- Home

- »

- Next Generation Technologies

- »

-

Anime Streaming Services Market Size, Industry Report, 2030GVR Report cover

![Anime Streaming Services Market Size, Share & Trends Report]()

Anime Streaming Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Demographics (Kids, Teens, Adults), By Content Type (Shounen/Shoujo, Seinen/Josei), By Business Model (Subscription-Based, Ad-Supported), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-573-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Anime Streaming Services Market Summary

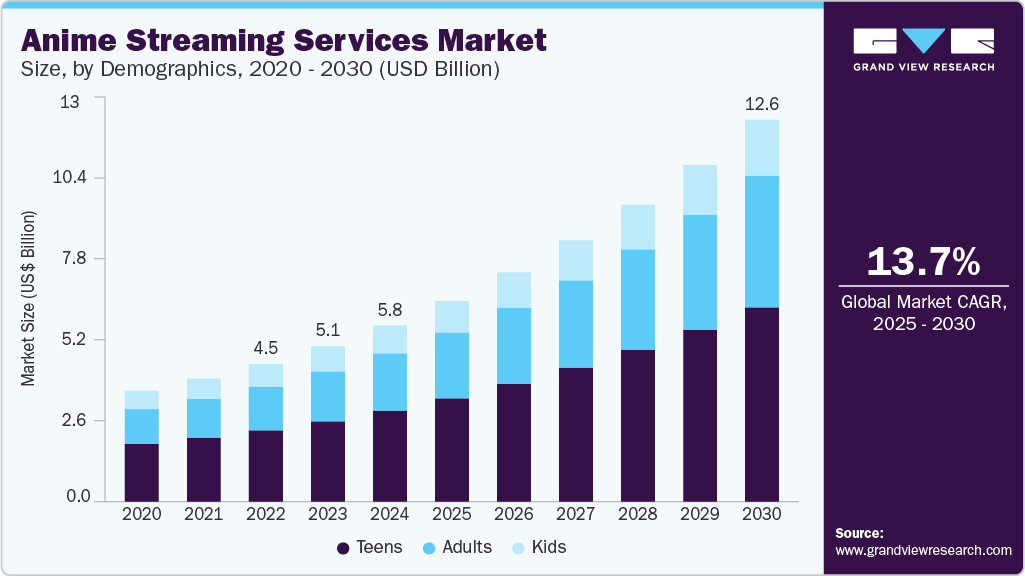

The global anime streaming services market size was estimated at USD 5,795.3 million in 2024 and is projected to reach USD 12,562.4 million by 2030, growing at a CAGR of 13.7% from 2025 to 2030. The market growth is primarily driven by the rising global popularity of anime content across diverse demographics, fueled by increased internet penetration and the widespread adoption of smartphones.

