- Home

- »

- Biotechnology

- »

-

Upstream Bioprocessing Market Size & Share Report, 2030GVR Report cover

![Upstream Bioprocessing Market Size, Share & Trends Report]()

Upstream Bioprocessing Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Bioreactors/Fermenters, Cell Culture Products), By Workflow (Media Preparation, Cell Culture), By Use Type (Multi-use, Single-use), By Mode, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-592-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Upstream Bioprocessing Market Trends

The global upstream bioprocessing market size was estimated at USD 24.12 billion in 2023 and is projected to grow at a CAGR of 14.3% from 2024 to 2030. Market growth can be attributed to the advantages associated with the implementation of single-use technology in the bio manufacturing process, increasing demand for biopharmaceuticals, and rising outsourcing of biopharmaceutical manufacturing. The implementation of single-use technology in bio manufacturing processes offers several advantages that resonate throughout the biopharmaceutical industry.

Single-use systems significantly reduce the risk of cross-contamination, ensuring product purity & integrity. By eliminating the need for cleaning and sterilization between batches, these systems enhance operational efficiency, leading to shorter turnaround times and increased productivity. In addition, single-use technology offers greater flexibility in scaling production, allowing manufacturers to adapt quickly to changing market demands. This agility is particularly valuable in upstream bioprocessing, where the ability to rapidly adjust production volumes can optimize resource utilization and minimize costs.

Outsourcing bioprocessing activities enables companies to concentrate on their core competencies, achieve cost savings, and improve productivity. Moreover, major firms are increasingly turning to CMOs to handle their manufacturing requirements, allowing them to prioritize new product development. Recently, there has been a notable increase in the integration of single-use technologies into bioprocesses by CMOs, utilizing single-use assemblies to accelerate processing and simplify process changeovers, further presenting a promising growth opportunity in the market.

The upstream bioprocessing market experienced a positive impact from the COVID-19 pandemic, particularly with the increased demand for upstream bioprocessing products driven by the heightened need for vaccines, treatments, and assays. These products played an important role in facilitating the rapid scaling up of production by biopharmaceutical companies to meet the unprecedented global demand for vaccines. Furthermore, owing to the effectiveness of monoclonal antibodies in treating numerous ailments, there is a substantial demand for biologics & biosimilars. The introduction of innovative vaccines targeting infectious diseases is expected to fuel the growth of the market.

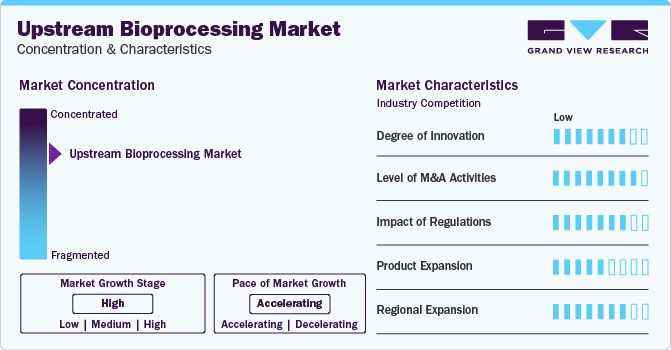

Market Concentration & Characteristics

Numerous industry players are introducing new and innovative products that can streamline operations in upstream bioprocessing. For instance, in October 2023, CDMO WuXi Biologics announced the launch of the novel bioprocessing platform WuXiUI, which is anticipated to boost the productivity of multiple CHO or other mammalian cell lines. Such product launches mark a significant advancement in the field of upstream bioprocessing.

The market is characterized by the high level of merger and acquisition activities undertaken by several industry players. This is due to several factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. Some of the players undergoing mergers and acquisitions in the industry include Getinge, Repligen Corporation, Sartorius AG, SaniSure, etc.

