- Home

- »

- Automotive & Transportation

- »

-

Asia Automotive Camshaft Market Size, Industry Report 2030GVR Report cover

![Asia Automotive Camshaft Market Size, Share & Trends Report]()

Asia Automotive Camshaft Market Size, Share & Trends Analysis Report By Engine (Inline Engine, V-Engine, Others), By Fuel, By Manufacturing Technology, By Vehicle, By Sales Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-342-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Asia Automotive Camshaft Market Trends

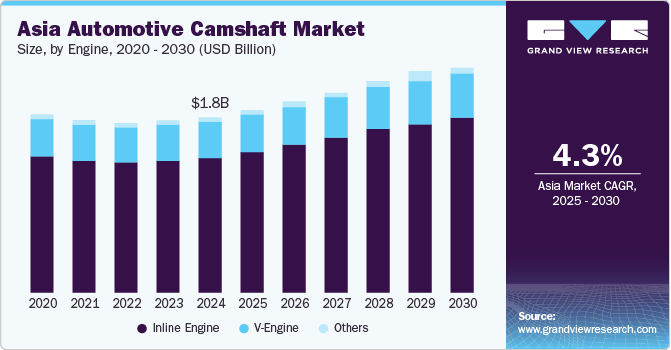

The Asia automotive camshaft market size was valued at USD 1.84 billion in 2024 and is projected to grow at a CAGR of 4.3% from 2025 to 2030. The growth of this market is primarily influenced by the factors such as increasing sales of passenger cars and commercial vehicles, coupled with the adoption of double overhead camshaft engines in passenger cars. Moreover, stringent government regulations associated with carbon emissions have forced automotive OEMs to adopt lightweight engines, which are anticipated to boost product demand shortly. Automotive engine manufacturers are increasing the number of valves in the engine to enhance the volumetric efficiency and power output of engines, which can be achieved using a double overhead camshaft.

A double overhead camshaft incorporates four valves for each cylinder, two exhausts, and two intakes. Using four valves per cylinder allows for a more effortless flow of gases and fuel, both in and out of the cylinder, thus increasing the vehicle's performance, particularly at high speeds. Therefore, the rise in the adoption of double overhead camshaft engines is likely to fuel the market growth over the forecast period.

Increasing vehicle production in the Asia Pacific region, cost-effective manufacturing, positive government regulations that promote the region's manufacturing activities, and growing demand for replacement engines are projected to add numerous growth opportunities. In addition, the robust automotive industry, with the presence of multiple foreign and domestic participants, has been contributing to the growth of this market in recent years. According to Organisation Internationale des Constructeurs d’Automobiles (OICA) correspondents survey world motor vehicle production, nearly 93 million vehicles were manufactured in 2023 worldwide.

Engine Insights

The inline engine segment dominated the Asia automotive camshaft industry with a revenue share of 77.0% in 2024. The cost-effectiveness of inline engine vehicles, performance efficiency, and adaptability to changing environments are primarily adding growth to this segment. Inline engines produce fewer vibrations and offer quieter driving experience than other vehicles. This has significantly influenced customer preferences in recent years and developed a surge in demand for small & compact, lightweight & economical, and more fuel-efficient engines. Inline engines are the most common in hatchbacks, SUVs, and trucks. L3, L4, and L6 are Asia's most preferred engine configurations.

The V-engine segment is projected to experience moderate growth over the forecast period. V-engines are generally used in premium, luxury, and sports cars. The increasing demand for premium and luxury cars across emerging economies, such as China and India, is expected to support the growth of this segment. However, high costs and complex designs could restrict the segment’s growth over the forecast period.

Fuel Insights

The gasoline segment held the largest revenue share of the Asia automotive camshaft industry in 2024. Gasoline cars comply with most countries’ emission regulations. They are efficient and emit fewer gases compared to their diesel counterparts. Rising demand for gasoline across countries, including China and India, is anticipated to drive the segment's growth. Increasing awareness regarding the carbon footprint and growing efforts by governments and organizations to reduce carbon emissions are adding to the growth of this segment.

