- Home

- »

- Advanced Interior Materials

- »

-

Artificial Lift Systems Market Size, Industry Report, 2030GVR Report cover

![Artificial Lift Systems Market Size, Share & Trends Report]()

Artificial Lift Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Rod Lifts), By Component (Pump), By Mechanism, By Well Type, By Technology (Onshore, Offshore), By Region, And Segment Forecasts

- Report ID: 978-1-68038-659-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Artificial Lift Systems Market Summary

The global artificial lift systems market size was estimated at USD 22.7 billion in 2023 and is projected to reach USD 33.5 billion by 2030, growing at a CAGR of 5.7% from 2024 to 2030. The market is experiencing significant growth owing to the necessity to enhance production from matured oil and gas fields facing diminishing reservoir pressure.

Key Market Trends & Insights

- North America artificial lift systems market dominated the market with a revenue share of 27.7% in 2023.

- The U.S. artificial lift systems dominated North America in 2023 owing to its mature oil and gas industry.

- Based on product, Electrical submersible pumps (ESPs) dominated the market and accounted for a share of 43.8% in 2023.

- In terms of component, the pump segment accounted for the largest revenue share in 2023.

- On the basis of mechanism, the pump-assisted segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 22.7 billion

- 2030 Projected Market Size: USD 33.5 billion

- CAGR (2024-2030): 5.7%

- North America: Largest market in 2023

The older fields require artificial lift methods, such as pumps and gas injection, essential for maintaining pressure and increasing recovery rates. Effective extraction is necessary for satisfying energy needs as a large portion of worldwide oil and gas output originates from mature fields.

The exploration and development of unconventional oil and gas deposits create new opportunities for the artificial lift system sector. Due to their unique geological characteristics, shale oil and gas reserves often require immediate artificial lift methods. The surge in global energy consumption is fueling the demand for artificial lift technologies. Moreover, technological advancements are improving the efficiency and cost-effectiveness of artificial lift systems. Developing intelligent systems, which are remotely monitored, improves effectiveness, and reduces maintenance costs.

The growth of the artificial lift market is driven by an increase in energy demand due to industrialization, population growth, and urbanization. The rise in global oil consumption and the economic development of various industries such as aviation, power generation, transportation, and others is expected to increase the demand for artificial lift systems.

Product Insights

Electrical submersible pumps (ESPs) dominated the market and accounted for a share of 43.8% in 2023. ESPs handle large quantities and a wider range of flow rates, performing well even in challenging conditions. Moreover, ESPs are the only viable optionfor artificial lift deployment in adverse environmental conditions. Additionally, ESPs are recognized for their high level of energy efficiency, which leads to reduced operating expenses in the long run.

Rod lifts is expected to register a significant CAGR of 5.9% over the forecast period. The natural simplicity, dependability, and affordability make them a highly appealing option for matured oilfields with moderate well depths and stable formations. Additionally, advancements in rod lift technology, such as the use of durable and lighter materials, are increasing their effectiveness and suitability in various well conditions, therefore the segment is expected to grow significantly.

Component Insights

The pump segment accounted for the largest revenue share in 2023. The key growth factors in this sector include growing energy demand, advancements in pump technology, and more mature oil fields needing artificial lift solutions to sustain production levels. Moreover, the market has increasingly relied on modern pump systems due to their ability to handle high-viscosity fluids effectively and their versatility in different well conditions.

The controller segment is expected to register a significant CAGR during the forecast period. The increasing adoption of high-tech artificial lift systems requires advanced controllers for optimal performance and efficiency, driving segment growth. The growing focus on remote management and automation requires strong and dependable controllers for efficient monitoring and control. Advancements in controller technology, such as integration with digitalization and cloud-based solutions, enable further optimization of artificial lift processes and enhanced well productivity.

Mechanism Insights

The pump-assisted segment dominated the market in 2023. The pump-assisted systems, specifically Electric Submersible Pumps (ESPs), are highly effective in managing high volumes and a wide range of flow rates. The pump-assisted mechanism operates effectively in adverse conditions, such as high well depths and harsh environments. Furthermore, innovations in pump technology, such as advancements in materials science and downhole monitoring capabilities, are enhancing the reliability and efficiency of pumps, making them a reliable option for operators.

