- Home

- »

- Pharmaceuticals

- »

-

Anti-hypertensive Drugs Market Size, Industry Report, 2033GVR Report cover

![Anti-hypertensive Drugs Market Size, Share & Trends Report]()

Anti-hypertensive Drugs Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (ACE Inhibitors (ACEIs), Angiotensin II Receptor Blockers (ARBs)), By Type, By Route Of Administration (Oral, Transdermal), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-166-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-hypertensive Drugs Market Summary

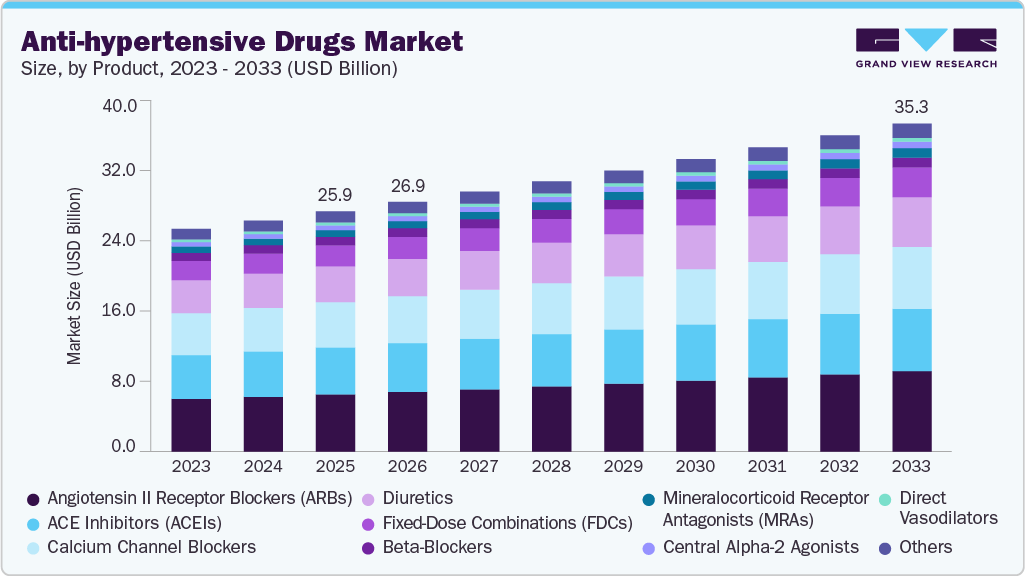

The global anti-hypertensive drugs market size was estimated at USD 25.88 billion in 2025 and is projected to reach USD 35.32 billion by 2033, growing at a CAGR of 3.96% from 2026 to 2033. The market is driven by the rising prevalence of hypertension due to aging populations, sedentary lifestyles, obesity, and urbanization.

Key Market Trends & Insights

- North America anti-hypertensive drugs industry held the largest share of 35.42% of the global market in 2025.

- The anti-hypertensive drugs industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the angiotensin II receptor blockers (ARBs) segment held the largest market share of 23.82% in 2025.

- By type, the standard hypertension segment held the largest market share of 87.67% in 2025.

- By route of administration, the oral segment dominated the market with a share of 91.83% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 25.88 Billion

- 2033 Projected Market Size: USD 35.32 Billion

- CAGR (2026-2033): 3.96%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Increasing awareness of cardiovascular health, advances in drug development, introduction of novel fixed-dose combinations, and improved diagnostics are boosting demand. Expanding healthcare infrastructure in emerging economies further supports market expansion. High blood pressure (hypertension) increases the risk of heart disease and stroke, two major causes of death in the U.S. According to data published by the Centers for Disease Control and Prevention (CDC) in January 2025, high blood pressure affects nearly half of U.S. adults, causes over 664,000 deaths annually, and costs USD 131 billion each year. Prevalence is higher in men (50%) vs. women (44%), and highest among Black adults (58%), followed by Whites (49%), Asians (45%), and Hispanics (39%). Only 1 in 4 people with hypertension have it under control, with disparities across sex, race, and geography. Millions remain untreated, especially those with severely elevated blood pressure. The high prevalence of uncontrolled hypertension and low treatment adherence has driven strong demand for antihypertensive drugs. Rising costs of hypertension to the healthcare system further support investment in effective therapies, expanding the global anti-hypertensive drugs industry.

