- Home

- »

- Animal Health

- »

-

Artificial Intelligence (AI) In Animal Health Market Report 2030GVR Report cover

![Artificial Intelligence (AI) In Animal Health Market Size, Share & Trends Report]()

Artificial Intelligence (AI) In Animal Health Market Size, Share & Trends Analysis Report By Solutions, By Application (Diagnostics, Identification, Tracking & Monitoring), By Animal Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-100-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global artificial intelligence (AI) in animal health market size was estimated at USD 997.33 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.09% from 2023 to 2030. Key market growth drivers include increasing applications of AI in animal health, availability of AI-based solutions, initiatives by key companies, increasing expenditure on animals, and demand for improving animal health outcomes. In March 2023, Zoetis expanded the capabilities of its AI-enabled Vetscan Imagyst diagnostics platform with the addition of the AI dermatology application and AI equine Fecal Egg Count (FEC) analysis.

The COVID-19 pandemic notably impacted the animal health market. Some of the positive impacts of the pandemic include increased digitalization of animal health sectors, adoption of veterinary technologies by end-users, and a boost towards technological advancements in the domain. However, the market also witnessed dampened demand and sales in some areas due to limited access to veterinary care, operational challenges, and delays in installations. Furthermore, the pandemic highlighted the importance of early detection and rapid response to diseases thus propelling the uptake of AI-enabled veterinary diagnostic solutions from key companies such as Zoetis and IDEXX.

Strategic initiatives by key market players is one of the major factors fueling the market growth. In June 2023, Mars Incorporated acquired Heska Corporation to accelerate R&D and innovation, expand access to diagnostics and technology, and broaden its customer base. Following the acquisition, Heska was merged into Mars Petcare’s Science & Diagnostics division. The company also gained Heska’s wide portfolio of diagnostic products including the Element AIM-AI-based and fully automated Microscopy analyzer. In February 2021, Petriage-a pet health technology company received an industry-first patent from the U.S. Patent and Trademark Officefor its artificial intelligence-driven online pet symptom checker.

Moreover, increasing research undertaken to explore new applications of AI in veterinary health is a key market driver. Machine learning algorithms have helped in drug discovery and development by analyzing vast biological datasets, identifying patterns, and predicting the efficacy of new treatments. This accelerates the development of innovative therapies and vaccines for animal diseases. Macso Technologies, a New Zealand-based start-up, for example, is utilizing the power of artificial intelligence to identify animal diseases and enhance animal well-being. The company has developed a platform that emulates the sensory capabilities of the human brain to facilitate various environmental monitoring applications. Their initial offering utilizes AI-powered audio sensors to assist in the early detection of animal illnesses by "listening" for indications of respiratory diseases.

Solutions Insights

The hardware segment dominated the market and accounted for a revenue share of 63.40% in 2022. The software and services segment is estimated to grow at the fastest CAGR of about 20% over the forecast period. Continuous advancements in hardware and software technologies, such as sensors, imaging devices, computer vision, deep learning, and wearables, are fueling the growth of the segments. Improved performance, miniaturization, increased processing power, and cost reductions are making these solutions more accessible to animal owners.OneCup AI, for example, offers BETSY-an automated precision ranching solution forcattle, horses, and sheep using Artificial Intelligence and Computer Vision.

The growth of the market is also attributed to factors such as increasing collaborations between software developers, technology companies, veterinary clinics, research institutions, and industry associations. These partnerships have led to the development of innovative AI solutions tailored specifically for animal health applications. In May 2023, MYANIML introduced new geolocation technology as part of its AI-enabled predictive health platform, aiming to enhance the security of the beef and dairy supply chain. The new addition enables the identification and tracking of sick animals 2 to 3 days in advance of symptoms thus facilitating early disease prediction.