Key Market Trends & Insights

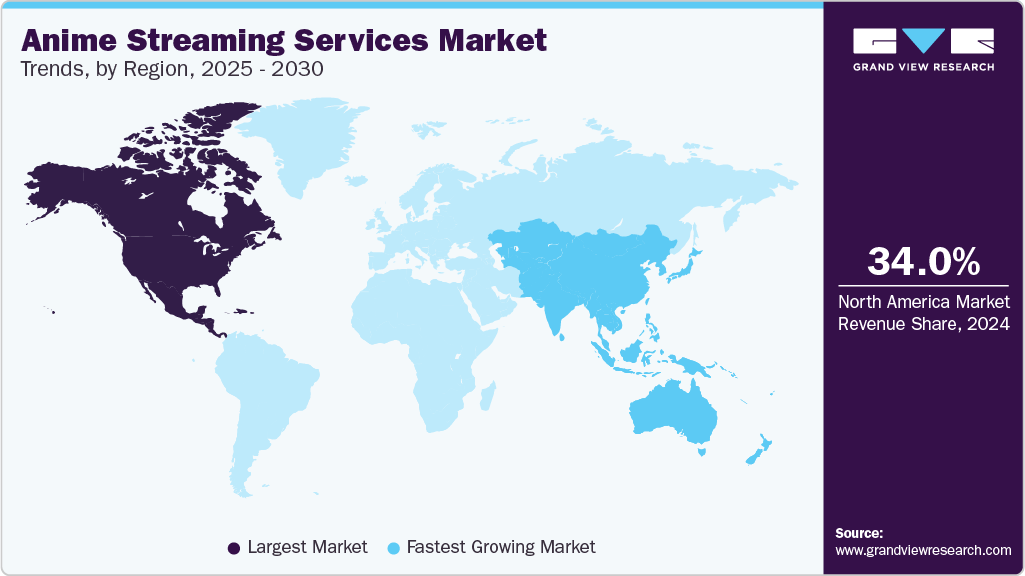

- North America accounted for the largest share of over 34% in 2024.

- The U.S. anime streaming services industry accounted for the largest revenue share of over 77% in 2024.

- By demographics, the teens (ages 13-19) segment accounted for the largest market share of over 51% in 2024.

- By content type, the seinen/josei segment is expected to witness the highest CAGR from 2025 to 2030.

- By business model, the subscription-based (SVOD) segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,795.3 Million

- 2030 Projected Market Size: USD 12,562.4 Million

- CAGR (2025-2030): 13.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The proliferation of exclusive content, localization strategies, and strategic partnerships with Japanese production studios is further accelerating market expansion. The integration of advanced recommendation algorithms, cloud-based streaming technologies, and AI-driven content curation is also enhancing user engagement, supporting the increasing growth of the anime streaming services industry.The growing demand for entertainment and the global expansion of high-speed internet are fundamentally transforming the anime streaming services industry. As consumers increasingly favor convenient, anytime, anywhere access to niche content, streaming platforms are leveraging this shift to expand their user base. Anime, with its global fan base and rich content library, is particularly well-positioned to benefit from this transformation. The widespread availability of affordable smartphones and smart TVs is further accelerating access to streaming platforms, reshaping how audiences discover and engage with anime content.

Additionally, the rising preference for original and exclusive anime content is acting as a key growth driver for the anime streaming services market. Streaming platforms are investing heavily in licensing deals and co-producing anime series to differentiate their offerings and retain subscribers. As platforms compete to deliver fresh, unique content, the overall value proposition of anime streaming services continues to fuel the growth of the anime streaming services industry.

The integration of artificial intelligence and machine learning is revolutionizing the way anime streaming services operate. AI-powered recommendation engines are enhancing user experience by personalizing content delivery based on viewing habits and preferences. Predictive analytics help platforms optimize content libraries and understand audience engagement, while AI-based subtitle generation and dubbing are making content more accessible to a global audience. This technological advancement is driving increased user satisfaction and retention, thereby boosting the anime streaming services industry.

Moreover, strategic partnerships and global expansion initiatives are playing a significant role in strengthening the anime streaming services market. Leading platforms are collaborating with Japanese studios, international content distributors, and telecom providers to broaden their reach and improve content accessibility. These partnerships facilitate content localization and support subscription growth in emerging markets. The resulting cross-border synergy is fueling rapid market expansion and creating new opportunities for monetization and content innovation.

Demographics Insights

The teens (ages 13-19) segment accounted for the largest market share of over 51% in 2024, owing to the increasing accessibility of digital devices, heightened engagement with online entertainment platforms, and the cultural resonance of anime within this age group. Teen audiences are highly active on social media and streaming platforms, where anime plays a central role in shaping entertainment preferences and community discussions. As platforms respond with tailored content strategies, including exclusive releases, interactive experiences, and mobile-first streaming, the influence and dominance of the teen demographic continue to grow in shaping the future of the anime streaming services landscape.