Recent regulatory approvals and positive clinical trial outcomes have accelerated market growth and reshaped therapeutic strategies. For instance, in June 2025, George Medicines received FDA approval for WIDAPLIK, the first and only single-pill triple combination therapy (telmisartan, amlodipine, indapamide) for hypertension in adults, including as an initial treatment. Available in three dosage strengths, WIDAPLIK offers the benefits of combination therapy in a simplified form, addressing the common need for multiple medications in hypertension management. The U.S. commercial launch is expected in Q4 2025, with additional global regulatory submissions planned. The approval of WIDAPLIK marks a significant innovation in the anti-hypertensive drugs industry, introducing a convenient, first-in-class triple combination therapy for newly diagnosed and uncontrolled patients. By simplifying treatment and improving adherence, it is expected to capture strong demand in the US, where nearly half of adults have hypertension but only one in four has it under control. This approval strengthens the shift towards single-pill combinations and is likely to set new benchmarks for hypertension management globally.

Furthermore, in April 2024, Alnylam Pharmaceuticals announced positive results from the Phase 2 KARDIA-2 trial, evaluating zilebesiran, an investigational RNAi-based therapy targeting angiotensinogen (AGT) for uncontrolled hypertension. A single 600 mg subcutaneous dose added to standard antihypertensives (indapamide, amlodipine, or olmesartan) achieved significant reductions in ambulatory systolic BP of up to 12.1 mmHg at 3 months and sustained reductions up to 6 months. Zilebesiran represents a first-in-class RNAi therapeutic in hypertension, offering a long-acting, twice-yearly dosing option that could disrupt the traditional oral drug market. By improving adherence and providing consistent BP control, it targets a major unmet need in patients with uncontrolled hypertension. Its success could significantly reshape the anti-hypertensive drugs industry, expanding precision and biologics-based approaches beyond conventional therapies.

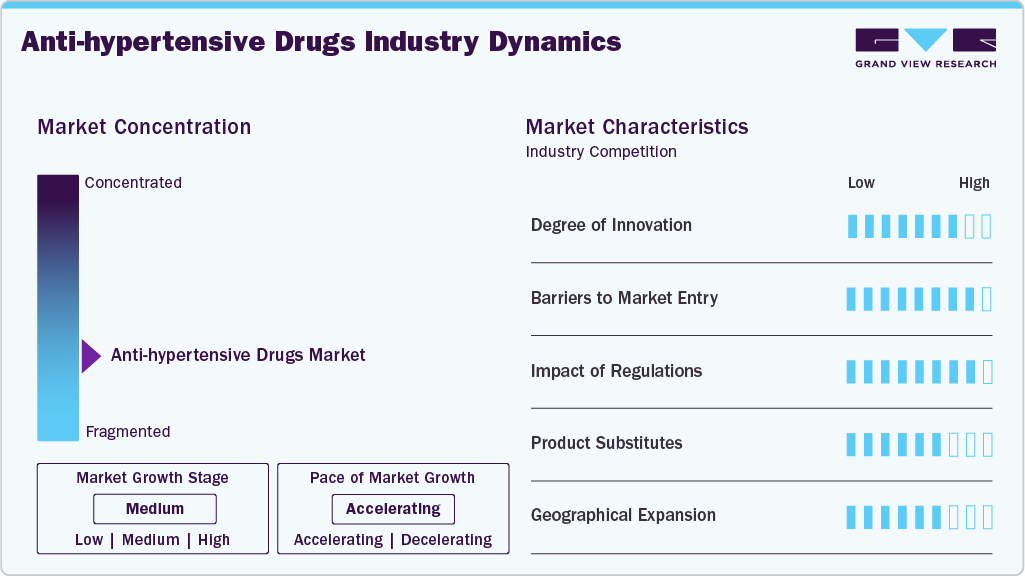

Market Concentration & Characteristics

Innovation in the anti-hypertensive drugs industry is driven by pharmaceutical research in novel drug classes, fixed-dose combinations, and improved delivery systems such as transdermal patches and extended-release formulations. Companies are prioritizing therapies for treatment-resistant hypertension and exploring precision medicine approaches. R&D investment focuses on enhancing efficacy, reducing side effects, and improving patient adherence, with pipeline innovations targeting unmet needs. Digital integration for remote patient monitoring is increasingly influencing product development strategies.

