- Home

- »

- Next Generation Technologies

- »

-

AI In Video Surveillance Market Size, Industry Report, 2030GVR Report cover

![AI In Video Surveillance Market Size, Share & Trends Report]()

AI In Video Surveillance Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Software, Hardware, Services), By Deployment, By End-use, By Use Cases, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-333-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Video Surveillance Market Summary

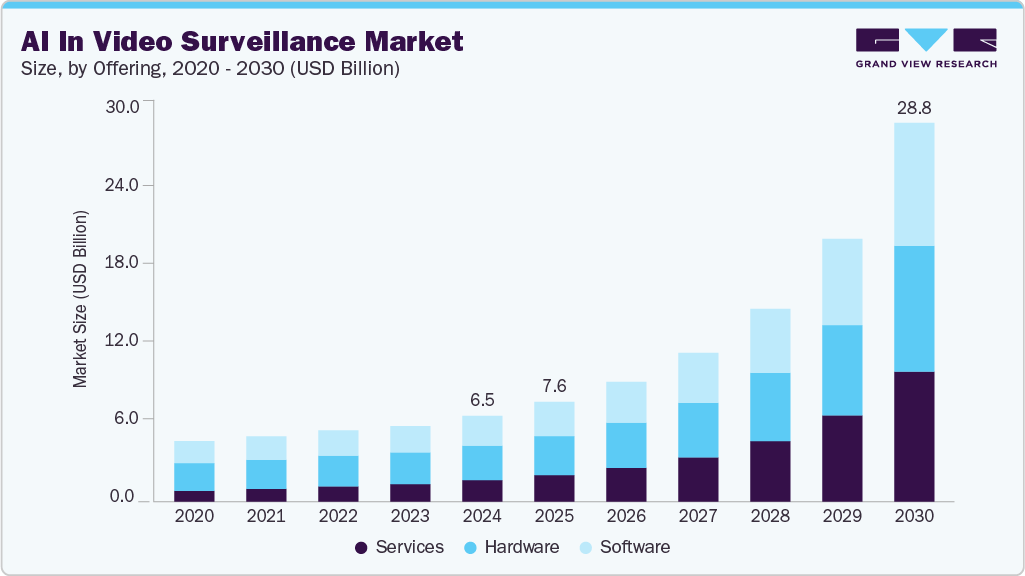

The global AI in video surveillance market size was estimated at USD 6.51 billion in 2024 and is projected to reach USD 28.76 billion by 2030, growing at a CAGR of 30.6% from 2025 to 2030. The adoption of cloud-based video surveillance systems is on the rise, as they offer scalability, remote access, and reduced infrastructure costs compared to on-premises systems.

