- Home

- »

- Power Generation & Storage

- »

-

Asia Microgrid Market Size & Share, Industry Report, 2033GVR Report cover

![Asia Microgrid Market Size, Share & Trends Report]()

Asia Microgrid Market (2025 - 2033) Size, Share & Trends Analysis Report By Grid Connectivity (On Grid, Off Grid), By Source, By Offering, By Pattern, By Type, By Power Rating, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-677-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Microgrid Market Summary

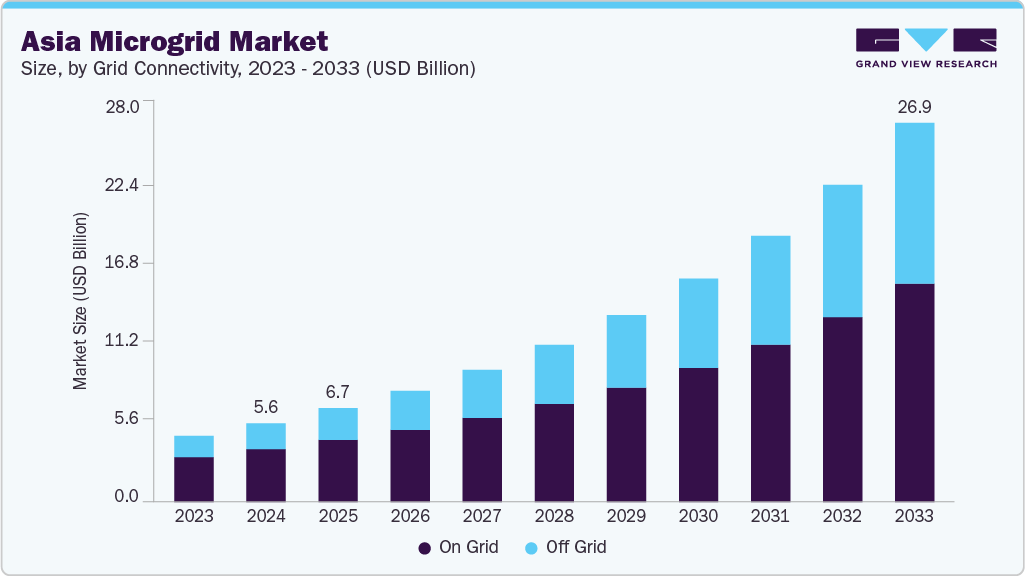

The Asia microgrid market size was estimated at USD 5.58 billion in 2024 and is projected to reach USD 26.92 billion by 2033, growing at a CAGR of 19.1% from 2025 to 2033. This growth is primarily fueled by rapid urbanization, growing energy access needs, and government mandates to increase the share of renewable energy across developing economies.

Key Market Trends & Insights

- East Asia Microgrid market held the largest share of 40.78 % of the Asia market in 2024.

- By grid connectivity, the on grid segment held the highest market share of 67.17% in 2024.

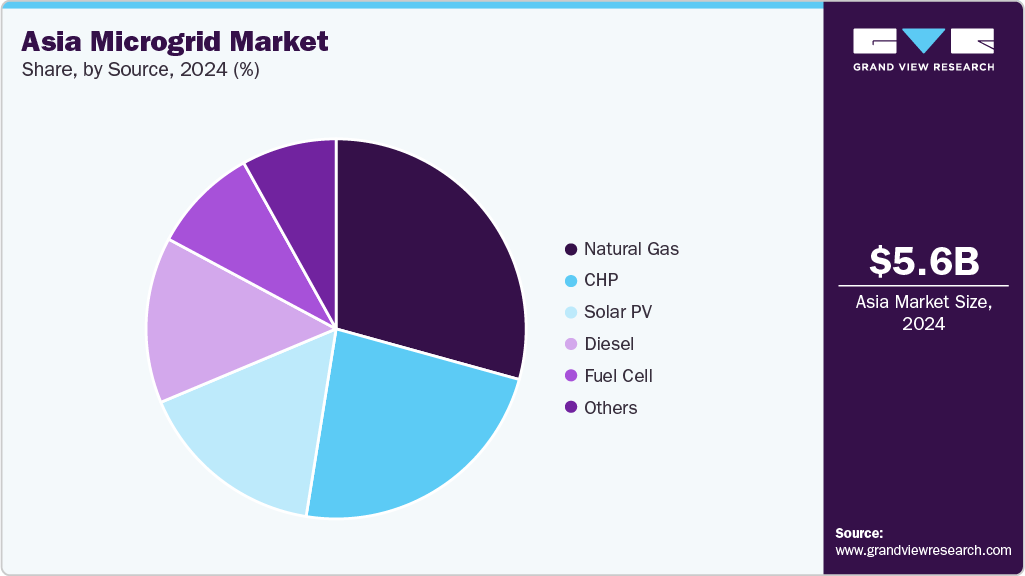

- By source, the solar PV segment led the Asia microgrid market with the largest market share of 29.03% in 2024.