Pharmaceutical entry into the anti-hypertensive drugs industry demands significant capital for drug discovery, clinical trials, and regulatory approvals. Patent portfolios of established players, coupled with strong brand recognition, create high entry barriers. New entrants must invest heavily in proving safety and efficacy through long-term clinical data. Distribution network access and physician relationships further strengthen incumbent advantages, leading to moderate market concentration dominated by major pharmaceutical companies.

Regulatory frameworks are central to pharmaceutical strategy in the anti-hypertensive drugs industry. Regulatory compliance requires comprehensive clinical trial data, adherence to Good Manufacturing Practices (GMP), and post-market surveillance. Regulatory requirements vary globally, influencing launch strategies and timelines. Established pharmaceutical companies leverage regulatory expertise to accelerate approvals, secure patents, and expand product portfolios, ensuring competitive advantage.

From a pharmaceutical standpoint, substitutes include lifestyle interventions and non-drug therapies, but these do not replace pharmacological treatment for most hypertensive patients. Device-based interventions such as renal denervation present niche competition. Pharma companies mitigate substitution risks through formulation innovation, fixed-dose combinations, and broadening therapeutic indications to maintain product relevance.

For pharmaceutical companies, geographical expansion focuses on high-potential markets such as Asia Pacific, driven by growing hypertension prevalence and expanding healthcare infrastructure. Established markets in North America and Europe remain critical due to strong payer systems and high R&D capacity. Strategic approaches include licensing agreements, partnerships, localized manufacturing, and portfolio diversification to strengthen presence in emerging markets while sustaining growth in mature markets.

Product Insights

The angiotensin II receptor blockers (ARBs) segment held the largest market share of 23.82% in 2025, owing to their proven efficacy in lowering blood pressure, favorable safety profile, and widespread adoption for long-term management of hypertension and associated cardiovascular conditions. ARBs are particularly preferred in patients who are intolerant to ACE inhibitors due to cough or angioedema. In addition, their ability to reduce the risk of stroke, heart failure, and kidney disease has further strengthened their position as a leading choice in antihypertensive therapy.

The fixed-dose combinations (FDCs) segment is expected to grow at a significant CAGR of over the forecast period, mainly because simplified regimens improve adherence in patients who often require multiple antihypertensive agents. By reducing pill burden and supporting consistent medication use, FDCs help achieve faster and more sustained blood pressure control compared with monotherapies. Broader reimbursement by payers, driven by evidence that effective combination therapy lowers cardiovascular events and related hospital costs, further supports adoption. New dual and triple combinations are expanding treatment options, while the availability of lower cost generic FDCs is improving access in emerging markets. These factors collectively position FDCs as one of the strongest growth areas within the anti-hypertensive drugs industry.

Type Insights

The standard hypertension segment held the largest market share of 87.67% in 2025, due to the high prevalence of patients whose blood pressure can be controlled with one to three antihypertensive agents. This segment benefits from well-established treatment protocols, widespread availability of generic medications, and greater patient adherence compared to more complex resistant hypertension cases. In addition, increasing awareness, routine screening, and early diagnosis enable effective management of standard hypertension, driving consistent demand for antihypertensive therapies in this segment globally.

Treatment-Resistant Hypertension (TRH) is expected to grow at the fastest CAGR in the anti-hypertensive drugs industry. This growth is driven by the rising prevalence of hypertension, increasing cases unresponsive to standard treatments, and development of targeted therapies. Novel drugs like baxdrostat and lorundrostat are advancing treatment options. These innovations address unmet needs, offering alternatives to traditional therapies such as ACE inhibitors. As a result, TRH is projected to see significant market expansion through 2024 and beyond.

Route of Administration Insights

The oral segment dominated the market with a share of 91.83% in 2025, owing to its convenience, ease of administration, and high patient compliance. Oral antihypertensive medications are preferred for long-term management, allowing patients to self-administer therapy at home without the need for medical supervision. In addition, the wide availability of oral formulations across various drug classes, including ACE inhibitors, ARBs, calcium channel blockers, and diuretics, further reinforces their dominance in the global antihypertensive market.

The transdermal segment is expected to register the fastest CAGR over the forecast period. Growth is driven by rising demand for non-invasive, controlled, and sustained drug delivery systems that improve patient adherence. Transdermal patches offer benefits such as steady drug release, reduced dosing frequency, and minimized gastrointestinal side effects. Advances in formulation technology and increasing preference for convenient treatment options further support adoption. These factors position the transdermal segment for significant growth in the anti-hypertensive drugs industry during the projected timeframe.