Key Market Trends & Insights

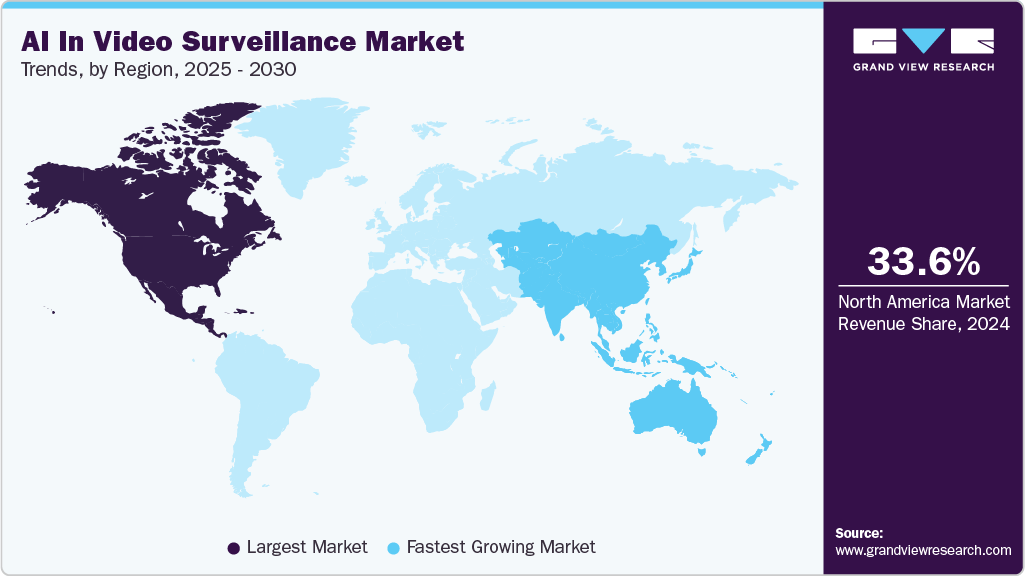

- North America dominated the market and accounted for a 33.6% share in 2024.

- The U.S. has seen significant growth as cloud-based AI video surveillance systems become increasingly prevalent in the market.

- By offering, the hardware segment led the market and accounted for 40.48% of the global revenue in 2024.

- By deployment, the cloud segment has the highest revenue share in 2024.

- By use cases, the intrusion detection segment held the highest market share of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.51 Billion

- 2030 Projected Market Size: USD 28.76 Billion

- CAGR (2025-2030): 30.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Cloud-based solutions enable organizations to easily scale their video surveillance capabilities to meet changing needs, without the need for significant upfront investments in hardware and IT infrastructure. Additionally, cloud-based systems provide remote access, allowing security personnel to monitor and manage video feeds from anywhere, improving responsiveness and efficiency.The demand for intelligent video analytics is growing, as organizations seek to extract more value from their video surveillance data. Integrating advanced AI algorithms with cloud-based video surveillance further enhances the capabilities of these systems, enabling real-time analytics and intelligent monitoring to identify potential threats. AI-powered analytics can provide real-time insights, such as detecting suspicious activities, tracking people and vehicles, and generating actionable intelligence, driving AI's adoption in video surveillance. By automating the analysis of video footage, AI-based analytics can help security personnel identify potential threats and respond more quickly, while also providing valuable data for operational optimization and business intelligence. As organizations recognize the benefits of leveraging AI to enhance their video surveillance capabilities, the demand for these technologies will continue growing.

Integrating AI-powered video surveillance systems with the Internet of Things (IoT) and edge computing is a key trend. This allows for distributed processing and decision-making at the edge, reducing the need for constant data transmission to the cloud and enabling faster response times for critical applications. By processing video data locally on IoT devices or edge computing platforms, AI-powered video surveillance systems can identify and respond to events in real-time, without the latency associated with cloud-based processing. This integration with IoT and edge computing also enhances the scalability and resilience of video surveillance systems, as they can operate independently even in the event of network disruptions or cloud outages.

As the use of AI in video surveillance becomes more widespread, there are growing concerns about privacy, bias, and the ethical implications of these technologies. This has led to the development of regulatory frameworks and guidelines to ensure the responsible and ethical use of AI in video surveillance applications. Policymakers and industry organizations are working to establish guidelines and standards that address issues such as data privacy, algorithmic bias, and the transparency of AI-powered video analytics. These regulatory efforts aim to balance AI-powered video surveillance's security and operational benefits with protecting individual rights and civil liberties. As the adoption of AI in video surveillance continues to grow, the need for robust ethical frameworks and regulatory oversight will become increasingly important.

Offering Insights

The hardware segment led the market and accounted for 40.48% of the global revenue in 2024. The growing demand for AI in video surveillance is driven by the increasing use of cameras deployed worldwide due to rising security concerns across multiple verticals. The industry shift toward IP cameras has led to many hardware-based innovations that provide better low-light performance, object tracking, and built-in security. As the number of cameras installed globally continues to rise, the need for AI-powered video analytics to effectively process and interpret the vast amounts of video data generated will also increase. This trend is particularly evident in sectors like retail, transportation, and smart cities, where the deployment of video surveillance cameras has become more widespread to enhance security, improve operational efficiency, and enable data-driven decision-making.

