- Home

- »

- Next Generation Technologies

- »

-

AI In Sales Market Size And Share, Industry Report, 2033GVR Report cover

![AI In Sales Market Size, Share & Trends Report]()

AI In Sales Market (2025 - 2033) Size, Share & Trends Analysis Report By Software Type (Chatbots & Assistants, Customer relationship management, Email generators), By Sales Process Application, By Deployment, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-746-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Sales Market Summary

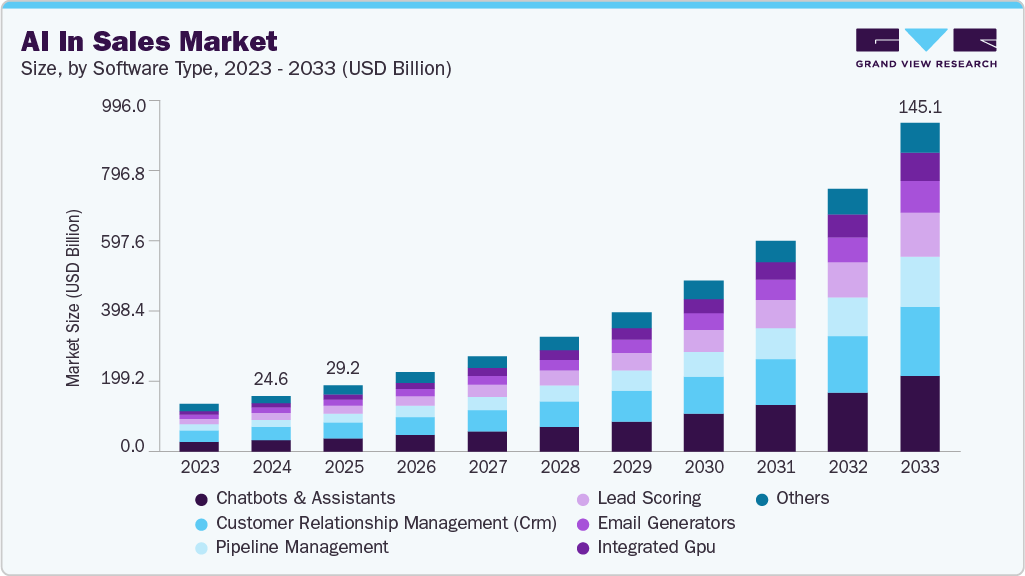

The global AI in sales market size was estimated at USD 24.64 billion in 2024 and is projected to reach USD 145.12 billion by 2033, growing at a CAGR of 22.2% from 2025 to 2033. The market is driven by the advancements in AI technologies, increased market adoption, and evolving customer expectations.

Key Market Trends & Insights

- North America dominated the global AI in sales market with the largest revenue share of 34.3% in 2024.

- The AI in sales market in the U.S. led the North America Market and held the largest revenue share in 2024.

- By software type, customer relationship management (CRM) led the market and held the largest revenue share of 23.6% in 2024.

- By sales process application, the customer engagement & communication segment held the dominant position in the market and accounted for the leading revenue share of 23.9% in 2024.

