- Home

- »

- Animal Health

- »

-

Animal Workstations Market Size And Share Report, 2030GVR Report cover

![Animal Workstations Market Size, Share & Trends Report]()

Animal Workstations Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal Type (Large, Small), By Product (Dual Access Workstation, Bedding Disposal Workstation, Single-Sided Workstation), By Technology, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-686-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2028

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Animal Workstations Market Size & Trends

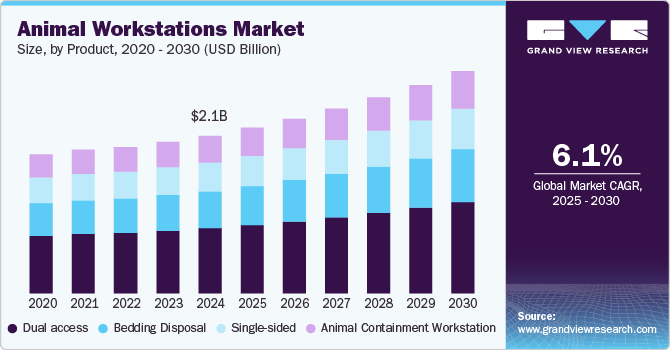

The global animal workstations market size was estimated at USD 2.14 billion in 2024 and is expected to grow at a CAGR of 6.1% from 2025 to 2030. Increasing research activities and stringent regulatory guidelines are expected to propel the market growth over the forecast period. According to a report by Cruelty-Free International published in December 2023, in Canada, the use of animals in experiments saw a shocking increase in 2022, particularly among monkeys (up 15% to 7,848) and dogs (up 4% to 10,417), amidst a total of over 3.5 million animals used. This ongoing demand for more humane research approaches emphasizes the importance of enhancing animal workstations and facilities to accommodate ethical research practices better and ensure the welfare of laboratory animals.

The direction of biomedical research shifted to support the response to COVID-19. This resulted in high demand for animals, such as ferrets and mice, for research use directed toward developing vaccines and treatments, thus requiring more workstations. The OIE recommended implementing national risk reduction strategies to prevent transmission of SARS-CoV-2 between susceptible animals and humans. It developed guidelines for people working with susceptible farmed animals to aid countries in implementing these measures. This contributed to the demand for animal workstations, and the trend is expected to continue.

Moreover, the increase in veterinary surgeries significantly drives the animal workstation market due to the growing demand for advanced surgical facilities and equipment in veterinary clinics. For instance, in August 2024, The Greater Chennai Corporation plans to conduct 50,000 Animal Birth Control (ABC) surgeries on stray dogs annually, with a budget exceeding ₹9.45 crore (USD 1.12 million). Two new ABC centers will be established, increasing the capacity to perform 210 surgeries daily across seven centers. Similarly, the American Veterinary Medical Association (AVMA) reported that approximately 80% of veterinarians have seen an increase in surgical procedures in recent years. This surge in surgeries necessitates the use of high-quality animal workstations that provide ergonomic designs and improved functionality, contributing to the overall growth of the market.

Furthermore, increasing demand for veterinary surgeries is driving market growth. Modern surgeries have various advantages, such as smaller surgical wounds & fewer stitches, giving confidence to pet parents to opt for advanced minimally invasive surgeries. Rising adoption of companion animals and increasing demand for improved animal healthcare are factors anticipated to increase the demand for veterinary surgeries. Moreover, increasing research activities in developing countries such as China, India, and South Korea is boosting revenue.

Market Concentration & Characteristics

The market exhibits moderate industry concentration, with several key players dominating the landscape, including Allentown, Esco Lifesciences, and Thermo Fisher Scientific. These companies influence their established reputations, extensive product lines, and strong distribution networks to maintain competitive advantages. While the market features some niche players focusing on specialized solutions, the presence of large multinational corporations often drives consolidation and innovation, resulting in a landscape where a few leading firms significantly influence market trends and pricing strategies.

The degree of innovation in the market is characterized by advancements in containment technologies, such as ELISA-verified systems and ULPA filtration, which ensure superior protection against airborne contaminants. Additionally, the integration of smart technologies, like real-time airflow monitoring and intuitive user interfaces, enhances operational efficiency and user experience. Companies are also focusing on ergonomic designs and energy-efficient systems to meet both regulatory standards and the evolving demands of researchers.

The animal workstation market has seen strategic mergers and acquisitions to expand technological capabilities and service portfolios as well as to meet increasing demands in biomedical research. For instance, in January 2024, Allentown acquired ClorDiSys to enhance its offerings in the animal workstation and vivarium sectors, expanding into chlorine dioxide-based sterilization for pre-clinical research and adjacent markets. This addition strengthens Allentown's role as a comprehensive provider of biomedical and life sciences equipment, emphasizing safe, efficient decontamination.

