- Home

- »

- Medical Devices

- »

-

ANZ Dental Implants Market Size, Industry Report, 2030GVR Report cover

![ANZ Dental Implants Market Size, Share & Report]()

ANZ Dental Implants Market (2024 - 2030) Size, Share & Analysis Report By Type (Zirconium, Titanium), And Segment Forecasts

- Report ID: GVR-4-68040-404-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

ANZ Dental Implants Market Size & Trends

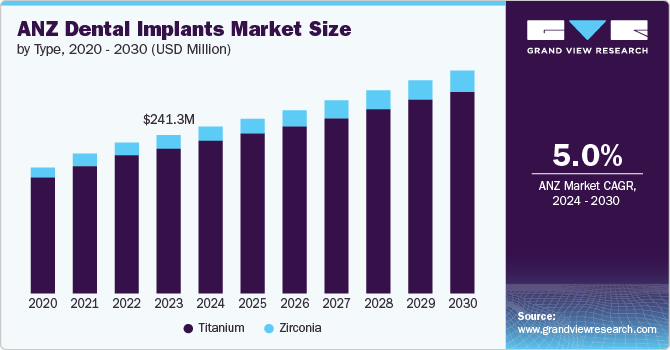

The ANZ dental implants market size was estimated at USD 241.28 million in 2023 and is anticipated to grow at a CAGR of 5.0% from 2024 to 2030. This growth is driven by the increasing application of dental implants and a rising demand for prosthetics, vital for oral rehabilitation and restoring both function and aesthetics. The preference for dental implants over removable prosthetics, which often cause discomfort and require significant maintenance, is growing among patients and dental professionals. The aging populations in both countries, which are more susceptible to tooth loss, further amplify this demand. According to the Judicial Commission of New South Wales, by 2036, over 21.0% of people will be 65 and older. Also, a heightened awareness of the benefits of dental implants compared to traditional dentures contributes to market expansion.

The increasing prevalence of dental conditions and a growing aging population susceptible to tooth loss fuels the demand for durable and practical dental solutions. The Patient Experience Survey 2021-22 (ABS 2022) revealed that nearly half (49.0%) of individuals aged 15 and over visited a dental professional in 2022. Among those who needed dental care, 57.0% had multiple visits within the year. Approximately 10.0% received public dental care. Moreover, around 33.0% of individuals delayed and avoided dental visits, with 16.0% attributing this delay to cost concerns.

The COVID-19 pandemic significantly affected the market, impacting patients and dental professionals. As per the Australian Institute of Health and Welfare, in 2020-21, approximately 12.0% of adults aged 15 and over had delayed or missed dental appointments at least once due to pandemic-related disruptions. The crisis altered the volume, type, and delivery of dental services, with restrictions leading to a temporary decrease in elective procedures, including dental implants. This shift resulted in a backlog of treatments and an adaptation to new protocols for delivering care, which has influenced the overall market dynamics.

Moreover, the rising demand for prosthetics significantly drives the market. As the population ages and dental issues become more prevalent, there is a growing need for effective and durable prosthetic solutions. Dental implants are increasingly favored for their ability to provide a natural-looking, functional replacement for missing teeth compared to traditional prosthetics like dentures. For instance, implants such as the Straumann BLX implant system offer superior stability and aesthetic outcomes, which enhance patient satisfaction and confidence. These implants integrate seamlessly with the jawbone, mimicking the function and impression of natural teeth more closely than removable prosthetics. In addition, advancements in implant technology, including using high-quality materials like titanium and zirconia, contribute to their growing acceptance.

Furthermore, in the 2020 -21 financial year, Australia’s total expenditure on dental services amounted to approximately USD 11.1 billion. This figure reflects a substantial investment in dental care across the country. Patients covered most of these costs, totaling around USD 6.5 billion, 59.0% of the total expenditure. This translates to an average out-of-pocket expense of USD 253.0 per person annually, not including additional costs covered by private health insurance premiums. Private health insurance providers contributed approximately USD 2.2 billion, which represents 20.0% of the total dental spending. The substantial out-of-pocket costs borne by patients and the role of insurance in mitigating these expenses highlight the financial pressures that can influence decisions around dental care and implant procedures.

