- Home

- »

- Biotechnology

- »

-

Aseptic Connectors & Welders Market Size Report, 2033GVR Report cover

![Aseptic Connectors & Welders Market Size, Share & Trends Report]()

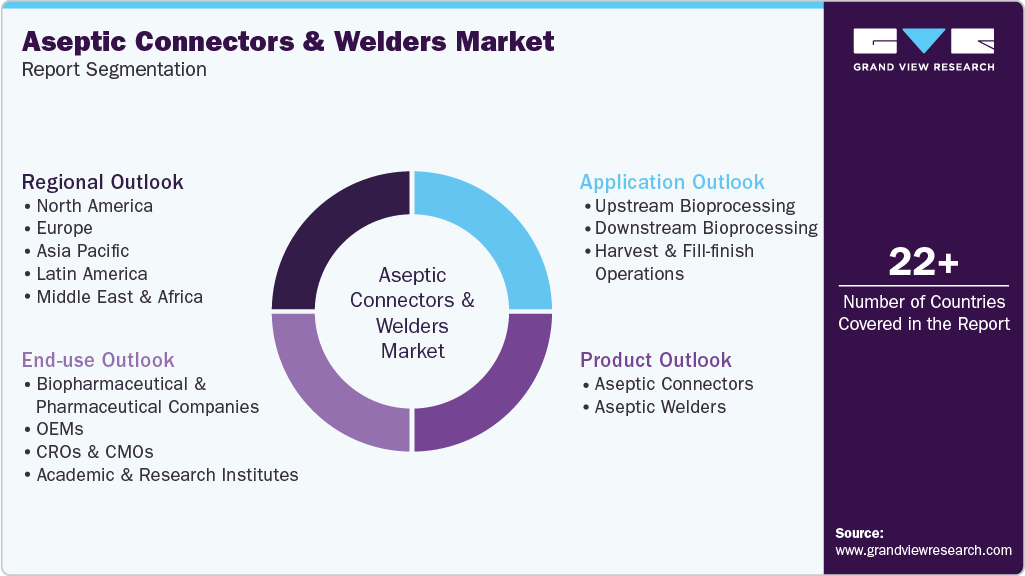

Aseptic Connectors & Welders Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Connectors, Welders), By Application (Upstream Bioprocessing, Downstream Bioprocessing), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-636-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aseptic Connectors & Welders Market Summary

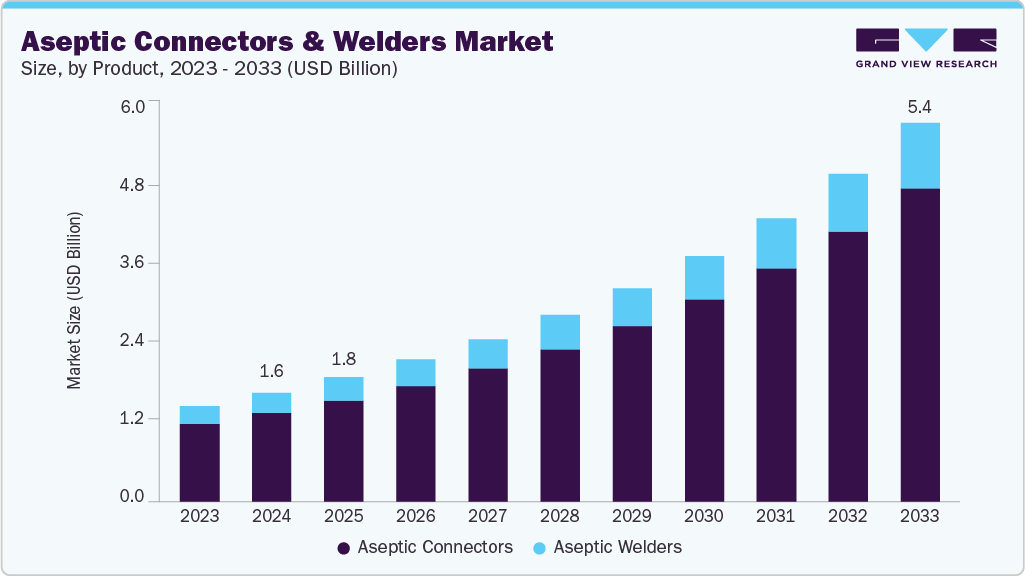

The global aseptic connectors & welders market size was estimated at USD 1.55 billion in 2024 and is projected to reach USD 5.39 billion by 2033, growing at a CAGR of 14.96% from 2025 to 2033. This growth is driven by increasing demand for sterile fluid transfer solutions in the biopharmaceutical, food & beverage, and healthcare industries, where maintaining product purity and process integrity is critical.

