- Home

- »

- Animal Health

- »

-

Animal Wound Care Market Size, Industry Report, 2030GVR Report cover

![Animal Wound Care Market Size, Share & Trends Report]()

Animal Wound Care Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Surgical, Therapy Devices), By Animal Type (Companion, Livestock), By Distribution Channel, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-257-0

- Number of Report Pages: 154

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Animal Wound Care Market Summary

The global animal wound care market was estimated at USD 1.38 billion in 2024 and is projected to reach USD 2.10 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of 7.40% from 2025 to 2030. The market is driven by an increasing focus on R&D investment, which enhances current wound management practices and introduces innovative techniques.

Key Market Trends & Insights

- North America dominated the animal wound care market globally, with the largest revenue share of 36.52% in 2024.

- The U.S. animal wound care market accounted for the largest revenue share in North America in 2024.

- By product, the surgical wound care products segment dominated the market, holding the largest revenue share of 40.17% in 2024.

- By animal type, the livestock animal segment is expected to grow at the fastest CAGR of 7.75% from 2025 to 2030.

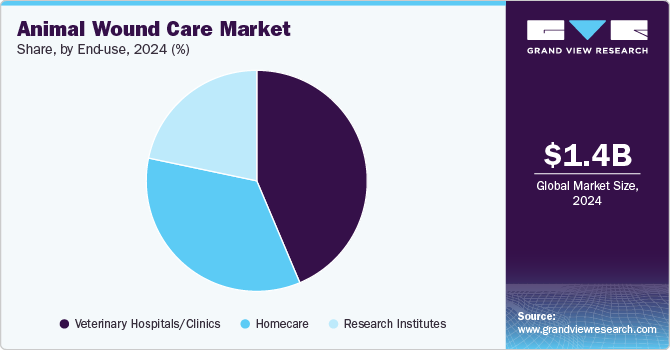

- Based on end use, the veterinary hospitals and clinics segment led the market with the largest revenue share of 43.65% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.38 Billion

- 2030 Projected Market Size: USD 2.10 Billion

- CAGR (2025-2030): 7.40%

- North America: Largest market in 2024

Furthermore, clinical research significantly influences this market by validating the effectiveness of new products. For example, in August 2024, Noxsano's Restore Wound Pads and Gels accelerate healing with nitric oxide technology, offering cost-effective, versatile solutions for veterinarians and pet owners. Clinically validated, they are available in the U.S., with global expansion and human healthcare applications in progress.

Increasing pet ownership significantly contributes to this growth, as more households adopt pets, leading to a higher demand for veterinary services, including surgical procedures that necessitate effective management solutions. The rising prevalence of surgical interventions and improvement in wound management & treatment infrastructure in companion animals further amplifies this demand, as many pets undergo surgeries annually, creating a pressing need for postoperative care.

Educational conferences and awareness programs for veterinary professionals play a crucial role in driving the growth of the veterinary wound cleansers market by promoting best practices and advancements in animal wound care. For instance, in 2024, Essity organized five workshops in Nottingham, Derby, Dunstable, and Manchester, focusing on topics such as wound assessment, post-operative complications, case studies, and hands-on practicals. These events included practical demonstrations on managing wound care for companion animals, highlighting the importance of holistic wound assessment. Such initiatives keep veterinary practitioners informed about the latest research, technologies, and products, encouraging the adoption of effective wound care solutions and fostering the use of high-quality cleansers in clinical settings, thereby boosting market growth.

Several product launches and regulatory approvals are key drivers of growth in the animal wound care industry, addressing evolving consumer and industry needs. For instance, in November 2024, Vet Aid introduced its "Vet Aid Wound Care Spray and Foam," a natural solution formulated with Red Sea minerals. These eco-friendly products meet the rising demand for safer, natural alternatives to chemical-based treatments, catering to diverse applications for pets, livestock, and exotic animals. By emphasizing natural and regenerative properties, these innovations align with the growing preference for sustainable and holistic care. Such advancements expand the options available to veterinarians and pet owners, fostering market growth and setting higher standards for veterinary wound care solutions.