The adults (ages above 20) segment is expected to witness a significant CAGR of over 14% from 2025 to 2030. This growth is attributed to the increasing consumption of anime content among adult viewers, driven by nostalgic engagement, mature storytelling, and the expansion of diverse genres that cater to adult interests. As streaming platforms continue to license and produce anime with complex narratives and sophisticated themes, adult audiences are engaging more consistently and deeply with the content. Moreover, the rise in disposable income, flexible viewing options, and the availability of subtitled and dubbed versions in multiple languages are further enhancing the viewing experience and fueling the growth of the adult segment in the anime streaming services industry.

Content Type Insights

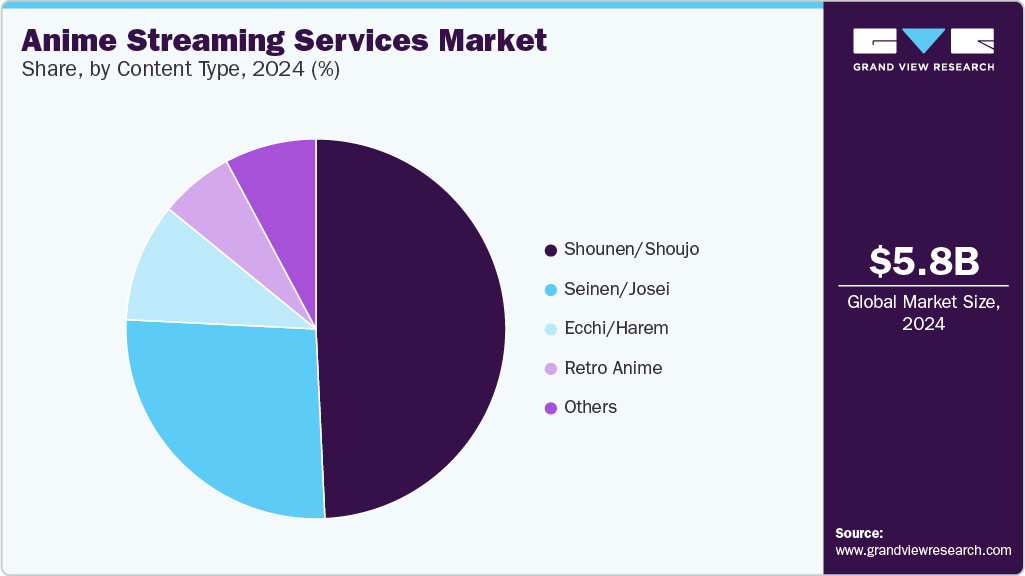

The shounen/shoujo segment accounted for the largest market share in 2024, owing to its broad appeal across diverse age groups and its foundational role in anime content libraries. These genres have consistently driven high viewership due to their engaging storylines, character development, and emotional resonance with both younger and older audiences. Additionally, these genres benefit from strong fan loyalty and global recognition, encouraging streaming platforms to prioritize them in content acquisition and recommendation algorithms. This sustained demand and widespread cultural impact have contributed to the dominance of the shounen/shoujo segment.

The seinen/josei segment is expected to witness the highest CAGR from 2025 to 2030. Seinen and Josei genres, known for their sophisticated narratives, character development, and realism, are increasingly resonating with viewers. Streaming platforms are capitalizing on this trend by expanding their seinen/josei libraries and producing original content in these categories to attract and retain older viewers. Furthermore, the rise of personalized recommendation algorithms is helping platforms surface such niche content to the right audiences, driving increased engagement and sustained viewership for this segment.

Business Model Insights

The subscription-based (SVOD) segment accounted for the largest market share in 2024, owing to the growing consumer preference for uninterrupted, ad-free viewing experiences and exclusive anime content. As anime gains traction across global audiences, streaming platforms are increasingly adopting the SVOD model to provide consistent access to curated libraries, simulcasts, and original productions. This model supports predictable revenue streams and enables platforms to invest in content development and user personalization. Additionally, the rise of niche anime communities and the willingness of fans to pay for premium experiences are fueling SVOD adoption, thereby driving segmental growth.