Key Market Trends & Insights

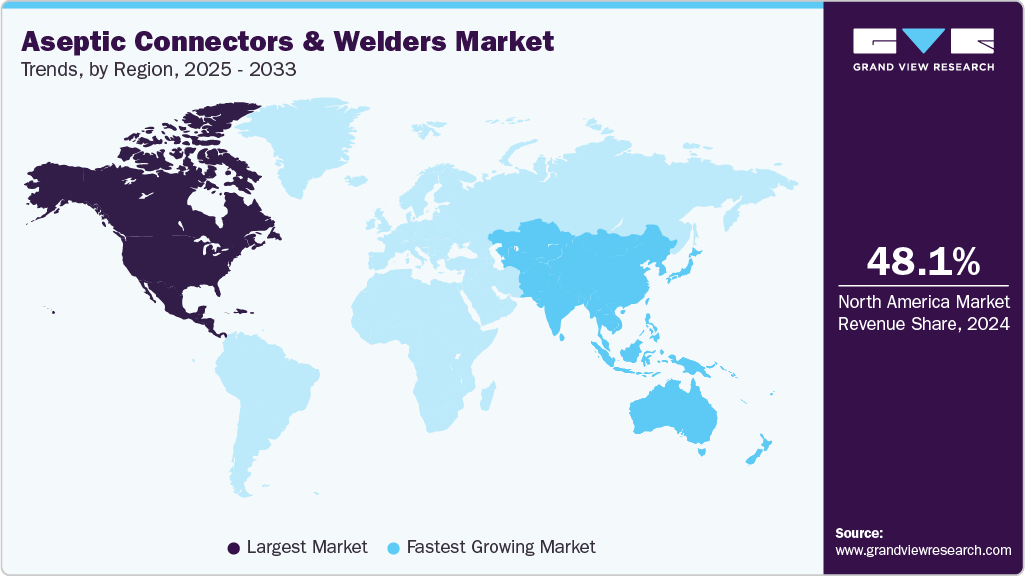

- In terms of region, North America held the largest revenue share of 48.11% of the global market in 2024.

- The aseptic connectors & welders industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the aseptic connectors segment held the highest market share in 2024.

- Based on application, the upstream bioprocessing segment held the highest market share of 45.19% in 2024.

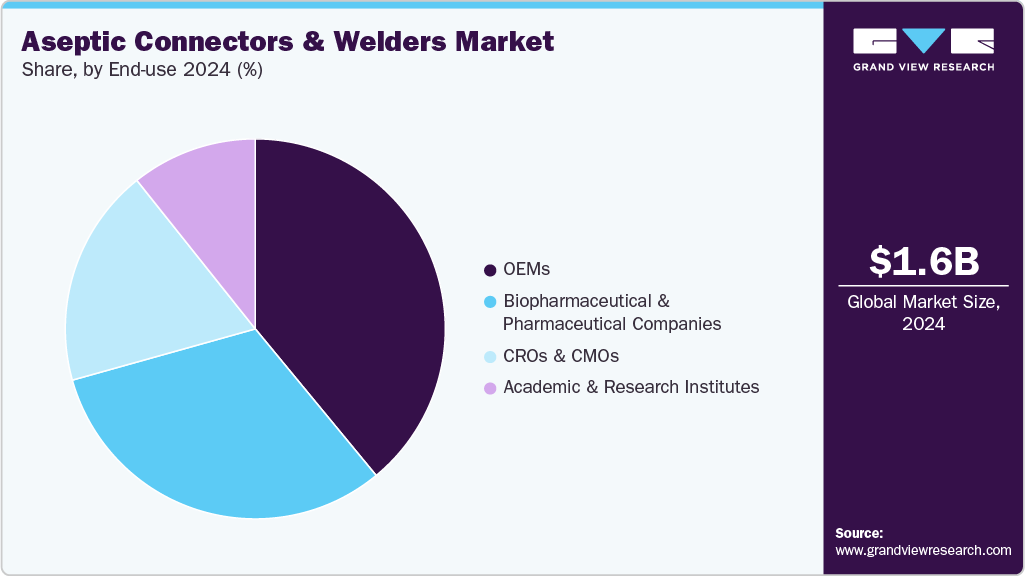

- By end use, the OEMs segment held the highest market share of 39.02% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.55 Billion

