- Home

- »

- Next Generation Technologies

- »

-

Artificial Intelligence In Military Market, Industry Report, 2030GVR Report cover

![Artificial Intelligence In Military Market Size, Share & Trends Report]()

Artificial Intelligence In Military Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), By Application ( Warfare Platform, Logistics & Transportation), By Technology, By Platform, By Installation, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-021-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Artificial Intelligence In Military Market Summary

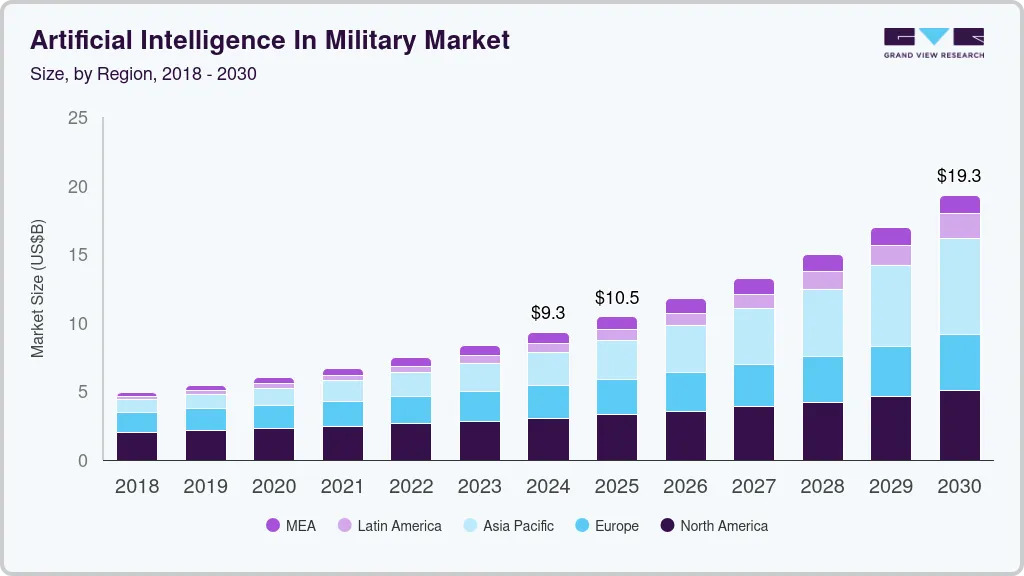

The global artificial intelligence in military market size was estimated at USD 9.31 billion in 2024 and is projected to reach USD 19.29 billion by 2030, growing at a CAGR of 13.0% from 2025 to 2030. Increased government spending on research and development of advanced AI-enabled military weaponry is a major catalyst.

Key Market Trends & Insights

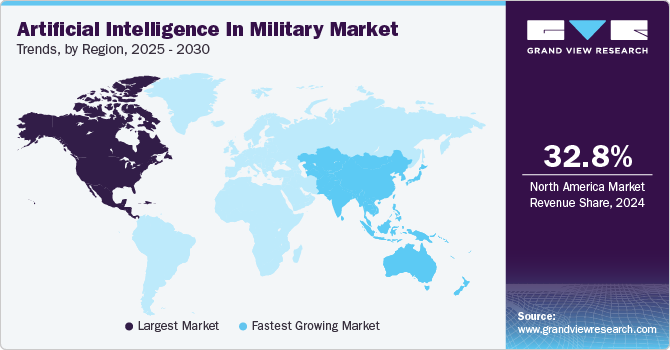

- North America holds a significant share of the artificial intelligence in military market, accounting for 32.8% of the revenue in 2024.

- The artificial intelligence in military market in Asia Pacific is expected to grow with the fastest CAGR from 2025 to 2030.

- Based on offering, the software segment dominates the market, with a revenue share of 42.5% in 2024.

- Based on technology, the machine learning segment is anticipated to represent the largest revenue share in 2024.