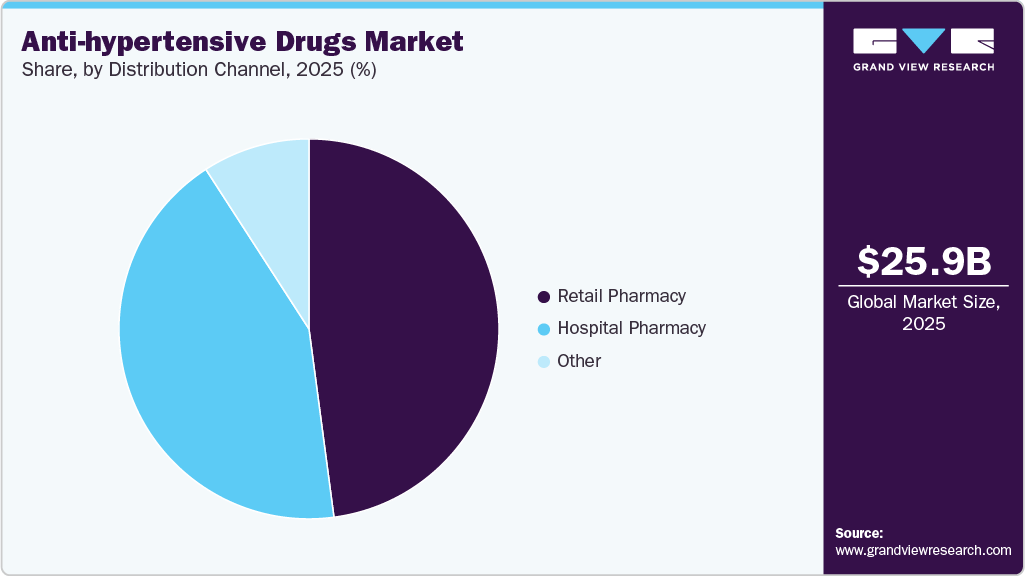

Distribution Channel Insights

The retail pharmacy segment dominated the market with a share of 47.90% in 2025, driven by easy accessibility, widespread presence in urban and rural areas, and the ability to provide prescription and over-the-counter antihypertensive medications. Retail pharmacies offer personalized guidance, patient counseling, and convenient refill services, which enhance adherence to therapy. In addition, partnerships with healthcare providers and insurance coverage for medications at retail outlets further support the preference for this distribution channel, making it the leading choice for patients managing hypertension globally.

The hospital pharmacy segment is expected to grow at a significant CAGR over the forecast period, due to rising hypertension related admissions and the increasing need for coordinated medication management in acute and chronic cardiovascular cases. Hospitals often initiate or adjust antihypertensive therapy during inpatient stays, which drives higher dispensing volumes. Greater adoption of clinical guidelines that emphasize timely control of elevated blood pressure in emergency and perioperative settings also supports demand. Integrated care pathways encourage hospitals to optimize regimens before discharge, increasing the use of combination therapies and evidence based products. In addition, expanding hospital infrastructure in emerging regions, combined with improved reimbursement for cardiovascular care, is widening access to antihypertensive drugs and reinforcing segment growth.

Regional Insights

North America anti-hypertensive drugs market held the largest market share, accounting for 35.42% in 2025, driven by the high prevalence of hypertension and advanced healthcare infrastructure. The U.S. leads regional growth through strong adoption of novel drug classes, fixed-dose combinations, and transdermal delivery systems. Pharmaceutical companies such as Novartis, Pfizer, and AstraZeneca maintain dominance via clinical trial programs, robust distribution channels, and physician engagement. Increasing focus on treatment-resistant hypertension and digital monitoring tools is boosting adoption, supported by strong R&D ecosystems and favorable reimbursement frameworks.

U.S. Anti-hypertensive Drugs Market Trends

The U.S. anti-hypertensive drugs industry accounts for the largest share in the North American region, driven by a high burden of cardiovascular disease and a well-developed healthcare system. Demand for innovative therapies, including aldosterone synthase inhibitors and fixed-dose combinations, is rising. Pharmaceutical companies focus on targeted treatment for resistant hypertension and patient-friendly delivery methods, including transdermal patches. Collaborations between pharma companies and healthcare providers are refining treatment protocols. Growing awareness and updated hypertension management guidelines support steady market growth.