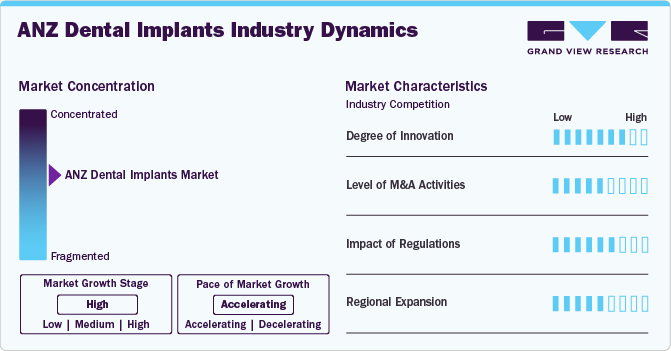

Market Concentration & Characteristics

The market is concentrated and dominated by major global players such as Straumann, Nobel Biocare (part of Danaher Corporation), Dentsply Sirona, and Osstem Implant. These companies leverage their strong brand presence, extensive product portfolios, and well-established distribution networks to maintain significant market shares. The market is characterized by high competition among these leading firms and a growing presence of regional players. The increasing preference for dental implants over traditional prosthetics and the rise in dental health awareness contribute to market dynamics, driving both growth and innovation in the sector.

Innovation is a critical driver in the dental implants market, with advancements in materials, technology, and surgical techniques playing a pivotal role. Recent developments include using advanced materials such as zirconia and titanium alloys, which enhance implants' durability and aesthetic appeal. Integrating digital technologies, including 3D imaging and computer-aided design (CAD), improves the precision and customization of implant procedures. Furthermore, minimally invasive techniques reduce recovery times and improve patient outcomes. These innovations contribute to higher success rates and increased patient satisfaction, further stimulating market growth.

The market has witnessed notable mergers and acquisitions as companies strive to expand their technological capabilities and market reach. The MandA activities allow companies to integrate new technologies, enter new markets, and strengthen their competitive positions. Consolidating market players through MandA contributes to a more dynamic and innovative market landscape, fostering advancements in implant technology and broader access to dental care.

Regulatory frameworks are crucial in shaping the market. In Australia, the Therapeutic Goods Administration (TGA) oversees the approval and regulation of dental implants, ensuring they meet high safety and efficacy standards, which can increase costs for manufacturers. In New Zealand, Medsafe enforces similar regulatory requirements, aligning with international standards to maintain product quality and safety. Compliance with these regulations is vital for market entry and maintaining high product standards. Moreover, the Australian Society of Implant Dentistry (ASID) supports the field by providing a network for professionals, sharing knowledge, and educating the public, contributing to advancing dental implant technology and patient outcomes in both countries.

Regional expansion is a critical trend in the dental implants market, with global companies increasing their presence in Australia and New Zealand to capitalize on the growing demand. This expansion includes establishing new clinics, enhancing distribution networks, and forming strategic regional partnerships. Some international firms are also exploring local manufacturing opportunities to reduce costs and improve supply chain efficiency. Regional expansion enhances patient access to advanced dental implant technologies and treatments, intensifies provider competition, and drives innovation and quality improvements within the market.

