- Home

- »

- Clinical Diagnostics

- »

-

Arbovirus Testing Market Size, Share, Industry Report, 2030GVR Report cover

![Arbovirus Testing Market Size, Share & Trends Report]()

Arbovirus Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (ELISA-Based Tests, RT-PCR Based Tests), By End-use (Diagnostic Laboratories, Hospitals, Research Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-178-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Arbovirus Testing Market Summary

The global arbovirus testing market size was valued at USD 1.12 billion in 2024 and is projected to reach USD 1.43 billion by 2030, growing at a CAGR of 4.5% from 2025 to 2030. The rising incidence of arboviral diseases such as Zika, dengue, and West Nile is fueling the demand for robust testing solutions.

Key Market Trends & Insights

- North America arbovirus testing market dominated the global market with the largest revenue share of 41.6% in 2024.

- The U.S. arbovirus testing market held the largest share in 2024.

- By type, the ELISA-based tests segment dominated the arbovirus testing industry with the largest revenue share of 48.7% in 2024.

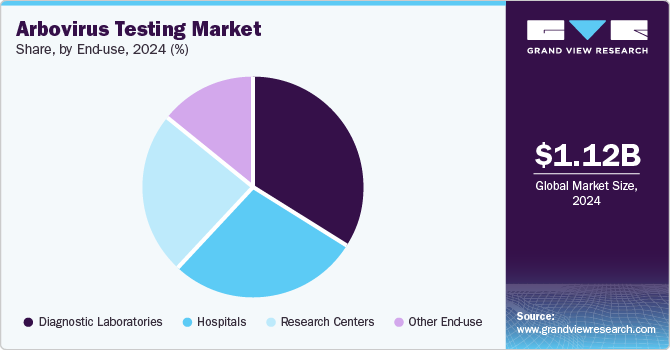

- By end-use, the diagnostic laboratories segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.12 Billion

- 2030 Projected Market Size: USD 1.43 Billion

- CAGR (2025-2030): 4.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing prevalence of these diseases in various regions has heightened the need for accurate diagnostics to manage outbreaks effectively. Increased awareness among the public and healthcare systems has led to improved surveillance efforts, enabling faster identification and response to potential outbreaks. This greater focus on disease monitoring drives the arbovirus testing market, as governments and health organizations prioritize timely detection to control the spread of these infections.Arbovirus testing has emerged as a pivotal tool in preventing the spread of these Neglected Tropical Diseases (NTDs). According to WHO estimates, around one-fifth of the population-about 1.7 billion people, mostly in developing and low-income nations-must receive diagnosis and treatment for at least one noncommunicable disease annually. The dengue and chikungunya NTD epidemic impacted almost 40% of Africa. These illnesses are more common in impoverished communities in tropical and hard-to-reach locations due to a favorable environment for virus growth and lack of hygiene. Thus, most NTD cases are reported from Brazil, Yemen, India, Bangladesh, China and several countries in Central and East Africa. Thus, the rising incidence of dengue and chikungunya is anticipated to fuel the demand for arbovirus testing, thereby driving market growth.

Moreover, several international organizations run programs to raise awareness of NTDs, including the United States Global Health Initiative, the Global NTD Program by the Centers for Disease Control and Prevention, the World Health Organization's Global NTD Programs, and the NTD Program by the United States Agency for International Development. These programs focus mainly on reducing or eliminating NTDs such as dengue and chikungunya. In addition, the WHO introduced a pilot program for a WHO Expert Review Panel for Diagnostic Products (ERPD) for NTDs in October 2023. This program focuses on enhancing the quality control and availability of NTD diagnostic tools for medical professionals.

Type Insights

The ELISA-based tests segment dominated the arbovirus testing industry with the largest revenue share of 48.7% in 2024 due to their high sensitivity, reliability, and ease of use. These tests offer rapid and accurate results, making them ideal for detecting a wide range of arboviruses. The cost-effectiveness and adaptability of ELISA tests further contribute to their dominance, allowing them to be widely implemented in both research and diagnostic settings. The growing demand for efficient diagnostic solutions and advancements in ELISA technology continue to drive its widespread adoption across various healthcare sectors.

The RT-PCR-based tests segment is anticipated to be the fastest-growing segment, with a CAGR of 4.7% from 2025 to 2030, owing to high accuracy and sensitivity in detecting viral RNA. These tests enable precise identification of arboviruses such as Zika, dengue, and West Nile, making them essential for early diagnosis and efficient disease control. Increasing awareness of arbovirus-related health risks and advancements in RT-PCR technology are expected to drive demand. In addition, government initiatives for improved disease surveillance and testing are set to further propel the adoption of RT-PCR-based tests.

End-use Insights

The diagnostic laboratories segment held the largest revenue share in 2024, attributed to their critical role in providing accurate and timely results for disease detection. These laboratories are equipped with advanced diagnostic tools, allowing them to efficiently test for multiple arboviruses. The increasing prevalence of vector-borne diseases and the need for rapid diagnosis have driven the demand for such services. Moreover, the ability of diagnostic laboratories to offer high-throughput testing and support public health surveillance contributes to their dominance in the market.

The research centers segment is expected to grow at the fastest CAGR during the forecast period, propelled by the increasing demand for in-depth viral transmission and vaccine development studies. These centers focus on advancing diagnostic methods, improving surveillance techniques, and understanding arbovirus behavior, which accelerates innovations in testing technologies. Growing government investments and public-private collaborations further bolster the expansion of research facilities. Increased emphasis on epidemic preparedness and response to emerging diseases highlights the critical role of research centers in shaping the future of arbovirus diagnostics.