The gas-assisted mechanism is projected to grow at a significant CAGR over the forecast period.It provides a cost-efficient option for artificial lift, especially for applications with low reservoir pressure or moderate fluid production rates. Furthermore, advancements in gas lift methods, such as optimization software and real-time monitoring systems, enhance operational efficiency and effectiveness. These factors are expected to contribute to the global market's consistent growth of the gas-assisted lift segment.

Well Type Insights

The vertical segment dominated the market in 2023. Artificial lift is essential for sustaining production in mature wells due to their declining reservoir pressure. The shape of vertical wellbores is typically simple and easier to access, making the installation and operation of different artificial lift systems. Moreover, the well-established infrastructure and expertise regarding vertical wells make them a cost-efficient option for operators implementing artificial lift solutions.

The horizontal segment is projected to grow at the fastest CAGR over the forecast period. The growing focus on unconventional resources such as shale oil and gas, which are frequently extracted using horizontal drilling methods, requires the immediate use of artificial lift because of their low natural flow rates. Due to their complex wellbore geometry, advanced artificial lift solutions are required for efficient hydrocarbon recovery in horizontal wells. Furthermore, technological advancements in horizontal drilling and completion methods are creating new possibilities for tapping into unconventional resources, driving the growth of the horizontal lift system sector.

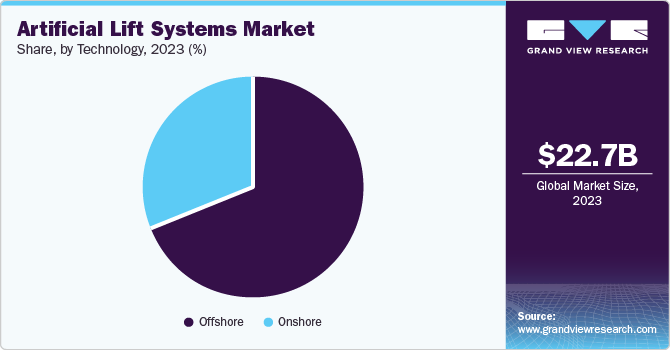

Technology Insights

The offshore segment dominated the market in 2023.Offshore environments often contain deep-water and ultra-deep-water reserves, necessitating artificial lift to overcome difficulties associated with extracting hydrocarbons from depths. The vast potential of undiscovered offshore reserves compels companies to invest heavily in exploration and production, increasing the need for strong artificial lift solutions. Moreover, the complex nature, challenging conditions, and distinctive traits of offshore reservoirs require advanced artificial lift technologies, further propelling the dominance of this segment.

The onshore technology is projected to grow at a significant CAGR over the forecast period.The development of unconventional resources, such as shale oil and gas, primarily located onshore, necessitates the prompt deployment of artificial lift systems due to the inherent geological characteristics of these formations. Advances in onshore lift technologies are improving their efficiency and applicability in a wider range of well conditions, contributing to the segment's projected growth.

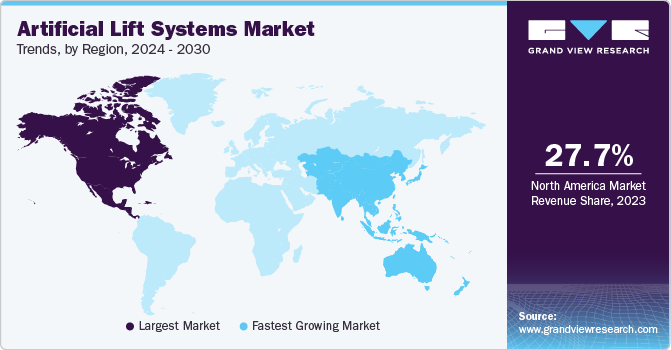

Regional Insights

North America artificial lift systems market dominated the market with a revenue share of 27.7% in 2023. The surge in unconventional resources, such as shale oil and gas, fuels the region's dominance. Oil and gas companies depend significantly on artificial lift technologies such as gas lift and electric submersible pumps as their reserves mature and natural pressure decreases to maintain or increase production.

U.S. Artificial Lift Systems Market Trends

The U.S. artificial lift systems dominated North America in 2023 owing to its mature oil and gas industry, which heavily depends on unconventional resources such as shale. The demand for enhanced production from old fields and declining natural reservoir pressure drive the necessity for artificial lift technologies such as ESPs and gas lift systems in the country.