- By the offering, the hardware segment led the Asia microgrid industry with the largest market share of 63.08% in 2024.

- By pattern, the urban / metropolitan segment led the Asia microgrid market with the largest market share of 42.63% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.58 Billion

- 2033 Projected Market Size: USD 26.92 Billion

- CAGR (2025-2033): 19.1%

With vast populations still lacking reliable electricity, particularly in South and Southeast Asia, microgrids are increasingly considered a strategic solution to bridge the electrification gap. Nations such as India, Bangladesh, Vietnam, and Myanmar are scaling up decentralized power systems to efficiently serve remote and underserved regions. Moreover, frequent natural disasters and the rising risk of grid instability push governments and utilities to adopt resilient and modular energy systems like microgrids. Technological advancements in lithium-ion batteries, AI-based grid monitoring, and hybrid solar-diesel systems enhance performance and cost-competitiveness.

Countries like Japan and South Korea also deploy urban microgrids for energy security and carbon neutrality goals. While high capital requirements and policy fragmentation remain key hurdles, supportive regulatory frameworks, international funding, and growing public-private collaboration are poised to transform the Asia microgrid industry into a key driver of the region’s sustainable energy transition.

Drivers, Opportunities & Restraints

The need for decentralized and resilient energy solutions in underserved and disaster-prone regions primarily drives the Asia microgrid market’s growth. Countries across Asia, particularly India, Indonesia, the Philippines, and Vietnam, are witnessing surging electricity demand from rural and rapidly urbanizing areas, where conventional grid infrastructure is often inadequate or cost-prohibitive. Microgrids, capable of operating independently or in conjunction with the main grid, offer a reliable and flexible solution for meeting localized energy needs. Additionally, increasing emphasis on integrating renewable sources like solar, wind, and biomass into energy systems is supported by favorable government policies, subsidies, and electrification mandates that collectively accelerate the adoption of microgrids. The region's susceptibility to typhoons, floods, and earthquakes further drives demand for energy systems that can withstand and recover from power disruptions.

Opportunities in the Asia microgrid industry are expanding due to advancements in modular system design, energy storage technologies, and intelligent control systems that improve efficiency and reduce lifecycle costs. Rising international investment, including concessional financing and climate funds, has unlocked greater potential for microgrid deployment in developing nations. Joint ventures between governments and private developers are also helping scale projects in off-grid and peri-urban areas. However, the market continues to face restraints such as high capital expenditure, long payback periods, and fragmented regulatory environments that vary widely across countries. The lack of skilled technicians and standardized interconnection protocols further complicates implementation. To address these challenges, targeted policy reforms, technical training programs, and harmonized regulations will be essential to sustain the market's growth trajectory across Asia.

Offering Insights

The hardware segment led the Asia microgrid industry with the largest market share of 63.08% in 2024. Hardware components, such as power generation units (solar PV panels, wind turbines, diesel gensets), energy storage systems (batteries), power conditioning equipment (inverters, converters), and control systems, form the backbone of microgrid installations. The growing deployment of renewable-integrated microgrids across Asia, particularly in rural and peri-urban areas, drives hardware demand significantly.

The dominance of the hardware segment is further reinforced by increasing investments in upgrading physical grid infrastructure and scaling up renewable generation capacity. Countries like India, China, and Indonesia focus on building resilient and modular energy systems, which require high-performance Hardware to ensure stability, energy efficiency, and remote operation capability. Moreover, ongoing advancements in battery technologies, power electronics, and smart sensors are enhancing the reliability and affordability of hardware solutions. Strategic partnerships between governments and technology providers also facilitate the large-scale rollout of hardware-intensive microgrid projects across the region. As Asia continues its push toward sustainable energy access and grid modernization, the hardware segment will remain at the forefront of market expansion.