The increasing sophistication of AI-driven video surveillance systems is pushing demand for specialized consulting and integration services. Organizations are seeking expert advice to integrate AI capabilities into their existing surveillance infrastructure efficiently and seamlessly. This integration involves not only the hardware but also the optimization of AI algorithms for specific applications, such as facial recognition or behavior analysis. As industries like banking, retail, and critical infrastructure adopt advanced security measures, consulting firms are pivotal in customizing solutions to meet stringent regulatory and operational requirements. Consequently, these services are evolving to offer more holistic support, including risk assessments and system audits.

Deployment Insights

The cloud segment has the highest market in 2024. The adoption of cloud-based AI surveillance systems is driven by their capability for remote accessibility and real-time monitoring from any location. This feature is particularly valuable for organizations with distributed sites or mobile security operations, enabling centralized management and monitoring across multiple locations. The cloud facilitates real-time data analysis and instant alerts, enhancing responsiveness to security incidents and operational anomalies. This trend is accelerating as mobile and remote work become more common, necessitating the ability to manage and access surveillance systems from anywhere, thereby improving overall security management and operational flexibility.

The on-premises approach is preferred by organizations that require highly customized surveillance solutions and need to integrate AI capabilities with existing legacy systems. This trend is particularly evident in large enterprises and critical infrastructure sectors where bespoke solutions can be designed to address unique operational and environmental conditions. On-premises systems offer greater flexibility for customization, including the ability to deploy specific AI algorithms and configure hardware to meet precise performance requirements. The ability to seamlessly integrate with legacy infrastructure without significant overhauls is a key advantage, allowing organizations to leverage existing investments while upgrading their surveillance capabilities.

Use Cases Insights

The intrusion detection segment held the highest market in 2024. Integrating cloud and edge computing with AI intrusion detection systems is becoming more prevalent, providing a balance between real-time processing and scalability. Edge computing allows for immediate analysis and response at the perimeter, reducing latency and bandwidth usage, while cloud integration facilitates centralized management and long-term data storage. This hybrid approach supports the deployment of AI analytics at the edge for quick threat detection and decision-making, complemented by cloud-based resources for more extensive analysis and archiving. This trend is particularly advantageous for large-scale surveillance networks, enabling flexible and efficient intrusion detection across diverse environments and locations.

Facial recognition technology can be a valuable tool in smart city initiatives, enhancing public safety by monitoring public spaces, transportation systems, and critical infrastructure. The use of facial recognition systems in crime prevention can help detect and alert security personnel to suspicious activities, reducing the risk of security breaches. Additionally, the integration of facial recognition systems with emergency response systems can provide real-time data and analytics to first responders, improving their ability to respond quickly and effectively to emergencies. These smart city initiatives leverage the power of facial recognition technology to create safer and more secure urban environments.