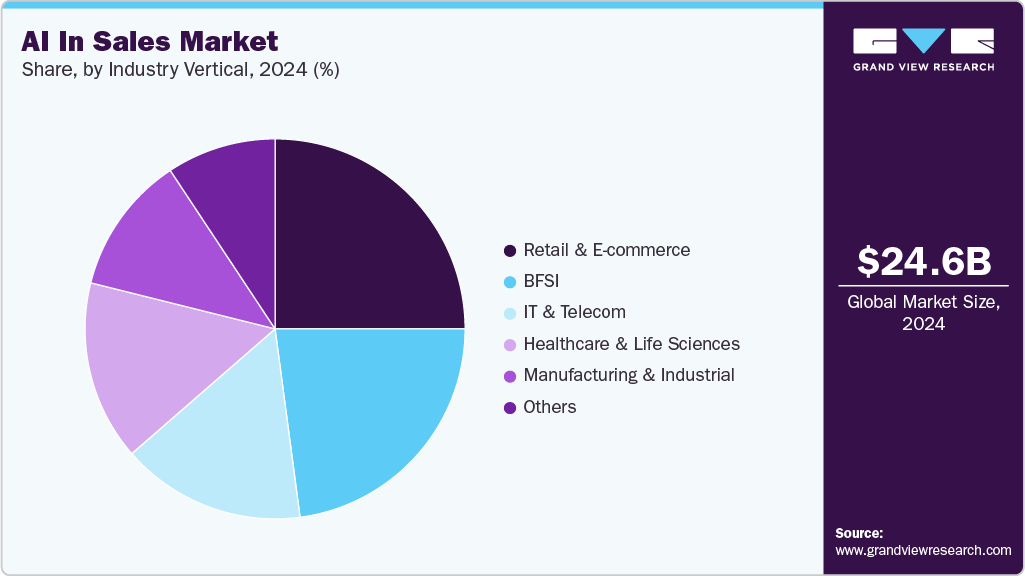

- By industry vertical, the retail and e-commerce segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 24.64 Billion

- 2033 Projected Market Size: USD 145.12 Billion

- CAGR (2025-2033): 22.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

It helps sales teams to automate routine tasks, gain actionable insights from real-time data, and deliver personalized customer experiences at scale. This shift helps organizations respond quickly to buyer signals and competing demands, contributing to prominent gains in sales productivity and efficiency. Predictive analytics has become important to sales strategies, evolving from simple forecasting to complex models that incorporate market trends, customer behavior, and economic factors. These AI-powered models enable sales teams to identify high-conversion leads more accurately and reduce lead follow-up time, boosting conversion rates and sales effectiveness. Additionally, autonomous AI agents capable of independently executing multi-step tasks such as researching prospects, customizing outreach, and managing timing, are reforming the sales background by acting as virtual sales assistants that operate with minimal human oversight, improving operational scale and responsiveness.

The rise of hyper-personalization is another key trend, where AI analyzes customer data such as business metrics, web interactions, and social media behavior to tailor offers, messages, and follow-ups that meet individual buyer needs. This targeted approach enhances customer lifetime value, purchase frequency, and retention by ensuring communications resonate with buyer preferences and market conditions. Organizations leveraging these AI capabilities report significant improvements in sales outcomes, including larger order sizes and higher conversion rates.

Furthermore, the AI market for sales is anticipated to grow strongly, driven by digital transformation efforts and demand for personalized customer experiences across regions. Efficiency gains such as time saved on repetitive tasks and reductions in marketing costs support business investment in AI, highlighting its growing role as a strategic tool for competitive differentiation in sales and marketing operations.

Software Type Insights

The customer relationship management (CRM) segment led the market and accounted for 23.6% of the global revenue in 2024. AI is transforming customer relationship management (CRM) software by making sales operations smarter and more efficient. It helps personalize interactions, automate repetitive tasks, and provide predictive insights that guide better decision-making. By analyzing past data and market trends, AI improves the accuracy of sales forecasts and supports stronger pipeline management. Automation also frees sales teams from administrative work, giving them more time to focus on customers. At the same time, AI ensures more personalized communication that aligns with each customer’s needs. As adoption grows, companies are also prioritizing data security and compliance to protect customer privacy and maintain fairness in the sales process. For instance, in April 2025, HubSpot introduced 200 enhancements focused on AI-powered efficiency across marketing, sales, and customer support for SMBs. Key launches include new Breeze AI agents such as the Knowledge Base Agent, Customer Agent, Prospecting Agent, and Content Agent, each designed to improve automation, personalization, and workflow integration within the HubSpot CRM.

The chatbots & assistants segment is predicted to foresee significant growth in the forecast period as customers expect faster, more personalized, and always-available support. Powered by advanced language models and generative AI, these tools can analyze customer behavior and buying patterns to provide timely and relevant interactions. By handling routine queries, they free up sales teams to focus on more complex tasks, improving both efficiency and conversion rates. Their ability to work across multiple websites and messaging platforms makes them widely accessible, while also enabling businesses to scale their marketing efforts with minimal technical effort. For instance, in September 2023, Salesforce, inc. launched Einstein 1 Platform, a trusted AI platform integrating data, automation, and generative AI across its CRM applications. The launch included Einstein Copilot, a conversational AI assistant embedded in the user interface, enabling natural language interactions and customized workflows. Additional tools such as Copilot Studio empower enterprises to build AI-driven applications with prompt, model, and skills builders. Salesforce also enhanced data accessibility by providing Data Cloud and Tableau licenses at no extra cost for qualifying customers, reinforcing their emphasis on secure, scalable AI-driven customer experiences.