The diesel segment is anticipated to expand with a steady growth rate across the forecast period. Diesel cars are still in high demand due to the high compression ratio, which allows for better efficiency than gasoline engines. A diesel engine is more straightforward than a gas engine as it has no associated electrical system and the spark plugs needed for it. Growth of this segment is driven by factors such as the large number of existing diesel vehicles in use, ease of accessibility and availability, extensive utilization in the commercial sector, fuel efficiency, and comparatively less maintenance costs associated with diesel vehicles. In addition, factors such as replacements of older engines, emission standard regulations, and inclination towards achieving enhanced performances are adding growth opportunities for this market.

Manufacturing Technology Insights

The cast camshaft segment dominated the Asia automotive camshaft market in 2024. Cast camshafts offer several advantages, such as dimensional accuracy and smooth surface finish. Government regulations focused on pollution control and the ease of availability associated with chilled cast iron drive the growth in the utilization of cast camshafts. Additionally, vast supply chain networks facilitated by large-scale production of cast camshafts in Asia add to the enhanced accessibility of cast camshafts.

The assembled camshaft segment is expected to witness the fastest growth over the forecast period owing to its cost-effectiveness and lightweight nature. These camshafts are robust and durable, resulting in the optimized performance of the overall powertrain, thereby improving the vehicle’s fuel efficiency. Furthermore, the process leads to higher tensile strength and allows for higher flexibility to optimize all components in terms of cost, material, and performance in the manufacturing process. According to MAHLE GmbH, assembled camshafts are 45% lighter than cast and forged camshafts. However, cast and forged camshafts would not phase out completely due to their heavy-duty vehicle applications.

Vehicle Insights

The passenger cars segment held the largest revenue share of the Asia automotive camshaft market in 2024. This is attributed to increasing vehicle fleets and rising per capita vehicles in the continent. According to The European Automobile Manufacturers’ Association, or ACEA, China produces nearly 34.0% of the worldwide car production each year. Large-scale adoption of passenger cars by individual and commercial users and increasing availability facilitated by the entry of multiple global automotive enterprises are assisting the growth of this segment. Significant enhancements in roads and transportation infrastructure in Asia are projected to add growth opportunities.

The commercial cars segment is expected to experience significant growth from 2025 to 2030. Growing demand for commercial vehicles is driven by increasing trade in Asia, and the focus of commercial car owners on performance enhancements and ease of availability facilitated by the vast distribution networks are fueling the growth. Awareness regarding emissions control is also expected to drive the demand for this segment.

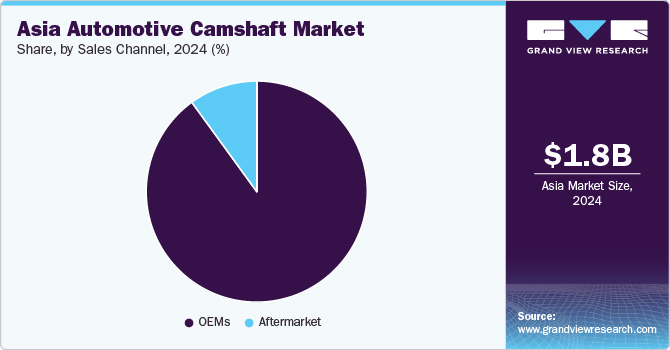

Sales Channel Insights

OEMs segment dominated the Asia automotive camshaft industry in 2024. The growth of this segment is mainly driven by the integration of camshafts during the vehicle manufacturing stage. OEMs comprise vehicle manufacturers such as Volkswagen AG, General Motors, and BMW Motorrad. The camshafts offered by OEMs are highly durable and preferred by customers as their first purchase choice. The authenticity of the products provided by the OEMs and ease of accessibility supported by effective distribution are also contributing to the growth of this segment.

Aftermarket refers to the secondary market, which includes distributing, manufacturing, installing, and retailing all vehicle accessories and parts after the vehicle is sold. The aftermarket segment is anticipated to expand at a significant CAGR over the forecast period, owing to a significant rise in demand for automotive products at affordable rates and through hassle-free processes. Trends such as engine downsizing also contribute to the development of this segment. Additionally, the growing adoption of variable valve timing (VVT) systems and wear-downs over the years are expected to drive demand in the coming years.

