- Home

- »

- Beauty & Personal Care

- »

-

Antibacterial Products Market Size, Industry Report, 2030GVR Report cover

![Antibacterial Products Market Size, Share & Trends Report]()

Antibacterial Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Hand Soaps, Body Wash, Hand Cream & Lotion), By Distribution Channel (Hypermarkets & Supermarkets, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-653-5

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antibacterial Products Market Summary

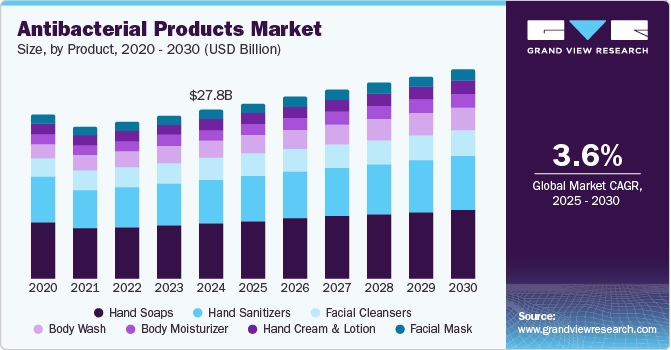

The global antibacterial products market was estimated at USD 27.85 billion in 2024 and is projected to reach USD 34.52 billion by 2030, growing at a CAGR of 3.6% from 2025 to 2030. Increasing demand for antibacterial products, driven by rising customer awareness about personal hygiene, contributes to market growth.

Key Market Trends & Insights

- Asia Pacific dominated the global antibacterial products market in 2024 with a 46.9% revenue share.

- Countrywise, the U.S. antibacterial products market held the largest revenue share in 2024.

- By product, hand soaps dominated the market in 2024 with a 33.3% revenue share.

- By distribution channel, the online distribution segment is projected to experience the fastest CAGR during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 27.85 Billion

- 2030 Projected Market Size: USD 34.52 Billion

- CAGR (2025-2030): 3.6%

- Asia Pacific: Largest market in 2024

Moreover, the increasing prevalence of bacterial and viral diseases, such as cellulitis, impetigo, and leprosy, has boosted the demand for antibacterial products worldwide.

Demand for hand soaps, masks, hand washes, and hand sanitizers to prevent the increased risks associated with bacterial infections has grown significantly in urban markets of various regions, especially Asia Pacific and Europe. A large number of consumers seeking prevention measures such as antibacterial products to avoid acne and similar skin-health-related problems are adding to the growth of this market.

According to the American Academy of Dermatology Association, acne is one of the most common skin conditions experienced by nearly 50 million Americans every year. This includes 85.0% of individuals between ages 12 and 24 who experience minor acne at some point. Additionally, skin conditions such as atopic dermatitis and others have been prevailing rapidly. These factors are expected to influence the demand for antibacterial products in the approaching years.

Individuals with sensitive skin, weak immune systems, and diabetes are prone to skin infections, including cellulitis, impetigo, and staphylococcal (staph), which leads to skin problems such as rashes, swelling, redness, pain, pus, and itching. Such instances and an increasing number of individuals seeking easy-to-use and readily available antibacterial products are likely to generate a surge in demand for this market.

According to the World Health Organization’s Bacterial Priority Pathogens List for 2024, antibacterial resistance is one of the major challenges for human health. Rising cases of antibacterial resistance are expected to generate requirements for more potent antibacterial products and a wider spectrum of antibacterial agents used in their formulation.

Moreover, individuals with sensitive skin, weak immune systems, and diabetes are prone to skin infections, including cellulitis, impetigo, and staphylococcal (staph), which leads to skin problems such as rashes, swelling, redness, pain, pus, and itching. These instances are further expected to drive the adoption of antibacterial products in the coming years.

Product manufacturers are launching innovative products to engage an increasing number of consumers. For instance, in March 2021, Keepers Collective LLC launched its new range of honey face wash, which contains antibacterial and antimicrobial properties that prevent dirt and help eliminate bacteria from the skin to treat and prevent blemishes.

