- Home

- »

- Animal Feed and Feed Additives

- »

-

Aquafeed Additives Market Size, Share, Industry Report 2030GVR Report cover

![Aquafeed Additives Market Size, Share & Trends Report]()

Aquafeed Additives Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredient (Feed Acidifiers, Anti-parasitic, Prebiotics), By Application (Tilapia, Catfish, Sea Bass, Groupers), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-555-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aquafeed Additives Market Size & Trends

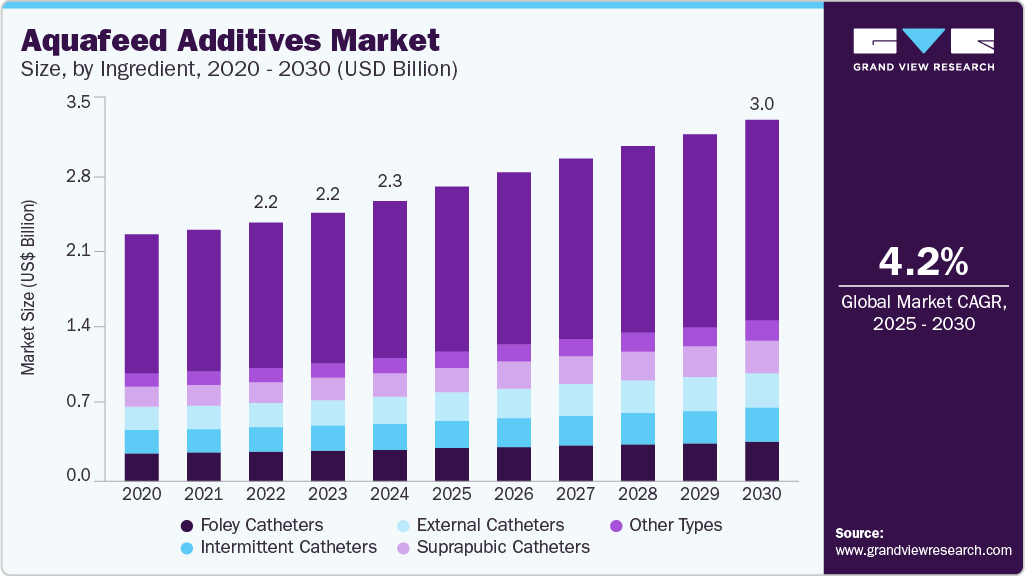

The global aquafeed additives market size was estimated at USD 2,339.00 million in 2024 and is projected to grow at a CAGR of 4.2% from 2025 to 2030. The market growth is attributed to the increasing demand for fish and seafood products.

Key Highlights:

- The Latin America dominated the global aquafeed additives market with the largest, revenue share of 37.64% in 2024.

- In terms of ingredient segment, the feed acidifiers segment held a remarkable revenue share of 11.3% in 2024.

- In terms of ingredient segment, essential oil & natural extracts segment is anticipated to register a revenue CAGR of 5.2% over the forecast period.

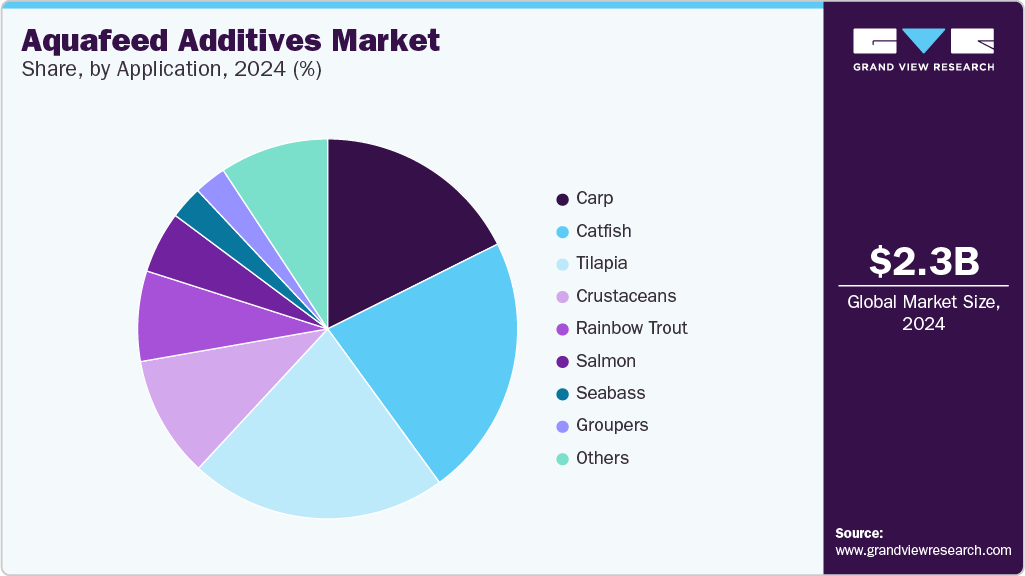

- In terms of application segment, the catfish segment dominated the market with the highest revenue share of 22.35% in 2024

- In terms of application segment, tilapia segment is anticipated to register a revenue CAGR of 4.9% over the forecast period.