Another market driver is the humanization trend, in which pets are increasingly viewed as family members. This has led to greater expenditures on their health and wellness. This is evident from the rise in pet insurance policies that cover postoperative care and the increased demand for high-quality, specialized veterinary services. The humanization trend not only influences spending habits but also drives innovations to improve the quality of life for pets, further propelling the market for effective animal wound care solutions.

Product Insights

The surgical wound care products segment led the market with the largest revenue share of 40.17% in 2024. This growth is due to their critical role in ensuring successful outcomes during and after surgical procedures. Skin staplers have gained popularity due to advantages such as simplicity, increased affordability, reduced surgery time, and easy removal. Absorbable and non-absorbable sutures can be used depending on the purpose. Surgical sutures and suture cassettes are used in various veterinary surgeries, including orthopedic, cardiovascular, and neurological, to provide temporary support for wound healing. Innovations such as Dolphin Sutures' fluorescent and cassette sutures highlight the growing need and demand for these products. These fluorescent sutures, launched in August 2024, enhance visibility under UV light, improving precision in minimally invasive or low-light surgeries while reducing tissue trauma and promoting faster healing. Cassette sutures streamline surgical workflows by eliminating manual threading and minimizing contamination risks through their sterile dispenser system. These advancements cater to the unique needs of veterinary surgeons, enhancing efficiency, patient safety, and post-surgical recovery. The growing adoption of such specialized tools reflects their importance in meeting the demands of modern veterinary medicine and driving market growth.

The therapy devices segment is expected to register at the fastest CAGR of 7.98% during the forecast period. This growth is driven by a number of advancements in the medical device sector for wound care. For instance, in October 2024, Vetlen Advanced Veterinary Devices LLC launched "Vetlen Pouch," an innovative drug delivery device that provides a novel approach to treating infected wounds in canine and equine patients by delivering high-dose, localized antibiotic therapy directly to surgical or wound sites. This pouch is capable of delivering continuous medication for up to 30 days and is adaptable to various small-molecule therapies. Such devices not only improve treatment outcomes but also reduce systemic antibiotic use, aligning with growing efforts to combat antimicrobial resistance. The combination of efficiency, versatility, and targeted treatment positions therapy devices as a key growth driver in the animal wound care industry.

Animal Type Insights

Based on animal type, the companion animal segment led the market with the largest revenue share of 63.92% in 2024. This can be attributed to the growing global pet population and increasing awareness among pet owners about the importance of veterinary care. Rising expenditures on pet healthcare, including advanced wound care solutions, reflect a strong commitment to improving the quality of life for pets. Common injuries such as cuts, abrasions, surgical wounds, and chronic conditions like diabetes in pets require specialized wound care products, fueling demand in this segment. In addition, advancements in companion animal care, such as antimicrobial dressings, hydrogel therapies, and pain management solutions, further enhance market growth. The increasing disposable income and the willingness of pet owners to invest in premium veterinary treatments underscore the dominance of the companion animal segment in the animal wound care industry.

The livestock animal segment is expected to grow at the fastest CAGR of 7.75% from 2025 to 2030. This growth is driven by the increasing awareness among farmers and veterinary professionals about advanced wound care. Many market players are involved in investing and raising funds to develop new solutions for wound care specific to livestock animals. For instance, in March 2023, NoBACZ Healthcare Ltd. closed a USD 3.4 million seed round to launch wound care solutions for livestock animals- dairy and beef cattle. This funding was also intended to support the company’s commercial growth and facilitate the research teams in the development of wound-dressing solutions tailored to the specific needs of horses and companion animals. Strategic collaborations and investments like these are expected to fuel the segment’s growth during the forecast period.

End Use Insights

Based on end use, the veterinary hospitals and clinics segment led the market with the largest revenue share of 43.65% in 2024, due to the high volume of surgical procedures performed in these settings, necessitating effective wound management solutions. Veterinary hospitals and clinics are equipped with the necessary infrastructure and expertise to administer a range of therapies, including sutures, staples, dressings, and others. The professional environment ensures that animals receive appropriate care and monitoring during recovery, contributing to the segment's leading position.

