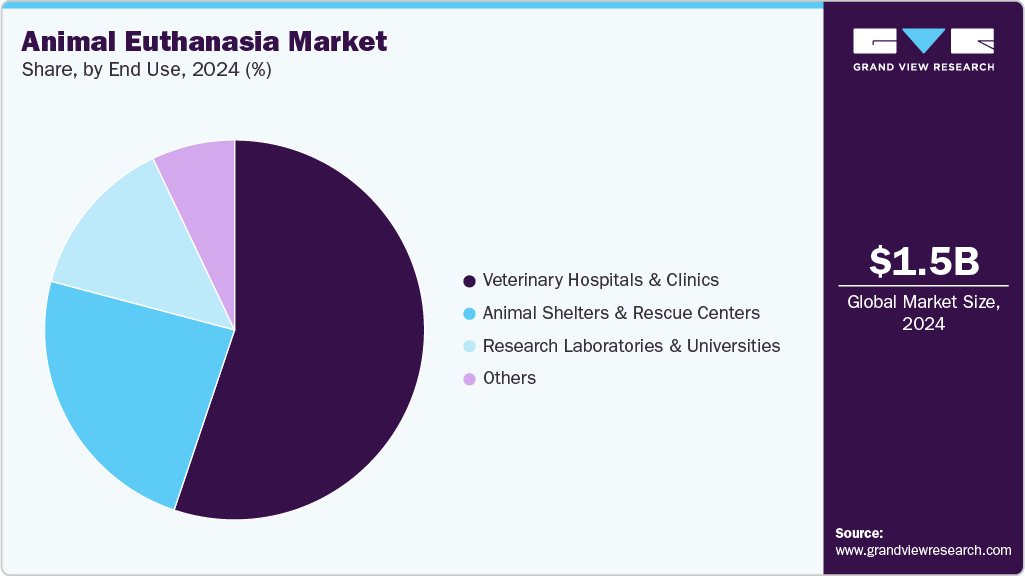

In this market, the end user concentration is primarily focused among veterinary hospitals, clinics, and animal shelters, which account for the majority of service demand. Companion animal owners, livestock farmers, and research facilities represent the key consumer bases, with veterinary professionals executing the procedures. High reliance on centralized veterinary services and organized shelter networks ensures consistent demand, while specialized mobile euthanasia providers are emerging to serve niche home-based markets, reflecting moderate end user concentration overall.

Product Insights

The pharmaceuticals segment led the animal euthanasia market with the largest revenue share of 62.61% in 2024, due to the widespread use of injectable euthanasia drugs, particularly pentobarbital-based solutions, which are considered the gold standard for humane and effective end-of-life care. Veterinary hospitals, clinics, and animal shelters prefer pharmaceutical agents because they provide rapid onset, predictable outcomes, and minimal stress for the animal. Additionally, established regulatory approvals, extensive availability, and veterinary familiarity with these drugs have reinforced their dominance, making pharmaceuticals the primary choice over mechanical or inhalant methods in both companion and livestock animal euthanasia.

The inhalants segment is expected to grow the fastest over the forecast period, due to increasing emphasis on humane, low-stress, and non-invasive methods, particularly for small companion animals and laboratory animals. Inhalant euthanasia agents, such as carbon dioxide (CO₂) and nitrogen-based gases, are gaining adoption in veterinary clinics, shelters, and research facilities as they provide a painless and controlled procedure. Regulatory guidelines and animal welfare standards in regions like North America and Europe are further encouraging the use of inhalants. At the same time, ongoing research on premedication and sedation techniques enhances their safety and effectiveness. This combination of ethical considerations, regulatory support, and technological advancements is driving the rapid growth of the segment.

Animal Insights

The companion animal segment dominated the animal euthanasia industry with the largest revenue share in 2024, driven by rising pet ownership, humanization of pets, and demand for humane end-of-life care. Pet owners are increasingly seeking professional veterinary services, including in-clinic and in-home euthanasia, to ensure a painless and dignified process for their dogs, cats, and other household pets. For instance, services like CodaPet in the U.S. and veterinary clinics across Europe and Asia offer tailored euthanasia solutions with sedation and aftercare options, reflecting the high willingness of owners to invest in compassionate care. The combination of emotional attachment, higher disposable income, and awareness of ethical euthanasia practices has solidified the dominance of companion animals in the market.