This trend is expected to continue in the future as the global population continues to grow and the demand for protein from aquatic sources increases. As the consumption of fish is anticipated to rise on account of several health benefits associated with it, including enhancing cognitive development in children, assisting in reducing the threat of cardiovascular diseases, and lowering the fat level in the body, which, in turn, reduces the threats associated with obesity. This, in turn, is expected to drive the demand for healthy, disease-free fish and high-quality fish products, consequently increasing the consumption of aquafeed additives during the forecast period.The global aquafeed additives market shows steady growth across most aquatic species, driven by increasing demand for seafood and enhanced aquaculture practices. Tilapia, catfish, and seabass lead in growth rates, indicating shifting consumption patterns and farming efficiencies. Overall, the market is expanding, reflecting global trends in sustainable aquaculture.

In North America, the U.S. emerged as the major market for aquafeed additives, driven by the growing aquaculture industry and increasing consumption of fish and seafood products in the country. The U.S. has a well-established aquaculture industry and a high per capita consumption of fish and seafood products, which is driving the growth of the market in the country.

The COVID-19 pandemic has had a significant impact on the market. The sudden outbreak of the pandemic in early 2020 led to a widespread disruption of global supply chains, resulting in delays and shortages of raw materials and finished products. This, in turn, has led to increased costs for aquafeed additive manufacturers, reduced production capacity, and limited availability of certain products.

In addition, the pandemic has also affected the demand for the product, as many fish farms and aquaculture operations have been forced to temporarily shut down or reduce their production levels due to quarantine measures and lockdowns. This has led to a decrease in demand for aquafeed additives, which has further compounded the challenges faced by manufacturers.

Market Concentration & Characteristics

The global aquafeed additives market is moderately fragmented and highly competitive, characterized by a broad mix of international and regional players. The market structure allows for significant competition, with no single player dominating entirely, leading to constant innovation and product diversification. Companies in this space focus heavily on research and development to improve the nutritional efficiency, growth performance, and health of aquatic species. The growing emphasis on sustainable aquaculture practices, which has driven demand for environmentally friendly and functional additives that reduce reliance on traditional marine-based ingredients.

Strategic expansion activities such as mergers, acquisitions, and the establishment of new production facilities are common, aimed at increasing market reach and addressing region-specific demands. Innovation is a key competitive factor, with advancements in enzyme technologies, probiotics, prebiotics, and plant-based proteins shaping the development of next-generation aquafeed solutions. Increasing global seafood consumption and regulatory support for sustainable aquaculture are further accelerating the adoption of high-performance additives. These trends are collectively contributing to the steady growth and dynamic evolution of the aquafeed additives market worldwide.

Ingredient Insights

The feed acidifiers segment held a remarkable revenue share of 11.3% in 2024. They are used to lower the pH level of animal feed and have become increasingly popular in recent years. The popularity is attributed to the increasing global population and rising demand for animal protein, which are driving the growth of the aquafeed industry, which in turn is driving the demand for feed acidifiers.

Feed acidifiers have been shown to have a number of benefits for fish, such as improving feed efficiency, reducing the risk of disease, and improving gut health. These benefits are driving the use of feed acidifiers. Moreover, consumers are increasingly demanding natural and organic products, and this trend is also evident in the feed industry. As a result, manufacturers are increasingly using natural ingredients in feed acidifiers, such as organic acids like citric acid and lactic acid.

Antiparasitic ingredients will also grow significantly over the forecast period. Antiparasitics play an important role in the market. They are effective at preventing or controlling parasitic infections, which is essential for the health and growth of fish and other aquatic animals. They also have the added benefit of reducing the use of antibiotics, which is beneficial for the environment and for the health of the fish. The increasing demand for natural and organic products is also driving the use of natural ingredients in antiparasitics, which is expected to drive the market for antiparasitics in the future.

Application Insights

The catfish segment dominated the market with the highest revenue share of 22.35% in 2024. Catfish has become increasingly popular as a food source due to its taste and versatility, as well as its high nutritional value. This has led to an increase in demand for catfish in both developed and developing countries. Catfish are well-suited to aquaculture due to their hardiness and adaptability and can be raised in fresh and saltwater environments.

Catfish are omnivorous fish and have a diverse diet, which requires a complex feed formulation with a high nutritional value. This increases the demand for high-quality aquafeed additives such as vitamins, minerals, amino acids, and antioxidants to meet the dietary requirements of catfish. Aquafeed additives such as antibiotics, antiparasitics, and probiotics play an important role in preventing and controlling these diseases, thus boosting the growth of the market.

