- Home

- »

- Next Generation Technologies

- »

-

AI Camera Market Size And Share, Industry Report, 2030GVR Report cover

![AI Camera Market Size, Share & Trends Report]()

AI Camera Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Type (Surveillance Cameras, Smartphone Cameras), By Technology, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-135-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Camera Market Summary

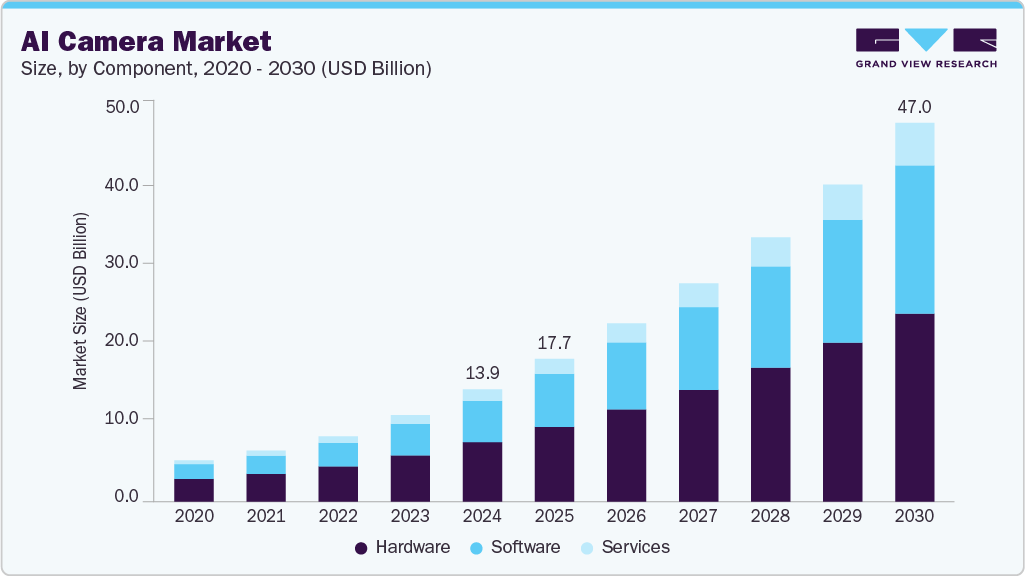

The global AI camera market size was estimated at USD 13.93 billion in 2024 and is projected to reach USD 47.02 billion by 2030, growing at a CAGR of 21.6% from 2025 to 2030. This growth is primarily driven by the increasing demand for intelligent surveillance solutions across sectors such as retail, transportation, government, and smart cities.

Key Market Trends & Insights

- The North America AI camera market accounted for the highest revenue share of over 34% in 2024.

- The U.S. AI camera industry dominated with the largest revenue share of over 65% in 2024

- By component , the hardware segment accounted for the largest market share of over 52% in 2024.

- By type, the surveillance cameras segment accounted for the largest market share in 2024