The ad-supported (AVOD) segment is expected to witness the highest CAGR from 2025 to 2030, as anime streaming services increasingly adopt this model to attract a broader audience and generate revenue without relying solely on subscriptions. With a growing global fan base and rising content consumption among younger, cost-sensitive viewers, AVOD platforms offer free access to popular anime titles in exchange for targeted advertising. This model enables companies to rapidly scale user acquisition while leveraging viewer data to deliver personalized ad experiences. Additionally, advancements in programmatic advertising, real-time bidding, and AI-driven content recommendations are enhancing monetization capabilities, making AVOD an increasingly attractive business model in the competitive anime streaming industry.

Regional Insights

North America accounted for the largest share of over 34% in 2024, primarily driven by the region’s growing appetite for international content and the mainstreaming of anime culture among younger demographics. The rising popularity of anime conventions, merchandise, and cosplay culture across the region reflects a strong fan engagement that continues to fuel subscription growth. The region’s willingness to invest in localized dubbing and curated content libraries has further strengthened North America’s position in the global market for anime streaming services.

U.S. Anime Streaming Services Market Trends

The U.S. anime streaming services industry accounted for the largest revenue share of over 77% in 2024, driven by the increasing demand for on-demand entertainment and the country's strong tech infrastructure. The growing interest in anime among younger demographics, fueled by social media and streaming recommendations, is broadening the audience base. Investment in exclusive anime content and localization efforts is also contributing to the market's growth. Personalized content delivery and AI-powered recommendations further enhance user engagement, driving the market forward in the U.S.

Europe Anime Streaming Services Market Trends

The Europe anime streaming services industry is expected to grow at a CAGR of over 13% from 2025 to 2030, driven by a strong cultural interest in anime and an increasing shift towards digital entertainment consumption. Additionally, the growing number of localized and subtitled anime content offerings is expanding the market's appeal in non-native regions. The strong presence of tech-savvy and entertainment-hungry youth populations across the region contributes to these platforms' rapid adoption. Furthermore, the growing trend of subscription-based services, along with the availability of global anime titles through European platforms, is driving the anime streaming industry.

The UK anime streaming services market is expected to experience significant growth. The country's robust digital infrastructure and widespread internet accessibility are key drivers of this expansion. With a growing interest in Japanese culture, particularly among younger generations, the UK is becoming a prime destination for anime content consumption. Furthermore, the UK's multicultural society and its position as a media hub within Europe further contribute to the expanding popularity of anime, making it an essential part of the anime streaming services landscape.

The anime streaming services market in Germany is propelled by the country’s increasing popularity of Japanese pop culture among younger demographics. The conventions, cosplay communities, and social media engagement are boosting the demand for readily accessible anime content. This cultural shift, combined with Germany’s openness to international media, is creating a favorable environment for anime streaming platforms to expand their offerings and deepen user engagement in the region.

Asia Pacific Anime Streaming Services Market Trends

Asia Pacific anime streaming services industry is expected to grow at a CAGR of over 14% from 2025 to 2030, driven by a large and growing population of anime consumers, expanding internet penetration, and the rising adoption of smartphones across emerging economies. The cultural affinity for anime, combined with increasing disposable incomes and a rapidly digitalizing entertainment sector, is fueling subscriber growth across the region. Additionally, local streaming platforms and international players are investing heavily in regional language dubbing, exclusive licensing deals, and partnerships with local creators, further enhancing the accessibility and appeal of anime content throughout Asia Pacific.

The Japan anime streaming services market is gaining traction, fueled by the country’s status as the global epicenter of anime production and culture. With a deeply rooted domestic demand for anime and a high level of digital literacy, Japan presents a thriving environment for streaming platforms. Japan’s strong creative ecosystem and continued investment in original content production further enhance the appeal of streaming platforms, making the region a cornerstone of growth for the global anime streaming industry.

