ASEAN Poultry Vaccines Market Size, Share & Trends Analysis Report By Application (Broiler, Layer), By Product, By Disease, By Distribution Channel, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-007-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

ASEAN Poultry Vaccines Market Trends

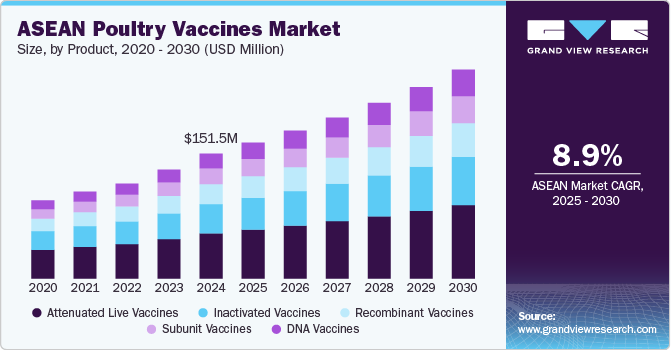

The ASEAN poultry vaccines market size was estimated at USD 151.46 million in 2024 and is anticipated to grow at a CAGR of 8.97% from 2025 to 2030. Growing populations, rapid urbanization, increased government initiatives, rising incidence of poultry diseases, and declining antibiotic use are the main factors driving the market growth. In recent years, the prevalence of infections caused by antibiotic-resistant salmonella species has increased in the poultry population of ASEAN countries, such as Malaysia, Myanmar, and Singapore, according to a study published by MDPI in July 2022. Thus, the industry’s focus has now shifted toward other feasible options, such as vaccinations.

Southeast Asian countries such as Cambodia, Indonesia, Thailand, and Vietnam are witnessing rapid urbanization and a growing population. The U.S. Bureau of Census data suggests that the ASEAN region’s (inclusive of 10 countries) total population grew by 11.6% in 2017 from 2008 and is expected to reach 720 million by 2027. In addition, according to Bloomberg, the urban population in the ASEAN region will grow by 100 million people by 2030. The per capita GDP of the region has increased by 3.4% annually during the past ten years, and 3.5% growth is anticipated for the coming decade.

As the region’s population, urbanization, and income are increasing, meat consumption is also widely growing. This region has witnessed several advancements in poultry production in the past decade. For instance, according to the U.S. Department of Agriculture, Southeast Asia's poultry production increased by 56% over the previous decade and is predicted to reach 12.3 MMT by 2028. Vietnam’s poultry and pig sectors have developed most rapidly compared to other ASEAN regions, and Indonesia is forecast to continue being the leading egg producer in the following decade. Furthermore, Thailand is thought to be the top exporter of poultry goods. Therefore, increasing poultry production in ASEAN countries and growing poultry meat consumption are driving market growth.

Poultry farmers face numerous challenges such as maintaining poultry health, immunity, and stable production. In addition, the rising concerns over food safety, reduction in consumer confidence, product safety & quality issues, and most importantly the re-emergence and new emergence of infectious diseases are continuously challenging ASEAN poultry production units. The recent foodborne or zoonotic disease outbreaks, such as COVID-19, avian influenza, and salmonellosis, have raised contagious issues among animal products, which reduced meat consumption rates. Due to cash flow issues, some chicken farms had to close as a result of the pandemic's decreased demand and production.

The players in the industry, particularly commercial farms, have been working to improve closed-house implementation to maximize production and efficiency. In the poultry industry, the increased synergy of companies, integration between upstream and downstream business divisions, and increasing initiatives from public & private market players are expected to fuel the market over the forecast period.

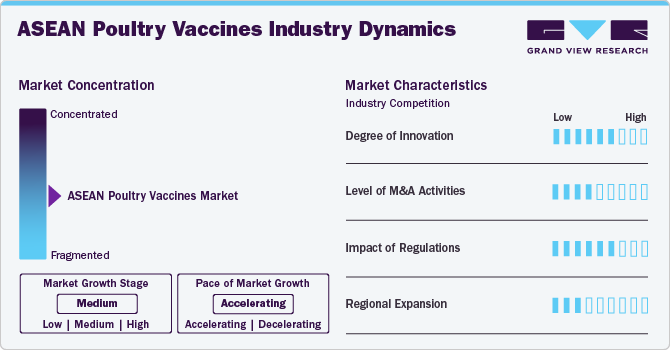

Market Concentration & Characteristics

The market exhibits a moderate market concentration, and the pace of the market growth is accelerating. One important factor driving the market is the increasing prevalence of diseases, such as avian influenza, Newcastle disease, and infectious bronchitis. These diseases can significantly impact poultry production, leading to substantial economic losses for farmers and the poultry industry. Vaccination has become a critical preventive measure to control disease outbreaks, ensure poultry health, and enhance productivity. The rising demand for quality products and export opportunities also contribute to the growing use of vaccines in the sector.