Regional Insights

North America arbovirus testing market dominated the global market with the largest revenue share of 41.6% in 2024. The rising incidence of arboviral diseases such as Zika, West Nile, and dengue in North America is significantly driving the demand for advanced testing solutions. Technological advancements in diagnostic methods, such as PCR-based assays, next-generation sequencing, and rapid antigen tests, have enhanced the speed and accuracy of detection, fueling market growth. Public health agencies and healthcare providers increasingly rely on these cutting-edge technologies to manage and prevent outbreaks. The growing focus on early detection, combined with better awareness, further propels the expansion of the North America arbovirus testing industry.

U.S. Arbovirus Testing Market Trends

The U.S. arbovirus testing market held the largest share in 2024. The increasing integration of telemedicine services for remote testing and consultation fuels the market expansion. Telemedicine enables easier access to diagnostic services, particularly in underserved or rural areas, facilitating timely disease detection and consultation. A strong focus on early detection and epidemic preparedness is further driving market growth, as public health systems prioritize proactive monitoring of arboviral infections. This shift toward preventive healthcare, coupled with advancements in telehealth platforms, enhances the efficiency of arbovirus testing, ensuring faster response times and minimizing the spread of diseases.

Europe Arbovirus Testing Market Trends

Europe arbovirus testing market is anticipated to witness growth over the forecast period. Government and public health initiatives focused on combating arboviral infections are significantly contributing to the growth of the Europe arbovirus testing industry. Increased funding for research, disease surveillance, and outbreak management enhances regional testing capabilities. Public awareness about the potential risks of arboviral infections, fueled by educational campaigns, encourages individuals to seek early testing. These combined efforts are driving the demand for advanced diagnostic solutions, improving detection rates, and promoting proactive healthcare measures, which ultimately expand the market and strengthen epidemic preparedness in Europe.

Asia Pacific Arbovirus Testing Market Trends

Asia Pacific arbovirus testing market is set to be the fastest-growing region with a CAGR of 6.4% from 2025 to 2030. Investment in healthcare infrastructure across the Asia Pacific region enhances the availability and quality of arbovirus testing services. Expansion of diagnostic laboratories and healthcare facilities enables quicker and more widespread access to testing. Focus on integrated diagnostic platforms, which offer simultaneous detection of multiple arboviruses, improve efficiency, and reduce testing costs. These advancements contribute to better disease management, especially in remote or rural areas. The combination of improved infrastructure and more accessible, integrated diagnostic solutions is expected to impel the growth of the Asia Pacific arbovirus testing industry.

China arbovirus testing market is projected to grow at the fastest CAGR in the regional market during the forecast period, driven by the adoption of rapid diagnostic kits in China. These kits provide quick, accurate results, enabling faster diagnosis and more efficient management of arboviral diseases. An increased focus on vector control programs aimed at reducing mosquito populations and preventing the spread of diseases further supports market expansion. The integration of rapid testing solutions with vector control efforts enhances the country’s ability to respond to outbreaks swiftly, improving overall public health outcomes and boosting demand for advanced diagnostic technologies.

Key Arbovirus Testing Company Insights

Some of the key companies in the arbovirus testing industry include Abbott; Thermo Fisher Scientific Inc.; Merck KGaA; F. Hoffmann-La Roche Ltd; and Siemens Healthineers AG.

-

Abbott offers a wide range of healthcare products, including diagnostic tests, medical devices, nutritional products, and branded generic medicines. Its innovations span across diagnostics, diabetes care, cardiovascular health, and nutrition to improve global health outcomes.

-

Thermo Fisher Scientific, Inc. provides a broad range of laboratory equipment, analytical instruments, reagents, and consumables. Its offerings support research, diagnostics, and biotechnology, helping scientists and healthcare professionals advance discoveries and improve patient outcomes worldwide.

Key Arbovirus Testing Companies:

The following are the leading companies in the arbovirus testing market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Thermo Fisher Scientific Inc.

- NovaTec Immundiagnostica GmbH (Gold Standard Diagnostics Frankfurt GmbH)

- Agilent Technologies, Inc.

- EUROIMMUN Medical Laboratory Diagnostics AG

- Merck KGaA

- F. Hoffmann-La Roche Ltd

- Siemens Healthineers AG

- QIAGEN

- Bio-Rad Laboratories, Inc.

Recent Developments

-

In May 2023, Astellas Pharma Inc. committed to supporting the third phase of the Global Health Innovative Technology Fund (GHIT Fund), working with diverse funding partners from various sectors to drive global health innovation.

-

In May 2022, Anitoa Systems introduced a portable RT-PCR molecular test for detecting the dengue virus. The solution features the Maverick qPCR instrument and a lyophilized one-step multiplex RT-PCR reagent. This test identifies dengue infections that can lead to severe health risks.

Arbovirus Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.15 billion

Revenue forecast in 2030

USD 1.43 billion

Growth rate

CAGR of 4.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Abbott; Thermo Fisher Scientific Inc.; NovaTec Immundiagnostica GmbH (Gold Standard Diagnostics Frankfurt GmbH); Agilent Technologies, Inc.; EUROIMMUN Medical Laboratory Diagnostics AG; Merck KGaA; F. Hoffmann-La Roche Ltd; Siemens Healthineers AG; QIAGEN; Bio-Rad Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Arbovirus Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global arbovirus testing market report on the basis of type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ELISA-based Tests

-

RT-PCR Based Tests

-

Other Test Types

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Laboratories

-

Hospitals

-

Research Centers

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.