Regulations play a significant role in shaping upstream bioprocessing practices within the biopharmaceutical industry. Regulatory bodies such as the FDA (Food and Drug Administration), EMA (European Medicines Agency), and the Medicines and Healthcare Products Regulatory Agency (MHRA) set stringent guidelines to ensure product safety, efficacy, and quality. These regulations impact various aspects of upstream processing.

Numerous industry players are focusing on expanding their product & service portfolio. They are launching novel equipment, thereby propelling market growth. For instance, in July 2023, Trelleborg Healthcare and Medical launched the BioPharmaPro family of advanced products and services for fluid path single-use equipment to boost the development of advanced therapies.

The industry is currently witnessing a high level of regional expansion, with growth prospects driven by an expanding customer base for upstream bioprocessing products & services. Increasing prevalence of diseases and the emergence of novel therapeutics against them further expedite the expansion of the biopharmaceutical industry.

Product Insights

The bioreactors/fermenters segment dominated the industry, accounting for a market share of 31.2% of the global revenue in 2023. This is due to the robust product offering by the key companies under this product category. Major companies are pivotal in developing bioprocessing equipment, including bioreactors, for various applications in biological research and therapeutic fields, which is expected to drive the segment. For instance, in September 2023, Getinge launched AppliFlex ST GMP, a single-use bioreactor for clinical gene and cell treatments, along with mRNA production. On the other hand, an increase in the number of installations of disposable bioreactors by market vendors is also anticipated to augment the segment growth. Furthermore, key companies continue to invest in the development of this segment for advancements. One such advancement includes the application of automated microscale bioreactors, which are cost-reducing alternatives for assessing drug production.

The cell culture products segment is expected to witness the highest CAGR over the forecast period. This can be attributed to the increasing usage of recombinant Chinese Hamster Ovary (CHO) cell lines by pharmaceutical companies. Well-established biopharmaceutical companies manage to produce their cell lines by using their proprietary cell line platform. This enables the companies to integrate recombinant cell line production for bio manufacturing with a streamlined screening process.

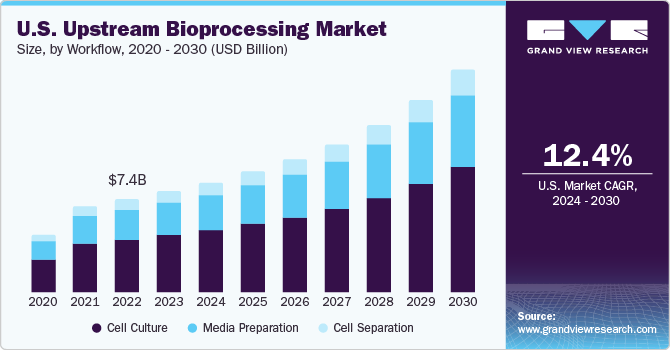

Workflow Insights

The cell culture segment accounted for the largest revenue share of 56.2% in 2023 and is anticipated to retain its dominance over the forecast period. Upstream bioprocesses have witnessed improved productivity due to a rise in cell line productivity. The preparation of high-productivity cultures involves the usage of smaller bioreactors, incurring lower capital and operating costs. Moreover, the time required to select the cells with higher productivity is expected to be minimized due to continuous advancements in better understanding of recombinant engineering of production cells. Hence, key companies are investing in cell culture development technologies. For instance, in July 2023, MilliporeSigma announced the facility expansion in Lenexa, Kansas, adding 98,000 square feet of production capability and lab space to manufacture cell culture media.

The media preparation segment is projected to witness the fastest growth rate from 2024 to 2030. Technicians focus on preparing media with exacting components required for each specific bioreactor stage of scale-up, from inoculum to cell separation. The prepared media comprises various major components, such as nitrogen, fats, carbohydrates, and trace amounts of salt. Media components are often offered in powdered form, which is further mixed with a high-purity grade Water for Injection (WFI). Furthermore, media preparation is carried out in carboys, tanks, bottles, or bags, where media components are mixed homogeneously and thoroughly before introducing cells into the culture.