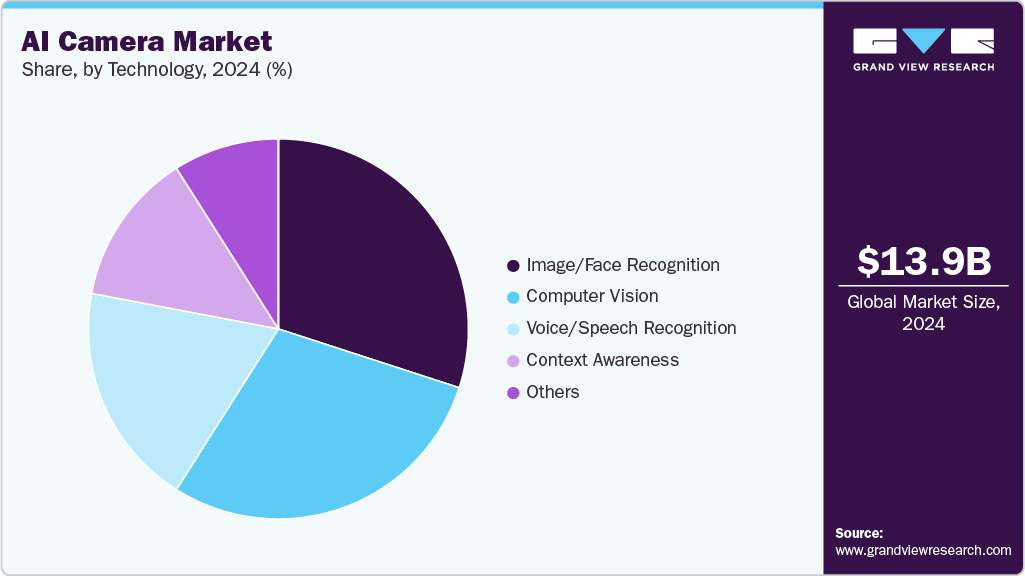

- By technology, the image/face recognition segment accounted for the highest market share in 2024

Market Size & Forecast

- 2024 Market Size: USD 13.93 Billion

- 2030 Projected Market Size: USD 47.02 Billion

- CAGR (2025-2030): 21.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rapid advancement of edge computing, deep learning algorithms, and real-time video analytics is accelerating the adoption of AI-powered cameras for enhanced security and operational efficiency. Additionally, growing concerns over public safety, rising crime rates, and the need for proactive threat detection are prompting organizations to invest in AI camera systems, further supported by integration with technologies such as facial recognition, IoT, and cloud platforms.Rising demand for real-time monitoring and intelligent threat detection across sectors such as transportation, manufacturing, and public safety is fueling the growth of the AI camera industry. The proliferation of edge computing and advanced analytics is enhancing on-device processing, enabling immediate incident response and reduced reliance on human intervention. Additionally, growing concerns over security and operational efficiency are prompting organizations to adopt AI-enabled surveillance systems. These factors, along with the ability of AI cameras to deliver actionable insights in real time, are anticipated to substantially drive the market growth.

The growing demand for smart and scalable surveillance infrastructure is significantly accelerating the adoption of AI cameras in smart city environments. Urban development authorities are implementing AI-powered vision systems to improve traffic management, ensure public safety, and monitor civic infrastructure. The integration of real-time analytics and centralized control centers is enabling data-driven urban planning and faster emergency response. These capabilities, combined with government investments in smart city projects worldwide, are expected to drive long-term growth in the AI camera market.

The market is witnessing increasing deployment across the retail and commercial sectors to enhance customer engagement and optimize operational decision-making. Retailers are using AI cameras to track customer movement, analyze shopping patterns, and assess product interaction in real time. The data generated supports targeted marketing, efficient store layout designs, and personalized experiences. These advantages, along with rising competition in the retail landscape, are expected to drive substantial growth in the industry.

The integration of AI cameras into traffic control systems and intelligent transportation networks is transforming road safety and urban mobility. AI-powered cameras are enabling real-time vehicle detection, automatic license plate recognition, and predictive congestion management. These systems are helping city authorities optimize traffic flow, reduce accidents, and enhance law enforcement capabilities. With increasing investments in smart mobility solutions, this trend is expected to strongly contribute to the market expansion.

The AI camera market is expanding into precision agriculture, where advanced vision systems are used to monitor crops, track livestock health, and manage irrigation with higher accuracy. Farmers are leveraging AI cameras for early detection of plant diseases, real-time surveillance of field conditions, and automated compliance with environmental regulations. These capabilities improve productivity while reducing resource waste and operational costs. The increasing digitization of agriculture is anticipated to open new growth avenues for the AI camera industry.

Component Insights

The hardware segment accounted for the largest market share of over 52% in 2024, driven by the need for high-performance and edge-capable hardware. The market is witnessing significant advancements in the hardware segment. Increasing adoption of AI cameras in real-time applications is pushing demand for powerful image sensors, neural processors, and integrated SoCs that enable fast, on-device analytics. These hardware innovations are essential for supporting advanced features such as facial recognition, object tracking, and low-light performance. As industries across retail, transportation, and manufacturing prioritize speed, accuracy, and reliability, the hardware segment is expected to experience sustained growth in the AI camera market.