The homecare segment is projected to grow at the fastest CAGR over the forecast period. This growth is driven by the rising preference for at-home treatment options among pet owners. Factors such as increasing costs of clinical visits, convenience, and the availability of user-friendly wound care products contribute to this trend. Products such as wound sprays, gels, and bandages designed for easy application at home enable pet owners to manage minor injuries and post-operative care effectively. In addition, advancements in telemedicine and remote veterinary consultations further support the growth of this segment, allowing professionals to guide pet owners in administering proper wound care at home. The increasing emphasis on reducing stress for animals during recovery and the demand for cost-effective treatment options make the homecare segment a significant growth driver in the animal wound care industry.

Distribution Channel Insights

Based on distribution channel, the veterinary hospitals/clinics segment led the market with the largest revenue share of 48.97% in 2024, due to their central role in providing specialized care for animals with wounds and injuries. These facilities are equipped with the necessary expertise, medical staff, and resources to handle complex wound management, including surgical wounds, trauma, and chronic conditions. Veterinary professionals rely on a wide range of wound care products, such as antimicrobial dressings, sutures, and advanced therapeutic devices, to ensure optimal healing and recovery for animals. The trusted environment and personalized care offered by veterinary clinics and hospitals make them the primary point of access for advanced wound care solutions, further driving the demand for such products. In addition, the growing number of veterinary clinics worldwide and the increasing focus on specialized animal care continue to solidify this channel's dominance in the animal wound care industry.

The e-commerce segment is projected to grow at the fastest CAGR over the forecast period. The convenience of online shopping and the increasing number of pet owners seeking accessible and cost-effective solutions drive this growth. Online platforms offer a wide range of wound care products, including dressings, sprays, and therapeutic devices, often accompanied by detailed product descriptions, usage instructions, and customer reviews. The growth of e-commerce is further fueled by advancements in digital payment systems, faster delivery options, and subscription services for recurring orders. In addition, the rise of direct-to-consumer brands and the integration of veterinary telehealth services with online product sales are contributing to this segment's rapid expansion. This shift aligns with the increasing preference for accessible and hassle-free shopping experiences, positioning e-commerce as the fastest-growing segment in the animal wound care industry.

Regional Insights

North America dominated the animal wound care market with the largest revenue share of 36.52% in 2024. This is attributed to the region's high pet adoption rate and advanced veterinary healthcare infrastructure. The rise in efforts taken by major players to advance their product portfolio and guarantee high-quality standards is expected to fuel the demand for wound care products in the region. For instance, Armis Biopharma, a U.S.-based biopharmaceutical company, is working on VeriClenz, a professional antibiotic wound cleanser for animals.

U.S. Animal Wound Care Market Trends

The animal wound care market in the U.S. accounted for the largest revenue share in North America in 2024, due to the country's well-established veterinary healthcare system and significant product launches by key players. For instance, in November 2023, Sonoma Pharmaceuticals, Inc. announced the launch of a new intraoperative pulse lavage irrigation treatment for wound care. This product, based on Microcyn technology, offers a safer and cost-effective alternative to traditional saline and aggressive rinsing solutions, preventing infection and improving healing time. The regenerative healing ability makes it particularly valuable in various surgical procedures, including those involving soft tissues, bones, and joints in both companion and livestock animals. The U.S. launch of this innovative product is poised to further drive growth in the animal wound care market by offering veterinarians a safer, more efficient method for managing surgical wounds and infections.

Europe Animal Wound Care Market Trends

The animal wound care market in Europe was identified as a lucrative region for the animal wound care industry. The region benefits from a high level of pet ownership and a strong focus on animal welfare. Countries such as Germany, France, and the UK have well-developed veterinary healthcare systems and supportive regulatory frameworks that facilitate the introduction of new therapeutics. For instance, in December 2023, NoBACZ Healthcare, a wound care company headquartered in England, launched NoBACZ Bovine, specifically developed for bovine wound care. It uses a patented natural polymer along with copper and zinc ions that rapidly set on contact with the skin. The development and adoption of such tailored products are expected to further propel the demand for specific wound care products and thus drive market growth.