Europe Anti-hypertensive Drugs Market Trends

Europe anti-hypertensive drugs industry is a key market, supported by a growing hypertensive population and advanced healthcare systems. Germany, France, and the UK are major contributors, with high adoption of combination therapies and novel drug classes. Bayer, Novartis, and Sanofi lead through product innovation and portfolio expansion. National healthcare systems and reimbursement policies support widespread adoption. Demand for therapies targeting treatment-resistant hypertension is rising. Increasing focus on preventive cardiovascular care drives growth, with fixed-dose combinations and improved formulations gaining traction.

The UK anti-hypertensive drugs industry is expanding due to increasing hypertension prevalence and growing emphasis on early treatment. Fixed-dose combinations and transdermal delivery systems are gaining acceptance to improve adherence. Pharmaceutical companies are investing in clinical studies to support new drug introductions. National guidelines encouraging early intervention and better hypertension management further boost adoption. Partnerships between healthcare providers and pharma players strengthen market growth. Rising patient demand for convenience and fewer side effects sustains investment in advanced anti-hypertensive therapies.

Germany anti-hypertensive drugs industry is a leading market in Europe, driven by a robust healthcare system and strong R&D infrastructure. High adoption of combination therapies and innovative drug delivery methods support growth. Leading pharmaceutical companies such as Bayer and Boehringer Ingelheim are investing in new formulations for resistant hypertension. Demand for patient-friendly dosing regimens, including transdermal systems, is increasing. The market benefits from strong reimbursement support and early adoption of innovative treatments in hospital and outpatient settings.

France’s anti-hypertensive drugs industry is supported by rising hypertension incidence and comprehensive cardiovascular care programs. Combination therapies and novel drug classes are increasingly adopted. Key pharma players focus on improving patient adherence through simplified regimens and transdermal systems. Government initiatives to control cardiovascular disease strengthen demand. Hospital and outpatient adoption of innovative therapies continues to expand. The growing preference for personalized treatment approaches is supporting steady market growth in France.

Asia Pacific Anti-hypertensive Drugs Market Trends

Asia Pacific anti-hypertensive drugs industry is expected to register the fastest CAGR over the forecast period. Growth is driven by rising hypertension prevalence, expanding healthcare access, and growing awareness. China, Japan, and India are major contributors. Increasing demand for affordable generics, fixed-dose combinations, and novel delivery systems supports market expansion. Pharmaceutical companies are investing in partnerships, local manufacturing, and clinical trials to capture growth opportunities. Asia Pacific’s expanding healthcare infrastructure positions it as the most dynamic regional market.

Japan’s anti-hypertensive drugs industry is driven by high awareness of hypertension management and government-led health programs. Adoption of fixed-dose combinations and transdermal systems is increasing. Hospitals and clinics are integrating new therapies into hypertension treatment protocols. Pharmaceutical companies are investing in clinical research to develop innovative products for resistant hypertension. The aging population and emphasis on preventive care are sustaining demand. Japan remains a major contributor to Asia Pacific market growth.

China’s anti-hypertensive drugs industry is growing rapidly due to rising cardiovascular disease prevalence and expanded healthcare access. Government initiatives to improve hypertension diagnosis and management are accelerating growth. Demand for affordable generics and innovative therapies is increasing. Domestic pharma companies, alongside global players, are investing in local manufacturing and licensing. Fixed-dose combinations and transdermal delivery systems are gaining traction. Strong distribution networks and growing patient awareness support China’s position as a high-growth market in the Asia Pacific region.

Latin America Anti-hypertensive Drugs Market Trends

Latin America’s anti-hypertensive drugs industry is growing steadily, driven by increasing hypertension prevalence and improving healthcare infrastructure. Demand is strong in urban centers with better access to modern healthcare. Brazil and Mexico are key contributors, with rising use of fixed-dose combinations and generic therapies. Pharmaceutical companies are expanding distribution networks and forging partnerships to enhance market reach. Public health initiatives targeting cardiovascular disease management are boosting adoption of anti-hypertensive drugs in the region.