Europe Artificial Lift Systems Market Trends

Europe artificial lift systems market was identified as a lucrative region in 2023 due to the presence of multiple mature oil fields and fluctuating energy prices. Artificial lift systems are required to continue production as the natural pressure of mature fields is depleting. Moreover, the fluctuating energy costs encourage businesses to extract resources as efficiently as possible, leading to increased investment in these technologies.

The UK artificial lift systems market is expected to grow rapidly in the coming years. The North Sea oil and gas fields significantly contribute to the UK's production, which is getting mature and experiencing reduced reservoir pressure. Additionally, the UK government's emphasis on ensuring energy security within the country due to fluctuations in the global market may encourage increased oil and gas production, further propelling the need for artificial lift technologies.

Asia Pacific Artificial Lift Systems Market Trends

Asia Pacific artificial lift systems market is anticipated to grow with the fastest CAGR during the forecast period. The key factors of market growth are rapid industrialization and population growth. Furthermore, using artificial lift technologies requires a growing focus on utilizing unconventional resources and optimizing production from mature fields. This is especially true for nations such as China and India due to their growing economies and increasing energy demands.

India artificial lift systems market is expected to grow rapidly in the coming years due to the country's growing energy demand. The government's emphasis on boosting local oil and gas extraction to reduce dependence on imports is expected to encourage more investments in artificial lift systems such as electric submersible pumps, hydraulic pumps, and gas lifts, driving the market growth.

Key Artificial Lift Systems Company Insights

Some of the key companies in the artificial lift systems market include ABB, Siemens, Schneider Electric, General Electric Company, Eaton, and others are the major players in the market, which are constantly developing new and improved technologies to gain a competitive edge in the industry. The companies are expanding their service offerings with products or equipment. The companies are taking several strategic initiatives, such as mergers and acquisitions, to gain access to new technologies and expertise in the market.

-

ABB is offers technology in electrification and automation, leading to a more sustainable and resource-efficient future. The company's solutions connect engineering expertise to enhance the manufacturing, transportation, energy, and operations processes.

-

Siemens is a technology-based company that focuses on industry, transportation, digital transformation, infrastructure as well as the transmission and generation of electricity. Siemens is a product-based company its product range includes industrial automation, drive technology, building technology, energy technology, financial services, medical technology, mobility solutions, software, and others.

Key Artificial Lift Systems Companies:

The following are the leading companies in the artificial lift systems market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Siemens

- Schneider Electric

- General Electric Company

- Cisco Systems, Inc.

- Honeywell International Inc.

- Emerson Electric Co.

- Schweitzer Engineering Laboratories, Inc. (SEL)

- Mitsubishi Electric Corporation

Recent Developments

-

In May 2024, ABB announced an agreement of acquisition of Siemens’ business of China. According to this agreement, ABB is planning to acquire smart home systems, peripheral home automation products, and wiring accessories, with the Siemens brand under a licensing agreement.

-

In May 2024, Schneider Electric partnered with Crux to assist in buying 45X advanced manufacturing production from Silfab Solar, a North American company that develops, designs, and manufactures premium solar PV modules. The collaboration is expected to accelerate the development and expansion of solar energy manufacturing within the U.S.

-

In January 2024, ABB acquired a majority of software service providers Meshmind, a research and development engineering firm, to enhance progress in artificial intelligence, Industrial IoT, machine vision, and software-based automation. This investment will improve skills in software development and AI-driven programs.

Artificial Lift Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.1 billion

Revenue forecast in 2030

USD 33.5 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, component, mechanism, well type, technology, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, France, Germany, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

ABB; Siemens; Schneider Electric; General Electric Company; Eaton; Cisco Systems, Inc.; Honeywell International Inc.; Emerson Electric Co.; Schweitzer Engineering Laboratories, Inc. (SEL); Mitsubishi Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Lift Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global artificial lift systems market report based on product, component, mechanism, well type, technology, and region:

-

Products Outlook (Revenue, USD Billion, 2018 - 2030)

-

Rod Lifts

-

Electric Submersible Pumps

-

Progressive Cavity Pumps

-

Gas lift

-

Hydraulic pumps

-

Others

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pump

-

Motor

-

Cable Systems

-

Controller

-

Others

-

-

Mechanism Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pump Assisted

-

Gas Assisted

-

-

Well Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Horizontal

-

Vertical

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.