Grid Connectivity Insights

In 2024, the on-grid segment held the dominant market share of 67.17%. On-grid microgrids, also known as grid-tied systems, are integrated with the central utility grid and are widely adopted in urban and industrial settings to enhance grid reliability, reduce electricity costs, and support renewable energy integration. Countries like China, Japan, and South Korea lead on-grid microgrid deployment, driven by strong policy support and ambitious decarbonization goals.

The popularity of on-grid microgrids stems from their ability to balance supply and demand dynamically, export surplus power back to the grid, and provide backup during outages. These systems are highly efficient for commercial and industrial consumers, offering economic benefits through peak load shaving, demand response participation, and grid services. With advancements in smart metering, real-time energy management systems, and distributed energy resources (DERs), on-grid microgrids are becoming more scalable and cost-effective. As urban centers across Asia aim to modernize grid infrastructure and strengthen energy security, on-grid microgrids are expected to play a pivotal role in the region’s evolving energy landscape.

Pattern Insights

The Urban / Metropolitan segment led the Asia microgrid market with the largest market share of 42.63% in 2024. The increasing demand for resilient, clean, and smart energy solutions in densely populated cities is driving the adoption of microgrids in urban settings. Cities across Asia, such as Tokyo, Seoul, Shanghai, and Mumbai, are investing heavily in distributed energy systems to reduce grid congestion, support electrification, and improve energy security amid rising consumption.

Urban microgrids are gaining momentum due to their ability to integrate multiple energy sources, optimize load balancing, and ensure uninterrupted power during peak demand or emergencies. These systems are especially valuable for critical infrastructure like hospitals, metro stations, data centers, and commercial complexes. As smart city initiatives expand across Asia, there is a growing emphasis on deploying intelligent, grid-connected microgrids equipped with real-time monitoring, demand-side management, and energy storage capabilities. The fusion of urbanization trends with decarbonization efforts is expected to boost the Urban / Metropolitan microgrid segment further, solidifying its role as a cornerstone in Asia's sustainable urban energy transition.

Type Insights

The AC microgrid segment dominated the Asia microgrid market with the largest market share of 48.13% in 2024. AC microgrids are widely adopted due to their compatibility with existing transmission and distribution infrastructure, making integration with the main grid more seamless. This type is particularly favored in both urban and rural electrification projects, as most electrical appliances and industrial equipment operate on alternating current.

The dominance of AC microgrids is further supported by their maturity, ease of scalability, and cost-effectiveness in handling long-distance power transmission. Countries like China, India, and South Korea increasingly deploy AC microgrids for applications ranging from community power supply and industrial parks to military bases and campus networks. Additionally, advances in AC-optimized energy management systems and control technologies are improving operational efficiency. As demand for stable, flexible, and grid-compatible power solutions continues to rise across Asia, AC microgrids remain the most preferred type in large-scale microgrid installations.

Power Rating Insights

The 1 MW to 5 MW segment led the Asia microgrid industry with the largest market share of 36.78% in 2024. This power range is ideally suited for various applications, including remote communities, commercial complexes, industrial facilities, and institutional campuses. It offers a balanced solution between scalability, reliability, and cost-effectiveness, making it the preferred choice for medium-sized microgrid projects across the region.

The growing demand for decentralized power systems that can operate independently and in conjunction with the main grid drives installations in the 1 MW to 5 MW category. Countries like India, Indonesia, and Thailand increasingly deploy microgrids in this range to support rural electrification and industrial cluster development. Furthermore, advancements in modular design and battery storage integration have made systems in this power range more adaptable and easier to deploy. As Asia continues to expand its renewable energy infrastructure and enhance energy access in underserved areas, the 1 MW to 5 MW power rating segment is expected to remain a key driver of market growth.

Application Insights

The commercial segment of the Asia microgrid market held the largest market share of 38.66% in 2024. The dominance of this segment is attributed to the increasing adoption of microgrids by commercial establishments such as office parks, shopping malls, hospitals, data centers, and educational institutions. These facilities require a reliable and uninterrupted power supply to maintain operations and avoid costly downtimes, making microgrids an attractive solution.

Commercial users benefit from the ability of microgrids to manage peak loads, integrate renewable energy sources, and reduce electricity costs through demand-side management. Urban areas across Asia are experiencing rapid commercial development, prompting businesses to invest in resilient and sustainable power infrastructure. Additionally, government incentives for clean energy adoption and grid support services are encouraging commercial property owners to implement microgrid systems. As the focus on energy efficiency, carbon reduction, and energy security intensifies, the commercial segment is expected to continue leading the market in terms of both deployment and investment.