The services segment is expected to witness the fastest CAGR of over 23% from 2025 to 2030, driven by the increasing complexity of AI camera deployments and the need for continuous support. The service segment is becoming a critical growth area in the AI camera industry. Organizations are seeking managed services, system integration, and maintenance contracts to ensure optimal performance and minimize downtime. Additionally, demand for AI model training, software updates, and cybersecurity services is rising as businesses adopt more sophisticated AI camera solutions. These factors, combined with the growing preference for end-to-end service offerings, are expected to substantially boost the service segment’s contribution to overall market growth.

Type Insights

The surveillance cameras segment accounted for the largest market share in 2024. The growing demand for intelligent surveillance cameras is significantly driving the segment’s growth. Organizations across sectors such as government, retail, and transportation are increasingly deploying AI-enabled surveillance systems to enhance security, automate threat detection, and support forensic analysis. These cameras offer advanced features like facial recognition, behavior analysis, and license plate recognition, improving safety and operational efficiency. The rising need for proactive security measures and regulatory compliance is expected to further accelerate adoption in this segment.

The smartphone cameras segment is expected to witness the fastest CAGR from 2025 to 2030. Rising demand for enhanced imaging and AI-powered features is propelling the segment’s growth. Smartphone manufacturers are integrating AI technologies to improve photo quality, enable scene recognition, and support augmented reality applications. These innovations enhance user experience by delivering smarter image processing, low-light performance, and real-time enhancements. As consumer expectations for advanced camera capabilities continue to rise, the smartphone cameras segment is poised to experience significant expansion.

Technology Insights

The image/face recognition segment accounted for the highest market share in 2024, primarily driven by the increasing adoption of image and face recognition technologies across diverse sectors. These technologies are being widely used in security, retail, banking, and healthcare for identity verification, access control, and customer behavior analysis. Advances in deep learning algorithms and improved camera hardware are enhancing accuracy and speed, making AI-powered recognition systems more reliable and scalable. As privacy regulations evolve and demand for secure authentication rises, the image/face recognition segment is expected to witness robust growth.

The context awareness segment is expected to witness the fastest CAGR from 2025 to 2030. The integration of context awareness capabilities is driving significant growth in the segment. AI cameras equipped with contextual understanding can analyze environmental factors, human behaviors, and situational cues to deliver more accurate and relevant insights. This technology is increasingly applied in smart retail, healthcare, and security to enable proactive responses and personalized experiences. With rising demand for intelligent systems that go beyond simple detection to interpret context, the context awareness segment is poised for strong expansion.

Industry Vertical Insights

The consumer electronics segment accounted for the highest share of the AI camera industry in 2024.The growing demand for AI-powered imaging solutions is driving robust growth in the consumer electronics segment. AI cameras are increasingly integrated into devices such as smart TVs, home assistants, drones, and wearable gadgets to enhance user interaction and enable features like gesture recognition and voice control. Consumers are seeking smarter, more intuitive devices that leverage AI for improved convenience and entertainment experiences. These trends, coupled with rapid innovation and expanding product portfolios, are expected to significantly boost the segment's growth.

The sports segment is expected to witness the fastest CAGR from 2025 to 2030.The rising demand for advanced performance analysis and immersive viewing experiences is driving growth in the AI camera market’s sports segment. AI cameras are increasingly used to capture detailed player movements, provide real-time statistics, and enhance broadcast quality with automated highlights and multi-angle replays. These technologies enable coaches, analysts, and fans to gain deeper insights and engagement during live events. As sports organizations invest more in technology to improve athlete performance and fan experience, the sports segment is expected to witness significant expansion.

Regional Insights

The North America AI camera market accounted for the highest revenue share of over 34% in 2024, driven by strong investments in smart city initiatives and advanced surveillance infrastructure. The region prioritizes integrating AI with existing security and analytics systems to enhance real-time threat detection and operational efficiency. Additionally, strict regulatory frameworks around data privacy and security are pushing organizations toward compliant AI camera solutions. These factors collectively position North America as a key growth region in the market.