Use Type Insights

The multi-use systems segment dominated the market with a share of 54.9% in 2023 in terms of revenue generation. Multi-use equipment is widely adopted for large commercial bioprocesses of biopharmaceuticals. This equipment are associated with a lower risk of leakage & bag breakage, which is a common issue about single-use equipment. Furthermore, low environmental impact and the requirement of a one-time investment for installing these systems are the other factors driving the multi-use segment growth.

The single-use segment is anticipated to grow at the fastest CAGR over the forecast period. Commercial biopharmaceutical manufacturing plants use single-use bioreactors for economical and feasible bioprocessing. Compared with stainless steel bioreactors, the major advantages are that Single-use systems (SUS) are available as sterile equipment and these systems eliminate the need for sterilization & cleaning steps and other plumbing required for bioprocessing facilities.

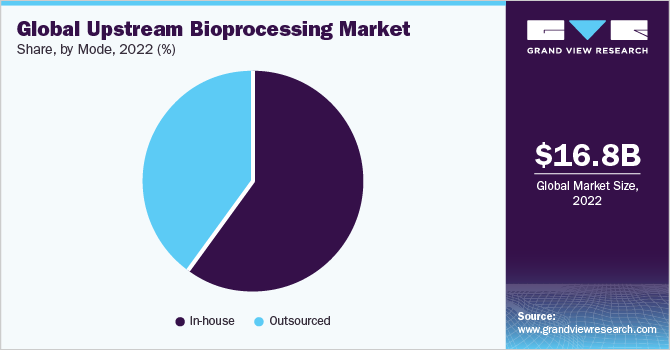

Mode Insights

The in-house segment dominated the market with the largest revenue share of 58.8% in 2023. Several well-established pharmaceutical & biotechnology companies can perform in-house bio manufacturing processes. Major companies are actively involved in Research & Development (R&D) to develop advanced and high-quality products. Moreover, increasing investments by leading players are expected to boost the upstream bioprocessing capacities in their facilities.

The outsourced segment is expected to grow at the highest CAGR over the forecast period due to the focus of drug manufacturers on cost-efficient productivity. Several Contract Manufacturing Organizations (CMOs) offer specialized and specific technical services that numerous companies may need to improve their facilities. Several studies have observed that numerous key players are increasing their spending on outsourced biopharmaceutical manufacturing. Moreover, companies are outsourcing bioprocesses to gain technical and strategic benefits.

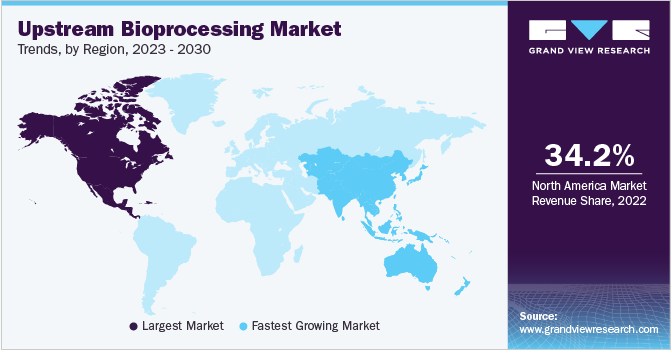

Regional Insights

North America dominated the market and accounted for a share of 36.2% in 2023. The region experiences market growth as bio manufacturers attempt to rationalize the processes and accelerate the growth of the market, the advantages associated with single-use systems position them as a foundation of modern bioprocessing strategies, driving innovation and efficiency across the industry.

Furthermore, the presence of key players like Thermo Fisher Scientific, Inc., Corning Incorporated, Danaher, VWR International, LLC, Repligen Corporation, and Entegris in the U.S. market is expected to support the regional expansion.

U.S. Upstream Bioprocessing Market Trends

The market in the U.S. is expected to grow over the forecast period as key companies are engaged in several business initiatives to advance in bioprocessing and strengthen their market position. For instance, in April 2023, Cytiva, a Danaher company, launched X-platform bioreactors.