End Use Insights

The institutes & campuses segment held the largest market share of 23.13% in 2024. Educational institutions, research centers, and universities across Asia increasingly adopt microgrids to ensure a reliable, efficient, and sustainable energy supply. These environments typically have stable, predictable energy demand and are ideal for demonstrating and testing advanced energy technologies, including solar PV, energy storage, and smart grid controls.

Institutes and campuses also benefit from the ability of microgrids to operate autonomously during grid outages, which enhances operational continuity and energy resilience. Many academic and research institutions also use microgrids as educational tools to support studies in renewable energy, engineering, and environmental science. Countries like India, China, and Japan are leading in this segment, supported by national programs and pilot projects to decarbonize large institutional facilities. As the push for sustainability and energy independence gains momentum, the Institutes & Campuses segment is expected to remain a key market growth driver.

Source Insights

The solar PV segment led the Asia microgrid market with the largest market share of 29.03% in 2024. The widespread adoption of solar PV in microgrid applications is driven by the region's abundant solar resources, decreasing module costs, and supportive government initiatives promoting solar electrification in remote and off-grid areas.

Solar PV-based microgrids are particularly favored in South and Southeast Asian countries such as India, Bangladesh, and Indonesia, where sunlight availability is high and grid infrastructure is limited. These systems are relatively easy to deploy, modular in design, and require minimal operational input, making them ideal for rural communities. Furthermore, integration with battery storage systems enhances reliability, allowing a continuous power supply even during non-sunny hours. As countries aim to meet their renewable energy targets and expand access to clean electricity, solar PV microgrids are expected to play a central role in the region's decentralized energy transition.

Regional Insights

The Asia microgrid market is witnessing robust growth, driven by the region’s vast and diverse geography, growing energy demand, and government initiatives to improve electrification in remote areas. Rapid economic development and increasing environmental awareness fuel investments in clean, decentralized energy solutions. Countries across Asia are leveraging microgrids to enhance energy access, reduce carbon emissions, and strengthen grid resilience against climate-related disruptions. Integrating solar PV, wind, and energy storage systems in hybrid microgrid setups is becoming increasingly common, supported by favorable policy frameworks and international funding for renewable projects.

East Asia Microgrid Market Trends

East Asia held the largest share of the Asia microgrid industry in 2024, driven by extensive deployment across China, Japan, and South Korea. China leads the region with widespread investments in urban microgrids, industrial zones, and rural electrification projects, supported by strong government policies and state-backed utilities. The country is aggressively expanding its renewable energy footprint and integrating energy storage and smart control systems into microgrid networks to enhance grid flexibility and reliability. Japan and South Korea are also key contributors, focusing on microgrid solutions for disaster resilience, carbon neutrality, and smart city initiatives. With advanced technological infrastructure and substantial public-private investments, East Asia continues to dominate the regional microgrid landscape.

South Asia Microgrid Market Trends

The South Asia microgrid industry’s growth is primarily propelled by the need to bridge energy access gaps in rural and underserved communities. India is the frontrunner in this region, with extensive rural electrification programs and public-private partnerships targeting microgrid development. The country is deploying solar-based and hybrid microgrids in remote villages, supported by state and central government initiatives. Bangladesh and Nepal are also adopting microgrids to power off-grid regions and reduce reliance on diesel generation. As affordability and technical know-how improve, microgrids become a key solution for South Asia’s long-term energy sustainability.

Southeast Asia Microgrid Market Trends

Southeast Asia is emerging as a high-potential microgrid market due to its archipelagic geography, frequent natural disasters, and large off-grid population. Countries like Indonesia and the Philippines are leading deployment efforts, focusing on solar-diesel hybrid systems and battery storage to power islands and remote communities. Vietnam, Thailand, and Malaysia also invest in microgrids to enhance energy resilience and integrate renewable energy into their national grids. Support from multilateral organizations and donor-funded initiatives is accelerating pilot projects and scaling efforts across the region, positioning Southeast Asia as a key contributor to Asia’s decentralized energy transformation.

Key Asia Microgrid Company Insights

Some of the key players operating in the Asia microgrid market include ABB (Hitachi ABB Power Grids), Schneider Electric, Siemens, Hitachi Energy, General Electric (GE), Eaton, Honeywell International, CleanGrid Partners, OMC Power, and Sindicatum.