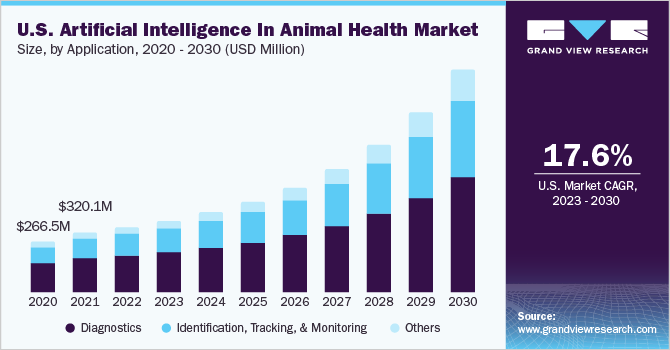

Application Insights

The diagnostics segment dominated the market and accounted for a revenue share of over 50% in 2022. Some of the factors contributing to this growth include the increasing integration of AI in veterinary diagnostics, the availability of AI-powered diagnostic solutions, as well as the need to improve diagnostic capabilities in animal health. IDEXX; Zoetis; SignalPET; and Vetology LLC are some of the key market players operating in AI in the veterinary diagnostics sector. SignalPET’s portfolio, for instance, includes SignalRAY, AI-based radiology test panels for common clinical findings. SignalRAY+ is an AI tool that adds history to refine clinical answers, and SignalSMILE-an AI-based dental radiology test panel for common pathologies.

The others segment is projected to grow at the highest CAGR of around 22% during the forecast period. It includes emerging applications of AI in animal health such as drug discovery & development, precision medicine, etc. For instance, FidoCure- a One Health Company (OHC) sequences canine DNA, identifies mutations, creates a personalized DNA report, and helps veterinary practitioners prescribe targeted therapies based on AI-informed decision-making. The Personalized Prediction Profile by ImpriMed on the other hand, provides AI-based drug response predictions for canine leukemia or lymphoma using the patient’s live cancer cells, medical history, and breed.

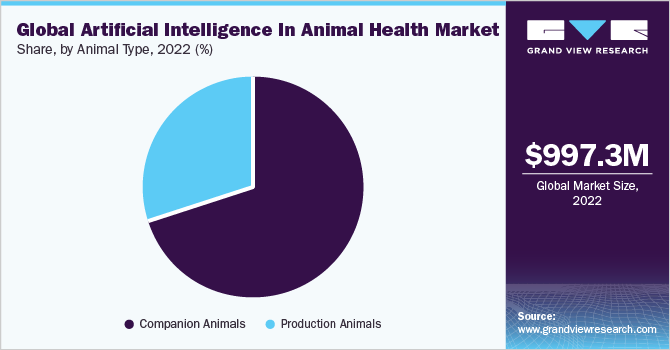

Animal type Insights

The companion animal segment held the highest revenue share of 70.47% in 2022. The increasing availability of AI-based pet health solutions, growing pet expenditure, and humanization of pets are some of the key drivers contributing to the segment share.Vetology LLC for instance, is a U.S.-based company that offers Veterinary Artificial Intelligence software & services for veterinary radiology. As of 2022, the company reported generating over 154,000 AI reports with over 6.6 million images in its image bank.ImpriMed, Inc., on the other hand, provides an AI-driven drug response prediction profile for treating canine cancer.

The production animal segment is estimated to witness the fastest CAGR of more than 20.0% in the near future. The global demand for animal protein, such as meat and dairy products, continues to rise due to population growth, urbanization, and changing dietary preferences. This drives the need for efficient and sustainable livestock production thus fueling the awareness and uptake of precision livestock farming solutions. AI-enabled devices and wearables can track and monitor vital signs, activity levels, and behavior of animals remotely. This helps in the early detection of health changes, ensuring timely intervention and reducing the need for frequent veterinary visits.

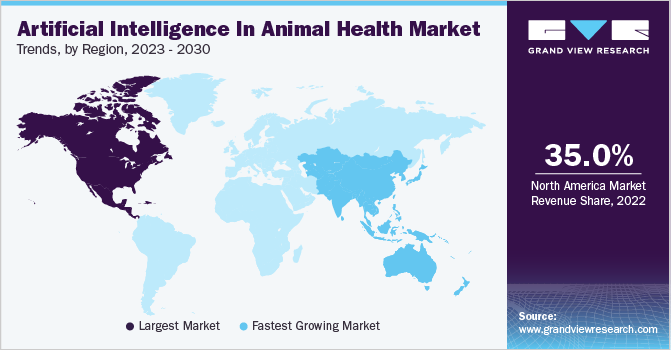

Regional Insights

North America dominated the market and held the largest revenue share of more than 35.0% in 2022. AI algorithms can analyze radiographs, CT scans, and MRI images to assist veterinarians in diagnosing diseases and abnormalities. These algorithms can detect patterns and markers that may be difficult for humans to identify, leading to improved accuracy and faster diagnosis. The growing integration of AI in veterinary diagnostics and advanced veterinary healthcare infrastructure in the U.S. and Canada are key factors contributing to the regional share.