U.S. AI Camera Market Trends

The U.S. AI camera industry dominated with the largest revenue share of over 65% in 2024, primarily driven by the widespread adoption of AI cameras across government, retail, and transportation sectors. The focus on privacy-preserving AI and edge computing technologies is fostering innovation within the market. Furthermore, substantial government and private sector funding for AI research supports the development of advanced AI camera capabilities. This combination is fueling a competitive and rapidly evolving AI camera market in the U.S.

Europe AI Camera Market Trends

The Europe AI camera industry is expected to grow at a CAGR of over 20% from 2025 to 2030. Due to stringent data protection regulations like GDPR, Europe is witnessing increased demand for secure and ethical AI camera solutions. The region’s smart city and infrastructure modernization projects are further accelerating AI camera deployments across public safety and commercial sectors. Collaborative efforts between governments and technology providers are fostering innovation in AI-driven surveillance and analytics. These factors are collectively driving the market growth.

The UK AI camera market is expected to grow at a significant CAGR in the forthcoming years. The increasing demand for AI cameras in law enforcement and retail sectors is shaping the UK market. Post-Brexit policies have encouraged investment in domestic AI technology development and robust data governance frameworks. Public safety enhancements and smart infrastructure projects are also key contributors to market expansion. This growing emphasis on security and innovation supports the UK’s rising position in the AI camera industry.

The AI camera market in Germany is expected to grow over the forecast period, due to the rising applications in industrial automation and smart manufacturing. Germany’s leadership in Industry 4.0 encourages the integration of AI cameras for quality control and workplace safety. Supportive government initiatives and ongoing R&D investments further stimulate adoption. These elements are expected to sustain Germany’s strong presence in the AI camera industry.

Asia Pacific AI Camera Market Trends

The Asia Pacific AI camera industry is expected to grow at the fastest CAGR of over 24% from 2025 to 2030, driven by rapid urbanization and large-scale smart city developments. The market is expanding swiftly, due to the increasing smartphone penetration and demand for AI-enabled consumer electronics are additional growth catalysts. Investments in AI startups and technological infrastructure across countries like India, South Korea, and Australia accelerate market maturation. Together, these trends position Asia Pacific as a high-growth region for AI cameras.

The Japan AI camera market is gaining traction, owing to its advanced robotics environment and demographic challenges. Japan is seeing increased demand for AI cameras in healthcare and disaster management. The country is heavily investing in AI-powered surveillance technologies to enhance public safety and operational efficiency. High consumer demand for smart electronics also supports the expansion of AI camera applications. These factors collectively drive the market growth.

The AI camera market in China is rapidly expanding, primarily driven by extensive deployments in public security, retail, and transportation sectors. Government-led smart city initiatives and the establishment of AI innovation hubs have spurred widespread adoption. However, growing regulatory scrutiny over data privacy and security is shaping the development and implementation of AI camera solutions. These dynamics together influence China’s dominant role in the Asia Pacific AI camera industry.

Key AI Camera Company Insights

Some of the key players operating in the market are Bosch Security Systems GmbH and Axis Communications AB.

-

Axis Communications AB specializes in network cameras and video surveillance solutions, known for pioneering IP-based security products. Their AI-enabled cameras integrate advanced analytics for real-time threat detection and scalable security management. Axis’s strong global presence and focus on innovation position them as a market leader in AI-driven surveillance.

-

Bosch Security Systems GmbH focuses on high-quality security systems with AI capabilities embedded in their intelligent video surveillance cameras. They emphasize integrating AI with IoT for smart building and city applications, enhancing safety and operational efficiency. Bosch’s reputation for robust hardware and software integration secures their position as a key market player.

Teledyne FLIR LLC and Canon Inc. are some of the emerging participants in the AI camera market.

-

Teledyne FLIR LLC is emerging as a specialist in thermal imaging and AI-enhanced sensor fusion cameras for security and industrial applications. Their innovations in infrared technology, combined with AI analytics, address niche markets such as critical infrastructure monitoring and perimeter security. Rapid product development and partnerships position FLIR as a rising contender in the AI camera industry.