The UK animal wound care market is anticipated to grow at the fastest CAGR during the forecast period. One major factor propelling the market in the UK is the growing demand for effective, easy-to-use wound care solutions and increasing recognition of innovative products. A prime example is Charlie The Vet's award-winning wound & skin care spray, which received the Pet Innovation Award in August 2024. This spray, designed for a range of conditions, including cuts, wounds, insect bites, and post-surgery care, claims to kill 99.99% of germs, including bacteria, viruses, and fungal spores. Such products are gaining popularity due to their dual benefits of promoting faster healing while offering antimicrobial protection. The success of such innovations highlights the growing trend in the UK towards effective, non-invasive, and efficient solutions for animal wound treatment, increasing market growth and increasing consumer confidence in these products.

Asia Pacific Animal Wound Care Market Trends

The animal wound care market in the Asia Pacific is anticipated to grow at the fastest CAGR of 8.97% during the forecast period, driven by increasing pet ownership, rising disposable incomes, and improving veterinary healthcare infrastructure in countries like China, India, and Japan. Since most of the nations are reliant on agricultural production and exports, the attainability of farm animals is at large. Furthermore, the increased awareness about livestock animal health further fuels the market growth of the region. Moreover, continual upgradation of healthcare infrastructure is expected to present the market with high potential growth opportunities over the forecast period.

The Japan animal wound care market is anticipated to grow at a significant CAGR during the forecast period. As pet ownership rises, pet life expectancy increases, and the prevalence of chronic orthopedic illnesses rises, Japan's market is expected to grow considerably. In Japan, pets are likely to live longer. This increases the pet population's vulnerability to long-term orthopedic conditions related to trauma and aging that affect the knee, hip, elbow, and shoulder. Furthermore, the presence of specialized veterinary hospitals contributes significantly to the market growth. Veterinary hospitals are essential for treating animals for therapeutic purposes, especially orthopedic surgeries. For example, the Japan Veterinary Medical Group is a chain of well-equipped veterinary hospitals in the country that specializes in various surgical procedures and other treatments that require wound-care products.

Latin America Animal Wound Care Market Trends

The animal wound care market in Latin America is driven by the increasing prevalence of pet injuries and, subsequently, increasing sales of products. In addition, rising pet care and the presence of domestic veterinary pharmaceutical companies are expanding the regional market space. Brazil and Argentina are key countries in the Latin American market; both have rapidly developing infrastructure & growing veterinary care services due to the increasing pet population. In addition, expanding private services in the country is anticipated to drive the demand for wound-care solutions in the region.

The Argentina animal wound care market is expected to grow at a significant CAGR over the forecast period. This can be attributed to growing pet ownership, rising concern for pet health, and increasing adoption of companion animals, creating future growth opportunities. In addition, ongoing developments for routine check-ups, surgeries, and emergency care are anticipated to drive the market over the forecast period. Similarly, the growing number of small to larger veterinary practices nationwide drives the need for specialized market products. Furthermore, the country's increasing number of market players fuels market growth.

MEA Animal Wound Care Market Trends

The animal wound care market in MEA is anticipated to grow at the fastest CAGR during the forecast period. South Africa, Saudi Arabia, UAE, and Kuwait are the key countries in the MEA market. Several regional companies are innovating medicines due to growing pet health concerns. The increase in the launch of innovative products for wound management in pets is significantly driving growth in the MEA market. These innovations meet the increasing demand for practical solutions to manage chronic conditions in pets. They help expand the market and improve overall animal healthcare in the region.