Regulations in the animal workstation market significantly impact design standards, operational requirements, and market entry for companies. Strict guidelines from bodies like the FDA, USDA, and EPA in the U.S. and similar entities globally mandate high containment levels, minimal environmental impact, and strict animal welfare compliance. Workstations must include features like HEPA/ULPA filtration, low-noise operation, and ergonomic design to protect operators and animals, which raises production costs but also drives product innovation. Compliance requirements encourage manufacturers to adopt advanced technologies and materials to meet safety and containment standards, enhancing the reliability and quality of animal workstations in research settings.

In the animal workstation market, product substitutes include general laboratory hoods, biosafety cabinets, and custom containment units. While these alternatives may provide basic containment, they often lack the specialized features-such as allergen and odor control, ergonomic access for animal handling, and ULPA filtration-that are critical for protecting both operators and lab animals in biomedical research. The use of non-specialized equipment may reduce initial costs. Still, it can compromise safety and efficiency, making dedicated animal workstations preferable for labs that require compliance with stringent animal welfare and safety standards.

Regional expansion in the animal workstation market is driven by increasing demand for pre-clinical research in emerging markets such as Asia-Pacific and Latin America. Key factors include rising investments in life sciences, stricter animal welfare regulations, and the growing prevalence of research institutions. Companies are strategically establishing local manufacturing and distribution networks to enhance service delivery and cater to the specific needs of regional customers.

Product Insights

The dual access segment held the largest revenue share of over 41.2% in 2024. The growth can be attributed to the increasing usage of these devices in research institutes. It has three filters that efficiently filter the activated carbon & contaminated air for better safety. Industry players such as ESCO MICRO PTE LTD; Geneva Scientific; Colcom Inc.; and NuAire are trying to manufacture advanced workstations to increase their market penetration. Increasing demand for high-precision research environments, particularly in medical, veterinary, and biological research, drives segment growth. Enhanced regulatory standards and the push for ethical practices, such as the '3Rs' (replacement, reduction, and refinement), are prompting institutions to invest in advanced workstations to optimize animal welfare while supporting scientific accuracy.

The bedding disposal segment is expected to showcase the fastest CAGR over the forecast period. The increasing usage of these workstations for various purposes such as veterinary research, drug development, production of biological agents, and development of treatment of diseases & infections are propelling the market. For instance, According to data published by Understanding Animal Research (UAR) in September 2024, ten major organizations in Great Britain conducted 54% of all animal research in 2023, totaling over 1.4 million procedures out of 2.68 million reported. Most of these procedures (99%) involved mice, fish, and rats.

Animal Type Insights

Based on animal type, the market is segmented into small and large animals. Small animals held the largest share of the global animal workstations market in 2024. This can be attributed to the increasing usage of small animals, especially rats and mice, for research purposes. For instance, In 2023, AstraZeneca used 182,458 animals, with over 97% being rodents or fish and less than 1% being dogs or primates. Similarly, in April 2024, a study published by Harvard Medical School in the U.S., about 95% of warm-blooded research animals are rats and mice.

Large animals also held a substantial share in the market. According to a February 2023 report published by Cruelty-Free International, there was a 6% rise in animal testing in the U.S. for 2021, totaling 712,683 animals, including 71,921 monkeys, 44,847 dogs, and 12,595 cats. Furthermore, animal research often uses species such as pigs, sheep, and non-human primates because of their comparable organ sizes, metabolic rates, and genetic similarities, which are valuable for pre-clinical trials and complex research fields like cardiology and neurology. Additionally, large animals are critical in long-term studies that require detailed tracking of systemic effects, supporting advancements in translational research and biomedical innovation. On the contrary, the use of non-rodent animals for research has decreased over the past two decades due to stringent regulations.

Technology Insights

The anesthesia workstations segment held the largest market share in 2024 and is expected to grow at a CAGR of 6.1% over the forecast period owing to the high usage of anesthesia for performing surgical procedures in animals. Furthermore, increasing technological advancements by market players are estimated to boost the segment growth. On the basis of technology, the global market is bifurcated into anesthesia workstations and others.

The others segment includes ventilated workstations and microscope workstations. The segment is anticipated to have significant growth during the projected period. This growth can be attributed to various product launches in the segment by major companies operating in the market.