The livestock animal segment is anticipated to grow at the fastest CAGR over the forecast period, due to the increasing awareness of humane slaughter practices, disease control measures, and regulatory compliance requirements in large-scale farming. Rising outbreaks of contagious diseases such as avian influenza, foot-and-mouth disease, and swine fever have necessitated timely and ethical euthanasia to prevent spread and minimize animal suffering. Additionally, advancements in euthanasia methods for large animals, such as injectable pentobarbital solutions and captive bolt devices, have improved efficiency and safety for both animals and farm personnel. Initiatives to train farm workers and veterinarians on proper euthanasia protocols in countries like Brazil and the U.S. further support the adoption of humane end-of-life practices, driving the segment’s growth.

Route of Administration Insights

The injectable segment held the largest revenue share of the animal euthanasia market in 2024, boosted by the widespread use of pentobarbital sodium-based formulations such as Euthasol and Pentobarsol. These injectable solutions are preferred for their rapid onset of action, ease of administration, and established safety profiles. For instance, Euthasol is specifically formulated for canine euthanasia, offering a humane and painless end-of-life solution. Similarly, Pentobarsol is utilized for equine euthanasia, providing a controlled and efficient method for practitioners. Their regulatory approval and widespread availability further support the dominance of injectables, making them the standard choice in veterinary practices globally.

Among injectables, the intravenous segment held the largest revenue share of 46.19% in 2024 due to their rapid onset and precise control over drug delivery, ensuring a humane and painless procedure. IV administration is preferred in veterinary practices for companion animals and large livestock, as it allows veterinarians to monitor the animal closely and adjust dosage if needed. The widespread use of IV pentobarbital-based solutions further supports its dominance in the market.

The inhalants segment is expanding at the fastest CAGR due to their perceived humaneness, especially in companion animal care. Inhalant euthanasia methods, such as carbon dioxide (CO₂) and nitrogen gas, are gaining popularity for their ability to induce a painless and stress-free death. These methods are increasingly utilized in veterinary clinics and animal shelters, aligning with evolving animal welfare standards emphasizing less invasive procedures. For instance, research has demonstrated that premedication with sedatives or inhalant anaesthesia can alleviate pain and stress associated with CO₂ euthanasia in mice. This shift reflects a broader trend toward more ethical and compassionate end-of-life care for animals.

End Use Insights

The veterinary hospitals and clinics segment held the largest revenue share in 2024. These facilities offer comprehensive services, including diagnostics, emergency care, and surgical procedures, positioning them as primary providers of euthanasia services. Their established infrastructure, skilled personnel, and access to necessary euthanasia drugs contribute to their significant market share. Additionally, the increasing pet ownership and demand for humane end-of-life care have further bolstered the role of veterinary hospitals and clinics in delivering euthanasia services. For instance, the merger of Southern Veterinary Partners and Mission Veterinary Partners in 2024 created a major U.S. veterinary care group, reflecting the growing demand in the veterinary sector and the consolidation of services, including euthanasia, within these institutions.

The animal shelters & rescue centers segment is expected to grow at the fastest CAGR over the forecast period. Overcrowding in shelters, driven by increased stray populations and limited adoption rates, necessitates the implementation of humane euthanasia practices to manage animal welfare effectively. For instance, in 2023, a surge in shelter populations led to rising euthanasia rates, particularly among homeless canines, highlighting the urgent need for efficient euthanasia solutions. Additionally, initiatives like the "Happy Pets Happy World" campaign by WePlay demonstrate the growing emphasis on animal welfare, where user interactions contribute to the donation of pet supplies, indirectly supporting shelters in their efforts. These developments underscore the critical role of shelters and rescue centers in the evolving market landscape.

Regional Insights

North America dominated the global animal euthanasia market in 2024, holding the largest revenue share of 42.79%.The market growth is attributed to the increasing pet ownership, awareness of humane end-of-life care, and advancements in veterinary services. The expansion of compassionate in-home pet euthanasia services further exemplifies the region's dominance. For instance, in September 2025, CodaPet extended its services to North Miami, FL, offering peaceful, stress-free end-of-life care for pets in the comfort of their homes, with services starting at $400 and aftercare and cremation available from $200. This trend reflects a growing preference for at-home euthanasia options, highlighting North America's leadership in providing accessible and compassionate end-of-life care for pets.