The anime streaming services market in China is rapidly expanding. China’s booming digital ecosystem, massive youth population, and increasing affinity for Japanese pop culture are driving market growth. The proliferation of smartphones, widespread internet connectivity, and government efforts to promote digital media consumption are enabling broader access to streaming services. Moreover, the growing trend of content localization and co-production between Chinese and Japanese studios fosters a culturally resonant viewing experience, thereby driving market growth.

Key Anime Streaming Services Company Insights

Some of the key players operating in the market include Netflix, Inc. and Amazon.com, Inc.

-

Netflix, Inc. is a global streaming entertainment service offering a wide variety of TV series, films, and documentaries across numerous genres and languages. In the anime streaming services market, Netflix has become a major force by producing and licensing a diverse array of anime titles, including both original productions and exclusives like "Devilman Crybaby," "Baki," and "Castlevania." By partnering with renowned Japanese studios and investing heavily in anime content, Netflix has expanded its reach in Japan and other international markets. Its global distribution capabilities, content personalization algorithms, and financial resources make it one of the most influential players in the anime streaming ecosystem.

-

Amazon.com, Inc. operates Amazon Prime Video, a major player in the global streaming space. Exclusively focused on anime, Amazon Prime Video has made significant strides in the anime market by securing exclusive streaming rights for series such as "Vinland Saga" and "Dororo," as well as distributing several anime films and series in partnership with Japanese studios. The platform combines vast global reach, integration with the Amazon Prime ecosystem, and high production values to position itself competitively in the anime streaming sector.

Medialink Group Limited. and Cineverse. are some of the emerging participants in the anime streaming services market.

-

Medialink Group Limited is an emerging entertainment and media company based in Hong Kong, known for its licensing and distribution of anime and Asian content across various digital platforms. Through its Ani-One brand, Medialink distributes anime series on YouTube and subscription-based services across Southeast Asia. The company leverages strategic partnerships with major Japanese studios and maintains a strong presence on digital and social media platforms. Medialink’s agility, regional expertise, and focus on accessible anime content make it an emerging force in the Asia-Pacific anime streaming market.

-

Cineverse (formerly Cinedigm Corp.) is an emerging digital entertainment company focused on streaming content across niche genres, including anime. Through its streaming brand RetroCrush, Cineverse delivers classic and cult anime titles to audiences in North America. The platform targets anime enthusiasts with a curated library that emphasizes nostalgic and historically significant series. Cineverse’s use of data-driven programming, targeted content strategies, and OTT distribution reflects its commitment to expanding its influence in the anime streaming industry.

Key Anime Streaming Services Companies:

The following are the leading companies in the anime streaming services market. These companies collectively hold the largest market share and dictate industry trends.

- Crunchyroll, LLC

- Hulu, LLC

- Netflix, Inc.

- Amazon.com, Inc.

- STAR.

- AMC Networks Entertainment LLC.

- LiveChart.me

- Medialink Group Limited.

- Cineverse.

- SideReel, Netaktion LLC

- Image Future Investment (HK) Limited.

Recent Developments

-

In April 2025, Cineverse Corp. announced the acquisition of exclusive U.S. streaming rights to the classic sci-fi anime series Future Boy Conan for its dedicated anime platform, RetroCrush. The deal, secured through a multi-year licensing agreement with GKIDS, coincides with RetroCrush's 5th anniversary.

-

In March 2025, Crunchyroll and Aniplex announced the formation of a new joint venture, aimed at planning, developing, and producing anime content exclusively for the Crunchyroll streaming platform worldwide. The venture reflects a strategic effort to deliver premium anime content to a global audience and strengthen both companies' positions in the competitive streaming market.

-

In March 2025, AMC Networks announced the expansion of its anime streaming service, HIDIVE, as a monthly ad-free add-on subscription on Amazon Prime Video Channels in select English-speaking countries and territories. Additionally, HIDIVE expanded its availability across connected TV platforms, including Samsung, LG, and VIZIO devices, to enhance global accessibility. Operated by Houston-based Sentai Filmworks.