- 2033 Projected Market Size: USD 5.39 Billion

- CAGR (2025-2033): 14.96%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, advancements in single-use technologies, stricter regulatory requirements, and rising investments in biologics manufacturing accelerate market expansion.

Growth of the biopharmaceutical industry

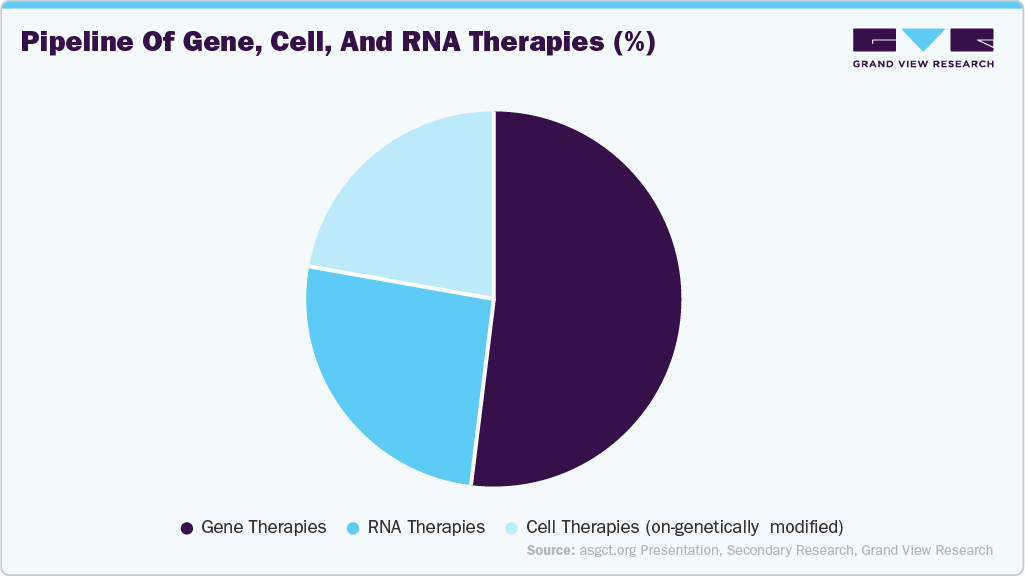

The growth of the biopharmaceutical industry is a major driver of the market. As the demand for complex biologics such as monoclonal antibodies, cell and gene therapies, and mRNA vaccines increases, manufacturers are under pressure to ensure contamination-free, sterile production environments. These high-value biologics are extremely sensitive to microbial contamination, making sterile fluid transfer a critical requirement. Aseptic connectors and welders enable secure, closed-system processing that ensures product integrity while meeting strict regulatory standards. The shift from stainless steel equipment to single-use systems (SUS) has also accelerated the need for reliable aseptic connection technologies that can support flexible and scalable production setups.

Moreover, the rapid advancement of cell and gene therapies, such as CAR-T cell treatments and personalized gene editing, further drives the demand for aseptic connection solutions. These therapies are typically produced in small, patient-specific batches, requiring highly sterile, adaptable workflows with frequent connections and disconnections. Aseptic connectors that offer ease of use, sterility assurance, and scalability are essential to support these complex processes. For instance, in April 2021, CPC emphasized adopting Single-Use Technology (SU and gene therapy (CGT) manufacturing to address scalability challenges.

As numerous CGTs advance from clinical trials to commercialization, traditional stainless-steel systems often fall short of meeting large-scale production demands. Connectors and welders offer greater flexibility, minimize contamination risks, and accelerate time-to-market, making them a crucial enabler in the successful commercialization of next-generation cell and gene therapies.