U.S. Animal Euthanasia Market Trends

The animal euthanasia industry in the U.S. accounted for the highest revenue share in North America, owing to its high pet ownership, advanced veterinary infrastructure, and growing awareness of humane, compassionate end-of-life care. Widespread availability of veterinary hospitals, mobile euthanasia services, and animal shelters, combined with the humanization of pets, has driven strong demand for professional euthanasia services across the country, making it the leading market in the region.

The Canada animal euthanasia market is expected to grow at a significant CAGR during the forecast period. The market is driven by rising veterinary costs, and limited access to affordable care may drive more owners toward euthanasia as a practical solution, thereby expanding the market for both clinic-based and in-home pet euthanasia services. For example, Animal rescue organizations in Calgary report a growing number of pets being surrendered because owners cannot afford veterinary care, with 78% of surrenders in 2024 attributed to external financial or social pressures rather than the pet itself. Rising vet costs, increased medication prices, and a shortage of trained professionals have intensified the issue, placing additional strain on shelters and rescue services.

Europe Animal Euthanasia Market Trends

The Europe animal euthanasia industry’s growth is driven by rising pet ownership, longer pet lifespans, and the growing humanization of pets, which has increased the demand for compassionate, end-of-life care. Enhanced veterinary practices and the adoption of more humane euthanasia methods have also contributed, alongside stricter animal welfare regulations that emphasize ethical and professional standards. These factors collectively have increased the focus on providing pets with dignified, stress-free, and comfortable end-of-life experiences, whether in clinics, shelters, or at home. Additionally, stricter animal welfare regulations and ethical standards across Europe have encouraged the adoption of professional, regulated euthanasia services. At the same time, advances in veterinary technology have made these procedures more humane and accessible, further supporting market growth.

The animal euthanasia market in Germany held the highest revenue share in 2024. This can be attributed to the rising veterinary costs (in part due to a recent update to the official veterinarian fee schedule, the GOT), which have increased the price of even basic procedures and made end-of-life treatment more expensive for pet owners. Shelter and animal welfare groups are under strain due to rising vet, energy, feeding, and staffing costs, leading to overcrowding and financial stress; this sets the stage for more difficult euthanasia decisions in shelters.

The UK animal euthanasia market is expected to grow significantly over the forecast period. The country’s growth is influenced by the rising veterinary costs, which are pushing more owners to choose euthanasia over expensive treatments, particularly during the cost-of-living crisis. According to the British Veterinary Association (BVA) report published in June 2025, rising veterinary costs in the UK are forcing more pet owners to delay treatment, give up pets, or opt for euthanasia instead of expensive care, with corporate ownership of vet practices driving prices up by over 60% since 2015. Also, according to a Kynetec "Cost-of-Living" report, more vets are noticing clients choosing euthanasia as a cost-saving measure, even for healthy animals, or giving up pets when they cannot afford care. The financial strain on pet owners is accelerating demand for euthanasia services, even in treatable cases, thereby expanding the market.

Asia Pacific Animal Euthanasia Market Trends

The Asia Pacific animal euthanasia industry is expected to grow at a significant CAGR over the forecast period. This expansion is attributed to factors such as increasing pet ownership, rising awareness of humane end-of-life care, and advancements in veterinary services. In countries like India and China, the growing pet population and the adoption of more compassionate pet care practices are contributing to the demand for euthanasia services. Additionally, the development of mobile and in-home euthanasia services enhances accessibility and convenience for pet owners, further driving market growth in the region.

The China animal euthanasia market is witnessing new growth opportunities due to rising pet ownership, increasing awareness of animal welfare, and the humanization of pets. Urban pet owners are seeking compassionate end-of-life care, prompting the expansion of in-home and clinic-based euthanasia services. For example, veterinary clinics in major cities such as Shanghai and Beijing now offer specialized euthanasia packages, including aftercare and cremation, to provide stress-free experiences for pets and their families. The development of veterinary infrastructure and adoption of modern medical technologies further support this trend, positioning China as a key emerging market for professional and humane pet euthanasia services.