Product Insights

Based on products, hand soaps dominated the global antibacterial products industry with a revenue share of 33.3% in 2024. The COVID-19 pandemic has significantly influenced the demand for these products as hand hygiene guidelines and similar measures were continuously distributed by authorities worldwide. Increased awareness regarding potential risks associated with bacterial or viral infections spread through human contact and the rapid rate of its implications on public health has also contributed to a rise in utilization. Growing demand by commercial users such as hotels, hospitality industry participants, corporate offices, facility management service providers, restaurants, airports, shopping centers, and others have also been adding to the collective growth in demand. Ease of availability facilitated by effective distribution through supermarkets and hypermarkets and accessibility through online portals have driven household demand for the products.

The body wash segment is expected to experience the fastest CAGR from 2025 to 2030. This is attributed to a large number of products launched by established consumer goods companies, enhanced availability, and increasing utilization by frequent flyers, travelers, health professionals, sportspersons, and others. The rise in demand from commercial buyers such as luxury hotels and resorts is adding significant growth to this segment. In recent years, demand for body washes in Asia Pacific has increased significantly due to substantial utilization by urban consumers. Several product manufacturers are offering a new range of variants with the addition of fragrances, which is projected to boost the segment growth. Furthermore, improving living standards, rising health expenditure, and increasing awareness about personal hygiene are expected to augment the segment growth.

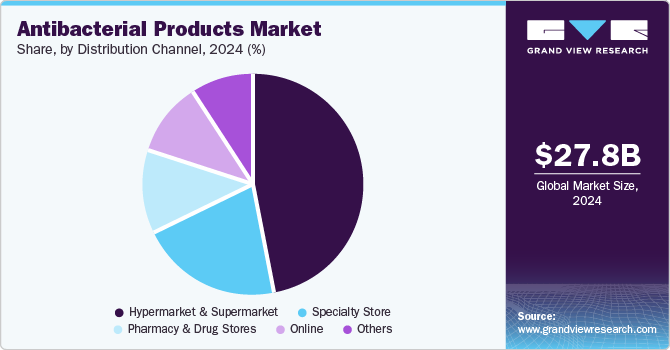

Distribution Channel Insights

The hypermarkets & supermarkets segment dominated the global antibacterial products industry in 2024. The growth is primarily driven by the increasing penetration of independent retail giants, which enhances product visibility and attracts a larger consumer base. Moreover, consumers prefer to physically verify skincare products before buying, driving sales through these channels. A large number of consumers visit hypermarkets & supermarkets for home essentials, cleaning products, groceries, and other household product requirements, contributing to the growth of this segment. Brands also invest significant resources in effective distribution through this channel as it ensures enhanced brand visibility.

The online distribution segment is projected to experience the fastest CAGR during the forecast period. This segment is expected to experience greater demand owing to changes in purchasing patterns and a considerable shift in consumer lifestyles. Online platforms offer increased product visibility, high levels of convenience, and at-home delivery features, driving the segment growth. The emergence of quick commerce platforms, which deliver products to the doorstep within a few minutes, also significantly influences this segment's development of this segment, especially in developing economies such as India.

Regional Insights

Asia Pacific dominated the global antibacterial market products industry with a revenue share of 46.9% in 2024. This market is primarily driven by increasing awareness regarding personal hygiene and cleanliness in densely populated countries such as China and India. Growing availability of diligently formulated products, enhanced portfolios, and easy accessibility through online portals are expected to drive the growth of this regional industry from 2025 to 2030. In recent years, multiple domestic consumer goods companies established global brands operating in the hygiene and cleaning products market and have launched various product lines and variants.

China Antibacterial Products Market Trends

China dominated the regional antibacterial market products industry in 2024. The availability of clinically tested products such as hand soaps, body washes, hand sanitizers, facial cleansers, and others is expected to generate greater growth for this market during the forecast period.

North America Antibacterial Products Market Trends

North America antibacterial products Market held a significant revenue share of the global antibacterial products industry in 2024. This market is primarily driven by factors such as the enhanced focus of consumer goods market participants on providing health-nutrition-based products in the skincare and personal care range and the growing availability facilitated by the rising market penetration of the e-commerce industry. Increasing awareness, a higher number of travelers who prefer using antibacterial products while using public transport facilities, and new product launches by multiple companies are expected to develop a surge in demand for this market.