Increased Focus on Contamination Control

A growing emphasis on contamination control across the biopharmaceutical, biotechnology, and life sciences sectors is a key driver of the market growth. With biologics and advanced therapies highly sensitive to microbial contamination, manufacturers prioritize closed-system processes that prevent exposure to external environments. For instance, in June 2021, Colder Products Company (CPC) published a report emphasizing the advantages of single-use systems for storing and shipping frozen drug materials. The report highlighted that pre-sterilized, single-use freeze-thaw systems offer biomanufacturers enhanced quality control by reducing cross-contamination risks, simplifying dispensing processes, and minimizing manual interventions during freezing, thawing, handling, and shipping. Aseptic connectors and tube welders enable sterile fluid transfer without compromising the integrity of the product, which is especially crucial in high-value applications like vaccine production, monoclonal antibody manufacturing, and media preparation.

Regulatory authorities such as the FDA, EMA, and WHO have intensified oversight of aseptic processing and Good Manufacturing Practices (GMP), raising the stakes for contamination control in compliant manufacturing. Facilities must now demonstrate stringent process validation, sterility assurance, and traceability. Aseptic connectors and welders help companies meet these demands through validated, reproducible connections that maintain sterility during critical process steps. As quality expectations rise and biologic manufacturing becomes more complex, the need for robust contamination control solutions continues to fuel market demand for these essential technologies.

Market Concentration & Characteristics

The degree of innovation in the aseptic connectors & welders industry has significantly accelerated market growth by enabling safer, more efficient, and more flexible biomanufacturing. Manufacturers continuously develop advanced connection technologies that improve usability, reduce operator error, and enhance sterility assurance. Innovations such as genderless connectors, automated tube welders, quick-connect systems, and single-use aseptic devices have transformed fluid transfer operations into sterile environments. These products reduce the time and training required while improving consistency and reducing contamination risks, making them highly attractive in regulated industries like biopharma and healthcare.

The level of mergers and acquisitions activity in the market is steadily increasing, serving as a strategic growth driver. Larger bioprocessing and life sciences companies are actively acquiring specialized firms to expand their product portfolios, access innovative technologies, and strengthen their position in the single-use and aseptic processing segment. For instance, in February 2025, Thermo Fisher Scientific announced its acquisition of Solventum’s purification and filtration business, strengthening its bioproduction capabilities and expanding its product portfolio. These M&A activities help companies meet rising demand and accelerate innovation and global market penetration, making them a significant contributor to the market’s expansion.

Regulations profoundly impact the aseptic connectors & welders industry, acting both as a market driver and a barrier to entry. Regulatory bodies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and World Health Organization (WHO) enforce strict guidelines related to Good Manufacturing Practices (GMP), aseptic processing, and sterility assurance in pharmaceutical and biopharmaceutical manufacturing. These stringent requirements compel manufacturers to adopt validated, sterile connection technologies that ensure product safety and compliance. For instance, facilities producing monoclonal antibodies or gene therapies must demonstrate aseptic integrity at every production stage. This drives the need for high-performance connectors and welders that offer traceability, reproducibility, and robust sterility. As global regulatory standards become more aligned and rigorous, the demand for reliable aseptic solutions continues to grow.

Product expansion is a key driver of market growth as manufacturers continually broaden their offerings to meet modern bioprocessing's increasing complexity and scale. With the rise of single-use systems, personalized medicine, and multi-product manufacturing facilities, there is a growing demand for diverse connection solutions supporting various applications, from small-batch clinical production to large-scale commercial manufacturing. Companies are expanding their product lines to include different sizes, flow rates, materials, connection types, and integrated sterile welding systems compatible with various tubing formats. For instance, in September 2021, CPC introduced the MicroCNX Series Connectors in the U.S., offering biopharmaceutical manufacturers a sterile, efficient alternative to tube welding for small volume closed aseptic processes. These connectors, designed for 1.6mm, 2.4mm, and 3.2mm tubing, streamline operations by reducing connection time by up to 75%, enhancing cleanroom space utilization, and eliminating the need for costly tube welders. This continuous product innovation and portfolio diversification allow suppliers to serve niche needs better, enhance user flexibility, and stay competitive in a fast-evolving market.