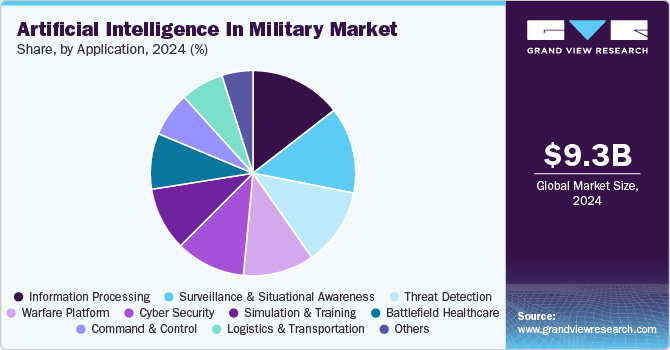

- Based on application, the information processing segment is expected to lead the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.31 Billion

- 2030 Projected Market Size: USD 19.29 Billion

- CAGR (2025-2030): 13.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Governments worldwide invest heavily in cutting-edge technologies to enhance defense systems' efficiency, precision, and effectiveness. Developing specialized AI chips designed to handle the intensive computational needs of military applications further accelerates this trend. These chips enable real-time decision-making, faster data processing, and seamless integration of AI into defense operations, making them indispensable for modern warfare.

Moreover, the rising adoption of big data in the defense sector transforms how threats are analyzed and addressed. AI-powered big data analytics enhances intelligence gathering, predictive capabilities, and operational planning, ensuring a more proactive approach to national security. In addition, increasing private sector investments in research and development fuel innovation, leading to the development of autonomous drones, AI-driven cybersecurity tools, and robotic systems. Growing geopolitical tensions, cross-border conflicts, and the need for technological superiority are further compelling nations to adopt AI in their defense strategies, solidifying their role in shaping the future of modern military operations.

Training and simulation, combining system and software engineering principles, are crucial in preparing soldiers for military operations through realistic models and scenarios. The U.S. Army is heavily investing in advanced technologies like virtual reality (VR), augmented reality (AR), and mixed reality (MR) to enhance infantry training, making it safer and more effective. These immersive technologies allow soldiers to practice complex combat scenarios, improving individual and team readiness. Moreover, the growing reliance on AI-powered cybersecurity to protect military systems is expected to drive further integration of artificial intelligence in the defense sector, increasing its role in both training and defense against evolving cyber threats.

Offering Insights

The software segment dominates the market, with a revenue share of 42.5% in 2024. The significance of AI software in creating the IT infrastructure and preventing security breaches is attributed to the segment's expansion. The increasing technological advancement in artificial intelligence creates innovative AI software and related software development tools anticipated to propel Artificial intelligence in military sector in the coming years. AI software integrated with computer systems executes complex procedures by combining data from hardware systems and processing it in an AI system to produce an intelligent response.

The hardware segment is predicted to register a significantly robust revenue growth throughout the projection period because of the increasing usage of AI technology for complicated processes and increasing demand for specialized hardware components such as AI processors and memory. AI processors are neuromorphic processing units that are significantly faster and more efficient than traditional processors. Memory is an important technology for advancing artificial intelligence processing. AI and machine learning can generate and analyze increasing amounts of mission data in real time, creating opportunities for autonomous cognitive electronic warfare and leading to the growth of the hardware sector.

Technology Insights

The machine learning segment is anticipated to represent the largest revenue share in 2024, driven by its increasing integration into military technologies. Machine learning-enabled military systems have the unique capability to efficiently process and analyze vast amounts of data, which is crucial for modern warfare. These systems can swiftly identify patterns, make predictions, and adapt to changing environments, allowing for real-time decision-making and improved operational efficiency. Furthermore, machine learning plays a pivotal role in enhancing the autonomy of military systems. By enabling more advanced self-control, self-regulation, and self-actuation, machine learning significantly improves the performance of combat systems, allowing them to function with minimal human intervention. This autonomy not only enhances the effectiveness of defense operations but also reduces the risk to personnel.

The computer vision segment is expected to grow during the forecast period. Computer vision programs are being developed to filter through a large amount of data and alert military intelligence officers to the presence of strategically important items or individuals. Moreover, autonomous weapon platforms use computer vision technology to recognize and track objects, and AI can assist in extracting meaningful information from equipment such as radars and automated identification systems. Thus, improving military tools, weapons, and equipment with advanced technology drives the expansion of artificial intelligence in the military sector.

Platform Insights

The space segment dominates the market, with a prominent revenue share in 2024. The Space segment includes Satellite Data Processing, Intelligent Navigation Systems, and AI Assistant Robots for Space Exploration. Integrating space segments with an AI platform enables effective ground station and spacecraft communication. Space artificial intelligence incorporates satellite sub-systems that form the foundation of other communication systems. The defense industry uses space-based sensors, artificial intelligence, and a scalable ground system that can connect to the army's weapon systems and offer better target recognition and sensing capabilities.