Europe Upstream Bioprocessing Market Trends

Europe is identified as a lucrative region in this industry. This is attributed to the adoption of single-use technologies, process improvements, and the increasing demand for high-quality biologic pharmaceuticals.

Germany upstream bioprocessing market is witnessing substantial growth rate. Germany is home to several established bioprocessing industry participants who have ensured easy access to novel upstream bioprocessing equipment for researchers and healthcare professionals in the country.

The upstream bioprocessing market in the UK is driven by the presence of numerous bioprocessing companies, such as Thermo Fisher Scientific Inc., ESI Ultrapure, and IDBS, among others. These companies undertake various business initiatives to gain market share, contributing to the market growth in the country. For instance, in November 2023, Lonza, a well-known biotechnology company, announced the purchase of a plot in the UK. This purchase is expected to offer additional development potential and would enable Lonza to expand in the UK market.

The upstream bioprocessing market in France is expected to grow over the forecast period as various companies operating in the market are keen on exploring lucrative opportunities offered by France and are subsequently undertaking initiatives. Furthermore, companies in the country are supported by receiving grants from various organizations. For instance, in December 2023, Naobios, a France-based CDMO delivering GMP production of clinical sets of products based on virus and bioprocess development, received a grant of USD 1.87 million (Euro 1.7million) from the Bill & Melinda Gates Foundation to support vaccine development.

Asia Pacific Upstream Bioprocessing Market Trends

Asia Pacific is expected to be the fastest-growing region in the market and is expected to grow at a CAGR of 17.4% during the forecast period. The regional market is expected to be driven by the increasing research & development in the field of therapeutics, and the growing number of biopharmaceutical companies. Moreover, the comparatively lower cost of drug manufacturing and development is a key factor that attracts European and North American bioprocessing companies to invest in this regional market. In addition, affordable labor costs, increasing focus on skilled professionals, and a large patient pool are some of the other factors contributing to the region’s fastest growth rate.

The Japan upstream bioprocessing market is expected to witness a rapid growth over the forecast period due to the increasing preference for automated upstream technologies to minimize human interference. Japanese laboratories observe a very distinct R&D approach for bioprocess engineering in upstream technologies, including recombinant protein development in animal and bacterial cells. Instead of emphasizing on incorporation of basic engineering principles, local healthcare professionals are more inclined toward making use of biological engineering principles that include medium development, screening, and selection.

The upstream bioprocessing market in China is expected to grow at the fastest CAGR over the forecast period due to the robust increase in biopharmaceutical manufacturing capacity in the country. In addition, the strong growth of mAb therapeutics industry is anticipated to create opportunities for expansion in the market. In the near future, the demand for new bioprocessing facilities is expected to significantly increase, with high demand for bioreactors having a capacity of more than 100,000 L.

The India upstream bioprocessing market is anticipated to grow at a rapid rate over the forecast period due to the robust growth of the country’s bio-economy. The country recorded a double-digit year-on-year growth rate for the past 9 years, which is further expected to drive the country to become one of the top five global bio-manufacturing hubs by 2025.

Middle East And Africa Upstream Bioprocessing Market Trends

The MEA market holds the lowest market revenue share, as this industry is in a nascent stage in the current global scenario. However, growing awareness about biopharmaceuticals, especially biosimilar products, in this region is expected to drive the demand for upstream processes.

The upstream bioprocessing market in Saudi Arabia is poised to witness significant developments. The Saudi Arabian government and market players are undertaking several initiatives in the biotechnology sector and vaccine development, which is expected to drive the market in the country. For instance, in October 2022, the Ministry of Investment of Saudi Arabia (MISA) and Ginkgo Bioworks, representing the Kingdom of Saudi Arabia, formally entered into a non-binding MoU. This collaboration aimed to advance biotechnology and biosecurity capabilities to implement innovative public health initiatives in the Kingdom of Saudi Arabia.