Sales Process Application Insights

The customer engagement & communication segment accounted for the largest market revenue share in 2024. This segment is driven by using AI-driven personalization, businesses can alter communication based on customer data, leading to stronger loyalty and satisfaction. Routine tasks are automated, allowing sales teams to spend more time on high-value activities. Predictive analytics helps in anticipating customer behavior and sales trends, making outreach and revenue planning more effective. At the same time, AI tools deliver real-time insights and proactive suggestions, helping sales teams engage customers more efficiently and meet their changing expectations. For instance, in March 2025, COGNISM LIMITED launched Sales Companion, to personalise B2B prospecting at scale. Integrating AI-driven recommendations with access to over 440 million contacts, the platform enhances sales productivity by delivering real-time insights such as intent signals and technographics, enabling sales teams to focus on the most relevant decision-makers efficiently. Sales Companion also offers personalized dashboards and seamless CRM integrations, streamlining workflows and improving prospect engagement and outreach precision.

The forecasting & pipeline optimization segment is predicted to foresee significant growth in the forecast period. AI in sales forecasting and pipeline optimization improves accuracy by analyzing large datasets encompassing past sales, customer behavior, and market trends, enabling dynamic updates of deal probabilities and real-time pipeline health monitoring. It identifies hidden patterns, prioritizes high-potential leads, and highlights bottlenecks in the sales process to optimize resource allocation and deal progression. This data-driven approach supports proactive strategy adjustments based on evolving market conditions and customer engagement signals, leading to more reliable forecasts and efficient pipeline management. For instance, in April 2025, Gong introduced AI agents designed specifically for revenue teams to integrate within business workflows and automate key processes. These AI agents uses more than a decade of customer interaction data to deliver verified insights for pipeline management, forecasting, coaching, and customer engagement. They provide actionable intelligence while allowing sales teams to focus on strategy and relationships, with customizable configurations to fit unique business needs. This innovation enhances productivity, predictability, and data-driven decision-making across revenue operations, included at no extra cost with Gong licenses.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2024, is driven as it helps businesses centralize customer data and streamline workflows, making sales teams more productive and efficient. With AI-powered predictive analytics, organizations can identify and prioritize the most promising leads, ensuring resources are used where they deliver the best results. Real-time data updates and automated management reduce manual work while improving accuracy, enabling consistent, data-driven decisions, and by integrating with collaboration tools and aligning stakeholders, cloud-based AI also delivers unified insights and practical recommendations that boost overall sales performance. For instance, in May 2025, IBM advanced its enterprise AI strategy through enhanced hybrid cloud capabilities, enabling seamless integration and orchestration of AI workloads across hybrid environments. The company expanded support for high-performance GPU infrastructure on IBM Cloud, including AMD Instinct and NVIDIA accelerators, to optimize compute-intensive AI applications. IBM introduced next-generation hybrid integration tools that automate complex workflows across apps, APIs, and partners, improving operational efficiency. These innovations support regulatory compliance, security, and scalability, empowering businesses to operationalize AI at scale while maintaining control over data and costs.

The on-premises segment is predicted to foresee significant growth in the forecast period. On-premises AI deployment in sales is chosen mainly for the control it offers over sensitive customer data, helping businesses stay compliant with privacy laws and data sovereignty rules. Its predictable cost structure makes it easier to manage budgets, especially for steady AI workloads such as inference, and often proves more cost-effective in the long run compared to cloud’s usage-based pricing. It also integrates smoothly with existing enterprise systems, can be customized to meet specific business requirements, and reduces reliance on third-party cloud providers, ensuring greater stability and security in operations.

Industry Vertical Insights

The retail and e-commerce segment accounted for the largest market revenue share in 2024, drivers include using cloud-based digital platforms that seamlessly connect distributors, salespeople, and retailers to streamline order management and enhance operational efficiency. AI-enabled insights allow for personalized assortment recommendations and targeted promotions, optimizing sales rep visits and increasing retailer loyalty and order values. Additionally, AI-powered data analytics and image recognition improve stock level monitoring and merchandising, while route optimization and automated resupply enhance distributor efficiency and delivery sustainability. For instance, in October 2024, Microsoft partnered with Rezolve AI to enhance retail digital engagement through Rezolve AI’s Brain Suite, Brain Commerce, Brain Checkout, and Brain Assistant, integrated with Microsoft Azure. This collaboration provides retailers with scalable AI-powered solutions to personalize customer interactions, streamline checkout processes, and reduce cart abandonment across digital channels in 95 languages.