The Saudi Arabia animal wound care market is primarily driven by increasing pet ownership and growing investments in veterinary care. As a result, veterinary care is becoming more important in Saudi Arabia for treating various injuries and infections. In addition, the launch of veterinary facilities in Saudi Arabia significantly drives the market. For instance, in August 2024, Saudi Aramco launched Olfa Animal Care Company, a non-profit initiative to shelter stray animals, provide veterinary healthcare, and control animal breeding. The organization establishes care and rehabilitation centers to promote animal welfare and community responsibility. The first phase of the launch includes launching mobile veterinary clinics offering examinations, vaccinations, and sterilizations, with plans to open an animal shelter in Dammam by 2025. The increase in the need for wound management therapies, including sterilization, is driving the regional market growth.

Key Animal Wound Care Company Insights

The market is relatively competitive and fragmented due to multiple small and large companies. Moreover, companies are increasingly adopting various strategies, such as mergers and acquisitions, geographic expansions, and product launches, to expand their market shares. Owing to constant research initiatives, this industry can be seen as moderate to high in innovation.

Key Animal Wound Care Companies:

The following are the leading companies in the animal wound care market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun Melsungen AG

- Medtronic

- 3M

- Johnson & Johnson (Ethicon)

- Virbac

- Advancis Veterinary Ltd.

- INNOVACYN, Inc.

- Vernacare (Robinson Healthcare)

- NEOGEN Corp.

- KeriCure, Inc.

Recent Developments

-

In September 2024, CytaCoat AB and Absorbest AB partnered to develop superabsorbent advanced wound care dressings, including solutions for the veterinary market. This collaboration focuses on enhancing wound care products with improved comfort, ease of use, and anti-biofilm properties to prevent infections, with commercial availability expected in 2025.

-

In August 2024, KeraVet Bio announced the May 2025 launch of KeraVet Gel that will support faster wound healing in companion animals.

-

In May 2024, epiq Animal Health and KeraVet Bio entered into a partnership to expand the distribution of a wound care animal product. epiq’s aim is to partner with animal health manufacturers and other distributors to provide innovative products to veterinary professionals and pet owners.

-

In April 2024, Kane Biotech sold its STEM Animal Health stake to Dechra for $11.5M CAD, enhancing its financial position to focus on global growth and clinical programs in wound care and dermatology.

Animal Wound Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.47 billion

Revenue forecast in 2030

USD 2.10 billion

Growth rate

CAGR of 7.40% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal type, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa and Kuwait

Key companies profiled

B. Braun Melsungen AG; Medtronic; 3M; Johnson & Johnson (Ethicon); Virbac; Advancis Veterinary Ltd.; INNOVACYN, Inc.; Vernacare (Robinson Healthcare); NEOGEN Corp.; KeriCure, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Wound Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal wound care market report based on product, animal type, end use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Wound Care Products

-

Sutures & staplers

-

Tissue Adhesive

-

-

Advanced Wound Care Products

-

Foam Dressings

-

Hydrocolloid dressing

-

Film Dressing

-

Hydrogel Dressing

-

Others

-

-

Traditional Wound care Products

-

Tapes

-

Bandages

-

Dressing

-

Absorbants

-

Others

-

-

Therapy Devices

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animal

-

Dogs

-

Cats

-

Horses

-

Others (Small mammals, birds)

-

-

Livestock Animal

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals/Clinics

-

Homecare

-

Research Institutes

-

-

Distribution Channel (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-commerce

-

Veterinary Hospitals/Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The surgical wound care products segment dominated the market for animal wound care and held the largest revenue share of 40.17% in 2024.

b. The companion animal segment dominated the market for animal wound care and held the largest revenue share of over 63.92% in 2024.

b. The veterinary hospitals and clinics segment dominated the market in 2024 due to the high volume of surgical procedures performed in these settings, necessitating effective wound management solutions.

b. Veterinary Hospitals/Clinics dominated the market in 2024 due to their central role in providing specialized care for animals with wounds and injuries. These facilities are equipped with the necessary expertise, medical staff, and resources to handle complex wound management, including surgical wounds, trauma, and chronic conditions.

b. The global animal wound care market size was estimated at USD 1.38 billion in 2024 and is expected to reach USD 1.47 billion in 2025.

b. The global animal wound care market is expected to grow at a compound annual growth rate of 7.40% from 2025 to 2030 to reach USD 2.10 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.