- Home

- »

- Pharmaceuticals

- »

-

Asia Pacific Astaxanthin Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Astaxanthin Market Size, Share & Trends Report]()

Asia Pacific Astaxanthin Market Size, Share & Trends Analysis Report By Product (Oil, Softgel, Liquid), By Source (Natural, Synthetic), By Application (Aquaculture & Animal Feed), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-301-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

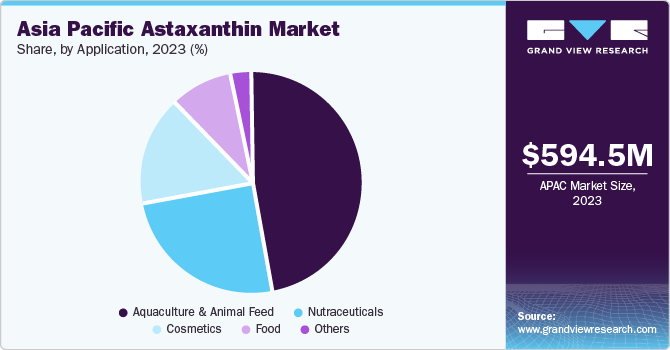

The Asia Pacific astaxanthin market size was estimated at USD 594.5 million in 2023 and is expected to grow at a CAGR of 18.8% from 2024 to 2030. Increasing adoption of natural astaxanthin in industries, such as aquaculture, animal feed, nutraceuticals, food & beverages, pharmaceuticals, and cosmetics, is one of the key driving factors for projected growth. In addition, increasing production and export of the fisheries industry in China, positive industry trends inalgae extraction & end-product formulation, and entry of new players in the APAC market have resulted in the growing product demand.

The Asia Pacific astaxanthin market held a share of 25.4% of the global astaxanthin market revenue in 2023. In recent years, several market participants have identified multiple opportunities in the APC regional market for astaxanthin production and distribution. Fish production and export from China play a vital role in the projected growth of astaxanthin. According to the “2024 China Fishery Products Report” prepared by the Foreign Agriculture Service of the U.S. Department of Agriculture, China continued its dominance in seafood production in 2023. An official estimated production was 71 million metric tons (MMT), with a 3.5% increase from 2022. The use of astaxanthin to enhance the color of salmon, krill and other ornamental fish has been driving demand in this market.

Source Insights

The natural astaxanthin segment held the largest revenue share of 55.0% in 2023. Some of the natural sources of astaxanthin are yeast, algae, salmon, shrimp, trout, crayfish, and krill. Haematococcus pluvialis is considered one of the finest sources of natural astaxanthin. Natural astaxanthin has greater demand in industries, such as food, animal feed, pharmaceuticals, and nutraceuticals.

It is expected to experience the fastest CAGR of 21.4% from 2024 to 2030. Owing to its capability to enrich skin health, it is comprehensively incorporated as the key ingredient in the preparation of several cosmetic offerings. The estimated growth can be attributed to the rising adoption of natural astaxanthin in the treatments and cures related to complicated diseases, such as hypercholesterolemia, cancer, Alzheimer’s, stroke, and Parkinson’s.

Product Insights

The dried algae meal or biomass segment held the largest share of 25.1% from 2024 to 2030. A dried algae meal is a dry mix of algae cells, molasses, glutinous concentrate of corn solubles, and ethoxyquin. Astaxanthin biomass is also used for feed production to enhance the coloration of salmon, shrimp, trout, and other aquatic as well as poultry animals. In recent years, several key companies have been launching new products to enhance their portfolios. This has driven market growth in the region.

The softgel segment is expected to experience a lucrative CAGR of 19.4% from 2024 to 2030. This segment growth is largely driven by the budding acceptance of astaxanthin-based softgels. Veggie softgels, created from glycerin and modified cornstarch, are preferred by nutraceutical suppliers due to their herbal origin and least adverse effects. Many buyers prefer astaxanthin-based softgels to nurture and enhance skin health and eyesight.

Application Insights

The aquaculture and animal feed segment dominated the market and held the largest revenue share of 46.6% in 2023. It is increasingly used as one of the prime ingredients in the coloration of fish, development of nutraceuticals, cosmetic formulations, food & beverage production, and treatment of various diseases. The key application of natural astaxanthin is in the development of dietary supplements.

The nutraceuticals segment is anticipated to experience a remarkable CAGR of 19.8% from 2024 to 2030. The segment growth can attributed to the demand for astaxanthin-based nutritional supplements. In addition, an increase in awareness regarding the powerful antioxidant activity of astaxanthin has led to its inclusion in the formulation of multiple dietary supplements. Deficiencies of essential nutrients, the sedentary nature of lifestyle in urbanized areas, and the rising geriatric population are expected to generate higher demand for nutraceuticals in the coming years.