The healthcare & life sciences segment is projected to grow significantly over the forecast period. In Healthcare & Life Sciences sales, AI adoption is growing as generative AI is used to boost productivity and innovation across areas such as sales and physician engagement. While moving from pilot projects to large-scale use, organizations face challenges such as aligning strategies at the enterprise level, building skilled teams, and setting up strong governance frameworks to get the best results. Key applications focus on helping healthcare professionals make better decisions and cut down on administrative tasks, with a strong emphasis on transparency, quality, and close collaboration between AI developers and end users. At the same time, changing regulations and reimbursement policies continue to shape how AI is adopted and scaled in this sector. For instance, in May 2025, Salesforce launched the Life Sciences Partner Network, a curated ecosystem of consulting firms, AI innovators, and industry-focused partners designed to accelerate adoption of the Life Sciences Cloud and Agentforce AI sales platform. The network supports pharmaceutical, biotech, and medtech companies in migrating from legacy CRM systems to a unified, compliant, and AI-powered platform. It enables real-time data integration, workflow automation, and personalized engagement with healthcare professionals and patients.

Regional Insights

North America dominated the market and accounted for a 34.3% share in 2024. North America’s AI in sales market is driven by high capital concentration and leadership from global companies such as Microsoft, Google, and Amazon, offering foundation models and AI-as-a-service infrastructure. The region benefits from enterprise-grade adoption, especially across regulated sectors such as healthcare and finance, with AI integrated not only for automation but also for core business transformation. A strong ecosystem of startups, research institutions, and supportive policy frameworks drives production-scale AI deployment and continuous innovation. These combined factors contribute to North America maintaining a substantial share of global AI investments and advanced use cases.

U.S. AI In Sales Market Trends

The U.S. dominates AI in sales adoption in North America, driven by strong R&D investments and leadership from major technology companies heavily involved in AI innovation. The availability of venture capital and strong private-public partnerships supports continuous advancements in AI-driven sales tools, including generative AI for content creation and prospect outreach. Emphasis on leveraging predictive analytics and automation enhances customer personalization and operational efficiencies. Furthermore, evolving workforce capabilities and organizational readiness enable the integration of AI into strategic sales functions, reshaping sales roles and processes toward data-driven decision-making.

Europe AI In Sales Market Trends

Europe’s AI in sales market is growing, driven by regulatory frameworks highlighting data privacy, ethical AI use, and transparency, which guide AI deployments across industries. The focus on complying with stringent GDPR requirements influences AI in sales platform adoption strategies, especially in customer data-driven sales. Collaborative initiatives between governments and private sectors foster AI innovation aimed at enhancing customer engagement and operational efficiency. Additionally, Europe emphasizes the integration of AI with existing enterprise systems, supporting sustainable and responsible AI practices in sales processes.

Asia Pacific AI In Sales Market Trends

Asia Pacific is expected to record the fastest CAGR during the forecast period. The region's AI sales market is driven by rapid digitalization, widespread mobile adoption, and government-led initiatives supporting AI ecosystem growth, especially for startups. It emphasizes AI-driven hyper-personalization and automated customer interactions to serve large, diverse consumer bases. Increased investments in AI infrastructure and cloud technologies enable scalable deployments, while AI's cross-industry applications extend beyond sales into supply chain and marketing. The competitive landscape and differences in market maturity across countries create unique patterns of AI sales innovation and adoption within the region. For example, in March 2025, Oracle launched its AI Centre of Excellence in Singapore to assist organizations in Southeast Asia with adopting advanced AI technologies. The center offers both physical and digital spaces equipped with Oracle’s latest cloud and AI solutions, allowing companies to train teams, experiment, and transform business processes. It leverages a network of partners and Oracle experts to promote skill development and innovation across industries.

Key AI In Sales Company Insights

Some key companies in the AI in sales industry are Microsoft, Salesforce, inc, ZoomInfo Technologies LLC, IBM

-

Microsoft is known for its lead generation & qualification offerings such as Windows and Microsoft Office, along with a rapidly growing presence in cloud computing and artificial intelligence via Microsoft Azure. The company has made major strides in AI innovation and enterprise cloud solutions, fostering transformation across industries. Microsoft prioritizes trust, sustainability, inclusion, and empowering customers and employees to achieve more through its technologies.