Carp plays an important role in the growth of the market, driven by the high demand for the fish, the well-developed carp culture, the complex nutritional requirements of carp, the increasing adoption as an alternative to other species and their tolerance to environmental stressors. The continued popularity of carp and increasing adoption of carp culture in aquaculture is expected to drive the demand for high-quality aquafeed additives specifically formulated for carp culture in the future.

Regional Insights

North America aquafeed additives market is estimated to grow at a CAGR of 3.9% by 2030. North American is one of the major regional markets for aquafeed additives. The region has a well-developed aquaculture industry, particularly in the U.S., driving the demand. In addition, the increasing awareness of the benefits of aquafeed additives, stringent regulations to ensure the safety and environmental impact of aquafeed ingredients, and government support for the aquaculture industry are expected to drive market growth in North America.

Latin America Aquafeed Additives Market Trends

The Latin America dominated the global aquafeed additives market with the largest, revenue share of 37.64% in 2024. The growth is attributed to many factors such as this region is home to some of the world's largest aquaculture industries, such as Brazil, Chile, and Ecuador, which are driving the demand. The increasing population, and urbanization, which are driving the demand for fish as a source of protein, are also driving the market in the region.

Europe Aquafeed Additives Market Trends

Europe is a relatively smaller market compared to Asia Pacific and North America, but it is expected to grow at a moderate rate in the future. The European Union has implemented strict regulations on the use of feed additives in aquaculture, which is expected to drive the demand for natural and organic feed additives.

Key Aquafeed Additives Company Insights

Some of the key players operating in the market include Alltech, DuPont de Nemours Inc,Nutriad Inc., and Calanus AS.

-

Aker BioMarine is a leading company that sustainably harvests and processes Antarctic krill for use in nutrition, pharmaceuticals, and aquaculture. It focuses on producing high-quality, omega-3-rich products while prioritizing environmental responsibility and traceability. The company combines advanced biotechnology with sustainable practices to support health and preserve marine ecosystems.

-

Nutriad Inc. is a global provider of specialized feed additives for aquaculture and other livestock sectors. Headquartered in Belgium, it offers products that enhance feed palatability, digestion, and mycotoxin control. Since its acquisition by Adisseo in 2018, Nutriad has expanded its global footprint and expertise in animal nutrition.

Key Aquafeed Additives Companies:

The following are the leading companies in the aquafeed additives market. These companies collectively hold the largest market share and dictate industry trends.

- Aker Biomarine

- Nutriad Inc.

- Calanus AS

- Olmix Group

- Norel SA

- Lallemand Inc.

- Alltech

- Kemin Industries

- Nouryon

- DuPont de Nemours Inc

- Biorigin

- Phileo by Lesaffre

Recent Developments

-

In July 2025, Kemin Industries’ AquaScience™ line continues to enhance aquafeed efficiency and safety. Their innovative products, including lysophospholipids, enzymes, organic acids, and antioxidants, improve nutrient absorption, control microbial spoilage, and extend feed shelf life, supporting sustainable aquaculture with better feed conversion and fish health.

-

In July 2025, Dr. Vivi Koletsi,a global technical support specialist within Alltech’s Technology Group emphasized that sustainable aquafeed efficiency can be maximized by using flexible plant-based formulations combined with multi-enzyme technologies. These advances improve nutrient absorption, boost fish growth, reduce environmental impact, and lower costs, supporting the aquaculture industry's sustainable expansion and responsible seafood production.

-

In July 2024, Aker BioMarine sold its Feed Ingredients business to Aker Capital and American Industrial Partners. The move allows Aker BioMarine to sharpen its strategic focus, highlighting the unit’s value and growth potential. The transaction involved several partners and reflects strong industry interest and confidence in the company’s future.

Aquafeed Additives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,459.60 million

Revenue forecast in 2030

USD 3,017.65 million

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Ingredient, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; China; India; Japan; South Korea; Vietnam; Thailand; Brazil; Argentina; Chile; Ecuador; South Africa; Iran; Egypt; Nigeria

Key companies profiled

Kemin Industries; Diana Group; Nouryon; Phileo by Lesaffre; DuPont de Nemours Inc.; Nutriad Inc.; Olmix Group; Lallemand Inc.; Biorigin; AKER BIOMARINE; Alltech; Calanus AS

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aquafeed Additives Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aquafeed additives market report based on ingredient, application, and region.

-

Ingredient Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Anti-parasitic

-

Feed Acidifiers

-

Prebiotics

-

Essential Oils & Natural Extracts

-

Palatants

-

Hydrolysates

-

Yeast Extracts

-

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carp

-

Rainbow Trout

-

Salmon

-

Crustaceans

-

Tilapia

-

Catfish

-

Sea Bass

-

Groupers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

Ecuador

-

-

Middle East & Africa

-

South Africa

-

Iran

-

Egypt

-

Nigeria

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.