Anime Streaming Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,600.4 million

Revenue forecast in 2030

USD 12,562.4 million

Growth rate

CAGR of 13.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Demographics, content type, business model, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Crunchyroll, LLC; Hulu, LLC; Netflix, Inc.; Amazon.com, Inc.; STAR.; AMC Networks Entertainment LLC.; LiveChart.me; Medialink Group Limited.; Cineverse.; SideReel, Netaktion LLC; Image Future Investment (HK) Limited.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anime Streaming Services Market Report Segmentation

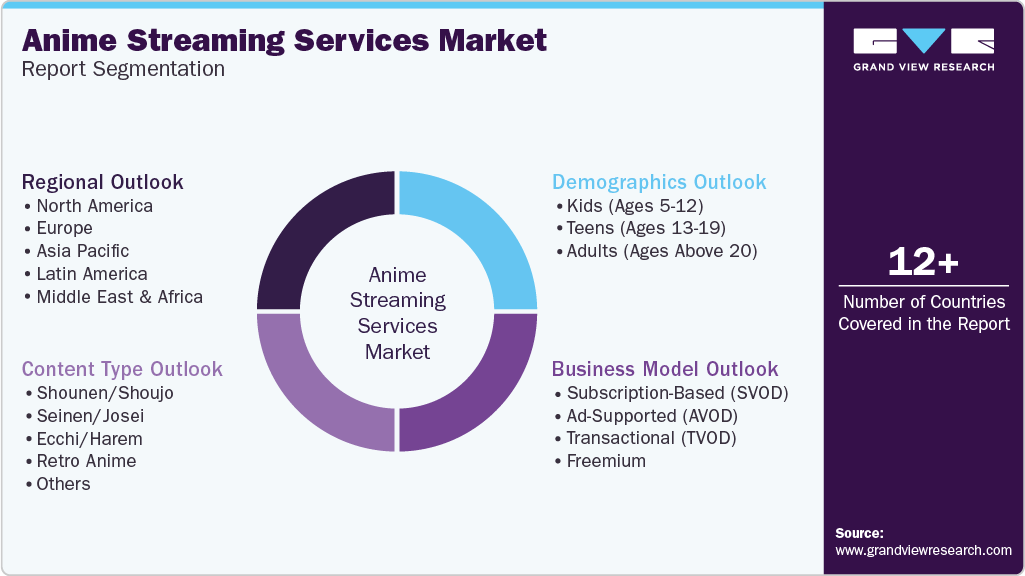

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the anime streaming services market report based on demographics, content type, business model, and region:

-

Demographics Outlook (Revenue, USD Million, 2018 - 2030)

-

Kids (Ages 5-12)

-

Teens (Ages 13-19)

-

Adults (Ages Above 20)

-

-

Content Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Shounen/Shoujo

-

Seinen/Josei

-

Ecchi/Harem

-

Retro Anime

-

Others

-

-

Business Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Subscription-Based (SVOD)

-

Ad-Supported (AVOD)

-

Transactional (TVOD)

-

Freemium

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global anime streaming services market size was estimated at USD 5,795.3 million in 2024 and is expected to reach USD 6,600.4 million in 2025.

b. The global anime streaming services market is expected to grow at a compound annual growth rate of 13.7% from 2025 to 2030 to reach USD 12,562.39 million by 2030.

b. North America accounted for the largest share of over 34% in 2024, primarily driven by the region’s growing appetite for international content and the mainstreaming of anime culture among younger demographics

b. Some key players operating in the anime streaming services market include Crunchyroll, LLC; Hulu, LLC; Netflix, Inc.; Amazon.com, Inc.; STAR.; AMC Networks Entertainment LLC.; LiveChart.me; Medialink Group Limited.; Cineverse.; SideReel, Netaktion LLC; Image Future Investment (HK) Limited.

b. The key factors driving the anime streaming services market include the rising global popularity of anime content across diverse demographics, the proliferation of exclusive content, localization strategies, and strategic partnerships with Japanese production studios.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.