-

In February 2024, General Electric (GE) unveiled a new suite of modular microgrid controllers equipped with AI-based load forecasting and renewable integration tools. The controllers are aimed at improving efficiency and scalability in urban and island grid applications across Asia.

-

In January 2024, Schneider Electric launched its next-generation EcoStruxure Microgrid Flex platform in Southeast Asia. The platform is designed for quick deployment in commercial and industrial facilities. The solution supports seamless integration of solar, battery storage, and demand-side management tools, helping businesses reduce their carbon footprints and energy costs.

Key Asia Microgrid Companies:

- ABB (Hitachi ABB Power Grids)

- Schneider Electric

- Siemens

- Hitachi Energy

- General Electric (GE)

- Eaton

- Honeywell International

- CleanGrid Partners

- OMC Power

- Sindicatum

Asia Microgrid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.66 billion

Revenue forecast in 2033

USD 26.92 billion

Growth rate

CAGR of 19.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, volume in MW, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Grid connectivity, source, offering, pattern, type, power rating, application, end use, region

Regional scope

East Asia; South Asia; Southeast Asia

Country scope

China; South Korea; Japan; Taiwan; India; Vietnam; Malaysia; Indonesia; Singapore; Thailand

Key companies profiled

ABB (Hitachi ABB Power Grids); Schneider Electric; Siemens; Hitachi Energy; General Electric (GE); Eaton; Honeywell International; CleanGrid Partners; OMC Power; Sindicatum

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Microgrid Market Report Segmentation

This report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Asia microgrid market report based on grid connectivity, source, offering, pattern, type, power rating, application, end use, and region.

-

Grid Connectivity Outlook (Volume, MW; Revenue, USD Million, 2021 - 2033)

-

On Grid

-

Off Grid

-

-

Source Outlook (Volume, MW; Revenue, USD Million, 2021 - 2033)

-

Natural Gas

-

CHP

-

Solar PV

-

Diesel

-

Fuel Cell

-

Others

-

-

Offering Outlook (Volume, MW; Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Pattern Outlook (Volume, MW; Revenue, USD Million, 2021 - 2033)

-

Urban / Metropolitan

-

Semi Urban

-

Rural / Island

-

-

Type Outlook (Volume, MW; Revenue, USD Million, 2021 - 2033)

-

AC Microgrid

-

DC Microgrid

-

Hybrid Microgrid

-

-

Power Rating Outlook (Volume, MW; Revenue, USD Million, 2021 - 2033)

-

Less than 1 MW

-

1 MW to 5 MW

-

6 MW to 10 MW

-

Above 10 MW

-

-

Application Outlook (Volume, MW; Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

End Use Outlook (Volume, MW; Revenue, USD Million, 2021 - 2033)

-

Remote Areas

-

Military

-

Government

-

Utilities

-

Institutes & Campuses

-

Healthcare

-

-

Regional Outlook (Volume, MW; Revenue, USD Million, 2021 - 2033)

-

Asia

-

East Asia

-

China

-

South Korea

-

Japan

-

Taiwan

-

-

South Asia

-

India

-

-

Southeast Asia

-

Vietnam

-

Malaysia

-

Indonesia

-

Singapore

-

Thailand

-

-

-

Frequently Asked Questions About This Report

b. The Asia microgrid market size was estimated at USD 5.58 billion in 2024 and is expected to reach USD 6.66 billion in 2025.

b. The Asia microgrid market is expected to grow at a compound annual growth rate of 19.1% from 2025 to 2033 to reach USD 26.92 billion by 2033.

b. East Asia dominated the Asia microgrid market 2024, accounting for the largest regional share of 48%. Significant investments and large-scale deployments in countries such as China, Japan, and South Korea primarily drive this leadership.

b. Some of the key vendors in the Asia microgrid market include ABB (Hitachi ABB Power Grids), Schneider Electric, Siemens, Hitachi Energy, General Electric (GE), Eaton, Honeywell International, CleanGrid Partners, OMC Power, and Sindicatum.

b. The key factors driving the growth of the Asia microgrid market include the rising need for a reliable and resilient power supply, especially in remote and underserved regions, and the increasing integration of renewable energy sources such as solar and wind. Asian governments actively promote decentralized energy systems to enhance energy access, reduce transmission losses, and meet sustainability targets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.