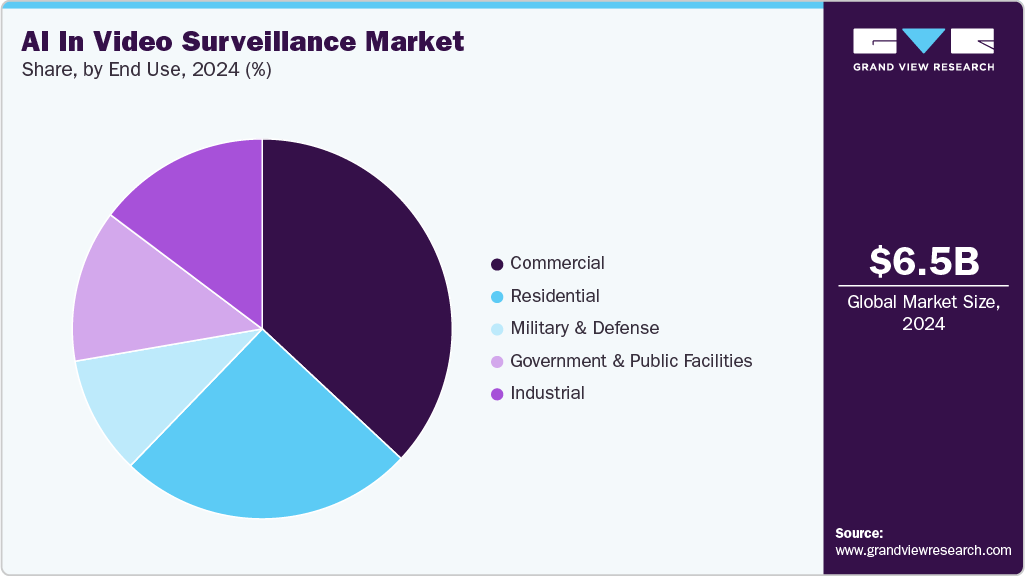

End Use Insights

The commercial segment has the highest market in 2024. AI surveillance is increasingly being integrated with other smart building and business management systems, creating comprehensive, interconnected solutions. These integrations can include access control systems, allowing for more sophisticated entry management and employee tracking. In retail, AI surveillance can be linked with point-of-sale systems to correlate visual data with transaction information, helping to detect fraud or improve customer service. Smart building systems can use surveillance data to optimize energy usage based on occupancy patterns. This trend towards integration is making AI surveillance a central component of broader digital transformation initiatives in the commercial sector, enhancing overall operational efficiency and effectiveness.

The military & defense sector is increasingly adopting AI-powered surveillance systems to enhance situational awareness, improve threat detection, and enhance operational efficiency. AI-driven video analytics can analyze vast amounts of video data in real-time, enabling faster and more accurate threat detection and response. This trend is driven by the growing need for military & defense organizations to stay ahead of evolving security threats and make more informed decisions in high-stakes environments. The adoption of AI-powered surveillance systems is expected to continue to grow as technology becomes more advanced and accessible, providing military & defense personnel with a powerful tool for enhancing their operational capabilities.

Regional Insights

North America dominated the market and accounted for a 33.6% share in 2024. The North America AI-driven video surveillance market is experiencing an increasing demand for AI-powered video surveillance systems across various sectors, including retail, transportation, and financial services. The region's focus on public safety, the presence of leading technology companies and research institutions driving innovations in artificial intelligence and video analytics, and the increasing adoption of AI-powered surveillance systems are expected to continue fueling the market's expansion in North America.

U.S. AI In Video Surveillance Market Trends

The U.S. has seen significant growth as cloud-based AI video surveillance systems become increasingly prevalent in the market. These solutions offer scalability, remote access, and reduced on-premises hardware requirements. Cloud platforms also enable easier integration of advanced AI analytics and facilitate centralized management of distributed camera networks.

Europe AI In Video Surveillance Market Trends

The rise of smart home devices and the integration of AI-enabled cameras are driving the demand for AI-based video surveillance in European households. Homeowners are seeking advanced security solutions that can provide intelligent monitoring and analytics.

Asia Pacific AI In Video Surveillance Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. Businesses in Asia Pacific are rapidly adopting AI-enabled surveillance cameras and video analytics solutions to enhance security, improve operational efficiency, and gain valuable business insights. Technologies like facial recognition, object detection, and behavior analysis are being widely deployed.

Key AI In Video Surveillance Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

Axis Communications, founded in 1984 and headquartered in Lund, Sweden, specializes in advanced network video surveillance solutions. They offer a comprehensive portfolio that includes IP cameras, encoders, video management software, and recorders, enhanced by AI-driven analytics for actionable insights at the edge. Their AI video surveillance integrates intelligent analytics to improve security and safety by enabling real-time response to incidents. Axis also provides access control, IP intercoms, and IP audio solutions, combining video, communication, and remote entry control in scalable, flexible systems. Collaborating globally with partners, Axis drives innovation for a smarter, safer world through sustainable, cybersecurity-focused technologies.

-

Honeywell offers advanced AI-driven video surveillance solutions designed to enhance security and situational awareness. Their Honeywell Advance Analytics (Ci2MS) uses AI and deep learning to monitor video feeds for specific people, vehicles, and suspicious behaviors with real-time alarms. The MAXPRO Video Management Solution integrates AI-based analytics for centralized, multi-site security monitoring and rapid response. Honeywell’s 70 Series AI cameras feature built-in smart analytics like facial recognition, license plate recognition, and smart motion detection, reducing false alarms and improving accuracy even in challenging conditions. These solutions are widely deployed, including large-scale smart city projects like Bengaluru’s AI-powered surveillance network.