The market demonstrates a moderate to high degree of innovation. Innovation in the poultry vaccines market is being driven by various advancements in vaccine development, delivery methods, and biotechnology. These innovations aim to improve the efficacy, safety, and accessibility of vaccines, benefiting both the poultry industry and overall animal health. Some key areas of innovation include nanoparticles-based vaccines. Nanotechnology is being leveraged to create more effective delivery systems. Nanoparticles can protect the antigens until they reach the target cells in the poultry’s body, improving the uptake of the vaccine and the immune response.

Within the market, there exists a moderate level of mergers and acquisitions activity, indicative of ongoing consolidation and strategic acquisition and partnerships among industry players. For instance, in January 2023, Merck acquired Imago BioSciences, Inc. After the completion of this merger, Imago was expected to transform into a fully owned subsidiary of Merck.

The market experiences a high impact of regulations. Vaccines must undergo a rigorous approval process before they are marketed. This involves laboratory research, clinical trials, and reviews of safety, efficacy, and quality. Vaccines must be registered and licensed by national regulatory authorities in ASEAN countries. This involves proving the vaccine’s safety, efficacy, and compliance with local regulations. Manufacturers must provide extensive documentation and data on clinical trials, production processes, and quality control.

Moderate levels of regional growth operations in the market are caused by initiatives by major competitors in the market. For instance, along with the ERYSENG PARVO/LEPTO (inactivated vaccine against swine erysipelas, porcine parvovirus, and leptospira), HIPRA Thailand introduced its two smart vaccines, EVALON (live attenuated vaccine against avian coccidiosis) and UNISTRAIN PRRS (modified-live vaccine against porcine reproductive and respiratory syndrome).

Product Insight

The attenuated live vaccines segment led the market with the largest revenue share of 36.00% in 2024. The most traditional immunization technique in use in the veterinary industry is live attenuation. This method is also under trial for the development of additional applications. Attenuated live vaccines tend to induce a more robust and longer-lasting immune response compared to inactivated or subunit vaccines. Moreover, attenuated live vaccines offer superior protection against a wide range of poultry diseases such as Newcastle disease, infectious bronchitis, and fowl pox. They tend to generate a robust immune response by mimicking a natural infection, which is highly effective in regions with high disease prevalence.

The DNA vaccine segment is anticipated to grow at the fastest CAGR over the forecast period. DNA vaccines work by introducing genetic material (DNA) encoding specific antigens from the pathogen into the host’s cells, which then produce the antigen and stimulate an immune response. This mechanism allows the immune system to recognize and fight the actual pathogen in the future. DNA vaccines have the potential to offer better protection against complex poultry diseases like avian influenza and infectious bursal disease. DNA vaccines can be manufactured more easily and rapidly compared to traditional vaccines, which often require the growth of live pathogens in large quantities. This production advantage makes DNA vaccines a viable option for meeting the growing demand for poultry vaccines in the ASEAN market, especially during disease outbreaks when quick deployment is critical.

Disease Insights

Based on disease, the avian influenza segment led the market with the largest revenue share of 9.93% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Avian Influenza impacts wild, zoo, and pet birds in addition to farmed poultry. A few AI viruses are highly pathogenic, producing severe systemic disease with multiple organ failure and significant mortality, while most AI viruses in domestic poultry are of moderate pathogenicity, causing subclinical infections, respiratory sickness, or decreases in egg production. In agar gel immunodiffusion assays, serology can identify avian influenza viruses of type a orthomyxoviruses, often known as Influenzavirus A or Alphainfluenzavirus. They are distinguished by antigenically similar nucleoprotein and matrix internal proteins. There are 16 hemagglutinin (H1-16) and 9 neuraminidase (N1-9) subtypes of AI viruses.