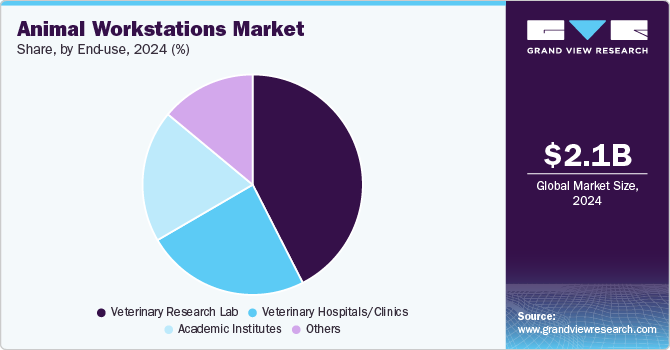

End-use Insights

Veterinary research labs held the largest revenue in the end use segment owing to the large number of animal testing performed under these facilities. Demand for animal workstations is expected to increase, with the growing need for laboratory animals for use in clinical trials & other research purposes. The COVID-19 pandemic has intensified research activities, while the research labs are focused on finding a solution for African swine fever and Highly Pathogenic Avian Influenza (HPAI).

The academic institutes segment is expected to show lucrative growth over the forecast period. Rising adoption of pet animals and increasing healthcare spending on pets are factors fueling the growth of research institutes & universities. The Harbin Veterinary Research Institute (HVRI) in China conducts research through its various divisions-animal influenza, livestock infectious diseases, and avian respiratory diseases divisions. In March 2020, HVRI developed an experimental vaccine against African swine fever. Before launching the vaccine, HVRI would be conducting clinical trials on 10,000 to 20,000 pigs, thus fueling the market growth.

Regional Insights

North America animal workstations market dominated the global market. The dominant share can be attributed to the presence of a large number of research labs and pre-clinical trial activities in this region. Moreover, the presence of big industry players and ongoing R&D activities are further bolstering the market. According to the Animal Justice Canada Legislative Fund data published in January 2024, In Canada, over 3.5 million animals, including mice, fish, dogs, and non-human primates, were used in scientific experiments in 2022, according to The Canadian Council on Animal Care (CCAC). Moreover, the increasing number of funded animal research activities is propelling the market.

U.S. Animal Workstations Market Trends

The animal workstation market in the U.S. is expected to grow at a significant pace over the forecast period, driven by increased research funding, technological advancements, and stringent regulations for humane animal treatment in laboratories. Rising demand for ergonomic, contamination-free environments to support accurate results in pre-clinical trials has further propelled growth. For instance, the National Institutes of Health (NIH) allocates significant funds for animal research, which in turn raises demand for high-quality workstations designed to reduce researcher fatigue and improve animal welfare.

Europe Animal Workstations Market Trends

The animal workstation market in Europe is influenced by several trends, driven by an increase in the use of research animals in Europe. For instance, in 2022, a total of 9,237,542 animals were used for research purposes across the EU and Norway, marking an 8.3% decrease from the previous year. France led the use of animals in research with 1,829,827 (21.8%), followed by Norway (1,389,148 or 16.6%), Germany (1,342,404 or 16%), Spain (1,047,233 or 12.5%), and Belgium (430,671 or 5.1%). Furthermore, ongoing emphasis on improving animal care, reducing stress during experiments, and ensuring regulatory compliance is also pushing laboratories to upgrade their existing facilities, thereby propelling market growth.

Additionally, a rise in funding for animal research, particularly in areas like drug development and disease studies, further fuels market growth. For example, the European Commission's support for animal research initiatives promotes innovation and enhances the capabilities of research facilities. Additionally, stringent regulatory requirements surrounding animal welfare compel laboratories to invest in compliant and efficient workstation solutions.

The UK animal workstations market held the largest share of the Europe market in 2024. In recent years, animal research in Great Britain has seen a significant increase, with the UK Home Office reporting a rise in the number of animals used in scientific procedures. According to the PETA, In the UK, 2.68 million procedures involving living animals were conducted in 2023. Mice, fish, birds, and rats comprised 95% of this total, though dogs and monkeys were also included in the research, reflecting a growing emphasis on animal-based studies in fields like biomedical research and drug development. Concurrently, changes in British regulations, such as the Animal Welfare (Sentencing and Recognition of Sentience) Bill and the new guidance from the Animals in Science Regulation Unit (ASRU), have enhanced welfare standards and ethical considerations in animal research. These regulatory advancements necessitate the adoption of specialized animal workstations to ensure compliance, improve animal welfare, and promote better research practices, thus driving the market growth.

Asia Pacific Animal Workstations Market Trends

The animal workstations market in Asia Pacific is expanding rapidly due to increasing investments in veterinary research, particularly in countries like China and India, enhancing the demand for advanced animal workstations. The growing awareness of animal welfare and regulatory changes promoting humane testing practices also contribute to market growth. Additionally, technological advancements, such as the development of simulation models and non-invasive research methods, are gaining traction, reflecting a shift towards more ethical research methodologies.