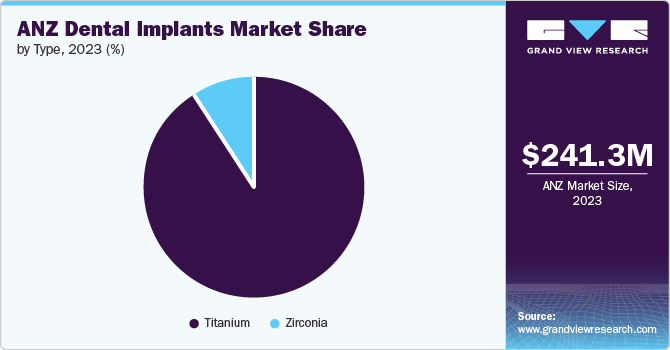

Type Insights

Based on type, the market is segmented into titanium implants and zirconium implants. The titanium segment held the largest share in 2023. This growth is attributed to their well-established clinical success, demonstrated by extensive research confirming their effective osseointegration with the jawbone, which ensures stability and durability. Titanium’s remarkable strength and corrosion resistance make it suitable for withstanding the mechanical stresses of chewing, contributing to its widespread use. Furthermore, titanium implants are cost-effective, with lower production costs than zirconium implants, making them more affordable and accessible to patients. The proven performance, material benefits, cost advantages, and robust market support solidifies titanium implants as the leading choice in the dental implants industry.

The zirconium segment is anticipated to be the fastest-growing product segment over the forecast period. Aesthetic advantages are a primary factor, as zirconium implants are made from zirconia ceramic, which closely mimics the natural appearance of teeth and blends seamlessly with the surrounding dentition. This natural look is highly valued, especially for visible anterior teeth, where esthetics are crucial. In addition, zirconium implants are biocompatible and less likely to cause allergic reactions than metal implants, making them a preferred choice for patients with metal sensitivities. Recent advancements have further bolstered zirconium's appeal; for instance, new high-strength zirconia ceramics, like those developed by companies like Straumann with their Roxolid technology, offer improved durability and resistance to fracture while maintaining aesthetic qualities. These innovations address previous concerns about the brittleness of zirconium, enhancing its overall reliability and contributing to its rapid market.

Key ANZ Dental Implants Company Insights

The market is characterized by several key players dominating the landscape with substantial market share. These companies are leading the industry through technological innovations, extensive distribution networks, and a broad portfolio of implant solutions.

Key ANZ Dental Implants Companies:

- BioHorizons IPH, Inc.

- Nobel Biocare Services AG

- Zimmer Biomet Holdings, Inc.

- OSSTEM IMPLANT

- Institut Straumann AG

- Bicon, LLC

- DENTSPLY Sirona

- KYOCERA Medical Corp.

Recent Developments

-

In November 2023, researchers at the University of Melbourne introduced a new rectangular block dental implant. This implant features a novel surface coating that promotes faster and more effective bone integration, improving its stability and longevity.

“The dental profession has a very good understanding of how dental implants behave in the oral environment, setting a high benchmark for patient-centered care,”

- University of Melbourne Associate Professor (Prosthodontics) Roy Judge.

ANZ Dental Implants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 253.33 million

Revenue forecast in 2030

USD 339.40 million

Growth Rate

CAGR of 5.00% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type

Country scope

Australia and New Zealand

Key companies profiled

BioHorizons IPH, Inc.; Nobel Biocare Services AG; Zimmer Biomet Holdings, Inc.; OSSTEM IMPLANT; Institut Straumann AG; Bicon, LLC; DENTSPLY Sirona; KYOCERA Medical Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

ANZ Dental Implants Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the ANZ dental implant market report based on type:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Titanium

-

Zirconia

-

Frequently Asked Questions About This Report

b. The ANZ dental implants market was valued at USD 241.28 million in 2023 and is anticipated to reach USD 253.33 million in 2024.

b. The Australia and New Zealand dental implants market is anticipated to grow at a CAGR of 5.00% from 2024 to 2030 to reach USD 339.40 million by 2030.

b. The titanium segment held the largest share in 2023 with over 90.0% revenue. This growth is attributed to their well-established clinical success.

b. Some prominent players in the market include BioHorizons IPH, Inc., Nobel Biocare Services AG, Zimmer Biomet Holdings, Inc., OSSTEM IMPLANT, Institut Straumann AG, Bicon, LLC, DENTSPLY Sirona, KYOCERA Medical Corp.

b. The ANZ dental implant market growth is driven by the increasing application of dental implants and a rising demand for prosthetics, vital for oral rehabilitation, restoring both function and aesthetics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.