The salmonella segment held the second largest market share in 2024. The prevalence of Salmonella spp. in developed economies compared to developing ones is lower in chicken and poultry products. Overall Salmonella spp. infection incidence is on the rise. In addition, the review noted the existence of multidrug-resistant salmonella strains in several Asian countries. Treating, preventing, and engaging in campaigns to control the infections typically bear a significant cost, and therefore, the rising number of infectious diseases linked to Salmonella has become a burden for most developing economies. In addition, researchers and the general public are more aware of the wide range of Salmonella serovars and the high frequency of shifting trends in salmonellosis as a result of the emergence of novel serotypes and antibiotic resistance.

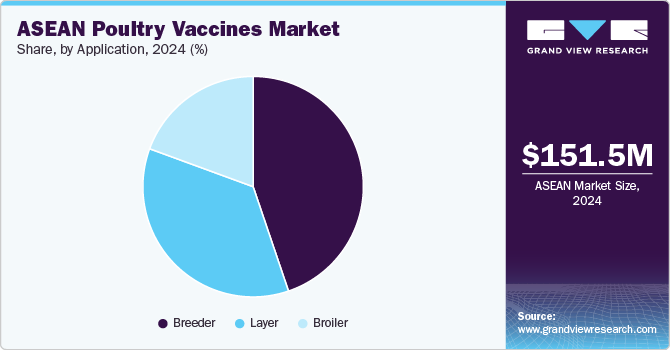

Application Insights

Based on application, the breeder segment led the market with the largest revenue share of 44.80% in 2024. Breeders are those who produce both layers (eggs) and broilers (meat). Many different people breed poultry for a variety of reasons and objectives. Commercial breeding, village/backyard breeding, and fancy/exhibition breeding are the three primary subcategories of breeding. Australia's most common species for producing both meat and eggs is chicken, by far. Hatcheries supply both the broiler and layer industries and breeding for the commercial poultry business is done on a massive industrial scale. According to the Thai Broiler Processing Exporters Association, The Thai poultry market features more than 40 players. Only 20% of these market participants are integrated commercial farms or large to medium commercial farms. With 29% of global production, Charoen Pokphand Foods Thailand is the largest company by production volume. Laemthong, Betagro, Thai Foods Group, Saha Farm, and GFPT are the companies that come after it.

The layer segment is estimated to witness at the fastest CAGR over the forecast period. Layer poultry farming is the practice of producing commercial egg production by raising egg-laying birds. A special breed of a hen, named the layer, needs to be cared for from day one. They start producing eggs for the marketplace when they are 18 to 19 weeks old. They continue to lay eggs until they are about 72 and 78 weeks old. They might consume about 2.25 kg of feed during their egg-laying cycle and lay about 1 kg of eggs. The outbreak of COVID-19 in Myanmar and its subsequent response had a significant impact on both broiler and layer farms. Consumers now pay more for eggs due to layer farms' inadequate response to the spike in demand for eggs following the first COVID-19 waves.

Distribution Channel Insight

Based on distribution channel, the hospital/clinic pharmacy segment led the market with the largest revenue share of 47.01% in 2024. Hospitals and clinics serve as primary points of contact for poultry farmers seeking healthcare solutions for their flocks. These facilities are trusted by farmers for providing timely and reliable vaccines, which supports the widespread adoption of vaccination programs. Veterinary professionals in hospitals and clinics are well-equipped to administer vaccines, ensuring they are used properly, which enhances their effectiveness. Farmers and poultry producers often rely on the expertise of these professionals for vaccine recommendations and proper administration.

The E-commerce segment is anticipated to grow at the fastest CAGR over the forecast period. E-commerce plays a significant role in driving the market by increasing accessibility and convenience for veterinary products. Online platforms allow farmers and veterinarians to easily access a broader range of vaccines and supplies, reducing the need for in-person purchasing from physical stores or distributors. E-commerce also enables competitive pricing, improved product availability, and the ability to quickly compare different brands, which is critical in regions with logistical challenges.

Country Insights

The poultry vaccines market in Indonesialed the market with the largest market share of 18.99% in 2024, owing to the increasing chicken meat consumption and poultry production rates in the country, which further boosts the demand for import of technology for keeping, feeding, & storage. Approximately 90% of the country's population is Muslim and religiously forbidden from consuming pork, owing to which poultry is a primary source of animal protein.