The U.S. antibacterial products market held the largest revenue share of the global industry in 2024. This market is mainly influenced by the significant increase in utilization by household customers and commercial buyers such as corporate offices, public-use buildings, restaurants, hotels, and others. The large number of domestic market participants and the availability of a diverse range of products are projected to add noteworthy growth opportunities.

Middle East And Africa Antibacterial Products Market Trends

The Middle East and Africa's antibacterial products market is projected to experience the fastest CAGR during the forecast period. This is attributed to factors such as growing awareness regarding bacterial diseases and significant personal hygiene to prevent those. Ease of availability driven by hypermarkets & supermarkets in urbanized areas and online shopping websites is adding to the growth of this market.

Saudi Arabia held the largest regional antibacterial market products industry revenue share in 2024. This is attributed to factors such as increasing health-conscious customers, rising awareness regarding personal hygiene, and a large share of demand driven by travelers visiting the country. Enhanced accessibility through online portals and effective distribution through multiple points of sale are likely to increase growth in the coming years.

Key Antibacterial Products Company Insights

Some of the key companies in the global antibacterial products market are Reckitt Benckiser Group PLC; Unilever; GOJO Industries, Inc.; The Himalaya Drug Company; Sebapharma and others. To address growing competition and increasing demand from urban consumers, the key companies have been embracing strategies such as portfolio expansions, geographical expansions, product diversification, and more.

-

Reckitt Benckiser Group PLC offers one of the extensively used antibacterial range of products with the brand Dettol. This includes foaming hand wash, hand soap, antiseptic liquid, shower gel, hand sanitizer, shaving cream, multi-use skin & surface wipes, no-touch automatic hand wash, nourishing shower gel, and others.

-

Unilever, a multination fast moving consumer goods company, provides a range of products including human food products, animal food, coffee, ice cream, soft drinks, tea, toothpaste, cleaning products, and more. It offers variety of products under brand Lifebuoy, including soap, antibacterial hand wash, and alcohol based germ protection sanitizer hand sanitizer.

Key Antibacterial Products Companies:

The following are the leading companies in the antibacterial products market. These companies collectively hold the largest market share and dictate industry trends.

- Reckitt Benckiser Group PLC

- Unilever

- GOJO Industries, Inc.

- The Himalaya Drug Company

- Sebapharma

- Bielenda

- Colgate-Palmolive Company

- Henkel AG & Co. KGaA

- Johnson & Johnson Services, Inc.

- Farouk Systems International

Recent Developments

-

In October 2024, Dettol, a personal hygiene and cleaning products brand by Reckitt Benckiser Group PLC and NDTV, an Indian media channel, launched the 11th season of the Banega Swasth India campaign. The campaign was initiated in 2014 to promote a clean and healthy India, attempting to touch lives and change habits while aiming for a healthier society.

-

In November 2024, Proactiv, a brand by Taro Pharmaceuticals Inc., launched a new line of products with innovation-based formulations specially designed for acne-prone skins. Newly introduced clear skin routine brand products include smoothing BHA cleanser, solution minis trial size packs, smooth and bright resurfacing mask, and blemish control body cream.

Antibacterial Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.91 billion

Revenue forecast in 2030

USD 34.52 billion

Growth Rate

CAGR of 3.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, South Korea, Brazil, Argentina, UAE

Key companies profiled

Reckitt Benckiser Group PLC; Unilever; GOJO Industries, Inc.; The Himalaya Drug Company; Sebapharma; Bielenda; Colgate-Palmolive Company; Henkel AG & Co. KGaA; Johnson & Johnson Services, Inc.; Farouk Systems International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antibacterial Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antibacterial products industry report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Body Wash

-

Body Moisturizer

-

Hand Cream & Lotion

-

Hand Soaps

-

Hand Sanitizers

-

Facial Cleansers

-

Facial Mask

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket & supermarket

-

Pharmacy & Drug stores

-

Specialty Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.