Regional Insights

East Asia dominated the Asia automotive camshaft industry with a revenue share of 42.5% in 2024. This market is primarily driven by the robust automotive manufacturing industry in Greater China, Japan, and South Korea. Manufacturers in the region, such as Engine Power Components Inc., MAHLE GmbH, and others, add significant growth opportunities to this market. Greater China held the largest revenue share of the region owing to the large number of automotive manufacturers in the country. It is home to multiple well-applauded automotive brands such as BYD Company Ltd., Geely Auto, SAIC Motor Corporation Limited, and others. The increasing contribution of Chinese manufacturers to global car production and their focus on adopting technological advancements and innovation are adding to the growth potential of this market.

South Asia automotive camshaft market is projected to experience notable growth from 2025 to 2030. Increasing infrastructural enhancements in India, the focus of multiple commercial vehicle owners on ensuring performance enhancement, and rising availability facilitated by the vast distribution networks are adding to the growth. The presence of numerous automotive manufacturers in India, large-scale utilization of passenger cars in urban areas, and continuous increase in awareness regarding carbon footprint are expected to drive demand during the forecast period.

Key Asia Automotive Camshaft Companies:

- Engine Power Components, Inc.

- Guangzhou Disong Machinery Equipment Co., Ltd.

- Guizhou MEC, Inc.

- India Pistons Ltd. (IPL)

- MAHLE GmbH

- Musashi Seimitsu Industry Co., Ltd.

- PCL India

- thyssenkrupp AG

- Ruich Value (Shenyang) Tech. Co., Ltd.

- Shijiazhuang Jingshi New Material Science and Technology Co.,ltd

Key Asia Automotive Camshaft Company Insights

Some of the key companies in the Asia automotive camshaft market are Engine Power Components, Inc., MAHLE GmbH, PCL India, Thyssenkrupp AG, and others. Major market participants are embracing strategies such as innovation, technology advancements, product launches, collaboration with other organizations, and more to address significant competition increases.

-

Engine Power Components, Inc., a company that specializes in balanced shafts and engine camshafts, has a presence across multiple regions with facilities in Mexico, Spain, and the U.S. Its key alliances in India and China enable it to enhance its presence in Asia automotive camshafts industry. It uses various materials for its product development, including chilled grey iron, chilled ductile iron, cast iron, and more.

-

MAHLE GmbH is a German manufacturer of Engine Systems and Components, pump systems, filters, oil coolers, and other products. It also offers effective thermal management solutions and operates in the Electronic and mechatronics components business.

Asia Automotive Camshaft Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.91 billion

Revenue forecast in 2030

USD 2.35 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Engine, fuel, manufacturing technology, vehicle, sales channel, region

Regional scope

South Asia, South East Asia, East Asia, Central Asia, Western Asia

Country scope

India, Bangladesh, Singapore, Thailand, Vietnam, Greater China, Japan, South Korea, Central Asia, Western Asia

Key companies profiled

Engine Power Components, Inc.; Guangzhou Disong Machinery Equipment Co., Ltd.; Guizhou MEC, Inc.; India Pistons Ltd. (IPL); MAHLE GmbH; Musashi Seimitsu Industry Co., Ltd.; PCL India; thyssenkrupp AG; Ruich Value (Shenyang) Tech. Co., Ltd.; Shijiazhuang Jingshi New Material Science and Technology Co.,ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Automotive Camshaft Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the Asia automotive camshaft market report based on engine, fuel, manufacturing technology, vehicle, sales channel, and region:

-

Engine Outlook (Revenue, USD Million, 2018 - 2030)

-

Inline Engine

-

V-Engine

-

Others

-

-

Fuel Outlook (Revenue, USD Million, 2018 - 2030)

-

Diesel

-

Gasoline

-

-

Manufacturing Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Assembled Camshaft

-

Cast Camshaft

-

Forged Camshaft

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Cars

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEMs

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

South Asia

-

India

-

Bangladesh

-

-

Southeast Asia

-

Singapore

-

Thailand

-

Vietnam

-

-

East Asia

-

Greater China

-

Japan

-

South Korea

-

-

Central Asia

-

Western Asia

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."