The Thailandpoultry vaccines market is anticipated to grow at the fastest CAGR during the forecast period. The increased prevalence of poultry diseases, increasing poultry production, and expanding poultry product exports are important drivers projected to boost the market in Thailand. For instance, according to the USDA's annual report on poultry and products, the production of chicken meat increased by 3% in 2023 and 2% in 2022. Thailand's chicken meat production had increased for the rest of 2022 and 2023. Similar to other countries, Thailand's chicken market has rebounded from the pandemic, the effects of rising grain prices due to disruptions in global supply and commerce resulting from the conflict between Russia and Ukraine, and meat output grew by just 1% in the first half of 2022.

Key ASEAN Poultry Vaccines Company Insights

The market is highly competitive and marked by the existence of several small and large-scale manufacturers. These players are constantly involved in strategic initiatives, such as new product launches, regional expansions, joint ventures, mergers, and acquisitions, to gain deeper market penetration. For instance, in October 2022, Zoetis enhanced its poultry vaccination portfolio with the launch of Poulvac Procerta HVT-IBD-ND. With a single dosage, this recombinant vector vaccine is meant to guard against three different illnesses.

Key ASEAN Poultry Vaccines Companies:

The following are the leading companies in the ASEAN poultry vaccines market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim International GmbH

- Ceva

- HIPRA

- Zoetis

- Phibro Animal Health Corporation

- Elanco

- Merck & Co., Inc.

- Medion Farma

- Malaysian Vaccines & Pharmaceuticals Sdn Bhd.

- Kemin Industries, Inc

Recent Developments

-

In April 2022, Elanco, in collaboration with Ginkgo Bioworks, launched a new animal healthcare company called BiomEdit. This was established to provide animal healthcare services using probiotics and engineered bacteria.

-

In May 2021, Boehringer Ingelheim launched the VAXXITEK HVT+IBD+ND vaccine protect poultry against Newcastle Disease, Marek’s Disease, and Infectious Bursal Disease.

ASEAN Poultry Vaccines Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 164.78 million |

|

Revenue forecast in 2030 |

USD 253.22 million |

|

Growth rate |

CAGR of 8.97% from 2025 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, disease, distribution channel, country |

|

Country scope |

Indonesia; Vietnam; Myanmar; Malaysia; Thailand; Philippines; Laos; Cambodia |

|

Key companies profiled |

Boehringer Ingelheim International GmbH; Ceva; HIPRA; Zoetis; Phibro Animal Health Corporation; Elanco; Merck & Co., Inc.; Medion Farma; Malaysian Vaccines & Pharmaceuticals Sdn Bhd.; Kemin Industries, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global ASEAN Poultry Vaccines Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the ASEAN poultry vaccines market report based on application, product type, disease, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Attenuated Live Vaccines

-

Inactivated Vaccines

-

Subunit Vaccines

-

DNA Vaccines

-

Recombinant Vaccines

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Broiler

-

Layer

-

Breeder

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Bronchitis

-

Infectious Bursal Diseases

-

Infectious Laryngotracheitis

-

Egg Drop Syndrome

-

Adenovirus

-

Duck Viral Enteritis

-

Inclusion Body Hepatitis

-

Coccidiosis

-

Avian Influenza

-

Marek's Disease

-

Newcastle Disease

-

Salmonella

-

Avian Encephalomyelitis

-

Fowl Cholera

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/ Clinic Pharmacy

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Thailand

-

Vietnam

-

Cambodia

-

Indonesia

-

Laos

-

Malaysia

-

Philippines

-

Myanmar

-

Frequently Asked Questions About This Report

b. The ASEAN poultry vaccines market size was estimated at USD 151.46 million in 2024 and is expected to reach USD 164.78 million in 2025.

b. The ASEAN poultry vaccines market is expected to grow at a compound annual growth rate (CAGR) of 8.97% from 2025 to 2030 to reach USD 253.22 million by 2030.

b. Attenuated live vaccines dominated the ASEAN poultry vaccines market with a share of over 36% in 2024. This is attributable to the wide usage of this type of vaccine among poultry farms.

b. Some key players operating in the ASEAN poultry vaccines market include Boehringer Ingelheim International GmbH; Ceva; HIPRA; Zoetis; Phibro Animal Health Corporation; Elanco; Merck & Co., Inc.; Medion Farma; Malaysian Vaccines & Pharmaceuticals Sdn Bhd.; Kemin Industries, Inc.

b. Key factors that are driving the market growth include the growing poultry population, rapid urbanization, increased government initiatives, rising incidence of poultry diseases, and declining antibiotic use

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."