The animal euthanasia market in Japan is driven by the rising demand for compassionate end-of-life care, the rising pet ownership, and the growing acceptance of in-home services as a preferable alternative to traditional clinical settings. Japan has dramatically reduced pet euthanasia rates, from nearly a million animals annually in the past to around 3,000 dogs and 9,000 cats in 2022, thanks to stricter animal welfare laws, microchipping mandates, sterilization programs, and increased adoption initiatives. Despite these successes, challenges such as shelter overcrowding, insufficient veterinary resources, and limited humane euthanasia options for strays remain. The significant decline in euthanasia rates has shifted the Japanese market toward preventive and adoption-focused services, with growing demand for sterilization, veterinary care, and no-kill shelters. While traditional euthanasia services remain necessary for medical or welfare reasons, the market is increasingly focused on humane alternatives, in-home end-of-life care, and animal welfare initiatives, creating opportunities for veterinary services, pet care providers, and nonprofit organizations in Japan.

The India animal euthanasia market is experiencing notable growth, driven by increasing pet ownership, urbanization, and evolving attitudes toward animal welfare. The market's expansion is evident from the rising demand for humane euthanasia services, particularly in metropolitan areas. For instance, IncrediPets, a pet care service launched in April 2022, has served over 30,000 families across cities like Delhi, Mumbai, and Pune. This indicates a growing inclination among pet owners to seek professional end-of-life care for their pets. Additionally, Kerala's recent policy to permit euthanasia of seriously ill stray dogs reflects a shift towards more compassionate and regulated approaches to animal welfare. These developments underscore a broader cultural shift towards responsible pet ownership and the demand for ethical euthanasia practices in India.

Latin America Animal Euthanasia Market Trends

The animal euthanasia industry in Latin America is expected to witness significant growth over the forecast period, driven by increasing pet ownership, rising awareness of animal welfare, and expanding veterinary infrastructure. Trends indicate a shift toward more humane and regulated euthanasia practices, with veterinary clinics and mobile services offering in-home end-of-life care for companion animals. For example, in Brazil, both domestic and international providers are expanding distribution networks for sedation products and euthanasia services in urban areas. At the same time, training programs in the swine and dairy industries promote timely and ethical euthanasia. Additionally, growing adoption of sterilization and vaccination programs across the region reflects a broader trend of preventive animal care that complements the evolving euthanasia market.

Brazil animal euthanasia Market is witnessing notable growth due to the rising pet ownership, increased awareness of animal welfare, and the expansion of veterinary healthcare services. Demand for humane euthanasia practices and effective sedation solutions is rising alongside higher household spending on companion animal care. The market is further supported by education and training initiatives in both the swine and dairy cattle industries, aimed at promoting timely and ethical euthanasia practices. Overall, the market is evolving with a focus on improved veterinary services, awareness, and access to professional end-of-life care for animals.

Middle East & Africa Animal Euthanasia Market Trends

The Middle East & Africa animal euthanasia industry is expanding significantly, due to rising pet ownership, awareness of animal welfare, and the expansion of veterinary services in urban centers. Market trends indicate a growing preference for humane and professional euthanasia practices, including in-clinic and mobile services for companion animals. For instance, in the UAE, veterinary clinics in cities like Dubai and Abu Dhabi are offering end-of-life care packages that include sedation, euthanasia, and aftercare, reflecting an increased focus on compassionate pet care. Additionally, awareness campaigns and training programs for livestock handlers in countries like South Africa are promoting timely and ethical euthanasia practices, further shaping the market toward regulated and humane approaches.

The South Africa animal euthanasia Market is expected to grow the fastest over the forecast period, propelled by an overwhelming overpopulation crisis and limited shelter capacity. With an estimated 4 million homeless cats and dogs, around 650,000 enter shelters annually. Yet, adoption rates remain very low, illustrated by three SPCAs receiving 982 animals in a single month, of which only 50 were adopted and 20 reclaimed, leaving more than 90% facing euthanasia. The scale of the problem is compounded by high reproductive rates, i.e., one unsterilized female dog and her offspring can produce up to 67,000 puppies in six years, while a single unsterilized female cat line can yield 370,000 kittens in seven years. As a result, approximately 2,800 animals are euthanized daily in South Africa due to the lack of homes and resources, making shelter overcrowding, irresponsible breeding, and insufficient sterilization programs the key drivers of demand for euthanasia services and products in the region.