Based on the platform, the land segment accounts for significant growth over the forecast period. The land segment includes autonomous combat vehicles, unmanned ground vehicles, and autonomous combat robots. The rise in demand for unmanned ground vehicles to perform civilian tasks and lower dangers to human lives drive the expansion of the land segment in the Artificial intelligence in military industry during the projected period. The combination of combat vehicles and autonomy is essential for avoiding casualties in war scenarios.

Installation Insights

The New Procurement segment is expected to account for the largest revenue share in 2024. This is attributed to the government's increased drive to include AI in the defense sector and the rise of new developments related to AI technology in the military industry.

Incorporating artificial intelligence (AI) into regular military operations could upgrade logistics, administration, maintenance, training, personal management, and routine activities or exercises, which is responsible for propelling the growth of the upgradation sector in Artificial intelligence in military market during the forecasted period. Moreover, it can reduce institutional workload and free up warriors for core operations. The upgrade of AI in defense transforms warfare from customized mechanized conflict to intelligent robotized digitized dispute. Moreover, Global powers are preparing their military forces to use modern intelligent technologies to optimize war consequences.

Application Insights

The information processing segment is expected to lead the market in 2024, holding a significant revenue share. The increasing reliance on big data for decision-making across industries drives this growth. AI integration during the data collection and processing stages allows for efficiently handling vast amounts of information, enabling faster and more accurate insights. By automating the identification of patterns and trends, AI enhances decision-making, reduces human error, and improves operational efficiency. The information processing segment is set for continued expansion as AI adoption grows.

Meanwhile, the cybersecurity segment is forecasted to expand with a significant growth rate during the forecast period. The rise in cybercrime, fueled by the development of new tools and technologies, has been exacerbated by the increase in state-sponsored cyberattacks. Corporate and government entities are swiftly adopting AI-driven solutions that can predict, prevent, and address cyber threats. By leveraging deep learning and machine learning for predictive analytics, AI solutions hold significant potential in key areas such as decision support, cyber defense, risk management, virus detection, and pattern recognition. These advancements are particularly poised to transform the defense sector.

Regional Insights

North America holds a significant share of the artificial intelligence in military market, accounting for 32.8% of the revenue in 2024. The region is poised to maintain its leadership due to the substantial and growing investments in artificial intelligence (AI) technologies. In recent years, North American governments and private sector companies have ramped up their focus on AI to drive innovation, enhance economic competitiveness, and address various technological challenges. Furthermore, there is a growing emphasis on using AI to enhance cybersecurity measures. AI technologies are critical in identifying and neutralizing emerging cyber threats and safeguarding critical infrastructure from increasingly sophisticated network attacks.

U.S. Artificial Intelligence In Military Market Trends

The artificial intelligence in military market in the U.S. dominated the market as the military rapidly integrates artificial intelligence (AI) into operations to maintain a strategic edge over adversaries like China. A recent directive from President Biden emphasizes the urgency of adopting AI technologies, labeling them as "era-defining" for national security. This initiative aims to enhance decision-making, data processing, and combat simulations while addressing ethical concerns related to civil liberties. Major tech companies, such as Meta, are now allowing their AI models to be utilized for military applications, reflecting a shift towards collaborative innovations in defense. Overall, the Pentagon's focus on AI is crucial for improving operational efficiency and ensuring the U.S. remains a leader in military technology.

Europe Artificial Intelligence In Military Market Trends

The artificial intelligence in military market in Europe is rapidly evolving, particularly in response to geopolitical tensions like the conflict in Ukraine. European nations are increasingly leveraging AI technologies for defense purposes, with applications ranging from unmanned aerial vehicles to autonomous underwater drones, enhancing capabilities in intelligence and deterrence against threats such as Russia1. However, the EU faces challenges in establishing a cohesive regulatory framework for military AI, as the proposed AI Act notably excludes military applications, leaving member states to navigate governance independently.

Asia Pacific Artificial Intelligence In Military Market Trends

The artificial intelligence in military market in Asia Pacific is expected to grow with the fastest CAGR from 2025 to 2030. The Asia-Pacific region is witnessing a significant transformation in military capabilities driven by artificial intelligence (AI), with countries like China, Japan, and India leading the charge. China is heavily investing in AI for military applications, enhancing its People's Liberation Army (PLA) capabilities in areas such as algorithmic warfare and autonomous systems, which could shift the regional power balance and challenge U.S. influence. Japan's Ministry of Defense has adopted its first AI policy to improve efficiency and effectiveness in defense operations amid a declining population, focusing on target detection and logistics support.