-

Salesforce, inc is a leading American cloud-based software company specializing in customer relationship management (CRM) applications, including sales, marketing automation, service, e-commerce, and artificial intelligence solutions. The company has revolutionized enterprise cloud computing with a scalable, multi-tenant architecture that supports seamless integration and rapid customization. Salesforce India also hosts a major innovation center focused on AI training and development, reinforcing the region as a vital hub for the company’s global growth.

Key AI In Sales Companies:

The following are the leading companies in the AI in sales market. These companies collectively hold the largest market share and dictate industry trends.

- Apollo

- COGNISM LIMITED

- Fireflies.ai Corp

- Gong.io Ltd.

- HubSpot, Inc.

- IBM

- Microsoft

- Regie.ai.

- Salesforce, inc.

- ZoomInfo Technologies LLC

Recent Developments

-

In September 2025, HubSpot released a comprehensive blueprint for building hybrid human-AI teams, featuring over 200 product updates, including the new Data Hub and Breeze AI Agents. These innovations integrate and clean data from various sources, embed AI within workflows to reduce busywork, and provide specialized AI teammates to support marketing, sales, and service functions. HubSpot’s updates enable teams to unify customer data, automate repetitive tasks, and enhance productivity by combining human creativity with AI-powered insights and assistance, helping businesses accelerate growth and improve customer engagement.

-

In April 2025, Fireflies introduced over 200 AI Apps designed to enhance productivity across various departments by automating meeting transcription, summarization, and workflow integration. The apps provide role-specific features such as sales prospect analysis, candidate evaluation, customer support insights, and marketing campaign reviews, delivering outputs that update CRMs and collaboration tools automatically. Fireflies emphasizes strong data privacy measures, including private storage and HIPAA compliance, making it suitable for regulated industries.

-

In April 2025, ZoomInfo launched new Copilot features delivering AI-driven sales capabilities that enhance account insights beyond initial prospecting, enabling sales teams to accelerate late-stage opportunities with precision and confidence. These updates include AI-powered real-time buying signals, automated account tracking, personalized outreach through AI-generated emails, and integration with key CRM platforms. Copilot's advanced analytics identify high-value prospects, key decision-makers, and relevant market signals, allowing sales professionals to act swiftly on critical opportunities.

AI In Sales Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 29.20 billion

Revenue forecast in 2033

USD 145.12 billion

Growth rate

CAGR of 22.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Software type, sales process application, deployment, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Europe; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Apollo; COGNISM LIMITED; Fireflies.ai Corp; Gong.io Ltd.; HubSpot, Inc.; IBM; Microsoft; Regie.ai.; Salesforce, inc.; ZoomInfo Technologies LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Sales Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI in sales market report based on software type, sales process application, deployment, industry vertical, and region:

-

Software Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Chatbots & Assistants

-

Customer relationship management (CRM)

-

Email generators

-

Integrated GPU

-

Lead scoring

-

Pipeline management

-

Others

-

-

Sales Process Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Lead Generation & Qualification

-

Customer Engagement & Communication

-

Forecasting & Pipeline Optimization

-

Training & Coaching

-

Revenue & Pricing Optimization

-

Customer Retention & Upselling

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-premises

-

-

Industry Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Healthcare & Life Sciences

-

Retail and e-commerce

-

IT & Telecom

-

Manufacturing & Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI in sales market size was estimated at USD 24.64 billion in 2024 and is expected to reach USD 29.20 billion in 2025.

b. The global AI in sales market is expected to grow at a compound annual growth rate of 22.2% from 2025 to 2033 to reach USD 145.12 billion by 2033.

b. North America dominated the AI in sales market with a share of 34.3% in 2024. North America’s AI in sales market is driven by high capital concentration and leadership from global companies such as Microsoft, Google, and Amazon, offering foundation models and AI-as-a-service infrastructure.

b. Some key players operating in the AI in sales market include Apollo; COGNISM LIMITED; Fireflies.ai Corp; Gong.io Ltd.; HubSpot, Inc.; IBM; Microsoft; Regie.ai.; Salesforce, inc.; ZoomInfo Technologies LLC

b. Key factors that are driving the market growth include predictive analytics has become important to sales strategies, evolving from simple forecasting to complex models that incorporate market trends, customer behavior, and economic factors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.