The UAE upstream bioprocessing market is witnessing broadening applications of biopharmaceutical products, which are expected to boost the adoption of these products, consequently increasing the demand for upstream bioprocessing products. Strategic initiatives adopted by companies to commercialize biopharmaceutical products in the country support market growth.

Key Upstream Bioprocessing Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships play a key role in propelling market growth.

Key Upstream Bioprocessing Companies:

The following are the leading companies in the upstream bioprocessing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Corning Incorporated

- Sartorius AG

- Eppendorf AG

- Danaher

- Boehringer Ingelheim GmbH

- Applikon Biotechnology

- PBS Biotech, Inc.

- Lonza

- VWR International, LLC

- Meissner Filtration Products, Inc.

- Repligen Corporation

- Entegris

- Kuhner AG

Recent Developments

-

In October 2023, Getinge announced an agreement to acquire the complete shares of Purity New England, Inc. Purity New England Inc. is a market leader in single-use technologies for bioprocessing applications.

-

In June 2023, PIF initiated Lifera, a CDMO in Saudi Arabia, to advance local biomanufacturing, targeting vaccines, insulins, plasma therapeutics, mAbs, CGTs, and small molecules.

-

In June 2023, Cytiva collaborated with Culture Biosciences to provide advanced upstream bioprocessing solutions to ensure the use of an in-silicon approach and digitalization, along with virtual monitoring with control experiments. This collaboration is anticipated to boost the usage of digital technologies in bioprocessing for flexible, fast, and cost-effective scaling.

-

In May 2023, Entegris and Agilitech collaborated to transform single-use technologies. Agilitech offers highly scalable, flexible, and future-proof single-use technologies for bioprocessing.

-

In April 2023, Merck KGaA launched Ultimus, a single-use process container film, to provide superior strength & leak resistance in single-use assemblies.

Upstream Bioprocessing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.55 billion

Revenue forecast in 2030

USD 59.24 billion

Growth Rate

CAGR of 14.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, workflow, use type, mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Norway; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; Corning Incorporated; Sartorius AG; Eppendorf AG; Danaher; Boehringer Ingelheim GmbH; Applikon Biotechnology; PBS Biotech, Inc.; Lonza; VWR International, LLC; Meissner Filtration Products, Inc.; Repligen Corporation; Entegris; Kuhner AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Upstream Bioprocessing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global upstream bioprocessing market report based on product, workflow, use type, mode, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bioreactors/Fermenters

-

Cell Culture Products

-

Filters

-

Bioreactors Accessories

-

Bags & Containers

-

Others

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Media Preparation

-

Cell Culture

-

Cell Separation

-

-

Use Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Multi-use

-

Single-use

-

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourced

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global upstream bioprocessing market size was estimated at USD 24.12 billion in 2023 and is expected to reach USD 26.55 billion in 2024

b. The global upstream bioprocessing market is expected to grow at a compound annual growth rate of 14.31% from 2024 to 2030 to reach USD 59.24 billion by 2030.

b. The multi-use systems segment dominated the upstream bioprocessing market with a share of 54.85% in 2023 in terms of revenue generation. Multi-use equipment is widely adopted for large commercial bioprocesses of biopharmaceuticals.

b. Some key players operating in the upstream bioprocessing market include Thermo Fisher Scientific, Inc.; Merck KGaA; Corning Incorporated; Sartorius AG; Eppendorf AG; Danaher; Boehringer Ingelheim GmbH; Applikon Biotechnology; PBS Biotech, Inc.; Lonza; VWR International, LLC; Meissner Filtration Products, Inc.; Repligen Corporation; Entegris; and Kuhner AG

b. Key factors that are driving the upstream bioprocessing market growth include the advantages associated with the implementation of single-use technology in the biomanufacturing process, increasing demand for biopharmaceuticals, and rising outsourcing of biopharmaceutical manufacturing

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.