The UAE animal euthanasia Market is experiencing growth driven by rising pet ownership, awareness of animal welfare, and the humanization of pets. Veterinary clinics across the country are offering both in-clinic and in-home euthanasia services, providing compassionate and dignified end-of-life care for pets. For instance, Pet Connection Veterinary Clinic in Dubai offers personalized euthanasia services, ensuring minimal stress for animals and their owners. Additionally, municipalities have established regulated protocols for handling deceased pets, including cremation services, reflecting a broader trend toward humane, ethical, and organized practices in the region.

Key Animal Euthanasia Company Insights

The global animal euthanasia drugs market is characterized by a competitive landscape featuring key players such as Zoetis Inc., Merck Animal Health, Virbac, and Vetoquinol S.A. These companies focus on expanding their product portfolios and enhancing distribution networks to meet the growing demand for humane euthanasia solutions. Injectable euthanasia drugs, particularly pentobarbital-based solutions, dominate the market due to their efficacy and rapid action. The market is also witnessing innovation in alternative euthanasia methods, such as inhalant agents and oral formulations, driven by advancements in veterinary medicine and evolving consumer preferences.

Key Animal Euthanasia Companies:

The following are the leading companies in the animal euthanasia market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis Inc.

- Boehringer Ingelheim GmbH

- Merck & Co. Inc.

- Elanco

- Vetoquinol SA

- Dechra Pharmaceuticals PLC

- Virbac

- Hikma Pharmaceuticals PLC

- Akorn Animal Health, Inc.

- Piramal Critical Care Inc.

Recent Developments

-

In September 2025, CodaPet extended its services to North Miami, FL, offering peaceful, stress-free end-of-life care for pets in the comfort of their homes, with services starting at $400 and aftercare and cremation available from $200.

-

In July 2025, the Kerala government has authorized local bodies to euthanize diseased stray dogs under the 2023 Animal Husbandry Rules to control rabies, amid rising dog bite cases, while also deploying mobile ABC units for sterilization and vaccination programs.

Animal Euthanasia Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.63 billion

Revenue forecast in 2033

USD 2.68 billion

Growth rate

CAGR of 6.47% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal, route of administration, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Zoetis Inc.; Boehringer Ingelheim GmbH; Merck & Co. Inc.; Elanco; Vetoquinol SA; Dechra Pharmaceuticals PLC; Virbac; Hikma Pharmaceuticals PLC; Akorn Animal Health, Inc.; Piramal Critical Care Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Euthanasia Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global animal euthanasia market report based on product, animal, route of administration, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceuticals

-

Barbiturates

-

Combination Drugs

-

Non-barbiturate anesthetics

-

-

Inhalants

-

Others

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Companion Animals

-

Livestock Animals

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Injectable

-

Intravenous

-

Intramuscular

-

Subcutaneous

-

-

Inhalants

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals and Clinics

-

Animal Shelters & Rescue Centers

-

Research Laboratories & Universities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global animal euthanasia market size was estimated at USD1.58 billion in 2024 and is expected to reach USD 1.63 billion in 2025.

b. The global animal euthanasia market is expected to grow at a compound annual growth rate of 6.47% from 2025 to 2033 to reach USD 2.68 billion by 2033.

b. North America dominated the global animal euthanasia market in 2024, holding the largest revenue share of 42.79%. The market growth is attributed to increasing pet ownership, awareness of humane end-of-life care, and advancements in veterinary services.

b. Some key players operating in the animal euthanasia market include Zoetis Inc., Boehringer Ingelheim GmbH, Merck & Co. Inc., Elanco, Vetoquinol SA, Dechra Pharmaceuticals PLC, Virbac, Hikma Pharmaceuticals PLC, Akorn Animal Health, Inc., Piramal Critical Care Inc.

b. The market is experiencing growth driven by increasing pet ownership, rising demand for humane end-of-life care, and the need for disease control in both companion and livestock animals. Growing awareness of ethical euthanasia practices and the expansion of mobile and in-clinic veterinary services further fuel market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.