Brazil anti-hypertensive drugs industry is a leading market in Latin America, driven by high cardiovascular disease prevalence and growing healthcare access. Demand for generics and fixed-dose combinations is increasing. Leading pharmaceutical companies are strengthening their presence through partnerships and local manufacturing. Government health programs targeting hypertension control are supporting growth. Rising awareness and better affordability of drugs further drive adoption. Brazil remains a strategic market for global and domestic pharma players.

Middle East & Africa Anti-hypertensive Drugs Market Trends

The Middle East & Africa anti-hypertensive drugs industry is developing steadily, supported by improving healthcare infrastructure and rising hypertension prevalence. Adoption is concentrated in advanced healthcare centers in the region. Demand for generics, fixed-dose combinations, and transdermal delivery systems is increasing. Pharmaceutical companies are exploring partnerships and expanding distribution to enhance penetration. Public health initiatives focusing on cardiovascular disease prevention are boosting market growth. The region presents significant potential for long-term expansion.

Saudi Arabia’s anti-hypertensive drugs industry is growing due to increasing hypertension prevalence and government investment in healthcare modernization. Hospitals are adopting advanced fixed-dose combinations and transdermal systems. Demand is concentrated in major cities with developed healthcare infrastructure. Pharmaceutical companies are strengthening partnerships and distribution networks to expand market reach. Government initiatives promoting cardiovascular health are supporting growth. Saudi Arabia is emerging as a key anti-hypertensive drugs industry in the Middle East region.

Key Anti-hypertensive Drugs Company Insights

Some of the key players in the anti-hypertensive drugs industry include Novartis, Sanofi, Bayer, Boehringer Ingelheim International GmbH, among others. These companies focus on market expansion and robust research and development (R&D) activities to strengthen their position. Strategies include developing novel drug classes, fixed-dose combinations, and advanced delivery systems such as transdermal patches to improve patient adherence. Companies also invest in clinical trials to support product efficacy and safety. Geographic expansion, strategic partnerships, licensing agreements, and local manufacturing are key approaches to enhance market reach. Continuous innovation and targeted marketing are central to maintaining competitiveness and attracting a broader customer base globally.

Key Anti-Hypertensive Drugs Companies:

The following are the leading companies in the anti-hypertensive drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Novartis

- Sanofi

- Bayer

- Boehringer Ingelheim International GmbH

- DAIICHI SANKYO COMPANY, LIMITED

- Takeda Pharmaceutical Company Limited

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Sandoz (Novartis)

- Sun Pharmaceutical Industries Ltd.

Recent Developments

-

In Feburary 2025, Novartis acquired Anthos Therapeutics for up to $3.1 billion. The acquisition aims to enhance their cardiovascular portfolio, focusing on hypertension and heart disease treatments, with innovative therapies in the pipeline.

-

In July 2025, Sanofi acquired Vicebio, a company specializing in respiratory vaccines, to expand its vaccine pipeline. While this acquisition is focused on respiratory diseases, it reflects Sanofi's ongoing strategy to enhance its portfolio in various therapeutic areas.

-

In July 2025, Sanofi completed the acquisition of Blueprint Medicines, a move aimed at bolstering its oncology and rare disease portfolios. While not directly related to antihypertension, this acquisition aligns with Sanofi's strategy to diversify and strengthen its overall therapeutic offerings.

Anti-hypertensive Drugs Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 26.91 billion

Revenue forecast in 2033

USD 35.32 billion

Growth rate

CAGR of 3.96% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, type, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Sanofi; Boehringer Ingelheim International GmbH; Novartis AG; Johnson & Johnson Services, Inc.; DAIICHI SANKYO COMPANY; LIMITED.; Merck & Co., Inc.; AstraZeneca; Pfizer Inc.; Lupin; Sun Pharmaceutical Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-hypertensive Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global anti-hypertensive drugs market report based on product, type, route of administration, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

ACE Inhibitors (ACEIs)

-

Angiotensin II Receptor Blockers (ARBs)

-

Direct Renin Inhibitor

-

Calcium Channel Blockers

-

Diuretics

-

Mineralocorticoid Receptor Antagonists (MRAs)

-

Beta-blockers

-

Alpha-1 Blockers

-

Central Alpha-2 Agonists

-

Direct Vasodilators

-

Fixed-dose Combinations (FDCs)

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Standard Hypertension

-

Treatment-resistant Hypertension

-

Hypertensive Emergency/ Urgency

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Transdermal

-

Parenteral / Intravenous

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail Pharmacy

-

Hospital Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.