Asia Pacific, on the other hand, is estimated to grow at the highest CAGR of more than 21.0% from 2023 to 2030. This is due to the increasing animal population and initiatives by local market players. Alibaba Cloud’s ET Agricultural Brain, for instance, extends the company’s self-developed AI technology to agriculture. The technology uses voice recognition, visual recognition, and real-time environmental parameter tracking to monitor animal activity, pregnancy, growth indicators, and other health conditions. ET Agricultural Brain is already adopted by a number of leading pig farming enterprises in China.

Key Companies & Market Share Insights

The market is competitive owing to the presence of diverse players, including large multinational animal health companies such as Zoetis to small private players. These are involved in incorporating AI in existing devices or systems to improve animal healthcare outcomes, enhance diagnostic accuracy, increase efficiency, and reduce costs. As the field continues to advance, other companies are anticipated to enter the market and contribute to the development of AI-driven solutions in veterinary medicine.

Existing market participants continue to implement strategic initiatives ranging from partnerships & collaborations, mergers & acquisitions, to product launches & upgrades to increase their market presence. For example, in April 2022, Zoetis enhanced its Vetscan Imagyst offerings with the addition of artificial intelligence (AI) blood smear testing to aid veterinarians in effectively diagnosing pets with hematologic abnormalities. Some prominent players in the global artificial intelligence (AI) in animal health market include:

-

Zoetis Services LLC

-

Merck & Co., Inc.

-

Heska Corporation

-

SignalPET

-

VetCT

-

Vetology LLC

-

OneCup AI

-

Petriage

-

ImpriMed, Inc.

-

IDEXX Laboratories, Inc.

Artificial Intelligence (AI) In Animal Health Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,108.04 million

Revenue forecast in 2030

USD 3.76 billion

Growth rate

CAGR of 19.09% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solutions, application, animal type, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Norway; Japan; China; India; South Korea; Australia; Brazil; Mexico; South Africa;

Key companies profiled

Zoetis Services LLC; Merck & Co., Inc.; Heska Corporation; SignalPET; VetCT; Vetology LLC; OneCup AI; Petriage; ImpriMed, Inc.; IDEXX Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

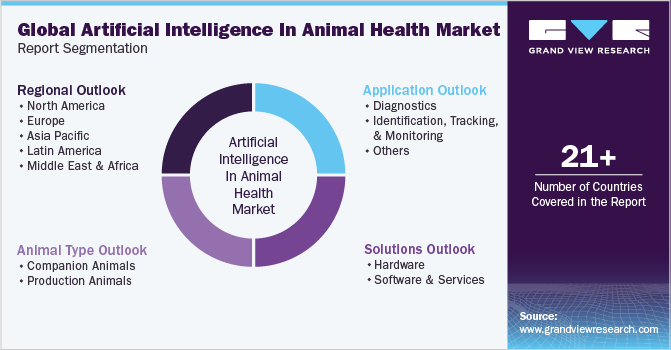

Global Artificial Intelligence (AI) In Animal Health Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the artificial intelligence (AI) in animal health market report based on solutions, application, animal type, and region:

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software & Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Identification, Tracking, and Monitoring

-

Others

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Production Animals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence (AI) in animal health market size was estimated at USD 997.33 million in 2022 and is expected to reach USD 1,108.04 million in 2023.

b. The global artificial intelligence (AI) in animal health market is expected to grow at a compound annual growth rate of 19.09% from 2023 to 2030 to reach USD 3.76 billion by 2030.

b. By region, North America held the largest share of more than 35% of the total market in 2022. AI algorithms can analyze radiographs, CT scans, and MRI images to assist veterinarians in diagnosing diseases and abnormalities. These algorithms can detect patterns and markers that may be difficult for humans to identify, leading to improved accuracy and faster diagnosis. The growing integration of AI in veterinary diagnostics and advanced veterinary healthcare infrastructure in the U.S. and Canada are key factors contributing to the regional share.

b. Some key players operating in the AI in animal health market include Zoetis Services LLC; Merck & Co., Inc.; Heska Corporation; SignalPET; VetCT; Vetology LLC; OneCup AI; Petriage; ImpriMed, Inc.; and IDEXX Laboratories, Inc.

b. Some of the key drivers of the artificial intelligence in animal health market include increasing applications of AI in animal health, availability of AI-based solutions, initiatives by key companies, increasing expenditure on animals, and demand for improving animal health outcomes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."