Regional expansion is a significant driver of the market, fueled by the global growth of biopharmaceutical manufacturing and the increasing adoption of advanced sterile processing technologies in emerging markets. Countries in Asia-Pacific, particularly China, India, and South Korea, are investing heavily in biotechnology infrastructure and local vaccine and biologics production. This has created a strong demand for high-quality aseptic connection systems that meet international regulatory standards. Similarly, Latin America and Eastern Europe are seeing increased pharmaceutical outsourcing and contract manufacturing activity, driving the need for modern, sterile fluid handling solutions. Leading companies are responding by establishing local manufacturing facilities, distribution networks, and technical support centers to serve these growing markets better.

Product Insights

The aseptic connectors segment dominated the market with the largest market share in 2024, driven by increasing adoption of single-use systems, heightened focus on contamination control, and rising demand for flexible and sterile fluid transfer solutions in biopharmaceutical manufacturing. For instance, in May 2022, Colder Products Company (CPC) introduced the AseptiQuik G DC Series Connector, enhancing sterile processing in biopharmaceutical manufacturing. This genderless connector enables sterile connections and disconnections using a single product, eliminating additional equipment. Its intuitive design simplifies aseptic procedures, even in non-sterile environments, thereby improving efficiency and reducing the risk of contamination. The segment's growth is further supported by advancements in connector design, such as genderless and quick-connect technologies, which improve ease of use, reduce human error, and enhance process efficiency.

The aseptic welders segment is expected to grow at a significant CAGR over the forecast period. The advancements in automated and portable welding equipment enhance operational efficiency, reduce contamination risks, and support flexible, small-batch production aligned with personalized medicine trends. The expansion of biomanufacturing infrastructure in emerging markets further accelerates this growth, positioning aseptic welders as a critical component in the evolution of sterile processing and biopharmaceutical production.

Application Insights

The upstream bioprocessing segment held the largest revenue share of 45.19% in 2024. This segment includes cell culture, fermentation, and media preparation, essential for producing high-quality biologics. The growth in this area has been propelled by the increasing demand for personalized medicines, advancements in bioprocessing technologies, and the need for efficient large-scale production. For instance, in September 2024, Multiply Labs announced a collaboration with Legend Biotech to automate cell therapy manufacturing, enhancing efficiency and scalability in bioprocessing. As biopharmaceuticals continue to gain prominence, upstream bioprocessing is expected to expand further, maintaining its leadership position in the market.

The downstream bioprocessing segment is expected to expand at the fastest CAGR during the forecast period due to increasing demand for high-purity biologics, advancements in purification technologies, and the rising adoption of automation and single-use systems. Moreover, the need for efficient and sterile processing of biologics such as monoclonal antibodies, vaccines, and gene therapies is driving the adoption of advanced aseptic connectors & welders in downstream applications. For instance, in June 2025, a webinar was launched in the US, focusing on 3D visualization and characterization of downstream bioprocessing structures to inform advanced design strategies for improving biomanufacturing efficiency. These factors collectively contribute to the segment's accelerated growth and technological innovations.

End Use Insights

The OEMs segment dominated the market in 2024 with the largest revenue share of 39.02%. The increasing demand for high-quality, compliant, and automated bioprocessing systems has driven OEMs to adopt innovative aseptic solutions, reinforcing their dominant position in the market. For instance, major pharmaceutical companies such as Pfizer and Moderna utilize specialized aseptic welding technologies in their vaccine manufacturing facilities, highlighting OEMs' critical role in maintaining product sterility and quality. Their focus on technological advancements and adherence to stringent regulatory standards fuel their growth and market share in this sector.

The CROs & CMOs segment is anticipated to grow at the fastest CAGR throughout the forecast period, driven by the increasing outsourcing of biopharmaceutical manufacturing processes to specialized contract organizations. This trend allows pharmaceutical companies to reduce costs, accelerate development timelines, and access advanced manufacturing expertise without significant capital investment. Their adoption of innovative, scalable, and efficient aseptic technologies is essential to meet evolving regulatory standards and production demands, positioning this segment for rapid growth in the forecast period.

Regional Insights

North America aseptic connectors & welders industry dominated the global market in 2024, accounting for the largest share of 48.11% of the overall revenue. This leadership is attributed to the region’s well-established biopharmaceutical and biotechnology sectors, high adoption of advanced single-use and aseptic technologies, and stringent regulatory frameworks that drive demand for sterile processing solutions. For instance, in May 2022, Cytiva opened a new manufacturing facility in Switzerland to enhance supply chain resilience and meet the growing global demand for biotechnology and life sciences solutions. Moreover, significant investments in research and development and the presence of major market players have further strengthened the region's position in this market.