Key AI In Video Surveillance Companies:

The following are the leading companies in the AI in video surveillance market. These companies collectively hold the largest market share and dictate industry trends.

- Teledyne Technologies Incorporated

- Axis Communications AB

- Bosch Security and Safety Systems GmbH

- Genetec Inc.

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- Ivideo

- Milestone Systems A/S

- NEC Corporation

- Panasonic Corporation

- Sensen.ai

- VIVOTEK Inc.

Recent Developments

-

In January 2025, NEC Corporation introduced a new technology that integrates video analysis with generative AI to deliver personalized, automated guidance for workers by identifying slight discrepancies between ideal and actual task movements. This solution facilitates self-guided training without the need for direct supervision and is applicable across sectors such as manufacturing, logistics, and construction. It aims to tackle issues like the lack of experienced mentors and increasing training costs.

-

In March 2023, Honeywell International Inc. successfully completed the first phase of the Safe City project in Bengaluru, installing over 4,100 video cameras at 3,000 strategic locations across the city. These cameras are designed to quickly identify serious situations and facilitate faster police response, while also being linked to a command center that leverages machine learning (ML) and artificial intelligence (AI) to enhance situational awareness and support informed decision-making.

-

In July 2023, Dahua Technology introduced AcuPick Search Technology, a groundbreaking innovation that significantly enhances the efficiency and accuracy of video search capabilities. This technology empowers users to quickly locate specific individuals, vehicles, and information by leveraging front-end and back-end AI innovations. With a single reference image, even if crucial details are not visible, AcuPick can help reduce the time spent searching for a specific person or vehicle captured on security footage.

AI In Video Surveillance Market Report Scope

Report Attribute

Details

Market size in 2025

USD 7.57 billion

Revenue forecast in 2030

USD 28.76 billion

Growth rate

CAGR of 30.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, deployment, end use, use cases, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; KSA; South Africa

Key companies profiled

Teledyne Technologies Incorporated; Axis Communications AB; Bosch Security and Safety Systems GmbH; Genetec Inc.; Honeywell International Inc.; Huawei Technologies Co. Ltd.; Ivideo; Milestone Systems A/S; NEC Corporation; Panasonic Corporation; Sensen.ai; VIVOTEK Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Video Surveillance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global AI In Video Surveillance market report based on offering, deployment, end use, use cases and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

Military & Defense

-

Government & Public Facilities

-

Industrial

-

-

Use Cases Outlook (Revenue, USD Million, 2018 - 2030)

-

Weapon Detection

-

Facial recognition

-

Intrusion detection

-

Smoke & Fire Detection

-

Traffic Flow Analysis

-

Parking Monitoring

-

Vehicle Identification

-

Others (Anomaly detection and Behavior Recognition, Object detection and tracking, Industrial Temperature Monitoring)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI in video surveillance market was estimated at 6.51 billion in 2024 and is expected to reach USD 7.57 billion in 2025.

b. The global AI in video surveillance market is expected to grow at a compound annual growth rate of 30.6% from 2025 to 2030, reaching USD 28.76 billion by 2030.

b. North America dominated the AI in video surveillance market with a share of 33.6% in 2024. The region's focus on public safety, the presence of leading technology companies and research institutions driving innovations in artificial intelligence and video analytics, and the increasing adoption of AI-powered surveillance systems are expected to continue fueling the market's expansion in North America.

b. Some key players operating in the AI in video surveillance market include Teledyne Technologies Incorporated, Axis Communications AB, Bosch Security and Safety Systems GmbH, Genetec Inc., Honeywell International Inc., Huawei Technologies Co. Ltd., Ivideo, Milestone Systems A/S, NEC Corporation, Panasonic Corporation, Sensen.ai, VIVOTEK Inc.

b. Key factors driving market growth include Rising security threats propelling the adoption of AI-powered video surveillance for advanced threat detection in real time, and Smart city initiatives with integrated AI security systems fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.