Japan's animal workstation market is evolving, albeit slowly, with increasing awareness of animal welfare and the adoption of alternative testing methods. While major companies still rely on traditional animal testing, institutions like Gifu University are pioneering the use of biological models and simulation for veterinary education. The demand for cruelty-free products is rising, illustrated by brands like Lush Japan Co Ltd, which highlights its commitment to non-animal testing. However, Japan's overall market remains significantly behind Western nations in terms of transparency and ethical practices in animal testing.

The animal workstation market in India is witnessing notable growth, evolving research methodologies, and regulatory changes. A growing emphasis on humane research practices is leading to increased adoption of alternatives to traditional animal testing, such as in vitro methods and computer modeling. For instance, advancements in "organs-on-a-chip" technology are providing researchers with innovative ways to study drug interactions without the use of live animals. Additionally, India's regulatory landscape is gradually shifting as discussions around reducing animal studies in drug trials gain momentum. This change is reflected in conferences highlighting alternative testing methods, positioning India as a potential leader in ethical research practices. As such, these factors are contributing to the expansion and modernization of animal workstations across the country.

Latin America Animal Workstations Market Trends

The Latin America animal workstation market is propelled by increasing investments in veterinary education and research, particularly in Brazil and Argentina. Growing awareness of animal welfare and the implementation of stricter regulations regarding animal testing are also significant drivers. Additionally, technological advancements, such as virtual simulations and alternative testing methods, enhance research capabilities. For example, universities in the region are adopting humane training practices that reduce reliance on live animals, reflecting a broader commitment to ethical research methodologies.

Brazil animal workstations market is expected to witness growth during the forecast period. The enactment of the Sansão Law in Brazil, which imposes stricter penalties for animal cruelty, is significantly driving the market growth. This legislation reflects an increased societal commitment to animal welfare, leading to increased demand for animal research and veterinary services. For example, with higher penalties, more resources are being allocated to develop humane animal research facilities, ensuring compliance with new regulations and fostering innovation in the sector. The law's focus on animal protection enhances the need for advanced workstations to facilitate ethical research practices.

Middle East & Africa Animal Workstations Market Trends

The Middle East & Africa animal workstations market is witnessing significant growth, driven by growing emphasis on veterinary education and research standards. Countries like South Africa and the UAE are investing in advanced training facilities that utilize humane and ethical practices, including simulation technologies. However, challenges remain, such as limited funding and awareness. Initiatives aimed at improving animal welfare regulations and integrating modern training techniques are helping to advance the market, aligning with global trends toward reducing animal testing in research and education.

The growth of the Saudi Arabia animal workstations market is driven by increasing investments in veterinary education and a growing emphasis on animal welfare. Opportunities arise from government initiatives to enhance research capabilities and modernize veterinary practices. Furthermore, partnerships with international research institutions can lead to knowledge transfer and technological advancements. For instance, the establishment of advanced veterinary research facilities aligns with Vision 2030, supporting innovation and sustainability in the animal healthcare sector. This evolving landscape positions Saudi Arabia as a potential leader in animal research and welfare in the region.

Key Animal Workstations Company Insights

The animal workstation market is fragmented, with many large and small players. These players implement various strategic initiatives to achieve their objectives and increase their revenue share. New launches, regional expansion, R&D development, and mergers & acquisitions are some of the initiatives deployed by key companies.

Key Animal Workstations Companies:

The following are the leading companies in the animal workstations market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Steelco S.p.A.

- NuAire, Inc.

- Allentown, LLC

- Avante Animal Health

- Air Science USA LLC

- Baker

- Labconco

- Shenzhen Mindray Animal Medical Technology Co., LTD.,

- Sychem Limited

Recent Developments

-

In September 2024, Esco Lifesciences Group acquired its South Korean distributor, Esco Korea Micro Ltd., to boost its reach in the region and to expand direct sales and service capabilities. This move also supports Esco's digital transformation initiatives, streamlining operations to meet the growing demands of the biopharma and research sectors.

-

In January 2024, Allentown, LLC acquired ClorDiSys Solutions, Inc., enhancing its service offerings in pre-clinical research and life sciences.

Animal Workstations Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.25 billion

Revenue Forecast in 2030

USD 3.02 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, animal type, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Steelco S.p.A.; NuAire, Inc.; Allentown, LLC; Avante Animal Health; Air Science USA LLC; Baker; Labconco; Shenzhen Mindray Animal Medical Technology Co., LTD.; Sychem Limited

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Workstations Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal workstation market report based on product, animal type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dual access

-

Bedding Disposal

-

Single-sided

-

Animal Containment Workstation

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Large Animals

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Anesthesia Workstations

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals/Clinics

-

Veterinary Research Lab

-

Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East & Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.