U.S Aseptic Connectors & Welders Market Trends

The aseptic connectors & welders industry in the U.S. is expected to grow steadily over the forecast period, driven by the country's strong biopharmaceutical industry, increasing adoption of single-use technologies, and stringent regulatory standards that emphasize contamination control. As manufacturers shift toward flexible, closed system processing to improve sterility and efficiency, demand for advanced aseptic connectors and tube welders continues to rise. Ongoing investments in biotechnology R&D and the presence of key industry players and robust healthcare infrastructure further support the market's expansion across clinical and commercial manufacturing applications.

Europe Aseptic Connectors & Welders Market Trends

Europe's aseptic connectors & welders industry is emerging as a lucrative region, driven by its well-established pharmaceutical and biotechnology industries, particularly in countries like Germany, Switzerland, and the UK. The region's strict regulatory framework, enforced by the European Medicines Agency (EMA), has pushed manufacturers to adopt advanced aseptic technologies to ensure product safety and compliance. For instance, in July 2024, Vanessa Vasadi Figueroa, Chief Microbiologist at VVF Science, emphasized the critical importance of precise aseptic connections in pharmaceutical manufacturing. She highlighted that, as companies adapt to EU GMP guidelines for Annex 1, distinguishing between "aseptic" and "sterile" is essential. "Aseptic" refers to a high probability of being free from contamination, while "sterile" denotes absolute freedom from microorganisms, achievable through validated processes. This distinction is crucial for ensuring sterility assurance throughout the manufacturing process. With strong government support for biotech infrastructure and increasing production of high-value biologics, Europe remains a key growth area in the global aseptic connectors & welders industry.

The aseptic connectors & welders industry in the UK held a significant share in 2024, driven by the country's robust pharmaceutical and biotechnology sectors. The UK's commitment to strict regulatory standards and its emphasis on maintaining high-quality manufacturing processes have led to increased adoption of aseptic technologies. This trend is further supported by the growing demand for biologics and the shift towards single-use systems, which require reliable and sterile connection solutions.

Germany's aseptic connectors & welders industry held a significant share in 2024, driven by the country's strong pharmaceutical and biotechnology industries, especially in the production of biologics and biosimilars. The growing adoption of single-use bioprocessing systems has increased the need for reliable aseptic connectors that ensure sterile fluid transfer during critical manufacturing. Technological improvements, such as genderless and quick-connect systems, have enhanced process efficiency and minimized contamination risks. For instance, Sartorius, a leading German company, has developed advanced aseptic connector solutions widely used in Germany's biomanufacturing facilities to support flexible and contamination-free production. Moreover, strict regulatory standards requiring adherence to Good Manufacturing Practices (GMP) have driven the region's demand for validated, high-quality aseptic technologies.

Asia Pacific Aseptic Connectors & Welders Market Trends

The Asia Pacific aseptic connectors & welders industry is projected to grow at the fastest CAGR of 15.31% over the forecast period, driven by the rapid expansion of biopharmaceutical manufacturing, increasing investments in single-use technologies, and growing demand for contamination-free processing solutions in key countries such as China, India, and South Korea. The region’s increasing focus on advanced biologics, vaccine production, and contract manufacturing organizations (CMOs) further propels the adoption of aseptic connectors & welders, critical for maintaining sterile and flexible fluid transfer systems. For instance, in January 2025, Apollo Hospitals and the University of Leicester launched the Centre for Digital Health and Precision Medicine in Chittoor, Andhra Pradesh, India, underscoring the region’s commitment to advancing innovative healthcare solutions. This initiative highlights the integration of cutting-edge research with biopharmaceutical development. It reinforces the growing need for reliable aseptic technologies to support scalable and contamination-free manufacturing processes in the region

The aseptic connectors & welders industry in China is expected to experience robust growth over the forecast period, driven by the country’s expanding biopharmaceutical industry, increased adoption of single-use technologies, and a strong focus on ensuring contamination-free processing. As China continues to invest heavily in advanced biologics and contract manufacturing organizations (CMOs), the demand for reliable aseptic connection solutions that support sterile and flexible fluid transfer systems is set to rise significantly. This growth reflects China’s commitment to enhancing its pharmaceutical manufacturing capabilities and meeting the increasing global demand for high-quality biopharmaceutical products.