Country Insights

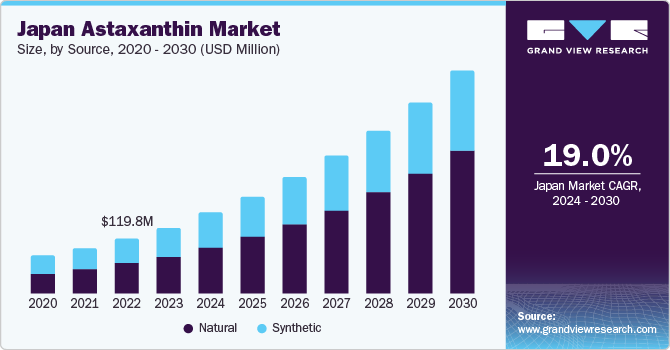

Japan Astaxanthin Market Trends

The Japan astaxanthin market held the largest revenue share of 24.6% in 2023. A variety of factors driving the growth of this market include the large production of nutraceuticals in the country, new natural astaxanthin therapies offered by key players, a growing geriatric population, and high consumption of fish. The presence of prominent companies, such as Fuji Chemical Industries Co., Ltd., ENEOS Techno Materials Corporation, BASF SE, and BGG Japan Co., Ltd. (BGG WORLD), also support market growth.

South Korea Astaxanthin Market Trends

The astaxanthin market in South Korea is expected to experience a CAGR of 19.5% from 2024 to 2030. Governing authorities in South Korea have been putting efforts to enhance its aquaculture industry. It was one of the very few countries to farm salmon. The growing aquaculture industry, increasing demand for natural ingredients, and new product launches by key players are expected to fuel market growth in this country.

Key Asia Pacific Astaxanthin Company Insights

Some of the prominent organizations in the Asia Pacific astaxanthin market are Fuji Chemical Industries Co., Ltd., ENEOS Techno Materials Corporation, BASF SE, BGG Japan Co., Ltd. (BGG WORLD), DSM (DSM-Firmenich), and others. With the growing potential of the regional market, companies have been implementing strategies, such as expansion, new product launches, partnerships, collaborations, and more.

-

Fuji Chemical Industries Co., Ltd., was founded in 1946 and is headquartered in Toyama Prefecture. The core businesses of the company are life sciences, retail, APIs, and pharmaceuticals. It develops health supplements with the inclusion of natural antioxidant astaxanthin

-

ENEOS Techno Materials Corporation is a Japanese establishment that develops a variety of technological materials and products. The company has its plants in Narita and Yokohama, while its nutrition innovation center is situated in Kawasaki, Japan

Key Asia Pacific Astaxanthin Companies:

- Fuji Chemical Industries Co., Ltd.

- ENEOS Techno Materials Corporation

- BASF SE

- BGG Japan Co., Ltd. (BGG WORLD)

- DSM (dsm-firmenich)

- Sv Agrofood

Recent Developments

-

In February 2024, OZiva, a consumer wellness brand that provides plant-based nutrition offerings, launched its newest product OZiva Bioactive Gluta Fizzy. OZiva Bioactive Gluta delivers a complete solution equipped with a distinctive formulation that puts together collagen builder from aloe vera, vitamin C with L glutathione, lycopene from tomato skin, and astaxanthin from red microalgae, along with hyaluronic acid

Asia Pacific Astaxanthin Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.0 billion

Growth rate

CAGR of 18.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

Japan; China; India; Australia; South Korea; Singapore; Thailand

Segments covered

Source, product, application, country

Key companies profiled

Fuji Chemical Industries Co., Ltd.; ENEOS Techno Materials Corporation; BASF SE; BGG Japan Co., Ltd. (BGG WORLD); DSM (dsm-firmenich); Sv Agrofood

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Astaxanthin Market Report Segmentation

This report forecasts revenue growth at the region and country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific astaxanthin market report based on source, product, application, and country:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Yeast

-

Krill/Shrimp

-

Microalgae

-

Others

-

-

Synthetic

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dried Algae Meal or Biomass

-

Oil

-

Softgel

-

Liquid

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Nutraceuticals

-

Cosmetics

-

Aquaculture & Animal Feed

-

Food

-

Functional Foods & Beverages

-

Other Traditional Food Manufacturing Applications

-

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Singapore

-

Thailand

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."