Key Artificial Intelligence In Military Company Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players.

-

Lockheed Martin is at the forefront of integrating artificial intelligence (AI) into military services and development, emphasizing the importance of advanced technologies in enhancing defense capabilities. To ensure national security and operational efficiency, the company creates innovative solutions across various sectors, including aeronautics, missiles, and space systems. Lockheed Martin actively recruits talent skilled in machine learning and software engineering to drive these advancements, reflecting their commitment to leveraging AI for improved decision-making and operational effectiveness. Their initiatives aim to address complex challenges in modern warfare, ensuring they remain leaders in delivering 21st-century security solutions.

-

BAE Systems is a global defense, aerospace, and security company emphasizing innovation in military services, particularly by integrating artificial intelligence (AI). The company leverages AI technologies to enhance operational effectiveness, improve decision-making, and ensure mission success across various defense sectors. BAE Systems provides insights into the future of warfare, focusing on AI-driven solutions that optimize systems for intelligence, surveillance, reconnaissance, and autonomous operations. Their commitment to advancing military capabilities through cutting-edge technology positions them as a leader in the defense industry, fostering enhanced security for nations worldwide.

Key Artificial Intelligence In Military Companies:

The following are the leading companies in the artificial intelligence in military market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems Plc.

- Charles River Analytics, Inc.

- International Business Machines Corporation

- L3Harris Technologies Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems

- Raytheon Technologies Corporation

- SparkCognition

- Thales Group

Recent Developments

-

In October 2024, BAE Systems announced a strategic collaboration with Aerospike to enhance real-time data solutions for the U.S. Army. This partnership aims to leverage Aerospike's advanced database technology and BAE Systems' expertise in defense and intelligence to deliver high-performance data analytics capabilities. The initiative will improve decision-making processes and operational efficiency for military applications, ensuring that critical information is accessible in real-time. This collaboration underscores both companies' commitment to innovation in defense technology, positioning them to meet the evolving needs of the U.S. Army.

Artificial Intelligence In Military Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.45 billion

Revenue forecast in 2030

USD 19.29 billion

Growth rate

CAGR of 13.0% from 2025 to 2030

Actual data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Market revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, application, technology, platform, installation, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France, China; India; Japan; South Korea; Australia; Brazil; UAE; KSA; South Africa

Key companies profiled

Lockheed Martin Corporation; BAE Systems, Inc.; Northrop Grumman Corporation; Raytheon Technologies;Rafael Advanced Defense Systems; SparkCognition; L3Harris Technologies Inc.;International Business Machines Corporation; Thales Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Global Artificial Intelligence In Military Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global artificial intelligence in military market based onoffering, application, technology, platform, installation, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Warfare Platform

-

Cyber Security

-

Logistics & Transportation

-

Surveillance & Situational Awareness

-

Command & Control

-

Battlefield Healthcare

-

Simulation & Training

-

Information Processing

-

Threat Detection

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Machine Learning

-

Deep Learning

-

Natural Language Processing

-

Context-Aware Computing

-

Computer Vision

-

Intelligent Virtual Agent (IVA) /Virtual Agents

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2017 - 2030)

-

Land

-

Naval

-

Airborne

-

Space

-

-

Installation Outlook (Revenue, USD Million, 2017 - 2030)

-

New Procurement

-

Upgradation

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence in military market size was estimated at USD 9.31 billion in 2024 and is expected to reach USD 10.45 billion in 2025.

b. The global artificial intelligence in military market is expected to grow at a compound annual growth rate of 13.0% from 2025 to 2030 to reach USD 19.29 billion by 2030.

b. North America dominated the artificial intelligence in military market with a share of 32.8% in 2024. The growing defence spending in North America to improve AI capabilities is attributed to the growth of AI in the military market.

b. Some key players operating in the AI in military market include BAE Systems Plc., Charles River Analytics, Inc., International Business Machines Corporation, L3Harris Technologies Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Rafael Advanced Defense Systems, Raytheon Technologies Corporation, SparkCognition, Thales Group

b. Key factors that are driving the market growth include increased governmental expenditure in the defense industry to augment growth, and the growing demand for advanced military equipment is attributed to the growth of artificial intelligence in the military market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.