The Japan aseptic connectors & welders industry is witnessing significant growth over the forecast period, driven by the country's strong biopharmaceutical sector, increasing focus on advanced therapies, and growing adoption of single-use technologies. Japan's emphasis on stringent quality standards and contamination control in biologics and vaccine manufacturing further fuels the demand for reliable aseptic connectors & welders. Moreover, the country's commitment to advancing its capabilities in aseptic manufacturing solutions highlights the increasing reliance on aseptic connection technologies to meet the growing demand for sterile and flexible fluid transfer systems in the biopharmaceutical industry.

MEA Aseptic Connectors & Welders Market Trends

The MEA aseptic connectors & welders industry is expected to grow exponentially over the forecast period due to the need for sterile connections in biopharmaceutical manufacturing. The rise of single-use technologies is also key, as these systems improve efficiency and validation in multi-product facilities, further increasing the demand in the aseptic connectors & welders industry.

Kuwait's aseptic connectors & welders industry is anticipated to grow over the forecast period. Increasing government initiatives to improve healthcare infrastructure and ongoing developments are expected to support further market expansion.

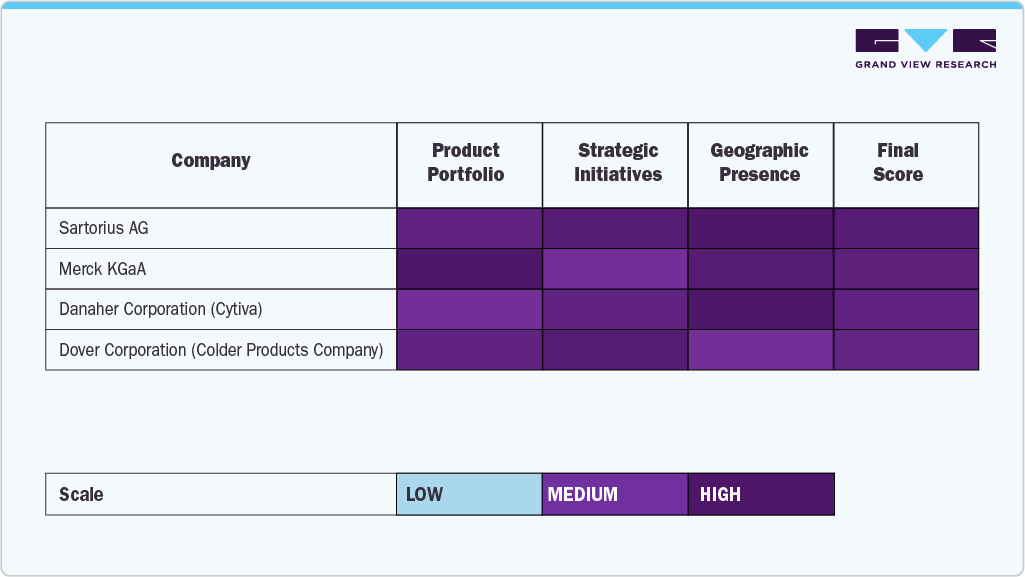

Key Aseptic Connectors & Welders Company Insights

The aseptic connectors & welders industry is a critical segment within the broader biopharmaceutical manufacturing landscape, driven by the increasing demand for sterile, reliable, and efficient fluid transfer solutions. Leading companies such as Sartorius AG, Merck KGaA, Danaher Corporation (Cytiva), Saint-Gobain, Dover Corporation (Colder Products Company), Liquidyne Process Technologies, Inc., MGA Technologies, and Watson-Marlow Fluid Technology Solutions have established themselves as key players by offering innovative aseptic connection and welding technologies designed to meet the stringent requirements of bioprocessing environments.

These organizations have built their market positions through extensive R&D efforts, developing high-quality, compliant products and strong global distribution networks that ensure timely delivery and technical support. Their product portfolios include a range of sterile connectors, welders, and associated accessories that facilitate contamination-free transfer of fluids in vaccine manufacturing, cell therapy, and other biologics production.