-

Canon Inc. is expanding its AI camera capabilities beyond traditional optics, focusing on intelligent imaging solutions that integrate AI for enhanced video analytics and object recognition. Their emphasis on combining optical excellence with AI-driven software enhances applications in retail and public safety. Canon’s move into AI-enabled cameras marks them as an emerging innovator in the market.

Key AI Camera Companies:

The following are the leading companies in the AI camera market. These companies collectively hold the largest market share and dictate industry trends.

- AV Costar

- Axis Communications AB

- Bosch Security Systems GmbH

- Canon Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Johnson Controls

- LG Electronics

- Nikon Corporation

- Panasonic Holdings Corporation

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Teledyne FLIR LLC

Recent Developments

-

In April 2025, HONOR launched the HONOR 400 Lite 5G, featuring a 108MP AI-powered camera and a dedicated AI Camera Button for quick photo capture and editing. The device includes a 6.7-inch AMOLED display with a 120Hz refresh rate and a 16MP front camera. It is powered by the MediaTek Dimensity 7025-Ultra chipset, supports 5G connectivity, and houses a 5230mAh battery.

-

In March 2025, Gather AI introduced MHE Vision, an AI-powered camera system designed to automate pallet tracking and boost warehouse efficiency. It integrates with existing material handling equipment, enabling real-time inventory and asset tracking without additional infrastructure. The solution provides actionable AI-driven insights to optimize throughput, productivity, and safety.

-

In March 2025, Lantronix announced the integration of its Open-Q SoM solutions with Teledyne FLIR’s thermal camera modules and Prism software to advance AI-enabled camera development. This collaboration targets autonomous navigation, drones, surveillance, and robotics applications. Leveraging Qualcomm’s Dragonwing platforms, it offers advanced thermal imaging, real-time object detection, and high-speed tracking capabilities.

AI Camera Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.71 billion

Revenue forecast in 2030

USD 47.02 billion

Growth rate

CAGR of 21.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, technology, industry vertical, and region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

AV Costar; Axis Communications AB; Bosch Security Systems GmbH; Canon Inc.; Hangzhou Hikvision Digital Technology Co., Ltd.; Honeywell International Inc.; Huawei Technologies Co., Ltd.; Johnson Controls; LG Electronics; Nikon Corporation; Panasonic Holdings Corporation; Samsung Electronics Co., Ltd.; Sony Corporation; Teledyne FLIR LLC

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global AI Camera Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the AI camera market report based on component, type, technology, industry vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Surveillance Cameras

-

Smartphone Cameras

-

Digital Cameras

-

Industrial Cameras

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Image/Face Recognition

-

Voice/Speech Recognition

-

Computer Vision

-

Context Awareness

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Manufacturing

-

Sports

-

Agriculture

-

Retail

-

Healthcare

-

Transportation

-

Government & Law Enforcement

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global AI camera market size was estimated at USD 13.93 billion in 2024 and is expected to reach USD 17.71 billion in 2025.

b. The global AI camera market is expected to grow at a compound annual growth rate of 21.6% from 2025 to 2030 to reach USD 47.02 billion by 2030.

b. North America region dominated the AI camera market with a share of over 34.0% in 2024. This can be attributed to the greater consumer inclination toward smart devices and technologically advanced solutions in the region. Moreover, the strong presence of various major technology companies and AI camera manufacturers in the region is also creating a positive outlook for the regional market.

b. Some key players operating in the AI camera market include Canon Inc., Bosch Security Systems GmbH, Honeywell International Inc., Sony Corporation, Hangzhou Hikvision Digital Technology Co., Ltd., Teledyne FLIR LLC, Huawei Technologies Co., Ltd., Panasonic Holdings Corporation, Nikon Corporation, Johnson Controls, AV Costar, Samsung Electronics Co., Ltd., LG Electronics, and Axis Communications AB.

b. The market's growth can be credited to the growing consumer inclination toward technologically advanced devices based on the latest technologies such as Artificial Intelligence (AI) and Machine Learning (ML). As a result, AI-based cameras are gaining massive traction not only across photography and videography domains but across several other verticals, such as government and law enforcement, consumer electronics, sports, agriculture, automotive, healthcare, manufacturing, etc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.