The market is evolving with a focus on innovation, regulatory compliance, and supply chain stability. Established players like Sartorius AG, Merck KGaA, Danaher Corporation (Cytiva), Saint-Gobain, Dover Corporation (Colder Products Company), Liquidyne Process Technologies, Inc., MGA Technologies, and Watson-Marlow Fluid Technology Solutions are leading the way by providing products that support safe, efficient, and scalable bioprocessing operations worldwide.

Key Aseptic Connectors & Welders Companies:

The following are the leading companies in the aseptic connectors & welders market. These companies collectively hold the largest market share and dictate industry trends.

- Sartorius AG

- Merck KGaA

- Danaher (Cytiva)

- Saint-Gobain

- Dover Corporation (Colder Products Company)

- Liquidyne Process Technologies, Inc.

- MGA Technologies

- Watson-Marlow Fluid Technology Solutions

- Terumo BCT, Inc.

- LePure Biotech LLC

Recent Developments

-

In January 2025, CPC (Colder Products Company) launched the MicroCNX Nano Series aseptic connectors in the U.S. at the Advanced Therapies Week meeting in Dallas. These connectors are designed to simplify sterile processing in cell and gene therapy (CGT) applications by providing a sterile flow path for 1/8-inch and 1/16-inch tubing without the need for traditional methods like tube welding or biosafety cabinets. The connectors can be quickly joined outside a biosafety cabinet, reducing holdup volume and minimizing contamination risks. Additionally, the small size of the connectors allows them to fit directly into freezing cassettes used in CGT product cryopreservation, supporting cell health during storage and transport. The connectors are made from polyphenylsulfone (PPSU), a high-performance polymer compatible with harsh chemicals used in cryopreservation, such as dimethyl sulfoxide (DMSO).

-

In May 2023, Cytiva and Pall Corporation's life sciences business merged under the Cytiva brand. They now have about 16,000 employees in 40 countries and a combined experience of over 300 years. This merger enhances their ability to innovate and provide valuable solutions.

Aseptic Connectors & Welders Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.77 billion

Revenue forecast in 2033

USD 5.39 billion

Growth rate

CAGR of 14.96% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Sartorius AG; Merck KGaA; Danaher (Cytiva); Saint-Gobain; Dover Corporation (Colder Products Company); Liquidyne Process Technologies, Inc.; MGA Technologies; Watson-Marlow Fluid Technology Solutions; Terumo BCT, Inc.; LePure Biotech LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Aseptic Connectors & Welders Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the aseptic connectors & welders market based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Aseptic Connectors

-

Connection type

-

Barbed fittings

-

Luer locks

-

Genderless

-

Others

-

-

Tubing Size

-

1/16 Inch

-

1/4 Inch

-

3/8 Inch

-

Others

-

-

-

Aseptic Welders

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Upstream Bioprocessing

-

Media Preparation

-

Cell Inoculation

-

Cell Expansion

-

Sampling

-

Other Applications

-

-

Downstream Bioprocessing

-

Purification

-

Filtration

-

Sampling

-

Fluid Transfer

-

Other Applications

-

-

Harvest & Fill-finish Operations

-

Product Collection

-

Filtration

-

Product Filling

-

Sampling

-

QC Testing

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical & Pharmaceutical Companies

-

OEMs

-

CROs & CMOs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global aseptic connectors & welders market size was estimated at USD 1.55 billion in 2024 and is projected to reach USD 1.77 Billion by 2025.

b. The global aseptic connectors & welders market is projected to reach USD 5.39 billion by 2033 growing at a CAGR of 14.96% from 2025 to 2033.

b. The aseptic connectors segment is dominating the aseptic connectors & welders industry with the highest market share in 2024, driven by increasing adoption of single-use systems, heightened focus on contamination control, and rising demand for flexible and sterile fluid transfer solutions in biopharmaceutical manufacturing.

b. Key players in the market include Sartorius AG; Merck KGaA; Danaher (Cytiva); Saint-Gobain; Dover Corporation (Colder Products Company); Liquidyne Process Technologies, Inc.; MGA Technologies; Watson-Marlow Fluid Technology Solutions; Terumo BCT, Inc.; LePure Biotech LLC

b. The market growth is driven by increasing demand for sterile fluid transfer solutions in the biopharmaceutical, food & beverage, and healthcare industries, where maintaining product purity and process integrity is critical. Furthermore, advancements in single-use technologies, stricter regulatory requirements, and rising investments in biologics manufacturing accelerate market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.